Key Insights

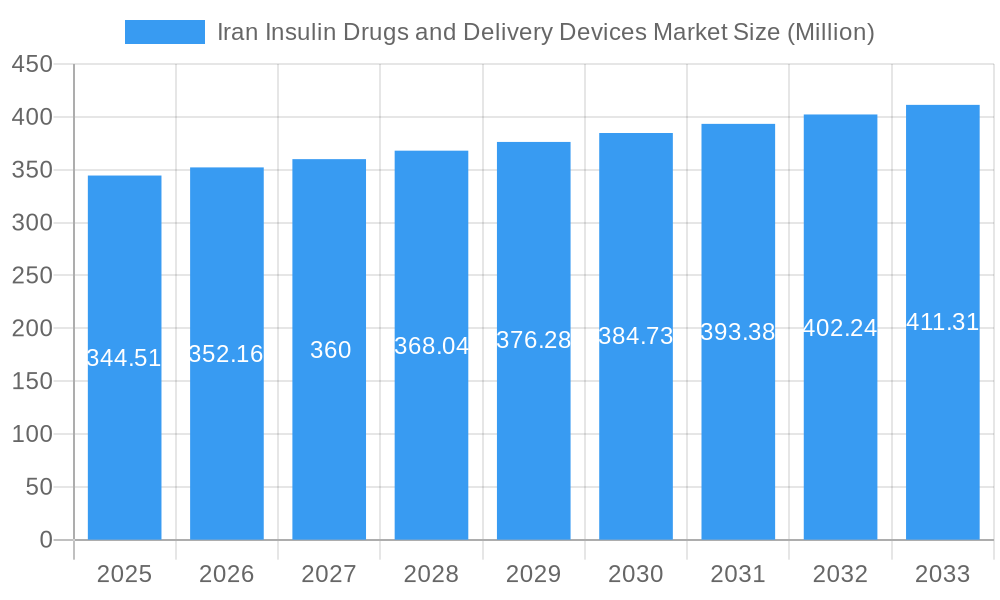

The Iran Insulin Drugs and Delivery Devices Market, valued at $344.51 million in 2025, is projected to experience steady growth over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 2.18% indicates a market expansion driven by several factors. The rising prevalence of diabetes, particularly type 1 and type 2, within Iran's population constitutes a major driver. Increasing awareness of diabetes management and improved access to healthcare contribute significantly to market growth. Furthermore, technological advancements in insulin delivery devices, such as the development of more user-friendly and accurate insulin pens and pumps, are fueling demand. While data on specific market segments is unavailable, it's reasonable to expect strong growth within the insulin pen and cartridge segment given their widespread adoption globally. Government initiatives promoting diabetic care and affordable medication access also positively influence market expansion. However, economic challenges and potential import restrictions could act as restraints, limiting market growth to a moderate pace. Major players like Novo Nordisk A/S, Sanofi, Eli Lilly and Company, and others are actively competing in this market, aiming to capture a larger share through product innovation and strategic partnerships with local distributors.

Iran Insulin Drugs and Delivery Devices Market Market Size (In Million)

The competitive landscape involves both multinational pharmaceutical companies and domestic players, leading to a mixed market structure. Growth will likely be influenced by the government's healthcare policies, investment in diabetes research, and the overall economic health of the nation. The market's relatively low CAGR suggests a degree of market maturity in terms of existing insulin therapies, although the ongoing introduction of advanced devices and formulations will likely stimulate further expansion. Future market growth will depend on factors such as increased public awareness campaigns targeting diabetes prevention and management, as well as sustained investment in infrastructure supporting diabetes care within the Iranian healthcare system. Continuous monitoring of government regulations and economic conditions is crucial for accurate forecasting in this dynamic market.

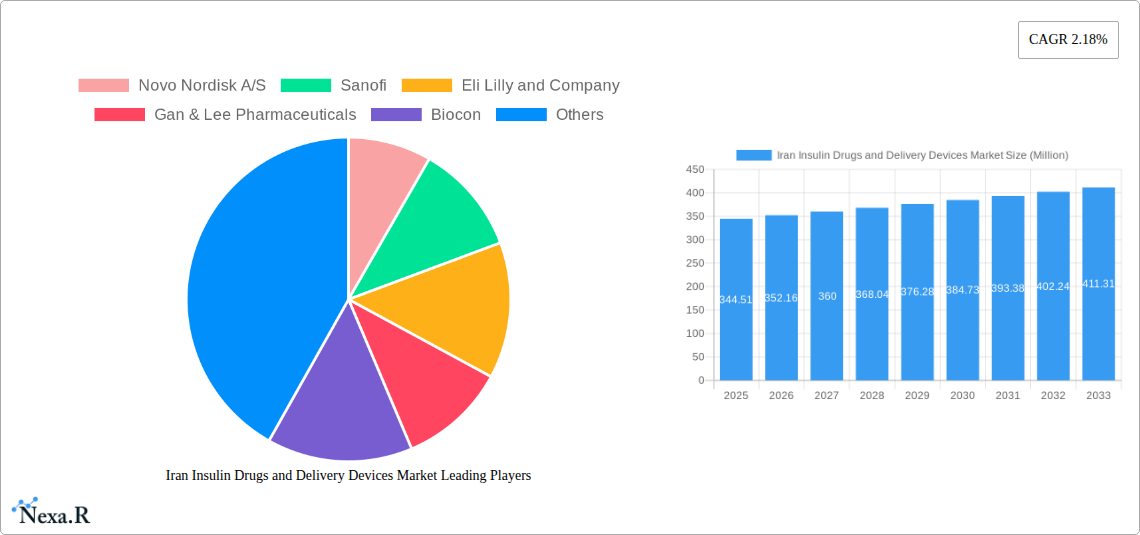

Iran Insulin Drugs and Delivery Devices Market Company Market Share

Iran Insulin Drugs and Delivery Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Iran Insulin Drugs and Delivery Devices Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report delves into the parent market of pharmaceutical drugs and the child market of insulin and delivery devices, offering invaluable insights for industry professionals, investors, and stakeholders. The market size is presented in million units.

Iran Insulin Drugs and Delivery Devices Market Dynamics & Structure

This section analyzes the market's structure, highlighting concentration levels, technological advancements, regulatory influences, competitive dynamics, and end-user demographics. The analysis incorporates both qualitative and quantitative data, including market share estimations and M&A activity.

- Market Concentration: The Iranian insulin market exhibits a [xx]% concentration ratio, with a few dominant players holding significant market share. This concentration is influenced by [explain factors, e.g., import restrictions, government regulations].

- Technological Innovation: Innovation in insulin delivery systems (e.g., smart pens, insulin pumps) is a key driver, though adoption rates are influenced by factors such as [explain factors, e.g., cost, accessibility]. The recent establishment of an insulin raw material production line represents a significant step towards technological self-sufficiency.

- Regulatory Framework: Stringent regulatory approvals and pricing policies impact market access and competition. The recent introduction of Raizodag, a foreign insulin brand covered by multiple insurance schemes, indicates a potential shift in regulatory strategy.

- Competitive Product Substitutes: [Discuss alternative diabetes treatments and their impact on the insulin market, e.g., oral hypoglycemic agents].

- End-User Demographics: The growing prevalence of diabetes among the Iranian population is a significant driver of market growth. [Provide quantitative data on diabetes prevalence and demographic breakdown].

- M&A Trends: [xx] M&A deals were recorded in the historical period (2019-2024), predominantly focused on [specify type of deals, e.g., distribution partnerships, technology licensing]. Future M&A activity is anticipated to [provide prediction, e.g., increase due to government initiatives promoting domestic production].

Iran Insulin Drugs and Delivery Devices Market Growth Trends & Insights

This section analyzes the market's historical and projected growth, considering factors such as adoption rates, technological disruptions, and evolving consumer behavior. The analysis leverages [Specify data source, e.g., market research databases, government reports] to provide a comprehensive overview.

[Insert 600-word analysis including specific data points such as CAGR (Compound Annual Growth Rate) and market penetration rates for various insulin types and delivery devices over the study period. The analysis should cover market size evolution, adoption rates, technological advancements such as the rise of biosimilar insulins, and how consumer preferences impact market dynamics.]

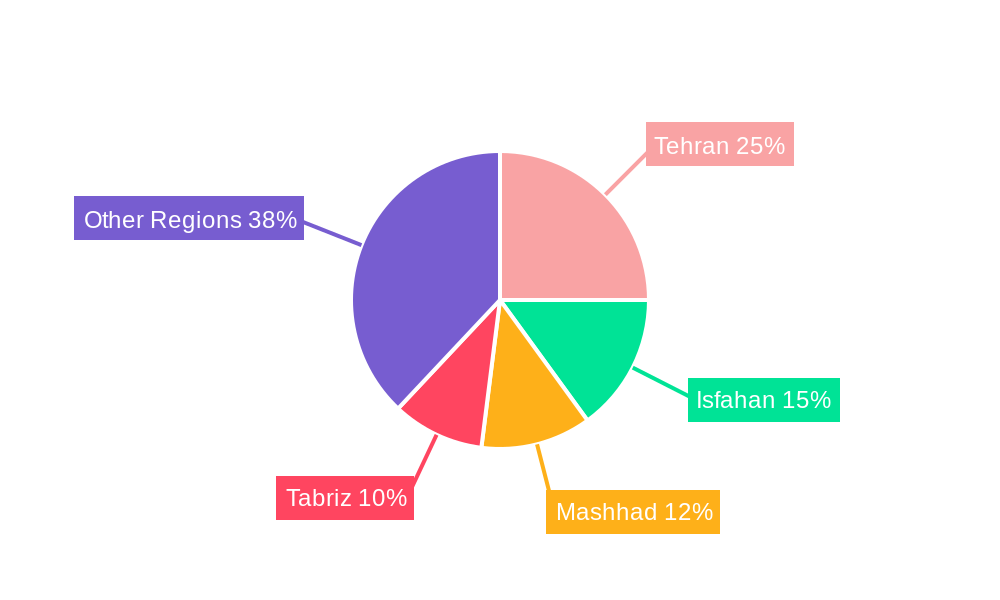

Dominant Regions, Countries, or Segments in Iran Insulin Drugs and Delivery Devices Market

This section identifies the leading regions, countries, or segments driving market growth. The analysis includes a breakdown of market share and growth potential, factoring in economic factors, infrastructure, and healthcare policies.

[Insert 600-word analysis, including data on market share distribution across different regions/provinces and market segments (e.g., insulin types, delivery devices). Highlight key drivers for each leading segment/region using bullet points. Analyze factors contributing to their dominance, including but not limited to economic policies, healthcare infrastructure, access to healthcare, disease prevalence, and government initiatives.]

Iran Insulin Drugs and Delivery Devices Market Product Landscape

This section details the product landscape, focusing on innovations, applications, and performance metrics. The analysis highlights the unique selling propositions (USPs) and technological advancements in insulin drugs and delivery devices available in the Iranian market.

[Insert 100-150-word paragraph discussing the types of insulin available (e.g., rapid-acting, long-acting), the types of delivery devices (e.g., syringes, pens, pumps), and any notable innovations in these areas. Mention specific product examples where possible.]

Key Drivers, Barriers & Challenges in Iran Insulin Drugs and Delivery Devices Market

This section outlines the primary drivers and challenges influencing market growth. The analysis includes both qualitative and quantitative factors, such as technological advancements, economic conditions, and regulatory hurdles.

Key Drivers:

- Increasing prevalence of diabetes

- Government initiatives to improve healthcare access

- Growing awareness of diabetes management

- Technological advancements in insulin delivery

Challenges and Restraints:

- Import restrictions and sanctions

- High cost of insulin and devices

- Supply chain disruptions

- Fluctuations in currency exchange rates

[Provide quantitative impact where possible, e.g., "Import restrictions have resulted in a xx% increase in insulin prices."]

Emerging Opportunities in Iran Insulin Drugs and Delivery Devices Market

This section highlights emerging trends and opportunities in the Iranian insulin market. The analysis focuses on untapped market segments, innovative applications, and evolving consumer preferences.

[Insert 150-word paragraph or bullet points discussing potential areas of growth, such as the growing demand for biosimilar insulins, the potential for increased adoption of insulin pumps, and the expansion of telehealth services for diabetes management.]

Growth Accelerators in the Iran Insulin Drugs and Delivery Devices Market Industry

This section explores catalysts driving long-term growth in the Iranian insulin market. The analysis focuses on technological breakthroughs, strategic partnerships, and market expansion strategies.

[Insert 150-word paragraph discussing factors that could significantly contribute to long-term growth, such as successful domestic production of insulin, increased investment in diabetes research, and collaboration between pharmaceutical companies and healthcare providers.]

Key Players Shaping the Iran Insulin Drugs and Delivery Devices Market Market

- Novo Nordisk A/S

- Sanofi

- Eli Lilly and Company

- Gan & Lee Pharmaceuticals

- Biocon

- Medtronic

- Becton Dickinson and Company

- *List Not Exhaustive

Notable Milestones in Iran Insulin Drugs and Delivery Devices Market Sector

- September 2024: Launch of Raizodag insulin brand, covered by health and Armed Forces insurance, with anticipated expansion to Social Security coverage. This signifies increased access to imported insulin options.

- September 2023: Inauguration of Iran's first insulin raw material production line, marking a crucial step towards self-sufficiency in insulin production and reducing reliance on imports.

In-Depth Iran Insulin Drugs and Delivery Devices Market Market Outlook

The Iranian insulin drugs and delivery devices market presents significant long-term growth potential driven by the increasing prevalence of diabetes, coupled with government initiatives promoting domestic production and improved healthcare access. Strategic partnerships between domestic and international players, along with continued technological advancements in insulin delivery systems, are poised to accelerate market expansion. The successful integration of biosimilar insulins and the potential for increased adoption of advanced insulin delivery technologies represent further opportunities for growth. The market is expected to show a [xx]% CAGR during the forecast period (2025-2033).

Iran Insulin Drugs and Delivery Devices Market Segmentation

-

1. Product Type

-

1.1. By Drug

- 1.1.1. Basal or Long-acting Insulins

- 1.1.2. Bolus or Fast-acting Insulins

- 1.1.3. Traditional Human Insulins

- 1.1.4. Other Product Types

-

1.2. By Device

- 1.2.1. Insulin Pumps

- 1.2.2. Insulin Pens

- 1.2.3. Insulin Syringes

- 1.2.4. Insulin Jet Injectors

-

1.1. By Drug

Iran Insulin Drugs and Delivery Devices Market Segmentation By Geography

- 1. Iran

Iran Insulin Drugs and Delivery Devices Market Regional Market Share

Geographic Coverage of Iran Insulin Drugs and Delivery Devices Market

Iran Insulin Drugs and Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran

- 3.3. Market Restrains

- 3.3.1. Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Iran

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Insulin Drugs and Delivery Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. By Drug

- 5.1.1.1. Basal or Long-acting Insulins

- 5.1.1.2. Bolus or Fast-acting Insulins

- 5.1.1.3. Traditional Human Insulins

- 5.1.1.4. Other Product Types

- 5.1.2. By Device

- 5.1.2.1. Insulin Pumps

- 5.1.2.2. Insulin Pens

- 5.1.2.3. Insulin Syringes

- 5.1.2.4. Insulin Jet Injectors

- 5.1.1. By Drug

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novo Nordisk A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sanofi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eli Lilly and Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gan & Lee Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Biocon

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Becton Dickinson and Company*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Novo Nordisk A/S

List of Figures

- Figure 1: Iran Insulin Drugs and Delivery Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Iran Insulin Drugs and Delivery Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 7: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Insulin Drugs and Delivery Devices Market?

The projected CAGR is approximately 2.18%.

2. Which companies are prominent players in the Iran Insulin Drugs and Delivery Devices Market?

Key companies in the market include Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Gan & Lee Pharmaceuticals, Biocon, Medtronic, Becton Dickinson and Company*List Not Exhaustive.

3. What are the main segments of the Iran Insulin Drugs and Delivery Devices Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 344.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Iran.

7. Are there any restraints impacting market growth?

Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran.

8. Can you provide examples of recent developments in the market?

September 2024: The Vice President of Food and Drugs at Hamedan University of Medical Sciences announced the introduction of a foreign insulin brand, Raizodag. The insulin, akin to the Nomix brand, was launched. It is covered by health insurance and the Armed Forces Medical Services insurance. The authority anticipates that Social Security insurance will extend its coverage soon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Insulin Drugs and Delivery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Insulin Drugs and Delivery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Insulin Drugs and Delivery Devices Market?

To stay informed about further developments, trends, and reports in the Iran Insulin Drugs and Delivery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence