Key Insights

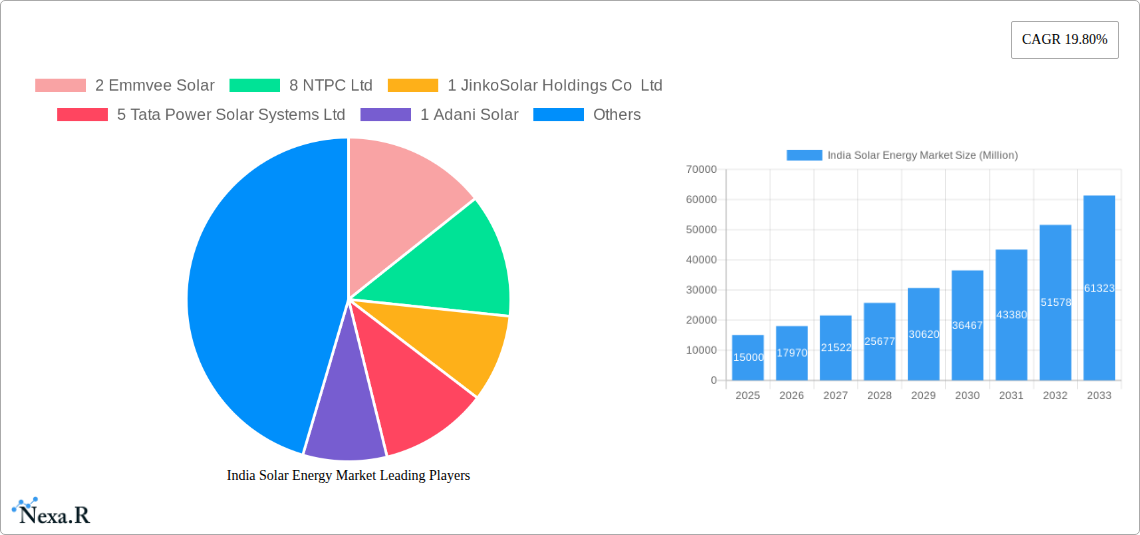

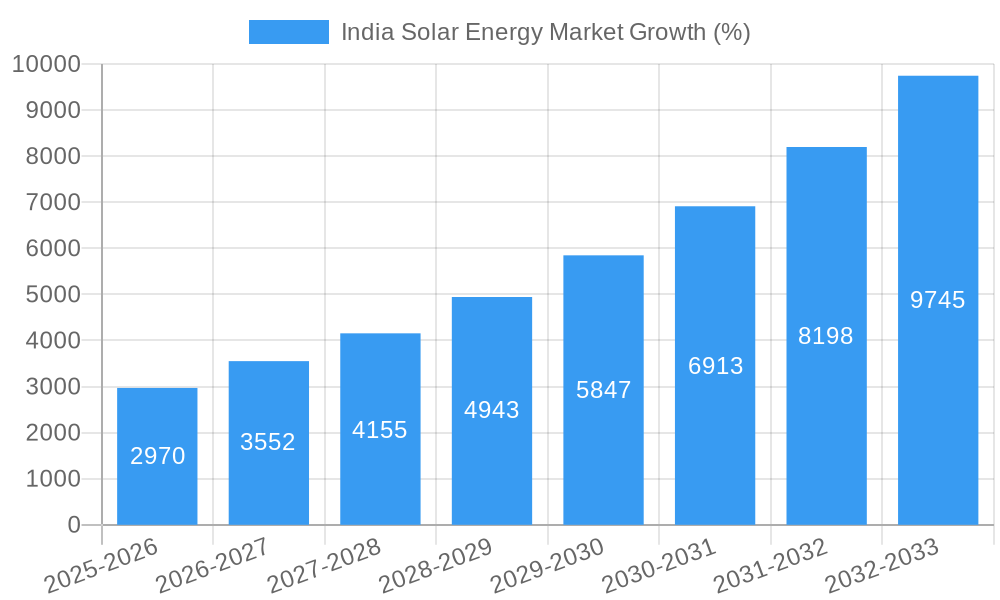

The India solar energy market is experiencing robust growth, driven by the government's ambitious renewable energy targets, decreasing solar panel costs, and increasing energy demand. The market, valued at approximately [Estimate based on CAGR and available data. For example, if the 2025 value is missing and the 2019 value is known, project it forward using the 19.80% CAGR] million USD in 2025, is projected to reach [Estimated 2033 value based on CAGR] million USD by 2033, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 19.80%. Key market drivers include supportive government policies such as the Jawaharlal Nehru National Solar Mission (JNNSM), increasing investments in solar infrastructure, and a growing awareness of the environmental benefits of solar energy. Technological advancements, particularly in solar photovoltaic (PV) technology, are also contributing to market expansion. The segments encompassing Solar Photovoltaic (PV) and Concentrated Solar Power (CSP) are experiencing significant growth, with PV dominating due to its cost-effectiveness and scalability.

Despite the positive outlook, the market faces certain challenges. Land acquisition issues, grid integration complexities, and the intermittency of solar power require careful consideration. However, these challenges are being actively addressed through innovative solutions like battery storage technologies and smart grid management systems. The competitive landscape is dynamic, featuring a mix of established domestic players like Tata Power Solar Systems Ltd, Adani Solar, and Vikram Solar Limited, alongside international companies such as JinkoSolar Holdings Co Ltd and First Solar Inc. Regional variations exist, with states like Gujarat, Rajasthan, and Karnataka leading the adoption of solar energy, driven by favorable solar irradiance and supportive state-level policies. The continued growth trajectory of the Indian solar energy market is assured by proactive government initiatives, technological innovation, and a strong private sector participation, contributing significantly to India’s energy security and sustainable development goals.

India Solar Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India solar energy market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a focus on both the parent market (renewable energy) and child markets (Solar Photovoltaic (PV) and Concentrated Solar Power (CSP)), this report offers invaluable insights for industry professionals, investors, and policymakers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period is 2019-2024. Market values are presented in million units.

India Solar Energy Market Dynamics & Structure

The Indian solar energy market is characterized by a dynamic interplay of factors influencing its growth and structure. Market concentration is moderate, with a mix of large multinational corporations and domestic players. Technological innovation, driven by advancements in PV technology and efficiency gains in CSP, is a key growth driver. Supportive government policies, including ambitious renewable energy targets and attractive incentives, shape the regulatory framework. While hydropower and wind power are competitive substitutes, solar energy's declining cost and versatility provide a strong competitive advantage. The end-user demographics are diverse, encompassing residential, commercial, industrial, and utility-scale sectors. Mergers and acquisitions (M&A) activity, though not overly frequent, showcases consolidation among major players. In 2024, approximately xx M&A deals were recorded in the Indian solar energy sector, contributing to a xx% increase in market concentration. Innovation barriers include high upfront capital costs, land acquisition challenges, and grid integration issues.

- Market Concentration: Moderate, with a mix of large and small players.

- Technological Innovation: Significant advancements in PV and CSP technologies.

- Regulatory Framework: Supportive government policies and incentives.

- Competitive Substitutes: Hydropower, wind power.

- End-User Demographics: Residential, commercial, industrial, and utility-scale.

- M&A Activity: xx deals in 2024, leading to a xx% increase in market concentration.

India Solar Energy Market Growth Trends & Insights

The Indian solar energy market has witnessed robust growth over the past few years, driven by factors such as declining solar panel prices, increasing energy demand, and supportive government policies. Market size has expanded significantly, with a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth trajectory is expected to continue into the forecast period (2025-2033), with a projected CAGR of xx%. The increasing adoption of solar energy across various sectors, including residential, commercial, and industrial, is a key driver. Technological advancements, particularly in PV technology, have further enhanced the market's growth potential. Consumer behavior shifts towards sustainable energy solutions are also supporting this expansion. Market penetration has increased steadily, reaching xx% in 2024 and expected to reach xx% by 2033.

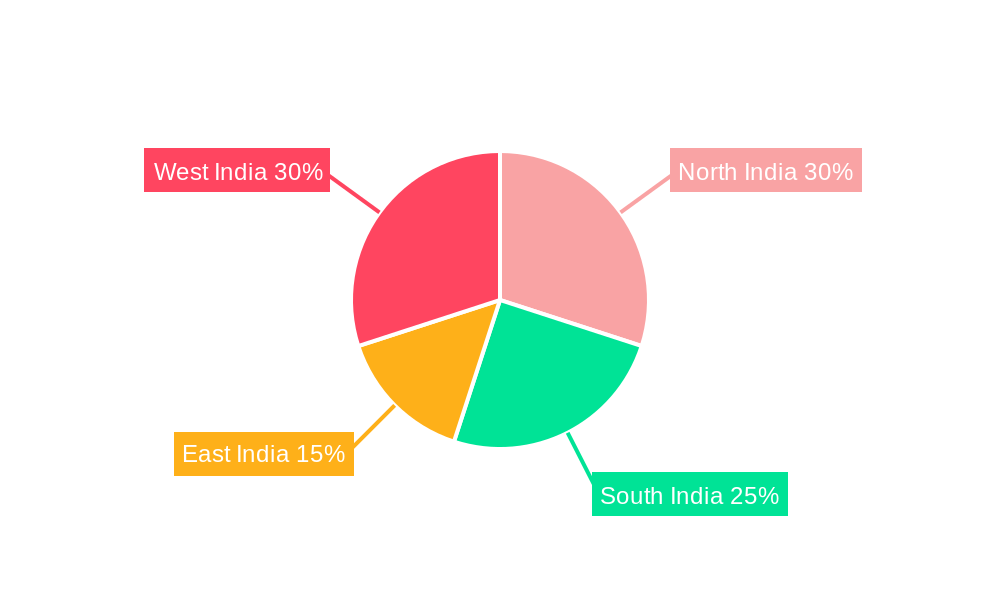

Dominant Regions, Countries, or Segments in India Solar Energy Market

The Indian solar energy market exhibits regional variations in growth and adoption. States like Rajasthan, Gujarat, and Karnataka have emerged as leading regions due to high solar irradiance levels, supportive state policies, and robust industrial infrastructure. The Solar Photovoltaic (PV) segment dominates the market, accounting for approximately xx% of the total market share in 2024, driven by the declining cost of PV modules and their ease of deployment. Concentrated Solar Power (CSP), while exhibiting slower growth, is also gaining traction with government support and investment in large-scale projects.

- Key Drivers for PV Segment Dominance:

- Abundant solar irradiation in several states.

- Declining costs of PV modules.

- Ease of deployment and scalability.

- Government support and incentives.

- Key Drivers for Regional Growth (Rajasthan, Gujarat, Karnataka):

- High solar irradiance.

- Supportive state policies.

- Strong industrial infrastructure.

India Solar Energy Market Product Landscape

The Indian solar energy market features a diverse product landscape, encompassing various PV technologies (monocrystalline, polycrystalline, thin-film) and CSP technologies (parabolic trough, power tower). Product innovation focuses on improving efficiency, reducing costs, and enhancing durability. Advanced PV modules with higher power output and improved performance are gaining popularity. CSP technologies are witnessing advancements in thermal storage solutions, extending operational hours and improving grid stability. Unique selling propositions (USPs) include long-term warranties, high energy yield, and reduced maintenance requirements.

Key Drivers, Barriers & Challenges in India Solar Energy Market

Key Drivers:

- Government Policies: Ambitious renewable energy targets and supportive policies. For example, the target of 500 GW renewable energy capacity by 2030.

- Declining Costs: Continuous reduction in the cost of solar PV modules and other technologies.

- Increasing Energy Demand: Rapid economic growth and rising energy consumption.

Key Challenges and Restraints:

- Land Acquisition: Difficulties in securing land for large-scale solar projects.

- Grid Integration: Challenges in integrating intermittent renewable energy sources into the existing grid.

- Financing: High upfront capital costs pose financing challenges for some projects. This is being addressed partly through initiatives like the USD 150 million IBRD loan secured in December 2022.

Emerging Opportunities in India Solar Energy Market

- Rooftop Solar: Significant untapped potential in the residential and commercial rooftop solar segments.

- Agri-voltaics: Integrating solar power generation with agricultural activities.

- Floating Solar: Utilizing water bodies for solar power generation.

Growth Accelerators in the India Solar Energy Market Industry

Technological breakthroughs, such as advancements in perovskite solar cells and improved energy storage solutions, are key growth catalysts. Strategic partnerships between domestic and international companies are fostering technology transfer and market expansion. Government initiatives to simplify project approvals and streamline grid connection processes are expected to significantly accelerate market growth. Furthermore, the increasing adoption of corporate sustainability goals and commitments is boosting investment in renewable energy.

Key Players Shaping the India Solar Energy Market Market

- 2 Emmvee Solar

- 8 NTPC Ltd

- 1 JinkoSolar Holdings Co Ltd

- 5 Tata Power Solar Systems Ltd

- 1 Adani Solar

- 9 Azure Power Global Ltd

- 7 ReNew Power Pvt Ltd

- 5 Trina Solar Limited

- 6 Vikram Solar Limited

- 2 First Solar Inc

- 3 Mahindra Susten Pvt Ltd

- 4 Sterling and Wilson Pvt Ltd

- 4 SMA Solar Technology AG

- 3 Hanwha Q Cells Co Ltd *List Not Exhaustive

Notable Milestones in India Solar Energy Market Sector

- December 2022: USD 150 million IBRD loan, USD 28 million CTF loan, and USD 22 million CTF grant secured to boost renewable energy capacity. This significantly bolsters the market by providing crucial financing and reaffirming the government's commitment to renewable energy.

- September 2022: Amazon India announces three solar farm projects (totaling 420 MW) in Rajasthan, showcasing significant private sector investment.

- January 2022: SJVN awarded a 125 MW solar project in Uttar Pradesh, demonstrating continued growth in project development.

In-Depth India Solar Energy Market Market Outlook

The Indian solar energy market is poised for sustained and significant growth in the coming years. Continued technological advancements, coupled with supportive government policies and rising energy demand, will drive market expansion. Strategic partnerships, both domestic and international, will play a crucial role in accelerating market development. Untapped potential in rooftop solar, agri-voltaics, and floating solar offers promising avenues for growth and investment. The target of 500 GW renewable energy capacity by 2030 will be a powerful driver of growth for the foreseeable future.

India Solar Energy Market Segmentation

-

1. Technology

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

India Solar Energy Market Segmentation By Geography

- 1. India

India Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology

- 3.3. Market Restrains

- 3.3.1. 4.; Unpredictability in the Continuity of Power Supply

- 3.4. Market Trends

- 3.4.1. Solar PV Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 2 Emmvee Solar

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 8 NTPC Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 1 JinkoSolar Holdings Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 5 Tata Power Solar Systems Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 1 Adani Solar

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 9 Azure Power Global Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 7 ReNew Power Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 5 Trina Solar Limited*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Domestic Players

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 6 Vikram Solar Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Foreign Players

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 2 First Solar Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 3 Mahindra Susten Pvt Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 4 Sterling and Wilson Pvt Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 4 SMA Solar Technology AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 3 Hanwha Q Cells Co Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 2 Emmvee Solar

List of Figures

- Figure 1: India Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: India Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Solar Energy Market Volume Megawatt Forecast, by Region 2019 & 2032

- Table 3: India Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: India Solar Energy Market Volume Megawatt Forecast, by Technology 2019 & 2032

- Table 5: India Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Solar Energy Market Volume Megawatt Forecast, by Region 2019 & 2032

- Table 7: India Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Solar Energy Market Volume Megawatt Forecast, by Country 2019 & 2032

- Table 9: North India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 11: South India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 13: East India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 15: West India India Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Solar Energy Market Volume (Megawatt) Forecast, by Application 2019 & 2032

- Table 17: India Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 18: India Solar Energy Market Volume Megawatt Forecast, by Technology 2019 & 2032

- Table 19: India Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Solar Energy Market Volume Megawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Energy Market?

The projected CAGR is approximately 19.80%.

2. Which companies are prominent players in the India Solar Energy Market?

Key companies in the market include 2 Emmvee Solar, 8 NTPC Ltd, 1 JinkoSolar Holdings Co Ltd, 5 Tata Power Solar Systems Ltd, 1 Adani Solar, 9 Azure Power Global Ltd, 7 ReNew Power Pvt Ltd, 5 Trina Solar Limited*List Not Exhaustive, Domestic Players, 6 Vikram Solar Limited, Foreign Players, 2 First Solar Inc, 3 Mahindra Susten Pvt Ltd, 4 Sterling and Wilson Pvt Ltd, 4 SMA Solar Technology AG, 3 Hanwha Q Cells Co Ltd.

3. What are the main segments of the India Solar Energy Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies for Developing Solar Energy4.; Declining Cost of Solar Power Technology.

6. What are the notable trends driving market growth?

Solar PV Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Unpredictability in the Continuity of Power Supply.

8. Can you provide examples of recent developments in the market?

December 2022: The Government of India, Solar Energy Corporation of India Limited (SECI), and the World Bank signed agreements for a USD 150 million International Bank for Reconstruction and Development (IBRD) loan, a USD 28 million Clean Technology Fund (CTF) loan, and a USD 22 million CTF grant to assist India in increasing its power generation capacity through cleaner and renewable energy sources. The agreement reaffirmed India's goal of reaching 500 gigatons (GW) of renewable energy by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Megawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Energy Market?

To stay informed about further developments, trends, and reports in the India Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence