Key Insights

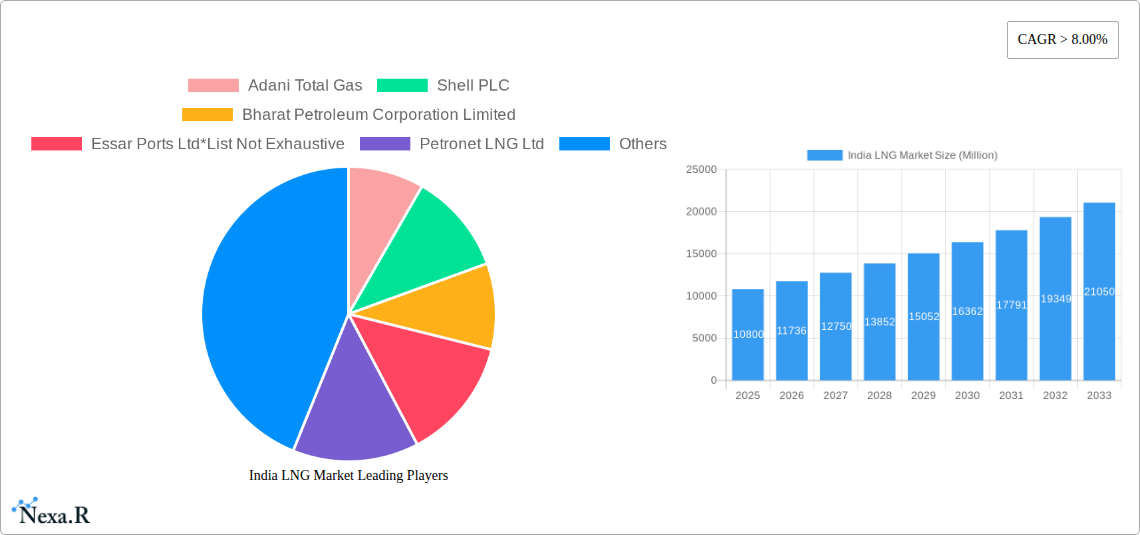

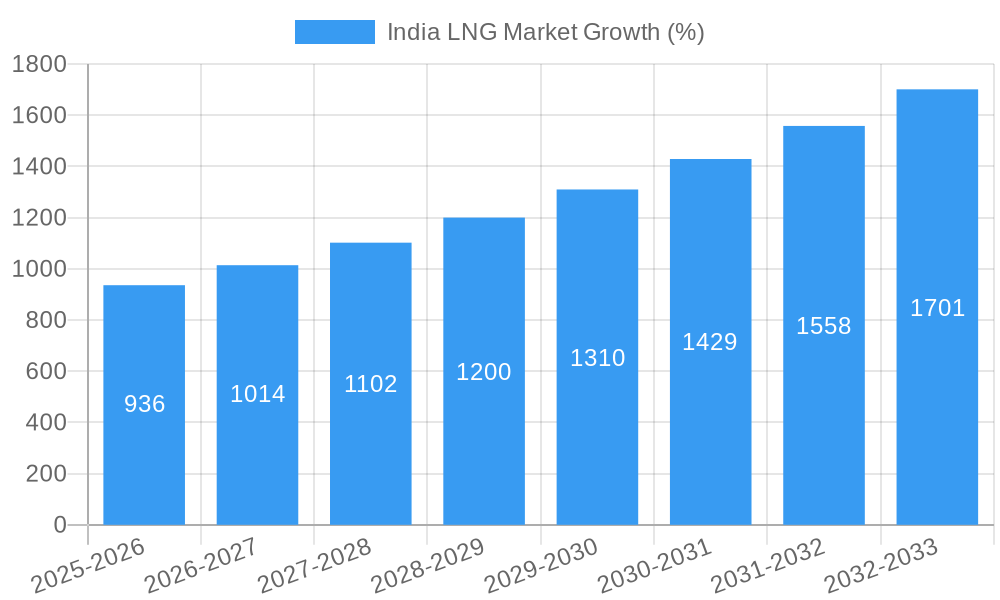

The India LNG market is experiencing robust growth, driven by increasing energy demand, government initiatives promoting cleaner fuels, and the expansion of city gas distribution networks. The market's Compound Annual Growth Rate (CAGR) exceeding 8% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. Firstly, the rising industrialization and urbanization across India are creating a surge in demand for natural gas, particularly in sectors like petrochemicals and power generation. Secondly, the Indian government's push for cleaner energy sources and its commitment to reducing carbon emissions is creating a favorable regulatory environment for LNG adoption. Finally, investments in LNG infrastructure, including liquefaction plants, regasification terminals, and pipelines, are expanding access to LNG across different regions of the country, especially in previously underserved areas. Major players like Adani Total Gas, Shell PLC, and Petronet LNG Ltd are actively investing in this expanding market, further fueling its growth. The segmentation reveals a substantial contribution from city gas distribution and the petrochemicals industry, suggesting a strong correlation between industrial and domestic energy consumption. Regional disparities exist, with potential for higher growth in regions currently with less developed infrastructure.

Looking forward, the forecast period from 2025 to 2033 promises continued expansion. While challenges such as infrastructure limitations and price volatility exist, the overall market outlook remains positive. Continued investment in infrastructure, especially in expanding pipelines and storage facilities, will be critical in maximizing the potential of the India LNG market. The diversification of applications beyond city gas distribution and petrochemicals, towards more specialized industrial uses, will also contribute to sustained growth. The competitive landscape will see further consolidation and strategic partnerships as companies vie for market share. The sustained focus on environmental sustainability in India positions the LNG market as a significant player in the country's energy transition. Market size estimation for 2025 requires more data; however, based on the provided 8%+ CAGR and assuming a 2024 market size of approximately $10 billion (a reasonable estimate given global trends), a 2025 market size of roughly $10.8 billion to $11 billion is plausible. This projection will be sensitive to factors impacting global LNG prices and domestic energy policies.

This comprehensive report provides an in-depth analysis of the India LNG market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes the latest data and expert analysis to deliver a clear and concise understanding of this rapidly evolving market, segmented by infrastructure (liquefaction, regasification, shipping) and application (city gas distribution, petrochemicals, others). The market size is presented in million units.

India LNG Market Dynamics & Structure

This section analyzes the competitive landscape of the Indian LNG market, considering market concentration, technological advancements, regulatory frameworks, and market dynamics. The report delves into the impact of mergers and acquisitions (M&A) activities, providing quantitative data on market share percentages and M&A deal volumes (xx Million units). Qualitative factors, such as innovation barriers and the influence of government policies, are also examined.

- Market Concentration: Analysis of market share held by key players (e.g., Adani Total Gas, Shell PLC, Bharat Petroleum Corporation Limited). Market concentration is expected to be moderately high (xx%), with a few dominant players and several smaller regional players.

- Technological Innovation: Examination of technological drivers, including advancements in liquefaction and regasification technologies, and their impact on market efficiency and cost reduction. The report assesses the pace of innovation and identifies barriers to adoption, such as cost and regulatory hurdles.

- Regulatory Framework: Analysis of the regulatory environment governing LNG production, import, distribution, and consumption in India. This includes examination of policies promoting LNG adoption and their potential impact on market growth.

- Competitive Product Substitutes: Exploration of potential substitutes for LNG, such as other fuels (e.g., coal, renewables), and their impact on the market’s competitive dynamics.

- End-User Demographics: Analysis of the end-user segments (city gas distribution, petrochemicals, power generation, etc.) and their consumption patterns, highlighting variations in demand and growth rates across different sectors.

- M&A Trends: Analysis of recent M&A activity within the Indian LNG market, assessing the impact of these deals on market consolidation and competition. The report provides an overview of past deals (xx Million units value), along with a prediction for future M&A activity.

India LNG Market Growth Trends & Insights

This section presents a detailed analysis of the India LNG market's growth trajectory, including historical data (2019-2024), current estimates (2025), and future projections (2025-2033). Using statistical modeling, we provide insights into market size evolution, adoption rates, and shifts in consumer behavior. Specific metrics, such as compound annual growth rate (CAGR) and market penetration rates, are included to provide comprehensive insights.

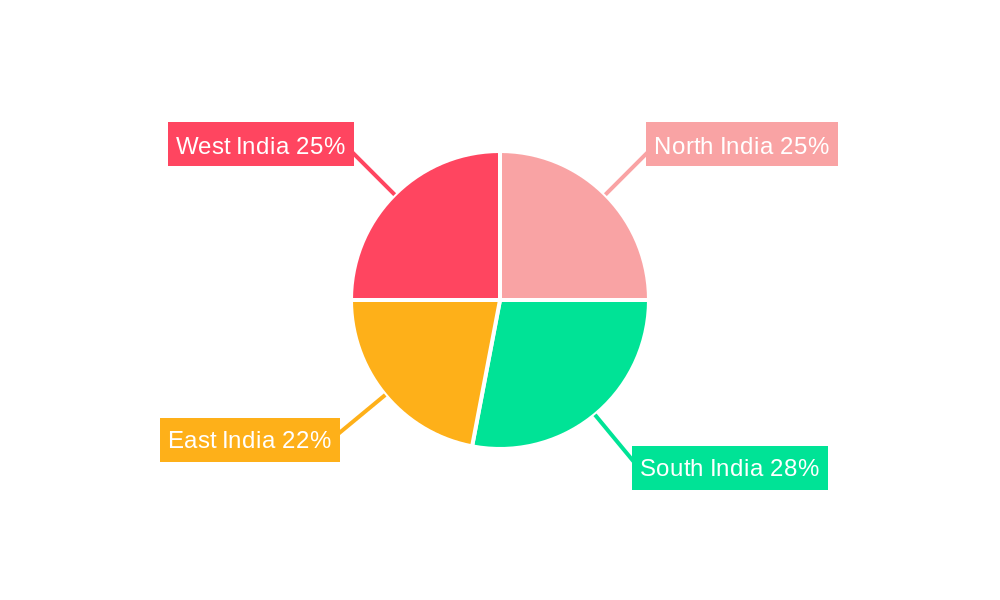

Dominant Regions, Countries, or Segments in India LNG Market

This section identifies the leading regions, countries, or segments within the Indian LNG market driving market growth. A detailed analysis is provided for each dominant segment (LNG Infrastructure: LNG Liquefaction Plants, LNG Regasification Facilities, LNG Shipping; Application: City Gas Distribution, Petrochemicals, Other Applications), focusing on market share, growth potential, and key drivers.

- City Gas Distribution: Analysis of growth drivers, including expanding city gas networks, government policies supporting CNG adoption, and increasing urbanization. Market size projections for the next decade are provided (xx Million units).

- Petrochemicals: Assessment of the role of LNG as a feedstock for petrochemical production, and the influence of petrochemical demand on LNG consumption. Growth potential within this segment is assessed (xx Million units).

- LNG Regasification Facilities: Detailed overview of operational regasification facilities across India, and forecasts for future capacity additions and expansion. Market size and growth are analyzed (xx Million units).

- Geographic Dominance: Identification of leading states/regions within India based on LNG consumption, infrastructure development, and regulatory support.

India LNG Market Product Landscape

This section provides an overview of product innovations, applications, and performance metrics within the Indian LNG market. It emphasizes unique selling propositions (USPs) and technological advancements in LNG processing, handling, and transportation, highlighting the role of efficiency improvements and environmental sustainability.

Key Drivers, Barriers & Challenges in India LNG Market

This section highlights the key factors driving growth and the challenges hindering market expansion.

Key Drivers:

- Government initiatives to promote LNG adoption.

- Increasing demand from the power and transportation sectors.

- Advances in LNG technology.

Challenges:

- Infrastructure limitations, specifically in transporting LNG from import terminals to consumption sites. (xx Million units representing capacity shortfall)

- Regulatory hurdles and permitting processes.

- Competition from alternative fuels. (xx Million units representing market share lost to alternatives)

Emerging Opportunities in India LNG Market

This section identifies emerging trends and opportunities, including exploring untapped markets (rural areas, smaller cities), innovative applications (LNG bunkering), and evolving consumer preferences for cleaner fuels.

Growth Accelerators in the India LNG Market Industry

This section discusses the factors that will drive long-term growth, such as technological breakthroughs, strategic partnerships, and market expansion strategies in under-penetrated regions.

Key Players Shaping the India LNG Market Market

- Adani Total Gas

- Shell PLC

- Bharat Petroleum Corporation Limited

- Essar Ports Ltd

- Petronet LNG Ltd

- GSPC LNG Limited

- GAIL Limited

- H-Energy Private Limited

- JSW Infrastructure

Notable Milestones in India LNG Market Sector

- April 2022: Petronet LNG announces the development of a floating LNG terminal in Odisha by 2025 (INR 1600 crore investment). Petronet also plans to invest INR 600 crore to increase the capacity of the Dahej LNG import terminal to 22.5 MTPA from 17.5 MTPA.

- January 2022: LNG Alliance announces a USD 290 million investment for an LNG import terminal in Karnataka, potentially India's first dedicated LNG bunkering facility (4 MTPA capacity).

In-Depth India LNG Market Market Outlook

This section summarizes the growth accelerators identified earlier, focusing on the future market potential and strategic opportunities for expansion and innovation within the Indian LNG market. The outlook emphasizes the potential for continued strong growth, driven by increasing demand and supportive government policies, but also notes the importance of addressing infrastructure constraints and regulatory challenges to ensure sustainable expansion. The report concludes with a summary of key findings and their implications for market participants.

India LNG Market Segmentation

-

1. LNG Infrastructure

- 1.1. LNG Liquefaction Plants

- 1.2. LNG Regasification Facilities

- 1.3. LNG Shipping

- 2. LNG Trade

-

3. Application

- 3.1. City Gas Distribution

- 3.2. Petrochemicals

- 3.3. Other Applications

India LNG Market Segmentation By Geography

- 1. India

India LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. City Gas Distribution segments to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India LNG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 5.1.1. LNG Liquefaction Plants

- 5.1.2. LNG Regasification Facilities

- 5.1.3. LNG Shipping

- 5.2. Market Analysis, Insights and Forecast - by LNG Trade

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. City Gas Distribution

- 5.3.2. Petrochemicals

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 6. North India India LNG Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India LNG Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India LNG Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India LNG Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Adani Total Gas

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shell PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bharat Petroleum Corporation Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Essar Ports Ltd*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Petronet LNG Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GSPC LNG Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GAIL Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 H-Energy Private Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 JSW Infrastructure

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Adani Total Gas

List of Figures

- Figure 1: India LNG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India LNG Market Share (%) by Company 2024

List of Tables

- Table 1: India LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India LNG Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: India LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 4: India LNG Market Volume metric tonnes Forecast, by LNG Infrastructure 2019 & 2032

- Table 5: India LNG Market Revenue Million Forecast, by LNG Trade 2019 & 2032

- Table 6: India LNG Market Volume metric tonnes Forecast, by LNG Trade 2019 & 2032

- Table 7: India LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: India LNG Market Volume metric tonnes Forecast, by Application 2019 & 2032

- Table 9: India LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India LNG Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 11: India LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: India LNG Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 13: North India India LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: North India India LNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 15: South India India LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South India India LNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 17: East India India LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: East India India LNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 19: West India India LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West India India LNG Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 21: India LNG Market Revenue Million Forecast, by LNG Infrastructure 2019 & 2032

- Table 22: India LNG Market Volume metric tonnes Forecast, by LNG Infrastructure 2019 & 2032

- Table 23: India LNG Market Revenue Million Forecast, by LNG Trade 2019 & 2032

- Table 24: India LNG Market Volume metric tonnes Forecast, by LNG Trade 2019 & 2032

- Table 25: India LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: India LNG Market Volume metric tonnes Forecast, by Application 2019 & 2032

- Table 27: India LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: India LNG Market Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India LNG Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India LNG Market?

Key companies in the market include Adani Total Gas, Shell PLC, Bharat Petroleum Corporation Limited, Essar Ports Ltd*List Not Exhaustive, Petronet LNG Ltd, GSPC LNG Limited, GAIL Limited, H-Energy Private Limited, JSW Infrastructure.

3. What are the main segments of the India LNG Market?

The market segments include LNG Infrastructure, LNG Trade, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

City Gas Distribution segments to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

In April 2022, Petronet LNG announced the development of a floating LNG terminal in Odisha by 2025 at the cost of INR 1600 crore. Furthermore, Petronet is likely to invest INR 600 crore in raising the capacity of the Dahej LNG import terminal to 22.5 million tonnes per annum from the current 17.5 million tonnes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India LNG Market?

To stay informed about further developments, trends, and reports in the India LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence