Key Insights

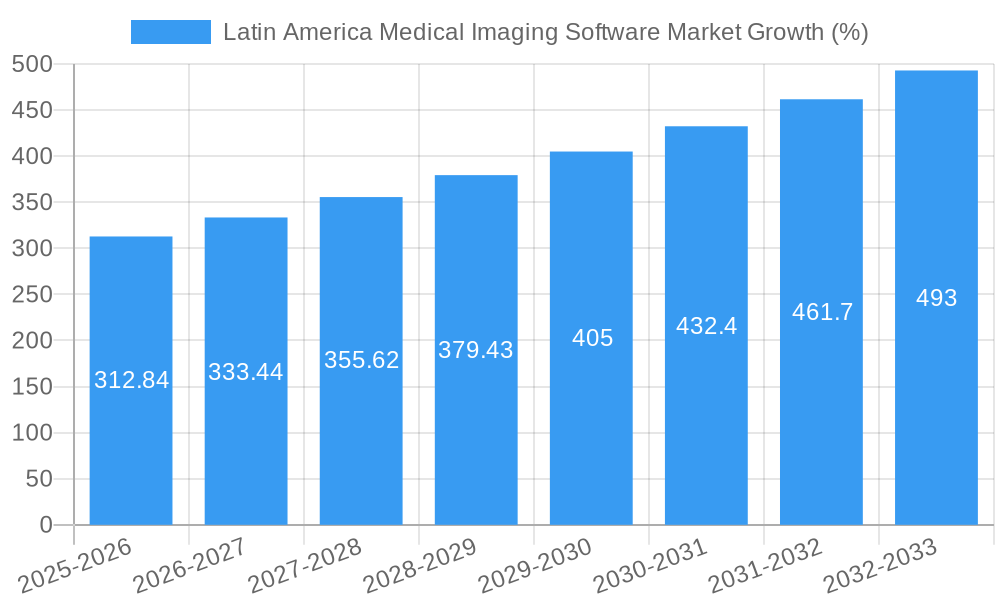

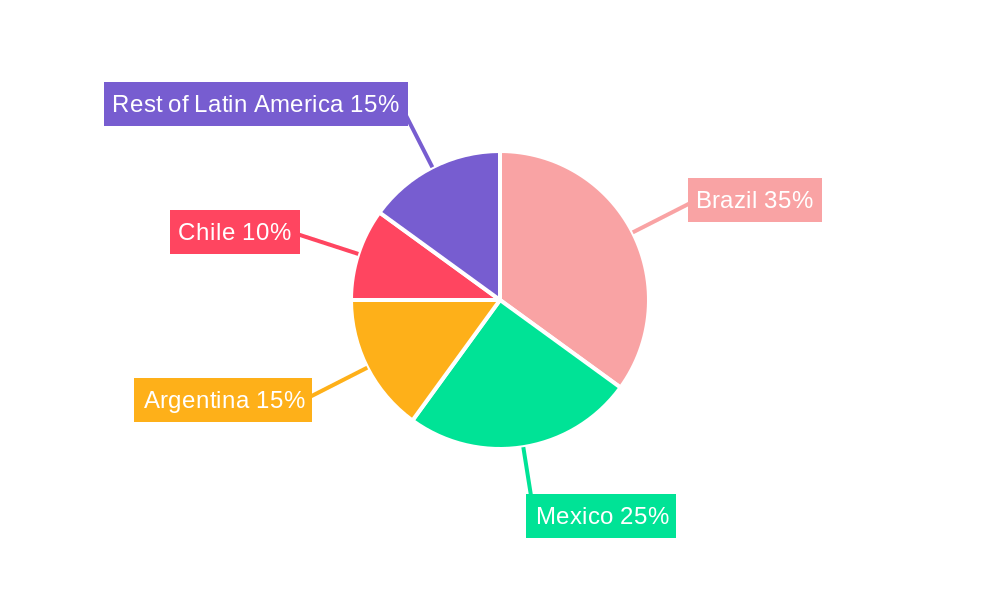

The Latin American medical imaging software market, valued at $4.94 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.26% from 2025 to 2033. This expansion is fueled by several key factors. Increasing prevalence of chronic diseases like cardiovascular ailments and cancer necessitates advanced diagnostic tools, boosting demand for sophisticated medical imaging software. Furthermore, government initiatives focused on improving healthcare infrastructure and increasing healthcare access across the region are significantly contributing to market growth. The rising adoption of telehealth and remote patient monitoring solutions further accelerates software adoption, enabling efficient diagnosis and treatment across geographically dispersed populations. Technological advancements, including the development of AI-powered image analysis and cloud-based solutions, are also improving diagnostic accuracy and operational efficiency, contributing to market expansion. Specific application areas like cardiology, orthopedics, and oncology are experiencing particularly strong growth due to their reliance on precise and timely image interpretation. Brazil, Mexico, and Argentina represent the largest national markets within the region, driven by a combination of higher population densities, improved healthcare spending, and robust private healthcare sectors.

Segmentation analysis reveals a strong preference for 2D and 3D imaging software, with a gradual but steady shift towards 4D imaging as technology matures and adoption costs decrease. However, market penetration of advanced imaging modalities remains limited in some areas due to affordability concerns and the need for specialized training. Despite significant growth potential, the market faces challenges including limited healthcare budgets in certain countries, uneven distribution of healthcare resources, and a potential shortage of trained professionals to effectively utilize and interpret complex imaging data. Nonetheless, the overall outlook for the Latin American medical imaging software market remains positive, with considerable opportunities for growth in the coming years, especially with increasing investments in digital healthcare transformation.

Latin America Medical Imaging Software Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America Medical Imaging Software market, covering market dynamics, growth trends, dominant segments, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The market is segmented by imaging type (2D, 3D, 4D), application (dental, orthopedic, cardiology, obstetrics & gynecology, mammography, urology & nephrology, others), and country (Brazil, Argentina, Mexico, Chile, Rest of Latin America). The total market size is expected to reach xx Million by 2033.

Latin America Medical Imaging Software Market Dynamics & Structure

The Latin American medical imaging software market is characterized by a moderately concentrated landscape, with key players like Sectra AB, Esaote SpA, Siemens Healthcare, GE Healthcare, and Philips Healthcare holding significant market share. Technological innovation, driven by AI and machine learning, is a primary growth driver. However, regulatory hurdles and varying levels of healthcare infrastructure across the region pose challenges. The market is witnessing increased mergers and acquisitions (M&A) activity, with approximately xx M&A deals recorded in the last 5 years, reflecting consolidation and strategic expansion efforts.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: AI-powered image analysis, cloud-based solutions, and advanced visualization techniques are key drivers.

- Regulatory Framework: Varying regulations across countries impact market penetration and adoption rates.

- Competitive Substitutes: Limited direct substitutes, but alternative diagnostic methods pose indirect competition.

- End-User Demographics: Growth fueled by increasing prevalence of chronic diseases, aging population, and rising healthcare expenditure.

- M&A Trends: Consolidation expected to continue, driven by strategic acquisitions and expansion into new markets.

Latin America Medical Imaging Software Market Growth Trends & Insights

The Latin American medical imaging software market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue during the forecast period (2025-2033), driven by factors such as increasing adoption of advanced imaging technologies, rising investments in healthcare infrastructure, and growing demand for efficient diagnostic solutions. Market penetration is expected to increase from xx% in 2025 to xx% by 2033. Technological disruptions, particularly the integration of AI and cloud computing, are transforming the market landscape, enhancing image analysis capabilities and improving workflow efficiency. Shifting consumer behavior towards digital health solutions and telehealth further contributes to the market's expansion. The market size is expected to reach xx Million in 2025 and xx Million by 2033.

Dominant Regions, Countries, or Segments in Latin America Medical Imaging Software Market

Brazil holds the largest market share in Latin America, driven by its robust healthcare infrastructure, higher disease prevalence, and significant government investments in healthcare technology. Mexico and Argentina follow as key markets, experiencing substantial growth due to increasing adoption of advanced imaging technologies. Within application segments, cardiology, radiology, and oncology applications are witnessing the highest demand due to their critical role in diagnosis and treatment planning. 2D imaging continues to dominate the market, but 3D and 4D imaging segments are rapidly growing due to their advanced diagnostic capabilities.

- Brazil: Largest market share, driven by strong healthcare infrastructure and government initiatives.

- Mexico & Argentina: Significant growth potential fueled by rising healthcare expenditure and increasing adoption of advanced technologies.

- Cardiology, Oncology, and Radiology Applications: Highest demand due to critical role in diagnosis and treatment planning.

- 2D Imaging: Dominant segment, with 3D and 4D imaging segments exhibiting strong growth.

Latin America Medical Imaging Software Market Product Landscape

The market offers a wide range of software solutions, including image acquisition, processing, analysis, and storage systems. Innovation is focused on enhancing image quality, improving diagnostic accuracy, and streamlining workflows through AI-powered tools, cloud-based platforms, and advanced visualization techniques. Unique selling propositions include improved diagnostic accuracy, reduced turnaround time, and enhanced collaboration capabilities. The focus is on integrating AI and machine learning to automate image analysis, improving efficiency and assisting in early disease detection.

Key Drivers, Barriers & Challenges in Latin America Medical Imaging Software Market

Key Drivers: Increasing prevalence of chronic diseases, government initiatives to improve healthcare infrastructure, rising investments in healthcare technology, and growing demand for efficient diagnostic solutions. The integration of AI and machine learning is a significant driver of innovation.

Challenges: High initial investment costs, limited healthcare infrastructure in certain regions, lack of skilled professionals, and regulatory complexities hinder market growth. Data security and privacy concerns also pose challenges. Approximately xx% of healthcare facilities lack access to high-speed internet, impacting the adoption of cloud-based solutions.

Emerging Opportunities in Latin America Medical Imaging Software Market

Untapped markets in rural areas present significant growth opportunities. The increasing adoption of telehealth and mobile health solutions creates avenues for innovative applications and remote diagnostic capabilities. Specialized software solutions for specific diseases and patient populations are gaining traction. The growing focus on preventive healthcare also fuels demand for screening and early detection tools.

Growth Accelerators in the Latin America Medical Imaging Software Market Industry

Technological advancements, strategic partnerships between software vendors and healthcare providers, and expansion into untapped markets are key growth catalysts. Government initiatives promoting digital health and investments in healthcare infrastructure further accelerate market expansion. The adoption of cloud-based solutions and AI-powered tools is reshaping the market landscape, creating new opportunities for growth.

Key Players Shaping the Latin America Medical Imaging Software Market Market

- Sectra AB

- Esaote SpA

- Siemens Healthcare

- GE Healthcare

- Philips Healthcare

- Agfa Gevaert HealthCare

- Carestream Health

- MIM Software Inc

- Canon Medical Systems Corporation

- Delft Imagin

Notable Milestones in Latin America Medical Imaging Software Market Sector

- June 2023: Hospital Israelita Albert Einstein in Sao Paulo, Brazil, partners with Lunit for AI-powered chest X-ray image processing. This highlights the growing adoption of AI in radiology.

- May 2023: Thermo Fisher Scientific and Pfizer collaborate to expand access to next-generation sequencing (NGS)-based cancer diagnostics in Latin America. This signifies the increasing focus on advanced genomic testing.

In-Depth Latin America Medical Imaging Software Market Outlook

The Latin American medical imaging software market is poised for sustained growth, driven by technological advancements, increasing healthcare investments, and expanding adoption of advanced imaging modalities. Strategic partnerships, focused on enhancing product offerings and expanding market reach, will play a pivotal role in shaping the future of this market. The integration of AI and cloud technologies will continue to transform the landscape, leading to more efficient and accurate diagnostic solutions. The market presents significant opportunities for growth, particularly in underserved regions and emerging applications.

Latin America Medical Imaging Software Market Segmentation

-

1. Imaging Type

- 1.1. 2D Imaging

- 1.2. 3D Imaging

- 1.3. 4D Imaging

-

2. Application

- 2.1. Dental Applications

- 2.2. Orthopaedic Applications

- 2.3. Cardiology Applications

- 2.4. Obstetrics and Gynaecology Applications

- 2.5. Mammography Applications

- 2.6. Urology and Nephrology Applications

- 2.7. Other Applications

Latin America Medical Imaging Software Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Medical Imaging Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases; Growing Application of Computer-Aided Diagnostic Methods

- 3.3. Market Restrains

- 3.3.1 High Set-up Cost of the Equipment; Limited Healthcare Infrastructure

- 3.3.2 Particularly in Rural and Remote Areas

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 5.1.1. 2D Imaging

- 5.1.2. 3D Imaging

- 5.1.3. 4D Imaging

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dental Applications

- 5.2.2. Orthopaedic Applications

- 5.2.3. Cardiology Applications

- 5.2.4. Obstetrics and Gynaecology Applications

- 5.2.5. Mammography Applications

- 5.2.6. Urology and Nephrology Applications

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 6. Brazil Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Sectra AB

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Esaote SpA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Siemens Healthcare

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 GE Healthcare

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Philips Healthcare

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Agfa Gevaert HealthCare

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Carestream Health

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 MIM Software Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Canon Medical Systems Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Delft Imagin

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Sectra AB

List of Figures

- Figure 1: Latin America Medical Imaging Software Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Medical Imaging Software Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Medical Imaging Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2019 & 2032

- Table 3: Latin America Medical Imaging Software Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Latin America Medical Imaging Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Medical Imaging Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2019 & 2032

- Table 13: Latin America Medical Imaging Software Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Latin America Medical Imaging Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Medical Imaging Software Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Latin America Medical Imaging Software Market?

Key companies in the market include Sectra AB, Esaote SpA, Siemens Healthcare, GE Healthcare, Philips Healthcare, Agfa Gevaert HealthCare, Carestream Health, MIM Software Inc, Canon Medical Systems Corporation, Delft Imagin.

3. What are the main segments of the Latin America Medical Imaging Software Market?

The market segments include Imaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases; Growing Application of Computer-Aided Diagnostic Methods.

6. What are the notable trends driving market growth?

Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Set-up Cost of the Equipment; Limited Healthcare Infrastructure. Particularly in Rural and Remote Areas.

8. Can you provide examples of recent developments in the market?

June 2023: The Hospital Israelita Albert Einstein in Sao Paulo, Brazil, and Lunit, a global supplier of AI-powered cancer treatments, have signed a software license deal. According to the agreement, Lunit will provide Hospital Israelita Albert Einstein for three years, or until 2025, with its artificial intelligence (AI) solution for chest x-ray image processing, Lunit INSIGHT CXR. The hospital intends to use Lunit's AI technology to screen chest X-ray images in its emergency room, intensive care unit, and during in-patient exams.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Medical Imaging Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Medical Imaging Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Medical Imaging Software Market?

To stay informed about further developments, trends, and reports in the Latin America Medical Imaging Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence