Key Insights

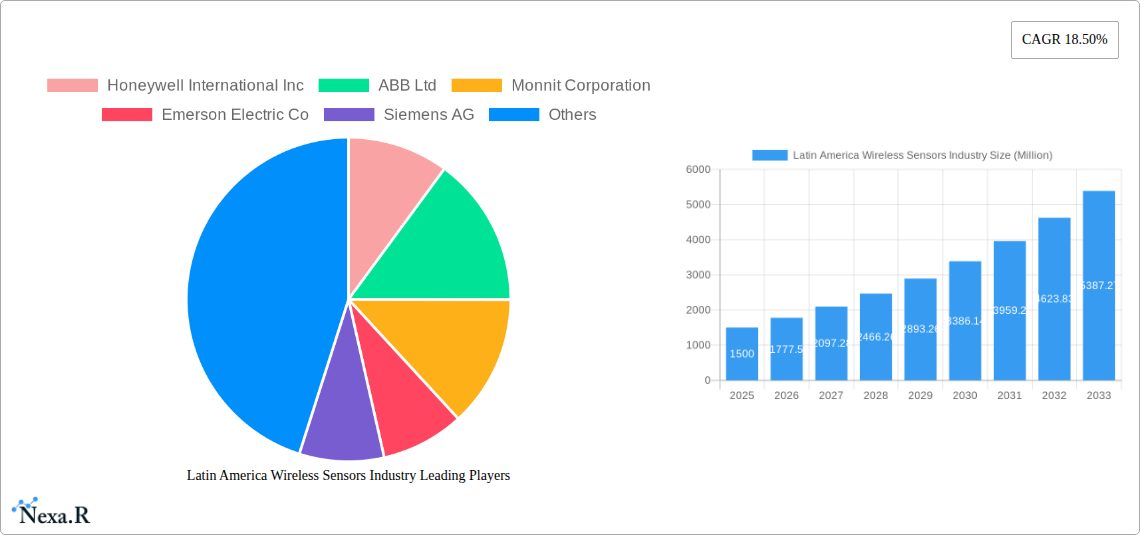

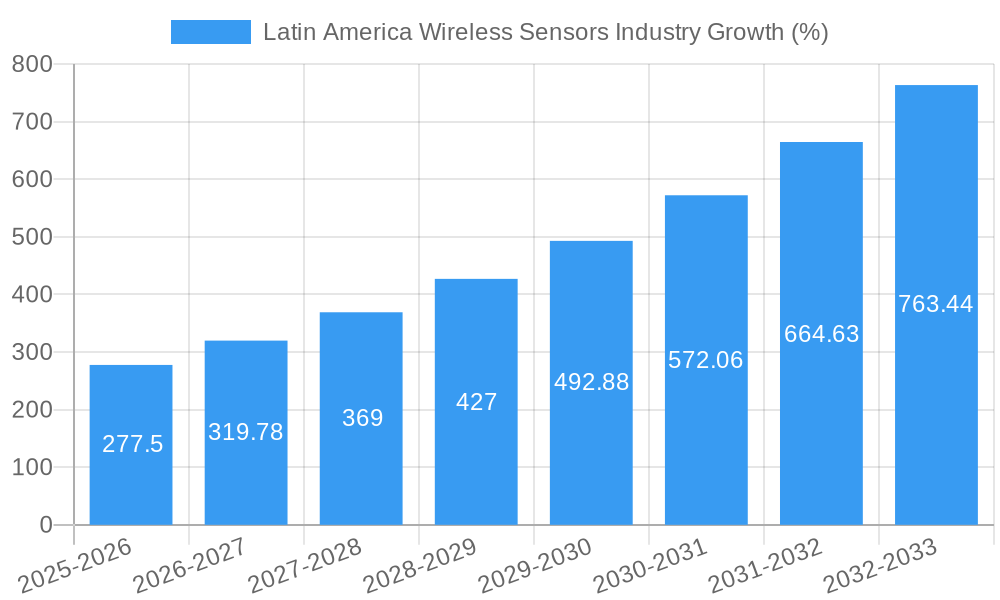

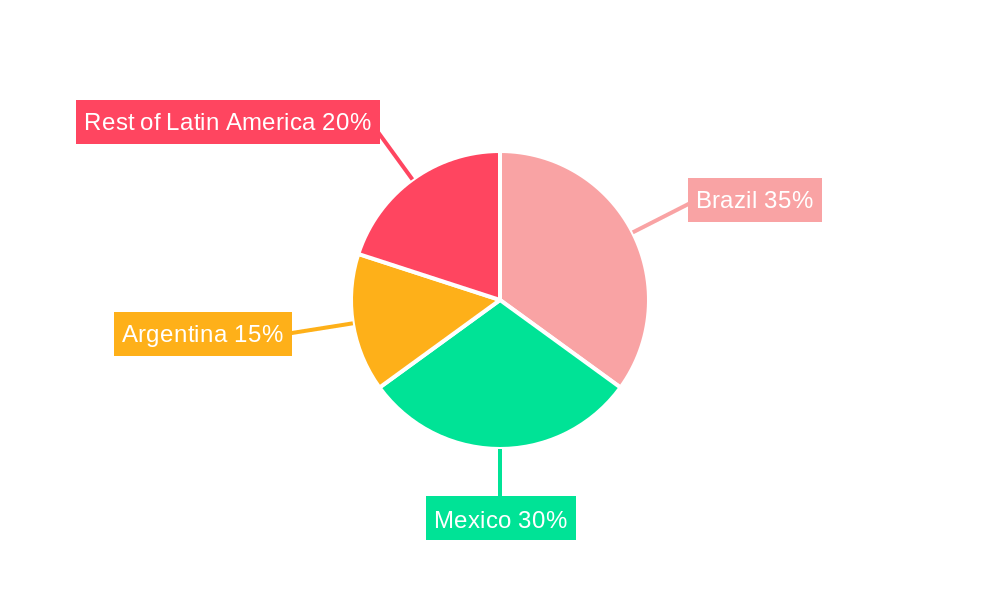

The Latin American wireless sensors market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 18.50% from 2025 to 2033. This surge is driven by several key factors. The increasing adoption of smart technologies across diverse sectors like automotive, healthcare, and industrial automation is fueling demand for sophisticated wireless sensor networks. Furthermore, the region's burgeoning infrastructure development projects, coupled with a growing emphasis on industrial efficiency and safety, create a fertile ground for wireless sensor deployment. Government initiatives promoting technological advancements and digital transformation are further accelerating market penetration. Specific growth drivers include the increasing need for remote monitoring and predictive maintenance in industrial applications, the expansion of smart cities initiatives, and the rising adoption of IoT technologies across various sectors in Brazil, Mexico, and Argentina – the largest contributors to the regional market. While the initial investment costs associated with implementing wireless sensor networks might act as a restraint, the long-term benefits in terms of reduced operational costs, improved efficiency, and enhanced safety significantly outweigh this initial hurdle. The market is segmented by end-user industry (automotive, healthcare, aerospace & defense, energy & power, food & beverage, and others), country (Mexico, Brazil, Argentina, and Rest of Latin America), and sensor type (pressure, temperature, chemical & gas, position & proximity, and others). Competitive landscape analysis reveals major players like Honeywell, ABB, Emerson Electric, and Siemens actively participating in this dynamic market, constantly innovating to meet the evolving needs of diverse industries.

The significant market expansion is primarily fueled by Brazil and Mexico, which represent major economic powerhouses within Latin America. Their robust industrial sectors, ongoing infrastructure modernization efforts, and adoption of Industry 4.0 principles are key contributors to the region's strong growth trajectory. Technological advancements, such as the development of more energy-efficient and robust wireless sensors, are further enhancing market appeal. The growth of the automotive sector, coupled with its increased reliance on advanced driver-assistance systems (ADAS) and connected car technologies, is significantly impacting the market. The increasing prevalence of smart agriculture and precision farming also contributes to the demand for wireless sensors in monitoring environmental parameters. While challenges exist in terms of technological maturity and infrastructure disparities across different parts of Latin America, the overall market outlook remains extremely positive, promising strong growth opportunities for industry stakeholders over the forecast period.

Latin America Wireless Sensors Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America wireless sensors market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. This report delves into market dynamics, growth trends, dominant segments, and key players, providing a complete understanding of this rapidly evolving sector. The market size is presented in million units.

Latin America Wireless Sensors Industry Market Dynamics & Structure

The Latin American wireless sensors market is characterized by a moderately fragmented landscape, with both established multinational corporations and smaller specialized players vying for market share. Technological innovation, driven by the Internet of Things (IoT) and Industry 4.0 initiatives, is a primary growth driver. However, regulatory frameworks and varying levels of digital infrastructure across the region present challenges. Competitive pressures from wired sensor alternatives and emerging technologies like LiFi need consideration. End-user demographics, especially in rapidly growing urban centers, significantly influence market demand. M&A activity remains moderate but shows potential for consolidation in the coming years.

- Market Concentration: Moderately fragmented, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Strong growth driven by IoT and Industry 4.0 adoption. Key areas of innovation include low-power wide-area networks (LPWAN) and advanced sensor technologies.

- Regulatory Frameworks: Varying regulations across countries impact market growth; harmonization efforts are underway.

- Competitive Product Substitutes: Wired sensors, LiFi technology, and other emerging sensor technologies pose competitive threats.

- End-user Demographics: Rapid urbanization and industrialization in key markets like Mexico and Brazil drive demand.

- M&A Trends: Moderate activity; xx M&A deals in the past five years, with a projected increase in the forecast period.

Latin America Wireless Sensors Industry Growth Trends & Insights

The Latin American wireless sensors market is experiencing robust growth, driven by increasing industrial automation, smart city initiatives, and rising demand for real-time monitoring across various sectors. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by the expanding adoption of IoT and Industry 4.0 technologies across diverse industries. Consumer behavior is shifting towards preference for data-driven decision-making and remote monitoring capabilities offered by wireless sensors. Technological disruptions, such as the development of more energy-efficient sensors and improved connectivity solutions, are continuously enhancing the market’s potential. Market penetration in key sectors is expected to increase significantly, with particular emphasis on the industrial and healthcare domains.

Dominant Regions, Countries, or Segments in Latin America Wireless Sensors Industry

Mexico and Brazil are the leading countries in the Latin American wireless sensors market, driven by strong industrial growth, expanding infrastructure projects, and a relatively advanced technological landscape. Within the end-user segments, the Energy and Power sector exhibits the highest demand, followed by the Automotive and Healthcare sectors. The pressure sensor segment holds the largest market share, due to its widespread use in various applications.

- Leading Region: Mexico and Brazil

- Leading Country: Mexico

- Leading End-user Segment: Energy and Power (market share: xx%)

- Leading Sensor Type: Pressure Sensor (market share: xx%)

- Key Drivers: Government initiatives promoting digitalization and industrial automation, expanding infrastructure development, increasing investments in renewable energy.

Latin America Wireless Sensors Industry Product Landscape

The Latin American wireless sensor market is characterized by a diverse range of products, featuring advancements in miniaturization, improved accuracy, and enhanced connectivity capabilities. Key innovations include low-power, long-range wireless communication technologies (e.g., LoRaWAN, Sigfox), advanced sensor fusion algorithms, and the integration of cloud-based data analytics platforms. Unique selling propositions often focus on ease of deployment, real-time data access, and enhanced system reliability.

Key Drivers, Barriers & Challenges in Latin America Wireless Sensors Industry

Key Drivers:

- Rising adoption of IoT and Industry 4.0 technologies.

- Increasing demand for real-time monitoring and data analytics.

- Government initiatives promoting digital transformation.

Key Challenges:

- High initial investment costs for deployment of wireless sensor networks.

- Concerns about data security and privacy.

- Inconsistent digital infrastructure across the region. This results in a xx% reduction in potential market growth.

Emerging Opportunities in Latin America Wireless Sensors Industry

Untapped market potential exists in the agricultural sector, particularly precision farming applications. Smart city initiatives offer significant opportunities for deploying wireless sensors in areas such as environmental monitoring, traffic management, and public safety. Growing adoption of wearables and telehealth in healthcare also presents a lucrative opportunity.

Growth Accelerators in the Latin America Wireless Sensors Industry

Technological advancements, strategic partnerships between sensor manufacturers and system integrators, and proactive government policies promoting digitalization will significantly accelerate market growth. Expansion into underserved regions and the development of tailored solutions for specific industry verticals are also vital growth catalysts.

Key Players Shaping the Latin America Wireless Sensors Industry Market

- Honeywell International Inc

- ABB Ltd

- Monnit Corporation

- Emerson Electric Co

- Siemens AG

- Phoenix Sensors LLC

- Schneider Electric

- Texas Instruments Incorporated

- Pasco Scientific

Notable Milestones in Latin America Wireless Sensors Industry Sector

- June 2021: Salunda launched a wireless sensor network (Hawk) for the oil and gas industry, enhancing safety and productivity.

- January 2021: Swift Sensors launched a secure wireless system for monitoring COVID-19 vaccine storage temperatures.

In-Depth Latin America Wireless Sensors Industry Market Outlook

The Latin American wireless sensors market is poised for substantial growth, driven by continued technological advancements and increasing adoption across diverse sectors. Strategic investments in infrastructure development, coupled with government support for digitalization initiatives, will create significant opportunities for market expansion. The focus on developing energy-efficient, cost-effective, and secure solutions will be crucial in driving future market penetration.

Latin America Wireless Sensors Industry Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Chemical and Gas Sensor

- 1.4. Position and Proximity Sensor

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Energy and Power

- 2.5. Food and Beverage

- 2.6. Other End-user Industries

Latin America Wireless Sensors Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Wireless Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation)

- 3.3. Market Restrains

- 3.3.1. False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 3.4. Market Trends

- 3.4.1. Position and proximity sensor is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Wireless Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Chemical and Gas Sensor

- 5.1.4. Position and Proximity Sensor

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy and Power

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Wireless Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Wireless Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Wireless Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Wireless Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Wireless Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Wireless Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ABB Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Monnit Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Emerson Electric Co

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Phoenix Sensors LLC*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Schneider Electric

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Texas Instruments Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Pasco Scientific

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Latin America Wireless Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Wireless Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Wireless Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Wireless Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Wireless Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Latin America Wireless Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Wireless Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Wireless Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Latin America Wireless Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Latin America Wireless Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Wireless Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Wireless Sensors Industry?

The projected CAGR is approximately 18.50%.

2. Which companies are prominent players in the Latin America Wireless Sensors Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Monnit Corporation, Emerson Electric Co, Siemens AG, Phoenix Sensors LLC*List Not Exhaustive, Schneider Electric, Texas Instruments Incorporated, Pasco Scientific.

3. What are the main segments of the Latin America Wireless Sensors Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation).

6. What are the notable trends driving market growth?

Position and proximity sensor is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems.

8. Can you provide examples of recent developments in the market?

June 2021 - Salunda launched a wireless sensor network for connectivity of critical production, operational, and safety systems in the oil and gas industry, such as Red Zone management. The Hawk wireless network can be retrofitted to existing infrastructure and rapidly commissioned while drilling activity continues, ensuring minimum downtime and disruption to productivity. The network can be integrated with third-party sensors and control systems to improve platform safety further, predict equipment failure, enhance production and operational efficiencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Wireless Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Wireless Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Wireless Sensors Industry?

To stay informed about further developments, trends, and reports in the Latin America Wireless Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence