Key Insights

The European winter sports equipment market is projected to reach €17.78 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.87% from 2025 to 2033. This growth is propelled by rising participation in skiing and snowboarding, particularly among younger demographics, and technological advancements enhancing equipment performance, comfort, and safety. Increased disposable incomes in key markets such as Germany, France, and the UK further contribute to market expansion. The market is segmented by sport, with skiing and snowboarding leading, by end-user (men, women, and children), and by distribution channel (online and offline retail). Competitive landscape features prominent brands like Rossignol, Burton, and Fischer, fostering innovation and diverse product portfolios. Key challenges include economic downturns affecting consumer spending, environmental concerns related to winter sports sustainability, and the growing appeal of alternative recreational activities.

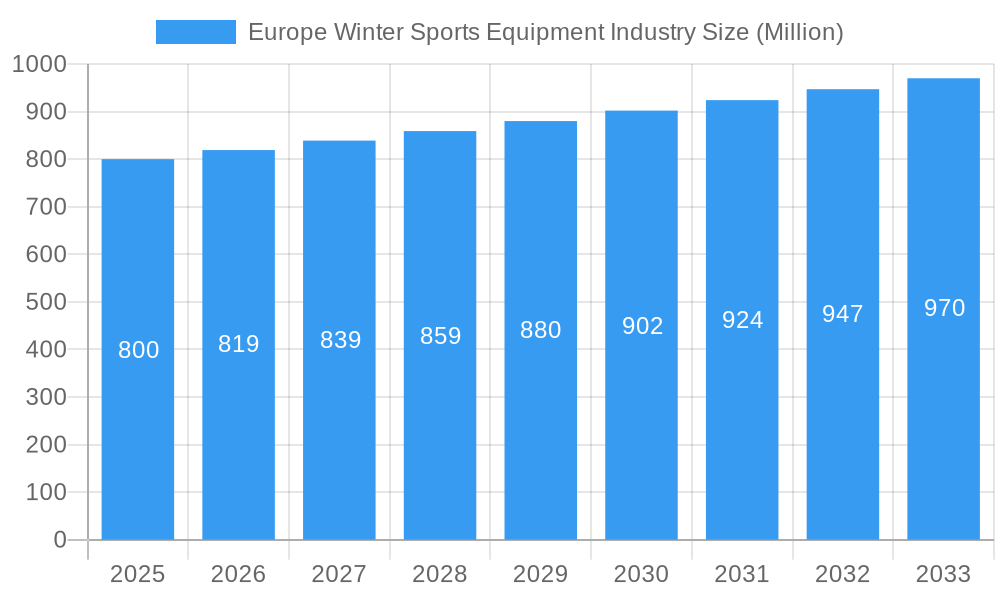

Europe Winter Sports Equipment Industry Market Size (In Billion)

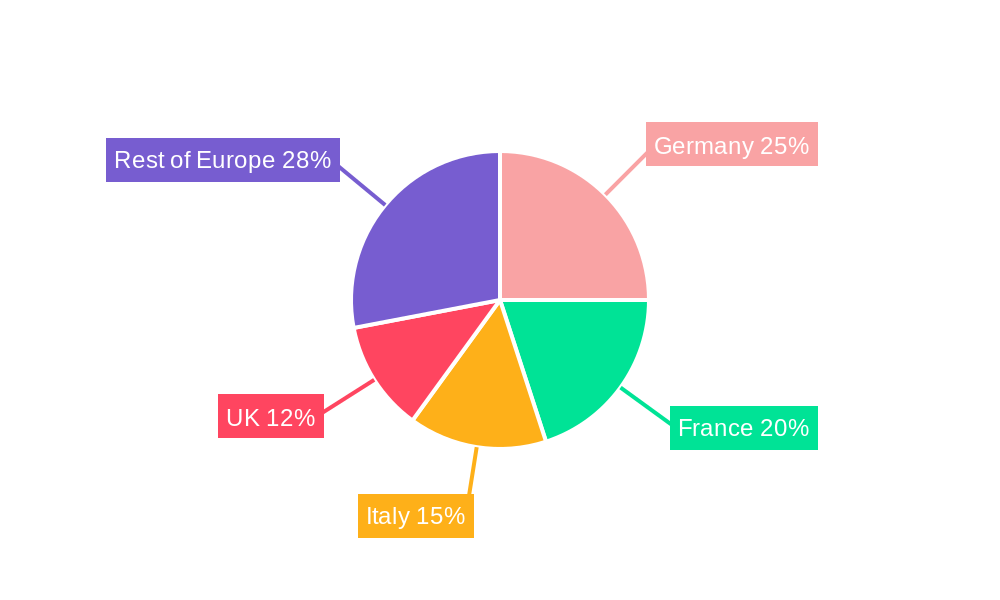

Geographically, Western European nations, including Germany, France, Italy, and the UK, dominate the market due to established winter sports infrastructure and a large consumer base. Eastern European markets are anticipated to experience growth as infrastructure develops. The online retail segment is rapidly expanding, driven by e-commerce growth and consumer convenience, necessitating strategic adaptations from manufacturers and retailers. The continued dominance of skiing and snowboarding presents opportunities for specialized equipment and accessories. Manufacturers are increasingly prioritizing sustainable and eco-friendly materials to address environmental concerns, catering to a segment of consumers who value environmentally conscious products. Ongoing research and development investments signal robust future growth prospects, with technological innovations poised to drive further market expansion.

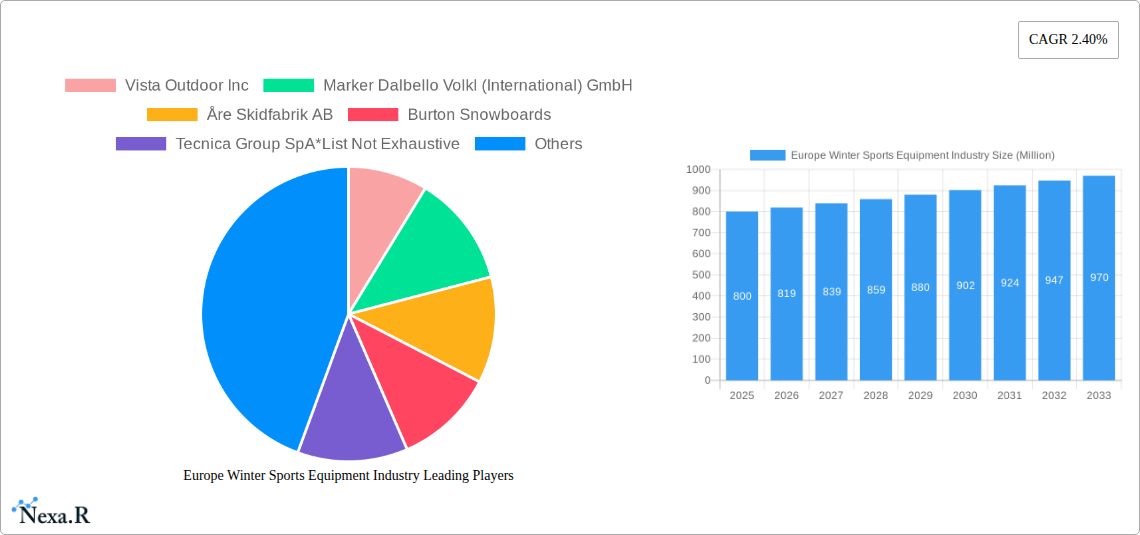

Europe Winter Sports Equipment Industry Company Market Share

Europe Winter Sports Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European winter sports equipment market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for industry professionals, investors, and strategists seeking a deep understanding of this dynamic market. The market is segmented by sport (ski, snowboard), end-user (men, women, children), and distribution channel (online, offline retail stores).

Europe Winter Sports Equipment Industry Market Dynamics & Structure

The European winter sports equipment market is characterized by a moderately concentrated landscape, with key players like Vista Outdoor Inc, Marker Dalbello Volkl (International) GmbH, Åre Skidfabrik AB, Burton Snowboards, Tecnica Group SpA, Groupe Rossignol, Amer Sports Oyj, UVEX group, Alpina d o o, Clarus Corporation, and Fischer Beteiligungsverwaltungs GmbH competing for market share. The market size in 2025 is estimated at XX million units.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a moderately concentrated market.

- Technological Innovation: Advancements in materials science (e.g., lighter, stronger skis and snowboards), ergonomic designs, and smart technology integration (e.g., performance tracking apps) are key drivers.

- Regulatory Framework: EU regulations on product safety and environmental impact influence manufacturing and distribution.

- Competitive Substitutes: The market faces competition from alternative winter recreational activities and budget-friendly options.

- End-User Demographics: The market is driven by the participation of men, women, and children across various age groups and income levels. Men currently constitute the largest segment (XX million units), followed by women (XX million units) and children (XX million units).

- M&A Trends: The past five years have witnessed xx M&A deals, primarily focused on consolidating market share and accessing new technologies.

Europe Winter Sports Equipment Industry Growth Trends & Insights

The European winter sports equipment market experienced significant growth during the historical period (2019-2024), driven by increasing participation in winter sports, favorable economic conditions in several European countries, and technological advancements. The market is projected to continue its growth trajectory during the forecast period (2025-2033), albeit at a moderated pace. The CAGR for the forecast period is estimated at xx%. This growth will be influenced by factors such as changing consumer preferences towards eco-friendly products, increasing demand for specialized equipment for niche sports, and a greater focus on personalized experiences. The adoption rate of technologically advanced equipment has also been increasing steadily. Consumer behavior shifts are towards more premium products, reflecting a focus on quality, performance, and durability. Market penetration of online retail is increasing, although offline retail channels still hold a significant share.

Dominant Regions, Countries, or Segments in Europe Winter Sports Equipment Industry

The Alpine region (France, Italy, Austria, Switzerland) dominates the European winter sports equipment market, driven by strong winter tourism, well-developed infrastructure for winter sports, and a high concentration of winter sports enthusiasts. Within this region, France holds the largest market share (XX million units). Germany also plays a significant role, representing XX million units of the market.

- By Sport: Ski equipment holds a larger market share (XX million units) compared to snowboarding equipment (XX million units).

- By End-User: The men's segment dominates, reflecting higher participation in winter sports.

- By Distribution Channel: Offline retail stores still hold a significant majority of the market share (XX million units), although the online segment is growing rapidly (XX million units) due to increased e-commerce penetration and online shopping convenience.

Key drivers for the Alpine region's dominance include government support for winter tourism, well-maintained ski resorts, and high disposable income levels.

Europe Winter Sports Equipment Industry Product Landscape

The market offers a wide range of products, from traditional skis and snowboards to advanced equipment incorporating cutting-edge technologies. Innovations include lighter and stronger materials, improved bindings for enhanced safety, and technologically integrated products for performance tracking and customization. Unique selling propositions focus on enhanced performance, comfort, safety, and sustainability.

Key Drivers, Barriers & Challenges in Europe Winter Sports Equipment Industry

Key Drivers:

- Increasing participation in winter sports.

- Technological advancements leading to improved product performance.

- Growing disposable incomes in key European markets.

Key Challenges:

- Fluctuations in weather patterns impacting the winter sports season.

- Intense competition and price pressures from low-cost manufacturers.

- Supply chain disruptions due to geopolitical instability. These disruptions reduced production output by approximately xx% in 2022.

Emerging Opportunities in Europe Winter Sports Equipment Industry

- Growing demand for eco-friendly and sustainable equipment.

- Increasing interest in niche winter sports, leading to demand for specialized equipment.

- Development of smart equipment integrating technology to enhance performance and user experience.

Growth Accelerators in the Europe Winter Sports Equipment Industry Industry

Long-term growth will be driven by strategic partnerships between equipment manufacturers and resorts to offer bundled packages, increasing investment in research and development for innovative products, and expansion into new markets through increased online sales and global partnerships.

Key Players Shaping the Europe Winter Sports Equipment Market

- Vista Outdoor Inc

- Marker Dalbello Volkl (International) GmbH

- Åre Skidfabrik AB

- Burton Snowboards

- Tecnica Group SpA

- Groupe Rossignol

- Amer Sports Oyj

- UVEX group

- Alpina d o o

- Clarus Corporation

- Fischer Beteiligungsverwaltungs GmbH

Notable Milestones in Europe Winter Sports Equipment Industry Sector

- 2020: Several companies launched new lines of sustainable winter sports equipment.

- 2022: Supply chain disruptions significantly impacted production and distribution across the industry.

- 2023: Increased investment in R&D to create smart winter sports equipment.

In-Depth Europe Winter Sports Equipment Industry Market Outlook

The European winter sports equipment market is poised for continued growth, fueled by technological innovations, increasing consumer demand, and the expansion of online retail channels. Strategic partnerships, sustainable product development, and targeted marketing campaigns will be crucial for capturing market share in this evolving industry. The potential for market expansion into emerging winter sports markets and continued growth in established markets presents substantial opportunities for key players.

Europe Winter Sports Equipment Industry Segmentation

-

1. Sport

-

1.1. Ski

- 1.1.1. Skis and Poles

- 1.1.2. Ski Boots

- 1.1.3. Other Protective Gear and Accessories

- 1.2. Snowboard

-

1.1. Ski

-

2. End-User

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Online Retail Stores

- 3.2. Offline Retail Stores

Europe Winter Sports Equipment Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Switzerland

- 6. Austria

- 7. Spain

- 8. Rest of Europe

Europe Winter Sports Equipment Industry Regional Market Share

Geographic Coverage of Europe Winter Sports Equipment Industry

Europe Winter Sports Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Growing Number Of Ski Destinations Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 5.1.1. Ski

- 5.1.1.1. Skis and Poles

- 5.1.1.2. Ski Boots

- 5.1.1.3. Other Protective Gear and Accessories

- 5.1.2. Snowboard

- 5.1.1. Ski

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Switzerland

- 5.4.6. Austria

- 5.4.7. Spain

- 5.4.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 6. United Kingdom Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 6.1.1. Ski

- 6.1.1.1. Skis and Poles

- 6.1.1.2. Ski Boots

- 6.1.1.3. Other Protective Gear and Accessories

- 6.1.2. Snowboard

- 6.1.1. Ski

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 7. Germany Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 7.1.1. Ski

- 7.1.1.1. Skis and Poles

- 7.1.1.2. Ski Boots

- 7.1.1.3. Other Protective Gear and Accessories

- 7.1.2. Snowboard

- 7.1.1. Ski

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 8. France Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 8.1.1. Ski

- 8.1.1.1. Skis and Poles

- 8.1.1.2. Ski Boots

- 8.1.1.3. Other Protective Gear and Accessories

- 8.1.2. Snowboard

- 8.1.1. Ski

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 9. Italy Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 9.1.1. Ski

- 9.1.1.1. Skis and Poles

- 9.1.1.2. Ski Boots

- 9.1.1.3. Other Protective Gear and Accessories

- 9.1.2. Snowboard

- 9.1.1. Ski

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 10. Switzerland Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 10.1.1. Ski

- 10.1.1.1. Skis and Poles

- 10.1.1.2. Ski Boots

- 10.1.1.3. Other Protective Gear and Accessories

- 10.1.2. Snowboard

- 10.1.1. Ski

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Children

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online Retail Stores

- 10.3.2. Offline Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 11. Austria Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 11.1.1. Ski

- 11.1.1.1. Skis and Poles

- 11.1.1.2. Ski Boots

- 11.1.1.3. Other Protective Gear and Accessories

- 11.1.2. Snowboard

- 11.1.1. Ski

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Men

- 11.2.2. Women

- 11.2.3. Children

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online Retail Stores

- 11.3.2. Offline Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 12. Spain Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 12.1.1. Ski

- 12.1.1.1. Skis and Poles

- 12.1.1.2. Ski Boots

- 12.1.1.3. Other Protective Gear and Accessories

- 12.1.2. Snowboard

- 12.1.1. Ski

- 12.2. Market Analysis, Insights and Forecast - by End-User

- 12.2.1. Men

- 12.2.2. Women

- 12.2.3. Children

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Online Retail Stores

- 12.3.2. Offline Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 13. Rest of Europe Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 13.1.1. Ski

- 13.1.1.1. Skis and Poles

- 13.1.1.2. Ski Boots

- 13.1.1.3. Other Protective Gear and Accessories

- 13.1.2. Snowboard

- 13.1.1. Ski

- 13.2. Market Analysis, Insights and Forecast - by End-User

- 13.2.1. Men

- 13.2.2. Women

- 13.2.3. Children

- 13.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.3.1. Online Retail Stores

- 13.3.2. Offline Retail Stores

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Vista Outdoor Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Marker Dalbello Volkl (International) GmbH

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Åre Skidfabrik AB

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Burton Snowboards

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Tecnica Group SpA*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Groupe Rossignol

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Amer Sports Oyj

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 UVEX group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Alpina d o o

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Clarus Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Fischer Beteiligungsverwaltungs GmbH

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Vista Outdoor Inc

List of Figures

- Figure 1: Europe Winter Sports Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Winter Sports Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 2: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 3: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 5: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 10: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 11: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 13: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 18: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 19: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 21: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 26: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 27: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 29: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 34: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 35: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 37: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 42: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 43: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 45: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 50: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 51: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 52: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 53: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 54: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 55: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 57: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 58: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 59: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 60: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 61: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 62: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 63: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 64: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 65: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 66: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 67: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 68: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 69: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 71: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Winter Sports Equipment Industry?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the Europe Winter Sports Equipment Industry?

Key companies in the market include Vista Outdoor Inc, Marker Dalbello Volkl (International) GmbH, Åre Skidfabrik AB, Burton Snowboards, Tecnica Group SpA*List Not Exhaustive, Groupe Rossignol, Amer Sports Oyj, UVEX group, Alpina d o o, Clarus Corporation, Fischer Beteiligungsverwaltungs GmbH.

3. What are the main segments of the Europe Winter Sports Equipment Industry?

The market segments include Sport, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Growing Number Of Ski Destinations Drives the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Winter Sports Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Winter Sports Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Winter Sports Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Winter Sports Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence