Key Insights

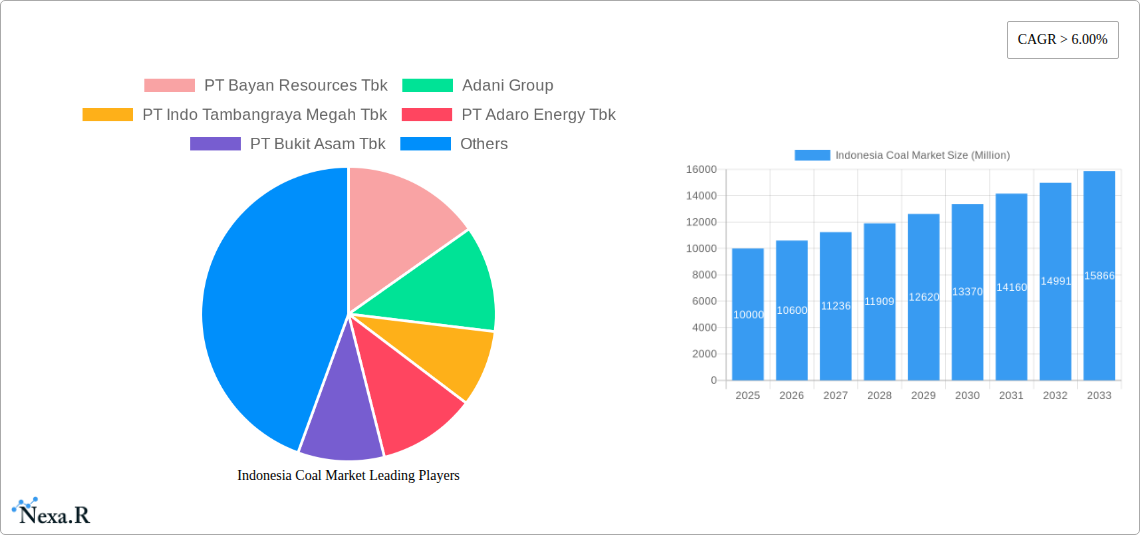

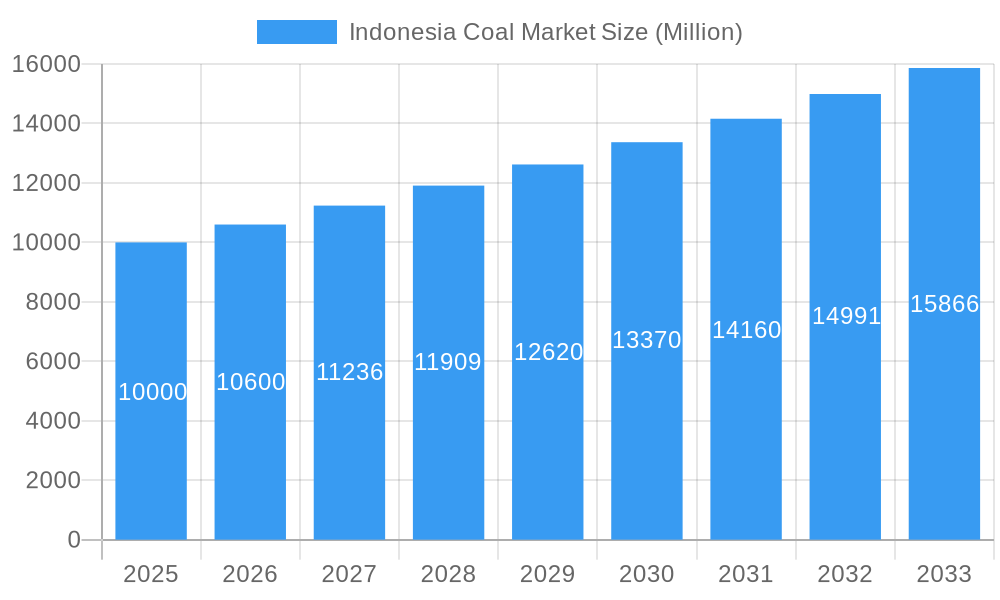

The Indonesian coal market, valued at approximately $XX million in 2025 (assuming a logical market size based on the provided CAGR and regional context), is projected to experience robust growth, exceeding a 6% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven primarily by the sustained demand from the electricity and iron and steel industries, both of which are undergoing significant infrastructure development within Indonesia. The increasing energy needs of a rapidly growing population and industrialization further fuel this market's growth. While global trends towards cleaner energy sources present a potential restraint, Indonesia's abundant coal reserves and its relatively lower production costs compared to other global producers are expected to mitigate this effect in the short to medium term. Key players such as PT Bayan Resources Tbk, Adani Group, and PT Indo Tambangraya Megah Tbk are strategically positioned to capitalize on this growth, with their operations heavily concentrated within Indonesia's coal-rich regions. The "Other Applications" segment, encompassing uses in cement production and other industrial processes, also contributes to the overall market size and is expected to show moderate growth alongside the primary sectors. The market’s resilience is further supported by government policies aimed at balancing energy security with environmental sustainability.

Indonesia Coal Market Market Size (In Billion)

However, the long-term trajectory of the Indonesian coal market is subject to evolving global regulations concerning greenhouse gas emissions and increasing pressure to transition towards renewable energy sources. While the short-term outlook remains positive, companies are likely to invest more in efficiency improvements and explore opportunities to diversify into related sectors, such as coal-to-chemicals, to ensure long-term sustainability. The success of these strategies will be critical in shaping the long-term growth trajectory of the Indonesian coal market, influencing its overall size and the market share held by individual companies. The forecast period (2025-2033) will likely witness shifts in market share, driven by factors such as technological advancements, government policies, and the competitive landscape. Continuous monitoring of these factors is crucial for stakeholders to effectively navigate the dynamic nature of this sector.

Indonesia Coal Market Company Market Share

Indonesia Coal Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesian coal market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and policymakers seeking a thorough understanding of this dynamic sector. The report segments the market by application (Electricity, Iron and Steel Industry, Other Applications) and provides granular insights into key players such as PT Bayan Resources Tbk, Adani Group, PT Indo Tambangraya Megah Tbk, and more.

Indonesia Coal Market Market Dynamics & Structure

The Indonesian coal market is a dynamic and evolving landscape, shaped by a confluence of domestic and international forces. Its structure is characterized by a notable degree of market concentration, with a few dominant entities controlling a substantial portion of production and sales. While technological innovation is afoot, its widespread adoption is often constrained by the significant capital investment required and the entrenched nature of existing infrastructure and operational practices. The regulatory environment, meticulously managed by the Indonesian government through policies on production quotas, environmental standards, and export tariffs, exerts a profound influence on market operations and strategic decision-making. In parallel, the market faces intensifying competition from the rapidly expanding renewable energy sector, which is increasingly positioned as a viable and sustainable alternative to coal. The demand profile is predominantly dictated by end-user demographics, with the energy generation and heavy industrial sectors, particularly iron and steel manufacturing, being the primary consumers. Mergers and acquisitions (M&A) remain a pertinent strategy for industry consolidation and the optimization of resource utilization, though such activities are subject to rigorous regulatory oversight.

- Market Concentration: The market exhibits high concentration, with the top 5 players estimated to hold approximately 75-80% of the market share in 2024, signifying significant market power among a few key entities.

- Technological Innovation: Innovation is progressing at a moderate pace, primarily hindered by substantial upfront investment costs for new technologies and the need to adapt or replace existing, well-established infrastructure.

- Regulatory Framework: The Indonesian government's regulatory framework plays a pivotal role, with production quotas, stringent environmental regulations, and export policies significantly dictating market dynamics and future investment decisions.

- Competitive Substitutes: The growing prominence and cost-competitiveness of renewable energy sources, such as solar and wind power, present a significant and increasing competitive threat to coal's dominance in the energy sector.

- End-User Demographics: The demand for coal is primarily driven by the electricity generation sector and the industrial segment, with a substantial portion consumed by iron and steel production facilities.

- M&A Trends: M&A activity is moderate, driven by strategic objectives such as consolidating market positions, achieving economies of scale, and optimizing resource management. An estimated 8-12 M&A deals occurred within the historical period of 2019-2024, reflecting a strategic approach to industry restructuring.

Indonesia Coal Market Growth Trends & Insights

The Indonesian coal market has experienced fluctuating growth over the historical period (2019-2024), influenced by global energy prices, domestic policies, and economic conditions. While growth slowed in certain years due to global events, a steady recovery is projected for the forecast period. Adoption rates across various sectors remain robust, particularly in the electricity generation segment. Technological disruptions, such as improved extraction techniques and cleaner coal technologies, have played a limited role, thus far, due to associated costs. Consumer behavior, particularly among industrial users, is largely driven by price competitiveness and reliability of supply. The CAGR for the forecast period (2025-2033) is estimated at xx%, with market penetration reaching xx% by 2033.

Dominant Regions, Countries, or Segments in Indonesia Coal Market

The electricity sector is the dominant application segment, contributing approximately xx% of total coal consumption in 2024. This is mainly driven by Indonesia's significant reliance on coal-fired power plants for electricity generation. The East Kalimantan region leads in coal production and exports due to its rich reserves and established infrastructure.

Key Drivers for Electricity Segment Dominance:

- High demand for electricity fueled by rapid economic growth and increasing population.

- Extensive coal reserves located in proximity to power plants.

- Relatively lower cost of coal-fired power generation compared to alternatives (at least currently).

Dominance Factors:

- Abundant coal reserves in specific regions.

- Well-established mining and transportation infrastructure.

- Strong government support for coal-based power generation.

Indonesia Coal Market Product Landscape

The Indonesian coal market primarily comprises thermal coal for power generation and metallurgical coal for steel production. Product innovation focuses on improving coal quality to enhance energy efficiency and reduce emissions. Technological advancements center on optimizing mining processes and improving transportation logistics to reduce costs and environmental impact. Unique selling propositions often hinge on consistent quality, reliable supply, and competitive pricing.

Key Drivers, Barriers & Challenges in Indonesia Coal Market

Key Drivers:

- Sustained robust domestic demand for electricity generation, crucial for economic growth and industrial development.

- Abundant domestic coal reserves, providing a secure and readily available energy source.

- Historically low production costs, making Indonesian coal a competitive option in both domestic and international markets.

- Government policies historically favoring coal-based power generation for energy security, though this is undergoing a significant transition.

Key Challenges & Restraints:

- Escalating global and domestic environmental concerns, coupled with increasing pressure to transition towards cleaner, renewable energy sources.

- Significant price volatility in the international coal market, impacting profitability and long-term investment planning.

- Existing infrastructure limitations and logistical bottlenecks in certain key coal-producing and consuming regions, hindering efficient supply chain operations.

- Increasing regulatory scrutiny and the implementation of more stringent environmental regulations, necessitating higher compliance costs and operational adjustments.

- An anticipated reduction of approximately 20-25% in coal demand by 2033 due to accelerated renewable energy initiatives and global decarbonization efforts.

Emerging Opportunities in Indonesia Coal Market

- Coal-to-chemicals: Increased focus on converting coal into value-added chemicals.

- Carbon capture and storage (CCS) technologies: Implementing CCS to mitigate environmental impact.

- Optimized mining techniques: Adoption of more efficient and environmentally friendly mining methods.

- Export diversification: Expanding export markets beyond traditional partners.

Growth Accelerators in the Indonesia Coal Market Industry

Future growth in the Indonesian coal market will be significantly propelled by strategic collaborations aimed at fostering technological advancements and embedding more sustainable operational practices. Crucial investments in upgrading and expanding transportation infrastructure, particularly railway networks and port facilities, will be instrumental in enhancing logistical efficiency and reducing costs. Furthermore, the exploration and development of novel applications for coal, such as its utilization in the chemical industry for producing advanced materials, could unlock new revenue streams and diversify the market beyond traditional energy generation, thereby enhancing its long-term viability.

Key Players Shaping the Indonesia Coal Market Market

- PT Bayan Resources Tbk

- Adani Group

- PT Indo Tambangraya Megah Tbk

- PT Adaro Energy Tbk

- PT Bukit Asam Tbk

- BlackGold Group

- Golden Energy and Resources Limited

- PT Bumi Resources Tbk

- PT Bhakti Energi Persada

Notable Milestones in Indonesia Coal Market Sector

- November 2022: The Indonesian government greenlit the construction of 13 GW of new coal-fired power plants, signaling a continued, albeit debated, reliance on coal for immediate energy needs.

- November 2022: The Asian Development Bank announced a pivotal partnership with a private entity to facilitate the refinancing and subsequent retirement of the 660-MW Cirebon 1 coal power plant, marking a significant step towards decarbonization.

In-Depth Indonesia Coal Market Market Outlook

The outlook for the Indonesian coal market is intrinsically tied to the global trajectory of energy transitions and the evolving landscape of domestic energy policy. While a gradual decline in coal demand is projected due to heightened environmental awareness and the accelerating adoption of renewable energy technologies, the market is expected to maintain a considerable presence in the near to medium-term horizon, driven by the nation's energy security needs and developmental imperatives. Strategic avenues for sustained market relevance lie in enhancing production efficiency, developing higher-value coal-based products, and investing in innovative technologies designed to mitigate environmental impacts. Ultimately, the long-term prosperity of the Indonesian coal market will hinge on its ability to adeptly navigate the intricate equilibrium between ensuring energy security, fostering economic progress, and upholding environmental sustainability principles.

Indonesia Coal Market Segmentation

-

1. Application

- 1.1. Electricity

- 1.2. Iron and Steel Industry

- 1.3. Other Applications

Indonesia Coal Market Segmentation By Geography

- 1. Indonesia

Indonesia Coal Market Regional Market Share

Geographic Coverage of Indonesia Coal Market

Indonesia Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Electricity Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electricity

- 5.1.2. Iron and Steel Industry

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Bayan Resources Tbk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Indo Tambangraya Megah Tbk

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Adaro Energy Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Bukit Asam Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BlackGold Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Golden Energy and Resources Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Bumi Resources Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Bhakti Energi Persada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PT Bayan Resources Tbk

List of Figures

- Figure 1: Indonesia Coal Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Coal Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Indonesia Coal Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Indonesia Coal Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Indonesia Coal Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Indonesia Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Coal Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Indonesia Coal Market?

Key companies in the market include PT Bayan Resources Tbk, Adani Group, PT Indo Tambangraya Megah Tbk, PT Adaro Energy Tbk, PT Bukit Asam Tbk, BlackGold Group, Golden Energy and Resources Limited, PT Bumi Resources Tbk, PT Bhakti Energi Persada.

3. What are the main segments of the Indonesia Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Electricity Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In November 2022, the Indonesian government announced that they would allow the construction of new coal plants, with a combined capacity of 13 gigawatts, that have already been tendered out. The plan is laid out in the country's 10-year energy plan for 2021-2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Coal Market?

To stay informed about further developments, trends, and reports in the Indonesia Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence