Key Insights

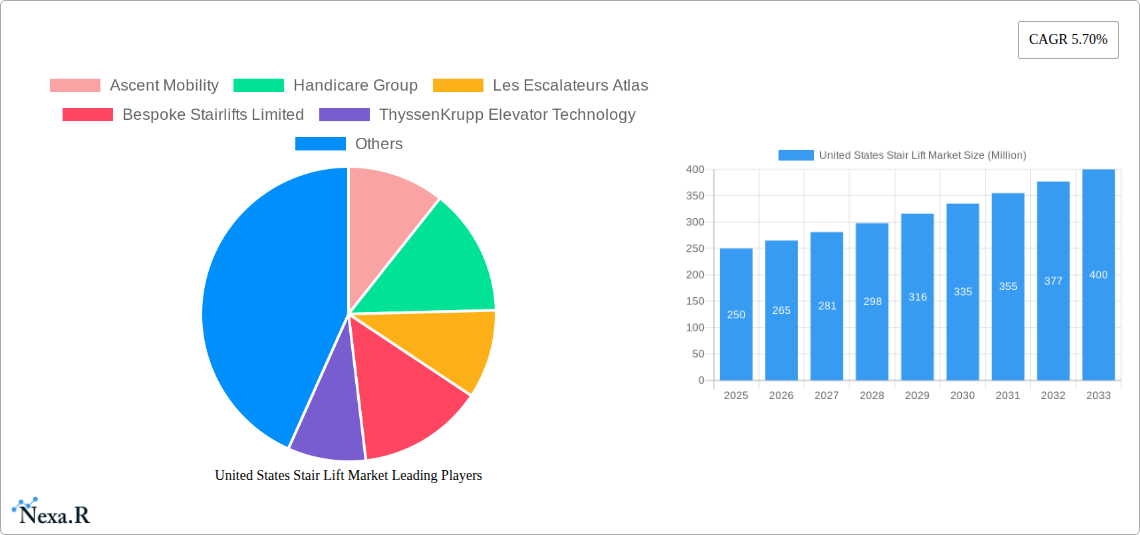

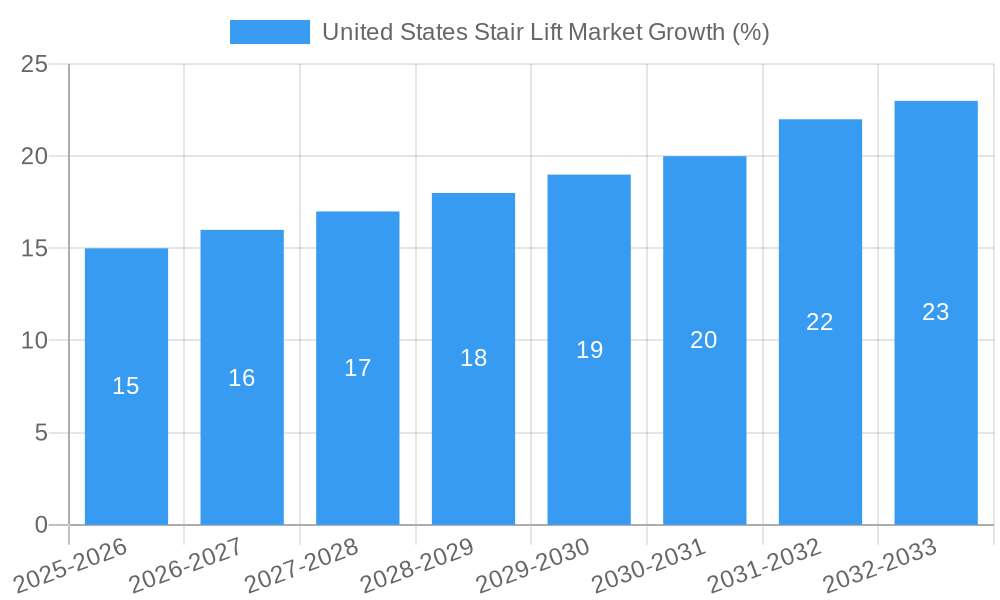

The United States stair lift market is experiencing robust growth, driven by an aging population and increasing demand for accessibility solutions in residential and healthcare settings. The market's compound annual growth rate (CAGR) of 5.70% from 2019 to 2024 suggests a significant expansion, which is projected to continue throughout the forecast period (2025-2033). Several factors contribute to this growth. The rising prevalence of age-related mobility issues, coupled with increasing disposable incomes and a greater emphasis on aging in place, fuels demand for stair lifts. Technological advancements, such as the development of more compact, aesthetically pleasing, and user-friendly models, also contribute to market expansion. Furthermore, the growing awareness of accessibility regulations and the availability of financing options, such as insurance coverage and home equity loans, are making stair lifts more accessible to a wider range of consumers. The segment breakdown reveals that the seated stair lift category holds a substantial share, while the increasing adoption of integrated and outdoor installations suggests a shift towards comprehensive accessibility solutions. Key players in the US market are constantly innovating and expanding their product lines to cater to diverse needs, leading to increased competition and driving further market growth.

The significant market expansion is primarily attributed to the increasing number of elderly individuals in the US population, coupled with growing preference for assisted living within the familiar confines of their homes. This preference for aging-in-place is further fueled by the rising awareness of improved quality of life made possible by accessible home modifications. The market is segmented by various factors including the type of installation, user orientation (seated, standing or integrated), and the application type (residential, healthcare, others). The residential sector forms the largest segment, reflecting the growing demand among senior citizens to retain their independence and improve mobility within their own homes. The healthcare sector also constitutes a significant portion of the market, driven by the increasing demand for accessible facilities in hospitals, assisted living facilities, and nursing homes. Competitive dynamics are characterized by established players and new entrants continually introducing innovative products and services to enhance the market's appeal and improve user experience. Future growth will likely be propelled by factors such as advancements in assistive technologies, government initiatives to promote accessibility, and continued growth in the elderly population.

United States Stair Lift Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States stair lift market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period spanning 2025-2033. The market is segmented by rail orientation (straight, curved), user orientation (seated, standing, integrated), installation (indoor, outdoor), and application (residential, healthcare, others). The market size is valued in million units.

United States Stair Lift Market Dynamics & Structure

The US stair lift market exhibits a moderately consolidated structure, with key players like Acorn Stairlifts Inc, Stannah Lifts Holdings Ltd, and Bruno Independent Living Aids Inc holding significant market share. Technological innovation, particularly in areas like quieter operation, enhanced safety features, and improved design aesthetics, is a major driver. Regulatory compliance, specifically regarding safety standards and accessibility regulations, plays a significant role. Competitive substitutes include home elevators and ramps, though stair lifts often provide a more cost-effective and space-saving solution. The aging population and increasing accessibility awareness are key demographic factors driving market growth. The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with larger players strategically acquiring smaller companies to expand their product portfolio and market reach.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on quieter operation, enhanced safety, improved aesthetics.

- Regulatory Framework: Compliance with safety and accessibility standards is crucial.

- Competitive Substitutes: Home elevators and ramps pose limited competition.

- End-User Demographics: Aging population and rising accessibility awareness are major drivers.

- M&A Trends: Moderate activity observed, with strategic acquisitions for market expansion. Approximately xx M&A deals occurred between 2019 and 2024.

United States Stair Lift Market Growth Trends & Insights

The US stair lift market experienced a steady growth trajectory during the historical period (2019-2024), driven by factors such as the aging population, increasing disposable incomes, and greater awareness of accessibility solutions. The market size grew from xx million units in 2019 to xx million units in 2024, reflecting a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace due to economic factors and market saturation in certain segments. Technological advancements like smart features and improved designs are expected to stimulate further adoption. Consumer behavior is shifting towards premium, feature-rich models, impacting overall market value. The market penetration rate for stair lifts in the residential sector is currently at approximately xx%, with significant potential for growth.

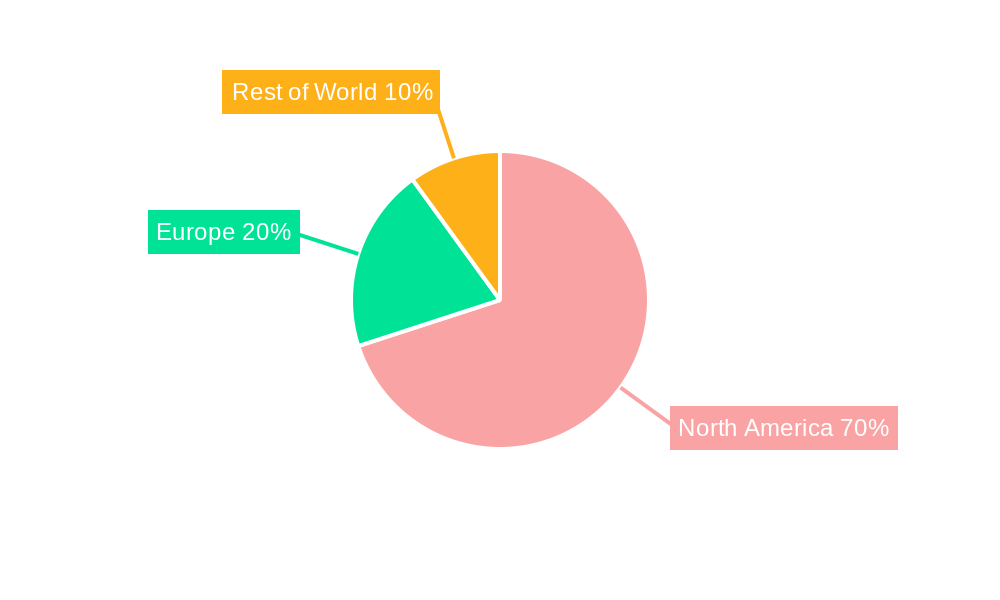

Dominant Regions, Countries, or Segments in United States Stair Lift Market

The residential sector dominates the US stair lift market, accounting for approximately xx% of total market value in 2024. Growth is primarily driven by the increasing number of older adults living independently at home. Within rail orientation, the straight stair lift segment holds the largest market share due to its simpler design and lower installation cost. However, the curved stair lift segment is exhibiting faster growth, driven by increased demand for customized solutions for homes with non-straight staircases. Geographically, the market is concentrated in high-population density states with aging populations, like California, Florida, and Texas.

- Key Drivers: Aging population, rising disposable incomes, increased accessibility awareness.

- Residential Sector Dominance: Driven by aging population preferring independent living.

- Straight Rail Segment: Largest market share due to lower cost and simpler installation.

- Curved Rail Segment: Fastest growth due to customization needs.

- Regional Concentration: High-population density states with large senior populations lead.

United States Stair Lift Market Product Landscape

Stair lift products are constantly evolving, with innovations focused on enhancing safety, improving comfort, and integrating smart features. Modern stair lifts incorporate features such as swivel seats, foldable footrests, and emergency stop mechanisms. Technological advancements include improved power systems for quieter operation, advanced safety sensors, and the integration of remote control and monitoring capabilities. These advancements address key consumer needs for convenience, safety, and ease of use, shaping the competitive landscape.

Key Drivers, Barriers & Challenges in United States Stair Lift Market

Key Drivers: The aging US population and increased awareness regarding accessibility are the primary drivers. Government incentives and tax credits for home accessibility improvements also stimulate market growth. Technological advancements, such as improved safety features and smart home integration, further enhance market appeal.

Key Challenges: High initial costs can be a barrier for some consumers. Limited skilled labor for installation in certain areas can slow down market expansion. Competition from alternative solutions, such as home elevators and ramps, presents challenges.

Emerging Opportunities in United States Stair Lift Market

The market presents opportunities in expanding into underserved rural areas, focusing on affordable stair lift models, and developing innovative applications in commercial settings such as assisted living facilities. The integration of smart technology features, including remote monitoring and connectivity to home healthcare systems, offers significant potential for growth. Furthermore, catering to diverse user needs, such as customized designs for users with limited mobility, represents a promising avenue for market expansion.

Growth Accelerators in the United States Stair Lift Market Industry

Strategic partnerships between stair lift manufacturers and home healthcare providers will accelerate market growth by creating integrated solutions for elderly care. Technological breakthroughs like enhanced battery life and more compact designs will expand product accessibility. Marketing campaigns focused on the benefits of stair lifts for maintaining independence and enhancing safety will increase consumer awareness and drive sales.

Key Players Shaping the United States Stair Lift Market Market

- Ascent Mobility

- Handicare Group

- Les Escalateurs Atlas

- Bespoke Stairlifts Limited

- ThyssenKrupp Elevator Technology

- Acme Home Elevator

- Acorn Stairlifts Inc

- Harmar

- Stannah Lifts Holdings Ltd

- Bruno Independent Living Aids Inc

- AmeriGlide Distributing 2019 Inc

Notable Milestones in United States Stair Lift Market Sector

- October 2021: Harmar Mobility's Highlander II Vertical Platform Lift (VPL) wins HME Business's 2021 New Product Award.

In-Depth United States Stair Lift Market Market Outlook

The US stair lift market is poised for continued growth, driven by demographic trends, technological advancements, and increasing awareness of accessibility solutions. The market's future success hinges on manufacturers' ability to innovate, provide affordable solutions, and establish strong distribution networks. Strategic partnerships and expansions into new market segments will be crucial for sustained growth. Focus on providing customized solutions and integrating smart technologies will further differentiate players and enhance market appeal. The forecast suggests a sustained increase in market size, with a projected xx million unit market size by 2033.

United States Stair Lift Market Segmentation

-

1. Rail Orientation

- 1.1. Straight

- 1.2. Curved

-

2. User Orientation

- 2.1. Seated

- 2.2. Standing

- 2.3. Integrated

-

3. Installation

- 3.1. Indoor

- 3.2. Outdoor

-

4. Application

- 4.1. Residential

- 4.2. Healthcare

- 4.3. Others

United States Stair Lift Market Segmentation By Geography

- 1. United States

United States Stair Lift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Old age and disability significantly propel the demand for stair lifts

- 3.3. Market Restrains

- 3.3.1. High installation cost and post installation services

- 3.4. Market Trends

- 3.4.1. Increasing Health Issues is Driving the Stair Lift Market in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Stair Lift Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 5.1.1. Straight

- 5.1.2. Curved

- 5.2. Market Analysis, Insights and Forecast - by User Orientation

- 5.2.1. Seated

- 5.2.2. Standing

- 5.2.3. Integrated

- 5.3. Market Analysis, Insights and Forecast - by Installation

- 5.3.1. Indoor

- 5.3.2. Outdoor

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Residential

- 5.4.2. Healthcare

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 6. North America United States Stair Lift Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 7. Europe United States Stair Lift Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United kingdom

- 7.1.2 Germany

- 7.1.3 Rest of Europe

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Ascent Mobility

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Handicare Group

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Les Escalateurs Atlas

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Bespoke Stairlifts Limited

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 ThyssenKrupp Elevator Technology

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Acme Home Elevator

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Acorn Stairlifts Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Harmar

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Stannah Lifts Holdings Ltd

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bruno Independent Living Aids Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 AmeriGlide Distributing 2019 Inc

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 Ascent Mobility

List of Figures

- Figure 1: United States Stair Lift Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Stair Lift Market Share (%) by Company 2024

List of Tables

- Table 1: United States Stair Lift Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Stair Lift Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United States Stair Lift Market Revenue Million Forecast, by Rail Orientation 2019 & 2032

- Table 4: United States Stair Lift Market Volume K Unit Forecast, by Rail Orientation 2019 & 2032

- Table 5: United States Stair Lift Market Revenue Million Forecast, by User Orientation 2019 & 2032

- Table 6: United States Stair Lift Market Volume K Unit Forecast, by User Orientation 2019 & 2032

- Table 7: United States Stair Lift Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: United States Stair Lift Market Volume K Unit Forecast, by Installation 2019 & 2032

- Table 9: United States Stair Lift Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: United States Stair Lift Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: United States Stair Lift Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: United States Stair Lift Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: United States Stair Lift Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Stair Lift Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United States United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United States Stair Lift Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Stair Lift Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: United kingdom United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United kingdom United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Germany United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Germany United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: United States Stair Lift Market Revenue Million Forecast, by Rail Orientation 2019 & 2032

- Table 28: United States Stair Lift Market Volume K Unit Forecast, by Rail Orientation 2019 & 2032

- Table 29: United States Stair Lift Market Revenue Million Forecast, by User Orientation 2019 & 2032

- Table 30: United States Stair Lift Market Volume K Unit Forecast, by User Orientation 2019 & 2032

- Table 31: United States Stair Lift Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 32: United States Stair Lift Market Volume K Unit Forecast, by Installation 2019 & 2032

- Table 33: United States Stair Lift Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: United States Stair Lift Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 35: United States Stair Lift Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Stair Lift Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Stair Lift Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the United States Stair Lift Market?

Key companies in the market include Ascent Mobility, Handicare Group, Les Escalateurs Atlas, Bespoke Stairlifts Limited, ThyssenKrupp Elevator Technology, Acme Home Elevator, Acorn Stairlifts Inc, Harmar, Stannah Lifts Holdings Ltd, Bruno Independent Living Aids Inc, AmeriGlide Distributing 2019 Inc.

3. What are the main segments of the United States Stair Lift Market?

The market segments include Rail Orientation, User Orientation, Installation, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Old age and disability significantly propel the demand for stair lifts.

6. What are the notable trends driving market growth?

Increasing Health Issues is Driving the Stair Lift Market in United States.

7. Are there any restraints impacting market growth?

High installation cost and post installation services.

8. Can you provide examples of recent developments in the market?

October 2021 - Harmar Mobility's new product Vertical Platform Lift (VPL), the Highlander II, won HME Business's 2021 New Product Award competition. The New Product Award honors exceptional product development achievements by HME service providers and manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Stair Lift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Stair Lift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Stair Lift Market?

To stay informed about further developments, trends, and reports in the United States Stair Lift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence