Key Insights

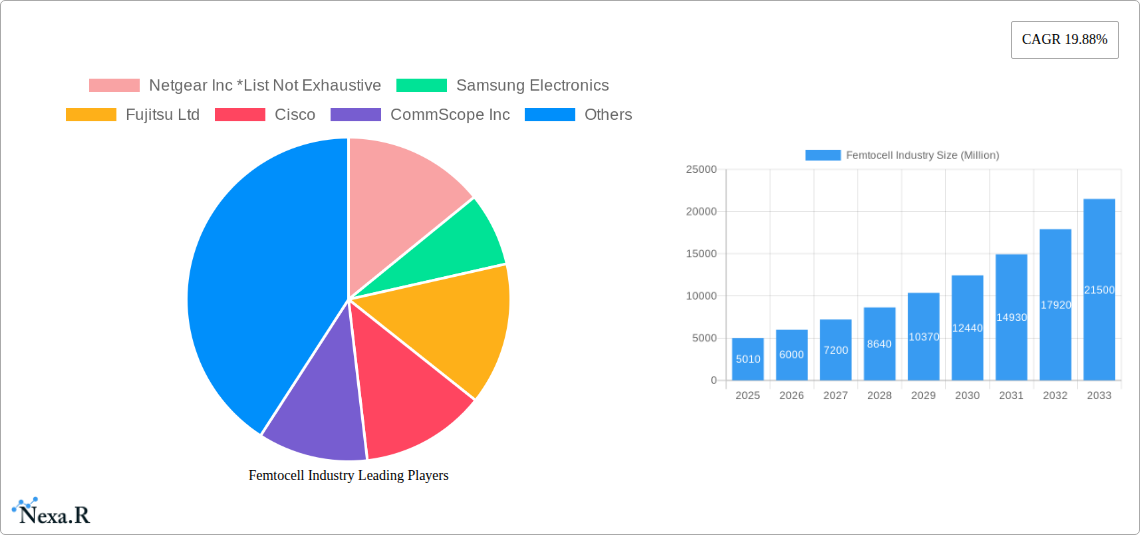

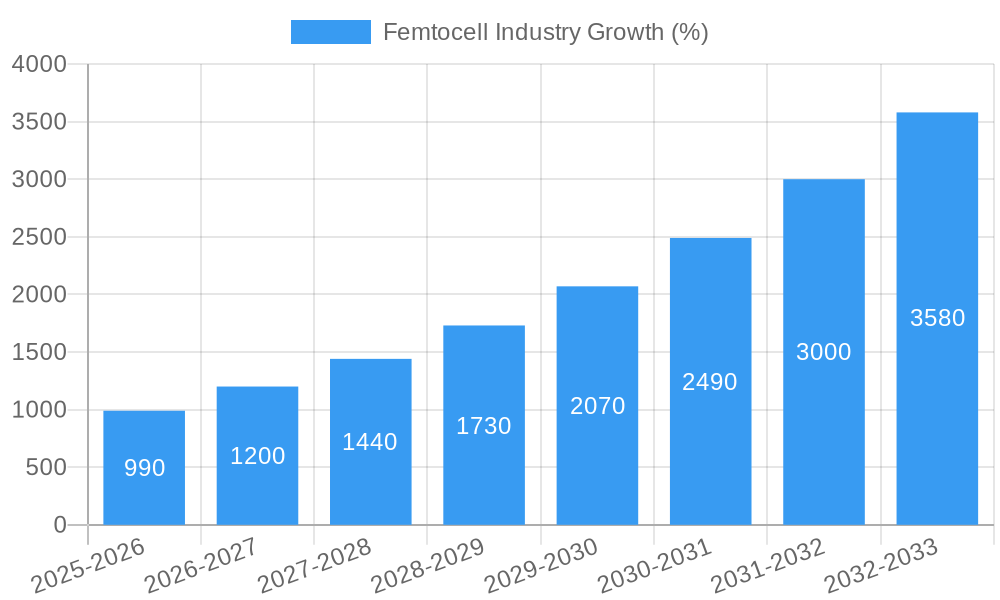

The femtocell market, valued at $5.01 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 19.88% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for high-speed internet access, particularly in areas with poor cellular coverage, fuels the adoption of femtocells in both residential and commercial settings. The rising penetration of smartphones and other mobile devices further contributes to this growth, as users seek seamless connectivity. Furthermore, advancements in technology, such as improved power efficiency and smaller form factors, are making femtocells more appealing and cost-effective for consumers and businesses alike. Network operators are also increasingly deploying femtocells to enhance network capacity and coverage, especially in densely populated areas and challenging terrains. The commercial sector, including enterprises and small businesses, is a major driver, relying on femtocells for improved internal communication and reliable data transfer.

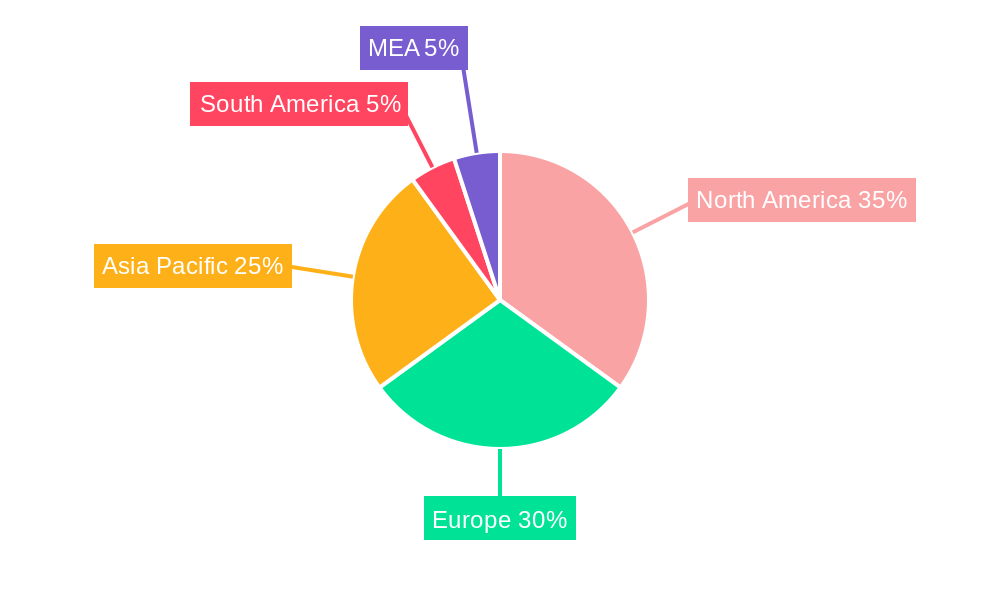

However, the market also faces some challenges. High initial investment costs for infrastructure setup can deter some potential adopters. Concerns regarding security and interference with existing cellular networks also need to be addressed to ensure wider acceptance. Regulatory hurdles and spectrum allocation policies in different regions can also impact market penetration. Despite these restraints, the overall market outlook remains positive, with significant opportunities for growth in emerging economies and expanding applications in sectors such as healthcare, education, and transportation. The competitive landscape is populated by major players including Netgear, Samsung, Fujitsu, Cisco, and others, each striving to innovate and capture market share through technological advancements and strategic partnerships. The geographic distribution shows a significant concentration in North America and Europe initially, but rapid growth is anticipated in the Asia-Pacific region fueled by increasing mobile usage and infrastructure development.

Femtocell Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global femtocell industry, encompassing market dynamics, growth trends, regional insights, product landscapes, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) to forecast market trends until 2033. This in-depth analysis is crucial for industry professionals, investors, and stakeholders seeking to understand and capitalize on the evolving femtocell market landscape. We delve into both parent markets (small cell networks) and child markets (residential and commercial applications) to provide a holistic view.

Femtocell Industry Market Dynamics & Structure

The femtocell market, a crucial component of the broader small cell network infrastructure, exhibits a moderately concentrated structure. Key players like Netgear Inc, Samsung Electronics, Fujitsu Ltd, Cisco, CommScope Inc, Airvana Inc, ZTE Corporation, Nokia Corporation, and Qualcomm hold significant market share, although the exact percentages vary based on region and application. Technological innovation, particularly in 5G and software-defined radio (SDR) technologies, is a primary driver. Regulatory frameworks, including spectrum allocation policies and licensing requirements, significantly influence market growth. Competitive product substitutes, such as Wi-Fi and other small cell solutions, pose challenges. End-user demographics, primarily driven by residential and commercial needs for improved connectivity, define market segmentation. M&A activity in the sector has been relatively moderate in recent years, with an estimated xx deals completed in the past five years, primarily focused on enhancing technological capabilities and expanding market reach. Innovation barriers include high initial investment costs and complex deployment procedures.

- Market Concentration: Moderately concentrated, with top players holding xx% of the market share.

- Technological Innovation: Driven by 5G, SDR, and open RAN standards.

- Regulatory Framework: Spectrum allocation and licensing impact market growth significantly.

- Competitive Substitutes: Wi-Fi and other small cell technologies compete for market share.

- End-User Demographics: Primarily residential and commercial sectors driving demand.

- M&A Activity: Approximately xx deals in the last five years, focusing on technological advancements and market expansion.

Femtocell Industry Growth Trends & Insights

The global femtocell market witnessed significant growth from 2019 to 2024, expanding from xx million units to xx million units. This translates to a CAGR of xx%. The market is projected to continue its expansion, reaching xx million units by 2033, driven by increasing demand for enhanced mobile broadband coverage, particularly in areas with limited macrocell network penetration. Technological disruptions, such as the adoption of 5G and the integration of IoT devices, are accelerating market growth. Consumer behavior shifts towards greater reliance on mobile devices and increased data consumption are further fueling market expansion. Adoption rates are increasing, especially in residential and commercial applications. The residential segment displays a greater adoption rate than the commercial segment because of the ease of installation and use for household purposes. Market penetration is expected to reach xx% by 2033, driven by advancements in technology and decrease in cost.

Dominant Regions, Countries, or Segments in Femtocell Industry

The North American region currently dominates the global femtocell market, holding approximately xx% market share in 2025. This dominance is largely attributable to the early adoption of advanced technologies, robust infrastructure development, and a high concentration of key players. Within North America, the United States holds the largest share due to a large base of individual users. The robust mobile infrastructure and a substantial number of users driving the demand for improved indoor coverage have facilitated the region's growth. Meanwhile, Europe and Asia Pacific are expected to experience substantial growth over the forecast period, driven by increasing investments in 5G infrastructure and rising demand for enhanced mobile connectivity.

- North America: Dominant region with xx% market share in 2025, driven by early adoption of technology and strong infrastructure.

- Europe: Significant growth potential fueled by 5G infrastructure development and increasing mobile data consumption.

- Asia Pacific: High growth potential due to expanding mobile subscriber base and rising investments in telecommunications infrastructure.

- By Application: Residential segment currently leads with xx% market share, driven by the rising demand for improved home network connectivity and the increasing use of IoT devices.

- Key Drivers: Robust mobile infrastructure, high consumer demand for improved connectivity, substantial government investment in communication infrastructure and technological advancements.

Femtocell Industry Product Landscape

Femtocell products are evolving rapidly, with a focus on improved performance, enhanced security, and simplified installation. Modern femtocells support 4G/5G LTE and 5G New Radio (NR) networks, offering superior data speeds and lower latency. Many products incorporate advanced features such as self-organizing networks (SON) and software-defined networking (SDN) to optimize network performance and simplify management. Unique selling propositions include seamless integration with existing networks, enhanced security features, and easy-to-use interfaces. Technological advancements are focusing on smaller form factors, lower power consumption, and improved spectrum efficiency.

Key Drivers, Barriers & Challenges in Femtocell Industry

Key Drivers:

- Increased demand for improved mobile broadband coverage: Expanding mobile user base and rising data consumption are key factors pushing demand.

- Growth of the Internet of Things (IoT): Femtocells provide seamless connectivity for a growing number of IoT devices.

- Advancements in 5G technology: 5G femtocells offer superior performance and capacity.

- Government initiatives and supportive regulatory policies: Various countries are promoting the adoption of femtocell technology to improve network coverage.

Key Challenges & Restraints:

- High initial investment costs: The cost of deploying and maintaining femtocell networks can be high, limiting adoption in price-sensitive markets.

- Interference and frequency coordination issues: Careful planning is required to prevent interference with existing macrocell networks.

- Regulatory hurdles and licensing complexities: Obtaining necessary approvals and licenses can be time-consuming and complex.

- Competitive pressures from alternative technologies: Wi-Fi and other small cell technologies provide competitive alternatives. This translates to a xx% reduction in market growth yearly.

Emerging Opportunities in Femtocell Industry

- Untapped markets in developing countries: Expanding mobile penetration in these markets presents substantial growth opportunities.

- Integration with private LTE and 5G networks: Femtocells are finding increasing adoption in private networks for enhanced security and control.

- New applications in smart homes and smart cities: Femtocells are playing an increasingly important role in delivering reliable connectivity for various smart applications.

- Expansion into enterprise and industrial settings: Femtocells offer improved coverage and reliability for businesses with high network requirements.

Growth Accelerators in the Femtocell Industry

Technological breakthroughs, such as the development of more energy-efficient and cost-effective femtocell devices, are pivotal for sustained growth. Strategic partnerships between network operators and femtocell manufacturers are enhancing market penetration and adoption rates. Market expansion strategies, focusing on underserved regions and emerging applications, are further contributing to long-term growth. The continuous evolution of 5G technology and the increasing integration of femtocells into private LTE and 5G networks drive strong future potential.

Key Players Shaping the Femtocell Industry Market

- Netgear Inc

- Samsung Electronics

- Fujitsu Ltd

- Cisco

- CommScope Inc

- Airvana Inc

- ZTE Corporation

- Nokia Corporation

- Qualcomm

Notable Milestones in Femtocell Industry Sector

- September 2022: AT&T launched a new femtocell from Nokia to facilitate the 3G to 5G transition, shipping 145,000 devices.

- February 2023: Vodafone showcased a prototype 5G network-in-a-box at MWC 2023, highlighting the potential for private 5G networks.

In-Depth Femtocell Industry Market Outlook

The femtocell market is poised for continued expansion, driven by technological advancements, increasing demand for high-speed mobile broadband, and the growth of IoT applications. Strategic partnerships and market expansion initiatives will play a crucial role in unlocking the full market potential. The market is expected to witness significant growth in emerging economies and new applications, creating numerous opportunities for innovation and investment.

Femtocell Industry Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Residential

Femtocell Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Femtocell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Role of Femtocells in the Continuity of 4G and 5G; Demand for Heterogeneous Networks

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professional Across Industries

- 3.4. Market Trends

- 3.4.1. Commercial Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Residential

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Residential

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Residential

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Residential

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Residential

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Femtocell Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Netgear Inc *List Not Exhaustive

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Samsung Electronics

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Fujitsu Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Cisco

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 CommScope Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Airvana Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 ZTE Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Nokia Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Qualcomm

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Netgear Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Femtocell Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Femtocell Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Femtocell Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Femtocell Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Femtocell Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Femtocell Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia Pacific Femtocell Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia Pacific Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Latin America Femtocell Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Latin America Femtocell Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Latin America Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Latin America Femtocell Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East Femtocell Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Middle East Femtocell Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Middle East Femtocell Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East Femtocell Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Femtocell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Femtocell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Femtocell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Belgium Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherland Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Nordics Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southeast Asia Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailandc Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Peru Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Chile Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Colombia Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Ecuador Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Venezuela Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United States Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Canada Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Mexico Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Arab Emirates Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Saudi Arabia Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East and Africa Femtocell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Femtocell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Femtocell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Femtocell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Femtocell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Global Femtocell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Femtocell Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Femtocell Industry?

The projected CAGR is approximately 19.88%.

2. Which companies are prominent players in the Femtocell Industry?

Key companies in the market include Netgear Inc *List Not Exhaustive, Samsung Electronics, Fujitsu Ltd, Cisco, CommScope Inc, Airvana Inc, ZTE Corporation, Nokia Corporation, Qualcomm.

3. What are the main segments of the Femtocell Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Role of Femtocells in the Continuity of 4G and 5G; Demand for Heterogeneous Networks.

6. What are the notable trends driving market growth?

Commercial Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Professional Across Industries.

8. Can you provide examples of recent developments in the market?

February 2023 - Vodafone announced a prototype of a 5G network-in-a-box which was on display at Vodafone’s booth in Hall 3 during MWC 2023. The outer casing of the network-in-a-box is created using a 3D printer. The software defined radio (SDR) and it’s 5G SA are at the core. The board design is compliant with open Radio Access Network (RAN) standards. It can be used to provide coverage in a home and addresses the gap for people who want their own private network for IoT or business purposes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Femtocell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Femtocell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Femtocell Industry?

To stay informed about further developments, trends, and reports in the Femtocell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence