Key Insights

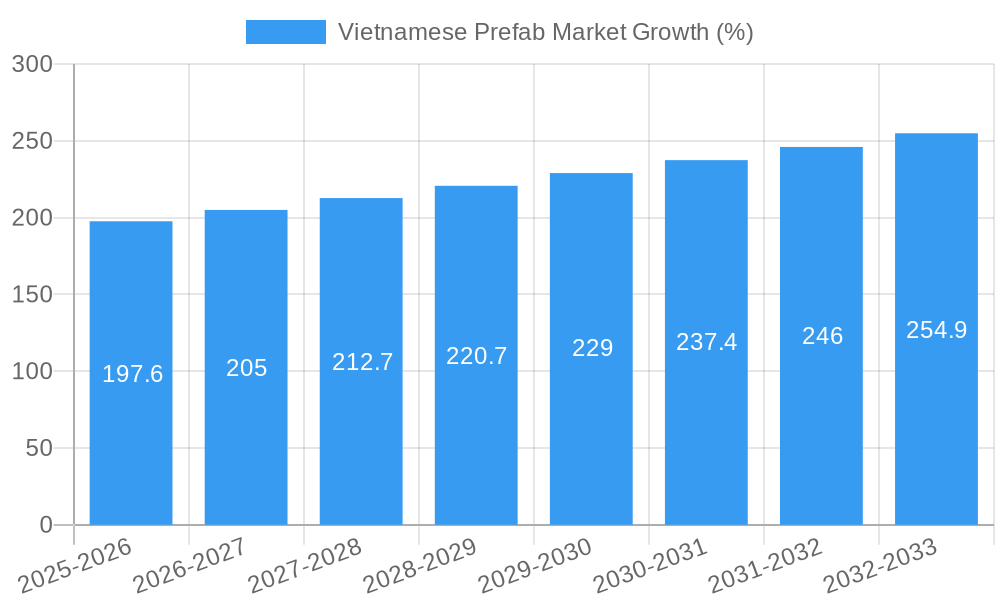

The Vietnamese prefabricated building market, valued at $4.89 billion in 2025, is projected to experience robust growth, driven by several key factors. Rapid urbanization, increasing infrastructure development, and a growing need for affordable and efficient housing solutions are fueling demand for prefabricated structures. The preference for faster construction timelines, reduced labor costs, and improved building quality compared to traditional methods further contributes to market expansion. Concrete and steel remain dominant material types, catering to both residential and commercial applications. However, increasing environmental concerns are driving interest in sustainable materials like timber and other eco-friendly options, representing a significant growth opportunity within the market. While challenges such as regulatory hurdles and a need for skilled labor exist, the overall market outlook remains positive. The diverse range of companies operating in this sector, including both domestic and international players, indicates a competitive landscape with scope for further consolidation and technological advancements. This competitive environment fosters innovation, which in turn drives the market's dynamism. The projected Compound Annual Growth Rate (CAGR) of 4.00% over the forecast period (2025-2033) indicates sustained market expansion, with significant potential for growth in both urban and rural areas as government initiatives aimed at improving housing and infrastructure gather momentum.

The segment breakdown reveals a strong preference for concrete and steel materials across various applications, suggesting that continued investment in these sectors will play a crucial role in future growth. However, the "Other Material Types" segment, which encompasses sustainable and innovative materials, shows promising potential, particularly considering the rising awareness of environmental sustainability in construction. Further expansion is expected across all application segments – residential, commercial, and industrial – creating diverse opportunities for market players. Government policies promoting sustainable development and infrastructure projects will play a significant role in shaping the market's trajectory in the coming years. The presence of both established and emerging companies within the market indicates a thriving and competitive environment poised for continued expansion. The market's future success will hinge on technological innovation, sustainable material adoption, and skillful navigation of regulatory landscapes.

This comprehensive report provides an in-depth analysis of the Vietnamese prefabricated building market, encompassing market size, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. It segments the market by material type (concrete, glass, metal, timber, other) and application (residential, commercial, industrial, institutional, infrastructure). This crucial analysis will equip industry professionals and investors with actionable insights to navigate the dynamic Vietnamese prefab market.

Vietnamese Prefab Market Dynamics & Structure

The Vietnamese prefabricated building market is experiencing significant growth, driven by increasing urbanization, infrastructure development, and government initiatives promoting sustainable construction. Market concentration is moderate, with a mix of large multinational companies and local players. Technological innovation, particularly in modular construction and sustainable materials, is a key driver. The regulatory framework is evolving, aiming to streamline the adoption of prefabricated buildings. Competitive substitutes include traditional construction methods, though prefab's cost-effectiveness and speed are increasingly appealing. End-user demographics show strong demand from both residential and commercial sectors. M&A activity is expected to increase as larger companies seek to expand their market share.

- Market Concentration: Moderate, with both large and small players. xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on modular design, sustainable materials (e.g., timber, recycled materials), and smart building technologies.

- Regulatory Framework: Government support for sustainable construction is driving positive regulatory changes, though some streamlining is still needed.

- Competitive Substitutes: Traditional construction methods pose competition, but prefab's speed and efficiency offer a compelling alternative.

- End-User Demographics: Strong growth in both residential and commercial sectors, with expanding demand from industrial and infrastructure projects.

- M&A Trends: A predicted xx M&A deals in the prefab sector are expected between 2025 and 2033, driven by consolidation and expansion strategies.

Vietnamese Prefab Market Growth Trends & Insights

The Vietnamese prefabricated building market is projected to experience robust growth over the forecast period (2025-2033). Driven by factors such as rapid urbanization, increasing disposable incomes, and government initiatives promoting affordable housing, the market is expected to witness a significant expansion in both the residential and commercial sectors. Technological advancements in prefabrication, such as the adoption of Building Information Modeling (BIM) and 3D printing, further contribute to increased efficiency and reduced construction times, boosting market adoption. Consumer behavior is shifting towards eco-friendly and cost-effective housing solutions, making prefabricated buildings an attractive option. The market’s Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period, with market penetration expected to reach xx% by 2033. Increased adoption of sustainable materials and government incentives are key drivers for this growth.

Dominant Regions, Countries, or Segments in Vietnamese Prefab Market

The metal segment dominates the Vietnamese prefab market in terms of material type due to its versatility, durability, and cost-effectiveness. The residential sector holds the largest share of the application segment, driven by the rising demand for affordable housing. Ho Chi Minh City and Hanoi are the leading regions, attracting substantial investments in infrastructure and real estate development.

- Material Type: Metal (xx% market share) due to its versatility and cost-effectiveness.

- Application: Residential (xx% market share) due to high demand for affordable and efficient housing.

- Regions: Ho Chi Minh City and Hanoi, benefiting from robust infrastructure development and real estate investments.

- Key Drivers: Government initiatives for affordable housing, infrastructure development projects, and rising urbanization.

Vietnamese Prefab Market Product Landscape

The Vietnamese prefab market showcases a diverse range of products, from basic modular units to sophisticated, customized designs incorporating smart home technologies. Innovation focuses on enhancing design flexibility, improving energy efficiency, and incorporating sustainable materials. Products are differentiated through unique selling propositions such as faster construction times, reduced waste, and improved durability. Technological advancements include modular construction techniques, prefabricated components with integrated utilities, and 3D-printed building elements.

Key Drivers, Barriers & Challenges in Vietnamese Prefab Market

Key Drivers:

- Government initiatives: Policies supporting affordable housing and sustainable construction are accelerating market growth.

- Rapid urbanization: The increasing population in urban centers fuels the demand for efficient and cost-effective housing solutions.

- Infrastructure development: Large-scale infrastructure projects require efficient construction methods, benefiting the prefab market.

Key Challenges:

- Supply chain issues: Potential disruptions in the supply of materials can impact project timelines and costs. This is estimated to impact project completion times by xx% in 2025.

- Regulatory hurdles: While improving, regulatory frameworks still need streamlining to fully support the widespread adoption of prefab construction.

- Competitive pressures: Competition from traditional construction methods remains a challenge, requiring constant innovation and cost optimization.

Emerging Opportunities in Vietnamese Prefab Market

Untapped markets in rural areas and the growing demand for eco-friendly housing present significant opportunities. Innovative applications in commercial and industrial sectors are also expected to drive market growth. Evolving consumer preferences towards customized and sustainable building solutions offer further avenues for expansion. The integration of smart home technologies and renewable energy sources offers high potential for innovation.

Growth Accelerators in the Vietnamese Prefab Market Industry

Technological advancements, strategic partnerships between prefab manufacturers and developers, and expansion into new markets will significantly accelerate market growth. Government support for sustainable construction and investment in infrastructure projects further enhance the long-term outlook. Innovation in material science and construction techniques will play a critical role in driving efficiency and cost reduction.

Key Players Shaping the Vietnamese Prefab Market Market

- TLC Modular

- Lien Son Thang Long Joint Stock Company

- TDH Green Building Solution Co Ltd

- DTH Prefab

- VMSteel Joint Stock Company

- Best Metal Building and Accessory Joint Stock Company

- Tran Duc Joint Stock Company

- Dai Dung Corporation Group

- Seico Steel Building Construction Joint Stock Company

- Quick Smart House

- Zamil Steel Buildings Vietnam Co Ltd

- Diamond Development Group

- QH Plus Phu My Co Ltd

Notable Milestones in Vietnamese Prefab Market Sector

- September 2022: Lotte Group's groundbreaking ceremony for Lotte Eco Smart City Thu Thiem, a USD 900 million investment showcasing the potential of prefab in large-scale projects.

- November 2022: QH Plus's handover of the Sun Signature Show project, highlighting advancements in vortex technology and prefab construction techniques.

In-Depth Vietnamese Prefab Market Market Outlook

The Vietnamese prefab market holds immense potential for future growth, driven by continued urbanization, infrastructure investments, and government support for sustainable construction. Strategic partnerships, technological innovation, and the expansion into new market segments will create significant opportunities for market players. The market is projected to experience sustained growth, with increasing adoption of prefab construction across various sectors.

Vietnamese Prefab Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Vietnamese Prefab Market Segmentation By Geography

- 1. Vietnam

Vietnamese Prefab Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Government Policies Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnamese Prefab Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TLC Modular

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lien Son Thang Long Joint Stock Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TDH Green Building Solution Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DTH Prefab

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 VMSteel Joint Stock Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Best Metal Building and Accessory Joint Stock Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tran Duc Joint Stock Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dai Dung Corporation Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Seico Steel Building Construction Joint Stock Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Quick Smart House

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Zamil Steel Buildings Vietnam Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Diamond Development Group**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Qh Plus Phu My Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 TLC Modular

List of Figures

- Figure 1: Vietnamese Prefab Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnamese Prefab Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnamese Prefab Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnamese Prefab Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Vietnamese Prefab Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Vietnamese Prefab Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnamese Prefab Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnamese Prefab Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Vietnamese Prefab Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Vietnamese Prefab Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnamese Prefab Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Vietnamese Prefab Market?

Key companies in the market include TLC Modular, Lien Son Thang Long Joint Stock Company, TDH Green Building Solution Co Ltd, DTH Prefab, VMSteel Joint Stock Company, Best Metal Building and Accessory Joint Stock Company, Tran Duc Joint Stock Company, Dai Dung Corporation Group, Seico Steel Building Construction Joint Stock Company, Quick Smart House, Zamil Steel Buildings Vietnam Co Ltd, Diamond Development Group**List Not Exhaustive, Qh Plus Phu My Co Ltd.

3. What are the main segments of the Vietnamese Prefab Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Government Policies Boosting the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

November 2022: QH plus handover sun signature show project & the two parts of the kissing bridge have been connected. With Sun Signature Show, where vortex technologies have been applied for a very attractive show, the installation of 3 orbits has been finished and handover to the investor for further progress.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnamese Prefab Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnamese Prefab Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnamese Prefab Market?

To stay informed about further developments, trends, and reports in the Vietnamese Prefab Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence