Key Insights

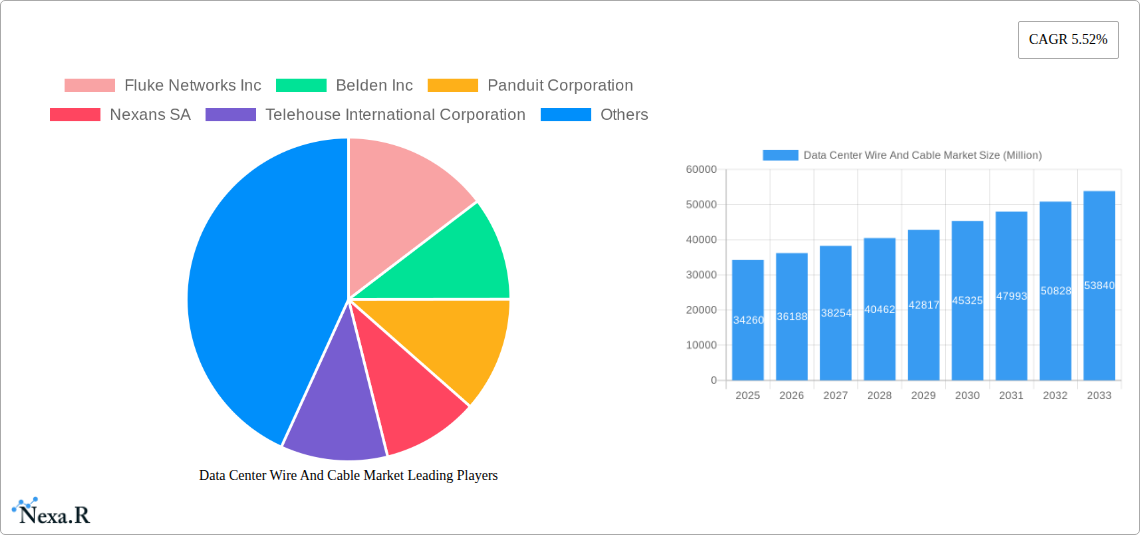

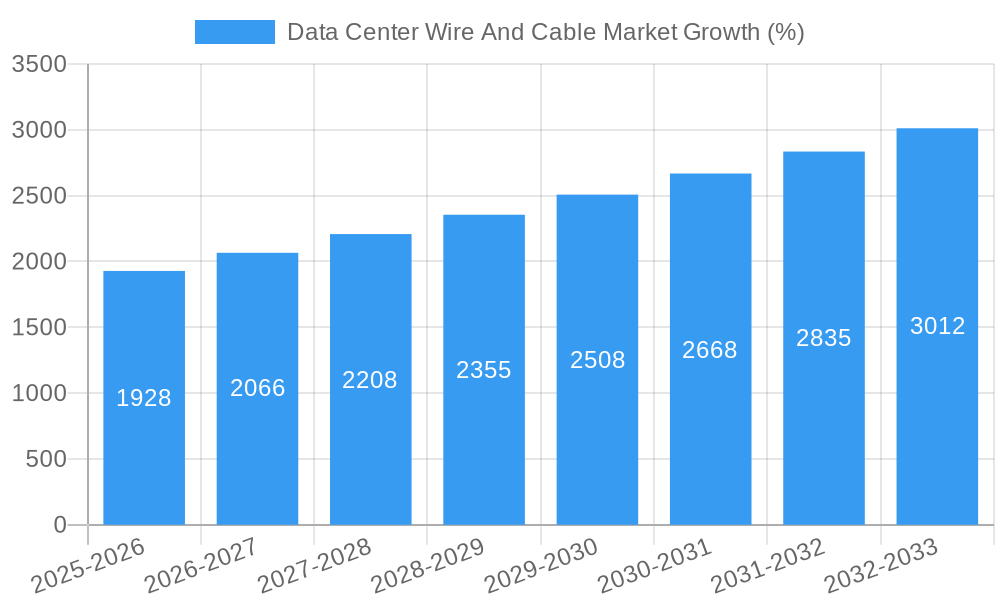

The Data Center Wire and Cable market, valued at $34.26 billion in 2025, is projected to experience robust growth, driven by the escalating demand for high-speed data transmission and the rapid expansion of data centers globally. The market's Compound Annual Growth Rate (CAGR) of 5.52% from 2019 to 2024 indicates a consistent upward trajectory, expected to continue throughout the forecast period (2025-2033). Key drivers include the increasing adoption of cloud computing, the proliferation of edge data centers, and the growing need for high-bandwidth connectivity solutions to support emerging technologies like 5G, artificial intelligence, and the Internet of Things (IoT). Furthermore, the shift towards higher density data center deployments necessitates the use of advanced cabling solutions capable of handling increased power and data throughput. While challenges such as supply chain disruptions and fluctuating raw material prices may present headwinds, the overall market outlook remains positive, fueled by ongoing digital transformation initiatives across diverse sectors.

The market segmentation, while not explicitly detailed, can be reasonably inferred to include various cable types (fiber optic, copper, hybrid), application segments (server rooms, storage areas, network infrastructure), and geographic regions. Leading players such as Fluke Networks, Belden, Panduit, Nexans, and CommScope are actively investing in research and development to enhance their product offerings and cater to the evolving needs of data center operators. The competitive landscape is characterized by both technological innovation and strategic partnerships, aiming to provide comprehensive cabling solutions that improve efficiency, scalability, and reliability within data center environments. Future growth will hinge on factors such as the advancements in cabling technology, the development of sustainable and energy-efficient solutions, and the ability of companies to meet the increasing demand for customized and integrated cabling systems.

Data Center Wire and Cable Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Data Center Wire and Cable Market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. With a study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers both the parent market (Data Center Infrastructure) and the child market (Data Center Wire and Cable), delivering a granular understanding of market segmentation and growth potential. The market size is predicted to reach xx Million units by 2033.

Data Center Wire and Cable Market Dynamics & Structure

The Data Center Wire and Cable market is characterized by a moderately consolidated structure, with key players holding significant market shares. Market concentration is influenced by factors such as technological innovation, regulatory compliance, and mergers and acquisitions (M&A) activities. The market witnesses continuous technological advancements, driving the adoption of high-bandwidth, low-latency solutions. Regulatory frameworks, particularly concerning data security and environmental standards, play a crucial role in shaping market dynamics. Competitive pressures from substitute products, including wireless technologies, also influence market growth. The end-user demographics are primarily driven by hyperscale data centers, cloud providers, and colocation facilities. M&A activity has been moderately high in the recent past, indicating strategic consolidation and market expansion.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Focus on high-speed fiber optics, shielded cables, and advanced connectivity solutions.

- Regulatory Framework: Compliance with data security regulations and environmental standards is crucial.

- Competitive Substitutes: Wireless technologies pose a competitive threat to wired solutions, particularly in specific applications.

- End-User Demographics: Hyperscale data centers, cloud providers, and colocation facilities are the primary end-users.

- M&A Trends: Moderate M&A activity observed in recent years, with xx major deals completed between 2020 and 2024.

Data Center Wire and Cable Market Growth Trends & Insights

The Data Center Wire and Cable market experienced significant growth during the historical period (2019-2024), driven by factors such as the increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT). The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including the deployment of 5G networks and advancements in fiber optic technology, are accelerating market growth. The market penetration rate is expected to reach xx% by 2033. Consumer behavior shifts towards increased digitalization and data consumption further fuel market expansion. This growth trajectory is influenced by continuous innovation in fiber optic cables and related technologies, offering higher bandwidth, lower latency, and improved performance. Furthermore, the rising demand for high-performance computing (HPC) and artificial intelligence (AI) is accelerating the adoption of advanced cabling solutions. The global data center build-out is driving up the demand for reliable and high-performance cables, underpinning the market's continued growth.

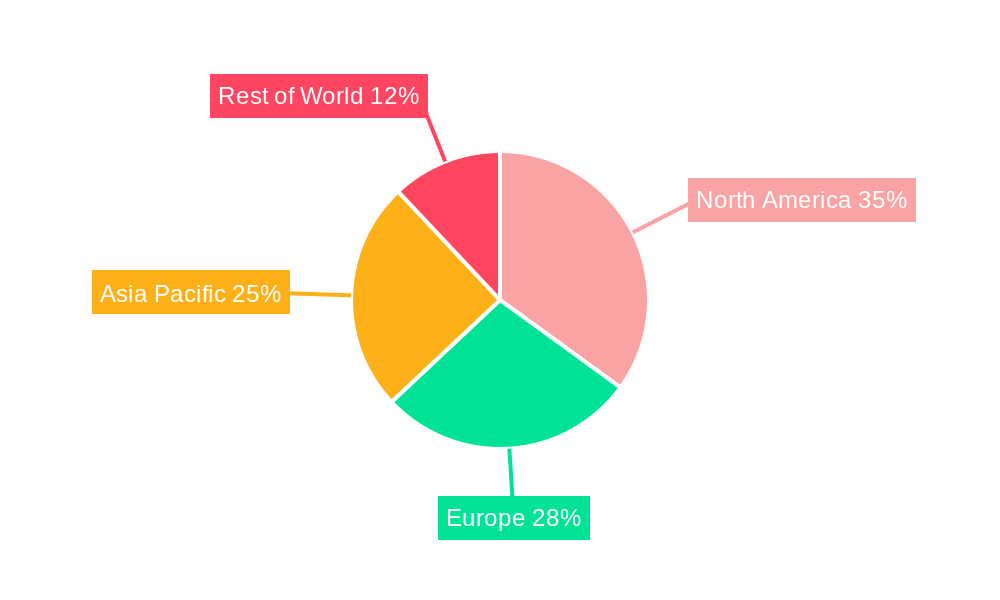

Dominant Regions, Countries, or Segments in Data Center Wire and Cable Market

North America currently holds the largest market share in the Data Center Wire and Cable market, driven by factors such as a robust technological infrastructure, high adoption rates of cloud computing, and a dense concentration of hyperscale data centers. However, Asia-Pacific is expected to witness the fastest growth during the forecast period, fueled by rapid economic development, increasing digitalization, and government initiatives promoting digital infrastructure development. Europe is also expected to display healthy growth, supported by investments in digital infrastructure and the growing adoption of data-intensive technologies.

- North America: High adoption of cloud computing and dense concentration of hyperscale data centers.

- Asia-Pacific: Rapid economic growth, increasing digitalization, and supportive government policies.

- Europe: Investments in digital infrastructure and growing adoption of data-intensive technologies.

- Market Share: North America holds approximately xx% of the market share in 2024, with Asia-Pacific projected to increase its share to xx% by 2033.

Data Center Wire and Cable Market Product Landscape

The Data Center Wire and Cable market offers a diverse range of products, including copper cables, fiber optic cables, and related connectivity solutions. Recent innovations focus on higher bandwidth capacities, improved signal integrity, and enhanced durability. These advancements are driven by the increasing demand for high-speed data transmission and the need for reliable connectivity in demanding data center environments. Key product differentiators include bandwidth capacity, attenuation characteristics, and the integration of advanced features such as intelligent cable management systems.

Key Drivers, Barriers & Challenges in Data Center Wire and Cable Market

Key Drivers: The escalating demand for high-bandwidth connectivity, driven by the proliferation of cloud computing, big data, and IoT, is a primary driver. The increasing adoption of 5G networks and the growing demand for high-performance computing are further catalysts for market growth. Government initiatives promoting digital infrastructure development also play a significant role.

Key Challenges: Supply chain disruptions can lead to production delays and increased costs. Stringent regulatory requirements concerning environmental standards and data security can increase compliance costs. Intense competition from established players and new entrants can create pricing pressures.

Emerging Opportunities in Data Center Wire and Cable Market

Emerging opportunities exist in the development of high-density cabling solutions, addressing the challenges of space constraints in modern data centers. There is also potential for growth in specialized cabling solutions for specific applications, such as AI and machine learning deployments. Furthermore, innovative cable management systems and intelligent connectivity solutions offer significant growth potential.

Growth Accelerators in the Data Center Wire and Cable Market Industry

Technological advancements in fiber optics, increasing data center construction, and strategic partnerships between cable manufacturers and data center operators are accelerating market growth. Expanding into new markets and developing customized cabling solutions for specialized applications offer further growth opportunities.

Key Players Shaping the Data Center Wire and Cable Market Market

- Fluke Networks Inc

- Belden Inc

- Panduit Corporation

- Nexans SA

- Telehouse International Corporation

- Service Wire Company

- CommScope Holding Company Inc

- Prysmian SpA

- Hubbell

- Leviton Manufacturing Co Inc

Notable Milestones in Data Center Wire and Cable Market Sector

- April 2024: GlobalConnect's Nordic Digital Infrastructure Project reinforces the region's position as a data center hub, driving demand for advanced cabling solutions.

- January 2024: OFS launches LaserWave Dual-Band OM4+ Multimode Optical Fiber, enhancing high-density, low-power multimode link capabilities.

In-Depth Data Center Wire and Cable Market Market Outlook

The Data Center Wire and Cable market is poised for continued growth, driven by the ongoing expansion of data centers globally and the increasing demand for high-bandwidth connectivity. Strategic partnerships, technological innovation, and expansion into emerging markets will be key factors in shaping future market dynamics. The market's long-term potential is significant, offering numerous opportunities for growth and innovation.

Data Center Wire And Cable Market Segmentation

-

1. Offering Type

- 1.1. Optical Fiber Cables

- 1.2. Copper Cables

- 1.3. Power Cables

- 1.4. Other Ca

-

2. Data Center Type

- 2.1. Enterprise

- 2.2. Colocation

- 2.3. Hyperscalers

Data Center Wire And Cable Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Data Center Wire And Cable Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust data center expansion across the globe; Growth of High-Performance Computing (HPC) applications; Growing demand for High-Speed Connectivity

- 3.3. Market Restrains

- 3.3.1. Robust data center expansion across the globe; Growth of High-Performance Computing (HPC) applications; Growing demand for High-Speed Connectivity

- 3.4. Market Trends

- 3.4.1. Hyperscalers are Analyzed to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Data Center Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering Type

- 5.1.1. Optical Fiber Cables

- 5.1.2. Copper Cables

- 5.1.3. Power Cables

- 5.1.4. Other Ca

- 5.2. Market Analysis, Insights and Forecast - by Data Center Type

- 5.2.1. Enterprise

- 5.2.2. Colocation

- 5.2.3. Hyperscalers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering Type

- 6. North America Data Center Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering Type

- 6.1.1. Optical Fiber Cables

- 6.1.2. Copper Cables

- 6.1.3. Power Cables

- 6.1.4. Other Ca

- 6.2. Market Analysis, Insights and Forecast - by Data Center Type

- 6.2.1. Enterprise

- 6.2.2. Colocation

- 6.2.3. Hyperscalers

- 6.1. Market Analysis, Insights and Forecast - by Offering Type

- 7. Europe Data Center Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering Type

- 7.1.1. Optical Fiber Cables

- 7.1.2. Copper Cables

- 7.1.3. Power Cables

- 7.1.4. Other Ca

- 7.2. Market Analysis, Insights and Forecast - by Data Center Type

- 7.2.1. Enterprise

- 7.2.2. Colocation

- 7.2.3. Hyperscalers

- 7.1. Market Analysis, Insights and Forecast - by Offering Type

- 8. Asia Data Center Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering Type

- 8.1.1. Optical Fiber Cables

- 8.1.2. Copper Cables

- 8.1.3. Power Cables

- 8.1.4. Other Ca

- 8.2. Market Analysis, Insights and Forecast - by Data Center Type

- 8.2.1. Enterprise

- 8.2.2. Colocation

- 8.2.3. Hyperscalers

- 8.1. Market Analysis, Insights and Forecast - by Offering Type

- 9. Australia and New Zealand Data Center Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering Type

- 9.1.1. Optical Fiber Cables

- 9.1.2. Copper Cables

- 9.1.3. Power Cables

- 9.1.4. Other Ca

- 9.2. Market Analysis, Insights and Forecast - by Data Center Type

- 9.2.1. Enterprise

- 9.2.2. Colocation

- 9.2.3. Hyperscalers

- 9.1. Market Analysis, Insights and Forecast - by Offering Type

- 10. Latin America Data Center Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Offering Type

- 10.1.1. Optical Fiber Cables

- 10.1.2. Copper Cables

- 10.1.3. Power Cables

- 10.1.4. Other Ca

- 10.2. Market Analysis, Insights and Forecast - by Data Center Type

- 10.2.1. Enterprise

- 10.2.2. Colocation

- 10.2.3. Hyperscalers

- 10.1. Market Analysis, Insights and Forecast - by Offering Type

- 11. Middle East and Africa Data Center Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Offering Type

- 11.1.1. Optical Fiber Cables

- 11.1.2. Copper Cables

- 11.1.3. Power Cables

- 11.1.4. Other Ca

- 11.2. Market Analysis, Insights and Forecast - by Data Center Type

- 11.2.1. Enterprise

- 11.2.2. Colocation

- 11.2.3. Hyperscalers

- 11.1. Market Analysis, Insights and Forecast - by Offering Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Fluke Networks Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Belden Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Panduit Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nexans SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Telehouse International Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Service Wire Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CommScope Holding Company Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Prysmian SpA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hubbell

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Leviton Manufacturing Co Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Fluke Networks Inc

List of Figures

- Figure 1: Data Center Wire And Cable Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Data Center Wire And Cable Market Share (%) by Company 2024

List of Tables

- Table 1: Data Center Wire And Cable Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Data Center Wire And Cable Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Data Center Wire And Cable Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: Data Center Wire And Cable Market Volume Billion Forecast, by Offering Type 2019 & 2032

- Table 5: Data Center Wire And Cable Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 6: Data Center Wire And Cable Market Volume Billion Forecast, by Data Center Type 2019 & 2032

- Table 7: Data Center Wire And Cable Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Data Center Wire And Cable Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Data Center Wire And Cable Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 10: Data Center Wire And Cable Market Volume Billion Forecast, by Offering Type 2019 & 2032

- Table 11: Data Center Wire And Cable Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 12: Data Center Wire And Cable Market Volume Billion Forecast, by Data Center Type 2019 & 2032

- Table 13: Data Center Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Data Center Wire And Cable Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Data Center Wire And Cable Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 16: Data Center Wire And Cable Market Volume Billion Forecast, by Offering Type 2019 & 2032

- Table 17: Data Center Wire And Cable Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 18: Data Center Wire And Cable Market Volume Billion Forecast, by Data Center Type 2019 & 2032

- Table 19: Data Center Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Data Center Wire And Cable Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Data Center Wire And Cable Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 22: Data Center Wire And Cable Market Volume Billion Forecast, by Offering Type 2019 & 2032

- Table 23: Data Center Wire And Cable Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 24: Data Center Wire And Cable Market Volume Billion Forecast, by Data Center Type 2019 & 2032

- Table 25: Data Center Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Data Center Wire And Cable Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Data Center Wire And Cable Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 28: Data Center Wire And Cable Market Volume Billion Forecast, by Offering Type 2019 & 2032

- Table 29: Data Center Wire And Cable Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 30: Data Center Wire And Cable Market Volume Billion Forecast, by Data Center Type 2019 & 2032

- Table 31: Data Center Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Data Center Wire And Cable Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Data Center Wire And Cable Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 34: Data Center Wire And Cable Market Volume Billion Forecast, by Offering Type 2019 & 2032

- Table 35: Data Center Wire And Cable Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 36: Data Center Wire And Cable Market Volume Billion Forecast, by Data Center Type 2019 & 2032

- Table 37: Data Center Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Data Center Wire And Cable Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Data Center Wire And Cable Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 40: Data Center Wire And Cable Market Volume Billion Forecast, by Offering Type 2019 & 2032

- Table 41: Data Center Wire And Cable Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 42: Data Center Wire And Cable Market Volume Billion Forecast, by Data Center Type 2019 & 2032

- Table 43: Data Center Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Data Center Wire And Cable Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Wire And Cable Market?

The projected CAGR is approximately 5.52%.

2. Which companies are prominent players in the Data Center Wire And Cable Market?

Key companies in the market include Fluke Networks Inc, Belden Inc, Panduit Corporation, Nexans SA, Telehouse International Corporation, Service Wire Company, CommScope Holding Company Inc, Prysmian SpA, Hubbell, Leviton Manufacturing Co Inc.

3. What are the main segments of the Data Center Wire And Cable Market?

The market segments include Offering Type, Data Center Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust data center expansion across the globe; Growth of High-Performance Computing (HPC) applications; Growing demand for High-Speed Connectivity.

6. What are the notable trends driving market growth?

Hyperscalers are Analyzed to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Robust data center expansion across the globe; Growth of High-Performance Computing (HPC) applications; Growing demand for High-Speed Connectivity.

8. Can you provide examples of recent developments in the market?

April 2024 - GlobalConnect unveiled its Nordic Digital Infrastructure Project, positioning the Nordics as the next global data center hub. The company's newly established fiber routes are strategically designed to draw significant foreign investments into the Nordic region. This next phase focuses on broadening and fortifying its digital infrastructure. The expansion is a response to the escalating demand for data capacity, spurred partly by the AI boom, and a strategic move to cement the Nordics' status as the partly-optimized optimized global data center hotspot.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Wire And Cable Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Wire And Cable Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Wire And Cable Market?

To stay informed about further developments, trends, and reports in the Data Center Wire And Cable Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence