Key Insights

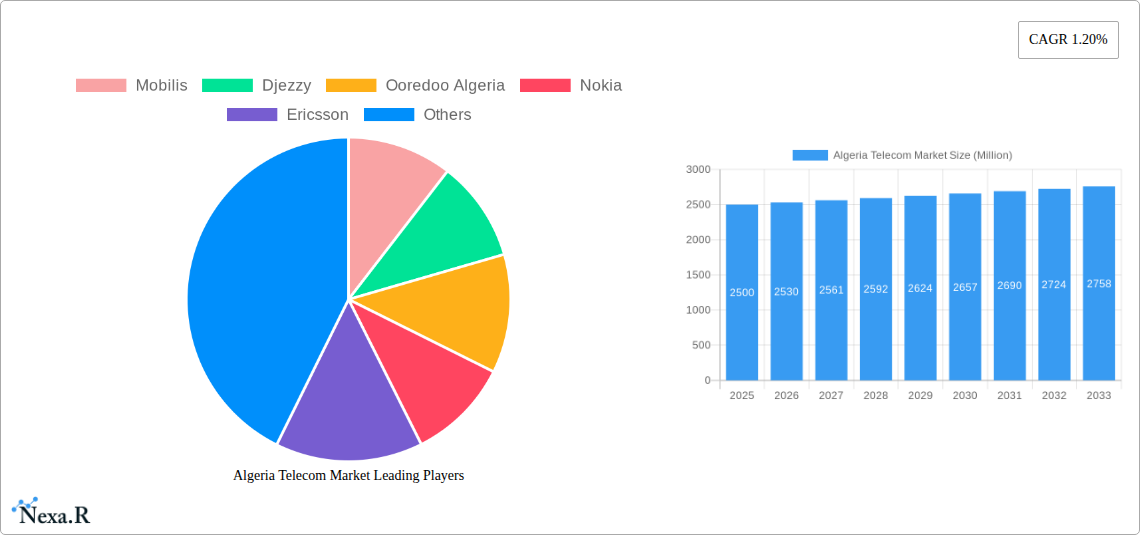

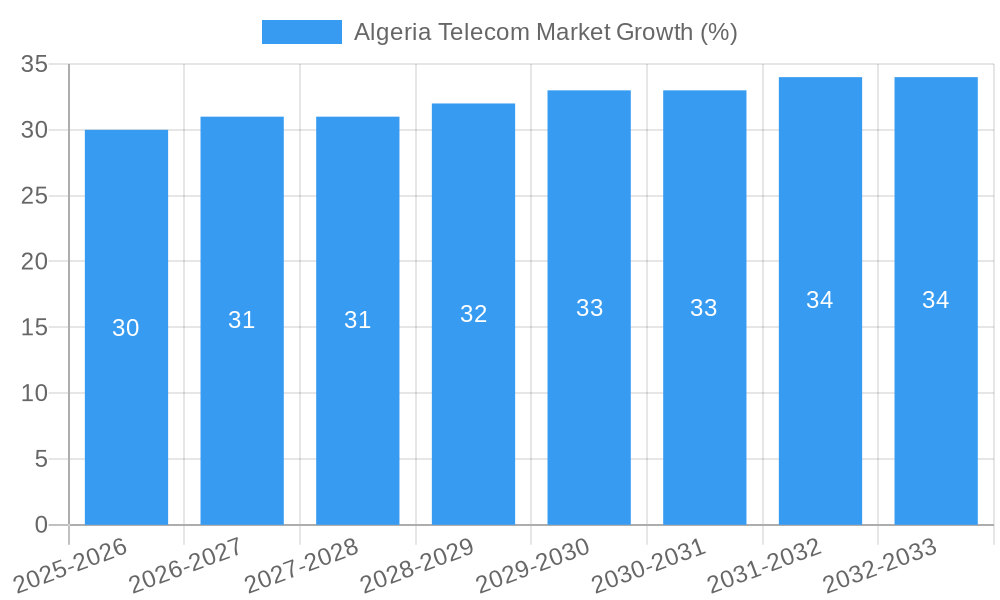

The Algerian telecom market, valued at approximately $X million in 2025 (assuming a logical market size based on regional comparisons and the provided CAGR), is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 1.20% from 2025 to 2033. This growth is fueled by increasing smartphone penetration, rising data consumption driven by social media and streaming services, and the government's ongoing investment in infrastructure upgrades to expand 4G and 5G networks. Key market drivers include the expanding young population's demand for affordable mobile data plans and the government's initiatives to promote digital inclusion. However, challenges remain, including economic volatility impacting consumer spending, the need for further infrastructure development in rural areas, and intense competition among established players like Mobilis, Djezzy, and Ooredoo Algeria, along with the presence of significant players in the equipment and services sectors like Nokia, Ericsson, and others. The market is segmented by service type (mobile, fixed-line, broadband), technology (2G, 3G, 4G, 5G), and geography.

The forecast period of 2025-2033 will see a gradual but consistent increase in market value, influenced by factors like improved network quality, the introduction of innovative mobile financial services (MFS), and the rise of the Internet of Things (IoT). The competitive landscape suggests a shift towards enhanced customer service and data-centric offerings, requiring providers to invest strategically in network capacity and digital innovation to maintain their market share. The sustained growth in the Algerian telecom market underscores its resilience and growth potential despite economic fluctuations, making it an attractive region for telecom investments and technological advancements. The presence of international vendors further underscores this opportunity.

Algeria Telecom Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Algeria Telecom market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader North African Telecom market, while the child market is the Algerian fixed and mobile telecommunications sector.

Algeria Telecom Market Dynamics & Structure

The Algerian telecom market exhibits a moderately concentrated structure, dominated by three major mobile network operators: Mobilis, Djezzy, and Ooredoo Algeria. These players account for approximately xx% of the market share. Technological innovation, driven by the increasing demand for high-speed data services, is a key dynamic. Regulatory frameworks, while evolving, continue to play a significant role in shaping market competition. The market also experiences pressure from competitive substitutes, such as VoIP services and satellite internet. End-user demographics show a growing young population with increasing mobile penetration, fueling demand. M&A activity has been relatively limited in recent years, with xx deals recorded between 2019 and 2024.

- Market Concentration: Oligopolistic, with three major players controlling xx% of the market.

- Technological Innovation: Driven by 5G deployment, increasing data consumption, and demand for improved network infrastructure.

- Regulatory Framework: Evolving to promote competition and enhance digital inclusion.

- Competitive Substitutes: VoIP services, satellite internet, and other emerging technologies pose challenges.

- End-User Demographics: A predominantly young population with rising mobile and internet usage.

- M&A Activity: Limited in recent years, with xx deals recorded (2019-2024), representing a total value of xx Million.

Algeria Telecom Market Growth Trends & Insights

The Algerian telecom market experienced steady growth between 2019 and 2024, driven by increased mobile penetration and rising data consumption. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Adoption rates of mobile broadband services have been particularly strong, reflecting the increasing demand for faster internet access. Technological disruptions, including the deployment of 5G networks, are expected to accelerate growth in the coming years. Consumer behavior shifts towards greater digital engagement, fueled by smartphone adoption, are also contributing to market expansion. Market penetration of mobile services is high, exceeding xx% in 2024.

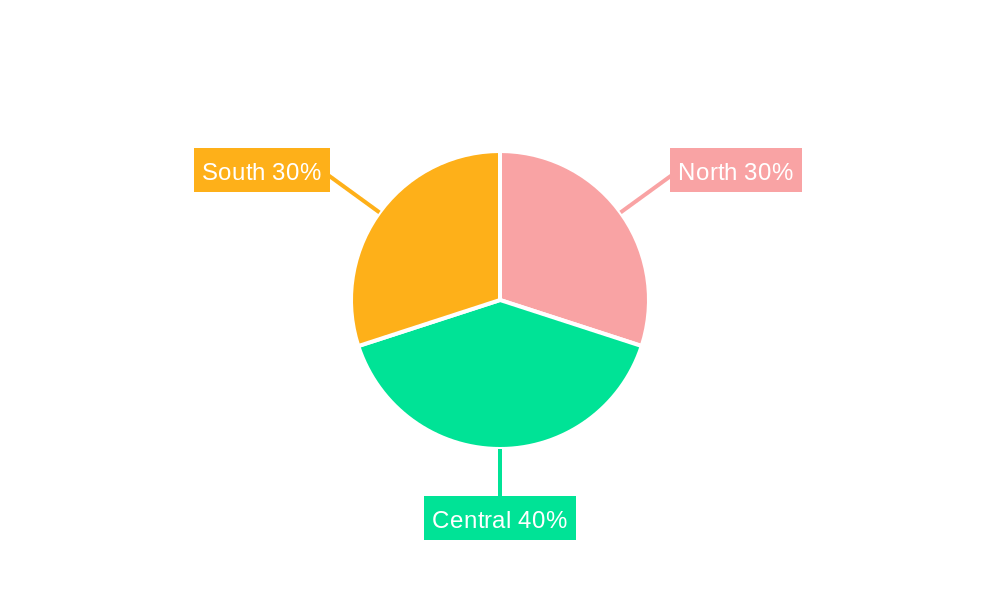

Dominant Regions, Countries, or Segments in Algeria Telecom Market

The Algiers metropolitan area and major urban centers represent the most dominant regions, driving market growth due to higher population density, greater internet access, and higher disposable incomes. The fixed-line segment shows limited growth but remains critical for business services. Government initiatives to promote broadband infrastructure development in rural areas are expected to spur growth in those regions.

- Key Drivers: High population density in urban areas, growing demand for data services, and government infrastructure investments.

- Dominance Factors: High market share and significant growth potential in urban areas.

- Growth Potential: Untapped market potential in rural regions with government infrastructure expansion.

Algeria Telecom Market Product Landscape

The market offers a range of products and services, including mobile voice, mobile data, fixed-line telephony, and broadband internet access. Recent innovations include the deployment of 5G networks and the expansion of fiber optic infrastructure. Key performance metrics such as download speeds and network latency are continuously improving, enhancing user experience. Unique selling propositions center around network coverage, pricing strategies, and value-added services.

Key Drivers, Barriers & Challenges in Algeria Telecom Market

Key Drivers: Rising smartphone penetration, increasing data consumption, government initiatives to expand broadband access, and the deployment of 5G technology.

Key Challenges: Limited investment in infrastructure, especially in rural areas; regulatory hurdles that sometimes hinder market expansion; and intense competition among major players. These challenges are estimated to restrain market growth by xx% annually.

Emerging Opportunities in Algeria Telecom Market

Emerging opportunities are present in the expansion of 5G coverage, the growth of the IoT (Internet of Things) sector, and the development of innovative digital services tailored to the specific needs of the Algerian market. Furthermore, opportunities exist in improving digital literacy and fostering digital inclusion among the population.

Growth Accelerators in the Algeria Telecom Market Industry

Long-term growth will be accelerated by sustained investments in infrastructure, the development of new digital services, strategic partnerships between telecom operators and technology companies, and government policies promoting digital transformation. Furthermore, international collaborations will play a crucial role in bringing technological advancements to the Algerian market.

Key Players Shaping the Algeria Telecom Market Market

- Mobilis

- Djezzy

- Ooredoo Algeria

- Nokia

- Ericsson

- Djaweb

- EEPAD

- Swan Informatique

- IcosNet

- Smart link Communication

Notable Milestones in Algeria Telecom Market Sector

- March 2023: Algeria Telecom launches a new data center in Constantine, signaling plans for nationwide expansion. This represents a significant investment in improving the country's digital infrastructure.

In-Depth Algeria Telecom Market Market Outlook

The Algerian telecom market is poised for continued growth, driven by increasing digitalization and government support for infrastructure development. Strategic opportunities exist for companies to capitalize on the expanding 5G network, the growth of the IoT sector, and the development of innovative digital services. The market's long-term potential is substantial, promising significant returns for investors and businesses operating within this dynamic sector.

Algeria Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Algeria Telecom Market Segmentation By Geography

- 1. Algeria

Algeria Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising demand for 5G; Growth of IoT usage in Telecom

- 3.4. Market Trends

- 3.4.1. Rising Demand for 5G

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mobilis

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Djezzy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ooredoo Algeria

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nokia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ericsson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Djaweb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EEPAD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swan Informatique

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IcosNet

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smart link Communication*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mobilis

List of Figures

- Figure 1: Algeria Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Algeria Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Algeria Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Algeria Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Algeria Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Algeria Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 5: Algeria Telecom Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Telecom Market?

The projected CAGR is approximately 1.20%.

2. Which companies are prominent players in the Algeria Telecom Market?

Key companies in the market include Mobilis, Djezzy, Ooredoo Algeria, Nokia, Ericsson, Djaweb, EEPAD, Swan Informatique, IcosNet, Smart link Communication*List Not Exhaustive.

3. What are the main segments of the Algeria Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Rising Demand for 5G.

7. Are there any restraints impacting market growth?

Rising demand for 5G; Growth of IoT usage in Telecom.

8. Can you provide examples of recent developments in the market?

March 2023- Algeria Telecom has launched a new data center in Constantine, more than 350km east of the capital, Algiers. The company said it is also planning to build other data centers nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Telecom Market?

To stay informed about further developments, trends, and reports in the Algeria Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence