Key Insights

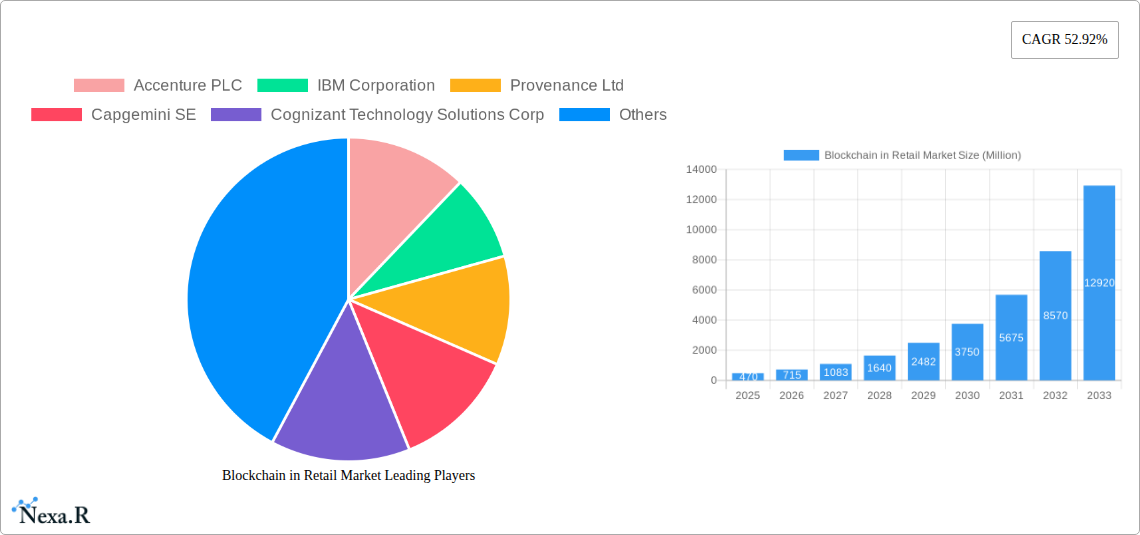

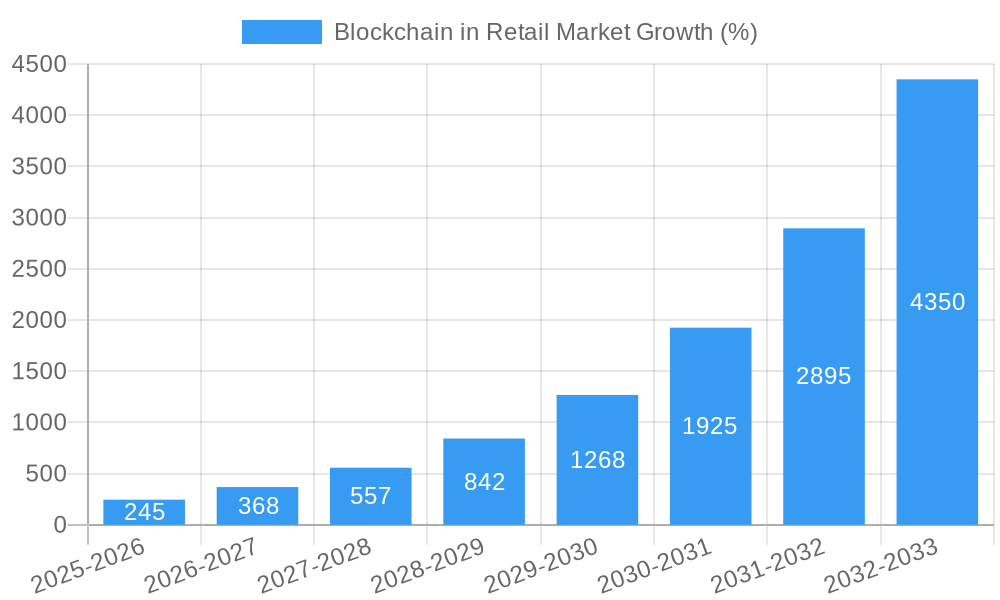

The Blockchain in Retail market is experiencing explosive growth, projected to reach a substantial size driven by increasing adoption of innovative technologies. The market's Compound Annual Growth Rate (CAGR) of 52.92% from 2019 to 2024 indicates a rapidly expanding sector, poised for significant expansion in the coming years. This robust growth is fueled by several key drivers. The demand for enhanced supply chain transparency and traceability is paramount, with blockchain's immutable ledger technology offering a solution to track goods from origin to consumer, mitigating risks associated with counterfeiting and improving efficiency. Furthermore, the increasing focus on data security and privacy is pushing retailers to adopt blockchain solutions for secure customer data management and identity verification. Applications like smart contracts automate processes, reducing transaction times and costs, while improving compliance management across various regulatory frameworks. The rising adoption of automated customer service powered by blockchain promises personalized and efficient interactions, leading to improved customer satisfaction. Although challenges like scalability and regulatory uncertainty exist, the market's positive trajectory suggests that these obstacles will be overcome as the technology matures and its benefits become increasingly clear.

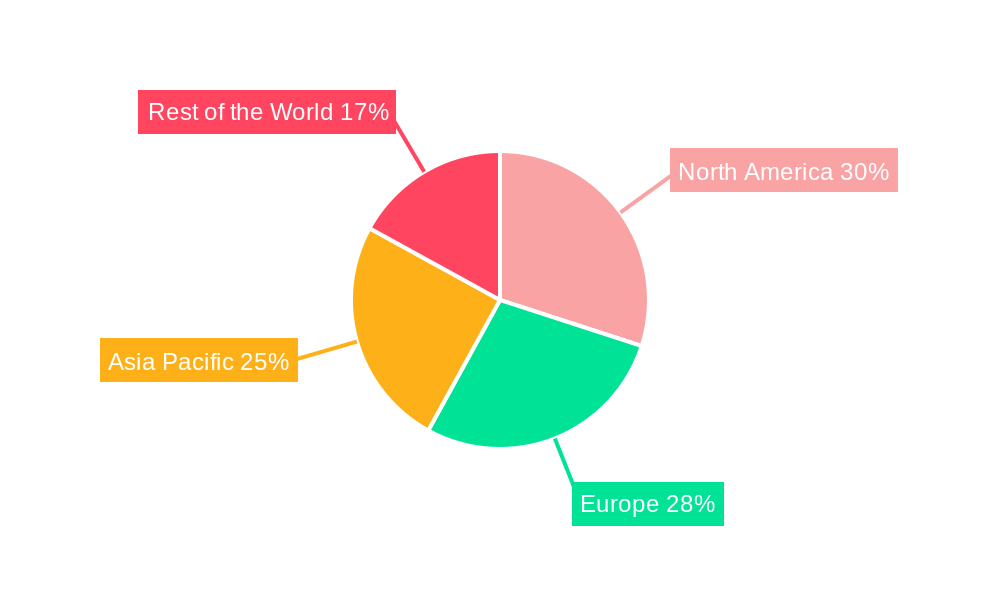

The market segmentation reveals strong growth across various applications. Compliance management, leveraging blockchain's audit trail capabilities, is a major driver, followed by the deployment of smart contracts for automated agreements and supply chain improvements. Transaction management benefits from increased security and speed, while identity management offers secure and efficient customer verification. Automated customer service is also gaining traction, utilizing blockchain for secure and personalized interactions. Leading players like Accenture, IBM, and Amazon Web Services are actively contributing to the market's expansion, investing in research and development, and offering a wide range of blockchain-based solutions tailored to the retail sector. Geographical distribution shows a strong presence in North America and Europe, with the Asia-Pacific region demonstrating significant growth potential due to increasing digitalization and e-commerce adoption. While precise regional market shares are unavailable, a logical assumption given the global nature of the market, would be a near even distribution initially, with Asia-Pacific experiencing faster growth over the forecast period. The overall market presents a compelling investment opportunity, promising high returns in the long term.

Blockchain in Retail Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Blockchain in Retail Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report offers invaluable insights for retail businesses, technology providers, investors, and industry professionals seeking to understand and capitalize on the transformative potential of blockchain technology in the retail sector. The market is segmented by application (Compliance Management, Smart Contract, Supply Chain and Inventory Management, Transaction Management, Automated Customer Service, Identity Management) and geographically analyzed to pinpoint high-growth areas. The total market value is projected to reach xx Million by 2033.

Blockchain in Retail Market Market Dynamics & Structure

The Blockchain in Retail Market is characterized by a dynamic interplay of technological advancements, regulatory landscapes, and competitive pressures. Market concentration is currently moderate, with several major players vying for market share, but the landscape is rapidly evolving with increasing participation from smaller, specialized firms. Technological innovation is a key driver, with continuous advancements in blockchain scalability, security, and interoperability fostering wider adoption. Regulatory frameworks, while still evolving, are gradually shaping the market landscape, particularly concerning data privacy and security. The emergence of alternative technologies presents competitive substitutes, albeit with limitations in functionality and security compared to blockchain's distributed ledger capabilities. End-user demographics are expanding beyond early adopters, encompassing large retailers and enterprises as well as smaller businesses. Mergers and acquisitions (M&A) activity is increasing, as larger players seek to consolidate their positions and acquire specialized blockchain solutions.

- Market Concentration: Moderate, with a shift towards greater fragmentation.

- Technological Innovation: Significant, focused on improving scalability, interoperability, and security.

- Regulatory Framework: Evolving, with increasing focus on data privacy and security.

- Competitive Substitutes: Emerging, but lacking the inherent security and transparency of blockchain.

- M&A Activity: Increasing, driven by strategic acquisitions of blockchain technology companies.

- Market Share (2025): Accenture PLC (15%), IBM Corporation (12%), Others (73%). (These are estimated values).

Blockchain in Retail Market Growth Trends & Insights

The Blockchain in Retail Market is experiencing significant growth, driven by increasing adoption across various retail applications. Market size has grown considerably from xx Million in 2019 to an estimated xx Million in 2025, reflecting a Compound Annual Growth Rate (CAGR) of xx%. Market penetration is increasing steadily, particularly among larger retailers and enterprises seeking improved supply chain transparency, enhanced security, and streamlined operations. Technological advancements, such as the development of more scalable and efficient blockchain platforms, are further accelerating market growth. Consumer behavior shifts towards greater transparency and trust in brands are also boosting adoption. The forecast indicates robust growth, projecting a market value of xx Million by 2033. The CAGR for 2025-2033 is projected at xx%. Key growth catalysts include increased consumer demand for secure and transparent transactions, the growing need for efficient supply chain management, and the increasing adoption of Web3 technologies.

Dominant Regions, Countries, or Segments in Blockchain in Retail Market

North America currently holds the leading position in the Blockchain in Retail Market, driven by early adoption of blockchain technologies, strong technological infrastructure, and the presence of major players in the retail and technology sectors. However, the Asia-Pacific region is exhibiting rapid growth, fueled by increasing digitalization, expanding e-commerce activities, and supportive government policies. Within applications, Supply Chain and Inventory Management dominates market share, followed by Compliance Management, driven by the need for enhanced traceability and security throughout the supply chain.

- Key Drivers (North America): Strong technological infrastructure, early adoption of blockchain technologies, presence of major players.

- Key Drivers (Asia-Pacific): Increasing digitalization, expanding e-commerce, supportive government policies.

- Dominant Segment: Supply Chain and Inventory Management (xx% market share).

- Growth Potential: Asia-Pacific region demonstrates the highest growth potential.

Blockchain in Retail Market Product Landscape

The Blockchain in Retail Market encompasses a range of products, including blockchain platforms, solutions for supply chain management, customer loyalty programs, and identity management systems. These products offer unique selling propositions focused on enhanced security, transparency, efficiency, and reduced costs. Technological advancements continuously improve product functionalities, incorporating features such as improved scalability, interoperability, and user-friendly interfaces. Innovation is concentrated on developing tailored solutions catering to specific retail needs, such as provenance tracking, counterfeit prevention, and customer data protection.

Key Drivers, Barriers & Challenges in Blockchain in Retail Market

Key Drivers:

- Growing demand for enhanced security and transparency in retail transactions.

- Increased need for efficient supply chain management and traceability.

- Rising adoption of IoT and other emerging technologies that complement blockchain solutions.

Challenges & Restraints:

- Scalability issues with some blockchain platforms.

- Regulatory uncertainty and evolving data privacy concerns.

- Lack of blockchain expertise among some retailers. This leads to approximately a xx% reduction in expected market growth.

Emerging Opportunities in Blockchain in Retail Market

- Untapped Markets: Expansion into developing economies with growing e-commerce sectors.

- Innovative Applications: Exploring the use of blockchain in areas such as NFT-based loyalty programs and decentralized autonomous organizations (DAOs) for retail operations.

- Evolving Consumer Preferences: Catering to the increasing consumer demand for ethical and sustainable products through enhanced traceability.

Growth Accelerators in the Blockchain in Retail Market Industry

Strategic partnerships between technology providers and retail giants are accelerating market growth, fostering innovation and wider adoption. Furthermore, technological breakthroughs, such as advancements in scalability and interoperability, are paving the way for more mainstream acceptance. Expanding regulatory frameworks, while posing challenges, also provide a degree of certainty and stimulate investment.

Key Players Shaping the Blockchain in Retail Market Market

- Accenture PLC

- IBM Corporation

- Provenance Ltd

- Capgemini SE

- Cognizant Technology Solutions Corp

- Amazon Web Services Inc

- Oracle Corporation

- Microsoft Corp

- BlockVerify

- SAP SE

Notable Milestones in Blockchain in Retail Market Sector

- February 2023: Flipkart and Polygon partnered to establish a Blockchain-eCommerce Centre of Excellence (CoE) in India.

- January 2023: Lowe's launched Project Unlock, a blockchain-based solution to combat retail theft.

In-Depth Blockchain in Retail Market Market Outlook

The Blockchain in Retail Market is poised for significant long-term growth, driven by continuous technological advancements, expanding adoption across various retail segments, and the increasing need for enhanced security and transparency. Strategic partnerships and innovative applications will further propel market expansion, creating lucrative opportunities for businesses and investors alike. The market's future is bright, with potential for substantial growth and market transformation.

Blockchain in Retail Market Segmentation

-

1. Application

- 1.1. Compliance Management

- 1.2. Smart Contract

- 1.3. Supply Chain and Inventory Management

- 1.4. Transaction Management

- 1.5. Automated Customer Service

- 1.6. Identity Management

Blockchain in Retail Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Blockchain in Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 52.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Retail Frauds Prevention and Detection is Driving the Market Growth; Improved Transactions Transparency is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Industry Standardisation for Blockchain is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Supply Chain and Inventory Management segment is expected to acquire major share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Compliance Management

- 5.1.2. Smart Contract

- 5.1.3. Supply Chain and Inventory Management

- 5.1.4. Transaction Management

- 5.1.5. Automated Customer Service

- 5.1.6. Identity Management

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Compliance Management

- 6.1.2. Smart Contract

- 6.1.3. Supply Chain and Inventory Management

- 6.1.4. Transaction Management

- 6.1.5. Automated Customer Service

- 6.1.6. Identity Management

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Compliance Management

- 7.1.2. Smart Contract

- 7.1.3. Supply Chain and Inventory Management

- 7.1.4. Transaction Management

- 7.1.5. Automated Customer Service

- 7.1.6. Identity Management

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Compliance Management

- 8.1.2. Smart Contract

- 8.1.3. Supply Chain and Inventory Management

- 8.1.4. Transaction Management

- 8.1.5. Automated Customer Service

- 8.1.6. Identity Management

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Compliance Management

- 9.1.2. Smart Contract

- 9.1.3. Supply Chain and Inventory Management

- 9.1.4. Transaction Management

- 9.1.5. Automated Customer Service

- 9.1.6. Identity Management

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Accenture PLC

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 IBM Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Provenance Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Capgemini SE

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Cognizant Technology Solutions Corp

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Amazon Web Services Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Oracle Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Microsoft Corp

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 BlockVerify*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 SAP SE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Accenture PLC

List of Figures

- Figure 1: Global Blockchain in Retail Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Asia Pacific Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Asia Pacific Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Rest of the World Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Rest of the World Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blockchain in Retail Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Blockchain in Retail Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain in Retail Market?

The projected CAGR is approximately 52.92%.

2. Which companies are prominent players in the Blockchain in Retail Market?

Key companies in the market include Accenture PLC, IBM Corporation, Provenance Ltd, Capgemini SE, Cognizant Technology Solutions Corp, Amazon Web Services Inc, Oracle Corporation, Microsoft Corp, BlockVerify*List Not Exhaustive, SAP SE.

3. What are the main segments of the Blockchain in Retail Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Retail Frauds Prevention and Detection is Driving the Market Growth; Improved Transactions Transparency is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Supply Chain and Inventory Management segment is expected to acquire major share..

7. Are there any restraints impacting market growth?

Lack of Industry Standardisation for Blockchain is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

In Feb 2023, E-commerce giant Flipkart and blockchain platform Polygon entered a strategic partnership to set up a Blockchain-eCommerce Centre of Excellence (CoE). The CoE will work on research and development of Web3 and metaverse commerce use cases in India to accelerate the adoption of Web3.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain in Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain in Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain in Retail Market?

To stay informed about further developments, trends, and reports in the Blockchain in Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence