Key Insights

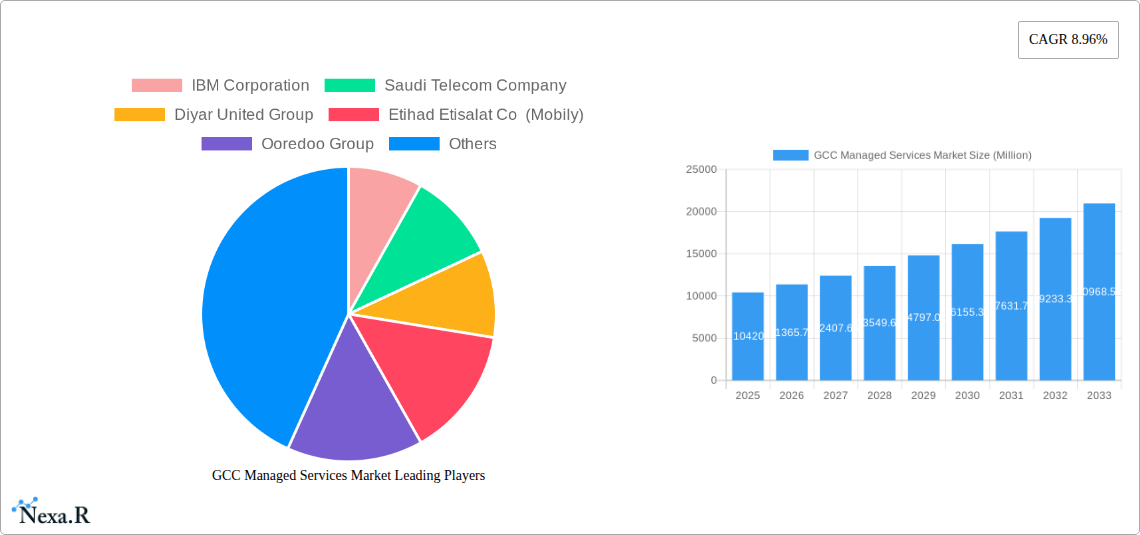

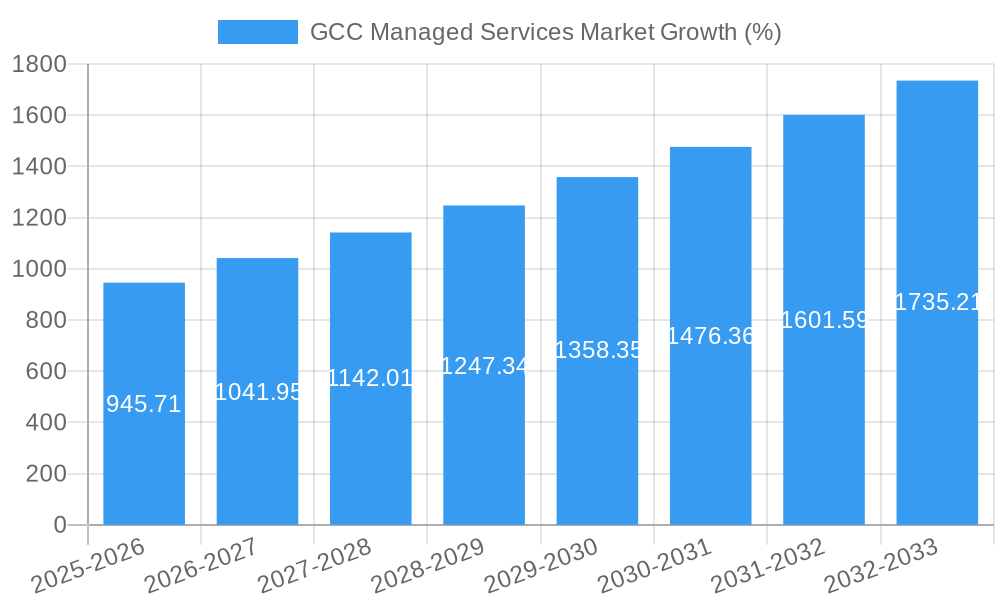

The GCC Managed Services Market, valued at $10.42 billion in 2025, is projected to experience robust growth, driven by the region's increasing digital transformation initiatives and the rising adoption of cloud technologies across various sectors. The Compound Annual Growth Rate (CAGR) of 8.96% from 2025 to 2033 signifies a significant expansion, primarily fueled by the demand for enhanced IT infrastructure efficiency, improved security, and reduced operational costs. Key growth drivers include the burgeoning BFSI and IT & Telecom sectors, which are heavily investing in managed infrastructure, cloud, and security services. Furthermore, the growing need for disaster recovery and business continuity solutions amidst increasing cyber threats contributes significantly to market expansion. The increasing government initiatives promoting digitalization across sectors in countries like Saudi Arabia, UAE, and Qatar, further bolster market growth. Competitive pressures from established players like IBM and Saudi Telecom Company, alongside emerging regional players, are shaping the market landscape, leading to innovative service offerings and pricing strategies.

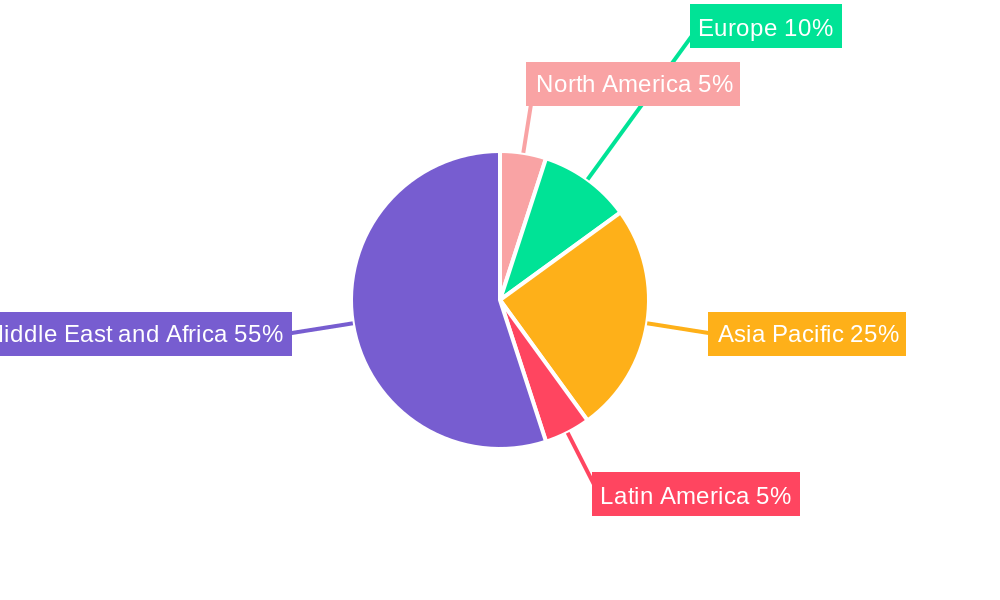

The market segmentation reveals a diverse landscape. Managed cloud services are expected to dominate the "by type" segment, due to the increasing preference for scalable and cost-effective cloud solutions. The BFSI sector is anticipated to lead the "by end-user vertical" segment, driven by their stringent regulatory requirements and the need for robust security and data management. While precise regional breakdowns within the GCC are unavailable, Saudi Arabia and the UAE are likely to hold the largest market shares, given their advanced digital infrastructure and significant investments in technology. The forecast period of 2025-2033 offers promising growth opportunities for both established and new market entrants. Successful players will need to leverage technological advancements, build robust partnerships, and focus on delivering customized solutions tailored to specific industry needs within the diverse GCC landscape.

GCC Managed Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the GCC Managed Services Market, covering market dynamics, growth trends, dominant segments, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report utilizes data from the historical period (2019-2024) and forecasts market trends until 2033. The market is segmented by type (Managed Infrastructure Services, Managed Hosting Services, Managed Security Services, Managed Cloud Services, Disaster Recovery & Business Continuity Services) and end-user vertical (IT & Telecom, BFSI, Oil & Gas, Healthcare, Government, Other End-user Verticals). Key players analyzed include IBM Corporation, Saudi Telecom Company, Diyar United Group, Etihad Etisalat Co (Mobily), Ooredoo Group, EITC Group (du), ACS Group, AGC Networks (An ESSAR Company), Emitac, MEEZA Group, HP Middle East, and Wipro Group. The market value is presented in Million units.

GCC Managed Services Market Dynamics & Structure

The GCC managed services market is experiencing robust growth, driven by increasing digital transformation initiatives across various sectors. Market concentration is moderate, with several large players and numerous smaller, specialized providers. Technological innovation, particularly in areas like AI and cloud computing, is a key driver, while regulatory frameworks and cybersecurity concerns shape market dynamics. Product substitutes, such as in-house IT solutions, exist but are increasingly less cost-effective for many organizations. End-user demographics are shifting towards greater adoption of managed services by SMEs, fueling market expansion. M&A activity is moderate, with strategic acquisitions aiming to expand service portfolios and geographical reach.

- Market Concentration: Moderate, with a mix of large multinational corporations and smaller regional players. The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Cloud computing, AI, and automation are major drivers. Barriers to innovation include legacy infrastructure and skills gaps.

- Regulatory Framework: Data privacy regulations and cybersecurity standards influence service offerings and adoption.

- Competitive Product Substitutes: In-house IT solutions represent a substitute but are often less cost-effective.

- End-User Demographics: Increasing adoption by SMEs drives growth; larger enterprises are consolidating providers.

- M&A Trends: Strategic acquisitions to broaden service portfolios and geographical reach, with xx major deals recorded in the past 5 years.

GCC Managed Services Market Growth Trends & Insights

The GCC managed services market demonstrates consistent growth, driven by several factors. The market size witnessed a significant expansion in the historical period, with a CAGR of xx% from 2019 to 2024. This growth trajectory is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%. Increased adoption of cloud-based services, heightened cybersecurity concerns, and the rising demand for improved IT infrastructure are key factors propelling this growth. Technological advancements, such as the deployment of AI and automation in managed services, are driving efficiency gains and creating new opportunities. Consumer behavior is shifting towards a preference for outsourced IT solutions, emphasizing agility and cost optimization. Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Regions, Countries, or Segments in GCC Managed Services Market

The UAE and Saudi Arabia are currently the leading markets within the GCC, capturing xx% and xx% of the market share respectively in 2025. These countries' robust economies and strong investments in digital infrastructure are key drivers. The Managed Cloud Services segment holds the largest market share by type in 2025 at approximately xx%, followed by Managed Security Services at xx%. The BFSI and IT & Telecom sectors are the most significant end-user verticals, accounting for approximately xx% and xx% respectively of the total market. Growth is fueled by the increasing need for robust IT infrastructure and cybersecurity solutions across these sectors.

- Key Drivers (UAE & Saudi Arabia): Strong government initiatives, large investments in digital infrastructure, and a thriving business environment.

- Key Drivers (Managed Cloud Services): Cost-effectiveness, scalability, and enhanced flexibility.

- Key Drivers (BFSI & IT & Telecom): High data security needs, increasing digital adoption, and compliance mandates.

- Qatar and Other GCC Countries: These markets are experiencing faster-than-average growth, driven by infrastructure development and economic diversification strategies.

GCC Managed Services Market Product Landscape

The GCC managed services market presents a wide range of products focusing on scalability, security, and flexibility. Vendors offer tailored solutions leveraging cutting-edge technologies such as AI-driven automation and cloud-native architectures. Key innovations include AI-powered security solutions, automated infrastructure management platforms, and advanced analytics capabilities for performance monitoring and optimization. The focus is on value-added services that enhance customer experience, reduce operational costs, and improve business agility.

Key Drivers, Barriers & Challenges in GCC Managed Services Market

Key Drivers: Growing adoption of cloud computing and digital transformation initiatives, increasing cybersecurity threats, and government support for technological advancement. The increasing demand for flexible and scalable IT solutions is also fueling market growth.

Key Challenges: Competition from international and local providers, skilled workforce shortages, and the complexity of integrating legacy systems with modern cloud-based solutions. Regulatory complexities and data security concerns also present significant hurdles. The impact of these challenges is estimated to slightly slow down the market growth in the next few years by about xx%.

Emerging Opportunities in GCC Managed Services Market

Untapped markets exist in smaller enterprises and specialized sectors within the GCC region. Opportunities include extending managed services to government organizations, providing more comprehensive cybersecurity solutions, and incorporating emerging technologies like blockchain and IoT. The focus on creating customized, value-added services will drive growth.

Growth Accelerators in the GCC Managed Services Market Industry

The long-term growth trajectory will be shaped by technological innovation, strategic partnerships between technology providers and managed services firms, and regional market expansion. Government support for digital transformation and investments in advanced infrastructure will also create opportunities for market expansion.

Key Players Shaping the GCC Managed Services Market Market

- IBM Corporation

- Saudi Telecom Company

- Diyar United Group

- Etihad Etisalat Co (Mobily)

- Ooredoo Group

- EITC Group (du)

- ACS Group

- AGC Networks (An ESSAR Company)

- Emitac

- MEEZA Group

- HP Middle East

- Wipro Group

Notable Milestones in GCC Managed Services Market Sector

- February 2023: Du and Ericsson's partnership to leverage AI and enhance IT operations marks a significant step towards digital transformation.

- May 2022: Fujitsu's collaboration with AWS aims to accelerate digital transformation in the financial and retail sectors.

- July 2022: Cisco's new Webex Wholesale Route-to-Market empowers service providers to offer managed services with greater agility.

In-Depth GCC Managed Services Market Market Outlook

The GCC managed services market is poised for continued growth, driven by ongoing digital transformation initiatives and increasing demand for sophisticated IT solutions. Strategic investments in advanced technologies, coupled with strong government support, will further accelerate market expansion. The focus on value-added services and tailored solutions will be crucial for success in this competitive landscape. The market is expected to reach a value of xx Million by 2033, presenting substantial opportunities for both established and emerging players.

GCC Managed Services Market Segmentation

-

1. Type

- 1.1. Managed Infrastructure Services

- 1.2. Managed Hosting Services

- 1.3. Managed Security Services

- 1.4. Managed Cloud Services

- 1.5. Disaster Recovery & Business Continuity Services

-

2. End-user Vertical

- 2.1. IT & Telecom

- 2.2. BFSI

- 2.3. Oil & Gas

- 2.4. Healthcare

- 2.5. Government

- 2.6. Other

GCC Managed Services Market Segmentation By Geography

- 1. Africa

GCC Managed Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Outsourcing of Noncore Operations in the BFSI and Retail Sector; Trend Toward Commoditization of Services and Growing Competition among MSPs; Growing Demand towards Managed Hosting Services to boost the market

- 3.3. Market Restrains

- 3.3.1. Integration and Regulatory Issues and Reliability Concerns

- 3.4. Market Trends

- 3.4.1. Managed Hosting Services expected to grow significantly over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Managed Infrastructure Services

- 5.1.2. Managed Hosting Services

- 5.1.3. Managed Security Services

- 5.1.4. Managed Cloud Services

- 5.1.5. Disaster Recovery & Business Continuity Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. IT & Telecom

- 5.2.2. BFSI

- 5.2.3. Oil & Gas

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saudi Telecom Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Diyar United Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Etihad Etisalat Co (Mobily)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ooredoo Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EITC Group (du)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACS Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGC Networks (An ESSAR Company)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emitac

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MEEZA Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HP Middle East

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wipro Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 IBM Corporation

List of Figures

- Figure 1: Global GCC Managed Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Africa GCC Managed Services Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Africa GCC Managed Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Africa GCC Managed Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: Africa GCC Managed Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: Africa GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Africa GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GCC Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global GCC Managed Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global GCC Managed Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global GCC Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global GCC Managed Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global GCC Managed Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Managed Services Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the GCC Managed Services Market?

Key companies in the market include IBM Corporation, Saudi Telecom Company, Diyar United Group, Etihad Etisalat Co (Mobily), Ooredoo Group, EITC Group (du), ACS Group, AGC Networks (An ESSAR Company), Emitac, MEEZA Group, HP Middle East, Wipro Group.

3. What are the main segments of the GCC Managed Services Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Outsourcing of Noncore Operations in the BFSI and Retail Sector; Trend Toward Commoditization of Services and Growing Competition among MSPs; Growing Demand towards Managed Hosting Services to boost the market.

6. What are the notable trends driving market growth?

Managed Hosting Services expected to grow significantly over the forecast period.

7. Are there any restraints impacting market growth?

Integration and Regulatory Issues and Reliability Concerns.

8. Can you provide examples of recent developments in the market?

February 2023: Du, from Emirates Integrated Telecommunications Company (EITC), and Ericsson announced a strategic partnership at Mobile World Congress 2023 to transform Du's Information Technology (IT) operations. In order to improve quality, unlock efficiencies, and increase agility, Du will use the services of Ericsson's Artificial Intelligence AI and Business and Operations Support Systems. A significant step forward in the Digital Transformation Programme of Du will be achieved through this partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Managed Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Managed Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Managed Services Market?

To stay informed about further developments, trends, and reports in the GCC Managed Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence