Key Insights

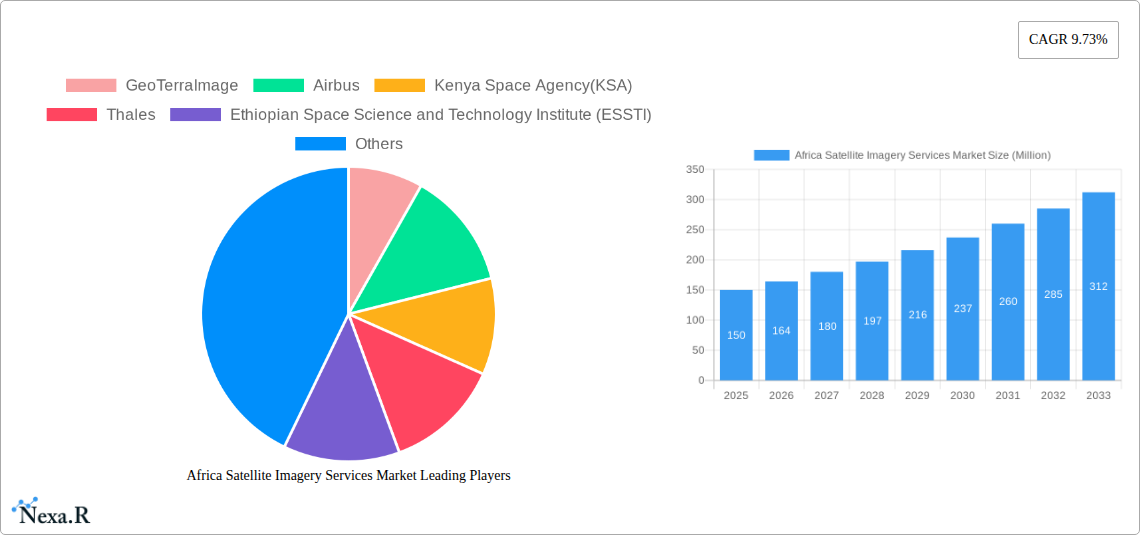

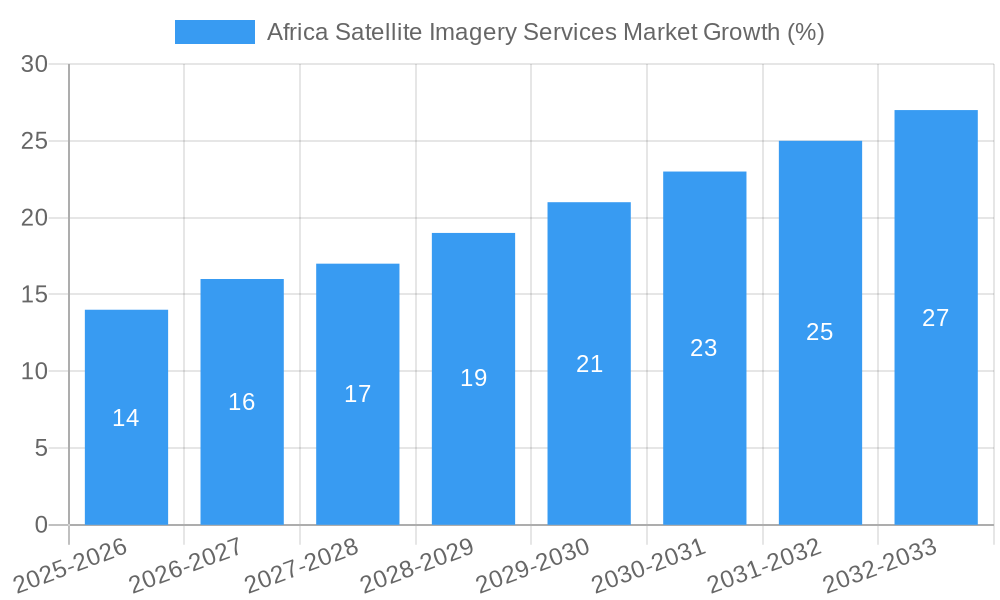

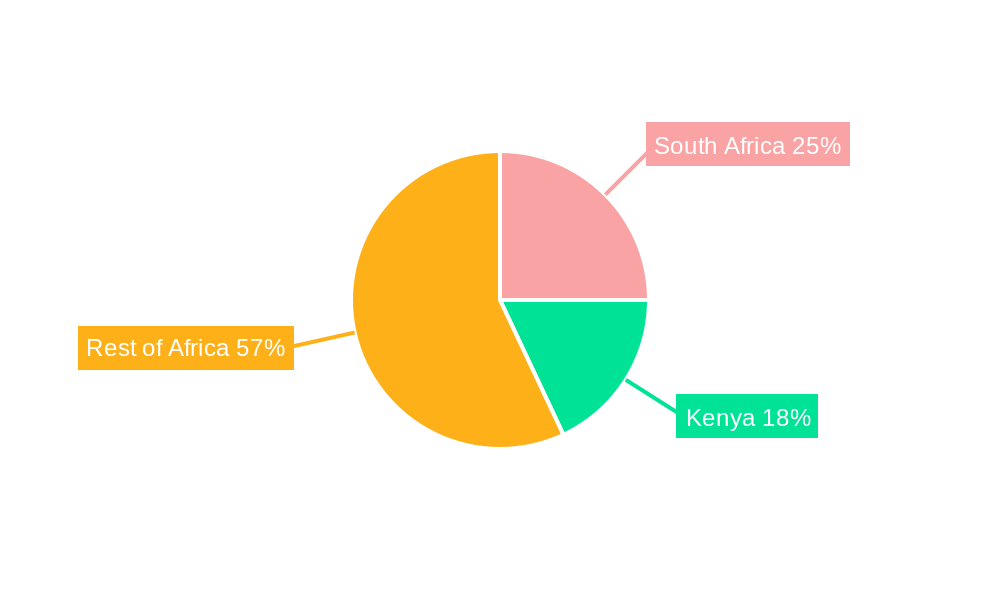

The Africa Satellite Imagery Services market is experiencing robust growth, projected to reach a substantial market size with a Compound Annual Growth Rate (CAGR) of 9.73% between 2025 and 2033. This expansion is driven by several key factors. Firstly, increasing government investments in infrastructure development and modernization across various sectors, particularly in agriculture, defense, and environmental monitoring, are fueling demand for high-resolution satellite imagery. Secondly, the rising adoption of cloud-based solutions for data storage and processing is improving accessibility and cost-effectiveness, particularly for Small and Medium Enterprises (SMEs). Furthermore, the burgeoning technological advancements in imagery and video analytics are enabling more sophisticated applications, leading to improved accuracy and efficiency in various sectors. The market is segmented by type (imagery and video analytics), deployment mode (on-premise and cloud), organization size (SMEs and large enterprises), and verticals (insurance, agriculture, defense & security, environmental monitoring, engineering & construction, and government). South Africa, Kenya, and other key African nations are leading the market, showcasing a strong potential for further expansion.

The competitive landscape is characterized by a mix of international giants like Airbus and Thales, alongside regional players such as the Kenya Space Agency (KSA) and the South African National Space Agency (SANSA). These companies are actively investing in R&D to enhance their offerings and cater to the growing demand for advanced analytics and customized solutions. However, challenges such as limited internet infrastructure in certain regions and the high cost of satellite imagery services, especially for SMEs, pose potential restraints to market growth. Despite these challenges, the long-term outlook remains positive, propelled by continuous technological improvements, rising government support, and the increasing awareness of the benefits of satellite imagery across diverse applications. Strategic partnerships and collaborations are expected to play a crucial role in mitigating the restraints and accelerating the market's growth trajectory.

Africa Satellite Imagery Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Africa Satellite Imagery Services Market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The market is segmented by type (Imagery Analytics, Video Analytics), deployment mode (On-Premise, Cloud), organization size (SMEs, Large Enterprises), and verticals (Insurance, Agriculture, Defense & Security, Environmental Monitoring, Engineering & Construction, Government, Others). The market size is projected to reach xx Million by 2033.

Africa Satellite Imagery Services Market Market Dynamics & Structure

The Africa Satellite Imagery Services market is characterized by a moderately concentrated landscape, with key players like Airbus, GeoApps Plus, and SANSA (South African National Space Agency) competing alongside emerging regional players such as Astrofica and the Ethiopian Space Science and Technology Institute (ESSTI). Market concentration is expected to shift slightly towards consolidation over the forecast period, with larger players acquiring smaller companies to expand their service portfolios. Technological innovation, particularly in AI-powered analytics and higher-resolution imagery, is a major driver. However, regulatory frameworks regarding data privacy and access vary across African nations, posing a barrier to seamless market expansion. Substitute technologies, such as drone imagery, offer competition but often lack the spatial coverage and consistency of satellite imagery.

- Market Concentration: Moderately concentrated, with a xx% market share held by the top 5 players in 2025.

- Technological Innovation: Driven by advancements in AI-powered analytics, improved sensor technologies, and higher resolution capabilities.

- Regulatory Framework: Varies significantly across countries, affecting data access and usage.

- Competitive Substitutes: Drone imagery and aerial photography present some level of competition.

- M&A Activity: An average of xx M&A deals per year are expected during the forecast period.

- End-User Demographics: Growing adoption across government, agriculture, and defense sectors.

Africa Satellite Imagery Services Market Growth Trends & Insights

The Africa Satellite Imagery Services market witnessed robust growth during the historical period (2019-2024), expanding at a CAGR of xx%. This growth is fueled by increasing government investments in infrastructure development, rising demand for precision agriculture solutions, and the growing adoption of satellite imagery in disaster response and environmental monitoring. The market is expected to continue this upward trajectory, projected to reach xx Million by 2033, with a CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in high-resolution imagery and AI-driven analytics, are significantly impacting market adoption rates. Consumer behavior is shifting towards cloud-based solutions due to their scalability and cost-effectiveness. The increasing availability of affordable internet connectivity across the continent is also accelerating market growth.

Dominant Regions, Countries, or Segments in Africa Satellite Imagery Services Market

The South African market currently holds the largest market share, driven by a well-established space agency (SANSA) and a relatively advanced technological infrastructure. However, significant growth potential exists in rapidly developing economies like Kenya, Nigeria, and Ethiopia. In terms of segments, the Imagery Analytics segment dominates, accounting for xx% of the market in 2025, followed by Video Analytics at xx%. The Cloud deployment mode is experiencing faster adoption rates compared to On-Premise solutions. Large Enterprises currently account for the largest share of the market due to their higher budgets and sophisticated data analysis capabilities. Key vertical segments include Agriculture (xx% market share), Defense and Security (xx%), and Government (xx%).

- Key Drivers: Increased government spending on infrastructure, rising adoption in agriculture for precision farming, and growing demand from the defense and security sectors.

- Dominance Factors: South Africa's established space program, presence of major players, and better infrastructure.

- Growth Potential: High growth potential in East and West Africa due to increasing infrastructure investments and adoption of geospatial technology.

Africa Satellite Imagery Services Market Product Landscape

The Africa Satellite Imagery Services market offers a wide range of products, including high-resolution optical and SAR imagery, aerial photography, and advanced analytics solutions. Recent product innovations focus on delivering high-quality data with improved accuracy and resolution. Key features include cloud-based platforms for data accessibility, AI-powered analytics for efficient processing and interpretation, and specialized solutions tailored to the specific needs of different sectors. Unique selling propositions include the ability to provide up-to-date information, monitor large areas, and analyze trends over time.

Key Drivers, Barriers & Challenges in Africa Satellite Imagery Services Market

Key Drivers: Increased government investments in infrastructure projects, the rising demand for precision agriculture, growing awareness of satellite imagery applications in disaster management and environmental monitoring, and the expansion of high-speed internet access across the continent.

Key Challenges: High initial investment costs for satellite technology and associated infrastructure, limited skilled workforce in geospatial analysis, inconsistent regulatory frameworks across different countries, data security and privacy concerns, and competition from alternative technologies like drone-based imagery. These challenges are estimated to reduce the market growth by approximately xx% annually.

Emerging Opportunities in Africa Satellite Imagery Services Market

The market presents significant untapped potential in underserved regions, particularly within the agricultural and infrastructure development sectors. Emerging opportunities include leveraging satellite imagery for climate change monitoring, urban planning, and wildlife conservation. Increased adoption of cloud-based services, and the development of mobile applications for easier data access and analysis, are expected to create new growth opportunities.

Growth Accelerators in the Africa Satellite Imagery Services Market Industry

Technological advancements, particularly in higher-resolution imagery and AI-powered analytics, are driving market growth. Strategic partnerships between international space agencies, local companies, and government institutions are accelerating market expansion. The increasing availability of affordable internet connectivity across the continent is also a crucial catalyst. Efforts to develop local expertise in geospatial technology through educational programs and skill-building initiatives are further fueling market growth.

Key Players Shaping the Africa Satellite Imagery Services Market Market

- GeoTerraImage

- Airbus

- Kenya Space Agency (KSA)

- Thales

- Ethiopian Space Science and Technology Institute (ESSTI)

- Astrofica

- NASRDA (National Space Research and Development Agency)

- GeoApps Plus

- SANSA (South African National Space Agency)

Notable Milestones in Africa Satellite Imagery Services Market Sector

- September 2023: European Space Imaging (EUSI) partners with Umbra, expanding access to high-resolution optical and SAR imagery across Europe and North Africa. This partnership significantly improves data availability and resolution, boosting the market's capabilities.

In-Depth Africa Satellite Imagery Services Market Market Outlook

The Africa Satellite Imagery Services market is poised for continued strong growth, driven by technological advancements, increasing government investment, and rising demand across various sectors. Strategic partnerships, investments in infrastructure, and the development of local expertise will be crucial factors in shaping the future of this dynamic market. The market's expansion into new applications and regions presents significant opportunities for both established players and new entrants. The focus on providing affordable and accessible solutions will be key to unlocking the market's full potential.

Africa Satellite Imagery Services Market Segmentation

-

1. Type

- 1.1. Imagery Analytics

- 1.2. Video Analytics

-

2. Deployment Mode

- 2.1. On Premise

- 2.2. Cloud

-

3. Organization Size

- 3.1. SMEs

- 3.2. Large Enterprises

-

4. Vericals

- 4.1. Insurance

- 4.2. Agriculture

- 4.3. Defense and Security

- 4.4. Environmental Monitoring

- 4.5. Engineeting & Construction

- 4.6. Government

- 4.7. Others

Africa Satellite Imagery Services Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Government Initiatives and Substantial Investments to Drive the Market Growth; Adoption of Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. Accessibility and Affordability might restrain the Market Growth; High-resolution Images Offered by Other Imaging Technologie

- 3.4. Market Trends

- 3.4.1. Natural Resource Management to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Imagery Analytics

- 5.1.2. Video Analytics

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Vericals

- 5.4.1. Insurance

- 5.4.2. Agriculture

- 5.4.3. Defense and Security

- 5.4.4. Environmental Monitoring

- 5.4.5. Engineeting & Construction

- 5.4.6. Government

- 5.4.7. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 GeoTerraImage

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Airbus

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kenya Space Agency(KSA)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Thales

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ethiopian Space Science and Technology Institute (ESSTI)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Astrofica

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NASRDA (National Space Research and Development Agency)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 GeoApps Plus

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SANSA (South African National Space Agency)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 GeoTerraImage

List of Figures

- Figure 1: Africa Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Satellite Imagery Services Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Africa Satellite Imagery Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Africa Satellite Imagery Services Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 6: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 7: Africa Satellite Imagery Services Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 8: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Organization Size 2019 & 2032

- Table 9: Africa Satellite Imagery Services Market Revenue Million Forecast, by Vericals 2019 & 2032

- Table 10: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Vericals 2019 & 2032

- Table 11: Africa Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Africa Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: South Africa Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Sudan Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Sudan Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Uganda Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Uganda Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Tanzania Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Kenya Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Africa Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Africa Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Africa Satellite Imagery Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 29: Africa Satellite Imagery Services Market Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 30: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Deployment Mode 2019 & 2032

- Table 31: Africa Satellite Imagery Services Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 32: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Organization Size 2019 & 2032

- Table 33: Africa Satellite Imagery Services Market Revenue Million Forecast, by Vericals 2019 & 2032

- Table 34: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Vericals 2019 & 2032

- Table 35: Africa Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Africa Satellite Imagery Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Nigeria Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Nigeria Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: South Africa Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Africa Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Egypt Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Egypt Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Kenya Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Kenya Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Ethiopia Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Ethiopia Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Morocco Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Morocco Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Ghana Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Ghana Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Algeria Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Algeria Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Tanzania Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Tanzania Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Ivory Coast Africa Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Ivory Coast Africa Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Satellite Imagery Services Market?

The projected CAGR is approximately 9.73%.

2. Which companies are prominent players in the Africa Satellite Imagery Services Market?

Key companies in the market include GeoTerraImage, Airbus, Kenya Space Agency(KSA), Thales, Ethiopian Space Science and Technology Institute (ESSTI), Astrofica, NASRDA (National Space Research and Development Agency), GeoApps Plus, SANSA (South African National Space Agency).

3. What are the main segments of the Africa Satellite Imagery Services Market?

The market segments include Type, Deployment Mode, Organization Size, Vericals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strategic Government Initiatives and Substantial Investments to Drive the Market Growth; Adoption of Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

Natural Resource Management to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Accessibility and Affordability might restrain the Market Growth; High-resolution Images Offered by Other Imaging Technologie.

8. Can you provide examples of recent developments in the market?

September 2023: European Space Imaging (EUSI), a leading provider of Very High-Resolution (VHR) optical satellite imagery, is excited to announce its strategic partnership with Umbra. This collaboration enables EUSI's customers to effortlessly procure Umbra's top-tier Synthetic Aperture Radar (SAR) data directly through EUSI's platform. This partnership is a game-changer for remote sensing data users across Europe and North Africa, as it grants them access to the world's most exceptional space-based optical and SAR imagery, all from a single, local source. These images boast impressive resolutions of 30 and 25 centimeters, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Satellite Imagery Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Satellite Imagery Services Market?

To stay informed about further developments, trends, and reports in the Africa Satellite Imagery Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence