Key Insights

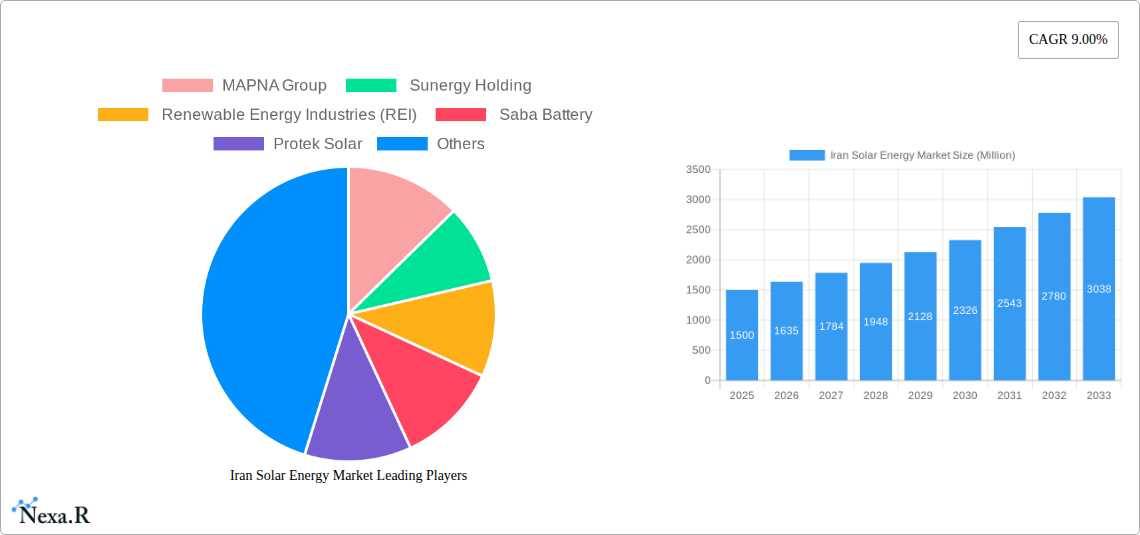

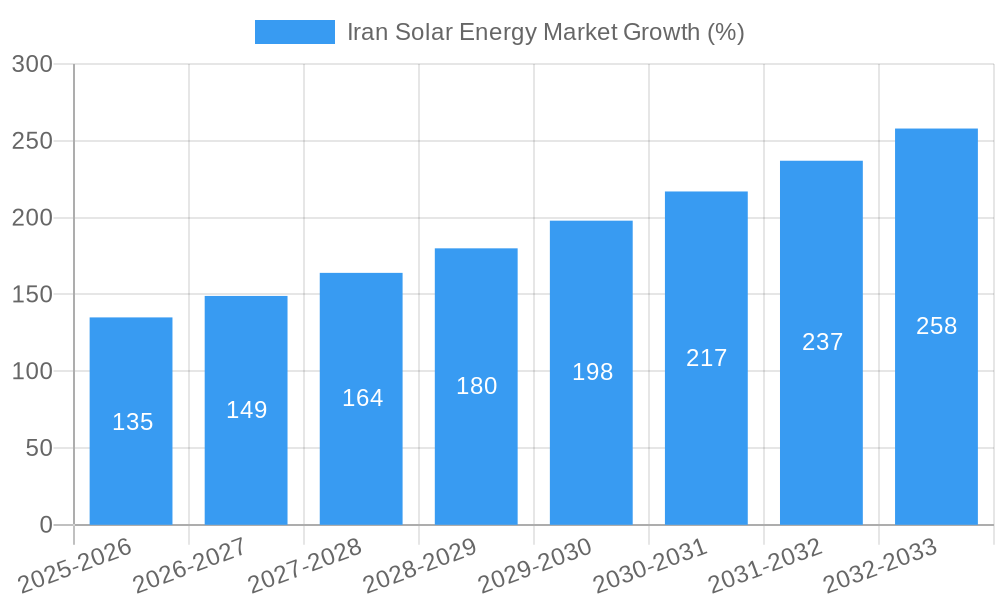

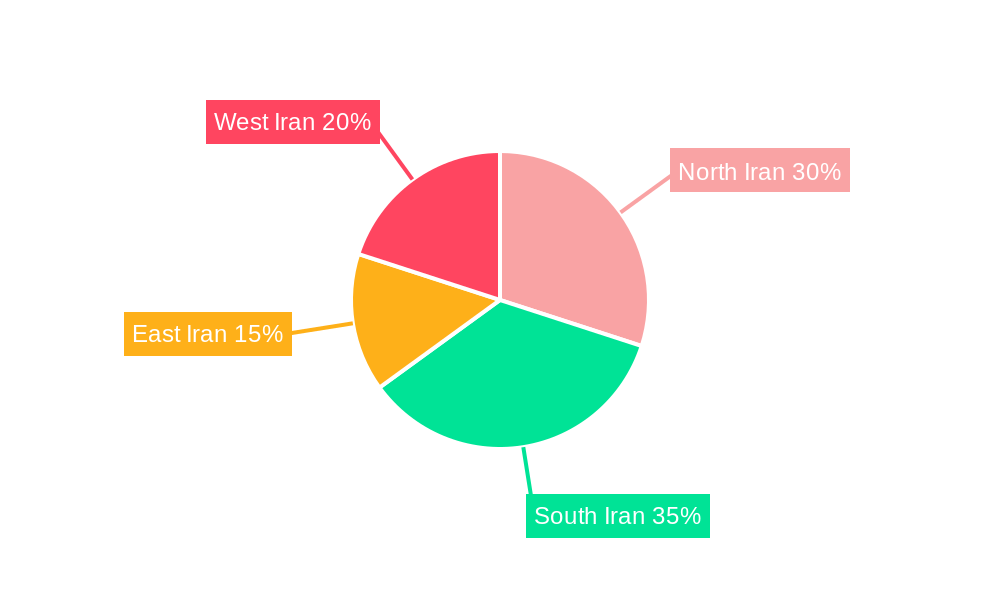

The Iranian solar energy market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9%, is poised for significant expansion between 2025 and 2033. Driven by increasing energy demand, government initiatives promoting renewable energy adoption, and falling solar panel costs, the market is projected to reach substantial value. The automotive, industrial, and portable segments are key application areas, with the industrial sector anticipated to experience the fastest growth due to the increasing adoption of solar power in manufacturing and infrastructure projects. Major players like MAPNA Group, Sunergy Holding, and Renewable Energy Industries (REI) are shaping the market landscape through technological advancements and strategic partnerships. While challenges such as grid infrastructure limitations and initial investment costs exist, the long-term economic viability and environmental benefits of solar energy are mitigating these restraints. Regional variations within Iran are expected, with areas receiving higher solar irradiation experiencing faster market penetration. The historical period (2019-2024) likely witnessed a slower growth trajectory than the forecast period, reflecting the gradual market maturation and regulatory developments. The base year 2025 serves as a crucial benchmark, capturing the current market dynamics and providing a realistic starting point for future projections.

The projected growth is underpinned by several factors. Government subsidies and incentives are accelerating solar adoption, and technological improvements are leading to increased efficiency and reduced costs. Furthermore, rising awareness of environmental sustainability and the need for energy independence are driving increased demand from both consumers and businesses. The competitive landscape is expected to remain dynamic, with both established players and new entrants vying for market share. Focus on research and development, particularly in areas such as energy storage and grid integration, will be crucial for sustained growth. The diversification of applications across the automotive, industrial, portable, and other sectors ensures market resilience and reduces dependence on any single segment. The regional distribution of solar energy projects will be influenced by geographical factors and government policies aimed at balanced development across the country.

Iran Solar Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Iran solar energy market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for investors, industry professionals, and policymakers. The report covers the parent market (Renewable Energy) and child market (Solar Energy) for a more targeted analysis. Market values are presented in million units.

Iran Solar Energy Market Dynamics & Structure

This section analyzes the Iranian solar energy market's structure, encompassing market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. We delve into the interplay of these factors, providing both quantitative and qualitative insights to paint a complete picture of the market landscape.

- Market Concentration: The Iranian solar energy market exhibits a moderately concentrated structure with a few dominant players (xx% market share collectively) and numerous smaller players.

- Technological Innovation: Innovation is driven by the need for cost reduction, efficiency improvements, and grid integration solutions. However, sanctions and import restrictions pose significant barriers.

- Regulatory Framework: Government policies and incentives play a crucial role in driving market growth. However, regulatory inconsistencies and bureaucratic processes can hinder development.

- Competitive Substitutes: Other renewable energy sources, like wind and hydro, compete for investment and market share. However, the abundant sunshine in Iran provides a compelling advantage for solar.

- End-User Demographics: The primary end-users are residential, commercial, and industrial sectors. Government initiatives are driving increased adoption across sectors.

- M&A Trends: The number of M&A deals in the Iranian solar sector has been xx in the past five years, driven primarily by consolidation and expansion strategies among key players.

Iran Solar Energy Market Growth Trends & Insights

This section leverages comprehensive data analysis to provide a detailed examination of market size evolution, adoption rates, technological disruptions, and evolving consumer behavior in the Iranian solar energy market. We present key metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates, offering a granular understanding of historical and projected growth trajectories. The analysis accounts for macroeconomic fluctuations, technological advancements (e.g., advancements in PV technology, improved energy storage solutions), and changing government policies influencing market growth from 2019 to 2033. The projected CAGR for the forecast period (2025-2033) is estimated at xx%.

Dominant Regions, Countries, or Segments in Iran Solar Energy Market

This section identifies the leading regions, countries, or segments within the Iranian solar energy market (Automotive, Industrial, Portable, Other Applications) driving market expansion. We analyze dominant factors, such as economic policies, infrastructure development, and government incentives, contributing to the market share and growth potential of each segment.

- Industrial Segment Dominance: The industrial segment is projected to be the largest segment with a market share of xx% by 2033, driven by the increasing demand for reliable and sustainable power sources in various industrial processes.

- Key Drivers: Favorable government policies promoting industrial renewable energy adoption, coupled with increasing energy costs and environmental concerns are major drivers.

- Growth Potential: The ongoing industrialization of Iran, coupled with government support for renewable energy initiatives, is set to propel substantial growth within the industrial segment in the coming years.

Iran Solar Energy Market Product Landscape

The Iranian solar energy market showcases a diverse product landscape, featuring various solar panel technologies (monocrystalline, polycrystalline, thin-film), inverters, and energy storage systems. Recent innovations focus on enhancing efficiency, durability, and affordability. Companies are focusing on developing customized solutions tailored to the unique needs of the Iranian market, addressing challenges such as dust accumulation and extreme temperatures. This focus on localized solutions is creating a competitive market, driving innovation and offering diverse choices for consumers.

Key Drivers, Barriers & Challenges in Iran Solar Energy Market

Key Drivers:

- Abundant solar irradiation in Iran provides a significant advantage for solar energy adoption.

- Government initiatives and subsidies promote renewable energy development.

- Increasing electricity costs and energy security concerns drive market demand.

Key Challenges & Restraints:

- International sanctions impose limitations on the import of crucial technologies and equipment.

- Financing challenges and high upfront costs can hinder project development.

- Grid infrastructure limitations restrict the large-scale integration of solar power. These constraints reduce the market adoption rate by an estimated xx% annually.

Emerging Opportunities in Iran Solar Energy Market

Emerging opportunities lie in the development of off-grid solar solutions for rural areas, the integration of solar energy with smart grids, and the exploration of hybrid energy systems combining solar with other renewable resources. Furthermore, the rising demand for electric vehicles (EVs) presents a significant opportunity for the automotive segment within the solar energy market. Growth in the tourism sector also presents potential for off-grid solar solutions in hotels and resorts.

Growth Accelerators in the Iran Solar Energy Market Industry

Technological advancements, notably in solar panel efficiency and battery storage technology, are pivotal growth catalysts. Strategic partnerships between domestic and international companies facilitate technology transfer and investment. Government support through favorable policies and regulatory frameworks fosters sustained growth and market expansion, while the development of robust local manufacturing capacity strengthens the domestic industry.

Key Players Shaping the Iran Solar Energy Market Market

- MAPNA Group

- Sunergy Holding

- Renewable Energy Industries (REI)

- Saba Battery

- Protek Solar

Notable Milestones in Iran Solar Energy Market Sector

- July 2022: Inauguration of Iran's first solar panel manufacturing plant in Khomein City (500 MW capacity, expandable to 1.5 GW). This significantly boosts domestic production capacity and reduces reliance on imports.

- January 2023: Submission of a bill to parliament seeking approval for the International Solar Alliance (ISA) membership. Joining ISA enhances collaboration and knowledge sharing, fostering further market development.

In-Depth Iran Solar Energy Market Market Outlook

The Iranian solar energy market possesses substantial untapped potential. Continued government support, technological advancements, and strategic investments are projected to fuel market expansion in the coming years. Focusing on cost reduction, grid integration enhancements, and developing localized solutions will be crucial for sustained growth and widespread adoption of solar energy across diverse sectors in Iran. This creates a promising outlook for investors and industry players.

Iran Solar Energy Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Solar Energy Market Segmentation By Geography

- 1. Iran

Iran Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand4.; Growth of Renewables

- 3.3. Market Restrains

- 3.3.1. 4.; Unstable Political Scenario of the Country

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North Iran Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 MAPNA Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sunergy Holding

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Renewable Energy Industries (REI)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Saba Battery

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Protek Solar

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Iran Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Solar Energy Market Volume watts per unit volume Forecast, by Region 2019 & 2032

- Table 3: Iran Solar Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Iran Solar Energy Market Volume watts per unit volume Forecast, by Production Analysis 2019 & 2032

- Table 5: Iran Solar Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Iran Solar Energy Market Volume watts per unit volume Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Iran Solar Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Iran Solar Energy Market Volume watts per unit volume Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Iran Solar Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Iran Solar Energy Market Volume watts per unit volume Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Iran Solar Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Iran Solar Energy Market Volume watts per unit volume Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Iran Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Iran Solar Energy Market Volume watts per unit volume Forecast, by Region 2019 & 2032

- Table 15: Iran Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Iran Solar Energy Market Volume watts per unit volume Forecast, by Country 2019 & 2032

- Table 17: North Iran Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: North Iran Solar Energy Market Volume (watts per unit volume) Forecast, by Application 2019 & 2032

- Table 19: South Iran Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Iran Solar Energy Market Volume (watts per unit volume) Forecast, by Application 2019 & 2032

- Table 21: East Iran Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: East Iran Solar Energy Market Volume (watts per unit volume) Forecast, by Application 2019 & 2032

- Table 23: West Iran Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: West Iran Solar Energy Market Volume (watts per unit volume) Forecast, by Application 2019 & 2032

- Table 25: Iran Solar Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Iran Solar Energy Market Volume watts per unit volume Forecast, by Production Analysis 2019 & 2032

- Table 27: Iran Solar Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Iran Solar Energy Market Volume watts per unit volume Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Iran Solar Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Iran Solar Energy Market Volume watts per unit volume Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Iran Solar Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: Iran Solar Energy Market Volume watts per unit volume Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Iran Solar Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: Iran Solar Energy Market Volume watts per unit volume Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: Iran Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Iran Solar Energy Market Volume watts per unit volume Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Solar Energy Market?

The projected CAGR is approximately 9.00%.

2. Which companies are prominent players in the Iran Solar Energy Market?

Key companies in the market include MAPNA Group , Sunergy Holding , Renewable Energy Industries (REI) , Saba Battery , Protek Solar.

3. What are the main segments of the Iran Solar Energy Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand4.; Growth of Renewables.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Unstable Political Scenario of the Country.

8. Can you provide examples of recent developments in the market?

January 2023: Iranian authorities submitted a bill to parliament seeking approval for the International Solar Alliance. The International Solar Alliance (ISA) is an action-oriented platform that members drive and that promotes increased deployment of solar energy technologies, in addition to ensuring energy accessibility and security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in watts per unit volume.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Solar Energy Market?

To stay informed about further developments, trends, and reports in the Iran Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence