Key Insights

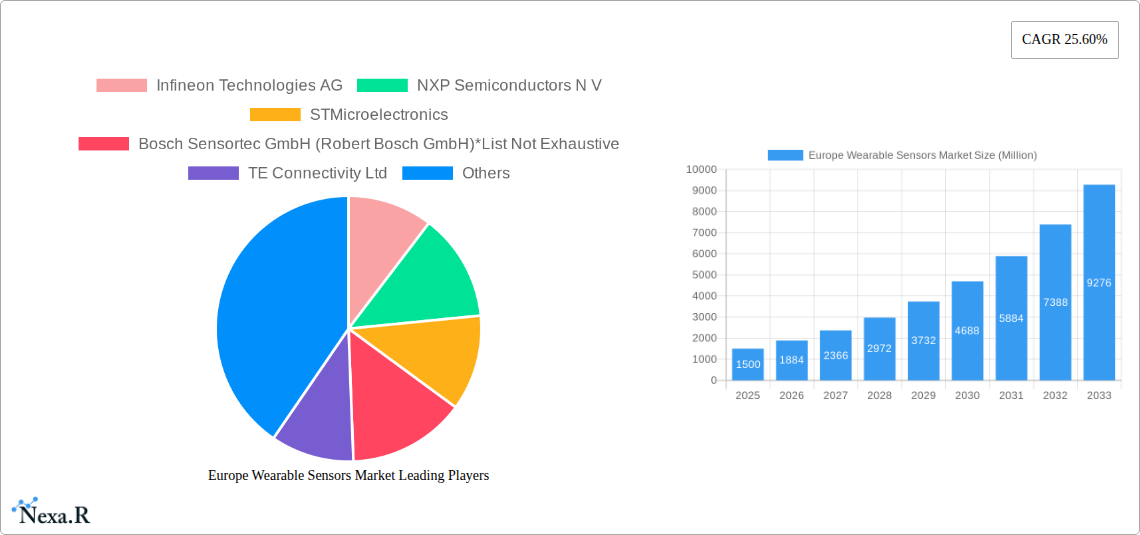

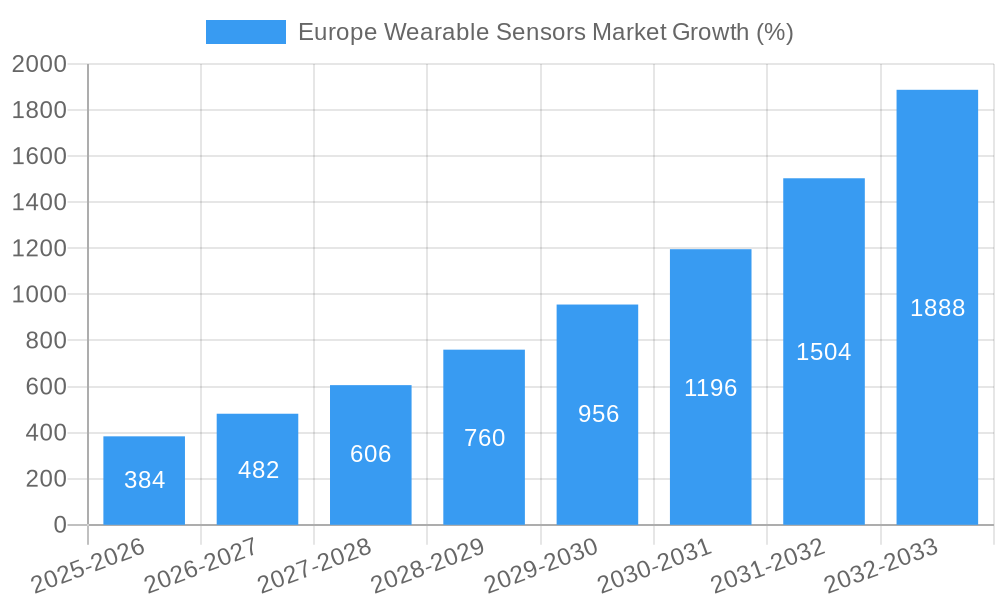

The European wearable sensors market is experiencing robust growth, driven by the increasing adoption of wearable technology for health and wellness applications, safety monitoring, and home rehabilitation. The market, valued at approximately €X million in 2025 (assuming a logical estimation based on the provided CAGR of 25.60% and a stated market size of XX million – further details on estimation methodology would require additional information), is projected to exhibit a significant Compound Annual Growth Rate (CAGR) through 2033. This expansion is fueled by several key factors. Firstly, advancements in sensor technology, particularly in miniaturization, power efficiency, and improved accuracy, are leading to more comfortable and effective wearable devices. Secondly, the rising prevalence of chronic diseases and the increasing demand for personalized healthcare solutions are bolstering the adoption of wearable sensors for remote patient monitoring and preventative healthcare. Furthermore, the growing popularity of fitness trackers and smartwatches, along with government initiatives promoting digital health, contribute significantly to market growth. The market segmentation reveals strong demand across various device types (wristwear, bodywear, footwear), applications (health and wellness dominating), and countries within Europe (the UK, Germany, and France leading the charge).

However, challenges exist. Cost remains a barrier for some consumers, particularly for advanced sensor technologies. Concerns surrounding data privacy and security also pose a significant restraint to market expansion. The competitive landscape is highly fragmented, with numerous established players and emerging startups vying for market share. Companies like Infineon Technologies, NXP Semiconductors, STMicroelectronics, and Bosch Sensortec are key players, leveraging their expertise in sensor technology and semiconductor manufacturing. The ongoing evolution of technology and the emergence of innovative applications will be crucial in shaping the future of this dynamic market. Future growth will likely be influenced by factors such as technological innovations, regulatory changes, and consumer acceptance of wearable technology.

This comprehensive report provides an in-depth analysis of the Europe Wearable Sensors market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report segments the market by device (wristwear, bodywear & footwear, others), application (health & wellness, safety monitoring, home rehabilitation, others), country (United Kingdom, Germany, France, others), and sensor type (health sensors, environmental sensors, MEMS sensors, motion sensors, others).

Europe Wearable Sensors Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping the European wearable sensors market. We delve into market concentration, identifying key players and their market share, and explore the impact of mergers and acquisitions (M&A) activities. Technological innovation, including the development of miniaturized sensors and advanced data analytics, is examined alongside its influence on market growth. The report also investigates the regulatory framework governing the use of wearable sensors in Europe, including data privacy regulations and safety standards.

- Market Concentration: The European wearable sensors market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top five players account for approximately xx% of the total market revenue in 2025 (Estimated).

- Technological Innovation: Ongoing miniaturization, improved power efficiency, and advanced sensor functionalities are driving market growth. The integration of AI and machine learning capabilities is creating new opportunities.

- Regulatory Framework: Stringent data privacy regulations (e.g., GDPR) and safety standards impact market dynamics, requiring manufacturers to comply with specific guidelines.

- Competitive Landscape: Intense competition among established players and emerging startups necessitates continuous innovation and differentiation strategies. M&A activities are expected to reshape the market landscape further. The number of M&A deals in the European wearable sensors market from 2019-2024 totalled xx.

- End-User Demographics: The increasing adoption of wearable technology by health-conscious consumers and the aging population are significant growth drivers.

- Innovation Barriers: High R&D costs, stringent regulatory approvals, and challenges in integrating multiple sensor types into wearable devices pose barriers to innovation.

Europe Wearable Sensors Market Growth Trends & Insights

This section details the historical and projected market size evolution of the Europe Wearable Sensors Market. Utilizing robust analytical methodologies, the report provides granular insights into adoption rates across diverse segments. The impact of technological disruptions, such as the development of advanced sensor technologies and the rise of Internet of Things (IoT) applications, is thoroughly examined. Consumer behavior shifts regarding the adoption of wearable sensors are also analyzed, incorporating data on purchasing patterns and usage trends.

- Market Size Evolution (Million Units): 2019 (xx), 2020 (xx), 2021 (xx), 2022 (xx), 2023 (xx), 2024 (xx), 2025 (Estimated xx), 2033 (Forecast xx).

- CAGR (2025-2033): xx%

- Market Penetration: The market penetration rate of wearable sensors in Europe is projected to reach xx% by 2033.

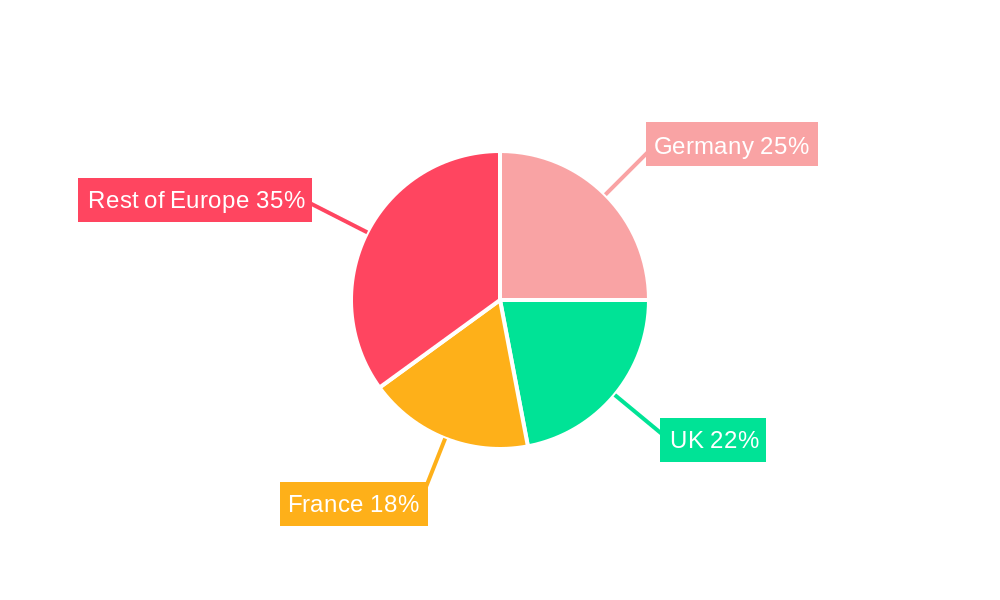

Dominant Regions, Countries, or Segments in Europe Wearable Sensors Market

This section identifies the leading regions, countries, and segments within the European wearable sensor market based on device type, application, and sensor type. We delve into the contributing factors driving their dominance, examining relevant economic policies, infrastructure development, and consumer preferences. Market share and growth potential are analyzed for each dominant segment, providing a clear picture of the market's future trajectory.

- By Device: Wristwear holds the largest market share, followed by bodywear and footwear. The growth of wristwear is driven by the popularity of smartwatches and fitness trackers.

- By Application: Health and wellness is the leading application segment, fueled by increasing health consciousness and the demand for personalized healthcare solutions. Safety monitoring is also a significant segment, with growth driven by demand from occupational safety and elderly care applications.

- By Country: The United Kingdom, Germany, and France are the dominant markets, owing to advanced healthcare infrastructure, technological adoption rates and a strong consumer base.

- By Type: Health sensors represent a major share of the market, owing to their widespread use in health and wellness applications. MEMS sensors are also gaining traction due to their miniaturized size and enhanced functionality.

Europe Wearable Sensors Market Product Landscape

The European wearable sensors market is characterized by a diverse range of products, encompassing various form factors, functionalities, and performance metrics. Innovations include the development of highly miniaturized, energy-efficient sensors with enhanced accuracy and reliability. Key technological advancements involve the integration of advanced signal processing capabilities and wireless communication technologies. These innovations are enabling the development of smarter and more user-friendly wearable devices that seamlessly integrate into daily life.

Key Drivers, Barriers & Challenges in Europe Wearable Sensors Market

Key Drivers:

- Technological advancements: Miniaturization, improved power efficiency, and enhanced sensor functionalities are driving market growth.

- Growing health consciousness: Increasing awareness of health and wellness is driving demand for wearable health monitoring devices.

- Favorable government regulations: supportive policies and funding for the development and adoption of wearable technologies are driving market growth.

Challenges & Restraints:

- High manufacturing costs: The production of sophisticated wearable sensors involves high costs, impacting market affordability.

- Data security and privacy concerns: Growing concerns about the security and privacy of personal health data are hindering wider adoption.

- Interoperability issues: The lack of standardization and interoperability among various wearable devices poses a challenge to widespread use.

Emerging Opportunities in Europe Wearable Sensors Market

Emerging opportunities in the European wearable sensors market include the expansion of applications in areas such as sports and fitness, industrial safety, and environmental monitoring. Further developments in sensor technology and the growing use of artificial intelligence (AI) in wearable devices offer opportunities for market expansion. Growing demand for personalized and preventive healthcare solutions presents significant growth prospects.

Growth Accelerators in the Europe Wearable Sensors Market Industry

Technological breakthroughs in miniaturization, power efficiency, and sensor integration are key drivers of long-term growth. Strategic partnerships between sensor manufacturers and wearable device companies are facilitating the development of innovative products. Market expansion through strategic acquisitions and expansion into new geographic markets are further contributing to sustained growth.

Key Players Shaping the Europe Wearable Sensors Market Market

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Analog Devices Inc

- InvenSense Inc

- Panasonic Corporation

Notable Milestones in Europe Wearable Sensors Market Sector

- October 2021: Semtech launched three ranges of smart sensors (PerSe Connect, PerSe Connect Pro, and PerSe Control) for consumer devices, enabling smarter control in wearables through intelligent human presence sensing and gesture control.

In-Depth Europe Wearable Sensors Market Market Outlook

The future of the European wearable sensors market appears bright, fueled by technological advancements, increasing demand for personalized healthcare, and the expansion into new applications. Strategic opportunities exist in developing innovative sensor technologies, fostering collaborations across the industry, and targeting underserved markets. The market's potential for growth is substantial, driven by ongoing technological advancements and a growing adoption of wearable technologies.

Europe Wearable Sensors Market Segmentation

-

1. Type

- 1.1. Health Sensors

- 1.2. Environmental Sensors

- 1.3. MEMS Sensors

- 1.4. Motion Sensors

- 1.5. Others

-

2. Device

- 2.1. Wristwear

- 2.2. Bodywear and Footwear

- 2.3. Others

-

3. Application

- 3.1. Health and Wellness

- 3.2. Safety Monitoring

- 3.3. Home Rehabilitation

- 3.4. Others

Europe Wearable Sensors Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Wearable Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing applications in the industrial sector and improvement in the battery sizes.; Development of wearable sensor devices that look fashionable

- 3.3. Market Restrains

- 3.3.1. Reluctance from end users in employing new innovations due to their expensive nature

- 3.4. Market Trends

- 3.4.1. Increasing applications in the industrial sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Health Sensors

- 5.1.2. Environmental Sensors

- 5.1.3. MEMS Sensors

- 5.1.4. Motion Sensors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Wristwear

- 5.2.2. Bodywear and Footwear

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Health and Wellness

- 5.3.2. Safety Monitoring

- 5.3.3. Home Rehabilitation

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Wearable Sensors Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Infineon Technologies AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 NXP Semiconductors N V

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 STMicroelectronics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 TE Connectivity Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Texas Instruments Incorporated

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Analog Devices Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 InvenSense Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Panasonic Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Europe Wearable Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Wearable Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Wearable Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Wearable Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Wearable Sensors Market Revenue Million Forecast, by Device 2019 & 2032

- Table 4: Europe Wearable Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Europe Wearable Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Wearable Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Wearable Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Europe Wearable Sensors Market Revenue Million Forecast, by Device 2019 & 2032

- Table 16: Europe Wearable Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Wearable Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Wearable Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wearable Sensors Market?

The projected CAGR is approximately 25.60%.

2. Which companies are prominent players in the Europe Wearable Sensors Market?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors N V, STMicroelectronics, Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive, TE Connectivity Ltd, Texas Instruments Incorporated, Analog Devices Inc, InvenSense Inc, Panasonic Corporation.

3. What are the main segments of the Europe Wearable Sensors Market?

The market segments include Type, Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing applications in the industrial sector and improvement in the battery sizes.; Development of wearable sensor devices that look fashionable.

6. What are the notable trends driving market growth?

Increasing applications in the industrial sector.

7. Are there any restraints impacting market growth?

Reluctance from end users in employing new innovations due to their expensive nature.

8. Can you provide examples of recent developments in the market?

October 2021: Semtech has launched three ranges of smart sensors for personally connected consumer device designs. The PerSe range has three core product lines - PerSe Connect, PerSe Connect Pro, and PerSe Control - for by intelligently and automatically sensing human presence via smartphones, laptops, and wearables PerSe Control enables smarter control in wearables to improve the user experience. PerSe Control enables human detection, automatic on/off, and start/stop response. It also delivers cutting-edge gesture control and response, including smart assistant, noise cancellation activation, and media player control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wearable Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wearable Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wearable Sensors Market?

To stay informed about further developments, trends, and reports in the Europe Wearable Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence