Key Insights

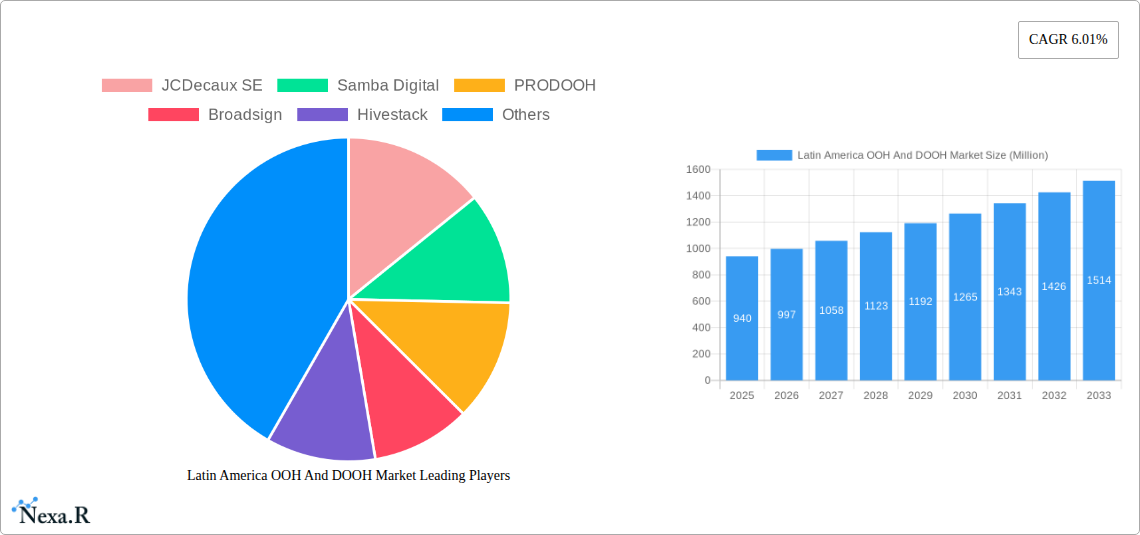

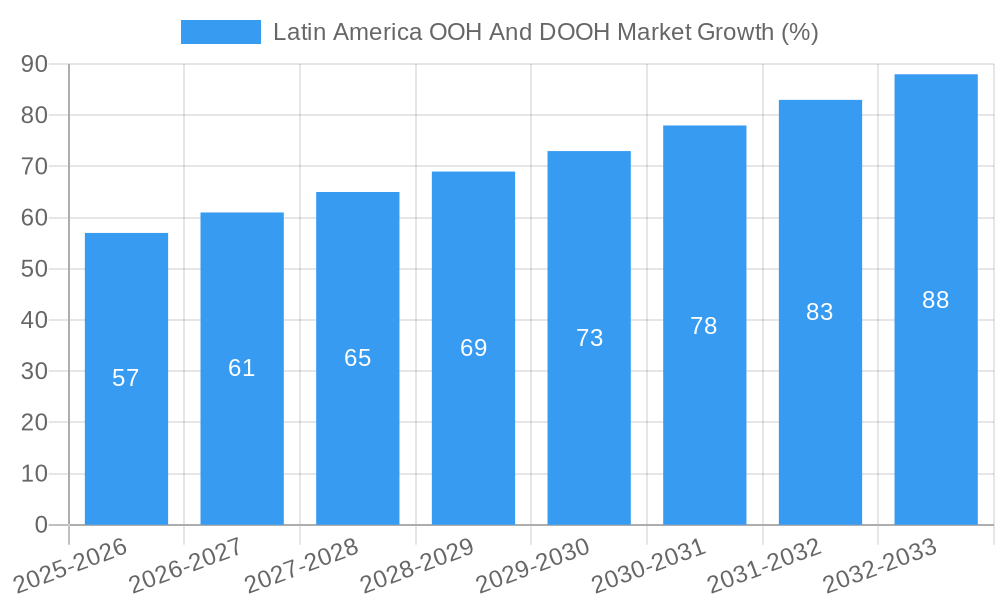

The Latin American Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market presents a compelling growth opportunity. With a 2025 market size of $940 million (based on the provided 0.94 billion value unit, assuming "million" as the unit), and a Compound Annual Growth Rate (CAGR) of 6.01%, the market is projected to experience significant expansion through 2033. This growth is fueled by increasing urbanization, rising smartphone penetration driving programmatic DOOH adoption, and a growing middle class with increased disposable income leading to higher ad spending. Furthermore, the strategic implementation of innovative DOOH formats, such as interactive displays and location-based advertising, are enhancing audience engagement and driving advertiser interest. The market is witnessing a shift towards data-driven campaigns and precise audience targeting, enhancing the effectiveness and measurability of OOH advertising. This makes the Latin American OOH and DOOH market an attractive prospect for both established players and new entrants.

However, certain challenges remain. Infrastructure limitations in some regions, varying levels of digital literacy among the population, and competition from other digital advertising channels are potential restraints. The market's success hinges on overcoming these challenges through strategic investments in infrastructure development, targeted marketing campaigns educating businesses on the benefits of DOOH, and leveraging data analytics to optimize campaign performance. The fragmented nature of the market, with numerous players like JCDecaux SE, Samba Digital, and Clear Channel Outdoor Americas Inc. vying for market share, indicates a competitive but dynamic landscape. The ongoing development of programmatic platforms will further shape the competitive landscape, favoring companies that can adapt quickly and offer advanced targeting capabilities. Successful players will likely be those focusing on both the traditional OOH and the rapidly expanding DOOH segments, capitalizing on the complementary nature of these channels.

Latin America OOH & DOOH Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Latin America Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The study covers key market segments, competitive landscape, technological advancements, and growth drivers, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (OOH) and the child market (DOOH) to deliver a complete understanding of the industry's evolution and future trajectory.

Latin America OOH And DOOH Market Market Dynamics & Structure

This section analyzes the market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends within the Latin American OOH and DOOH advertising landscape. We delve into the interplay of these factors to provide a holistic understanding of market structure and dynamics.

- Market Concentration: The Latin American OOH and DOOH market exhibits a moderately concentrated structure, with a few large players holding significant market share, while numerous smaller regional players also contribute to the market volume. The market share of the top 5 players is estimated at XX% in 2025.

- Technological Innovation: DOOH is driven by technological advancements such as programmatic buying, data analytics, and interactive displays. However, challenges remain in terms of infrastructure development and digital literacy across diverse regions.

- Regulatory Framework: Varying regulatory landscapes across Latin American countries create complexities for market expansion. Harmonization of regulations and streamlined permitting processes are crucial for future growth.

- Competitive Product Substitutes: Digital advertising channels, such as online video and social media, pose competitive pressure. The OOH and DOOH industry needs to constantly innovate and demonstrate its unique value proposition to maintain its relevance.

- End-User Demographics: The market is driven by diverse end-user segments, including retailers, FMCG companies, entertainment businesses, and political parties, with varying advertising budgets and objectives.

- M&A Trends: The past five years have seen XX M&A deals in the Latin American OOH and DOOH space, signaling consolidation and a drive towards greater market share. Strategic acquisitions are expected to continue as major players seek expansion and technological integration.

Latin America OOH And DOOH Market Growth Trends & Insights

This section leverages extensive data analysis to present a detailed overview of the market's size evolution, adoption rates, technological disruptions, and consumer behavior shifts. The report examines the impact of macroeconomic factors and evolving consumer preferences on market growth trajectories.

The Latin American OOH and DOOH market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and the adoption of digital technologies. The market size is projected to reach XXX million units by 2025, exhibiting a CAGR of XX% during the forecast period (2025-2033). Increased adoption of programmatic advertising and the integration of data analytics are key factors contributing to this growth. Consumer behavior is shifting towards digitally enhanced OOH experiences, demanding innovative and interactive solutions from advertisers. The penetration of DOOH within the overall OOH market is growing steadily, with XX% penetration expected by 2033.

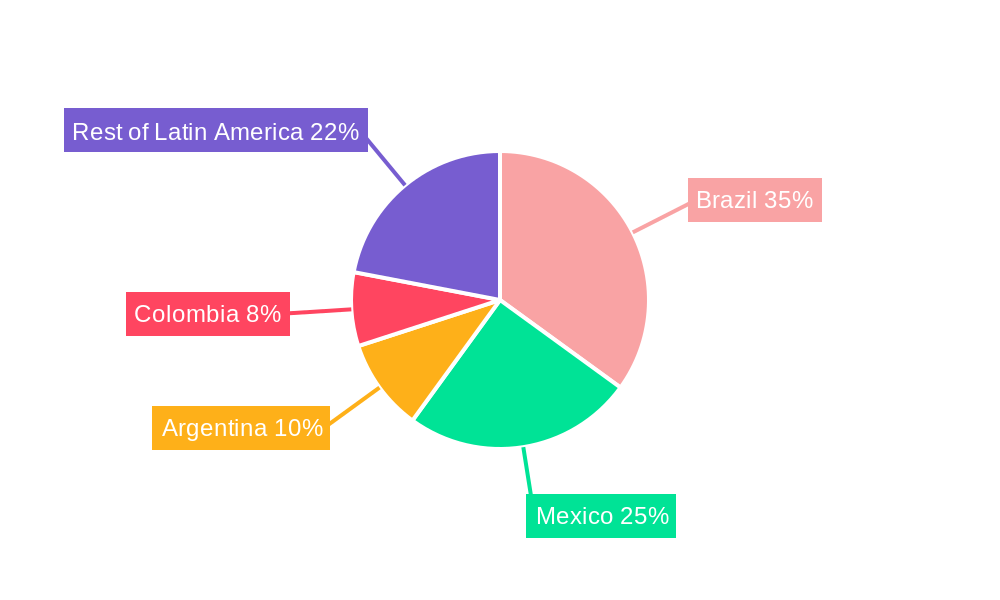

Dominant Regions, Countries, or Segments in Latin America OOH And DOOH Market

This section identifies the leading regions, countries, and segments driving market growth within Latin America. It examines the underlying factors contributing to their dominance, including economic strength, infrastructure development, and advertising expenditure.

- Brazil: Brazil remains the dominant market, accounting for XX% of the total market value in 2025, driven by a large population, robust economic activity (despite recent fluctuations), and a well-established OOH infrastructure in major cities.

- Mexico: Mexico is the second largest market, representing XX% of the market in 2025, fueled by increasing advertising budgets and a growing middle class.

- Colombia, Argentina, and Chile: These countries present significant growth potential and are experiencing a rapid expansion of their DOOH infrastructure.

- Key Segments: Retail, FMCG, and entertainment remain the key segments driving demand. However, growth is anticipated in sectors such as transportation and public spaces as DOOH solutions become increasingly prevalent.

Latin America OOH And DOOH Market Product Landscape

The Latin American OOH and DOOH market showcases a diverse range of products, from traditional billboards to sophisticated digital displays integrated with programmatic advertising platforms. Key innovations include interactive screens, augmented reality experiences, and data-driven targeting capabilities. These advancements enhance the engagement and effectiveness of OOH campaigns, delivering improved ROI for advertisers. The emphasis is shifting towards delivering measurable results, making the medium more attractive to data-driven marketers.

Key Drivers, Barriers & Challenges in Latin America OOH And DOOH Market

Key Drivers:

- Rising Smartphone Penetration: Increased smartphone usage facilitates location-based advertising and engagement.

- Urbanization and Population Growth: Expanding urban areas provide more opportunities for OOH placements.

- Growing Digital Literacy: Enhanced digital literacy among consumers allows for better interaction with DOOH advertisements.

Key Challenges:

- Infrastructure Gaps: Uneven infrastructure development across regions hinders widespread DOOH adoption.

- Regulatory Hurdles: Complex and varying regulations across countries pose challenges for consistent market expansion. This translates to added costs and complexities for advertisers and operators. The lack of standardization slows down the growth of programmatic DOOH.

- Economic Volatility: Economic instability in certain regions can impact advertising spending and market growth. XX% of the projected growth could be influenced by economic fluctuations.

Emerging Opportunities in Latin America OOH And DOOH Market

Emerging opportunities lie in untapped markets within smaller cities and towns, the integration of data analytics for more targeted campaigns, and the exploration of innovative technologies such as augmented reality (AR) and virtual reality (VR) to enhance the viewer experience. The use of DOOH in transportation hubs (airports, bus stations, metro systems) is also poised for significant growth.

Growth Accelerators in the Latin America OOH And DOOH Market Industry

Technological advancements, particularly in programmatic advertising and data analytics, are key growth accelerators. Strategic partnerships between OOH media owners and technology providers are facilitating seamless campaign execution. Furthermore, market expansion into less saturated regions and the development of innovative advertising formats will drive long-term growth.

Key Players Shaping the Latin America OOH And DOOH Market Market

- JCDecaux SE

- Samba Digital

- PRODOOH

- Broadsign

- Hivestack

- Mooving Walls

- Vistar Media

- Clear Channel Outdoor Americas Inc

- Adsmovil

- Location Media Xchange

Notable Milestones in Latin America OOH And DOOH Market Sector

- December 2023: Location Media Xchange (LMX) integrates with Latinad CMS, streamlining programmatic campaigns for Latin American media owners.

- February 2024: Hivestack partners with Eletromidia, bringing 46,000 Brazilian displays to its programmatic platform, reaching an estimated 29 million daily viewers.

In-Depth Latin America OOH And DOOH Market Market Outlook

The Latin American OOH and DOOH market presents significant long-term growth potential. Continued investment in infrastructure, technological innovation, and strategic partnerships will be critical drivers of this expansion. The focus on data-driven campaigns and the adoption of cutting-edge technologies will further enhance the effectiveness and appeal of OOH and DOOH advertising, attracting more advertisers and increasing market value. The market is ripe for further consolidation and innovation.

Latin America OOH And DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other Types

-

2. Appli

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-based Media

-

3. End-u

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

Latin America OOH And DOOH Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America OOH And DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.4. Market Trends

- 3.4.1. The Ongoing Shift Toward Digital Advertising is Expected to Boost the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America OOH And DOOH Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Appli

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-based Media

- 5.3. Market Analysis, Insights and Forecast - by End-u

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JCDecaux SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samba Digital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PRODOOH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Broadsign

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hivestack

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mooving Walls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistar Media

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clear Channel Outdoor Americas Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adsmovil

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Location Media Xchange*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SE

List of Figures

- Figure 1: Latin America OOH And DOOH Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America OOH And DOOH Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America OOH And DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America OOH And DOOH Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Latin America OOH And DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Latin America OOH And DOOH Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Latin America OOH And DOOH Market Revenue Million Forecast, by Appli 2019 & 2032

- Table 6: Latin America OOH And DOOH Market Volume Billion Forecast, by Appli 2019 & 2032

- Table 7: Latin America OOH And DOOH Market Revenue Million Forecast, by End-u 2019 & 2032

- Table 8: Latin America OOH And DOOH Market Volume Billion Forecast, by End-u 2019 & 2032

- Table 9: Latin America OOH And DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America OOH And DOOH Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Latin America OOH And DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Latin America OOH And DOOH Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Latin America OOH And DOOH Market Revenue Million Forecast, by Appli 2019 & 2032

- Table 14: Latin America OOH And DOOH Market Volume Billion Forecast, by Appli 2019 & 2032

- Table 15: Latin America OOH And DOOH Market Revenue Million Forecast, by End-u 2019 & 2032

- Table 16: Latin America OOH And DOOH Market Volume Billion Forecast, by End-u 2019 & 2032

- Table 17: Latin America OOH And DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America OOH And DOOH Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Brazil Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Brazil Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Argentina Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Chile Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Colombia Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Colombia Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Mexico Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Mexico Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Peru Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Peru Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Venezuela Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Venezuela Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Ecuador Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ecuador Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Bolivia Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Bolivia Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Paraguay Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Paraguay Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America OOH And DOOH Market?

The projected CAGR is approximately 6.01%.

2. Which companies are prominent players in the Latin America OOH And DOOH Market?

Key companies in the market include JCDecaux SE, Samba Digital, PRODOOH, Broadsign, Hivestack, Mooving Walls, Vistar Media, Clear Channel Outdoor Americas Inc, Adsmovil, Location Media Xchange*List Not Exhaustive.

3. What are the main segments of the Latin America OOH And DOOH Market?

The market segments include Type , Appli, End-u.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

The Ongoing Shift Toward Digital Advertising is Expected to Boost the Market's Growth.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

8. Can you provide examples of recent developments in the market?

February 2024: Hivestack by Perion, which operates a digital OOH advertising platform, announced its partnership with Eletromidia, an OOH media company based in Brazil. As part of the partnership, 46,000 Eletromidia displays across Brazil will be available to advertisers via the Hivestack supply side platform, with daily viewership estimated at 29 million for the Eletromidia display network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America OOH And DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America OOH And DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America OOH And DOOH Market?

To stay informed about further developments, trends, and reports in the Latin America OOH And DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence