Key Insights

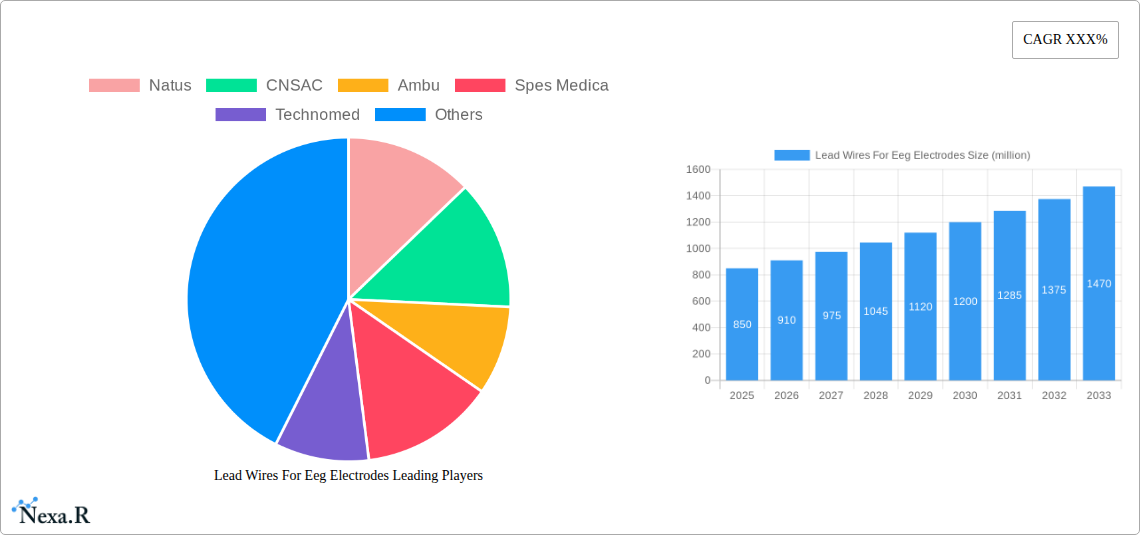

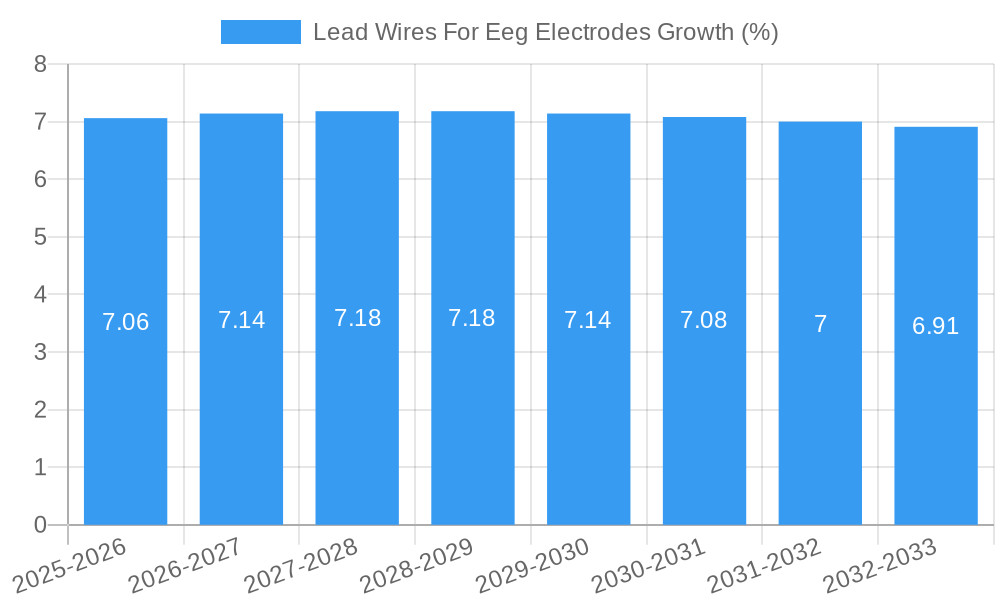

The global market for lead wires for EEG electrodes is poised for significant expansion, projected to reach approximately USD 850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.2% anticipated through 2033. This growth is underpinned by several compelling drivers, most notably the increasing prevalence of neurological disorders such as epilepsy, Alzheimer's disease, and Parkinson's disease, which necessitate advanced diagnostic and monitoring tools. The rising demand for non-invasive diagnostic procedures in healthcare settings, coupled with the expanding adoption of electroencephalography (EEG) in both clinical and research environments, further fuels market expansion. Furthermore, advancements in electrode and lead wire technology, focusing on improved conductivity, durability, and patient comfort, are contributing to market penetration. The increasing investment in healthcare infrastructure, particularly in emerging economies, alongside a growing awareness of neurological health, are also key growth facilitators. The market is segmented by application into hospitals, clinics, and other healthcare settings, with hospitals representing the largest segment due to higher patient volumes and the availability of specialized neurological departments. By type, the market includes various lengths, with 100 cm and 150 cm variants being particularly popular for their versatility in clinical applications.

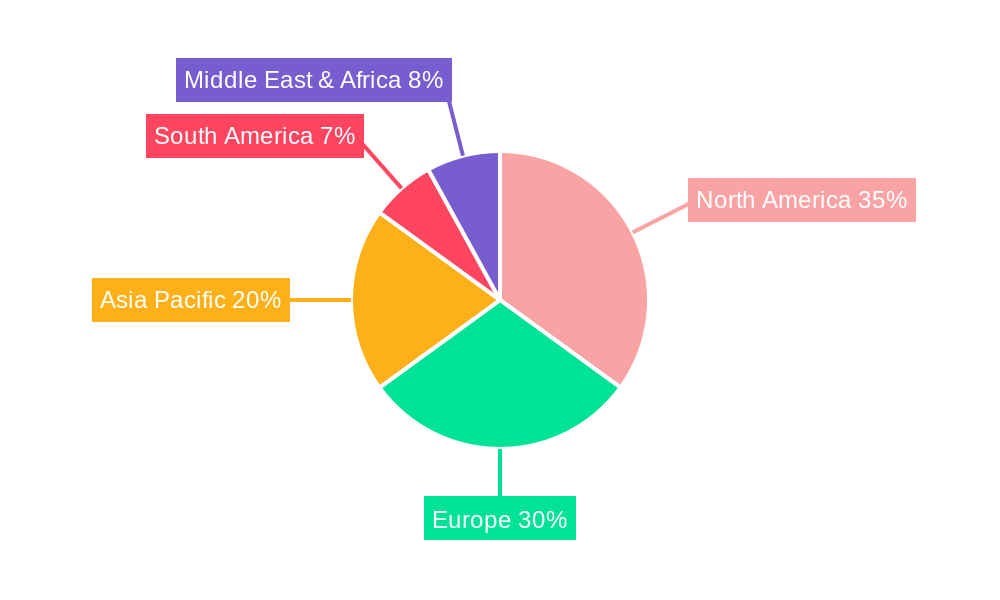

The market landscape for EEG electrode lead wires is characterized by a competitive environment with a mix of established global players and emerging regional manufacturers. Key trends include the development of wireless EEG systems, which, while not directly involving traditional lead wires, influence the overall demand for EEG consumables and push innovation in wired solutions for enhanced reliability and signal quality. The increasing use of EEG in non-traditional applications such as sleep monitoring, neurofeedback therapy, and even consumer-grade brain-computer interfaces is also a noteworthy trend. However, restraints such as the high cost of advanced EEG equipment and the need for skilled professionals to operate and interpret the data can pose challenges to market growth. Stringent regulatory approvals for medical devices also add to the development timelines and costs. Geographically, North America and Europe currently dominate the market due to their well-established healthcare systems and high adoption rates of advanced medical technologies. The Asia Pacific region, however, is expected to witness the fastest growth, driven by a large population, increasing disposable incomes, and a growing focus on neurological healthcare.

Lead Wires For Eeg Electrodes Market Dynamics & Structure

The global Lead Wires for EEG Electrodes market is characterized by a moderate level of concentration, with key players like Natus, CNSAC, Ambu, Spes Medica, and Technomed holding significant market share. Technological innovation is a primary driver, with ongoing advancements in material science and connector design enhancing signal quality and patient comfort. Regulatory frameworks, particularly those governing medical device manufacturing and approval in major markets like the US and Europe, play a crucial role in shaping market entry and product development. Competitive product substitutes, such as wireless EEG systems, present a growing challenge, although traditional wired solutions remain dominant due to their reliability and cost-effectiveness in many clinical settings. End-user demographics, including the increasing prevalence of neurological disorders and the growing adoption of EEG in non-traditional applications like brain-computer interfaces, are influencing demand. Mergers and acquisitions (M&A) trends, while not extensive, indicate strategic consolidations aimed at expanding product portfolios and market reach.

- Market Concentration: Moderate, with a few key players dominating the landscape.

- Technological Innovation Drivers: Enhanced signal fidelity, improved durability, and patient comfort through advanced materials and connector technologies.

- Regulatory Frameworks: Strict adherence to FDA, CE, and other regional medical device regulations is paramount for market access.

- Competitive Product Substitutes: Rise of wireless EEG systems posing a competitive threat, though wired solutions maintain strong market presence.

- End-User Demographics: Growing demand driven by aging populations, increasing neurological disorder prevalence, and emerging BCI applications.

- M&A Trends: Strategic acquisitions to broaden product offerings and strengthen market positions.

Lead Wires For Eeg Electrodes Growth Trends & Insights

The global Lead Wires for EEG Electrodes market is projected for robust growth over the forecast period, driven by escalating demand for advanced neurological diagnostic tools and the expanding applications of electroencephalography (EEG). Market size evolution is anticipated to be significant, with historical data from 2019–2024 indicating steady growth, and projections for 2025–2033 pointing towards an accelerated trajectory. The adoption rates of high-quality lead wires are increasing as healthcare providers prioritize accurate and reliable EEG data for patient diagnosis and treatment monitoring. Technological disruptions, such as the integration of smarter connector systems and materials with antimicrobial properties, are further propelling market penetration. Consumer behavior shifts are also evident, with a growing preference for disposable and sterile lead wires in clinical settings to mitigate infection risks and improve workflow efficiency. The increasing focus on home-based EEG monitoring and the burgeoning field of brain-computer interfaces (BCIs) are opening up new avenues for market expansion. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year 2025 through 2033. The market penetration of specialized lead wires for advanced applications is expected to rise by an estimated 15% within the forecast period.

Dominant Regions, Countries, or Segments in Lead Wires For Eeg Electrodes

North America is anticipated to be the dominant region in the Lead Wires for EEG Electrodes market throughout the forecast period, largely driven by its advanced healthcare infrastructure, high R&D spending, and the early adoption of innovative medical technologies. The United States, in particular, accounts for a substantial share due to its large patient population, well-established healthcare systems, and the presence of leading EEG device manufacturers. The Application segment of Hospitals is projected to exhibit the highest growth potential, fueled by an increasing number of diagnostic procedures for epilepsy, sleep disorders, and other neurological conditions. Within the Type segment, 150 cm and 200 cm lead wires are expected to see the most significant demand, catering to the diverse requirements of clinical setups and prolonged monitoring sessions. Economic policies supporting healthcare advancements and investments in neurological research are key drivers of this regional dominance. The market share held by North America is estimated to be around 35% in 2025, with a projected growth rate of 7.0% CAGR through 2033.

- Dominant Region: North America (primarily the United States).

- Key Drivers in North America: Advanced healthcare infrastructure, high R&D investment, strong presence of key manufacturers, and high adoption of new technologies.

- Dominant Application Segment: Hospitals.

- Growth Drivers in Hospital Segment: Rising incidence of neurological disorders, increasing demand for accurate diagnostic tools, and adoption of advanced EEG monitoring.

- Dominant Type Segment: 150 cm and 200 cm lead wires.

- Rationale for Type Dominance: Versatility for various clinical applications and patient comfort during extended monitoring.

- Market Share (North America, 2025): Approximately 35%.

- Projected CAGR (North America, 2025–2033): 7.0%.

Lead Wires For Eeg Electrodes Product Landscape

The product landscape for Lead Wires for EEG Electrodes is evolving with a focus on enhancing signal integrity, patient safety, and ease of use. Innovations include the development of highly conductive materials for superior signal transmission and the implementation of shielded designs to minimize electromagnetic interference. Disposable lead wires with integrated electrodes are gaining traction to improve hygiene and streamline clinical workflows. Features such as color-coding for easy identification and optimized connector designs for secure attachment are becoming standard. The performance metrics are centered around low impedance, high signal-to-noise ratio, and durability for repeated use or single-patient use applications. Companies are also investing in developing biocompatible materials that reduce the risk of skin irritation.

Key Drivers, Barriers & Challenges in Lead Wires For Eeg Electrodes

Key Drivers:

- Growing Prevalence of Neurological Disorders: Conditions like epilepsy, Alzheimer's, and Parkinson's necessitate frequent EEG monitoring, driving demand for lead wires.

- Technological Advancements: Development of more reliable, comfortable, and interference-resistant lead wires.

- Expansion of EEG Applications: Increased use in sleep studies, critical care, and emerging fields like brain-computer interfaces.

- Aging Global Population: Older demographics are more susceptible to neurological conditions.

Barriers & Challenges:

- Supply Chain Disruptions: Reliance on specific raw materials and manufacturing locations can lead to vulnerability.

- Stringent Regulatory Approvals: Obtaining certifications from bodies like the FDA and EMA can be time-consuming and costly.

- Competition from Wireless Systems: The increasing market presence of wireless EEG devices presents a direct alternative.

- Price Sensitivity in Emerging Markets: Cost can be a significant barrier to adoption in lower-income regions.

- Obsolescence of Older Technologies: Need for continuous investment in R&D to keep pace with evolving standards.

Emerging Opportunities in Lead Wires For Eeg Electrodes

Emerging opportunities lie in the development of specialized lead wires for wearable EEG devices and portable monitoring systems, catering to the growing trend of remote patient care. The integration of IoT capabilities for real-time data transmission and advanced analytics presents another significant avenue. Furthermore, the burgeoning field of neurofeedback and personalized medicine offers potential for customized lead wire solutions. Untapped markets in developing economies, with increasing healthcare investments, also represent a substantial growth prospect.

Growth Accelerators in the Lead Wires For Eeg Electrodes Industry

Growth accelerators in the Lead Wires for EEG Electrodes industry are primarily driven by continuous technological breakthroughs, such as the development of ultra-flexible, highly durable materials that enhance patient comfort during long-term monitoring. Strategic partnerships between lead wire manufacturers and EEG equipment developers are crucial for creating integrated solutions and expanding market reach. Furthermore, market expansion strategies focused on emerging economies, where the adoption of advanced neurological diagnostics is on the rise, will act as significant growth catalysts. The increasing emphasis on preventative healthcare and early disease detection also fuels the demand for reliable EEG monitoring equipment and accessories.

Key Players Shaping the Lead Wires For Eeg Electrodes Market

- Natus

- CNSAC

- Ambu

- Spes Medica

- Technomed

- Digitimer

- NR Sign

- Cadwell

- Rhythmlink

- Bird Healthcare

- BIOPAC

- OpenBCI

- LM Healthcare

- BESDATA

- Tenocom

- Repusi

- Wuhan Liannao

Notable Milestones in Lead Wires For Eeg Electrodes Sector

- 2019: Introduction of advanced biocompatible materials for reduced skin irritation.

- 2020: Increased demand for disposable and sterile lead wires due to the global pandemic.

- 2021: Significant investment in R&D for shielded lead wires to minimize noise interference.

- 2022: Launch of color-coded lead wires for improved clinical workflow efficiency.

- 2023: Growing adoption of lead wires for brain-computer interface applications.

- 2024: Development of lead wires compatible with miniaturized and wearable EEG devices.

In-Depth Lead Wires For Eeg Electrodes Market Outlook

The future outlook for the Lead Wires for EEG Electrodes market is highly promising, driven by ongoing technological advancements and the expanding utility of EEG in both clinical and research settings. Key growth accelerators include the development of next-generation materials that offer superior conductivity and patient comfort, alongside the integration of smart features for enhanced data acquisition. Strategic collaborations between manufacturers and healthcare providers will be instrumental in developing tailored solutions that meet the evolving demands of neurological diagnostics and therapeutic interventions. The increasing global focus on personalized medicine and the burgeoning field of brain-computer interfaces further present substantial opportunities for market expansion and product diversification.

Lead Wires For Eeg Electrodes Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Other

-

2. Type

- 2.1. 75 cm

- 2.2. 100 cm

- 2.3. 150 cm

- 2.4. 200 cm

- 2.5. 250 cm

Lead Wires For Eeg Electrodes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lead Wires For Eeg Electrodes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lead Wires For Eeg Electrodes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 75 cm

- 5.2.2. 100 cm

- 5.2.3. 150 cm

- 5.2.4. 200 cm

- 5.2.5. 250 cm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Lead Wires For Eeg Electrodes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 75 cm

- 6.2.2. 100 cm

- 6.2.3. 150 cm

- 6.2.4. 200 cm

- 6.2.5. 250 cm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Lead Wires For Eeg Electrodes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 75 cm

- 7.2.2. 100 cm

- 7.2.3. 150 cm

- 7.2.4. 200 cm

- 7.2.5. 250 cm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Lead Wires For Eeg Electrodes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 75 cm

- 8.2.2. 100 cm

- 8.2.3. 150 cm

- 8.2.4. 200 cm

- 8.2.5. 250 cm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Lead Wires For Eeg Electrodes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 75 cm

- 9.2.2. 100 cm

- 9.2.3. 150 cm

- 9.2.4. 200 cm

- 9.2.5. 250 cm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Lead Wires For Eeg Electrodes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 75 cm

- 10.2.2. 100 cm

- 10.2.3. 150 cm

- 10.2.4. 200 cm

- 10.2.5. 250 cm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Natus

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CNSAC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ambu

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Spes Medica

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Technomed

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Digitimer

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NR Sign

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cadwell

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rhythmlink

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bird Healthcare

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BIOPAC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 OpenBCI

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LM Healthcare

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BESDATA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tenocom

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Repusi

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Wuhan Liannao

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Natus

List of Figures

- Figure 1: Global Lead Wires For Eeg Electrodes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Lead Wires For Eeg Electrodes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Lead Wires For Eeg Electrodes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Lead Wires For Eeg Electrodes Revenue (million), by Type 2024 & 2032

- Figure 5: North America Lead Wires For Eeg Electrodes Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Lead Wires For Eeg Electrodes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Lead Wires For Eeg Electrodes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Lead Wires For Eeg Electrodes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Lead Wires For Eeg Electrodes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Lead Wires For Eeg Electrodes Revenue (million), by Type 2024 & 2032

- Figure 11: South America Lead Wires For Eeg Electrodes Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Lead Wires For Eeg Electrodes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Lead Wires For Eeg Electrodes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lead Wires For Eeg Electrodes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Lead Wires For Eeg Electrodes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Lead Wires For Eeg Electrodes Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Lead Wires For Eeg Electrodes Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Lead Wires For Eeg Electrodes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Lead Wires For Eeg Electrodes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Lead Wires For Eeg Electrodes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Lead Wires For Eeg Electrodes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Lead Wires For Eeg Electrodes Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Lead Wires For Eeg Electrodes Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Lead Wires For Eeg Electrodes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Lead Wires For Eeg Electrodes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Lead Wires For Eeg Electrodes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Lead Wires For Eeg Electrodes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Lead Wires For Eeg Electrodes Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Lead Wires For Eeg Electrodes Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Lead Wires For Eeg Electrodes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Lead Wires For Eeg Electrodes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Lead Wires For Eeg Electrodes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Lead Wires For Eeg Electrodes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lead Wires For Eeg Electrodes?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Lead Wires For Eeg Electrodes?

Key companies in the market include Natus, CNSAC, Ambu, Spes Medica, Technomed, Digitimer, NR Sign, Cadwell, Rhythmlink, Bird Healthcare, BIOPAC, OpenBCI, LM Healthcare, BESDATA, Tenocom, Repusi, Wuhan Liannao.

3. What are the main segments of the Lead Wires For Eeg Electrodes?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lead Wires For Eeg Electrodes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lead Wires For Eeg Electrodes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lead Wires For Eeg Electrodes?

To stay informed about further developments, trends, and reports in the Lead Wires For Eeg Electrodes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence