Key Insights

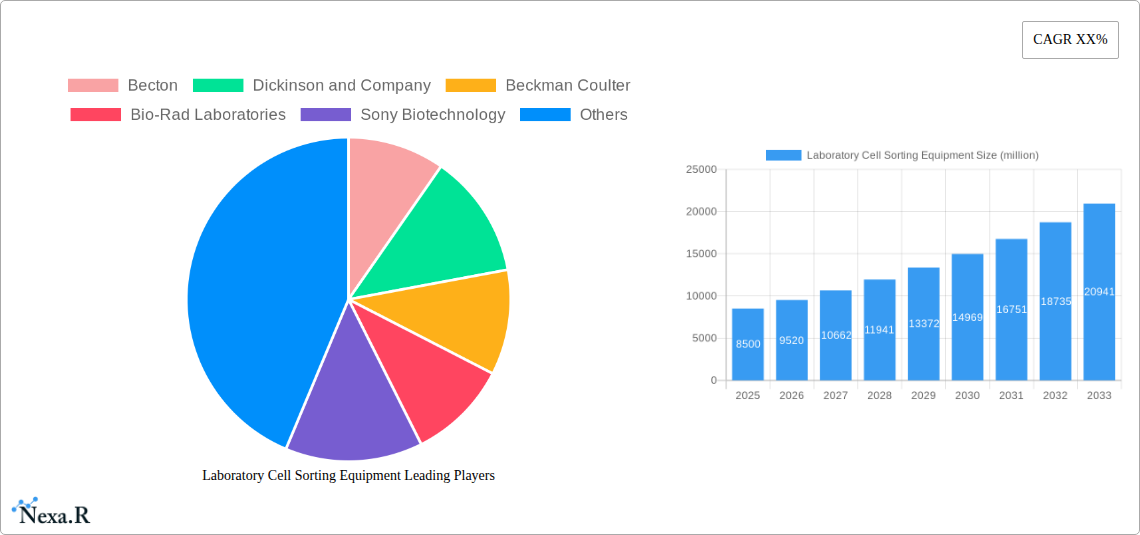

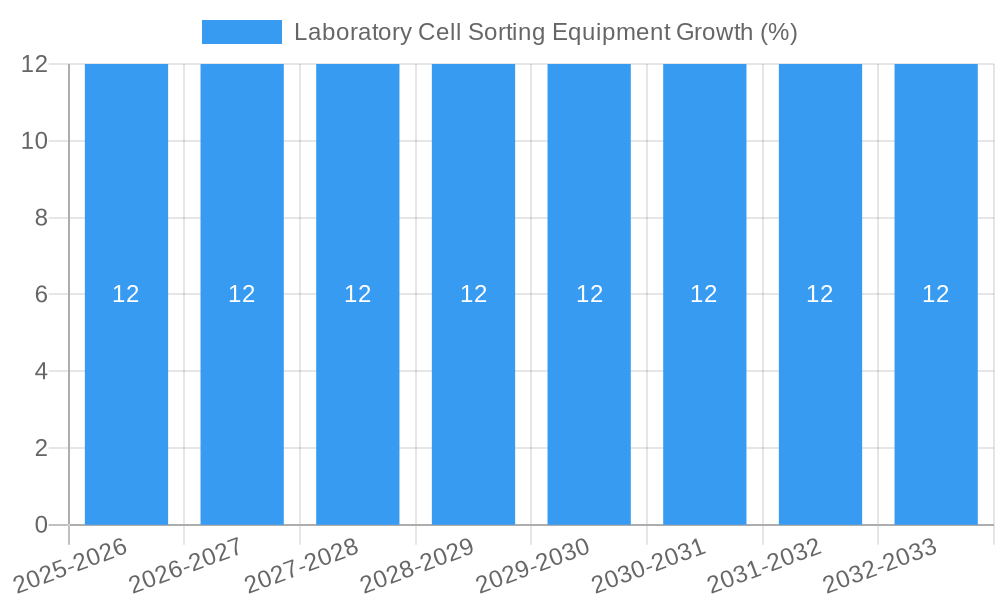

The global laboratory cell sorting equipment market is poised for significant expansion, projected to reach an estimated USD 8,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% anticipated from 2025 through 2033. This dynamic growth is primarily fueled by the escalating demand for advanced cell analysis and isolation techniques across a wide spectrum of life science disciplines. Scientific research institutes and university laboratories are at the forefront of this demand, leveraging cell sorting for fundamental research in genetics, immunology, and developmental biology. Furthermore, the burgeoning pharmaceutical and biotechnology sectors are heavily investing in cell sorting for drug discovery, personalized medicine development, and the production of cell-based therapeutics. The increasing prevalence of chronic diseases and cancer, coupled with a growing emphasis on early disease detection and diagnostics, are also key drivers propelling the market forward. Technological advancements, such as the integration of Artificial Intelligence (AI) and machine learning for enhanced sorting accuracy and throughput, are further shaping the market landscape and driving innovation.

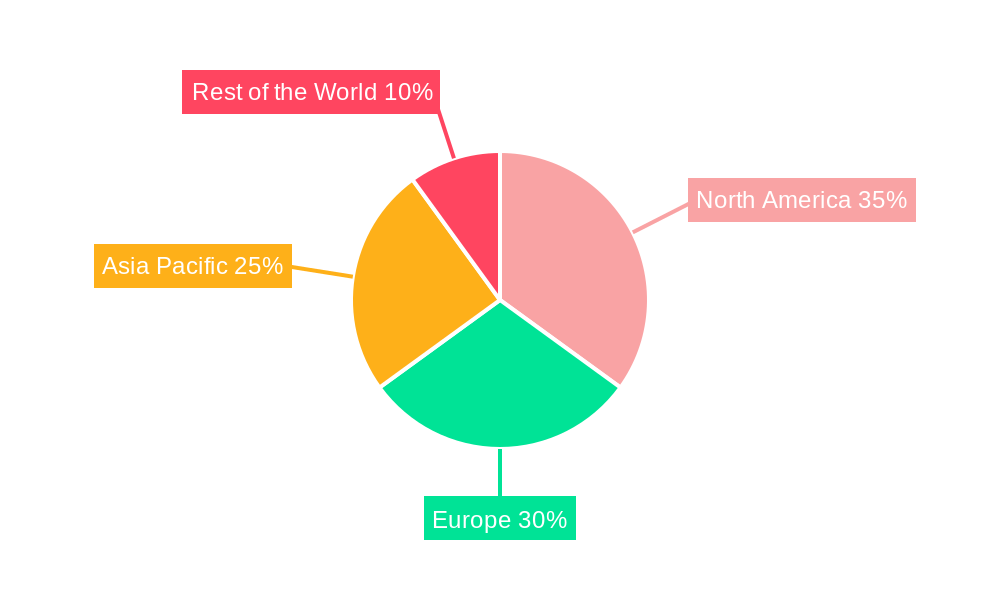

The market is segmented into key applications, with scientific research institutes, universities, and pharmaceutical companies dominating adoption due to their extensive research and development activities. Hospitals are also emerging as significant end-users, particularly in the fields of diagnostics and clinical research. In terms of technology, Fluorescent Activated Cell Sorting (FACS) represents the most prominent segment, owing to its high precision and versatility. However, Magnetic-activated Cell Sorting (MACS) is gaining traction due to its efficiency and cost-effectiveness for specific applications. The MEMS - Microfluidics segment, though nascent, holds immense potential for miniaturized and high-throughput cell analysis. Geographically, North America and Europe currently lead the market, driven by established research infrastructures and significant R&D investments. The Asia Pacific region, however, is exhibiting the fastest growth, propelled by increasing government support for life sciences research, a rising number of research collaborations, and a growing biopharmaceutical industry in countries like China and India. Despite the optimistic outlook, certain restraints such as the high initial cost of sophisticated cell sorting equipment and the need for specialized personnel can pose challenges to widespread adoption, particularly in resource-limited settings.

Here's an SEO-optimized report description for Laboratory Cell Sorting Equipment, incorporating your specific requirements and keywords:

Report Title: Laboratory Cell Sorting Equipment Market: Global Analysis, Trends, and Forecast (2019-2033)

Report Description:

Unlock critical insights into the burgeoning global Laboratory Cell Sorting Equipment market, a vital segment within the broader life sciences and biotechnology industries. This comprehensive report delivers an in-depth analysis of fluorescent activated cell sorting (FACS) and magnetic-activated cell sorting (MACS) technologies, alongside the emerging MEMS - Microfluidics based solutions. With a robust study period spanning 2019 to 2033, a base year of 2025, and a detailed forecast period of 2025 to 2033, this report provides actionable intelligence for pharmaceutical companies, biotechnology firms, scientific research institutes, universities, and hospitals.

Explore the intricate market dynamics, technological advancements, and competitive landscape, identifying key drivers, barriers, and emerging opportunities. This report offers granular details on the parent market (e.g., life science instrumentation) and the child market (laboratory cell sorting equipment), providing a holistic view of market evolution and potential. Gain strategic advantage by understanding market concentration, innovation drivers, regulatory influences, and the impact of M&A activities. Quantifiable data, including market share percentages and M&A deal volumes, combined with qualitative analysis, empowers informed decision-making.

This report is essential for stakeholders seeking to understand market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior, with projected market values in millions of USD. Identify dominant regions and countries driving growth, analyze product innovations and their applications, and uncover the key players shaping the future of cell sorting technology. Strategic insights into growth accelerators, including technological breakthroughs and market expansion strategies, are meticulously detailed.

Key Features:

- Comprehensive Market Analysis: Detailed examination of market dynamics, growth trends, and future outlook.

- Segmented Insights: In-depth analysis across applications (Scientific Research Institutes, University, Pharmaceutical Company, Hospital, Others) and types (Fluorescent Activated Cell Sorting, Magnetic-activated Cell Sorting, MEMS - Microfluidics).

- Global & Regional Focus: Identification of dominant regions and countries influencing market growth.

- Competitive Intelligence: Profiles of key players, notable milestones, and competitive product landscape.

- Data-Driven Forecast: Robust projections from 2025-2033, based on historical data (2019-2024) and a 2025 base year.

- Quantifiable Metrics: Market share percentages, CAGR, market penetration, and M&A deal volumes in millions.

Target Audience:

- Life Science Researchers

- Biotechnology Professionals

- Pharmaceutical Industry Stakeholders

- Academic Institutions

- Hospital Research Departments

- Investment Analysts

- Equipment Manufacturers and Suppliers

Order this indispensable report today to navigate the evolving Laboratory Cell Sorting Equipment market and capitalize on future growth opportunities.

Laboratory Cell Sorting Equipment Market Dynamics & Structure

The global laboratory cell sorting equipment market is characterized by a moderate to high level of concentration, with a few established players holding significant market share. Key technological innovation drivers include the increasing demand for high-throughput screening, precision diagnostics, and personalized medicine. Advancements in optics, fluidics, and automation are continuously pushing the boundaries of cell sorting capabilities, enabling finer resolution and greater efficiency. The regulatory frameworks governing the development and deployment of these sophisticated instruments, particularly for clinical applications, are becoming more stringent, emphasizing data integrity and patient safety. Competitive product substitutes, while limited for core cell sorting functionalities, exist in the form of alternative analytical techniques that offer complementary data. End-user demographics are diverse, ranging from academic researchers exploring fundamental biological processes to pharmaceutical companies developing novel therapeutics and hospitals implementing advanced diagnostic procedures. Mergers and acquisitions (M&A) are a notable trend, reflecting the industry's drive for consolidation, technology acquisition, and market expansion. For instance, recent years have seen several strategic partnerships and acquisitions aimed at integrating advanced software solutions or expanding geographic reach.

- Market Concentration: Moderate to high, with key players dominating specific niches.

- Technological Innovation Drivers: High-throughput screening, precision diagnostics, personalized medicine, AI integration in data analysis.

- Regulatory Frameworks: Increasing stringency for clinical applications, focusing on data validation and safety.

- Competitive Product Substitutes: Limited, but emerging technologies offer complementary analytical capabilities.

- End-User Demographics: Academics, pharmaceutical, biotech, clinical diagnostics, research institutes.

- M&A Trends: Active consolidation, technology acquisition, and strategic collaborations.

- Innovation Barriers: High R&D costs, complex integration of multiple technologies, and stringent validation processes.

Laboratory Cell Sorting Equipment Growth Trends & Insights

The global Laboratory Cell Sorting Equipment market is poised for substantial expansion, driven by an escalating need for advanced tools in biological research, drug discovery, and clinical diagnostics. The market size evolution indicates a consistent upward trajectory, with the base year 2025 witnessing significant activity, projected to reach approximately 1,850 million USD. This growth is further bolstered by increasing adoption rates of sophisticated cell sorting technologies, particularly fluorescent activated cell sorting (FACS), which continues to dominate due to its versatility and precision. However, magnetic-activated cell sorting (MACS) is gaining traction for specific enrichment applications, and MEMS - Microfluidics based sorters are emerging as disruptive innovations promising miniaturization, cost-effectiveness, and higher throughput for certain applications.

Technological disruptions are a constant feature, with ongoing advancements in laser technology, detector sensitivity, and software algorithms enhancing sorting accuracy and speed. The integration of artificial intelligence (AI) and machine learning for data interpretation and quality control is a significant emerging trend. Consumer behavior shifts are also playing a crucial role, with researchers and clinicians increasingly demanding user-friendly interfaces, comprehensive data analysis capabilities, and customizable solutions that can adapt to diverse experimental needs. The growing understanding of cellular heterogeneity and its implications in disease pathogenesis is fueling demand for high-resolution cell sorting to isolate specific cell populations for downstream analysis.

The forecast period, 2025–2033, is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.2%, reaching an estimated market valuation of 3,200 million USD by 2033. This robust growth is underpinned by increased government funding for life science research, growing investments from pharmaceutical and biotechnology companies in R&D, and the expanding applications of cell sorting in areas like cancer immunotherapy, stem cell research, and infectious disease diagnostics. Market penetration is deepening across both established and emerging economies as awareness of the benefits of precise cell isolation grows.

The historical period, 2019–2024, laid a strong foundation, characterized by steady growth and incremental technological improvements, with a market size of approximately 1,500 million USD in 2024. The COVID-19 pandemic, while initially disruptive, also highlighted the critical role of cell sorting in vaccine development and viral research, leading to accelerated innovation and investment in certain sub-segments. Overall, the market is demonstrating resilience and a strong forward momentum, fueled by scientific progress and unmet clinical needs.

Dominant Regions, Countries, or Segments in Laboratory Cell Sorting Equipment

The Laboratory Cell Sorting Equipment market is experiencing robust growth, with distinct regional and segmental dominance factors. Globally, North America, particularly the United States, stands out as the leading region, driven by a confluence of factors including a well-established life science research ecosystem, substantial government funding for scientific endeavors, and a high concentration of leading pharmaceutical and biotechnology companies. The presence of numerous scientific research institutes and universities with cutting-edge research programs significantly fuels the demand for advanced cell sorting technologies. The Pharmaceutical Company segment, within the application landscape, emerges as a dominant force, investing heavily in R&D for drug discovery and development, where precise cell isolation is paramount for target validation and efficacy studies.

In terms of technology types, Fluorescent Activated Cell Sorting (FACS) currently commands the largest market share due to its versatility, high throughput, and multicolor analysis capabilities, making it indispensable for a wide range of applications from basic research to clinical diagnostics. However, Magnetic-activated Cell Sorting (MACS) is a rapidly growing segment, particularly favored for cell enrichment and depletion tasks where simplicity and speed are critical. The emerging MEMS - Microfluidics based cell sorting technology, while still nascent, presents immense potential for miniaturization, cost reduction, and integration into point-of-care diagnostics, indicating significant future growth and potential to disrupt established segments.

Key drivers for North America's dominance include strong intellectual property protection, a favorable regulatory environment for innovation, and a highly skilled workforce. Economic policies that support research and development, alongside significant investments in healthcare infrastructure, further bolster market expansion. The market share within North America is estimated to be around 38% of the global market in 2025.

Europe, particularly countries like Germany, the United Kingdom, and Switzerland, represents the second-largest market, characterized by a strong academic research base and a robust pharmaceutical industry. Asia Pacific, led by China and Japan, is the fastest-growing region, driven by increasing government investments in biotechnology, expanding healthcare infrastructure, and a growing demand for advanced diagnostic tools. The Hospital segment, within applications, is also demonstrating accelerated growth, driven by the increasing adoption of cell sorting for diagnostic purposes, especially in hematology and oncology.

The dominance of FACS is further solidified by its widespread use in immunology, cancer research, and stem cell biology, areas that continue to receive substantial funding and attention. The growth potential for MEMS - Microfluidics is particularly high in applications requiring high-volume, low-cost cell analysis, potentially opening up new market segments and use cases. Understanding these regional and segmental dynamics is crucial for stakeholders aiming to strategize for market entry, expansion, or investment in the global laboratory cell sorting equipment sector.

Laboratory Cell Sorting Equipment Product Landscape

The laboratory cell sorting equipment product landscape is dynamic, marked by continuous innovation focused on enhancing throughput, accuracy, and multiplexing capabilities. Key advancements include the development of high-speed sorters capable of processing thousands of cells per second, alongside systems offering exceptional purity and viability of sorted cells. Sophisticated spectral detection systems, enabling the simultaneous analysis of a greater number of fluorescent markers, are a notable trend, expanding the complexity of cellular populations that can be analyzed. User-friendly software interfaces, coupled with advanced data analysis algorithms, are increasingly integrated to streamline workflows and provide deeper biological insights. Unique selling propositions often revolve around the ability to sort rare cell populations, perform single-cell dispensing for genomics and transcriptomics applications, and offer robust automation for increased reproducibility. The introduction of benchtop and portable cell sorters also signifies a move towards democratizing access to this technology.

Key Drivers, Barriers & Challenges in Laboratory Cell Sorting Equipment

Key Drivers:

- Rising Prevalence of Chronic Diseases: The increasing incidence of cancer, autoimmune disorders, and infectious diseases necessitates advanced diagnostic and research tools, including cell sorters, for better understanding and treatment.

- Growth in Biologics and Personalized Medicine: The expanding market for biologics and the shift towards personalized medicine require precise cell isolation for therapeutic development and patient stratification.

- Technological Advancements: Continuous improvements in fluorescence detection, laser technology, and microfluidics are enhancing sorting efficiency, accuracy, and speed.

- Increasing R&D Investments: Significant investments by pharmaceutical, biotechnology companies, and government research agencies in life sciences research fuel the demand for sophisticated laboratory equipment.

- Expanding Applications in Research: The growing use of cell sorting in fields like stem cell research, immunology, and regenerative medicine continues to drive market growth.

Barriers & Challenges:

- High Initial Cost of Equipment: Advanced cell sorting systems represent a substantial capital investment, which can be a barrier for smaller research labs or institutions with limited budgets.

- Complex Operation and Maintenance: Operating and maintaining sophisticated cell sorters requires specialized training and expertise, limiting widespread adoption in less specialized settings.

- Stringent Regulatory Hurdles: For clinical diagnostic applications, obtaining regulatory approval can be a time-consuming and costly process.

- Data Analysis Complexity: While software is improving, the sheer volume and complexity of data generated by high-throughput cell sorters can be challenging to manage and interpret effectively.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of critical components, leading to production delays and increased costs.

Emerging Opportunities in Laboratory Cell Sorting Equipment

Emerging opportunities in the laboratory cell sorting equipment market are centered around advancements in microfluidics, AI integration, and the expansion into novel research and clinical applications. The development of highly integrated, benchtop MEMS-based cell sorters promises to lower costs and increase accessibility, opening doors for use in point-of-care diagnostics and resource-limited settings. The application of AI and machine learning in interpreting complex sorting data and predicting optimal sorting parameters presents a significant growth area, enhancing efficiency and enabling new discovery pathways. Furthermore, the growing interest in single-cell multi-omics analysis, where precise cell isolation is a prerequisite, offers substantial potential. The increasing focus on liquid biopsies for cancer detection and monitoring also creates demand for highly sensitive cell sorting techniques to isolate rare tumor cells from blood.

Growth Accelerators in the Laboratory Cell Sorting Equipment Industry

Several catalysts are accelerating long-term growth in the laboratory cell sorting equipment industry. Technological breakthroughs, such as the development of more sensitive fluorescent dyes and novel detection systems, are continuously expanding the capabilities of FACS. The integration of automation and robotics for sample preparation and post-sorting processing is significantly boosting throughput and reducing hands-on time, making cell sorting more amenable to high-volume applications. Strategic partnerships between equipment manufacturers and reagent developers are fostering a more integrated ecosystem, providing comprehensive solutions for specific research challenges. Moreover, market expansion strategies targeting emerging economies, where demand for advanced life science instrumentation is rapidly growing, are crucial growth accelerators. The increasing application of cell sorting in cell and gene therapy development and manufacturing is another significant driver, creating sustained demand for highly precise and scalable sorting solutions.

Key Players Shaping the Laboratory Cell Sorting Equipment Market

- Becton, Dickinson and Company

- Beckman Coulter

- Bio-Rad Laboratories

- Sony Biotechnology

- Miltenyi Biotec GmbH

- Union Biometrica, Inc

- Bay Bioscience

- Cytonome/St, LLC

- On-Chip Biotechnologies Co.,Ltd.

Notable Milestones in Laboratory Cell Sorting Equipment Sector

- 2019: Introduction of enhanced spectral flow cytometers enabling analysis of over 40 parameters.

- 2020: Launch of automated cell sorting systems with advanced AI-driven software for improved data analysis.

- 2021: Significant advancements in microfluidic cell sorting leading to more portable and cost-effective devices.

- 2022: Increased investment and product development in cell sorting for CAR-T therapy manufacturing.

- 2023: Emergence of cloud-based data management and analysis platforms for cell sorting data.

- 2024: Introduction of novel fluorescent markers and reagents designed for higher sensitivity and specificity in cell sorting.

In-Depth Laboratory Cell Sorting Equipment Market Outlook

The future outlook for the laboratory cell sorting equipment market remains exceptionally bright, driven by the persistent advancements in biological sciences and the growing demand for precision in research and clinical applications. Growth accelerators, including the expansion of cell and gene therapy markets, the increasing utility of cell sorting in immunotherapy research, and the burgeoning field of liquid biopsies, will continue to fuel market expansion. Strategic opportunities lie in developing more integrated, user-friendly, and cost-effective solutions, particularly those leveraging MEMS technology and AI. Further penetration into emerging markets and the development of specialized instruments for niche applications will also be key to sustained growth. The market is expected to evolve towards more automated, high-throughput systems that provide comprehensive data analytics, solidifying its indispensable role in modern biological discovery and healthcare.

Laboratory Cell Sorting Equipment Segmentation

-

1. Application

- 1.1. Scientific Research Institutes

- 1.2. University

- 1.3. Pharmaceutical Company

- 1.4. Hospital

- 1.5. Others

-

2. Types

- 2.1. Fluorescent Activated Cell Sorting

- 2.2. Magnetic-activated Cell Sorting

- 2.3. MEMS - Microfluidics

Laboratory Cell Sorting Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laboratory Cell Sorting Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laboratory Cell Sorting Equipment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Scientific Research Institutes

- 5.1.2. University

- 5.1.3. Pharmaceutical Company

- 5.1.4. Hospital

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fluorescent Activated Cell Sorting

- 5.2.2. Magnetic-activated Cell Sorting

- 5.2.3. MEMS - Microfluidics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Laboratory Cell Sorting Equipment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Scientific Research Institutes

- 6.1.2. University

- 6.1.3. Pharmaceutical Company

- 6.1.4. Hospital

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fluorescent Activated Cell Sorting

- 6.2.2. Magnetic-activated Cell Sorting

- 6.2.3. MEMS - Microfluidics

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Laboratory Cell Sorting Equipment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Scientific Research Institutes

- 7.1.2. University

- 7.1.3. Pharmaceutical Company

- 7.1.4. Hospital

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fluorescent Activated Cell Sorting

- 7.2.2. Magnetic-activated Cell Sorting

- 7.2.3. MEMS - Microfluidics

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Laboratory Cell Sorting Equipment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Scientific Research Institutes

- 8.1.2. University

- 8.1.3. Pharmaceutical Company

- 8.1.4. Hospital

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fluorescent Activated Cell Sorting

- 8.2.2. Magnetic-activated Cell Sorting

- 8.2.3. MEMS - Microfluidics

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Laboratory Cell Sorting Equipment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Scientific Research Institutes

- 9.1.2. University

- 9.1.3. Pharmaceutical Company

- 9.1.4. Hospital

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fluorescent Activated Cell Sorting

- 9.2.2. Magnetic-activated Cell Sorting

- 9.2.3. MEMS - Microfluidics

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Laboratory Cell Sorting Equipment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Scientific Research Institutes

- 10.1.2. University

- 10.1.3. Pharmaceutical Company

- 10.1.4. Hospital

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fluorescent Activated Cell Sorting

- 10.2.2. Magnetic-activated Cell Sorting

- 10.2.3. MEMS - Microfluidics

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Becton

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dickinson and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Beckman Coulter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio-Rad Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sony Biotechnology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Miltenyi Biotec GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Union Biometrica

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bay Bioscience

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cytonome/St

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 On-Chip Biotechnologies Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Becton

List of Figures

- Figure 1: Global Laboratory Cell Sorting Equipment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Laboratory Cell Sorting Equipment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Laboratory Cell Sorting Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Laboratory Cell Sorting Equipment Revenue (million), by Types 2024 & 2032

- Figure 5: North America Laboratory Cell Sorting Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Laboratory Cell Sorting Equipment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Laboratory Cell Sorting Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Laboratory Cell Sorting Equipment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Laboratory Cell Sorting Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Laboratory Cell Sorting Equipment Revenue (million), by Types 2024 & 2032

- Figure 11: South America Laboratory Cell Sorting Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Laboratory Cell Sorting Equipment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Laboratory Cell Sorting Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Laboratory Cell Sorting Equipment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Laboratory Cell Sorting Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Laboratory Cell Sorting Equipment Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Laboratory Cell Sorting Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Laboratory Cell Sorting Equipment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Laboratory Cell Sorting Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Laboratory Cell Sorting Equipment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Laboratory Cell Sorting Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Laboratory Cell Sorting Equipment Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Laboratory Cell Sorting Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Laboratory Cell Sorting Equipment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Laboratory Cell Sorting Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Laboratory Cell Sorting Equipment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Laboratory Cell Sorting Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Laboratory Cell Sorting Equipment Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Laboratory Cell Sorting Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Laboratory Cell Sorting Equipment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Laboratory Cell Sorting Equipment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Laboratory Cell Sorting Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Laboratory Cell Sorting Equipment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laboratory Cell Sorting Equipment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Laboratory Cell Sorting Equipment?

Key companies in the market include Becton, Dickinson and Company, Beckman Coulter, Bio-Rad Laboratories, Sony Biotechnology, Miltenyi Biotec GmbH, Union Biometrica, Inc, Bay Bioscience, Cytonome/St, LLC, On-Chip Biotechnologies Co., Ltd..

3. What are the main segments of the Laboratory Cell Sorting Equipment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laboratory Cell Sorting Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laboratory Cell Sorting Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laboratory Cell Sorting Equipment?

To stay informed about further developments, trends, and reports in the Laboratory Cell Sorting Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence