Key Insights

The North American B2B e-commerce market is exhibiting strong expansion, driven by accelerated digital technology adoption and the pervasive shift to online procurement. This dynamic sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.73%. The market size is estimated at $1480.41 billion in the base year 2025. Key growth catalysts include enhanced operational efficiency, cost reductions from online transactions, improved supply chain transparency, and expanded market reach. The proliferation of niche B2B e-commerce platforms further stimulates market penetration. Emerging trends, such as AI integration for personalized customer experiences and predictive analytics, alongside mobile-first purchasing strategies, are fundamentally reshaping the industry. While data security challenges necessitate robust cybersecurity measures, the market trajectory remains optimistic. Dominant players and emerging specialized platforms contribute to a highly competitive yet innovative landscape. The evolving sales channel mix signals a transition from traditional direct sales towards more accessible and convenient marketplace models.

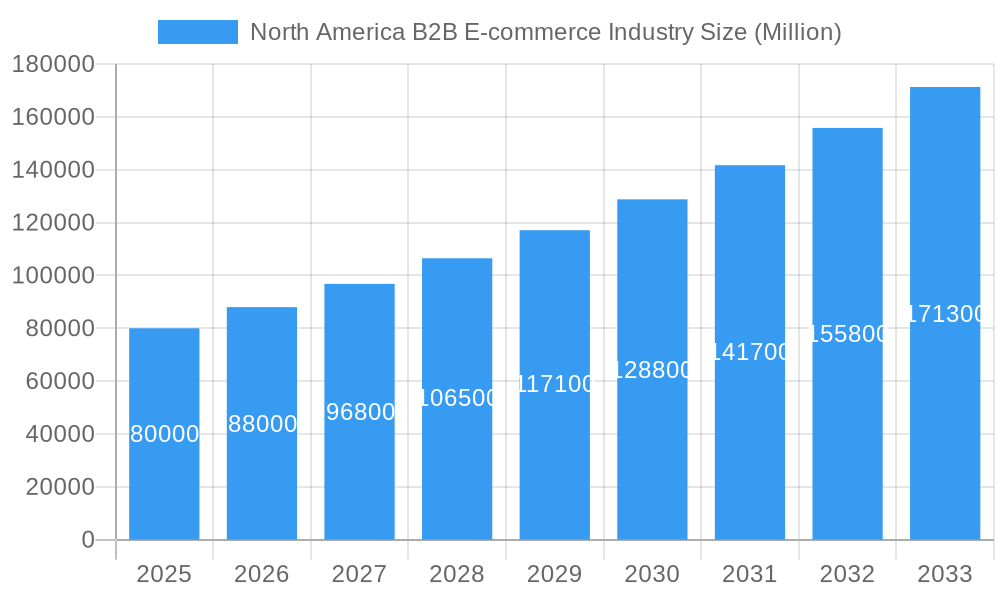

North America B2B E-commerce Industry Market Size (In Million)

North America, comprising the United States, Canada, and Mexico, represents a pivotal segment of the global B2B e-commerce sector, characterized by substantial market size and a healthy CAGR. The region's advanced technological infrastructure and favorable business climate attract significant investment. A competitive environment, fostered by established leaders and numerous specialized providers, drives continuous innovation. Future growth will be propelled by increasing high-speed internet access, ongoing advancements in e-commerce technology, and the accelerating embrace of digital transformation by businesses. Tailoring strategies to the specific demands of diverse industry verticals will be paramount for sustained success in this rapidly evolving marketplace.

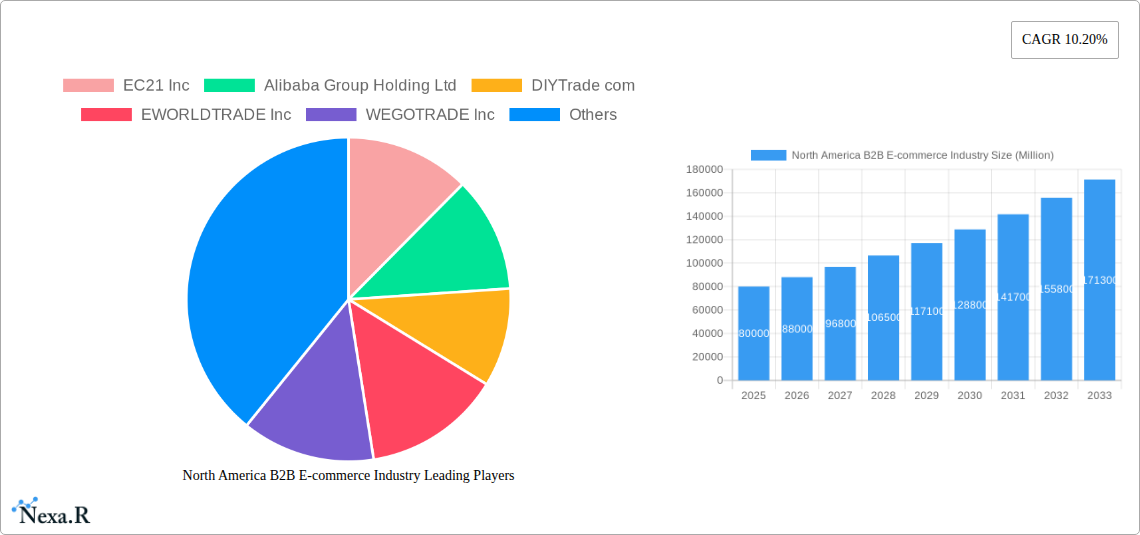

North America B2B E-commerce Industry Company Market Share

North America B2B E-commerce Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America B2B e-commerce industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for businesses, investors, and industry professionals seeking to understand and capitalize on the evolving landscape of B2B e-commerce in North America. The report analyzes both parent (B2B E-commerce) and child markets (Direct Sales and Marketplace Sales) providing granular insights.

North America B2B E-commerce Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market structure of the North American B2B e-commerce industry. The market is characterized by a combination of established giants and emerging players, resulting in a dynamic competitive environment.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players like Amazon Business holding significant market share, alongside numerous smaller players competing for niche segments. Amazon Business alone accounts for an estimated xx Million USD in revenue, holding approximately xx% market share in 2024.

- Technological Innovation: Rapid technological advancements, including AI-powered personalization, advanced analytics, and integrated supply chain solutions, are key drivers of innovation. However, challenges remain in integrating legacy systems and ensuring data security across platforms.

- Regulatory Frameworks: Varying state and federal regulations regarding data privacy, consumer protection, and taxation impact market operations. Compliance costs and varying regulations across regions present challenges for businesses operating across North America.

- Competitive Product Substitutes: Traditional B2B sales channels, including direct sales representatives and catalogs, remain viable alternatives, although their market share is steadily declining in favor of digital platforms.

- End-User Demographics: The industry caters to a broad range of businesses across various sectors, including manufacturing, retail, healthcare, and technology. The increasing adoption of digital tools and technologies across various industry segments fuels market growth.

- M&A Trends: The past five years have witnessed a moderate number of mergers and acquisitions (M&A) deals in the industry, with approximately xx deals valued at xx Million USD in total. The driving force behind these mergers were primarily to expand market reach, enhance technology capabilities, and consolidate market share.

North America B2B E-commerce Industry Growth Trends & Insights

The North American B2B e-commerce market has experienced significant growth in recent years, driven by factors including the increasing adoption of digital technologies, the expansion of e-commerce platforms, and favorable economic conditions. This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior from 2019 to 2033. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million USD by 2033. Market penetration is expected to increase from xx% in 2024 to xx% by 2033. The adoption of cloud-based solutions and mobile commerce continues to reshape the industry dynamics, improving efficiency and customer experience. Changing consumer behavior patterns, including the increased reliance on online channels for sourcing and procurement, further drive market growth.

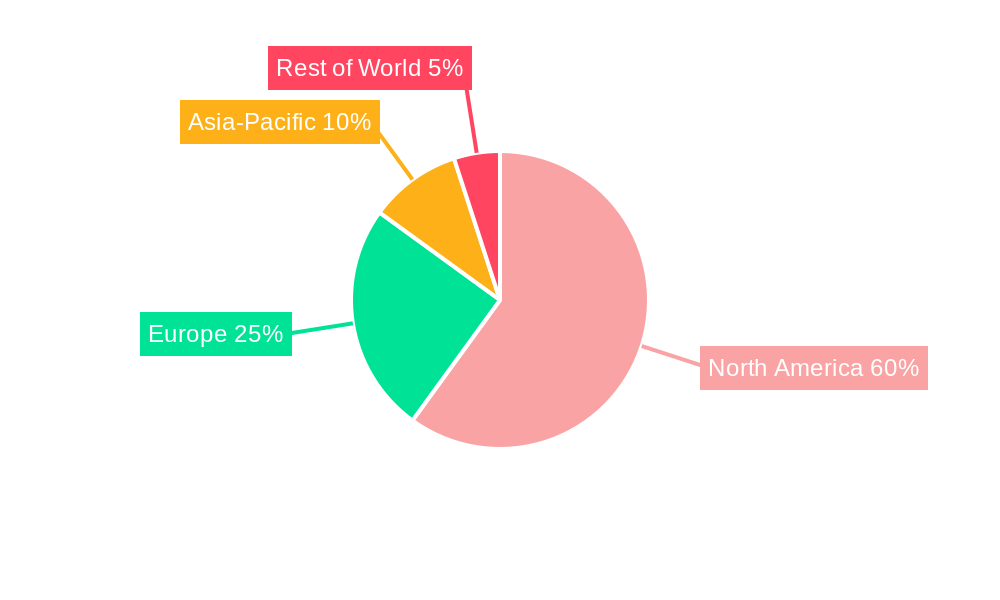

Dominant Regions, Countries, or Segments in North America B2B E-commerce Industry

The United States dominates the North American B2B e-commerce market, followed by Canada and Mexico. Within the U.S., key regions driving growth include the Northeast, West Coast, and Texas. The analysis examines the dominance factors for each region, focusing on economic policies, infrastructural development, and business environment.

- By Channel:

- Marketplace Sales: This segment is experiencing faster growth than direct sales, driven by the convenience and reach offered by platforms like Amazon Business and Alibaba.com. The ease of use and ability to reach diverse suppliers contributes to its dominance. Marketplace sales are projected to account for xx% of the total market share by 2033.

- Direct Sales: While experiencing slower growth compared to marketplace sales, direct sales retain a significant market share due to the need for personalized service and specialized products in certain industries. Companies focusing on direct sales strategies have to invest in their own infrastructure and marketing, hence their slower growth comparatively. Direct sales are estimated to hold xx% of the total market share in 2033.

North America B2B E-commerce Industry Product Landscape

The B2B e-commerce industry offers a diverse range of products and services, including software solutions for procurement, supply chain management, and inventory control. Advanced analytics tools provide data-driven insights to optimize purchasing decisions. The trend is towards integrated platforms that streamline all aspects of the B2B purchasing process, enhancing efficiency and cost savings. Unique selling propositions focus on personalized experiences, seamless integration with existing systems, and enhanced security features.

Key Drivers, Barriers & Challenges in North America B2B E-commerce Industry

Key Drivers:

- Technological advancements, such as AI and machine learning, are driving automation and efficiency gains.

- The increasing adoption of mobile commerce is broadening market reach and accessibility.

- Favorable economic conditions and government initiatives supporting digital transformation are fueling industry growth.

Challenges & Restraints:

- Supply chain disruptions, particularly evident in recent years, impact product availability and pricing. These disruptions cost the industry an estimated xx Million USD in 2024.

- Cybersecurity concerns and data breaches pose significant risks to businesses and consumer trust.

- Regulatory complexities and evolving compliance requirements add operational costs and administrative burdens.

Emerging Opportunities in North America B2B E-commerce Industry

- Untapped Markets: Expanding into underserved sectors like the agriculture and construction industries holds significant growth potential.

- Innovative Applications: The integration of augmented reality (AR) and virtual reality (VR) technologies for product visualization and remote collaboration are emerging opportunities.

- Evolving Consumer Preferences: Meeting the growing demand for personalized experiences, sustainable practices, and flexible payment options are crucial for success.

Growth Accelerators in the North America B2B E-commerce Industry Industry

Strategic partnerships between e-commerce platforms and industry-specific software providers are streamlining operations and expanding reach. Technological breakthroughs such as blockchain technology for secure transactions and AI-powered predictive analytics are shaping future growth. Expansion into new geographical markets and diversifying product offerings further drive long-term growth.

Key Players Shaping the North America B2B E-commerce Industry Market

- EC21 Inc

- Alibaba Group Holding Ltd

- DIYTrade com

- EWORLDTRADE Inc

- WEGOTRADE Inc

- Newegg Business Inc

- KOMPASS

- ASOS Marketplace Limited

- ThomasNet Inc

- BlueCart Inc

- Amazon com Inc (Amazon Business)

Notable Milestones in North America B2B E-commerce Industry Sector

- December 2021: Alibaba.com launched the Alibaba.com Grants Program, providing USD 10,000 grants to 50 small businesses and access to e-commerce resources. This initiative fostered the growth of smaller businesses in the B2B space.

- March 2022: Xeeva partnered with Amazon Business, integrating Amazon's search and ordering capabilities into Xeeva's Procure-to-Pay platform. This improved efficiency for businesses using both platforms.

In-Depth North America B2B E-commerce Industry Market Outlook

The North American B2B e-commerce market is poised for continued growth, driven by technological advancements, increasing digital adoption, and evolving consumer preferences. Strategic investments in innovative technologies, expansion into new market segments, and the development of robust supply chains will be crucial for businesses to capitalize on the long-term growth potential of this dynamic industry. The focus on personalized experiences and integrated solutions will further differentiate successful players in the market.

North America B2B E-commerce Industry Segmentation

-

1. Channel

- 1.1. Direct Sales

- 1.2. Marketplace Sales

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Product

- 3.1. Hybrid seeds

- 3.2. Conventional seeds

North America B2B E-commerce Industry Segmentation By Geography

- 1. United States

- 2. Canada

North America B2B E-commerce Industry Regional Market Share

Geographic Coverage of North America B2B E-commerce Industry

North America B2B E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Digital Experience of Modern B2B Buyers; Digitalization of Retail Business to Online Operations; Rising Popularity of Specialized B2B Online Marketplace

- 3.3. Market Restrains

- 3.3.1. Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution

- 3.4. Market Trends

- 3.4.1. Popularity of Retail Business Operations Online to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America B2B E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Direct Sales

- 5.1.2. Marketplace Sales

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Hybrid seeds

- 5.3.2. Conventional seeds

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. United States North America B2B E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Direct Sales

- 6.1.2. Marketplace Sales

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Hybrid seeds

- 6.3.2. Conventional seeds

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Canada North America B2B E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Direct Sales

- 7.1.2. Marketplace Sales

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Hybrid seeds

- 7.3.2. Conventional seeds

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 EC21 Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Alibaba Group Holding Ltd

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 DIYTrade com

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 EWORLDTRADE Inc

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 WEGOTRADE Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Newegg Business Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 KOMPASS

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 ASOS Marketplace Limited

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 ThomasNet Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 BlueCart Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Amazon com Inc (Amazon Business)

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 EC21 Inc

List of Figures

- Figure 1: North America B2B E-commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America B2B E-commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: North America B2B E-commerce Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: North America B2B E-commerce Industry Volume K Unit Forecast, by Channel 2020 & 2033

- Table 3: North America B2B E-commerce Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America B2B E-commerce Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: North America B2B E-commerce Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 6: North America B2B E-commerce Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 7: North America B2B E-commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America B2B E-commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America B2B E-commerce Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 10: North America B2B E-commerce Industry Volume K Unit Forecast, by Channel 2020 & 2033

- Table 11: North America B2B E-commerce Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America B2B E-commerce Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 13: North America B2B E-commerce Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: North America B2B E-commerce Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 15: North America B2B E-commerce Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America B2B E-commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: North America B2B E-commerce Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 18: North America B2B E-commerce Industry Volume K Unit Forecast, by Channel 2020 & 2033

- Table 19: North America B2B E-commerce Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America B2B E-commerce Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 21: North America B2B E-commerce Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 22: North America B2B E-commerce Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 23: North America B2B E-commerce Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America B2B E-commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America B2B E-commerce Industry?

The projected CAGR is approximately 4.73%.

2. Which companies are prominent players in the North America B2B E-commerce Industry?

Key companies in the market include EC21 Inc, Alibaba Group Holding Ltd, DIYTrade com, EWORLDTRADE Inc, WEGOTRADE Inc, Newegg Business Inc, KOMPASS, ASOS Marketplace Limited, ThomasNet Inc, BlueCart Inc, Amazon com Inc (Amazon Business).

3. What are the main segments of the North America B2B E-commerce Industry?

The market segments include Channel, Geography , Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 1480.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Digital Experience of Modern B2B Buyers; Digitalization of Retail Business to Online Operations; Rising Popularity of Specialized B2B Online Marketplace.

6. What are the notable trends driving market growth?

Popularity of Retail Business Operations Online to Drive the Market.

7. Are there any restraints impacting market growth?

Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution.

8. Can you provide examples of recent developments in the market?

March 2022 - Xeeva announced a partnership with Amazon Business, allowing Xeeva's Procure to Pay customers the flexibility of using Amazon to search and order directly within the P2P purchasing environment. Xeeva customers would no longer need to exit the P2P solution for searching Amazon for competitive pricing. The collaboration will allow users to search Amazon directly inside the P2P solution with the simple click of a button and instantly add desired items to their Xeeva shopping cart.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America B2B E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America B2B E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America B2B E-commerce Industry?

To stay informed about further developments, trends, and reports in the North America B2B E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence