Key Insights

The Asia-Pacific battery recycling market is poised for significant growth, with a projected compound annual growth rate (CAGR) exceeding 10.00% from 2025 to 2033. This robust expansion is primarily driven by increasing environmental concerns and stringent government regulations aimed at reducing battery waste. The market size is expected to reach a value of $500 million by 2025, growing to an estimated $1.2 billion by 2033. Key drivers include the rising adoption of electric vehicles (EVs) and portable electronic devices, which generate a higher volume of batteries requiring recycling. Additionally, technological advancements in recycling processes and the recovery of valuable materials such as lithium, cobalt, and nickel further propel market growth.

Major trends shaping the market include the integration of automated recycling systems and the development of closed-loop recycling solutions that enhance efficiency and reduce costs. However, challenges such as the high initial investment required for recycling infrastructure and the complexity of safely handling different types of batteries may restrain growth. The market is segmented into various types of batteries, with lithium-ion batteries holding a significant share due to their widespread use in EVs and consumer electronics. Leading companies in the market include Exide Industries Limited, GS Yuasa International Ltd, and Contemporary Amperex Technology Co Limited, among others. These firms are focusing on expanding their recycling capabilities and forming strategic partnerships to capitalize on the growing demand for sustainable battery disposal solutions across the Asia-Pacific region.

Asia-Pacific Battery Recycling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific battery recycling market, encompassing market dynamics, growth trends, dominant regions, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The market is segmented by battery type (Lithium-ion, Lead-acid, Nickel-Cadmium, etc.), recycling process (Hydrometallurgy, Pyrometallurgy, Direct Recycling), and application (Electric Vehicles, Consumer Electronics, etc). The total market size is projected to reach xx Million units by 2033.

Asia-Pacific Battery Recycling Market Market Dynamics & Structure

The Asia-Pacific battery recycling market is characterized by increasing market concentration, driven by mergers and acquisitions (M&A) activity among key players. Technological innovation, particularly in hydrometallurgy and direct recycling processes, is a significant driver, while stringent regulatory frameworks focused on environmental sustainability and resource recovery are shaping market practices. The rise of electric vehicles (EVs) and portable electronics fuels the growth of this market as it creates a massive amount of waste batteries, necessitating efficient and sustainable recycling solutions. Competitive pressures from substitute materials are relatively low, given the unique properties of recycled battery materials.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players holding significant market share (estimated at xx% combined in 2025).

- Technological Innovation: Hydrometallurgy and direct recycling are key areas of innovation, aiming to improve efficiency and reduce costs. Barriers to innovation include high capital investment and complex process optimization.

- Regulatory Framework: Stringent environmental regulations in several Asia-Pacific countries are driving the adoption of battery recycling practices.

- M&A Activity: The number of M&A deals in the sector has increased in recent years, indicating consolidation and strategic expansion by major players (xx deals recorded between 2020-2024).

- End-User Demographics: The market is driven primarily by the automotive, electronics, and energy storage industries. Demand is expected to grow with the increasing adoption of EVs and renewable energy technologies.

Asia-Pacific Battery Recycling Market Growth Trends & Insights

The Asia-Pacific battery recycling market is experiencing robust growth, driven by the rising demand for critical battery materials (lithium, cobalt, nickel) and the increasing environmental concerns related to e-waste. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the surge in EV adoption, the expansion of the consumer electronics market, and governmental initiatives promoting sustainable waste management. Technological advancements in battery recycling processes are enhancing efficiency and cost-effectiveness, thereby further accelerating market growth. Consumer behavior is shifting toward environmentally conscious purchasing decisions, increasing demand for recycled battery materials.

Dominant Regions, Countries, or Segments in Asia-Pacific Battery Recycling Market

China is currently the dominant region in the Asia-Pacific battery recycling market, driven by its massive EV manufacturing sector and robust government support for sustainable technologies. Other key countries include Japan, South Korea, and India. These countries are characterized by strong economic growth, growing EV adoption, and supportive regulatory frameworks that promote recycling.

- China: Dominant due to its large EV industry and supportive government policies. Market share (2025) estimated at xx%.

- Japan: Strong technological capabilities and a focus on resource efficiency contribute to its significant market share. Market share (2025) estimated at xx%.

- South Korea: A prominent player in the electronics industry, leading to a high volume of waste batteries. Market share (2025) estimated at xx%.

- India: Rapid growth of the EV market and increasing awareness of environmental sustainability are driving market expansion. Market share (2025) estimated at xx%.

Asia-Pacific Battery Recycling Market Product Landscape

The Asia-Pacific battery recycling market encompasses a diverse range of products and services, including hydrometallurgical and pyrometallurgical recycling technologies, specialized equipment, and post-treatment facilities. Innovations are focused on improving efficiency, reducing costs, and extracting high-purity materials from waste batteries. Direct recycling technologies are emerging as a promising alternative, offering faster and more cost-effective solutions. These advancements ensure the recovery of valuable materials with high purity, allowing for their efficient reuse in manufacturing new batteries and reducing reliance on mining.

Key Drivers, Barriers & Challenges in Asia-Pacific Battery Recycling Market

Key Drivers:

- The rising demand for critical battery materials such as lithium, cobalt, and nickel.

- Stringent environmental regulations and e-waste management policies.

- The rapid growth of the electric vehicle and consumer electronics markets.

- Technological advancements improving the efficiency and cost-effectiveness of recycling.

Key Challenges:

- High capital investment required for setting up advanced recycling facilities.

- Complex and time-consuming recycling processes.

- The need for skilled labor and specialized expertise.

- Fluctuations in the prices of recycled materials impacting profitability. (e.g., a 10% decrease in recycled lithium prices can reduce profits by an estimated xx Million units).

Emerging Opportunities in Asia-Pacific Battery Recycling Market

- Expanding into untapped markets with growing EV adoption and e-waste generation.

- Developing innovative recycling technologies with higher efficiency and lower environmental impact.

- Focusing on the recovery of valuable materials beyond the traditional battery metals.

- Creating strategic partnerships with battery manufacturers and automotive companies for closed-loop recycling systems.

Growth Accelerators in the Asia-Pacific Battery Recycling Market Industry

Long-term growth is accelerated by technological breakthroughs in battery recycling, particularly in direct recycling and hydrometallurgy. Strategic partnerships between battery manufacturers and recycling companies are crucial for establishing closed-loop systems. Expanding recycling infrastructure, particularly in developing countries with rapidly growing EV markets, also presents significant opportunities.

Key Players Shaping the Asia-Pacific Battery Recycling Market Market

- Exide Industries Limited

- GS Yuasa International Ltd

- Neometals Ltd

- Contemporary Amperex Technology Co Limited

- GEM Co Ltd

- TES

- ACS Lead Tech

- Umicore Cobalt & Specialty Materials

- NEC Corporation

- Nippon Recycle Center Corp

- List Not Exhaustive

Notable Milestones in Asia-Pacific Battery Recycling Sector

- July 2022: LG Energy Solution and Huayou Cobalt announce a joint venture for lithium-ion battery recycling in China, boosting capacity and securing material supply.

- May 2022: ACE Green Recycling plans to build four new lithium-ion battery recycling facilities with a combined annual capacity of over 30,000 tons, expanding recycling infrastructure across multiple countries including Thailand and India.

In-Depth Asia-Pacific Battery Recycling Market Outlook

The Asia-Pacific battery recycling market holds significant future potential, driven by the sustained growth of the EV and electronics industries and increasing environmental awareness. Strategic partnerships, technological advancements, and supportive government policies will be key factors in shaping the market's trajectory. The focus on closed-loop recycling systems and the recovery of critical materials will create new opportunities for market players, driving further expansion and innovation in the years to come.

Asia-Pacific Battery Recycling Market Segmentation

-

1. Battery Type

- 1.1. Lead-Acid Battery

- 1.2. Nickel Battery

- 1.3. Lithium-ion battery

- 1.4. Other Battery Types

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia-Pacific Battery Recycling Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Battery Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead-Acid Battery

- 5.1.2. Nickel Battery

- 5.1.3. Lithium-ion battery

- 5.1.4. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. China Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 6.1.1. Lead-Acid Battery

- 6.1.2. Nickel Battery

- 6.1.3. Lithium-ion battery

- 6.1.4. Other Battery Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 7. India Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 7.1.1. Lead-Acid Battery

- 7.1.2. Nickel Battery

- 7.1.3. Lithium-ion battery

- 7.1.4. Other Battery Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 8. Japan Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 8.1.1. Lead-Acid Battery

- 8.1.2. Nickel Battery

- 8.1.3. Lithium-ion battery

- 8.1.4. Other Battery Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 9. South Korea Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 9.1.1. Lead-Acid Battery

- 9.1.2. Nickel Battery

- 9.1.3. Lithium-ion battery

- 9.1.4. Other Battery Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 10. Rest of Asia Pacific Asia-Pacific Battery Recycling Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Battery Type

- 10.1.1. Lead-Acid Battery

- 10.1.2. Nickel Battery

- 10.1.3. Lithium-ion battery

- 10.1.4. Other Battery Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Battery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Exide Industries Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GS Yuasa International Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Neometals Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Contemporary Amperex Technology Co Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GEM Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TES

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACS Lead Tech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Umicore Cobalt & Specialty Materials

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NEC Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nippon Recycle Center Corp *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Exide Industries Limited

List of Figures

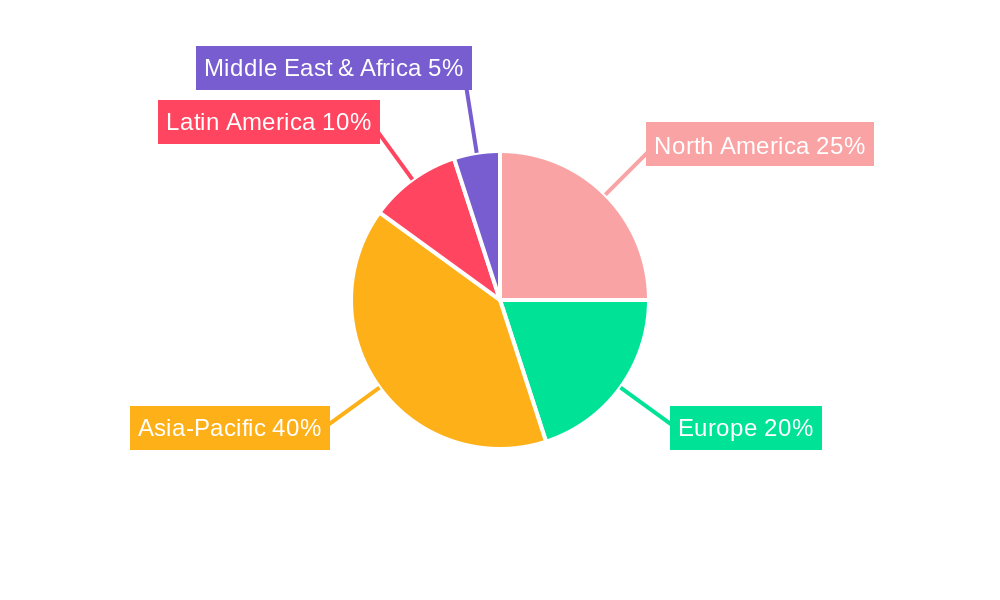

- Figure 1: Global Asia-Pacific Battery Recycling Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China Asia-Pacific Battery Recycling Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 3: China Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 4: China Asia-Pacific Battery Recycling Market Revenue (Million), by Geography 2024 & 2032

- Figure 5: China Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2024 & 2032

- Figure 6: China Asia-Pacific Battery Recycling Market Revenue (Million), by Country 2024 & 2032

- Figure 7: China Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: India Asia-Pacific Battery Recycling Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 9: India Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 10: India Asia-Pacific Battery Recycling Market Revenue (Million), by Geography 2024 & 2032

- Figure 11: India Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2024 & 2032

- Figure 12: India Asia-Pacific Battery Recycling Market Revenue (Million), by Country 2024 & 2032

- Figure 13: India Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Japan Asia-Pacific Battery Recycling Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 15: Japan Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 16: Japan Asia-Pacific Battery Recycling Market Revenue (Million), by Geography 2024 & 2032

- Figure 17: Japan Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2024 & 2032

- Figure 18: Japan Asia-Pacific Battery Recycling Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Japan Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South Korea Asia-Pacific Battery Recycling Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 21: South Korea Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 22: South Korea Asia-Pacific Battery Recycling Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: South Korea Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: South Korea Asia-Pacific Battery Recycling Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South Korea Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 27: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 28: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue (Million), by Geography 2024 & 2032

- Figure 29: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue Share (%), by Geography 2024 & 2032

- Figure 30: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Rest of Asia Pacific Asia-Pacific Battery Recycling Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 3: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 6: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 7: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 9: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 12: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 15: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 18: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Global Asia-Pacific Battery Recycling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Battery Recycling Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Asia-Pacific Battery Recycling Market?

Key companies in the market include Exide Industries Limited, GS Yuasa International Ltd, Neometals Ltd, Contemporary Amperex Technology Co Limited, GEM Co Ltd, TES, ACS Lead Tech, Umicore Cobalt & Specialty Materials, NEC Corporation, Nippon Recycle Center Corp *List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Battery Recycling Market?

The market segments include Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Lithium-ion Battery Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: LG Energy Solution announced plans to establish a battery recycling joint venture in China with the Chinese new energy Li-ion battery material research and development manufacturer Huayou Cobalt. The joint venture will use the infrastructure of Huayou Cobalt to extract nickel, cobalt, and lithium from waste batteries and then supply them to the Nanjing Factory of LG Energy Solution. A post-treatment plant for processing recycled metals was to be built in Quzhou, Zhejiang Province, where Huayou Cobalt operates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Battery Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Battery Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Battery Recycling Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Battery Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence