Key Insights

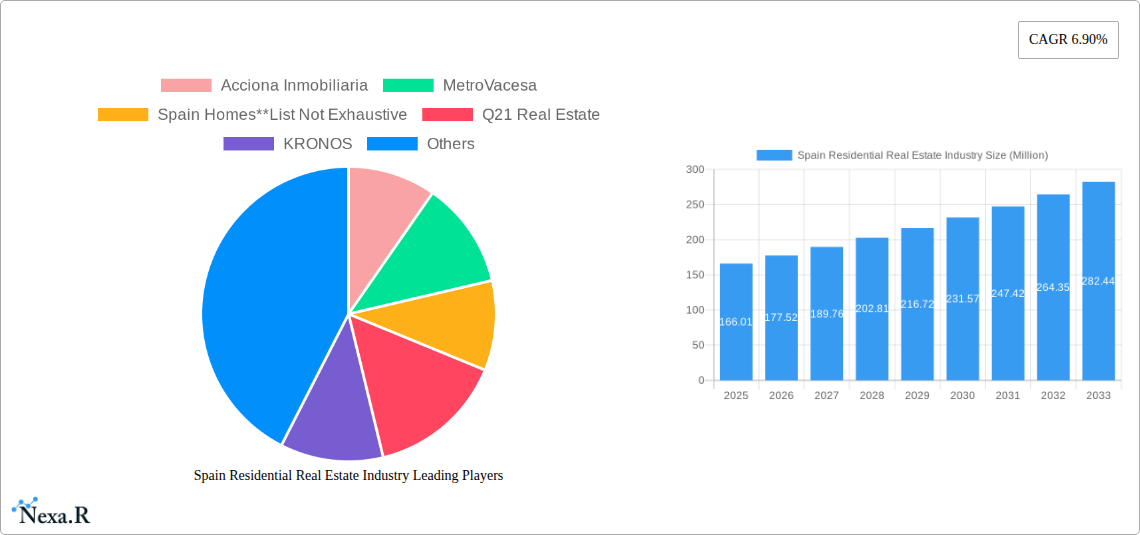

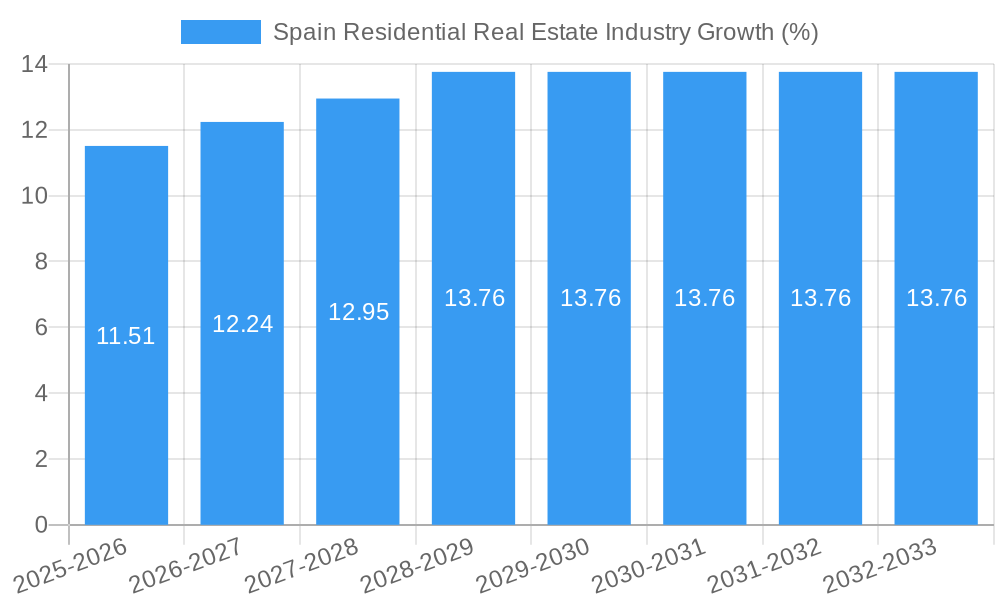

The Spain residential real estate market, valued at €166.01 million in 2025, is projected to experience robust growth, fueled by a Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033. Several factors contribute to this positive outlook. A burgeoning tourism sector consistently drives demand for holiday homes and rental properties, particularly in coastal regions like Malaga and Barcelona. Furthermore, Spain's improving economic conditions and increasing population density, especially in major cities like Madrid and Valencia, are creating a sustained need for residential units. Government initiatives aimed at boosting affordable housing and infrastructure development also contribute to market expansion. The market segmentation reveals a diverse landscape, with apartments and condominiums representing a significant share, followed by villas and landed houses, catering to a range of buyer preferences and budgets. While strong demand presents opportunities, potential challenges include fluctuating interest rates, construction material cost increases, and the ongoing impact of global economic uncertainty on buyer confidence. Nevertheless, the long-term forecast remains positive, suggesting continued growth in the Spanish residential real estate sector throughout the forecast period.

The key players in the Spanish residential real estate market, including Acciona Inmobiliaria, Metrovacesa, Spain Homes, Q21 Real Estate, and others, are actively shaping the market through new developments and strategic acquisitions. Competition is intense, requiring developers to offer innovative designs, sustainable building practices, and competitive pricing to attract buyers. The industry's ongoing evolution is marked by a shift towards technologically advanced building methods and a greater emphasis on environmentally friendly construction. Furthermore, the rise of online real estate platforms and sophisticated data analytics tools are changing how properties are marketed and transacted, fostering increased transparency and efficiency within the sector. The interplay of these factors suggests a dynamic and evolving market with significant potential for sustained growth over the next decade.

Spain Residential Real Estate Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Spain residential real estate market, covering market dynamics, growth trends, key players, and future outlook. With a focus on key segments like apartments & condominiums, villas & landed houses, and major cities including Madrid, Barcelona, Valencia, and Malaga, this report is an essential resource for investors, developers, and industry professionals. The study period spans 2019-2033, with 2025 as the base and estimated year.

Keywords: Spain Real Estate, Residential Property Spain, Spanish Housing Market, Madrid Real Estate, Barcelona Property, Valencia Real Estate, Spanish Real Estate Investment, Build-to-Rent Spain, Spanish Construction Industry, Real Estate Market Analysis Spain.

Spain Residential Real Estate Industry Market Dynamics & Structure

This section analyzes the Spanish residential real estate market's structure and dynamics, covering market concentration, technological innovation, regulatory frameworks, competitive landscape, and M&A activities. The analysis considers factors influencing market growth, including demographic shifts and economic conditions, from 2019 to 2024 and projects trends through 2033.

Market Concentration: The Spanish residential real estate market exhibits a moderately concentrated structure, with several large players like Acciona Inmobiliaria, Neinor Homes, and AEDAS Homes holding significant market share, but also featuring a sizable number of smaller, regional players. The market share of the top 5 developers is estimated at XX%.

Technological Innovation: Adoption of PropTech solutions like online property portals and virtual tours is increasing, though adoption faces barriers, including digital literacy among some demographics and varying levels of technological infrastructure across regions.

Regulatory Framework: Government regulations, including building codes and planning permissions, significantly impact development timelines and costs. Recent changes in legislation aimed at increasing affordable housing are influencing the market.

Competitive Product Substitutes: The primary substitutes are rental properties and alternative housing options (e.g., co-living spaces). The increasing popularity of the Build-to-Rent (BTR) model represents a significant competitive challenge for traditional homeownership.

End-User Demographics: The primary demographic drivers are young professionals, families, and retirees. Migration patterns within Spain, particularly towards coastal regions, also shape demand.

M&A Trends: The sector has witnessed a moderate level of M&A activity in recent years, driven by consolidation strategies among larger developers and foreign investment. The total value of M&A deals in the period 2019-2024 is estimated at XX Million EUR.

Spain Residential Real Estate Industry Growth Trends & Insights

This section provides a comprehensive overview of growth trends within the Spanish residential real estate market from 2019-2033. Using historical data and projections, it identifies factors that contribute to or impede expansion. Market size evolution, adoption rates of new technologies and shifting consumer preferences are also analyzed. Quantitative metrics including the Compound Annual Growth Rate (CAGR) will be provided to provide deeper insights. Specific metrics, such as CAGR and market penetration rates, will illuminate market dynamics. For example, the CAGR for the period 2019-2024 is estimated at XX%, and projected CAGR from 2025 to 2033 is XX%. The increasing preference for sustainable and energy-efficient housing is influencing market segments and driving growth in specific sectors.

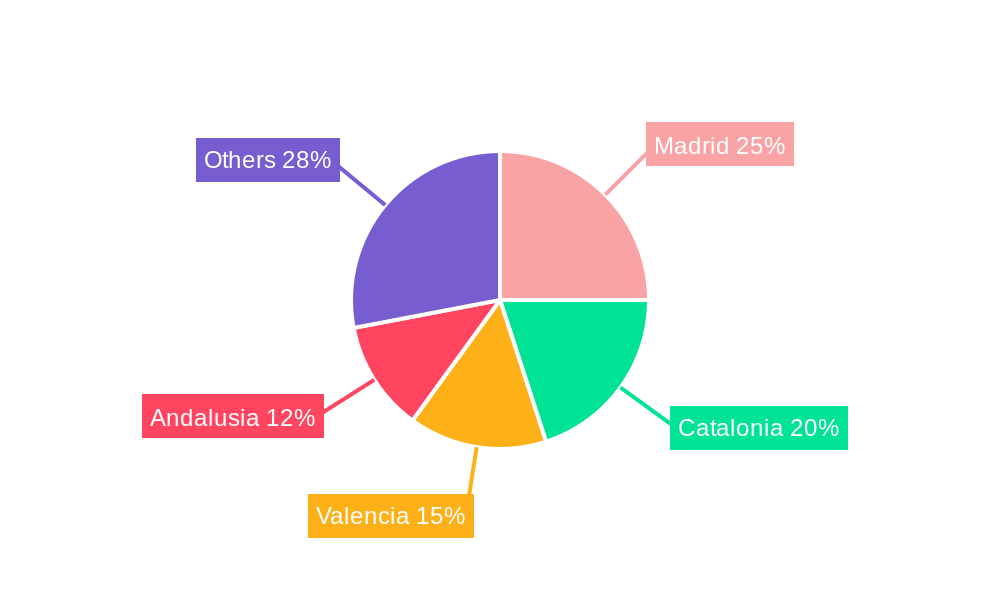

Dominant Regions, Countries, or Segments in Spain Residential Real Estate Industry

This section analyzes dominant regions, countries, and segments driving growth within the Spanish residential real estate market.

By Type: Apartments and condominiums constitute the largest segment, driven by high demand in urban areas and affordability. Villas and landed houses are a significant segment, mainly in coastal and suburban areas, appealing to a different demographic with higher purchasing power.

By Key Cities: Madrid and Barcelona consistently represent the largest markets due to strong economies, employment opportunities, and existing infrastructure. Valencia, Malaga, and Catalonia also demonstrate significant growth potential. The market share of Madrid and Barcelona combined is estimated to be around XX% of the total market.

Key Drivers:

- Economic Growth: Strong economic performance in key regions fuels demand.

- Tourism: Tourism-related investments and property purchases bolster the market in coastal areas like Malaga and Valencia.

- Infrastructure Development: Improvements to transportation and public services further enhance property value and appeal.

Dominance Factors:

- Market Share: Market share data for each region will be presented graphically.

- Growth Potential: Each region’s projected growth trajectory will be detailed.

Spain Residential Real Estate Industry Product Landscape

The Spanish residential real estate market displays a diverse product landscape, ranging from traditional apartments and villas to innovative, sustainable housing developments. Recent years have seen a rise in smart home features and eco-friendly designs. Developers are increasingly incorporating features that appeal to environmentally conscious buyers, such as solar panels and energy-efficient appliances. The focus on sustainability is a key selling proposition, driving higher demand in certain segments and price points.

Key Drivers, Barriers & Challenges in Spain Residential Real Estate Industry

Key Drivers:

- Increased domestic and international investment.

- Strong tourism sector boosting demand in coastal areas.

- Growing demand for sustainable and energy-efficient housing.

- Government initiatives aimed at supporting the construction sector and affordable housing.

Key Challenges:

- Supply chain disruptions and increased material costs (estimated impact on construction costs: XX%).

- Bureaucratic hurdles and lengthy permitting processes (average permitting time: XX months).

- Intense competition in major urban markets, leading to price pressures and decreased profit margins.

Emerging Opportunities in Spain Residential Real Estate Industry

- Build-to-Rent (BTR): The BTR sector presents substantial growth potential due to rising rental demand and institutional investment.

- Sustainable Housing: Demand for eco-friendly homes with energy-efficient features is expanding rapidly.

- Second-Home Market: The resurgence of international tourism will continue to stimulate the second-home market, especially in coastal regions.

Growth Accelerators in the Spain Residential Real Estate Industry

Technological advancements, strategic partnerships between developers and technology providers, and expansion into underserved markets will continue to drive growth. The incorporation of smart home technologies and data-driven insights will optimize development processes and improve energy efficiency. Furthermore, strategic acquisitions and mergers are expected to enhance market share and expand product portfolios.

Key Players Shaping the Spain Residential Real Estate Industry Market

- Acciona Inmobiliaria

- MetroVacesa

- Spain Homes

- Q21 Real Estate

- KRONOS

- Via Celere

- AELCA

- Neinor Homes

- Pryconsa

- AEDAS homes

Notable Milestones in Spain Residential Real Estate Industry Sector

- October 2022: Layetana Living and Aviva Investors formed a EUR 500 million (USD 531.20 Million) BTR joint venture, purchasing a 71-unit building in Barcelona.

- September 2022: Berkshire Hathaway HomeServices expanded into the Valencian Community, opening a new office in Denia.

In-Depth Spain Residential Real Estate Industry Market Outlook

The Spanish residential real estate market presents a positive long-term outlook, driven by sustained economic growth, population increases in key areas, and evolving consumer preferences. The increasing focus on sustainable development and the expansion of the BTR sector will create lucrative opportunities for investors and developers. Strategic partnerships and technological innovation will be crucial factors in achieving long-term success.

Spain Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Madrid

- 2.2. Catalonia

- 2.3. Valencia

- 2.4. Barcelona

- 2.5. Malaga

- 2.6. Others

Spain Residential Real Estate Industry Segmentation By Geography

- 1. Spain

Spain Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of High Net-Worth Individuals (HNWIs)

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Rise in International Property Buyers in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Madrid

- 5.2.2. Catalonia

- 5.2.3. Valencia

- 5.2.4. Barcelona

- 5.2.5. Malaga

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Acciona Inmobiliaria

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MetroVacesa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spain Homes**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Q21 Real Estate

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KRONOS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Via Celere

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AELCA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Neinor Homes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pryconsa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AEDAS homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Acciona Inmobiliaria

List of Figures

- Figure 1: Spain Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Spain Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Spain Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Spain Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spain Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Spain Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Spain Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Spain Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Residential Real Estate Industry?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Spain Residential Real Estate Industry?

Key companies in the market include Acciona Inmobiliaria, MetroVacesa, Spain Homes**List Not Exhaustive, Q21 Real Estate, KRONOS, Via Celere, AELCA, Neinor Homes, Pryconsa, AEDAS homes.

3. What are the main segments of the Spain Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 166.01 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of High Net-Worth Individuals (HNWIs).

6. What are the notable trends driving market growth?

Rise in International Property Buyers in Spain.

7. Are there any restraints impacting market growth?

4.; Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

October 2022: A build-to-rent (BTR) cooperation between Layetana Living and Aviva Investors was established in Spain. According to the statement, the collaboration between Aviva and the Spanish developer Layetana will construct a more than EUR 500 million (USD 531.20 Million) residential portfolio, already securing its first development project. Based on the recommendation of international real estate consultancy Knight Frank, the partnership purchased a 71-unit residential building in Barcelona's Sants neighborhood. Construction is scheduled to begin at the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Spain Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence