Key Insights

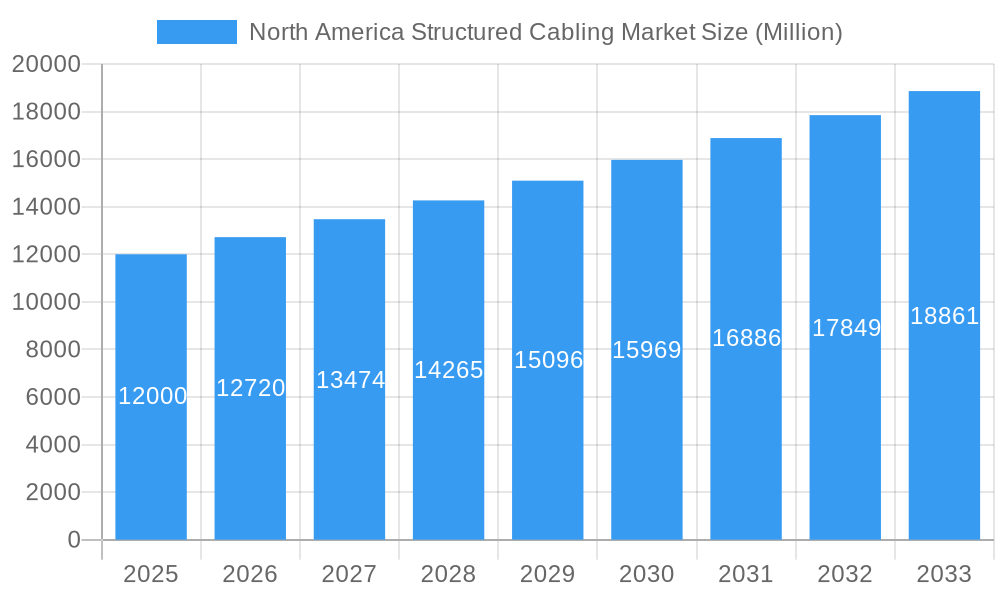

The North American structured cabling market is poised for significant expansion, propelled by the widespread adoption of advanced technologies such as cloud computing, the Internet of Things (IoT), and 5G networks. Across diverse sectors including healthcare, finance, and education, businesses are prioritizing robust network infrastructure upgrades to accommodate these innovations. The escalating demand for high-bandwidth, dependable, and scalable cabling solutions is a primary driver of market growth. This demand is amplified by the imperative for enhanced data security and superior network performance, particularly within data centers and enterprise environments. Projections indicate a consistent compound annual growth rate (CAGR) of 8.4% for the North American market, reflecting sustained investment in infrastructure modernization and digital transformation across the region. The proliferation of smart buildings and the sustained adoption of hybrid work models further contribute to this upward trajectory.

North America Structured Cabling Market Market Size (In Billion)

The market is also experiencing a pronounced shift towards advanced cabling technologies, notably fiber optics and high-speed copper cabling, to support escalating bandwidth and data transfer rate requirements essential for contemporary applications. The increasing network complexity and the need for efficient cabling management are fueling demand for specialized services, including design, installation, and maintenance. Intense vendor competition centers on innovation, cost-effectiveness, and the delivery of integrated solutions for market share acquisition. Government initiatives aimed at fostering digital infrastructure development further enhance the market's growth prospects, presenting a favorable outlook for the North American structured cabling market. The market size is projected to reach $13.33 billion by 2025.

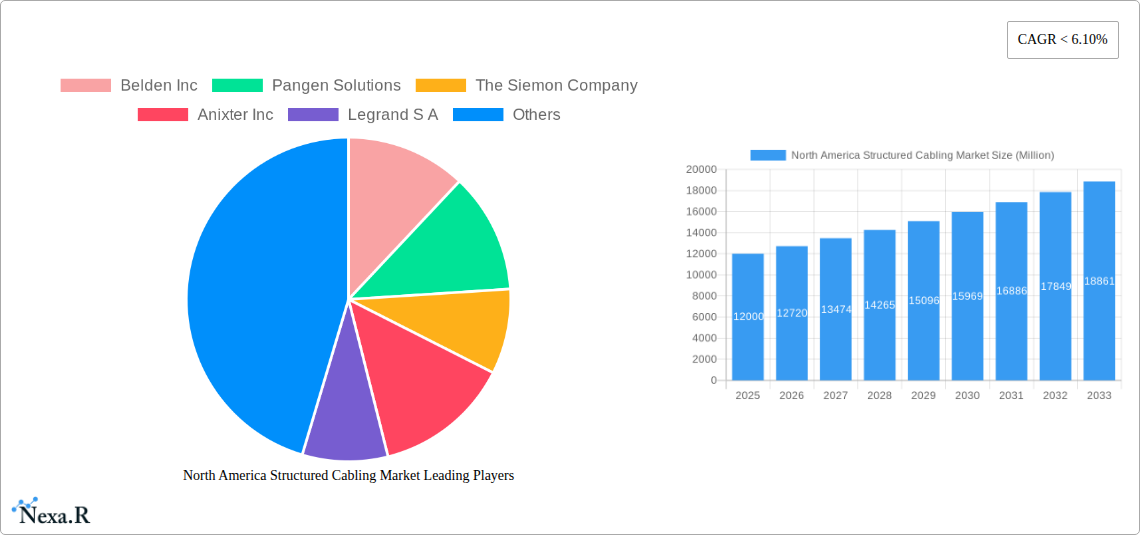

North America Structured Cabling Market Company Market Share

North America Structured Cabling Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America structured cabling market, covering the period 2019-2033. With a focus on market dynamics, growth trends, key players, and future opportunities, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this vital sector. The report segments the market by application (LAN, Datacenter), product type (Copper, Fiber), and country (within North America), providing granular insights into market performance and future projections. The total market size is projected to reach xx Million units by 2033.

North America Structured Cabling Market Dynamics & Structure

The North American structured cabling market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in high-speed fiber optics, is a primary growth driver. Stringent regulatory frameworks surrounding data security and network performance influence market dynamics. Competitive pressures arise from alternative connectivity solutions, while end-user demographics (primarily large enterprises and data centers) significantly impact demand. Mergers and acquisitions (M&A) activity within the sector remains steady, fostering consolidation and technological advancement.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Focus on higher bandwidth capabilities (e.g., 400G, 800G, 1.6 Tbps) and improved network efficiency.

- Regulatory Framework: Compliance with standards like TIA-568 and ISO/IEC 11801 impacts product design and adoption.

- Competitive Substitutes: Wireless technologies pose some competition, particularly in specific applications.

- End-User Demographics: Large enterprises and data centers are the primary consumers of structured cabling solutions.

- M&A Activity: An average of xx M&A deals were recorded annually during the historical period (2019-2024).

North America Structured Cabling Market Growth Trends & Insights

The North American structured cabling market witnessed a CAGR of xx% during the historical period (2019-2024), driven by the increasing adoption of high-speed data networks and cloud computing. The market is expected to continue its growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the ever-increasing demand for faster internet speeds, enhanced network reliability, and the expansion of data centers. Technological advancements, such as the introduction of higher bandwidth fiber optic cables and improved copper cabling solutions, are further propelling market expansion. Consumer behavior shifts toward greater reliance on digital technologies and remote work arrangements are also key factors contributing to market growth. Market penetration of fiber optic cabling is expected to increase from xx% in 2025 to xx% by 2033.

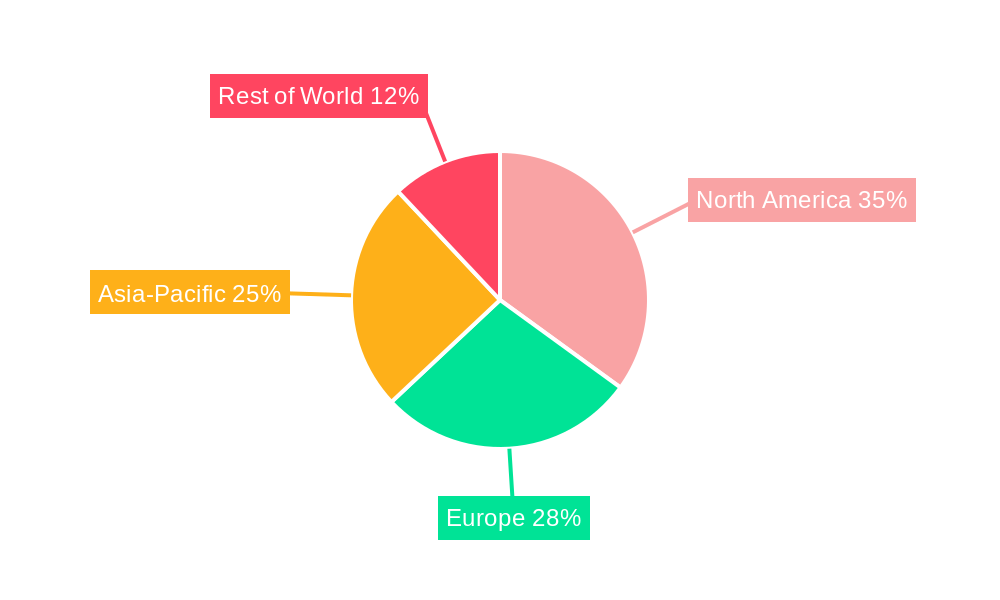

Dominant Regions, Countries, or Segments in North America Structured Cabling Market

The United States dominates the North American structured cabling market, driven by its robust IT infrastructure and large number of data centers. The Datacenter segment displays the highest growth rate, fuelled by the booming cloud computing industry and the increasing demand for high-bandwidth connectivity. The Fiber optic product type is experiencing significant growth owing to its superior bandwidth capacity compared to copper.

- Key Drivers (US): Strong IT infrastructure investment, high concentration of data centers, robust economic activity.

- Key Drivers (Datacenter Segment): Exponential growth of cloud computing, increasing demand for high-speed connectivity, 5G deployment.

- Key Drivers (Fiber Optic): Superior bandwidth, long-distance transmission capabilities, support for high-speed networking protocols.

- Market Share: The US holds approximately xx% of the total North American market share in 2025, while the Datacenter segment commands xx%, and the Fiber segment holds xx%.

North America Structured Cabling Market Product Landscape

The market offers a range of copper and fiber optic cabling solutions, including Cat 5e, Cat 6, Cat 6A, and multimode and single-mode fiber. Recent product innovations focus on higher bandwidth, improved signal integrity, and enhanced durability. Unique selling propositions include features like pre-terminated cabling systems, improved management capabilities, and integration with network management systems. Technological advancements involve the use of advanced materials and manufacturing techniques to improve performance and reliability.

Key Drivers, Barriers & Challenges in North America Structured Cabling Market

Key Drivers: The proliferation of data centers, increasing demand for high-speed internet, and the growth of cloud computing are primary drivers. Government initiatives promoting digital infrastructure development also contribute significantly.

Key Challenges: Supply chain disruptions can lead to material shortages and increased costs. Stringent regulatory compliance requirements can present hurdles for manufacturers. Intense competition among established players and emerging vendors creates pricing pressure. The estimated annual impact of supply chain disruptions on the market is xx Million units.

Emerging Opportunities in North America Structured Cabling Market

Emerging opportunities lie in the expansion of 5G networks, the growing adoption of IoT devices, and the increasing demand for high-speed connectivity in smart cities. The development of innovative cabling solutions for specialized applications, such as industrial automation and autonomous vehicles, presents further growth potential. Untapped markets exist within smaller businesses and residential sectors.

Growth Accelerators in the North America Structured Cabling Market Industry

Strategic partnerships between manufacturers and network infrastructure providers are accelerating market growth. Technological advancements in fiber optic technology and copper cabling solutions are key growth catalysts. Expansion into emerging markets and the development of new applications for structured cabling solutions further contribute to market expansion.

Key Players Shaping the North America Structured Cabling Market Market

- Belden Inc

- Pangen Solutions

- The Siemon Company

- Anixter Inc

- Legrand S A

- Datwyler IT Infra GmbH

- Siemens AG

- Schneider Electric SE

- Commscope Inc

- Corning Incorporated

Notable Milestones in North America Structured Cabling Market Sector

- January 2022: Prysmian and Panduit announced a branding update for PanGen structured cabling solutions, expanding their product portfolio.

- April 2022: CommScope launched its Propel high-speed fiber platform, addressing the growing demand for higher bandwidth in data centers.

In-Depth North America Structured Cabling Market Market Outlook

The North American structured cabling market is poised for continued growth, driven by technological advancements, increasing demand for high-speed connectivity, and the expansion of data centers. Strategic investments in infrastructure development and the adoption of innovative cabling solutions will further fuel market expansion. Opportunities exist for companies to leverage technological breakthroughs and strategic partnerships to capture significant market share in this dynamic sector.

North America Structured Cabling Market Segmentation

-

1. Product Type

-

1.1. Copper

- 1.1.1. Copper Cable

- 1.1.2. Copper Connectivity

-

1.2. Fiber

- 1.2.1. Fiber Cable (Single-mode & Multi-mode)

- 1.2.2. Fiber Connectivity

-

1.1. Copper

-

2. Application

- 2.1. LAN

- 2.2. Datacenter

North America Structured Cabling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Structured Cabling Market Regional Market Share

Geographic Coverage of North America Structured Cabling Market

North America Structured Cabling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Expansion of Data Centers; Technological Advancements to Augment the Market Growth

- 3.3. Market Restrains

- 3.3.1. Trust and Safety Issues

- 3.4. Market Trends

- 3.4.1. Data Center to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Structured Cabling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Copper

- 5.1.1.1. Copper Cable

- 5.1.1.2. Copper Connectivity

- 5.1.2. Fiber

- 5.1.2.1. Fiber Cable (Single-mode & Multi-mode)

- 5.1.2.2. Fiber Connectivity

- 5.1.1. Copper

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. LAN

- 5.2.2. Datacenter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Belden Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pangen Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Siemon Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Anixter Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Datwyler IT Infra GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Commscope Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corning Incorporated

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Belden Inc

List of Figures

- Figure 1: North America Structured Cabling Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Structured Cabling Market Share (%) by Company 2025

List of Tables

- Table 1: North America Structured Cabling Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Structured Cabling Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: North America Structured Cabling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Structured Cabling Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: North America Structured Cabling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Structured Cabling Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Structured Cabling Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: North America Structured Cabling Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: North America Structured Cabling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: North America Structured Cabling Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: North America Structured Cabling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: North America Structured Cabling Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America Structured Cabling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States North America Structured Cabling Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Structured Cabling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Structured Cabling Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Structured Cabling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Structured Cabling Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Structured Cabling Market?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the North America Structured Cabling Market?

Key companies in the market include Belden Inc, Pangen Solutions, The Siemon Company, Anixter Inc, Legrand S A, Datwyler IT Infra GmbH, Siemens AG, Schneider Electric SE, Commscope Inc, Corning Incorporated.

3. What are the main segments of the North America Structured Cabling Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.33 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Expansion of Data Centers; Technological Advancements to Augment the Market Growth.

6. What are the notable trends driving market growth?

Data Center to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Trust and Safety Issues.

8. Can you provide examples of recent developments in the market?

April 2022: CommScope announced that it had created a high-speed fiber platform to assist data center managers in dealing with the exponential rise in demand for computing power. According to the company, Propel enables network upgrades and introduces 16-fiber cabling to meet the rapidly expanding 400 Mbps and 800 Mbps speeds and the upcoming 1.6 TBPS speeds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Structured Cabling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Structured Cabling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Structured Cabling Market?

To stay informed about further developments, trends, and reports in the North America Structured Cabling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence