Key Insights

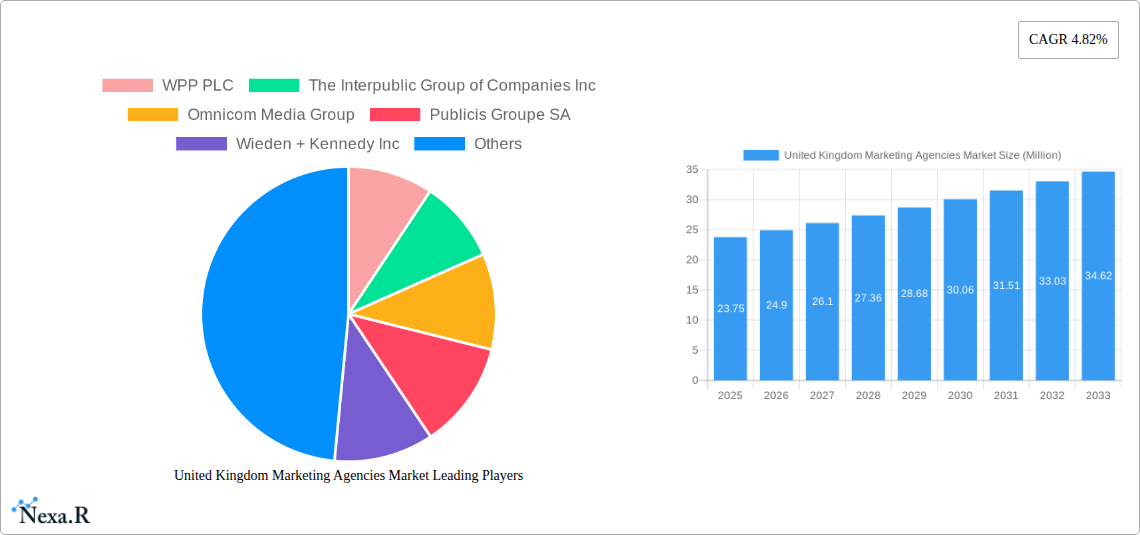

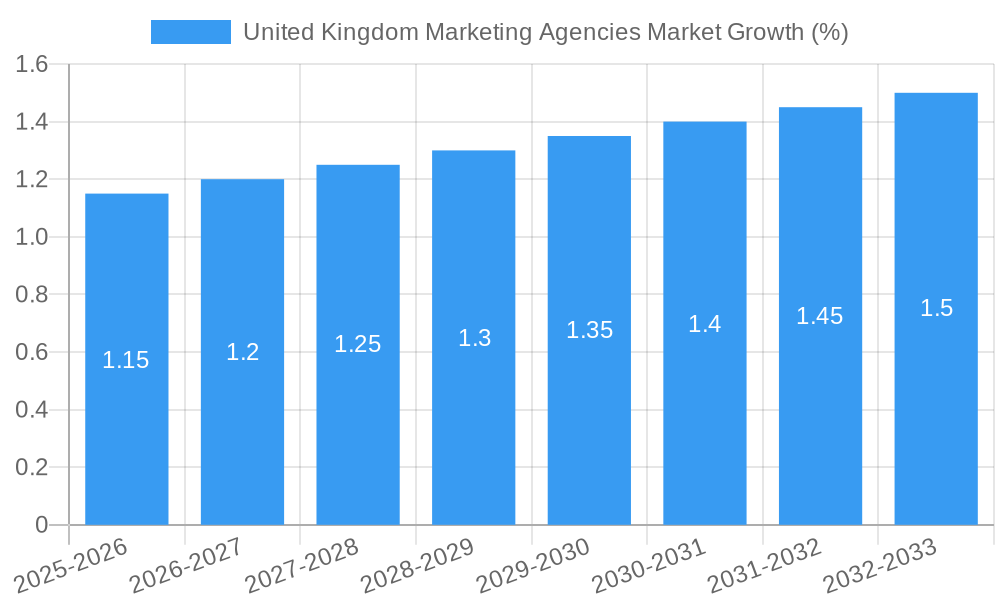

The United Kingdom marketing agencies market, valued at £23.75 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.82% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing digitalization across businesses necessitates sophisticated marketing strategies, driving demand for specialized agencies. The rise of e-commerce and the growing importance of targeted online advertising further contribute to this growth. Furthermore, the UK's vibrant creative industry and the presence of globally recognized agencies within its borders attract substantial investment and talent, strengthening the market's competitive landscape. While data privacy regulations and fluctuating economic conditions present potential restraints, the overall market outlook remains positive, driven by sustained investment in marketing and advertising by businesses of all sizes aiming to reach increasingly diverse and digitally-savvy consumer audiences. The market is segmented by service type (e.g., digital marketing, public relations, content creation), target audience (B2B, B2C), and agency size (small, medium, large), although specific segment data is not currently available. Key players such as WPP PLC, Omnicom Media Group, and Publicis Groupe SA dominate the market, leveraging their global networks and expertise to secure significant market share. The forecast period suggests continued growth, with a projected market expansion driven by the ongoing adoption of innovative marketing technologies and techniques.

The competitive landscape is dynamic, with both established multinational agencies and smaller, specialized boutique agencies vying for market share. The market's future success hinges on agencies’ ability to adapt to evolving consumer preferences, embrace technological advancements, and demonstrate measurable ROI for their clients. A key trend is the increasing integration of data analytics and artificial intelligence into marketing strategies, demanding expertise in these areas from agencies. Agencies are also focusing on developing sustainable and ethical marketing practices, responding to growing consumer demand for responsible business behavior. The UK's strategic location and strong economy provide a fertile ground for the continued growth of the marketing agencies sector, despite the aforementioned challenges. The next decade will likely see further consolidation and increased competition, as agencies strive to offer comprehensive and innovative solutions to meet the ever-changing needs of their clients.

United Kingdom Marketing Agencies Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom Marketing Agencies Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic sector. The report meticulously analyzes parent markets (e.g., advertising, digital marketing) and child markets (e.g., social media marketing, content marketing) to offer a granular perspective on market segmentation and opportunities.

United Kingdom Marketing Agencies Market Market Dynamics & Structure

The UK marketing agencies market is characterized by a moderately concentrated landscape, with several large multinational players holding significant market share. However, a vibrant ecosystem of smaller, specialized agencies also thrives. Technological innovation, particularly in areas like AI and data analytics, is a key driver, while regulatory frameworks (e.g., data privacy regulations) significantly impact operations. The market witnesses consistent M&A activity, with larger firms acquiring smaller agencies to expand their service offerings and geographic reach. Competitive substitutes include in-house marketing teams and freelance professionals. End-user demographics are broad, encompassing businesses of all sizes across diverse sectors.

- Market Concentration: The top 5 agencies hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024.

- Technological Innovation: AI and data-driven marketing solutions are driving significant change.

- Regulatory Landscape: GDPR and other data privacy regulations pose challenges and opportunities.

- Competitive Landscape: Intense competition exists between large multinational agencies and smaller specialized firms.

United Kingdom Marketing Agencies Market Growth Trends & Insights

The UK marketing agencies market has demonstrated consistent growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by increasing digital adoption among businesses, the rising importance of data-driven marketing strategies, and the growing demand for specialized marketing services. Technological disruptions, such as the rise of artificial intelligence (AI) and the metaverse, are reshaping the industry landscape. Consumer behavior shifts towards personalized experiences and increased online engagement also contribute to market expansion. Market penetration of digital marketing services continues to rise, exceeding xx% in 2025. The forecast period (2025-2033) projects a CAGR of xx%, driven by continued digital transformation and increasing marketing budgets across industries. The market size is estimated at £xx Million in 2025, projected to reach £xx Million by 2033.

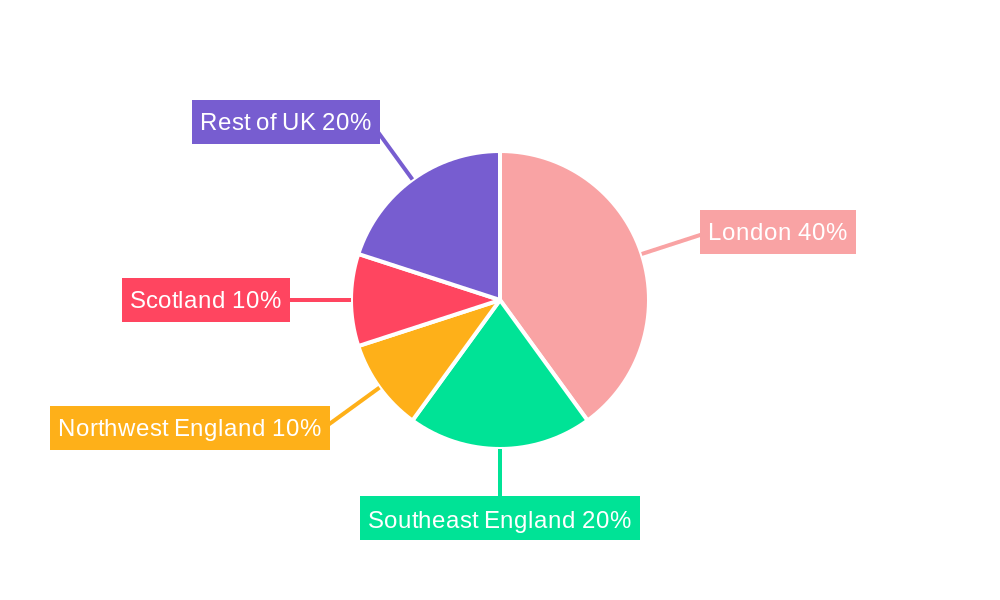

Dominant Regions, Countries, or Segments in United Kingdom Marketing Agencies Market

London remains the dominant region for marketing agencies in the UK, accounting for approximately xx% of the market in 2025. This dominance is attributed to its concentration of major corporations, a highly skilled workforce, and advanced infrastructure. Other major cities such as Manchester, Birmingham, and Edinburgh also contribute significantly to the market. The digital marketing segment currently holds the largest market share, projected to grow at a CAGR of xx% during the forecast period.

Key Drivers for London's Dominance:

- High concentration of large corporations and multinational companies.

- Highly skilled and experienced marketing workforce.

- Well-developed infrastructure and technological advancements.

- Access to a large pool of talent from across the globe.

Growth Potential in Other Regions: Regions outside London show strong growth potential, driven by increasing digital adoption and government initiatives supporting business growth.

United Kingdom Marketing Agencies Market Product Landscape

The UK marketing agencies market offers a diverse range of services, including traditional advertising, digital marketing (SEO, SEM, social media marketing), content marketing, public relations, and event marketing. Recent product innovations focus on data-driven strategies, AI-powered tools for campaign optimization, and personalized customer experiences. Key performance metrics include campaign ROI, brand awareness, lead generation, and customer engagement. Agencies are increasingly leveraging advanced analytics and technology to enhance campaign effectiveness and provide clients with data-driven insights.

Key Drivers, Barriers & Challenges in United Kingdom Marketing Agencies Market

Key Drivers: Increased digital adoption by businesses, growing demand for data-driven marketing, rising marketing budgets, and technological advancements (AI, automation).

Challenges & Restraints: Intense competition, fluctuating economic conditions impacting marketing spends, data privacy regulations (e.g., GDPR), and talent acquisition challenges. The economic downturn in 2023 impacted marketing budgets, resulting in a temporary slowdown in growth (approx. xx% reduction in new client acquisitions). Supply chain disruptions also played a minor role, impacting the availability of certain specialized marketing technologies.

Emerging Opportunities in United Kingdom Marketing Agencies Market

Emerging opportunities include the growth of influencer marketing, the expansion of marketing in the metaverse and Web3, and the increasing demand for sustainability-focused marketing campaigns. Untapped markets exist in niche sectors and among small and medium-sized enterprises (SMEs). The increasing adoption of AI and machine learning presents significant opportunities for agencies to enhance their service offerings and improve campaign performance.

Growth Accelerators in the United Kingdom Marketing Agencies Market Industry

Strategic partnerships, technological breakthroughs in AI and data analytics, and expansion into new market segments are key growth accelerators. The increasing adoption of subscription-based marketing services presents further growth opportunities. Agencies focusing on specialized services, such as influencer marketing or sustainable marketing, are poised for significant growth.

Key Players Shaping the United Kingdom Marketing Agencies Market Market

- WPP PLC

- The Interpublic Group of Companies Inc

- Omnicom Media Group

- Publicis Groupe SA

- Wieden + Kennedy Inc

- Havas SA

- Ogilvy

- Stagwell Group

- Zeninth Media

- PHD Media

- List Not Exhaustive

Notable Milestones in United Kingdom Marketing Agencies Market Sector

- April 2024: WPP and Google Cloud announced a pioneering collaboration to propel generative AI-driven marketing.

- February 2024: IPG partnered with Adobe to revolutionize content creation using generative AI.

In-Depth United Kingdom Marketing Agencies Market Market Outlook

The UK marketing agencies market is poised for continued growth driven by technological advancements, evolving consumer behavior, and increasing marketing budgets. Strategic partnerships and the adoption of innovative marketing strategies will be crucial for success. The focus on data-driven marketing, personalization, and sustainability will shape the future of the industry. Agencies that embrace technology, adapt to changing consumer preferences, and cultivate strong client relationships are best positioned for long-term success.

United Kingdom Marketing Agencies Market Segmentation

-

1. Service Type

- 1.1. Digital Marketing Services

- 1.2. Traditional Marketing Services

- 1.3. Full-Service Agencies

-

2. Mode

- 2.1. Online

- 2.2. Offline

-

3. Application

- 3.1. Large Enterprises

- 3.2. Small and Mid-sized Enterprises (SMEs)

-

4. End-User

- 4.1. BFSI

- 4.2. IT & Telecom

- 4.3. Retail & Consumer Goods

- 4.4. Public Services

- 4.5. Manufacturing and Logistics

United Kingdom Marketing Agencies Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Marketing Agencies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digital Dominance; Changing Landscape of Marketing

- 3.3. Market Restrains

- 3.3.1. Growing Digital Dominance; Changing Landscape of Marketing

- 3.4. Market Trends

- 3.4.1. Growing Digital Dominance is Fuelling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Marketing Agencies Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Digital Marketing Services

- 5.1.2. Traditional Marketing Services

- 5.1.3. Full-Service Agencies

- 5.2. Market Analysis, Insights and Forecast - by Mode

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Large Enterprises

- 5.3.2. Small and Mid-sized Enterprises (SMEs)

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI

- 5.4.2. IT & Telecom

- 5.4.3. Retail & Consumer Goods

- 5.4.4. Public Services

- 5.4.5. Manufacturing and Logistics

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 WPP PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Interpublic Group of Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omnicom Media Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Publicis Groupe SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wieden + Kennedy Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Havas SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ogilvy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stagwell Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zeninth Media

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PHD Media**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 WPP PLC

List of Figures

- Figure 1: United Kingdom Marketing Agencies Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Marketing Agencies Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 5: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 6: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Mode 2019 & 2032

- Table 7: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Marketing Agencies Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: United Kingdom Marketing Agencies Market Volume Billion Forecast, by End-User 2019 & 2032

- Table 11: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 15: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 16: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Mode 2019 & 2032

- Table 17: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Marketing Agencies Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: United Kingdom Marketing Agencies Market Volume Billion Forecast, by End-User 2019 & 2032

- Table 21: United Kingdom Marketing Agencies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Marketing Agencies Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Marketing Agencies Market?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the United Kingdom Marketing Agencies Market?

Key companies in the market include WPP PLC, The Interpublic Group of Companies Inc, Omnicom Media Group, Publicis Groupe SA, Wieden + Kennedy Inc, Havas SA, Ogilvy, Stagwell Group, Zeninth Media, PHD Media**List Not Exhaustive.

3. What are the main segments of the United Kingdom Marketing Agencies Market?

The market segments include Service Type, Mode, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digital Dominance; Changing Landscape of Marketing.

6. What are the notable trends driving market growth?

Growing Digital Dominance is Fuelling the Market.

7. Are there any restraints impacting market growth?

Growing Digital Dominance; Changing Landscape of Marketing.

8. Can you provide examples of recent developments in the market?

April 2024: WPP and Google Cloud announced a pioneering collaboration to propel generative AI-driven marketing to new heights. This partnership is poised to redefine marketing's efficacy and impact by leveraging Google's prowess in data analytics, generative AI technology, and cybersecurity alongside WPP's comprehensive marketing solutions, vast creative reach, and deep brand insights.February 2024: IPG made waves by unveiling a strategic collaboration with Adobe. The partnership aims to revolutionize content creation and activation within IPG's global operations. IPG stands out as the inaugural corporation to seamlessly incorporate Adobe GenStudio, a cutting-edge tool leveraging generative AI. This integration empowers brands to accelerate their content ideation, creation, production, and activation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Marketing Agencies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Marketing Agencies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Marketing Agencies Market?

To stay informed about further developments, trends, and reports in the United Kingdom Marketing Agencies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence