Key Insights

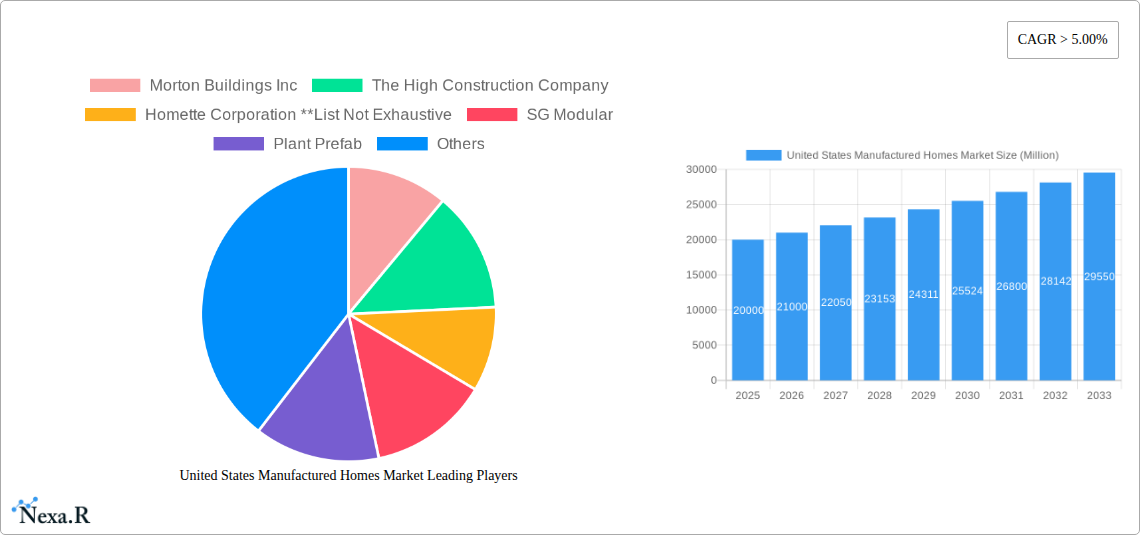

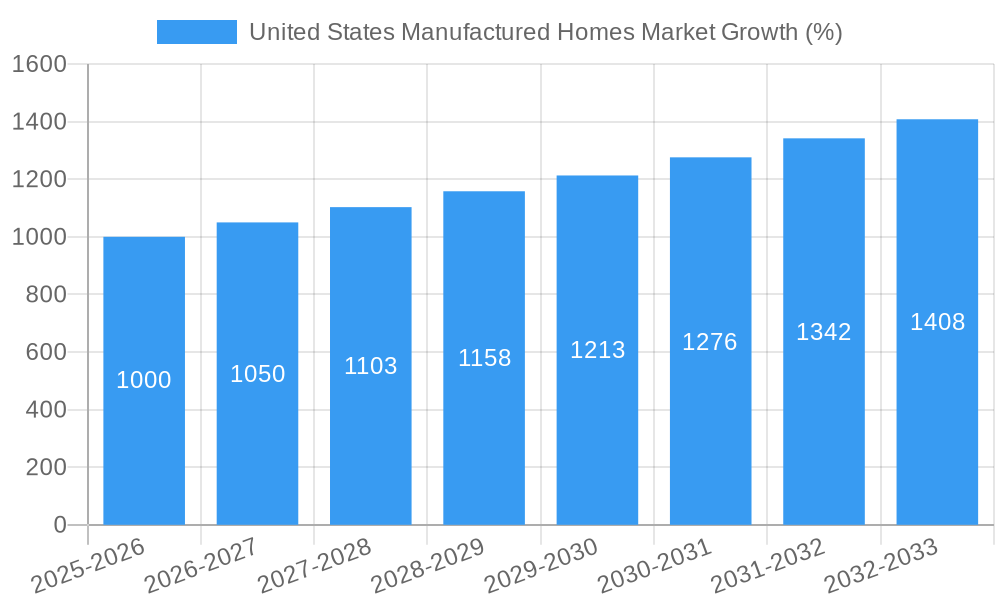

The United States manufactured homes market is experiencing robust growth, fueled by increasing affordability concerns and a persistent housing shortage. With a market size exceeding $XX million in 2025 and a compound annual growth rate (CAGR) exceeding 5%, the sector is projected to reach significant expansion by 2033. This growth is driven by several key factors: the rising demand for budget-friendly housing options, particularly among younger demographics and first-time homebuyers; the increasing efficiency and improved aesthetic appeal of modern manufactured homes, blurring the lines with traditional site-built homes; and the growing adoption of sustainable and eco-friendly building practices within the manufactured housing sector. Government initiatives aimed at affordable housing solutions also contribute positively to market expansion. However, challenges remain, including potential supply chain disruptions, fluctuations in material costs, and stringent zoning regulations that can limit the availability of suitable land for manufactured home communities. The market is segmented by type, primarily encompassing single-family and multi-family units, with single-family homes currently dominating the market share. Key players like Morton Buildings Inc., The High Construction Company, and Skyline Champion Corporation are actively shaping the market landscape through innovation and expansion.

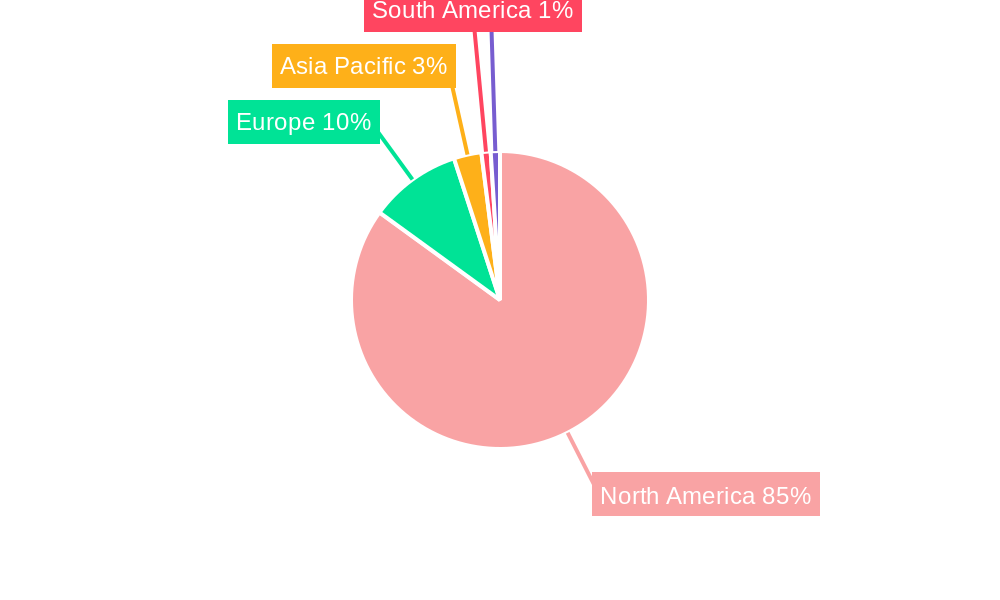

The forecast period (2025-2033) presents significant opportunities for market expansion. While precise regional breakdowns are unavailable, the North American market, particularly the US, is expected to dominate given the domestic demand drivers mentioned earlier. Continued technological advancements in manufacturing processes, improved energy efficiency standards, and increasing consumer awareness of the benefits of manufactured housing are expected to fuel this growth. Competition among established players and the entry of new entrants will further drive innovation and price competitiveness. Despite potential restraints, the overall outlook for the US manufactured homes market remains positive, promising substantial growth and market value enhancement in the coming years. This growth trajectory will be influenced by macroeconomic factors, interest rates, and overall housing market trends.

United States Manufactured Homes Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Manufactured Homes Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic sector. The parent market is the broader US Housing Market, and the child market specifically focuses on manufactured homes, encompassing single-family and multi-family dwellings. The report quantifies the market in Million units.

United States Manufactured Homes Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the US manufactured homes market. The market is moderately fragmented, with several major players and numerous smaller companies. Technological innovations are driving efficiency and affordability, while regulatory changes impact construction standards and safety regulations.

- Market Concentration: The market exhibits moderate concentration, with xx% market share held by the top 5 players.

- Technological Innovation: Advancements in materials, manufacturing processes (e.g., modular construction), and design are key drivers, alongside increasing adoption of sustainable building practices. Barriers include high initial investment costs for new technologies and the need for skilled labor.

- Regulatory Framework: Building codes, zoning regulations, and financing options significantly affect market growth. Changes in these regulations can create both opportunities and challenges.

- Competitive Product Substitutes: Traditional site-built homes and other forms of affordable housing represent key competitive substitutes.

- End-User Demographics: The primary end-users are first-time homebuyers, those seeking affordable housing options, and individuals in rural areas. Demographic shifts influence demand.

- M&A Trends: Consolidation is evident, with a moderate number of M&A deals (xx in the last 5 years) driven by economies of scale and expansion into new geographic markets. Examples include Champion Home Builders' acquisition of Manis Custom Builders.

United States Manufactured Homes Market Growth Trends & Insights

The US manufactured homes market has experienced steady growth in recent years, driven by factors such as affordability, shorter construction times, and increasing demand for housing. The market size has expanded from xx million units in 2019 to an estimated xx million units in 2025, exhibiting a CAGR of xx%. Technological disruptions, such as the increased use of prefabrication and modular construction techniques, are accelerating growth. Consumer behavior is shifting toward more energy-efficient and sustainable housing options.

The forecast period (2025-2033) projects continued growth, with a projected CAGR of xx%, reaching xx million units by 2033. This growth is attributed to ongoing demand, increasing affordability initiatives, and technological advancements.

Dominant Regions, Countries, or Segments in United States Manufactured Homes Market

The South region of the United States currently dominates the manufactured homes market, accounting for xx% of total sales in 2025. This dominance is driven by lower land costs, favorable regulatory environments, and a higher concentration of manufacturers. The single-family segment represents the largest portion of the market, holding xx% market share.

- Key Drivers for Southern Dominance:

- Lower land prices compared to other regions.

- Pro-growth housing policies at the state and local level.

- Established manufacturing infrastructure.

- Single-Family Segment Dominance:

- Higher affordability compared to multi-family units.

- Strong demand among first-time homebuyers.

- Wider range of design options and customizations available.

- Growth Potential: While the South currently leads, other regions demonstrate growth potential, particularly those experiencing population growth and housing shortages.

United States Manufactured Homes Market Product Landscape

Manufactured homes are evolving beyond traditional designs, incorporating modern aesthetics, energy-efficient features, and smart home technologies. Increased use of sustainable materials and improved insulation further enhance their appeal. Unique selling propositions focus on affordability, customization options, and faster construction times. Technological advancements include prefabrication and modular construction, improving efficiency and reducing construction costs.

Key Drivers, Barriers & Challenges in United States Manufactured Homes Market

Key Drivers:

- Affordability: Manufactured homes offer a more affordable housing option compared to site-built homes.

- Shorter Construction Times: Faster construction leads to quicker occupancy and reduced development costs.

- Technological Advancements: Innovations in materials, design, and manufacturing processes enhance quality and efficiency.

Challenges:

- Supply Chain Disruptions: Fluctuations in material costs and availability impact production and pricing. The impact is estimated at xx% increase in construction costs in 2024.

- Regulatory Hurdles: Building codes and zoning regulations can create barriers to entry and expansion.

- Negative Perceptions: Some consumers hold negative perceptions about the quality and durability of manufactured homes.

Emerging Opportunities in United States Manufactured Homes Market

- Growth in Rural Areas: Expanding into underserved rural markets offers significant potential.

- Sustainable and Green Building: Adopting eco-friendly materials and energy-efficient designs increases appeal.

- Smart Home Integration: Integrating smart home technologies enhances functionality and convenience.

Growth Accelerators in the United States Manufactured Homes Market Industry

Technological breakthroughs in modular construction and sustainable materials are key accelerators. Strategic partnerships between manufacturers, developers, and retailers expand market reach. Expansion into new geographic markets and a focus on diverse housing options further fuel growth.

Key Players Shaping the United States Manufactured Homes Market Market

- Morton Buildings Inc

- The High Construction Company

- Homette Corporation

- SG Modular

- Plant Prefab

- Skyline Champion Corporation

- Westchester Modular Homes Inc

- Varco Pruden

- Affinity Building Systems

- Z Modular

Notable Milestones in United States Manufactured Homes Market Sector

- July 2022: Skyline Champion Corporation expands its retail presence through Factory Expo Home Centers situated at 12 manufacturing plants.

- May 2022: Champion Home Builders acquires Manis Custom Builders, expanding its production capacity and retail footprint in North Carolina.

In-Depth United States Manufactured Homes Market Market Outlook

The US manufactured homes market is poised for continued growth, driven by strong underlying demand, technological advancements, and strategic initiatives by key players. Opportunities exist in expanding market segments, focusing on sustainable building practices, and leveraging technological innovations to enhance product offerings and improve efficiency. The long-term outlook remains positive, with significant potential for expansion and market share gains.

United States Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

United States Manufactured Homes Market Segmentation By Geography

- 1. United States

United States Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for prefab buildings; Surge in demand from residential segment

- 3.3. Market Restrains

- 3.3.1. Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas

- 3.4. Market Trends

- 3.4.1. States in the US Spending the Most on Manufactured Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. South America United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Morton Buildings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The High Construction Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Homette Corporation **List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SG Modular

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Plant Prefab

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Skyline Champion Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Westchester Modular Homes Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Varco Pruden

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Affinity Building Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Z Modular

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Morton Buildings Inc

List of Figures

- Figure 1: United States Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: United States Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Manufactured Homes Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the United States Manufactured Homes Market?

Key companies in the market include Morton Buildings Inc, The High Construction Company, Homette Corporation **List Not Exhaustive, SG Modular, Plant Prefab, Skyline Champion Corporation, Westchester Modular Homes Inc, Varco Pruden, Affinity Building Systems, Z Modular.

3. What are the main segments of the United States Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for prefab buildings; Surge in demand from residential segment.

6. What are the notable trends driving market growth?

States in the US Spending the Most on Manufactured Housing.

7. Are there any restraints impacting market growth?

Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas.

8. Can you provide examples of recent developments in the market?

July 2022: The Factory Expo Home Centers are situated at 12 Skyline Champion manufacturing plants around the United States. Champion Retail Housing, a subsidiary of Skyline Champion Corporation, agreed with Alta Cima Corporation to purchase the assets and take over the management of the Factory Expo Home Centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the United States Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence