Key Insights

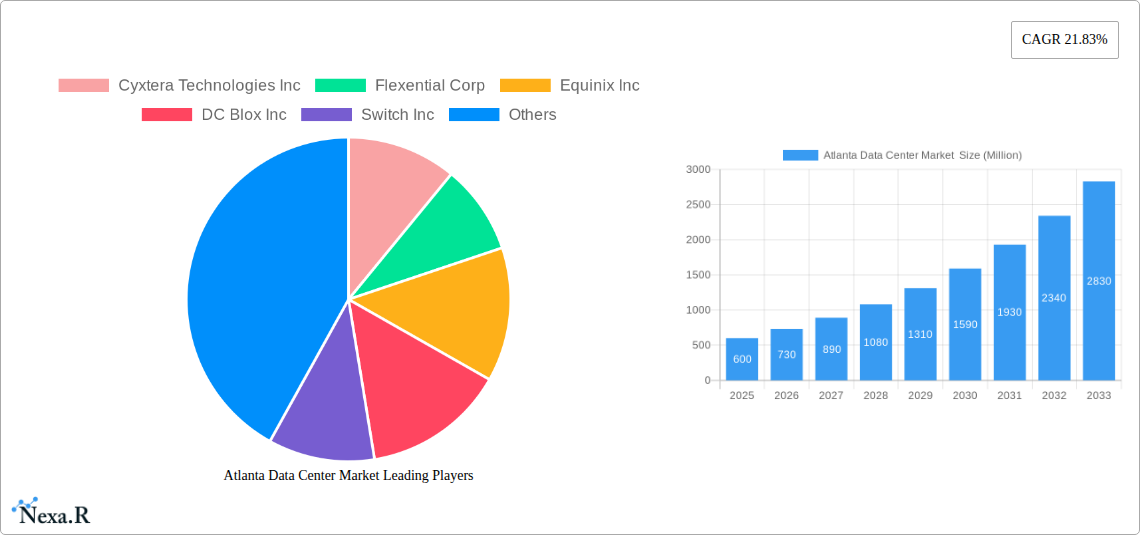

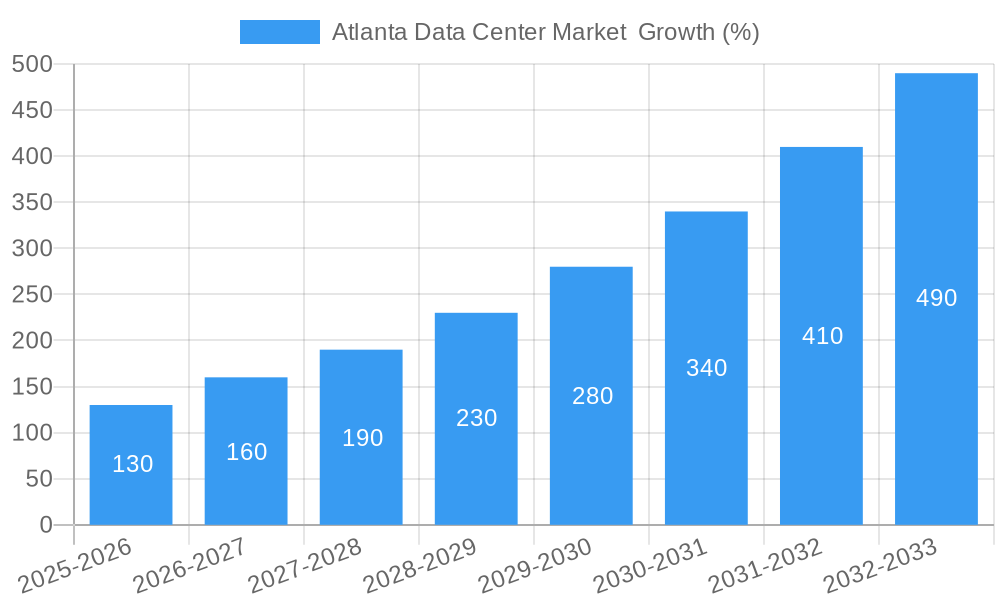

The Atlanta data center market is experiencing robust growth, fueled by a confluence of factors. Its strategic location as a major southeastern US hub, coupled with a strong economy and a burgeoning technology sector, makes it an attractive destination for data center investment. The market's expansion is driven by increasing cloud adoption, the rise of edge computing, and the growing demand for colocation services from diverse sectors, including finance (BFSI), e-commerce, and media & entertainment. The presence of major telecommunication networks and robust internet infrastructure further enhances Atlanta's appeal. While the exact market size for 2025 isn't provided, considering a national CAGR of 21.83%, and the significant growth potential of Atlanta, a reasonable estimate for the 2025 market size could be in the range of $500-700 million, with projections exceeding $1 billion by 2030. This growth will likely be concentrated in larger facilities (medium, large, and mega), catering to hyperscale providers and enterprises needing significant capacity. Future expansion will also be influenced by factors like energy costs, availability of skilled labor, and the ongoing expansion of fiber optic networks within the region. Competition is intense, with established players like Equinix and Switch competing with regional providers and newer entrants. Despite potential constraints such as land availability and energy consumption, Atlanta's market fundamentals suggest a strong and sustained trajectory of growth within the data center sector in the coming years. The diverse range of end-users and colocation models ensures a resilient and future-proof market.

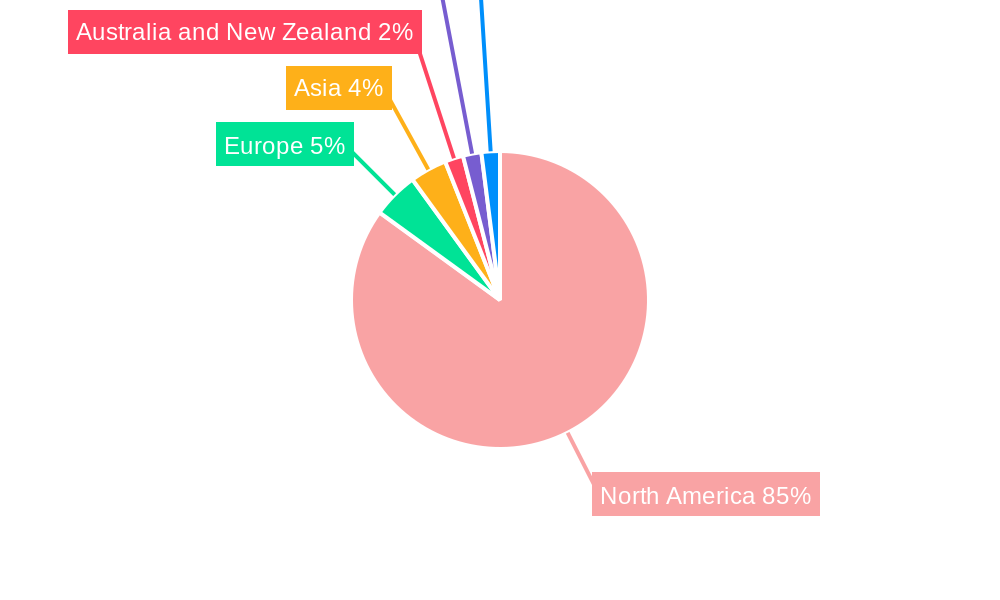

The segment breakdown suggests a strong demand across all facility sizes, with a potential shift towards larger facilities to accommodate hyperscale providers' growing needs. Retail colocation will likely continue to be a significant portion of the market, alongside a growing demand for wholesale solutions from large enterprises. Significant growth is expected in the cloud & IT, and BFSI sectors, driving the demand for secure and reliable data center infrastructure. While the specific regional breakdown for Atlanta isn't detailed, it's reasonable to expect that North America, and particularly the Southeast US, will dominate the regional market share given the focus of this analysis. The forecast period from 2025 to 2033 presents significant opportunities for investment and expansion in the Atlanta data center market, attracting both domestic and international players. Successful players will be those who can effectively manage operational costs, ensure power reliability, and provide robust connectivity solutions.

Atlanta Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Atlanta data center market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) to forecast market trends from 2025 to 2033. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving market.

Atlanta Data Center Market Market Dynamics & Structure

The Atlanta data center market exhibits a moderately concentrated structure, with several large players like Equinix Inc and Cyxtera Technologies Inc holding significant market share, alongside a number of smaller regional providers. Technological innovation, driven by increasing demand for higher bandwidth, lower latency, and enhanced security, is a key market driver. The regulatory landscape, including local zoning laws and environmental regulations, significantly impacts market development. Competitive pressures arise from alternative solutions such as cloud computing and edge computing, although colocation remains a significant segment. The end-user demographic is diverse, encompassing Cloud & IT, Telecom, Media & Entertainment, and Government sectors, among others. M&A activity has been moderate, with approximately xx deals recorded between 2019 and 2024, indicating consolidation trends within the market.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 60% market share.

- Technological Innovation: Focus on edge computing, AI-optimized infrastructure, and sustainable cooling solutions.

- Regulatory Framework: Local zoning regulations, environmental impact assessments, and power grid capacity constraints.

- Competitive Substitutes: Cloud computing, edge computing, and on-premise solutions.

- End-User Demographics: Significant presence of Cloud & IT, Telecom, Media & Entertainment, and Government clients.

- M&A Activity: xx deals (2019-2024), reflecting consolidation and strategic acquisitions.

Atlanta Data Center Market Growth Trends & Insights

The Atlanta data center market has experienced robust growth over the past five years, driven by factors such as increasing digital transformation initiatives, expanding cloud adoption, and the region's strong economic performance. Market size has grown from xx Million in 2019 to xx Million in 2024, indicating a CAGR of xx%. This upward trajectory is projected to continue, with the market expected to reach xx Million by 2033, fueled by ongoing demand for data center capacity and the proliferation of data-intensive applications. Technological disruptions, such as the rise of edge computing and AI-optimized infrastructure, are creating new growth avenues. Consumer behavior shifts toward digital services and remote work further underpin market expansion.

Dominant Regions, Countries, or Segments in Atlanta Data Center Market

Within the Atlanta data center market, the dominant segments are identified as follows. The Large and Mega data center segments exhibit the highest growth, driven by the needs of hyperscale cloud providers. Tier III and Tier IV data centers dominate due to their higher reliability and redundancy requirements. Utilized absorption shows the highest market share, showcasing strong demand. The Hyperscale colocation type is also a dominant force, reflecting the growing presence of major cloud providers. The Cloud & IT end-user segment remains the largest contributor, reflecting the increasing digitalization across all sectors. Economic factors, including a robust business environment and access to skilled labor, and infrastructure developments like improved power grid capacity and robust connectivity, all act as major growth drivers.

- Key Growth Drivers:

- Strong economic activity in Atlanta

- Robust telecommunications infrastructure

- Growing demand from hyperscale cloud providers

- Increasing adoption of cloud computing and digital services

- Dominant Segments: Large/Mega DC Size, Tier III/IV, Utilized Absorption, Hyperscale Colocation, Cloud & IT End-Users

Atlanta Data Center Market Product Landscape

The Atlanta data center market offers a wide range of products and services, including colocation space, managed services, cloud connectivity, and network infrastructure. Recent innovations include AI-powered data center management tools, improved cooling technologies to reduce energy consumption, and advanced security features to protect sensitive data. Unique selling propositions often center around high levels of reliability, availability, and security, along with strong connectivity and access to skilled workforce.

Key Drivers, Barriers & Challenges in Atlanta Data Center Market

Key Drivers: The primary drivers include the burgeoning digital economy, increased demand for cloud services, and the growth of data-intensive applications. The favorable business environment in Atlanta and the presence of numerous technology companies are also contributing factors.

Key Challenges: Challenges include high infrastructure costs, limited power grid capacity in certain areas, competition from other data center hubs, and regulatory hurdles related to environmental impact and zoning. Supply chain disruptions related to component shortages can also lead to project delays and increased costs. These constraints have a quantifiable impact, potentially leading to delays in projects, higher operating costs, and reduced profitability for some providers.

Emerging Opportunities in Atlanta Data Center Market

Emerging opportunities lie in the expanding edge computing market, the growth of 5G infrastructure, and the increasing adoption of sustainable data center technologies. Untapped markets include sectors with relatively lower data center adoption rates, such as specific verticals within the manufacturing and healthcare industries. The evolving consumer preferences towards digital services create consistent demand for robust and secure infrastructure, leading to several business expansion opportunities.

Growth Accelerators in the Atlanta Data Center Market Industry

Technological advancements like AI-driven automation, improved cooling techniques, and enhanced security features are key growth accelerators. Strategic partnerships between data center providers and cloud providers, as well as expansions into new geographic areas within Atlanta and its surrounding regions, will also bolster market growth.

Key Players Shaping the Atlanta Data Center Market Market

- Cyxtera Technologies Inc

- Flexential Corp

- Equinix Inc

- DC Blox Inc

- Switch Inc

- EdgeConneX Inc

- Sungard Availability Services

- Hivelocity Inc

- Cogent Communication

- H5 Data centers

- Colocrossing

- Stack Infrastructure

Notable Milestones in Atlanta Data Center Market Sector

- December 2022: Equinix, Inc. pledges to reduce power consumption by increasing operating temperatures in its data centers, aiming for more efficient cooling and a lower carbon footprint.

- June 2022: CoreSite enters the Atlanta market, integrating three American Tower assets into its data center ecosystem, adding over 250,000 square feet of data center space.

In-Depth Atlanta Data Center Market Market Outlook

The Atlanta data center market is poised for continued growth, driven by technological advancements, increasing demand for digital services, and the region's strong economic fundamentals. Strategic investments in sustainable infrastructure, expansion into underserved markets, and strategic partnerships will shape the future of the market. The focus on energy efficiency and sustainability is becoming increasingly crucial and presents significant opportunities for providers who embrace these initiatives. The market is expected to witness further consolidation, with larger players acquiring smaller ones to gain market share and scale.

Atlanta Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Atlanta Data Center Market Segmentation By Geography

- 1. Atlanta

Atlanta Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Surging Consumer Demand for Vehicle Safety

- 3.2.2 Security

- 3.2.3 and Comfort; Growing Inclination of Consumers Toward Alternative Fuel Vehicles to Reduce GHG Emissions

- 3.3. Market Restrains

- 3.3.1. Underdeveloped Aftermarket for Automotive Sensors in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Mega Size Data Center are Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Atlanta

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Flexential Corp

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DC Blox Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Switch Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 EdgeConneX Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sungard Availability Services

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hivelocity Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cogent Communication

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 H5 Data centers

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Colocrossing

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Stack Infrastructure

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Atlanta Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Atlanta Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Atlanta Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Atlanta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Atlanta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Atlanta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Atlanta Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Atlanta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Atlanta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Atlanta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Atlanta Data Center Market ?

The projected CAGR is approximately 21.83%.

2. Which companies are prominent players in the Atlanta Data Center Market ?

Key companies in the market include Cyxtera Technologies Inc, Flexential Corp, Equinix Inc, DC Blox Inc, Switch Inc, EdgeConneX Inc , Sungard Availability Services, Hivelocity Inc, Cogent Communication, H5 Data centers, Colocrossing, Stack Infrastructure.

3. What are the main segments of the Atlanta Data Center Market ?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Consumer Demand for Vehicle Safety. Security. and Comfort; Growing Inclination of Consumers Toward Alternative Fuel Vehicles to Reduce GHG Emissions.

6. What are the notable trends driving market growth?

Mega Size Data Center are Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Underdeveloped Aftermarket for Automotive Sensors in Emerging Economies.

8. Can you provide examples of recent developments in the market?

December 2022: Equinix, Inc., the world's digital infrastructure firm, announced the first pledge by a colocation data center operator to reduce overall power consumption by increasing operating temperature ranges within its data centers. Equinix will begin defining a multi-year global roadmap for thermal operations within its data centers immediately, aiming for much more efficient cooling and lower carbon footprints while maintaining the premium operating environment for which Equinix is recognized. This program is expected to help thousands of Equinix customers to reduce the Scope 3 carbon emissions connected with their data center operations over time as supply chain sustainability becomes an increasingly essential aspect of today's enterprises' total environmental activities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Atlanta Data Center Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Atlanta Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Atlanta Data Center Market ?

To stay informed about further developments, trends, and reports in the Atlanta Data Center Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence