Key Insights

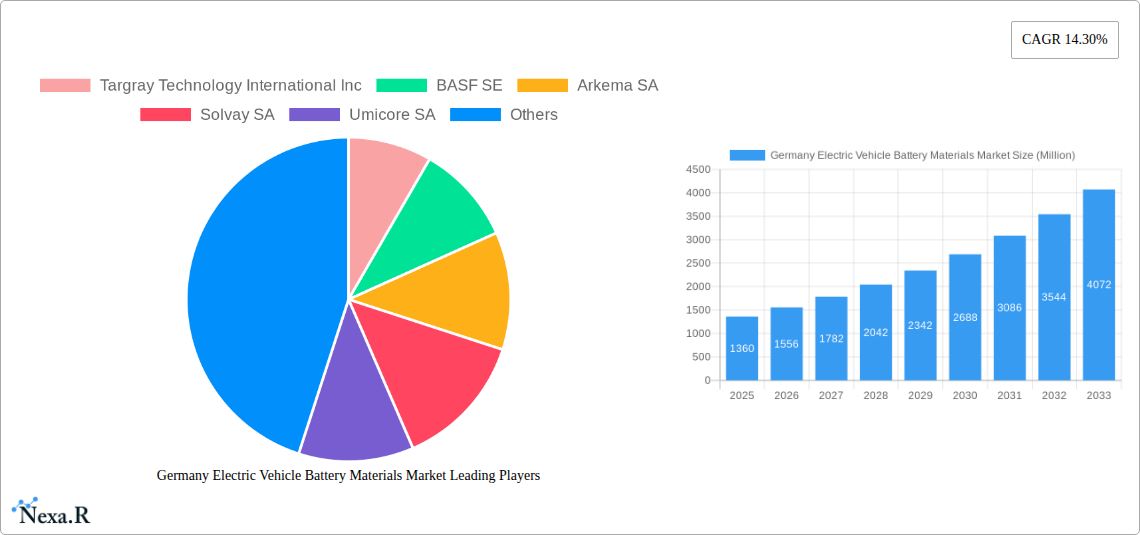

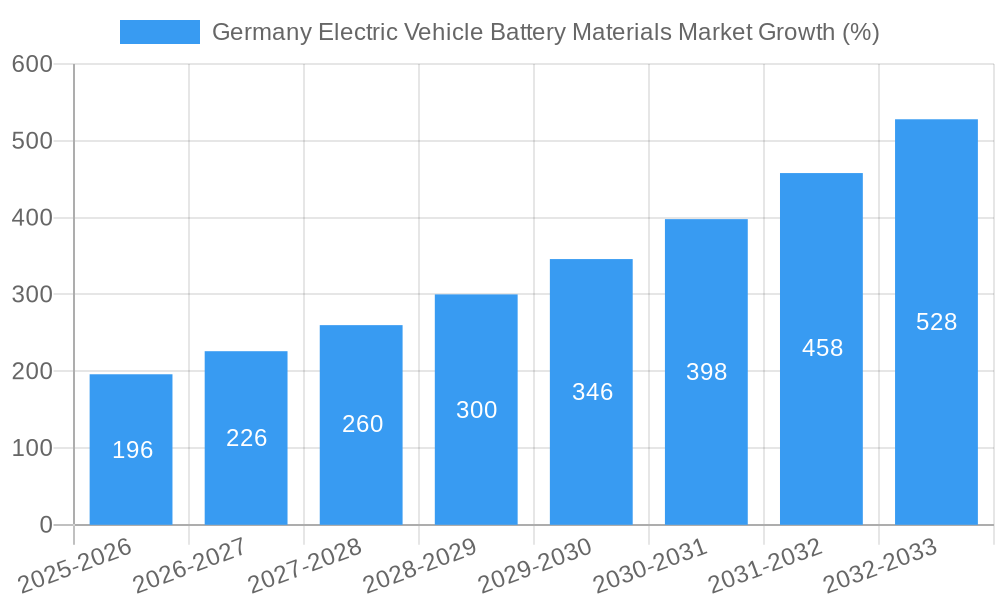

The Germany electric vehicle (EV) battery materials market is experiencing robust growth, driven by the increasing adoption of EVs within the country and stringent emission regulations promoting the transition to cleaner transportation. With a 2025 market size of €1.36 billion (based on the provided value unit of "Million" assumed to be in Euros), and a compound annual growth rate (CAGR) of 14.30% from 2025 to 2033, the market is projected to reach a significant size by the end of the forecast period. Key drivers include government incentives supporting EV infrastructure and manufacturing, growing consumer demand for sustainable transportation, and advancements in battery technology leading to improved energy density and lifespan. Trends such as the increasing focus on localized sourcing of battery materials to reduce supply chain vulnerabilities and the emergence of solid-state battery technology are shaping the market landscape. While potential restraints like fluctuations in raw material prices and the complexity of the EV battery supply chain exist, the overall market outlook remains strongly positive. Leading companies such as BASF, Solvay, and Umicore are actively investing in research and development, expanding their production capacities, and forming strategic partnerships to capitalize on this burgeoning market. The strong presence of established chemical companies coupled with the expanding EV sector in Germany ensures continued market expansion in the coming years.

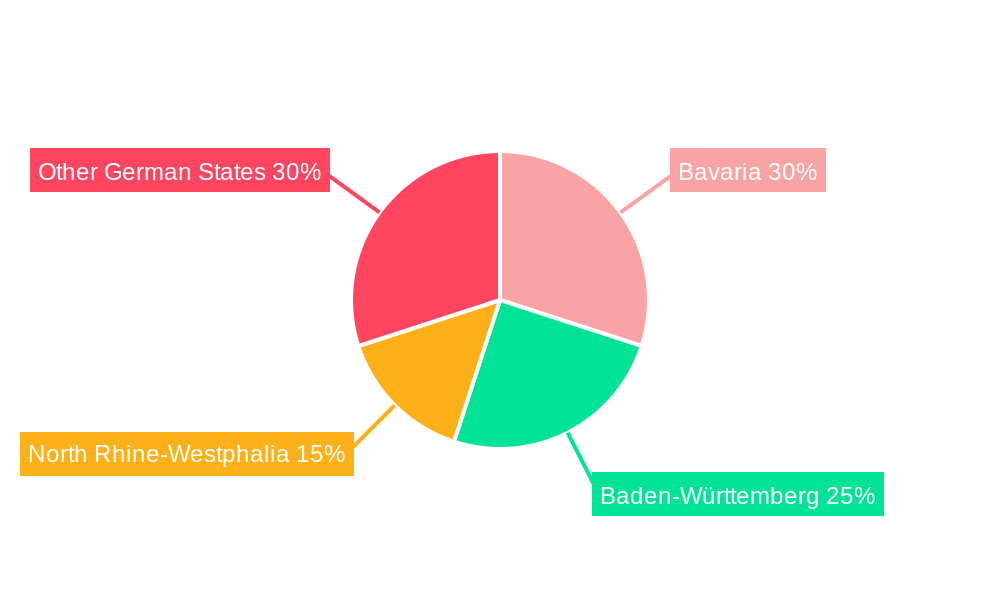

The segmentation within the German EV battery materials market is multifaceted, encompassing various materials like cathode materials (lithium iron phosphate, nickel manganese cobalt), anode materials (graphite), electrolytes, and separators. The market is further segmented geographically, with regions like Bavaria and Baden-Württemberg, benefiting from established automotive manufacturing hubs and strong government support for the EV industry. Competition among key players is intense, with companies focusing on innovation, cost optimization, and securing long-term supply contracts to maintain market share. The forecast period (2025-2033) promises significant growth opportunities, making the German EV battery materials market an attractive investment destination for both established players and new entrants. The continued growth of the EV industry and favorable government policies solidify the market’s positive trajectory.

Germany Electric Vehicle Battery Materials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Electric Vehicle (EV) Battery Materials market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report delves into market dynamics, growth trends, competitive landscapes, and future opportunities within this rapidly evolving sector. Parent market analysis of the broader European EV battery market and child market segmentation within Germany are included, providing a granular view of market segments and their performance. The market size is presented in million units.

Projected Market Size (Million Units): xx (2025), xx (2033)

CAGR (2025-2033): xx%

Germany Electric Vehicle Battery Materials Market Dynamics & Structure

The German EV battery materials market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, driven by the need for higher energy density and faster charging, is a primary growth driver. Stringent environmental regulations and government incentives supporting EV adoption significantly influence market dynamics. Competitive pressures from substitute materials and evolving end-user demographics are also shaping the market. Significant M&A activity in the sector indicates a dynamic and consolidating market.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2025).

- Technological Innovation: Focus on silicon anodes, solid-state batteries, and improved cathode materials.

- Regulatory Framework: Stringent environmental regulations and government subsidies for EV adoption.

- Competitive Substitutes: Alternative battery technologies and materials pose a competitive threat.

- End-User Demographics: Growing adoption of EVs across passenger vehicles and commercial fleets.

- M&A Trends: Increasing M&A activity, driven by consolidation and securing raw material supply chains. xx major M&A deals were recorded between 2019 and 2024.

Germany Electric Vehicle Battery Materials Market Growth Trends & Insights

The German EV battery materials market exhibits robust growth, fueled by the increasing demand for electric vehicles. Government policies promoting EV adoption, coupled with advancements in battery technology, are key factors driving market expansion. The shift towards higher energy density batteries and improved charging infrastructure further accelerates market growth. Consumer preference for eco-friendly vehicles also contributes significantly. This segment will benefit from the substantial investments pouring into the European battery ecosystem.

- Market Size Evolution: Significant growth from xx million units in 2019 to xx million units in 2024, projecting to reach xx million units by 2033.

- Adoption Rates: Rapidly increasing adoption of EVs in Germany is a crucial driver of market growth.

- Technological Disruptions: Innovations in battery chemistry and manufacturing processes are reshaping the market.

- Consumer Behavior Shifts: Growing environmental awareness and preference for sustainable transportation are boosting demand.

Dominant Regions, Countries, or Segments in Germany Electric Vehicle Battery Materials Market

While data specifics for regional breakdown within Germany are limited, the southern regions, with their established automotive industry, are likely the most dominant, closely followed by western regions with greater industrial density. This is driven by the concentration of automotive manufacturing and associated supply chains. Government incentives and infrastructure development further concentrate activity.

- Key Drivers: Strong automotive industry presence, government support for EV adoption, and well-developed infrastructure.

- Dominance Factors: High concentration of automotive manufacturers and suppliers in specific regions.

- Growth Potential: Significant growth opportunities due to continued investments in EV infrastructure and manufacturing.

Germany Electric Vehicle Battery Materials Market Product Landscape

The market offers a diverse range of battery materials, including cathodes, anodes, electrolytes, and separators. Ongoing innovation focuses on improving energy density, lifespan, safety, and cost-effectiveness. Silicon anodes, for example, are gaining traction for their potential to significantly enhance battery performance. The focus is increasingly on sustainable and ethically sourced materials.

Key Drivers, Barriers & Challenges in Germany Electric Vehicle Battery Materials Market

Key Drivers:

- Growing demand for electric vehicles driven by environmental concerns and government regulations.

- Technological advancements leading to improved battery performance and reduced costs.

- Government incentives and subsidies to promote EV adoption and domestic battery production.

Key Barriers & Challenges:

- Supply chain disruptions and dependence on raw material imports from politically volatile regions. (Impact: xx% increase in material costs in 2024).

- High initial investment costs for battery manufacturing facilities.

- Competition from established players and the emergence of new entrants.

Emerging Opportunities in Germany Electric Vehicle Battery Materials Market

- Growth in the e-mobility sector beyond passenger vehicles; expanding to commercial vehicles, buses, and trains.

- Development of second-life battery applications for energy storage solutions.

- Increased focus on sustainable and ethically sourced raw materials to mitigate supply chain risks.

Growth Accelerators in the Germany Electric Vehicle Battery Materials Market Industry

Technological breakthroughs in battery chemistry, strategic partnerships between battery material suppliers and automotive manufacturers, and market expansion into new segments like energy storage will significantly accelerate long-term growth. Government initiatives to create a robust domestic battery supply chain provide further impetus.

Key Players Shaping the Germany Electric Vehicle Battery Materials Market Market

- Targray Technology International Inc

- BASF SE

- Arkema SA

- Solvay SA

- Umicore SA

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Johnson Matthey

- Henkel Adhesive Technologies

- Heraeus Group

- Wacker Chemie AG

- List Not Exhaustive

Notable Milestones in Germany Electric Vehicle Battery Materials Sector

- July 2024: Group 14 secures a USD 300 million deal with CustomCells for silicon anode materials, boosting battery performance in EVs and other sectors.

- January 2024: Launch of the EBA Strategic Battery Materials Fund (EUR 500 million) aims to bolster Europe's battery raw material supply chain.

In-Depth Germany Electric Vehicle Battery Materials Market Outlook

The German EV battery materials market holds immense future potential, driven by continued EV adoption, technological innovation, and supportive government policies. Strategic partnerships and investments in domestic manufacturing will further strengthen the market’s position. The focus on sustainable and ethically sourced materials will also be a significant growth driver in the coming years. The market is poised for sustained expansion, presenting significant opportunities for investors and industry players.

Germany Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

Germany Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. Germany

Germany Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Growing Electric Vehicle (EVs) Sales Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Targray Technology International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Umicore SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Chemical Group Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UBE Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson Matthey

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henkel Adhesive Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Heraeus Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Wacker Chemie AG*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Targray Technology International Inc

List of Figures

- Figure 1: Germany Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Electric Vehicle Battery Materials Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 5: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 11: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 14.30%.

2. Which companies are prominent players in the Germany Electric Vehicle Battery Materials Market?

Key companies in the market include Targray Technology International Inc, BASF SE, Arkema SA, Solvay SA, Umicore SA, Mitsubishi Chemical Group Corporation, UBE Corporation, Johnson Matthey, Henkel Adhesive Technologies, Heraeus Group, Wacker Chemie AG*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the Germany Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Growing Electric Vehicle (EVs) Sales Drives the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

July 2024: Group 14, a Next-gen battery materials manufacturer, signed a deal with CustomCells, a German battery cell company, to purchase USD 300 million worth of Group 14’s silicon anode product. CustomCells is likely to incorporate Group14’s product into its battery cells to enhance battery performance for electric vehicles, aviation, and “e-mobility.January 2024: EIT InnoEnergy and Demeter Investment Managers announced the launch of a fund dedicated to developing a resilient and diverse battery raw material supply chain in Europe. With a target size of EUR 500 million (USD 544.5 million), the EBA Strategic Battery Materials Fund is building to boost domestic capacities for EV battery materials such as lithium, nickel, cobalt, manganese, and graphite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the Germany Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence