Key Insights

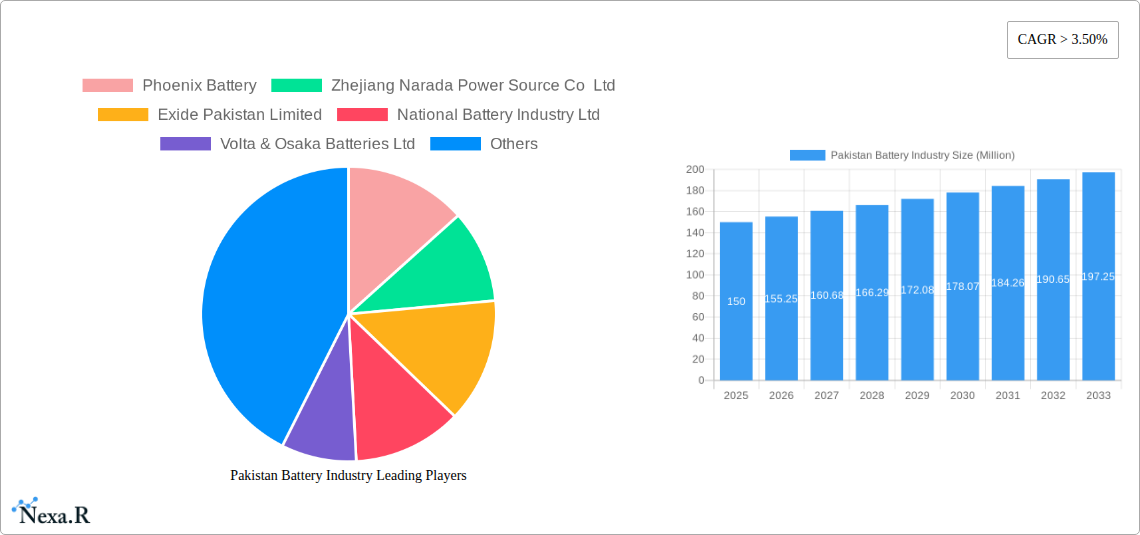

The Pakistan battery market, valued at approximately $1.2 billion in 2024, is poised for substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of 3.5% between 2024 and 2033. This growth is driven by escalating demand from the electric vehicle (EV) sector, despite its early-stage development in Pakistan, and the increasing reliance on portable batteries for telecommunications and consumer electronics. Industrial applications, such as backup power solutions for businesses and critical infrastructure, also significantly contribute to market value. While lead-acid batteries currently hold the largest share, a discernible shift towards lithium-ion batteries is underway, owing to their enhanced performance and longevity, though cost and infrastructure integration present ongoing challenges. Market expansion is tempered by volatile raw material prices, limited domestic manufacturing of advanced battery technologies, and potential supply chain vulnerabilities. The automotive sector, heavily dependent on Starting, Lighting, and Ignition (SLI) batteries, remains a key segment, directly influenced by vehicle sales and broader economic conditions. Leading companies, including Phoenix Battery and Zhejiang Narada Power Source Co Ltd, are actively evolving their strategies through innovation, product diversification, and strategic alliances to solidify their market positions.

Pakistan Battery Industry Market Size (In Billion)

The forecast period, 2024-2033, offers significant growth potential in specialized battery segments, particularly within industrial and renewable energy applications. Government initiatives supporting renewable energy adoption and energy efficiency measures are expected to act as catalysts for further market development. Nevertheless, addressing infrastructural deficits, fostering technological innovation, and achieving price competitiveness are critical for sustained growth. The implementation of robust battery recycling and sustainable disposal practices will gain paramount importance for both environmental stewardship and long-term industry viability. The specific market dynamics within Pakistan are shaped by its economic trajectory and infrastructure development, necessitating a thorough analysis for accurate long-term growth projections.

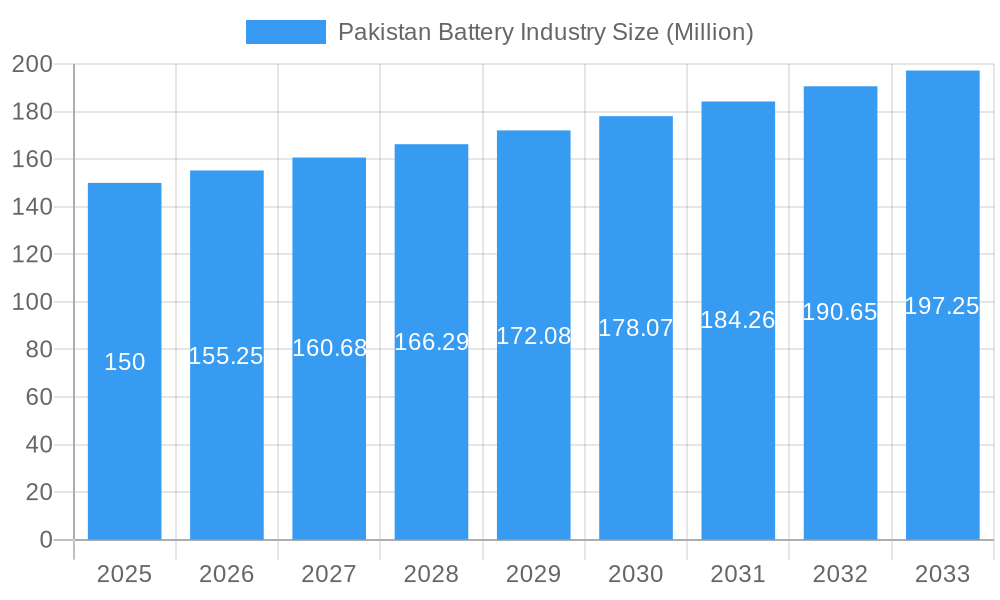

Pakistan Battery Industry Company Market Share

Pakistan Battery Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Pakistan battery industry, encompassing market dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data and expert insights to offer actionable intelligence for industry professionals, investors, and policymakers. It examines the parent market (energy storage) and child markets (automotive, industrial, portable batteries) to provide a holistic view.

Pakistan Battery Industry Market Dynamics & Structure

The Pakistan battery industry is characterized by a moderately concentrated market with key players like Atlas Battery Limited, Exide Pakistan Limited, and National Battery Industry Ltd. holding significant market share. Lead-acid batteries currently dominate the market, but lithium-ion battery technology is gaining traction, driven by the burgeoning electric vehicle (EV) sector. Regulatory frameworks, including import duties and environmental regulations, influence market dynamics. The industry faces competition from imported batteries, but local manufacturers are striving to improve their product offerings and production efficiency. Mergers and acquisitions (M&A) activity remains relatively low, but strategic partnerships are emerging to enhance technological capabilities and expand market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Primarily driven by the demand for EV batteries and advancements in lead-acid battery technology.

- Regulatory Framework: Import duties and environmental regulations influence pricing and technology adoption.

- Competitive Substitutes: Imported batteries pose a significant competitive challenge.

- End-User Demographics: Primarily automotive, industrial, and portable applications.

- M&A Trends: Limited M&A activity, but strategic alliances are gaining momentum.

Pakistan Battery Industry Growth Trends & Insights

The Pakistan battery market witnessed steady growth during the historical period (2019-2024), primarily driven by the increasing demand from the automotive and industrial sectors. The market size, estimated at xx million units in 2024, is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by expanding infrastructure development, rising disposable incomes, and increasing urbanization. Technological disruptions, such as the introduction of lithium-ion batteries, are transforming the landscape, while evolving consumer preferences towards more reliable and eco-friendly options are also driving market transformation. Market penetration of lithium-ion batteries is expected to increase significantly during the forecast period, albeit from a low base.

Dominant Regions, Countries, or Segments in Pakistan Battery Industry

The automotive segment, particularly SLI (Starting, Lighting, and Ignition) batteries, is the largest segment within the Pakistan battery industry, holding approximately xx% market share in 2024. This dominance is driven by the high vehicle ownership rates and increasing demand for replacement batteries. Lead-acid batteries account for the majority of the market, but the industrial segment shows higher growth potential for lithium-ion batteries due to increasing adoption in renewable energy storage systems. Punjab and Sindh provinces are the leading regions, benefiting from higher population density and industrial activity.

- Key Drivers for Automotive Segment: High vehicle ownership, increasing replacement battery demand, and relatively lower cost of lead-acid batteries.

- Key Drivers for Industrial Segment: Growth of renewable energy sector, increasing demand for energy storage solutions.

- Market Share: Automotive (xx%), Industrial (xx%), Portable (xx%), Other (xx%).

- Growth Potential: Industrial and portable segments show higher growth potential compared to the automotive segment.

Pakistan Battery Industry Product Landscape

The Pakistan battery industry offers a diverse range of lead-acid and lithium-ion batteries catering to various applications. Lead-acid batteries remain dominant due to their lower cost, while lithium-ion batteries are gaining traction due to their higher energy density and longer lifespan. Manufacturers are focusing on improving the performance, durability, and safety features of their products to meet evolving customer demands. Innovative designs and advanced manufacturing processes are being implemented to enhance product quality and competitiveness. Unique selling propositions include extended warranty periods, enhanced cycle life, and improved safety mechanisms.

Key Drivers, Barriers & Challenges in Pakistan Battery Industry

Key Drivers:

- Increasing demand from the automotive and industrial sectors.

- Growth of renewable energy projects and need for energy storage solutions.

- Government initiatives promoting electric vehicle adoption.

Challenges & Restraints:

- High import duties on raw materials and finished goods.

- Limited access to advanced technologies and skilled labor.

- Intense competition from imported batteries.

- Supply chain disruptions and fluctuating raw material prices.

Emerging Opportunities in Pakistan Battery Industry

- Growing demand for energy storage solutions in the renewable energy sector.

- Increasing adoption of electric vehicles and hybrid vehicles.

- Potential for growth in the portable battery segment, especially with the rise of smartphones and other portable devices.

- Development of innovative battery technologies like solid-state batteries.

Growth Accelerators in the Pakistan Battery Industry

Technological advancements in battery technology, particularly in lithium-ion batteries, are poised to accelerate growth. Strategic partnerships between domestic manufacturers and international players can bring in advanced technology and expertise. Government policies promoting electric mobility and renewable energy development create a favourable environment for market expansion. Investments in R&D and infrastructure development will further strengthen the industry's long-term growth prospects.

Key Players Shaping the Pakistan Battery Industry Market

- Atlas Battery Limited

- Exide Pakistan Limited

- National Battery Industry Ltd

- Volta & Osaka Batteries Ltd

- Phoenix Battery

- Zhejiang Narada Power Source Co Ltd

Notable Milestones in Pakistan Battery Industry Sector

- September 2022: Launch of NUR E-75, Pakistan's first locally manufactured electric vehicle, signifying a potential boost to the demand for EV batteries.

- Expected 2024: DICE Foundation and private players anticipated to begin importing advanced battery technologies.

In-Depth Pakistan Battery Industry Market Outlook

The Pakistan battery industry is poised for robust growth over the next decade, driven by technological advancements, government support, and expanding end-use applications. The increasing demand for electric vehicles and energy storage solutions presents significant opportunities for industry players. Strategic investments in R&D, capacity expansion, and supply chain optimization are crucial for maximizing long-term growth potential. The shift towards more sustainable and technologically advanced batteries will reshape the competitive landscape, favoring players with strong innovation capabilities and strategic partnerships.

Pakistan Battery Industry Segmentation

-

1. Technology

- 1.1. Lithium-ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Technologies

-

2. Application

- 2.1. SLI Batteries

- 2.2. Industrial Batteries

- 2.3. Portable

- 2.4. Automotive

- 2.5. Other Applications

Pakistan Battery Industry Segmentation By Geography

- 1. Pakistan

Pakistan Battery Industry Regional Market Share

Geographic Coverage of Pakistan Battery Industry

Pakistan Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Automotive Sector in the Country4.; The Low Cost of Lead and Lithium

- 3.3. Market Restrains

- 3.3.1. 4.; An Economic Slowdown and Increasing Government Debt

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SLI Batteries

- 5.2.2. Industrial Batteries

- 5.2.3. Portable

- 5.2.4. Automotive

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phoenix Battery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zhejiang Narada Power Source Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exide Pakistan Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Battery Industry Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volta & Osaka Batteries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Atlas Battery Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Phoenix Battery

List of Figures

- Figure 1: Pakistan Battery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Pakistan Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: Pakistan Battery Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Pakistan Battery Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Pakistan Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Pakistan Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 5: Pakistan Battery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Pakistan Battery Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Pakistan Battery Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Pakistan Battery Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 9: Pakistan Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Pakistan Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 11: Pakistan Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Pakistan Battery Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Battery Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Pakistan Battery Industry?

Key companies in the market include Phoenix Battery, Zhejiang Narada Power Source Co Ltd, Exide Pakistan Limited, National Battery Industry Ltd, Volta & Osaka Batteries Ltd, Atlas Battery Limited.

3. What are the main segments of the Pakistan Battery Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Automotive Sector in the Country4.; The Low Cost of Lead and Lithium.

6. What are the notable trends driving market growth?

Lithium-ion Battery Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; An Economic Slowdown and Increasing Government Debt.

8. Can you provide examples of recent developments in the market?

September 2022: NUR E-75, Pakistan's first locally manufactured and developed electric vehicle, claimed to have a range of 200 km with a top speed of 120 km/hr. The company DICE Foundation and private players in Pakistan were expected to start importing by the end of 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Battery Industry?

To stay informed about further developments, trends, and reports in the Pakistan Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence