Key Insights

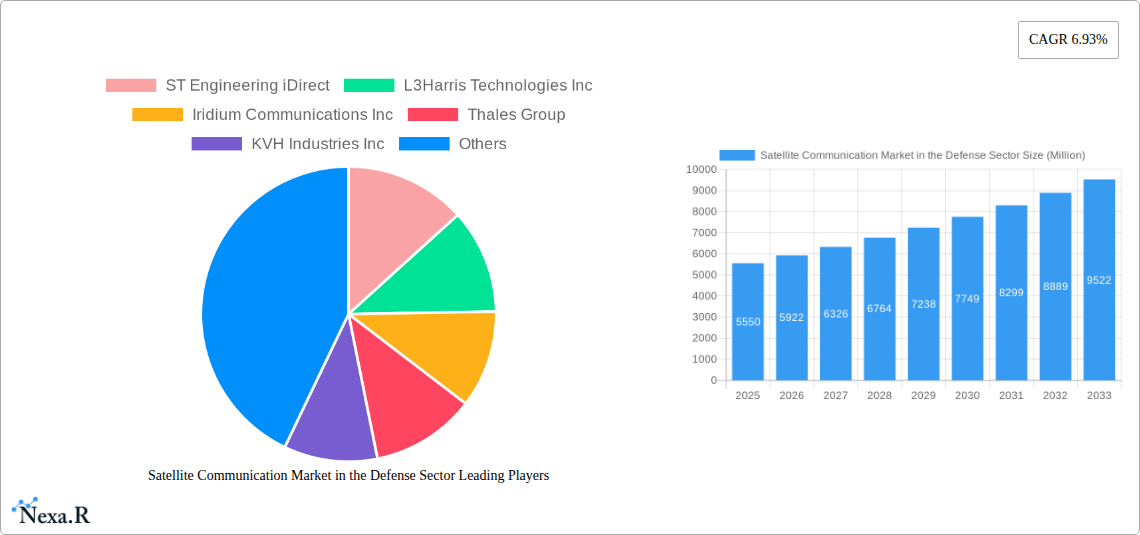

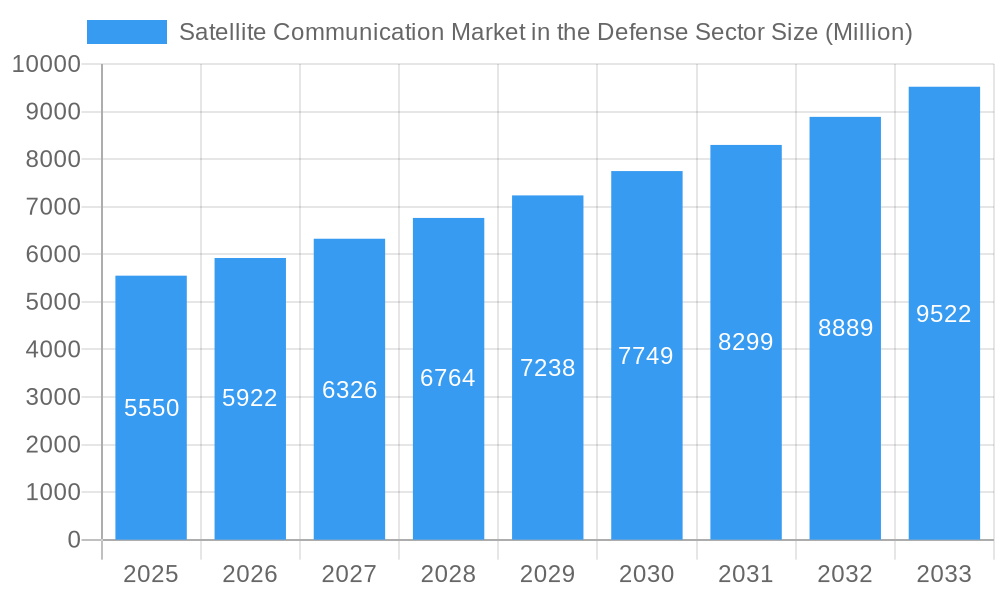

The global satellite communication market within the defense sector is experiencing robust growth, projected to reach a value of $5.55 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 6.93% from 2025 to 2033. This expansion is driven by increasing demand for secure and reliable communication in diverse defense applications, including surveillance and tracking, remote sensing, and disaster recovery. The rising adoption of advanced technologies like high-throughput satellites (HTS) and improved satellite-based communication systems is further fueling market growth. Ground equipment constitutes a significant segment, offering various communication solutions for defense forces, while the services segment is propelled by the increasing need for managed satellite communication services and technical support. Geographically, North America currently holds a substantial market share due to significant defense spending and technological advancements. However, the Asia-Pacific region is anticipated to witness rapid growth in the coming years driven by increasing investments in military modernization and infrastructure development. Challenges remain, including the high initial investment costs associated with satellite technology and the potential for signal interference and jamming. Nevertheless, ongoing technological advancements and the increasing strategic importance of robust satellite communication systems are likely to outweigh these restraints, ensuring continued growth throughout the forecast period.

Satellite Communication Market in the Defense Sector Market Size (In Billion)

The competitive landscape is marked by the presence of established players like ST Engineering iDirect, L3Harris Technologies Inc, and Iridium Communications Inc., among others, each contributing to innovation and competition. These companies are focusing on developing advanced satellite communication technologies, expanding their service portfolios, and forging strategic partnerships to enhance their market presence. The market segmentation by application reveals a strong demand across diverse defense applications, with surveillance and tracking maintaining a leading position due to its critical role in intelligence gathering and operational effectiveness. The rising need for reliable communication during natural disasters and humanitarian crises is also fostering growth in the disaster recovery segment. Looking ahead, the integration of artificial intelligence (AI) and machine learning (ML) into satellite communication systems is expected to revolutionize the sector, further enhancing its capabilities and driving demand in the coming years.

Satellite Communication Market in the Defense Sector Company Market Share

Satellite Communication Market in the Defense Sector: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Satellite Communication Market in the Defense Sector, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The report segments the market by type (Ground Equipment, Services) and application (Surveillance and Tracking, Remote Sensing, Disaster Recovery, Other Applications), offering a granular understanding of market dynamics and growth potential. Key players analyzed include ST Engineering iDirect, L3Harris Technologies Inc, Iridium Communications Inc, Thales Group, KVH Industries Inc, Thuraya Telecommunications Company (Al Yah Satellite Communications Company P J S C), Orbcomm Inc, Cobham PLC, ViaSat Inc, and Inmarsat Communications.

Satellite Communication Market in the Defense Sector Market Dynamics & Structure

This section delves into the intricate structure of the defense satellite communication market, examining its concentration, innovation drivers, regulatory landscape, competitive dynamics, and end-user trends. The analysis incorporates both qualitative and quantitative data, including market share percentages and M&A deal volumes.

Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The xx% market share held by the top five players reflects a trend of consolidation driven by mergers and acquisitions (M&A). The remaining market share is distributed among numerous smaller companies specializing in niche segments.

Technological Innovation: Advancements in satellite technology, such as the adoption of higher throughput satellites (HTS) and increased bandwidth capabilities, are key innovation drivers. The integration of AI and machine learning is further enhancing the performance and capabilities of satellite communication systems.

Regulatory Framework: Government regulations and defense procurement policies significantly impact market growth. Stringent security requirements and interoperability standards create both opportunities and challenges for market participants. Specific regulations surrounding data security, encryption, and spectrum allocation also influence market dynamics.

Competitive Landscape: The competitive landscape is characterized by intense competition among established players and emerging entrants. Companies are competing on the basis of technological innovation, service offerings, pricing, and customer support. M&A activity is common, reflecting the drive for consolidation and expansion. The number of M&A deals in the period 2019-2024 totaled xx, with an average deal value of xx million.

End-User Demographics: The primary end-users are government defense agencies, including armed forces, intelligence agencies, and border patrol units. The increasing demand for secure and reliable communication solutions drives the market's growth. The report analyzes the specific needs of these end-users and how these needs shape market development.

Satellite Communication Market in the Defense Sector Growth Trends & Insights

This section provides a comprehensive analysis of the market size evolution, adoption rates, technological disruptions, and shifting consumer behavior within the defense satellite communication market. Using data from various sources, we illustrate market growth trends and provide detailed insights into market dynamics.

The global defense satellite communication market size was valued at xx million in 2024 and is projected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is driven primarily by increased investments in defense modernization and the escalating demand for improved battlefield communication capabilities. The adoption rate of satellite communication systems within the defense sector is increasing, primarily fueled by the need for reliable, secure, and wide-area coverage communication solutions in remote or challenging operational environments. Technological disruptions, such as the transition towards HTS and the integration of advanced cybersecurity protocols, are significantly altering market dynamics. The growing focus on data analytics and the integration of AI in satellite communication is transforming the capabilities and value proposition of defense communication systems.

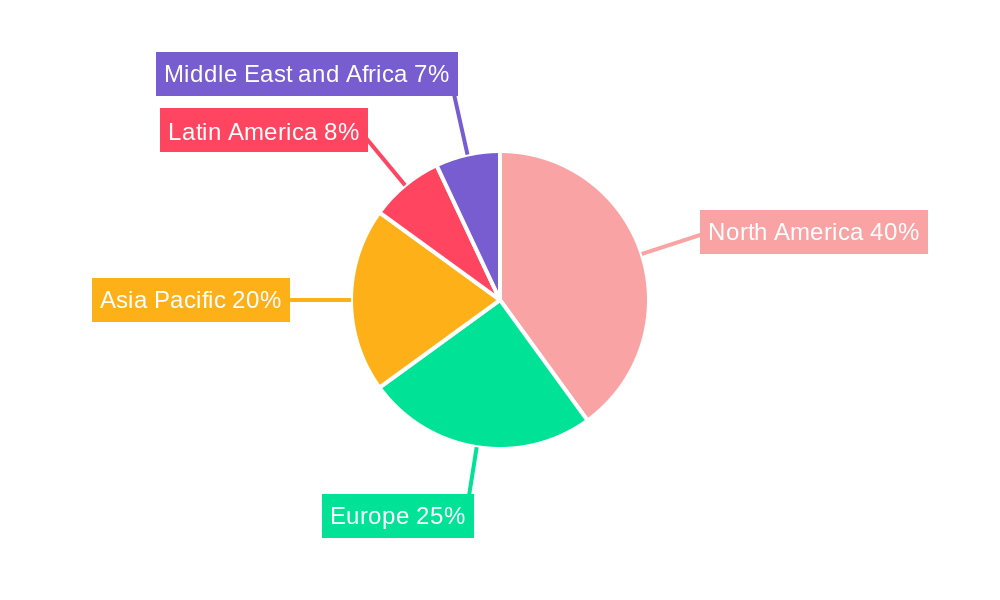

Dominant Regions, Countries, or Segments in Satellite Communication Market in the Defense Sector

This section identifies the leading regions, countries, and market segments driving growth within the defense satellite communication market. We use quantitative data, including market share and growth projections, to demonstrate market dominance.

Leading Region: North America currently dominates the market, accounting for xx% of global revenue in 2024. This dominance is attributed to significant investments in defense technologies, the presence of key industry players, and robust government spending on military modernization.

Leading Country: The United States is the leading national market within North America, driven by high defense budget allocations and a strong demand for advanced satellite communication capabilities.

Leading Segments:

By Type: The Services segment holds the largest market share in 2024, accounting for approximately xx% due to the increasing demand for managed services, and system maintenance and support. However, the Ground Equipment segment shows a higher growth rate projection, driven by the demand for advanced and more robust ground stations.

By Application: The Surveillance and Tracking application currently represents the largest segment, reflecting the growing need for real-time intelligence gathering and asset monitoring. The Disaster Recovery segment is expected to experience substantial growth due to increased global awareness of disaster management and preparedness.

Satellite Communication Market in the Defense Sector Product Landscape

The defense satellite communication market offers a diverse range of products, encompassing both ground-based equipment and satellite-based services. Recent product innovations include higher throughput satellites, enabling faster data transmission speeds, and advanced encryption technologies, providing enhanced security. Miniaturization of satellite terminals, improving portability and deployability in various operational environments, also highlights this market's progress. Many systems now integrate advanced features such as anti-jamming capabilities, ensuring reliable communication even under adverse conditions. The integration of AI and Machine Learning further enhances data processing and analysis, resulting in more efficient and effective defense communications.

Key Drivers, Barriers & Challenges in Satellite Communication Market in the Defense Sector

Key Drivers: The primary drivers include increased government spending on defense, growing demand for improved communication capabilities in remote areas, and ongoing technological advancements in satellite technology. The need for real-time intelligence and secure communication in military operations is a significant catalyst.

Challenges: Key challenges include high initial investment costs associated with satellite systems, the complexity of integrating different systems, and potential vulnerabilities to cyberattacks. Stringent regulations and interoperability standards also pose hurdles. Supply chain disruptions and competition from other communication technologies further impact the market. The estimated impact of these challenges on market growth is a projected reduction in CAGR by xx% during the forecast period.

Emerging Opportunities in Satellite Communication Market in the Defense Sector

Emerging opportunities lie in the development of more resilient and secure satellite communication systems, the expansion into new applications such as unmanned aerial vehicle (UAV) communications, and the integration of advanced technologies like quantum encryption. The increasing focus on space-based situational awareness and the exploration of new spectrum bands provide further opportunities. The growth of the Internet of Battlefield Things (IoBT) presents a significant, emerging market for improved and reliable data collection and transmission.

Growth Accelerators in the Satellite Communication Market in the Defense Sector Industry

Long-term growth will be accelerated by technological advancements, including the development of low-earth orbit (LEO) mega-constellations, improvements in network security, and the adoption of AI-powered communication solutions. Strategic partnerships between defense agencies and commercial satellite operators will also drive growth. Government initiatives to support the development and deployment of advanced satellite technologies will play a pivotal role in accelerating market expansion.

Key Players Shaping the Satellite Communication Market in the Defense Sector Market

- ST Engineering iDirect

- L3Harris Technologies Inc

- Iridium Communications Inc

- Thales Group

- KVH Industries Inc

- Thuraya Telecommunications Company (Al Yah Satellite Communications Company P J S C)

- Orbcomm Inc

- Cobham PLC

- ViaSat Inc

- Inmarsat Communications

Notable Milestones in Satellite Communication Market in the Defense Sector Sector

- February 2022: Thales plans to install a secure Satcom solution for French military tanker aircraft, deploying satellite stations by 2025.

- April 2022: NASA partners with Inmarsat Government Inc. to explore commercial satellite communication capabilities for near-Earth orbit spacecraft.

- May 2022: Cobham SATCOM signs a strategic agreement with UltiSat Inc., expanding market reach for DoD and NATO allies.

In-Depth Satellite Communication Market in the Defense Sector Market Outlook

The future of the defense satellite communication market is bright, driven by continued technological innovation, increasing defense spending, and the growing demand for secure and reliable communication in increasingly complex operational environments. Strategic partnerships, the emergence of new applications, and the expansion of satellite constellations will all contribute to significant market growth in the coming years. The focus on advanced technologies and cybersecurity will remain paramount, shaping product development and market competition.

Satellite Communication Market in the Defense Sector Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Application

- 2.1. Surveillance and Tracking

- 2.2. Remote Sensing

- 2.3. Disaster Recovery

- 2.4. Other Applications

Satellite Communication Market in the Defense Sector Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Satellite Communication Market in the Defense Sector Regional Market Share

Geographic Coverage of Satellite Communication Market in the Defense Sector

Satellite Communication Market in the Defense Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Seaborne Threats and Ambiguous Maritime Security Policies; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Reliance on High-cost Satellite Equipment

- 3.4. Market Trends

- 3.4.1. Remote Sensing to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Communication Market in the Defense Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Surveillance and Tracking

- 5.2.2. Remote Sensing

- 5.2.3. Disaster Recovery

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Satellite Communication Market in the Defense Sector Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ground Equipment

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Surveillance and Tracking

- 6.2.2. Remote Sensing

- 6.2.3. Disaster Recovery

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Satellite Communication Market in the Defense Sector Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ground Equipment

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Surveillance and Tracking

- 7.2.2. Remote Sensing

- 7.2.3. Disaster Recovery

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Satellite Communication Market in the Defense Sector Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ground Equipment

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Surveillance and Tracking

- 8.2.2. Remote Sensing

- 8.2.3. Disaster Recovery

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Satellite Communication Market in the Defense Sector Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ground Equipment

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Surveillance and Tracking

- 9.2.2. Remote Sensing

- 9.2.3. Disaster Recovery

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Satellite Communication Market in the Defense Sector Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ground Equipment

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Surveillance and Tracking

- 10.2.2. Remote Sensing

- 10.2.3. Disaster Recovery

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ST Engineering iDirect

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L3Harris Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Iridium Communications Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thales Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KVH Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thuraya Telecommunications Company (Al Yah Satellite Communications Company P J S C)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Orbcomm Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cobham PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ViaSat Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inmarsat Communications

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ST Engineering iDirect

List of Figures

- Figure 1: Global Satellite Communication Market in the Defense Sector Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Satellite Communication Market in the Defense Sector Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Satellite Communication Market in the Defense Sector Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Satellite Communication Market in the Defense Sector Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Satellite Communication Market in the Defense Sector Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Satellite Communication Market in the Defense Sector Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Satellite Communication Market in the Defense Sector Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Satellite Communication Market in the Defense Sector Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Satellite Communication Market in the Defense Sector Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Satellite Communication Market in the Defense Sector Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Satellite Communication Market in the Defense Sector Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Satellite Communication Market in the Defense Sector Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Satellite Communication Market in the Defense Sector Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Satellite Communication Market in the Defense Sector Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Satellite Communication Market in the Defense Sector Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Satellite Communication Market in the Defense Sector Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Satellite Communication Market in the Defense Sector Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Satellite Communication Market in the Defense Sector Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Satellite Communication Market in the Defense Sector Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Satellite Communication Market in the Defense Sector Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Satellite Communication Market in the Defense Sector Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Satellite Communication Market in the Defense Sector Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Satellite Communication Market in the Defense Sector Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Satellite Communication Market in the Defense Sector Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Satellite Communication Market in the Defense Sector Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Satellite Communication Market in the Defense Sector Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Satellite Communication Market in the Defense Sector Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Satellite Communication Market in the Defense Sector Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Satellite Communication Market in the Defense Sector Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Satellite Communication Market in the Defense Sector Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Satellite Communication Market in the Defense Sector Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Satellite Communication Market in the Defense Sector Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Communication Market in the Defense Sector?

The projected CAGR is approximately 6.93%.

2. Which companies are prominent players in the Satellite Communication Market in the Defense Sector?

Key companies in the market include ST Engineering iDirect, L3Harris Technologies Inc, Iridium Communications Inc, Thales Group, KVH Industries Inc, Thuraya Telecommunications Company (Al Yah Satellite Communications Company P J S C), Orbcomm Inc, Cobham PLC, ViaSat Inc, Inmarsat Communications.

3. What are the main segments of the Satellite Communication Market in the Defense Sector?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Seaborne Threats and Ambiguous Maritime Security Policies; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Remote Sensing to Drive the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Reliance on High-cost Satellite Equipment.

8. Can you provide examples of recent developments in the market?

May 2022 - Cobham SATCOM (formerly known as Thrane & Thrane A/S) signed a strategic agreement with UltiSat Inc, a provider of end-to-end communications. The deal allows both companies to extend their market reach, providing the DoD and NATO allies with easy access to a range of advanced satellite tracking systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Communication Market in the Defense Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Communication Market in the Defense Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Communication Market in the Defense Sector?

To stay informed about further developments, trends, and reports in the Satellite Communication Market in the Defense Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence