Key Insights

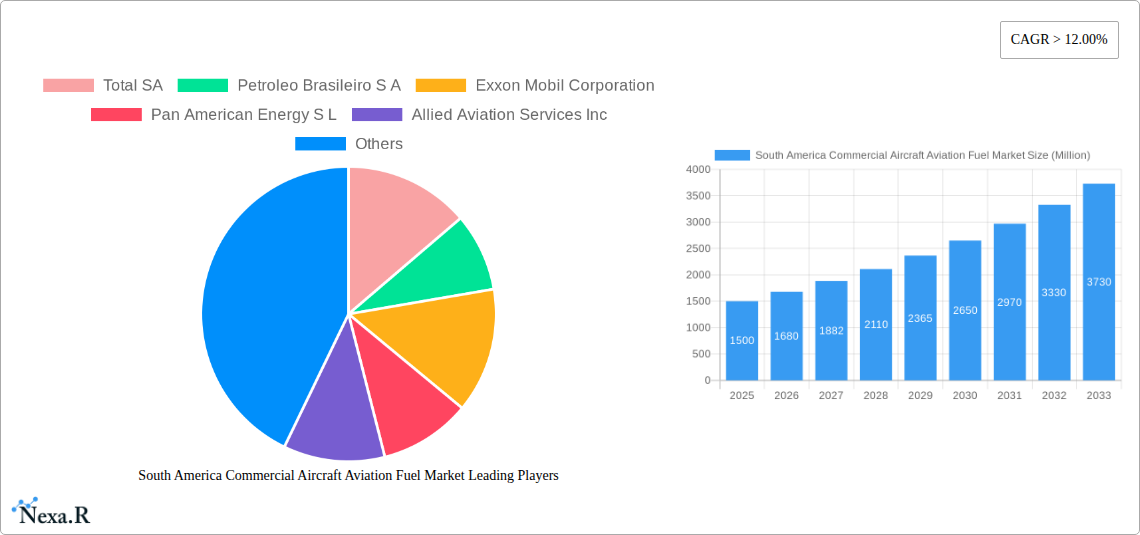

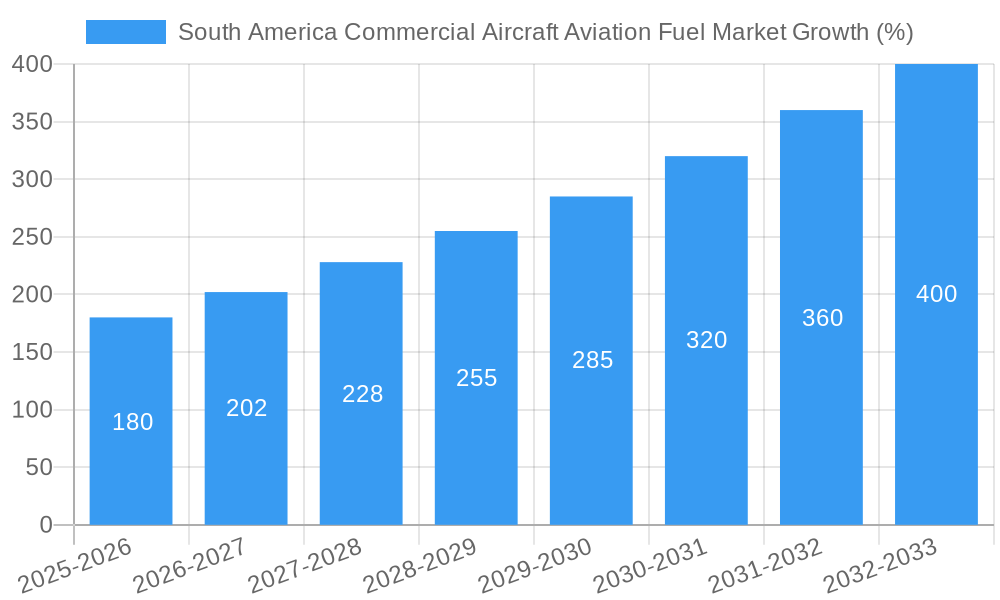

The South American commercial aircraft aviation fuel market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 12% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing number of air passengers in rapidly developing South American economies like Brazil and Argentina fuels demand for air travel and consequently, aviation fuel. Secondly, the expansion of regional airline networks and the growing adoption of larger, more fuel-efficient commercial airplanes contribute significantly to market growth. Furthermore, government initiatives promoting tourism and infrastructure development in the region are indirectly boosting the demand for aviation fuel. While price volatility in crude oil represents a significant restraint, the long-term outlook remains positive due to the predicted sustained growth in air travel within South America. The market segmentation reveals that Air Turbine Fuel (ATF) currently dominates the fuel type segment, followed by AVGAS, with aviation biofuel gradually gaining traction, reflecting a growing focus on sustainability. The commercial airplane segment constitutes the largest portion of the aircraft type segment, mirroring the overall dominance of scheduled passenger flights. Airlines and cargo carriers remain the primary end-users, although the private aircraft ownership segment is expected to show modest growth. Major players such as Total SA, Petrobras, ExxonMobil, and Shell are actively competing in this lucrative market, constantly adapting to market dynamics and regulatory changes.

The South American aviation fuel market presents a compelling investment opportunity, offering substantial returns despite inherent risks associated with oil price fluctuations. The market's future trajectory depends heavily on continued economic expansion in the region, sustained investments in airport infrastructure, and the adoption of more efficient and environmentally friendly aviation technologies. This includes the increasing adoption of sustainable aviation fuels (SAFs), potentially mitigating the environmental impact of the industry while presenting a new growth avenue for the market. The competitive landscape necessitates a keen understanding of regulatory frameworks and market trends to secure a profitable position.

South America Commercial Aircraft Aviation Fuel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Commercial Aircraft Aviation Fuel Market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and estimated year. The forecast period spans 2025-2033, and the historical period analyzed is 2019-2024. This report is crucial for airlines, fuel suppliers, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader South American energy sector, while the child market focuses specifically on aviation fuel for commercial aircraft.

South America Commercial Aircraft Aviation Fuel Market Dynamics & Structure

This section analyzes the market's structure, identifying key dynamics influencing its growth trajectory. We delve into market concentration, examining the market share held by major players like Total SA, Petroleo Brasileiro S A, Exxon Mobil Corporation, and others. Technological innovations, including the rise of sustainable aviation fuels (SAFs), are assessed alongside their impact on market competition. Regulatory frameworks, such as environmental regulations and fuel standards, are analyzed for their influence on market behavior. The report also examines the presence of competitive product substitutes and their market penetration. Finally, we explore end-user demographics (airlines, cargo carriers, private owners), their fuel consumption patterns, and the impact of mergers and acquisitions (M&A) activities on market consolidation.

- Market Concentration: The South American commercial aircraft aviation fuel market exhibits a moderately concentrated structure, with xx% market share held by the top five players in 2025.

- Technological Innovation: The adoption of SAFs is expected to increase gradually, with a projected xx% market share by 2033. Innovation barriers include high production costs and limited infrastructure.

- Regulatory Framework: Stringent environmental regulations are driving the transition towards sustainable aviation fuels. Compliance costs represent a significant challenge for smaller players.

- M&A Activity: The number of M&A deals in the aviation fuel sector in South America averaged xx per year during 2019-2024. Consolidation is anticipated to continue.

- End-User Demographics: Airlines account for xx% of the total fuel consumption, followed by cargo carriers (xx%) and private aircraft owners (xx%).

South America Commercial Aircraft Aviation Fuel Market Growth Trends & Insights

This section details the market's historical and projected growth, providing a comprehensive overview of its evolution. We analyze market size evolution from 2019 to 2024, highlighting key growth drivers and underlying trends. Adoption rates of different fuel types (ATF, biofuels, AVGAS) are examined, considering factors like price volatility, technological advancements, and environmental regulations. The analysis includes a detailed examination of technological disruptions, including the impact of SAFs and other innovative fuel technologies. Consumer behavior shifts, including airline fleet renewal strategies and evolving fuel efficiency standards, are explored in relation to their impact on demand. Detailed metrics, such as CAGR and market penetration rates, are provided to illuminate the market's growth trajectory. The report projects a CAGR of xx% for the South American commercial aircraft aviation fuel market during the forecast period (2025-2033), reaching a market size of xx million units by 2033.

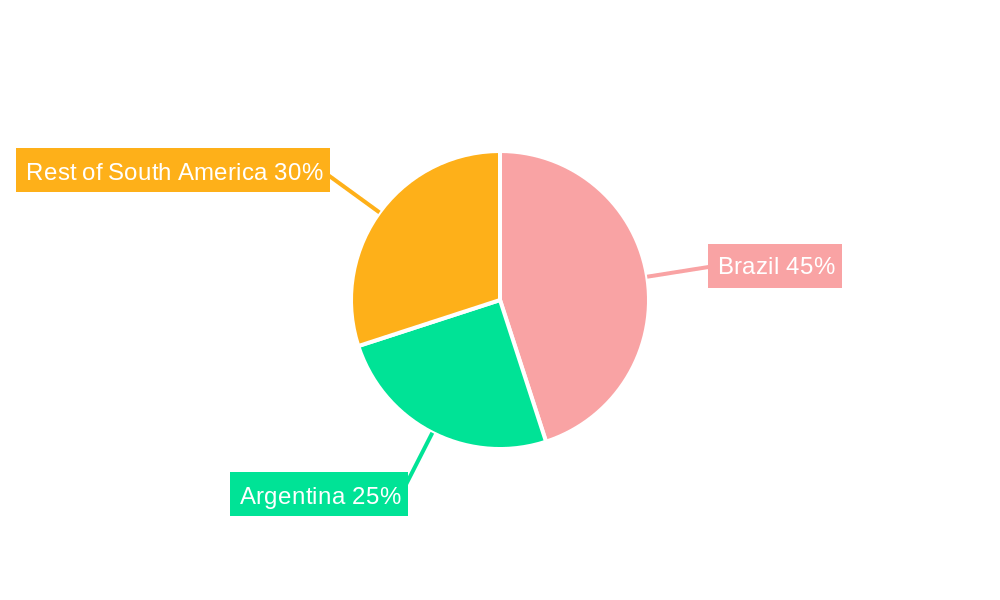

Dominant Regions, Countries, or Segments in South America Commercial Aircraft Aviation Fuel Market

This section pinpoints the leading regions, countries, and segments within the South American commercial aircraft aviation fuel market. We analyze the market dominance of different fuel types (ATF, Aviation Biofuel, AVGAS), aircraft types (Commercial Airplanes, Business Jets, Turboprops), and end-users (Airlines, Cargo Carriers, Private Aircraft Owners). Brazil is expected to remain the dominant market, driven by strong economic growth and a large airline industry. The report examines specific factors driving growth in each region and segment, including economic policies, infrastructure development, and government regulations. Detailed analysis of market share and growth potential is included for each segment.

- Fuel Type: ATF dominates the market, accounting for over xx% of the total consumption in 2025. Aviation Biofuel is expected to experience the fastest growth.

- Aircraft Type: Commercial airplanes represent the largest segment, accounting for xx% of total fuel consumption.

- End User: Airlines represent the largest end-user segment.

- Key Drivers: Brazil's expanding air travel sector and investments in airport infrastructure are major drivers of growth.

- Growth Potential: Countries with developing air travel infrastructure (e.g., Colombia, Peru) offer significant growth potential.

South America Commercial Aircraft Aviation Fuel Market Product Landscape

This section provides a concise overview of the product landscape, detailing innovations in aviation fuels and their applications. We discuss advancements in fuel formulations, focusing on performance metrics such as energy density, emissions, and cost-effectiveness. The unique selling propositions (USPs) of various fuel types and their technological advancements are highlighted. The focus is on sustainable aviation fuels and their increasing adoption by airlines to meet carbon reduction targets.

Key Drivers, Barriers & Challenges in South America Commercial Aircraft Aviation Fuel Market

This section outlines the key drivers and barriers influencing market growth. Drivers include factors such as rising air passenger traffic, increased cargo transportation, economic expansion, and government initiatives supporting the aviation sector. Challenges include price volatility of crude oil, stringent environmental regulations, the high cost of sustainable aviation fuels, and infrastructural limitations.

Key Drivers:

- Growing air passenger traffic.

- Expanding e-commerce and associated cargo transportation.

- Economic growth in several South American countries.

Key Challenges:

- Crude oil price volatility impacting fuel costs.

- Stringent environmental regulations increasing compliance costs.

- Limited availability and high cost of sustainable aviation fuels.

Emerging Opportunities in South America Commercial Aircraft Aviation Fuel Market

This section highlights emerging trends and opportunities. We explore potential untapped markets, focusing on regions with emerging air travel sectors. Innovative applications of aviation fuels, such as the development of SAFs and other sustainable alternatives, are highlighted. Evolving consumer preferences and regulatory changes are analyzed to identify potential future opportunities within the market.

Growth Accelerators in the South America Commercial Aircraft Aviation Fuel Market Industry

This section discusses catalysts that could accelerate long-term market growth. Emphasis is placed on technological breakthroughs in fuel efficiency and sustainability. Strategic partnerships and collaborative initiatives between fuel suppliers and airlines are highlighted. Market expansion strategies focusing on emerging economies and improving aviation infrastructure are also discussed.

Key Players Shaping the South America Commercial Aircraft Aviation Fuel Market Market

- Total SA

- Petroleo Brasileiro S A

- Exxon Mobil Corporation

- Pan American Energy S L

- Allied Aviation Services Inc

- Royal Dutch Shell PLC

- BP PLC

- Repsol SA

Notable Milestones in South America Commercial Aircraft Aviation Fuel Market Sector

- 2022 Q4: Petroleo Brasileiro S A announced investments in SAF production facilities.

- 2023 Q1: TotalEnergies partnered with a South American airline to test SAF blends.

- 2024 Q2: New environmental regulations were implemented, impacting fuel specifications. (Further specific milestones will be added upon data availability)

In-Depth South America Commercial Aircraft Aviation Fuel Market Market Outlook

This concluding section summarizes the market's future potential and strategic opportunities. It reiterates the key growth accelerators discussed previously and emphasizes the long-term growth prospects of the market, particularly driven by the increasing adoption of SAFs and the sustained growth of air travel in South America. The report underscores the importance of strategic partnerships and investments in sustainable fuel infrastructure for achieving long-term success within this dynamic market.

South America Commercial Aircraft Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Air Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

- 1.3. AVGAS

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Commercial Aircraft Aviation Fuel Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Commercial Aircraft Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. ATF to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Air Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.1.3. AVGAS

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Brazil South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Air Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.1.3. AVGAS

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Argentina South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Air Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.1.3. AVGAS

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Colombia South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Air Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.1.3. AVGAS

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of South America South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Air Turbine Fuel (ATF)

- 9.1.2. Aviation Biofuel

- 9.1.3. AVGAS

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Brazil South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Total SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Petroleo Brasileiro S A

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Exxon Mobil Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Pan American Energy S L

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Allied Aviation Services Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Royal Dutch Shell PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BP PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Repsol SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Total SA

List of Figures

- Figure 1: South America Commercial Aircraft Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Commercial Aircraft Aviation Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 3: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America Commercial Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America Commercial Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America Commercial Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 19: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Commercial Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Commercial Aircraft Aviation Fuel Market?

The projected CAGR is approximately > 12.00%.

2. Which companies are prominent players in the South America Commercial Aircraft Aviation Fuel Market?

Key companies in the market include Total SA, Petroleo Brasileiro S A, Exxon Mobil Corporation, Pan American Energy S L, Allied Aviation Services Inc, Royal Dutch Shell PLC, BP PLC, Repsol SA.

3. What are the main segments of the South America Commercial Aircraft Aviation Fuel Market?

The market segments include Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

ATF to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Commercial Aircraft Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Commercial Aircraft Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Commercial Aircraft Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the South America Commercial Aircraft Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence