Key Insights

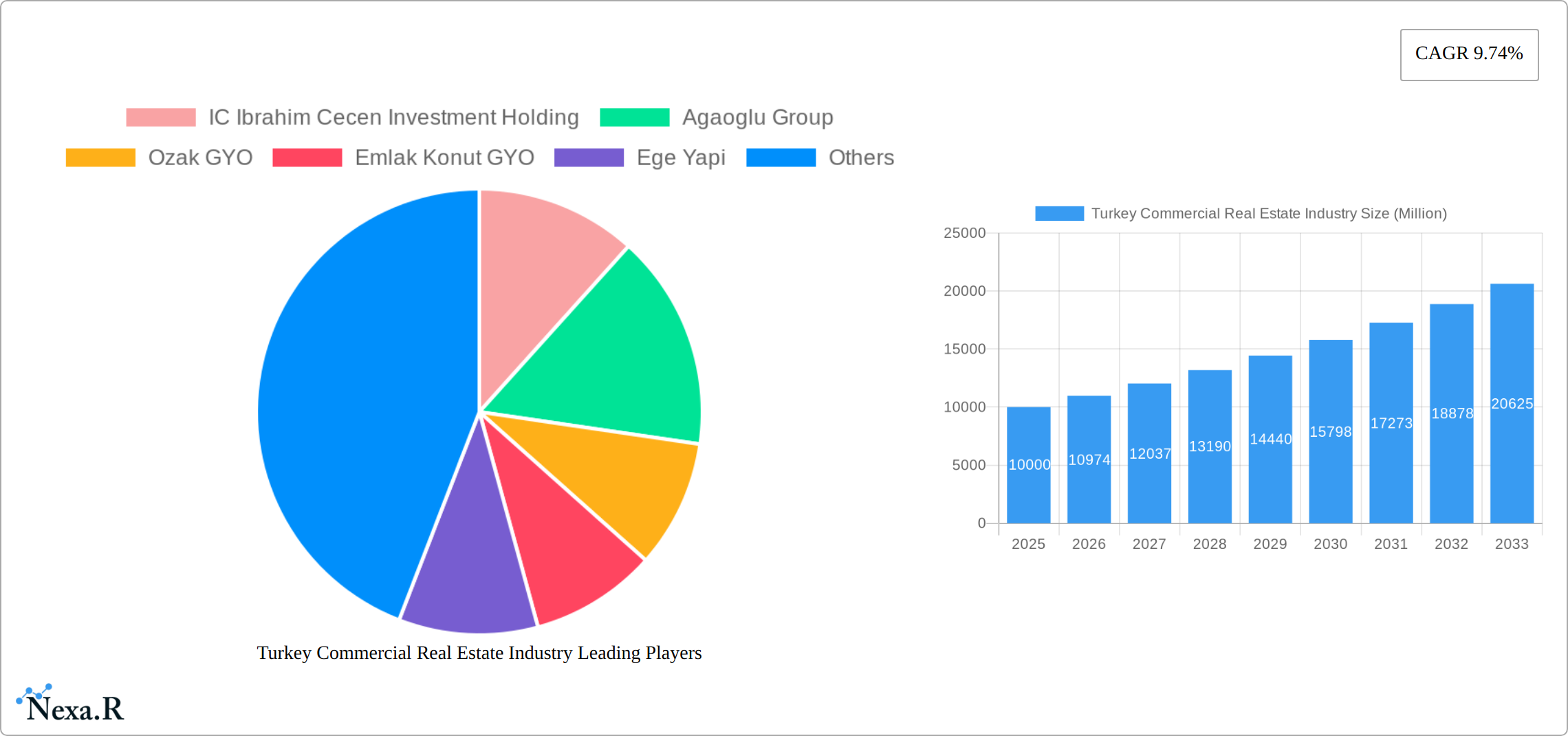

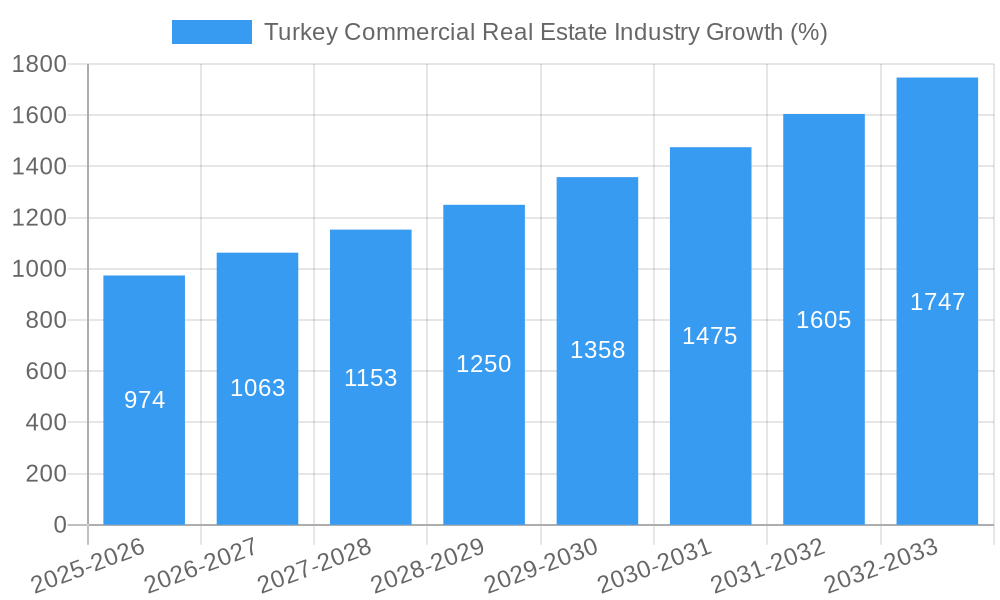

The Turkish commercial real estate (CRE) market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.74% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Turkey's burgeoning tourism sector, particularly in key cities like Istanbul, Antalya, and Bursa, fuels demand for hospitality and retail spaces. Secondly, a growing population and increasing urbanization contribute to the rising need for residential and office developments, particularly in multi-family housing. Thirdly, government initiatives aimed at infrastructure development and economic diversification are creating favorable conditions for CRE investment. While challenges such as economic volatility and fluctuating currency rates exist, the overall long-term outlook remains positive, with significant opportunities for investors across diverse segments. The robust growth in logistics and industrial sectors, fueled by e-commerce expansion and foreign direct investment, will also significantly impact the market over the forecast period.

The market segmentation reveals a diversified landscape. The office segment, driven by a growing corporate sector and increasing demand for modern workspaces, is anticipated to experience substantial growth. The retail sector benefits from strong domestic consumption and tourism. The industrial and logistics segments, although potentially smaller in overall value compared to office and retail, are likely to demonstrate the highest growth rates due to Turkey's strategic location and increasing role in global supply chains. Key players such as IC Ibrahim Cecen Investment Holding, Agaoglu Group, and Emlak Konut GYO, amongst others, are shaping the market dynamics through their extensive portfolios and development activities. Strategic partnerships and mergers and acquisitions are anticipated to become increasingly important as the market evolves. Analyzing these market dynamics is crucial for investors seeking opportunities within this expanding sector.

Turkey Commercial Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Turkish commercial real estate market, covering the period 2019-2033, with a focus on 2025. It examines market dynamics, growth trends, key players, and future opportunities, offering invaluable insights for investors, developers, and industry professionals. The report segments the market by type (Offices, Retail, Industrial, Logistics, Multi-family, Hospitality) and key cities (Istanbul, Bursa, Antalya), providing granular data for informed decision-making.

Turkey Commercial Real Estate Industry Market Dynamics & Structure

This section analyzes the market concentration, technological advancements, regulatory landscape, competitive dynamics, end-user demographics, and merger & acquisition (M&A) activity within the Turkish commercial real estate sector. The study period covers 2019-2024, with a base year of 2025 and a forecast period of 2025-2033.

- Market Concentration: The Turkish commercial real estate market exhibits a moderately concentrated structure, with a few large players like Agaoglu Group and Emlak Konut GYO holding significant market share (estimated at xx% and xx% respectively in 2025). Smaller players, however, account for a considerable portion, indicating a dynamic competitive landscape.

- Technological Innovation: Adoption of PropTech solutions, including Building Information Modeling (BIM) and smart building technologies, is gradually increasing. However, innovation barriers include high initial investment costs and a lack of skilled workforce.

- Regulatory Framework: Government policies and regulations concerning construction permits, zoning laws, and environmental standards significantly impact market dynamics. Recent changes to regulations (specify if available, otherwise state “Recent regulatory changes are expected to (positive or negative impact) the market.”)

- Competitive Product Substitutes: The primary competitive threat comes from alternative investment options and the availability of affordable housing stock which influences the demand for certain commercial real estate segments.

- End-User Demographics: The expanding urban population, particularly in Istanbul, fuels demand for office and retail spaces. Growth in e-commerce and logistics is driving demand for industrial and logistics facilities.

- M&A Trends: The M&A activity in the Turkish commercial real estate sector experienced (increase/decrease) in the historical period (2019-2024), with an estimated xx million USD worth of deals. (mention any specific significant M&A event).

Turkey Commercial Real Estate Industry Growth Trends & Insights

This section leverages market research data and expert analysis to examine the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the Turkish commercial real estate sector. The compound annual growth rate (CAGR) for the total market is projected to be xx% during the forecast period (2025-2033). Market penetration for various segments (e.g., green buildings, smart offices) will be assessed. Factors influencing consumer behavior, such as changing work styles and evolving retail preferences, will be analyzed. The analysis incorporates data from various sources including government reports, industry publications, and company financials.

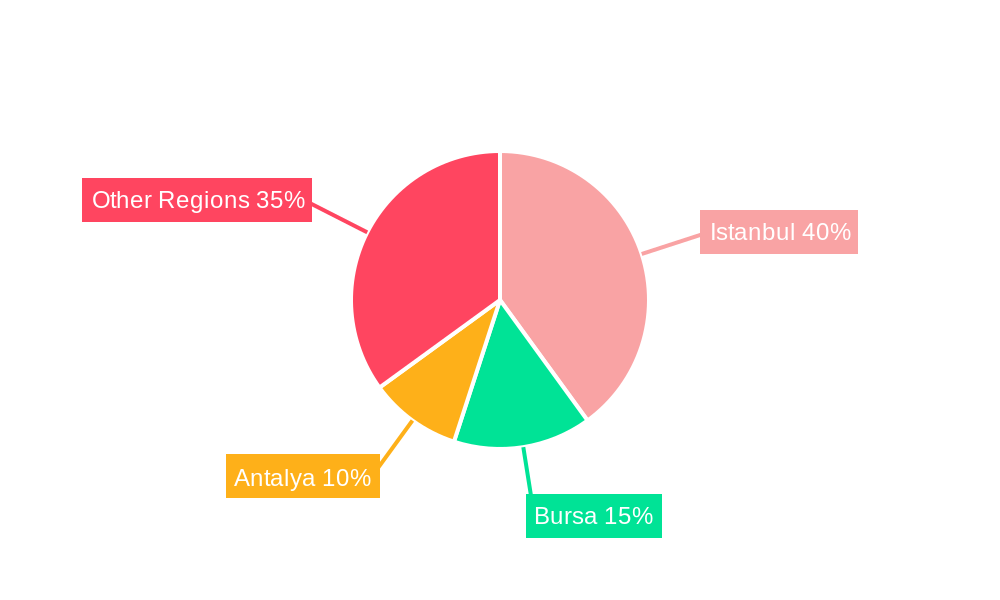

Dominant Regions, Countries, or Segments in Turkey Commercial Real Estate Industry

Istanbul, as Turkey's largest city and economic hub, dominates the commercial real estate market, accounting for approximately xx% of the total market value in 2025. Antalya and Bursa also show significant growth potential due to (mention specific factors for each city, e.g., tourism in Antalya, industrial development in Bursa). Among the segments, the office segment is expected to lead the market growth due to the increasing demand from both domestic and foreign businesses. The logistics segment is witnessing accelerated growth fueled by the expansion of e-commerce and the strategic location of Turkey on global trade routes.

- Key Drivers for Istanbul: Strong economic activity, favorable demographics, and substantial foreign investment.

- Key Drivers for Antalya: Tourism growth and associated hospitality infrastructure development.

- Key Drivers for Bursa: Industrial expansion and a strong manufacturing base.

- Key Drivers for Office Segment: Growth of the business process outsourcing (BPO) sector, expanding multinational corporations in Turkey, and increasing demand for modern workspaces.

- Key Drivers for Logistics Segment: Rapid growth in e-commerce, improved infrastructure, and Turkey's strategic geographical location.

Turkey Commercial Real Estate Industry Product Landscape

The Turkish commercial real estate sector is witnessing increased sophistication in building design, incorporating sustainable practices and smart technologies. Products focus on energy efficiency, advanced security systems, and flexible layouts to cater to diverse tenant needs. Innovative developments include the use of modular construction, which accelerates project timelines. Unique selling propositions are increasingly centered on sustainability credentials, tenant experience enhancements, and technological integration.

Key Drivers, Barriers & Challenges in Turkey Commercial Real Estate Industry

Key Drivers: Economic growth, urbanization, increasing foreign investment, and government initiatives to improve infrastructure are key drivers. Furthermore, the growing adoption of technology is streamlining processes and improving efficiency.

Key Barriers and Challenges: Economic volatility, fluctuating exchange rates, and regulatory uncertainties pose significant challenges. High construction costs, skilled labor shortages, and competition from other asset classes create hurdles for market expansion. Supply chain disruptions from global events also affect project timelines and costs.

Emerging Opportunities in Turkey Commercial Real Estate Industry

Emerging opportunities lie in the development of sustainable and green buildings, the expansion of logistics facilities, and investment in technology-driven solutions. Untapped markets exist in smaller cities and towns. The increasing focus on wellness and health within workplaces creates opportunities for innovative building designs and services.

Growth Accelerators in the Turkey Commercial Real Estate Industry Industry

Technological advancements, strategic partnerships between developers and technology companies, and government incentives for sustainable development are accelerating market growth. Expansion into new markets, both geographically and in terms of specialized property types, offers strong potential for expansion. The growing focus on the tenant experience and improved building management practices are enhancing market appeal.

Key Players Shaping the Turkey Commercial Real Estate Industry Market

- IC Ibrahim Cecen Investment Holding

- Agaoglu Group

- Ozak GYO

- Emlak Konut GYO

- Ege Yapi

- Ronesans Holding

- Artas Group

- Kiler GYO

- PEGA

- Calik holding

Notable Milestones in Turkey Commercial Real Estate Industry Sector

- 2021: Launch of a major new mixed-use development in Istanbul (provide details if available).

- 2022: Completion of a large-scale logistics park near Istanbul’s airport (provide details if available).

- 2023: Introduction of new regulations affecting sustainable building practices. (provide details if available).

In-Depth Turkey Commercial Real Estate Industry Market Outlook

The Turkish commercial real estate market is poised for continued growth, driven by robust economic fundamentals, infrastructure development, and technological innovation. Strategic partnerships, investments in sustainable development, and the expansion into new geographical locations and property types will create significant opportunities for market players. The increasing focus on tenant experience and building efficiency will further shape the sector's trajectory in the coming years. The market is expected to reach a value of xx Million USD by 2033.

Turkey Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key Cities

- 2.1. Istanbul

- 2.2. Bursa

- 2.3. Antalya

Turkey Commercial Real Estate Industry Segmentation By Geography

- 1. Turkey

Turkey Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw material prices

- 3.4. Market Trends

- 3.4.1. Improvement in Hospitality Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Istanbul

- 5.2.2. Bursa

- 5.2.3. Antalya

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IC Ibrahim Cecen Investment Holding

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Agaoglu Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ozak GYO

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emlak Konut GYO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ege Yapi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ronesans Holding

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Artas Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kiler GYO**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PEGA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Calik holding

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IC Ibrahim Cecen Investment Holding

List of Figures

- Figure 1: Turkey Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Turkey Commercial Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Turkey Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Commercial Real Estate Industry?

The projected CAGR is approximately 9.74%.

2. Which companies are prominent players in the Turkey Commercial Real Estate Industry?

Key companies in the market include IC Ibrahim Cecen Investment Holding, Agaoglu Group, Ozak GYO, Emlak Konut GYO, Ege Yapi, Ronesans Holding, Artas Group, Kiler GYO**List Not Exhaustive, PEGA, Calik holding.

3. What are the main segments of the Turkey Commercial Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture.

6. What are the notable trends driving market growth?

Improvement in Hospitality Sector.

7. Are there any restraints impacting market growth?

Volatility in Raw material prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Turkey Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence