Key Insights

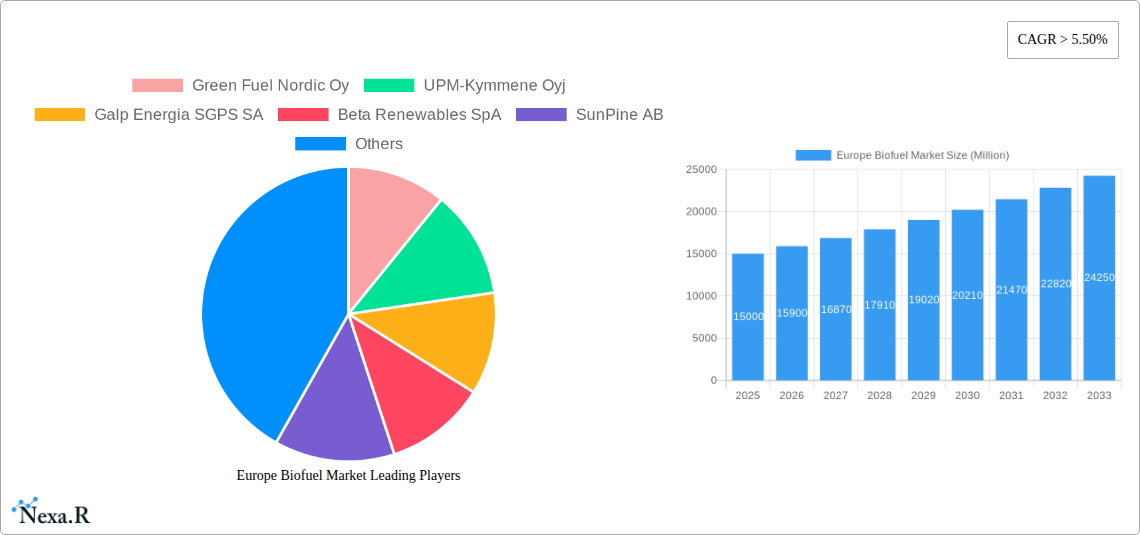

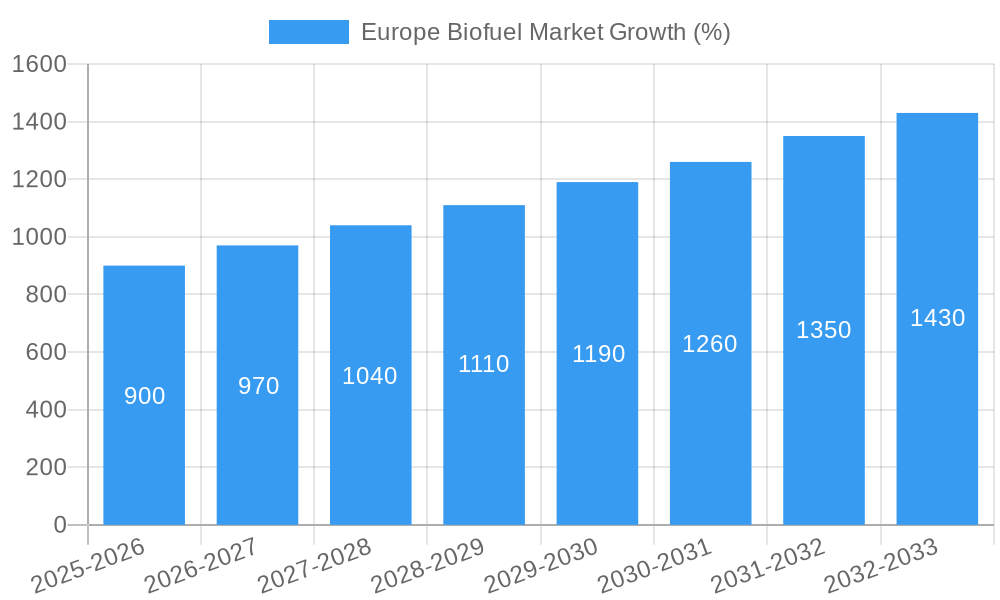

The European biofuel market, currently experiencing robust growth with a CAGR exceeding 5.5%, is projected to reach significant value in the coming years. Driven by stringent environmental regulations aimed at reducing greenhouse gas emissions from the transportation sector and increasing demand for sustainable alternatives to fossil fuels, the market shows considerable promise. Key factors fueling this expansion include supportive government policies promoting biofuel adoption, rising consumer awareness of environmental concerns, and technological advancements leading to increased biofuel production efficiency and cost reductions. The market is segmented by feedstock (coarse grain, sugar crops, vegetable oils, and others) and type (biodiesel, ethanol, and others), each exhibiting unique growth trajectories influenced by factors like agricultural yields, technological feasibility, and consumer preferences. Germany, France, Italy, the United Kingdom, and the Netherlands represent the leading national markets within Europe, demonstrating significant adoption rates and investment in biofuel infrastructure. However, challenges remain, including land-use competition with food production, potential impacts on biodiversity, and the need for further research and development to enhance the sustainability and cost-effectiveness of biofuel production.

Despite these challenges, the long-term outlook for the European biofuel market remains positive. The continuous development of advanced biofuel technologies, coupled with escalating global efforts to mitigate climate change, is expected to drive sustained market expansion throughout the forecast period (2025-2033). This growth will be particularly pronounced in segments utilizing next-generation feedstocks and advanced biofuel production methods. The competitive landscape is comprised of established players like Green Fuel Nordic Oy, UPM-Kymmene Oyj, and Galp Energia SGPS SA, alongside emerging companies specializing in innovative biofuel technologies. Further consolidation and strategic partnerships within the industry are likely as the market matures and competition intensifies. Overall, the European biofuel market presents substantial investment opportunities for companies operating across the entire value chain, from feedstock production to biofuel distribution and retail.

Europe Biofuel Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe biofuel market, encompassing market dynamics, growth trends, regional analysis, product landscape, and key player insights. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The study delves into the parent market of renewable energy and the child market of biofuels within Europe, offering invaluable data for industry professionals, investors, and strategic decision-makers. This report uses Million units for all value representations.

Europe Biofuel Market Dynamics & Structure

The Europe biofuel market is characterized by a moderately concentrated structure with several key players vying for market share. Technological innovation, driven by advancements in feedstock processing and biofuel conversion technologies, significantly influences market dynamics. Stringent regulatory frameworks, including EU renewable energy targets and emission reduction policies, shape industry practices. The market faces competition from traditional fossil fuels, with biofuels increasingly seeking to establish cost-competitiveness and performance parity. End-user demographics, heavily skewed towards the transportation sector, are a major driver. Mergers and acquisitions (M&A) activity, while moderate, signifies consolidation and expansion strategies among major players.

- Market Concentration: xx% market share held by top 5 players (2024).

- Technological Innovation: Focus on improving feedstock efficiency, reducing production costs, and enhancing biofuel quality.

- Regulatory Framework: EU Renewable Energy Directive and national policies drive market growth but create regulatory complexity.

- Competitive Substitutes: Fossil fuels remain a significant competitor, influencing pricing and market adoption.

- End-User Demographics: Transportation sector dominates consumption; Industrial and heating sectors show emerging potential.

- M&A Trends: xx M&A deals recorded between 2019 and 2024, indicating consolidation and expansion within the sector.

Europe Biofuel Market Growth Trends & Insights

The Europe biofuel market has witnessed consistent growth throughout the historical period (2019-2024). Driven by stringent environmental regulations and the increasing demand for sustainable transportation fuels, the market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million units by 2033. This growth is fueled by technological advancements, leading to improved efficiency and cost reductions in biofuel production. Shifting consumer preferences towards eco-friendly products are also contributing to market expansion. Market penetration is gradually increasing, particularly in the transportation sector, and is expected to reach xx% by 2033. Technological disruptions, such as the development of advanced biofuels with improved performance characteristics, are poised to further accelerate market growth.

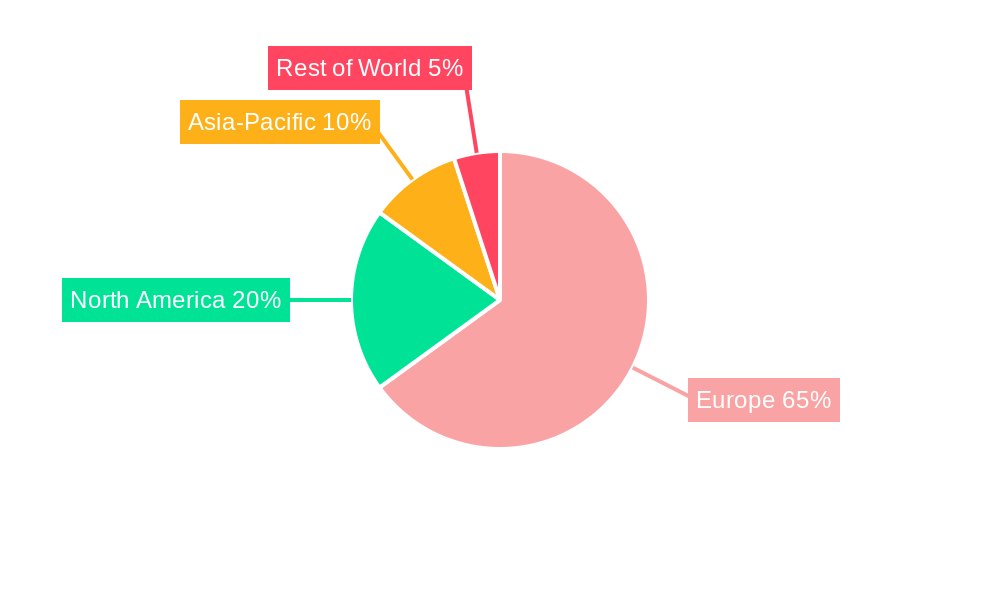

Dominant Regions, Countries, or Segments in Europe Biofuel Market

Germany, France, and the UK are the leading countries in the Europe biofuel market, accounting for xx% of the total market share in 2024. The strong presence of established biofuel producers, supportive government policies, and high demand for renewable energy sources contribute to their dominance. Within feedstock segments, vegetable oil holds the largest market share, followed by coarse grain. Biodiesel dominates the biofuel type segment, driven by its compatibility with existing infrastructure and widespread use in transportation.

- Key Drivers (Germany): Strong government support for renewable energy, well-developed infrastructure for biofuel production and distribution, and a large automotive industry.

- Key Drivers (France): Government incentives for biofuel adoption, substantial agricultural production of feedstock crops, and focus on reducing greenhouse gas emissions.

- Key Drivers (UK): Ambitious renewable energy targets, a large transportation sector, and investments in biofuel research and development.

- Feedstock Dominance: Vegetable oil (xx Million units in 2024) enjoys the largest market share due to its readily available supply and suitability for biodiesel production.

- Type Dominance: Biodiesel (xx Million units in 2024) is the most widely used type of biofuel due to its established market presence and extensive infrastructure.

Europe Biofuel Market Product Landscape

The Europe biofuel market offers a diverse range of products, including biodiesel derived from vegetable oils and animal fats, ethanol from sugar crops and other feedstocks, and advanced biofuels with enhanced properties. Ongoing innovations focus on improving the efficiency of production processes and reducing costs. These innovations include the use of advanced feedstock processing techniques and novel conversion technologies. The market is witnessing a rise in the demand for advanced biofuels, with several companies investing in research and development to improve their production capabilities. Unique selling propositions often involve reduced greenhouse gas emissions, higher energy density, and compatibility with existing infrastructure.

Key Drivers, Barriers & Challenges in Europe Biofuel Market

Key Drivers:

- Stringent environmental regulations and carbon emission reduction targets.

- Growing demand for sustainable transportation fuels.

- Government incentives and subsidies for biofuel production and consumption.

- Technological advancements leading to improved biofuel production efficiency and cost reduction.

Key Challenges:

- Competition from traditional fossil fuels, hindering market penetration.

- Fluctuations in feedstock prices impacting biofuel production costs.

- Supply chain bottlenecks and logistics challenges, particularly for specialized feedstocks.

- Regulatory uncertainties and evolving environmental policies requiring significant adaptation from producers.

- Land use concerns related to feedstock cultivation, potential conflicts with food production. This represents an estimated xx% reduction in potential market growth for 2033.

Emerging Opportunities in Europe Biofuel Market

- Expansion into untapped markets in Eastern Europe, including countries with less developed biofuel industries.

- Growing demand for advanced biofuels from renewable sources, including waste biomass and algae.

- Increasing use of biofuels in non-transportation sectors such as heating and power generation.

- Development of innovative biofuel blends and additives to improve fuel efficiency and reduce emissions.

- Leveraging digital technologies for improved supply chain management, optimization of production processes, and monitoring of environmental impact.

Growth Accelerators in the Europe Biofuel Market Industry

Several factors will act as catalysts to accelerate long-term growth in the European biofuel market. These include continuous technological breakthroughs resulting in higher efficiency and lower-cost production processes, strategic partnerships between biofuel producers and automotive manufacturers for integrating sustainable fuels into vehicle designs, and proactive expansion strategies that tap into emerging markets within Europe, fostering sustainable fuel infrastructure development. The expanding focus on circular economy models, which effectively utilize waste materials to produce biofuels, adds a substantial avenue for growth.

Key Players Shaping the Europe Biofuel Market Market

- Green Fuel Nordic Oy

- UPM-Kymmene Oyj

- Galp Energia SGPS SA

- Beta Renewables SpA

- SunPine AB

- Preem AB

- Svenska Cellulosa AB

- Borregaard ASA

- Biomethanol Chemie Nederland BV

- List Not Exhaustive

Notable Milestones in Europe Biofuel Market Sector

- March 2022: Rossi Biofuel Zrt inaugurated a new biodiesel plant in Komárom, Hungary, increasing its annual production capacity by 60,000 tons.

- January 2022: Liebherr announced plans to increase its use of Neste MY Renewable Diesel at its Kirchdorf, Germany plant.

- January 2022: Repsol SA selected Honeywell Technologies to supply an integrated control and safety system (ICSS) for its first advanced biofuel production plant in Spain.

In-Depth Europe Biofuel Market Market Outlook

The future of the European biofuel market is bright, characterized by sustained growth driven by stringent environmental policies, technological advancements, and evolving consumer preferences. Strategic opportunities exist in expanding into underserved markets, developing innovative biofuel blends, and forging partnerships to integrate sustainable fuels across various sectors. The focus on reducing carbon emissions and promoting circular economy principles will be key growth drivers, leading to a significant expansion of the market in the coming years. The predicted market value for 2033 suggests a substantial increase in demand, reflecting a positive outlook for the industry.

Europe Biofuel Market Segmentation

-

1. Type

- 1.1. Biodiesel

- 1.2. Ethanol

- 1.3. Other Types

-

2. Feedstock

- 2.1. Coarse Grain

- 2.2. Sugar Crop

- 2.3. Vegetable Oil

- 2.4. Other Feedstocks

Europe Biofuel Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Rest of Europe

Europe Biofuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa

- 3.4. Market Trends

- 3.4.1. Biodiesel is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biodiesel

- 5.1.2. Ethanol

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Feedstock

- 5.2.1. Coarse Grain

- 5.2.2. Sugar Crop

- 5.2.3. Vegetable Oil

- 5.2.4. Other Feedstocks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Biodiesel

- 6.1.2. Ethanol

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Feedstock

- 6.2.1. Coarse Grain

- 6.2.2. Sugar Crop

- 6.2.3. Vegetable Oil

- 6.2.4. Other Feedstocks

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Biodiesel

- 7.1.2. Ethanol

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Feedstock

- 7.2.1. Coarse Grain

- 7.2.2. Sugar Crop

- 7.2.3. Vegetable Oil

- 7.2.4. Other Feedstocks

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Biodiesel

- 8.1.2. Ethanol

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Feedstock

- 8.2.1. Coarse Grain

- 8.2.2. Sugar Crop

- 8.2.3. Vegetable Oil

- 8.2.4. Other Feedstocks

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Biodiesel

- 9.1.2. Ethanol

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Feedstock

- 9.2.1. Coarse Grain

- 9.2.2. Sugar Crop

- 9.2.3. Vegetable Oil

- 9.2.4. Other Feedstocks

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Germany Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Green Fuel Nordic Oy

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 UPM-Kymmene Oyj

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Galp Energia SGPS SA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Beta Renewables SpA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 SunPine AB

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Preem AB

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Svenska Cellulosa AB

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Borregaard ASA*List Not Exhaustive

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Biomethanol Chemie Nederland BV

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Green Fuel Nordic Oy

List of Figures

- Figure 1: Europe Biofuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Biofuel Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Biofuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 4: Europe Biofuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 15: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 18: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 21: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 24: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biofuel Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Europe Biofuel Market?

Key companies in the market include Green Fuel Nordic Oy, UPM-Kymmene Oyj, Galp Energia SGPS SA, Beta Renewables SpA, SunPine AB, Preem AB, Svenska Cellulosa AB, Borregaard ASA*List Not Exhaustive, Biomethanol Chemie Nederland BV.

3. What are the main segments of the Europe Biofuel Market?

The market segments include Type, Feedstock.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems.

6. What are the notable trends driving market growth?

Biodiesel is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa.

8. Can you provide examples of recent developments in the market?

March 2022: Rossi Biofuel Zrt, a subsidiary of the ENVIEN Group, inaugurated a new biodiesel plant in Hungary. This plant was built by BDI-BioEnergy International GmbH. The facility is a multi-feedstock plant in Komárom, Hungary. The new plant has a capacity of 60,000 tons per annum, and thus, the total biodiesel production capacity of the company has increased from 150,000 to 210,000 tons per annum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biofuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biofuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biofuel Market?

To stay informed about further developments, trends, and reports in the Europe Biofuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence