Key Insights

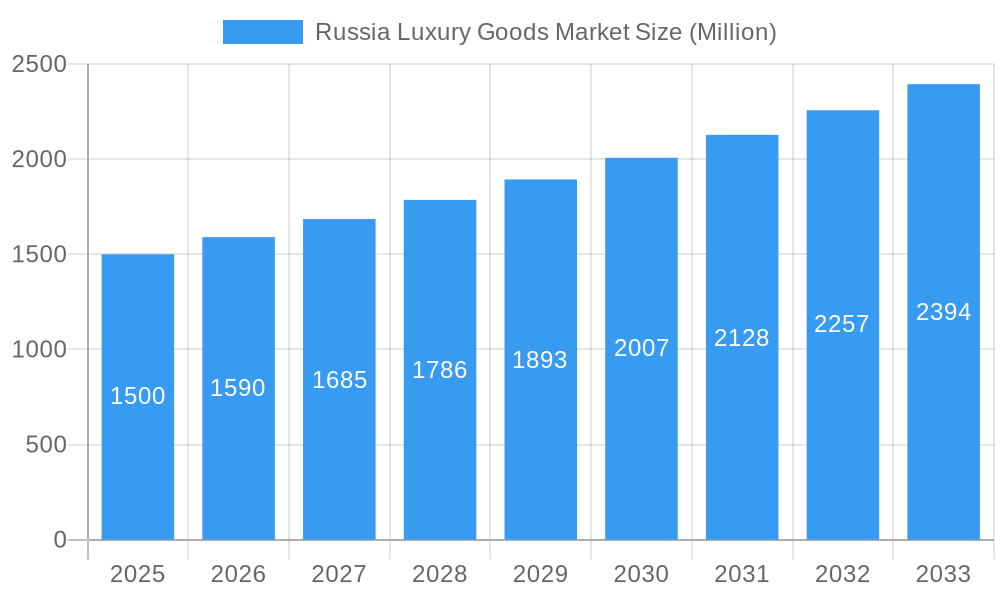

The Russia luxury goods market, projected to reach $2.59 billion by 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 2.81% between 2025 and 2033. This growth is driven by increasing disposable incomes among affluent Russians, a rising preference for premium brands, and a growing demand for aspirational products. Enhanced tourism, particularly from high-net-worth individuals, also contributes significantly to market expansion. Supportive government initiatives for domestic luxury brands and a more stable economic outlook further bolster market performance. The market is segmented by product categories including apparel, footwear, jewelry, watches, and accessories, and by distribution channels such as single-brand and multi-brand retail outlets, and online platforms. The e-commerce sector for luxury goods in Russia is experiencing accelerated growth, aligning with global digital retail trends.

Russia Luxury Goods Market Market Size (In Billion)

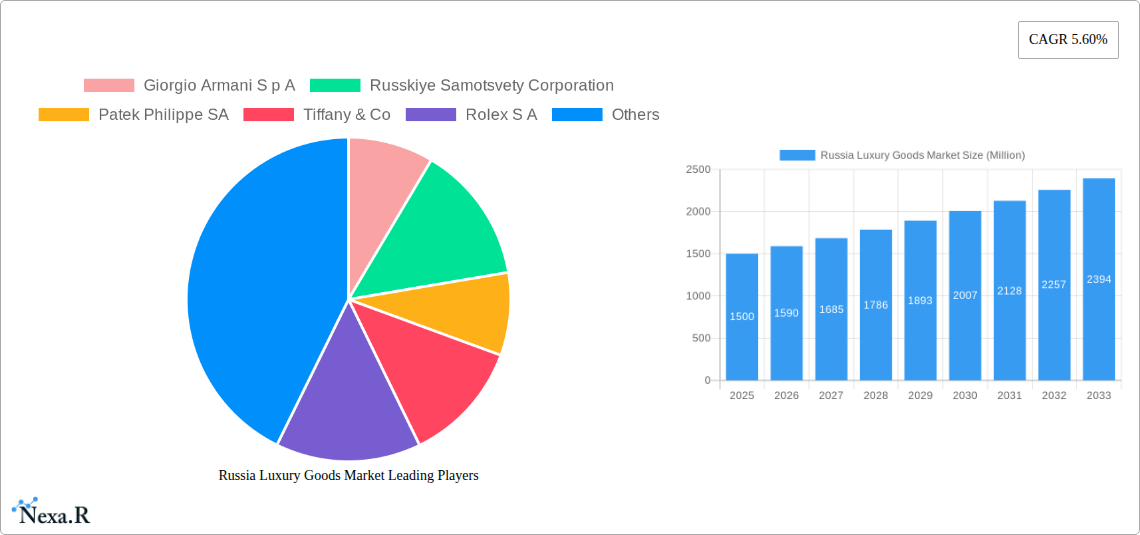

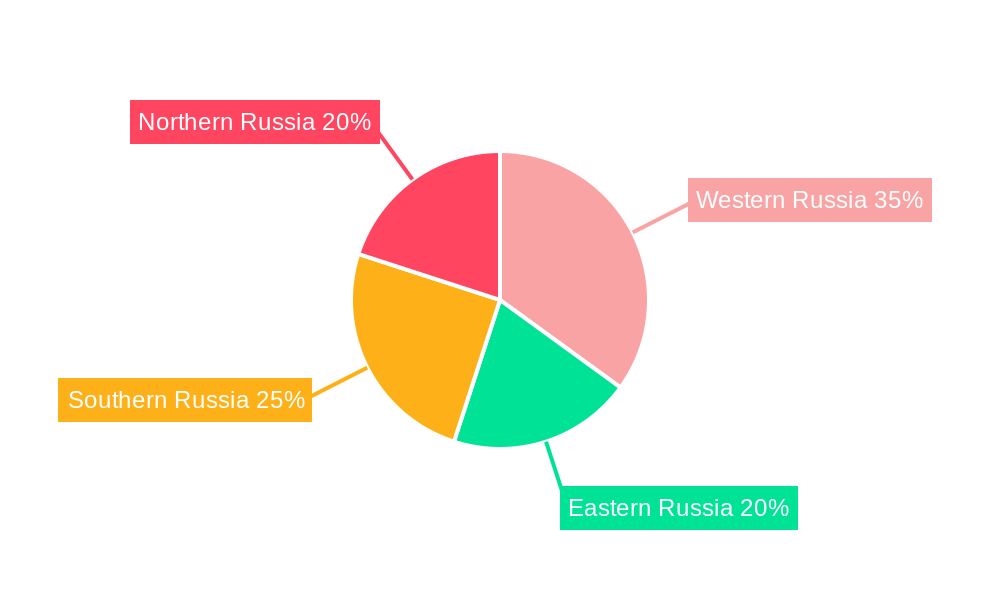

Challenges to market growth include economic instability within Russia and potential currency fluctuations, which can affect consumer purchasing power for luxury items. Geopolitical considerations and international sanctions also pose risks to market accessibility and consumer sentiment. The competitive landscape features established global brands alongside emerging domestic players. To succeed, companies must adopt strategic brand positioning, emphasize exclusivity, and implement targeted marketing campaigns for the sophisticated Russian luxury consumer. Regional variations in spending patterns and brand preferences across Western, Eastern, Southern, and Northern Russia necessitate tailored market strategies. Leading market participants, such as Giorgio Armani, Russkiye Samotsvety, Patek Philippe, Tiffany & Co, and Rolex, are actively responding to these market dynamics through strategic alliances, product diversification, and elevated customer engagement.

Russia Luxury Goods Market Company Market Share

Russia Luxury Goods Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia luxury goods market, offering invaluable insights for industry professionals, investors, and strategists. We delve into market dynamics, growth trends, key players, and future opportunities, providing a clear picture of this dynamic sector. The report covers the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory until 2033. The market is segmented by product type (Clothing & Apparel, Footwear, Jewelry, Watches, Bags, Other Types) and distribution channel (Single Brand Stores, Multi-Brand Stores, Online Stores, Other Distribution Channels).

Russia Luxury Goods Market Dynamics & Structure

The Russian luxury goods market, valued at xx million units in 2024, exhibits a complex interplay of factors influencing its structure and growth. Market concentration is moderate, with a few dominant players alongside numerous smaller, niche brands. Technological innovation, while present, faces barriers such as infrastructural limitations and regulatory complexities. The regulatory framework, though evolving, impacts import/export dynamics and influences pricing strategies. Competitive product substitutes, particularly from the mid-range segment, exert pressure on pricing and market share. The end-user demographic is primarily affluent urban consumers with a growing interest in both domestic and international luxury brands. M&A activity has been moderate in recent years, with a focus on consolidation within specific product categories.

- Market Concentration: Moderate, with a few key players holding significant share.

- Technological Innovation: Present but hindered by infrastructure and regulatory hurdles.

- Regulatory Framework: Impacts import/export and pricing.

- Competitive Substitutes: Mid-range brands exert pressure on pricing.

- End-User Demographics: Primarily affluent urban consumers.

- M&A Activity: Moderate, focusing on consolidation within segments. xx deals recorded between 2019-2024.

Russia Luxury Goods Market Growth Trends & Insights

The Russian luxury goods market is projected to experience robust growth throughout the forecast period (2025-2033), driven by rising disposable incomes, a growing middle class, and increasing demand for premium products. The market size is expected to reach xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by both domestic and international luxury brands catering to evolving consumer preferences. Technological disruptions, such as the rise of e-commerce and personalized marketing, are significantly influencing market dynamics and adoption rates. Changing consumer behavior, including a preference for experience-driven luxury and sustainable brands, presents both opportunities and challenges for market players. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Russia Luxury Goods Market

Moscow and St. Petersburg remain the dominant regions, accounting for the largest share of luxury goods sales. Within product types, Jewelry and Watches are currently the leading segments, followed by Clothing & Apparel. Single-brand stores constitute the largest distribution channel, though online stores are witnessing significant growth.

- Key Drivers: Rising disposable incomes, urbanization, increasing tourism, and growing popularity of online luxury retail.

- Dominance Factors: High concentration of affluent consumers in major cities, robust infrastructure in key regions, and strong brand presence.

- Moscow and St. Petersburg: Account for xx% of total market value in 2025.

- Jewelry and Watches: Hold a combined market share of xx% in 2025.

- Single-brand stores: Maintain a leading market share of xx% in 2025.

Russia Luxury Goods Market Product Landscape

Product innovation in the Russian luxury goods market is focused on personalization, sustainability, and technological integration. Smartwatches with luxury features, ethically sourced materials, and bespoke design services are gaining traction. Performance metrics are primarily driven by brand perception, customer satisfaction, and sales figures. Unique selling propositions often center around exclusivity, craftsmanship, and heritage. Technological advancements are focused on improving online experiences, enhancing personalization, and strengthening brand-customer relationships.

Key Drivers, Barriers & Challenges in Russia Luxury Goods Market

Key Drivers: Rising disposable incomes among the affluent population, increasing brand awareness through international exposure, and government initiatives to promote the luxury sector are driving market expansion.

Challenges: Geopolitical instability, economic fluctuations, fluctuating exchange rates, and evolving consumer preferences pose significant challenges to market growth. Supply chain disruptions, particularly impacting imports, have affected product availability and pricing. Regulatory hurdles and increased competition from domestic and international brands add to the complexity of the market.

Emerging Opportunities in Russia Luxury Goods Market

Untapped market segments, such as luxury experiences (e.g., bespoke travel, high-end spa services), and personalized luxury items are promising avenues for growth. The increasing adoption of e-commerce and social media marketing presents significant opportunities to reach a wider consumer base. Catering to a more conscious consumer, who values sustainability and ethical sourcing, will be pivotal in shaping future success.

Growth Accelerators in the Russia Luxury Goods Market Industry

Strategic partnerships between international and domestic luxury brands can unlock new market opportunities and enhance brand presence. Technological breakthroughs, such as the use of AI in personalized marketing and improved supply chain management, will enhance efficiency and customer experience. Market expansion into secondary and tertiary cities with growing affluent populations will also contribute to long-term growth.

Key Players Shaping the Russia Luxury Goods Market Market

- Giorgio Armani S p A

- Russkiye Samotsvety Corporation

- Patek Philippe SA

- Tiffany & Co

- Rolex S A

- Estee Lauder

- EssilorLuxottica SA

- Fossile Group

- Nika Watches Jewelry

- Sokolov Jewelry

Notable Milestones in Russia Luxury Goods Market Sector

- 2020: & Other Stories opened its first store in Russia, expanding the range of accessible luxury goods.

- 2021: Alrosa consolidated its jewelry production and launched an online store, focusing on origin-guaranteed Russian diamonds and combating market fraud.

- 2021: Sokolov planned a dual listing in New York and Moscow for 2023, aiming for expansion through its IPO.

In-Depth Russia Luxury Goods Market Market Outlook

The future of the Russia luxury goods market is bright, driven by a combination of factors including rising disposable incomes, technological advancements, and a growing appreciation for premium products. Strategic partnerships, innovative marketing strategies, and a focus on customer experience will be crucial for success. The market is poised for significant growth, presenting considerable opportunities for established players and new entrants alike. Continued investment in infrastructure, technological innovation, and brand building will be essential to sustaining long-term growth and competitiveness within this dynamic market.

Russia Luxury Goods Market Segmentation

-

1. Product Type

- 1.1. Clothing & Apparel

- 1.2. Footwear

- 1.3. Jewelry

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Types

-

2. Distibution Channel

- 2.1. Single Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Russia Luxury Goods Market Segmentation By Geography

- 1. Russia

Russia Luxury Goods Market Regional Market Share

Geographic Coverage of Russia Luxury Goods Market

Russia Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness

- 3.3. Market Restrains

- 3.3.1. High Risk and Safety Concerns; Fluctuating Weather Patterns

- 3.4. Market Trends

- 3.4.1. Consumer's Willingness to Spend on Luxury Grooming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing & Apparel

- 5.1.2. Footwear

- 5.1.3. Jewelry

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Russkiye Samotsvety Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Patek Philippe SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tiffany & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rolex S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Estee Lauder

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EssilorLuxottica SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fossile Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nika Watches Jewelry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sokolov Jewelry*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Russia Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Russia Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Russia Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Russia Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Russia Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Luxury Goods Market?

The projected CAGR is approximately 2.81%.

2. Which companies are prominent players in the Russia Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Russkiye Samotsvety Corporation, Patek Philippe SA, Tiffany & Co, Rolex S A, Estee Lauder, EssilorLuxottica SA, Fossile Group, Nika Watches Jewelry, Sokolov Jewelry*List Not Exhaustive.

3. What are the main segments of the Russia Luxury Goods Market?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness.

6. What are the notable trends driving market growth?

Consumer's Willingness to Spend on Luxury Grooming.

7. Are there any restraints impacting market growth?

High Risk and Safety Concerns; Fluctuating Weather Patterns.

8. Can you provide examples of recent developments in the market?

In 2021, The Russian company Alrosa completed the consolidation of its jewelry production and launched its first online jewelry store. The company's goal is to promote origin-guaranteed Russian diamonds, improve the user's experience, and combat fraud in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Russia Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence