Key Insights

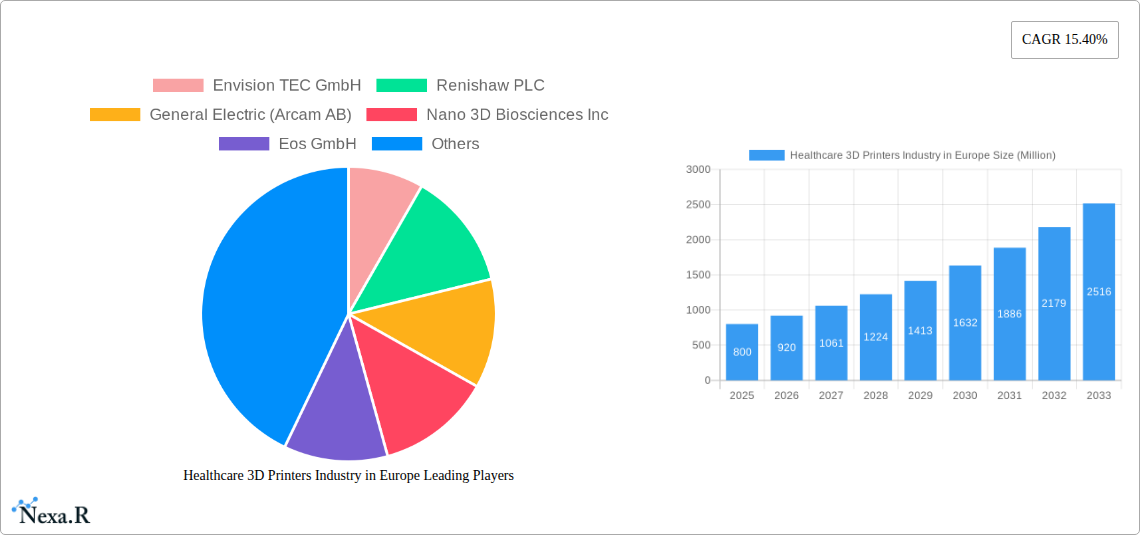

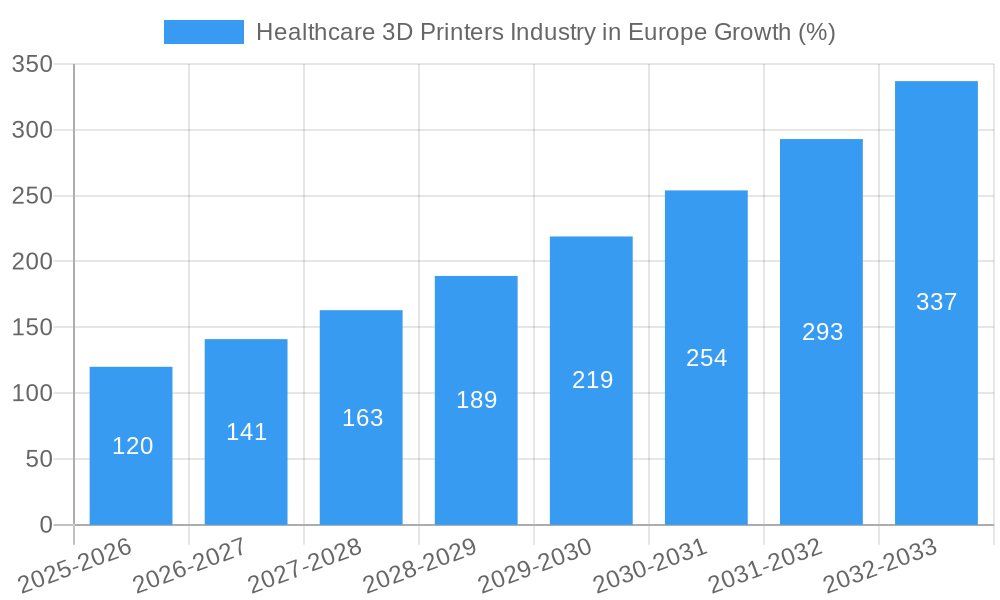

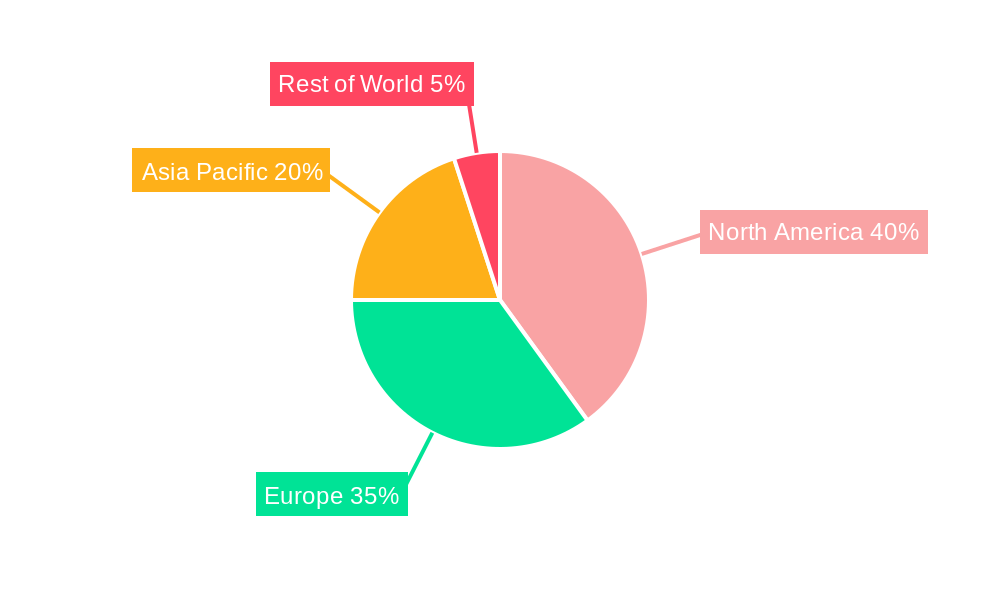

The European healthcare 3D printing market is experiencing robust growth, driven by increasing demand for personalized medicine, advancements in additive manufacturing technologies, and a rising prevalence of chronic diseases requiring customized treatments. The market, valued at approximately €800 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15.40% from 2025 to 2033, reaching an estimated €2.9 billion by 2033. Key drivers include the rising adoption of 3D printing for producing patient-specific implants, prosthetics, and surgical instruments, leading to improved surgical outcomes and patient recovery times. Furthermore, the growing interest in bioprinting for tissue engineering and regenerative medicine is fueling market expansion. Germany, France, and the United Kingdom are major contributors to this growth, benefiting from robust healthcare infrastructure and a concentration of leading medical device manufacturers and research institutions. The market segmentation reveals a strong focus on metal and polymer materials, along with technologies such as stereolithography and selective laser melting, reflecting a balance between established and emerging technologies. However, challenges remain, including high initial investment costs for 3D printing equipment and the need for regulatory approvals for medical devices produced using additive manufacturing. The market is expected to be shaped by ongoing technological advancements, increasing collaborations between medical device companies and 3D printing solution providers, and the evolving regulatory landscape.

The segment-wise breakdown reveals significant opportunities within specific applications. Bioprinting is anticipated to show particularly high growth due to its potential to revolutionize tissue regeneration and organ transplantation. The use of 3D printing in dentistry for creating custom-fit dental appliances and prosthetics also contributes significantly to the market's expansion. The materials segment indicates a preference for metals and polymers, driven by their biocompatibility and suitability for various medical applications. However, the "Other Materials" segment holds future potential with the introduction of new bio-compatible materials. The geographical distribution points to Germany, the UK, and France as key markets within Europe, but growth potential exists in other European countries as the awareness and adoption of 3D printing technology in healthcare increases. Competition is fierce among established players like 3D Systems Corporation and Stratasys Ltd. and newer entrants focusing on niche applications and innovative materials.

Healthcare 3D Printers Industry in Europe: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European healthcare 3D printing market, encompassing market dynamics, growth trends, key players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on this rapidly evolving sector. The parent market is the broader 3D printing industry, while the child market focuses specifically on the healthcare applications within Europe.

Healthcare 3D Printers Industry in Europe Market Dynamics & Structure

The European healthcare 3D printing market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, particularly in materials science and additive manufacturing processes, is a primary driver. Stringent regulatory frameworks, including those governing medical devices, significantly influence market growth. Competitive pressures arise from traditional manufacturing methods, but 3D printing's unique capabilities offer distinct advantages. End-user demographics, including hospitals, research institutions, and dental practices, shape demand. M&A activity has been relatively low (xx deals in the past 5 years), reflecting the market's ongoing consolidation and the high capital investments involved.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on bioprinting, high-resolution printing, and biocompatible materials.

- Regulatory Framework: Stringent regulations for medical devices create barriers to entry but ensure product safety.

- Competitive Substitutes: Traditional manufacturing processes for medical devices pose competition.

- End-User Demographics: Hospitals, research institutions, and dental clinics are primary end-users.

- M&A Trends: Relatively low M&A activity (xx deals in 2019-2024), but potential for future consolidation.

- Innovation Barriers: High R&D costs, regulatory hurdles, and the need for skilled workforce.

Healthcare 3D Printers Industry in Europe Growth Trends & Insights

The European healthcare 3D printing market experienced significant growth during the historical period (2019-2024), expanding from xx million units in 2019 to xx million units in 2024, reflecting a CAGR of xx%. This growth is attributed to increased adoption of 3D printing technologies in various healthcare applications, including implants, prosthetics, and bioprinting. Technological disruptions, such as the development of new materials and printing techniques, are further fueling market expansion. Consumer behavior shifts towards personalized medicine and patient-specific devices are also driving demand. The forecast period (2025-2033) anticipates continued expansion, projecting a market size of xx million units in 2033, with a CAGR of xx%. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Healthcare 3D Printers Industry in Europe

Germany, the UK, and France are the dominant regions in the European healthcare 3D printing market, driven by robust healthcare infrastructure, technological advancements, and substantial investments in R&D. Within the technology segments, Stereo Lithography and Laser Sintering hold significant market share due to their versatility and established presence. Bioprinting is a rapidly growing application segment, fueled by advancements in biocompatible materials and tissue engineering. Metals and alloys are the dominant materials segment, primarily due to their use in implants and prosthetics.

- Key Drivers: Strong healthcare infrastructure, government funding for research, and a skilled workforce.

- Germany: Leading market due to strong industrial base and focus on medical technology.

- UK: Significant research and development activities in bioprinting and personalized medicine.

- France: Growing adoption of 3D printing in various healthcare settings.

- Dominant Technology Segments: Stereo Lithography, Laser Sintering.

- Dominant Application Segment: Implants and Prosthetics.

- Dominant Material Segment: Metals and Alloys.

Healthcare 3D Printers Industry in Europe Product Landscape

The European healthcare 3D printing market showcases a diverse product landscape, featuring printers with varying functionalities and capabilities. Innovations focus on improving printing speed, accuracy, and material compatibility. Key performance metrics include print resolution, build volume, and material properties. Unique selling propositions often highlight ease of use, streamlined workflows, and integration with existing healthcare systems. Recent advancements include the introduction of bioprinters capable of creating complex tissue structures and the development of new biocompatible materials for implants.

Key Drivers, Barriers & Challenges in Healthcare 3D Printers Industry in Europe

Key Drivers:

- Increasing demand for personalized medicine.

- Advancements in biocompatible materials and printing techniques.

- Growing adoption of 3D printing in hospitals and research institutions.

- Government support and funding for R&D.

Key Challenges & Restraints:

- High initial investment costs for equipment and materials.

- Stringent regulatory requirements for medical devices.

- Skilled labor shortages in 3D printing technology.

- Competition from traditional manufacturing methods.

- Supply chain disruptions impacting the availability of materials and components. (estimated xx% impact on production in 2024).

Emerging Opportunities in Healthcare 3D Printers Industry in Europe

- Expanding applications of bioprinting in regenerative medicine and drug discovery.

- Growing demand for patient-specific implants and prosthetics.

- Development of new biocompatible materials with enhanced properties.

- Integration of 3D printing with artificial intelligence and machine learning.

- Increased adoption of 3D printing in dental and orthodontic applications.

Growth Accelerators in the Healthcare 3D Printers Industry in Europe Industry

Long-term growth in the European healthcare 3D printing market will be driven by continued technological advancements, strategic partnerships between manufacturers and healthcare providers, and expansion into new applications. Breakthroughs in bioprinting and materials science will unlock new possibilities in regenerative medicine. Collaborations with research institutions will accelerate innovation and product development. Market expansion into untapped segments, such as personalized drug delivery systems, will further drive growth.

Key Players Shaping the Healthcare 3D Printers Industry in Europe Market

- Envision TEC GmbH

- Renishaw PLC

- General Electric (Arcam AB)

- Nano 3D Biosciences Inc

- Eos GmbH

- Organovo Holding Inc

- 3D Systems Corporation

- Materialise NV

- Stratasys Ltd

- Oxford Performance Materials

Notable Milestones in Healthcare 3D Printers Industry in Europe Sector

- July 2022: Sculpteo and Daniel Robert Orthopedic launched a bio-sourced 3D-printed orthopedic device, expanding the use of sustainable materials in the sector.

- June 2021: Stratasys launched the J5 MediJet Medical 3D printer, enhancing the creation of detailed anatomical models and surgical guides.

In-Depth Healthcare 3D Printers Industry in Europe Market Outlook

The future of the European healthcare 3D printing market is promising, driven by the convergence of technological advancements, increasing demand for personalized healthcare, and supportive regulatory environments. Strategic partnerships and investments in R&D will continue to shape the industry landscape, creating significant opportunities for innovation and market expansion. The market's potential lies in the development of novel biomaterials, advanced printing techniques, and the integration of 3D printing into clinical workflows, ultimately transforming healthcare delivery.

Healthcare 3D Printers Industry in Europe Segmentation

-

1. Technology

- 1.1. Stereo Lithography

- 1.2. Deposition Modeling

- 1.3. Electron Beam Melting

- 1.4. Laser Sintering

- 1.5. Jetting Technology

- 1.6. Laminated Object Manufacturing

- 1.7. Other Technologies

-

2. Applications

- 2.1. Bioprinting

- 2.2. Implants

- 2.3. Prosthetics

- 2.4. Dentistry

- 2.5. Other Applications

-

3. Materials

- 3.1. Metals and Alloys

- 3.2. Polymers

- 3.3. Ceramics

- 3.4. Other Materials

Healthcare 3D Printers Industry in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Healthcare 3D Printers Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Leading to Enhanced Application; Increasing Demand for Customized 3D Printing

- 3.3. Market Restrains

- 3.3.1. Lack of Trained Professionals; Absence of Specific Regulatory Guidelines

- 3.4. Market Trends

- 3.4.1. Metal and Alloy Segment is Dominating the European Healthcare 3D Printing Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereo Lithography

- 5.1.2. Deposition Modeling

- 5.1.3. Electron Beam Melting

- 5.1.4. Laser Sintering

- 5.1.5. Jetting Technology

- 5.1.6. Laminated Object Manufacturing

- 5.1.7. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Bioprinting

- 5.2.2. Implants

- 5.2.3. Prosthetics

- 5.2.4. Dentistry

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Materials

- 5.3.1. Metals and Alloys

- 5.3.2. Polymers

- 5.3.3. Ceramics

- 5.3.4. Other Materials

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereo Lithography

- 6.1.2. Deposition Modeling

- 6.1.3. Electron Beam Melting

- 6.1.4. Laser Sintering

- 6.1.5. Jetting Technology

- 6.1.6. Laminated Object Manufacturing

- 6.1.7. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Bioprinting

- 6.2.2. Implants

- 6.2.3. Prosthetics

- 6.2.4. Dentistry

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Materials

- 6.3.1. Metals and Alloys

- 6.3.2. Polymers

- 6.3.3. Ceramics

- 6.3.4. Other Materials

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United Kingdom Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereo Lithography

- 7.1.2. Deposition Modeling

- 7.1.3. Electron Beam Melting

- 7.1.4. Laser Sintering

- 7.1.5. Jetting Technology

- 7.1.6. Laminated Object Manufacturing

- 7.1.7. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Bioprinting

- 7.2.2. Implants

- 7.2.3. Prosthetics

- 7.2.4. Dentistry

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Materials

- 7.3.1. Metals and Alloys

- 7.3.2. Polymers

- 7.3.3. Ceramics

- 7.3.4. Other Materials

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. France Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereo Lithography

- 8.1.2. Deposition Modeling

- 8.1.3. Electron Beam Melting

- 8.1.4. Laser Sintering

- 8.1.5. Jetting Technology

- 8.1.6. Laminated Object Manufacturing

- 8.1.7. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Bioprinting

- 8.2.2. Implants

- 8.2.3. Prosthetics

- 8.2.4. Dentistry

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Materials

- 8.3.1. Metals and Alloys

- 8.3.2. Polymers

- 8.3.3. Ceramics

- 8.3.4. Other Materials

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Italy Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stereo Lithography

- 9.1.2. Deposition Modeling

- 9.1.3. Electron Beam Melting

- 9.1.4. Laser Sintering

- 9.1.5. Jetting Technology

- 9.1.6. Laminated Object Manufacturing

- 9.1.7. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Applications

- 9.2.1. Bioprinting

- 9.2.2. Implants

- 9.2.3. Prosthetics

- 9.2.4. Dentistry

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Materials

- 9.3.1. Metals and Alloys

- 9.3.2. Polymers

- 9.3.3. Ceramics

- 9.3.4. Other Materials

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Spain Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Stereo Lithography

- 10.1.2. Deposition Modeling

- 10.1.3. Electron Beam Melting

- 10.1.4. Laser Sintering

- 10.1.5. Jetting Technology

- 10.1.6. Laminated Object Manufacturing

- 10.1.7. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Applications

- 10.2.1. Bioprinting

- 10.2.2. Implants

- 10.2.3. Prosthetics

- 10.2.4. Dentistry

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Materials

- 10.3.1. Metals and Alloys

- 10.3.2. Polymers

- 10.3.3. Ceramics

- 10.3.4. Other Materials

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Rest of Europe Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Stereo Lithography

- 11.1.2. Deposition Modeling

- 11.1.3. Electron Beam Melting

- 11.1.4. Laser Sintering

- 11.1.5. Jetting Technology

- 11.1.6. Laminated Object Manufacturing

- 11.1.7. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Applications

- 11.2.1. Bioprinting

- 11.2.2. Implants

- 11.2.3. Prosthetics

- 11.2.4. Dentistry

- 11.2.5. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Materials

- 11.3.1. Metals and Alloys

- 11.3.2. Polymers

- 11.3.3. Ceramics

- 11.3.4. Other Materials

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Germany Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Envision TEC GmbH

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Renishaw PLC

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 General Electric (Arcam AB)

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Nano 3D Biosciences Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Eos GmbH

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Organovo Holding Inc

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 3D Systems Corporation

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Materialise NV

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Stratasys Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Oxford Performance Materials

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Envision TEC GmbH

List of Figures

- Figure 1: Healthcare 3D Printers Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Healthcare 3D Printers Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 4: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 5: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 15: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 16: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 17: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 19: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 20: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 21: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 23: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 24: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 25: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 27: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 28: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 29: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 31: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 32: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 33: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 35: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 36: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 37: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare 3D Printers Industry in Europe?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the Healthcare 3D Printers Industry in Europe?

Key companies in the market include Envision TEC GmbH, Renishaw PLC, General Electric (Arcam AB), Nano 3D Biosciences Inc, Eos GmbH, Organovo Holding Inc, 3D Systems Corporation, Materialise NV, Stratasys Ltd, Oxford Performance Materials.

3. What are the main segments of the Healthcare 3D Printers Industry in Europe?

The market segments include Technology, Applications, Materials.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Leading to Enhanced Application; Increasing Demand for Customized 3D Printing.

6. What are the notable trends driving market growth?

Metal and Alloy Segment is Dominating the European Healthcare 3D Printing Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Trained Professionals; Absence of Specific Regulatory Guidelines.

8. Can you provide examples of recent developments in the market?

July 2022: Sculpteo and Daniel Robert Orthopedic launched a Bio-sourced 3D printed device. The collaboration will produce orthopedic devices from a bio-sourced material that will be made possible by 3D printing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare 3D Printers Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare 3D Printers Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare 3D Printers Industry in Europe?

To stay informed about further developments, trends, and reports in the Healthcare 3D Printers Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence