Key Insights

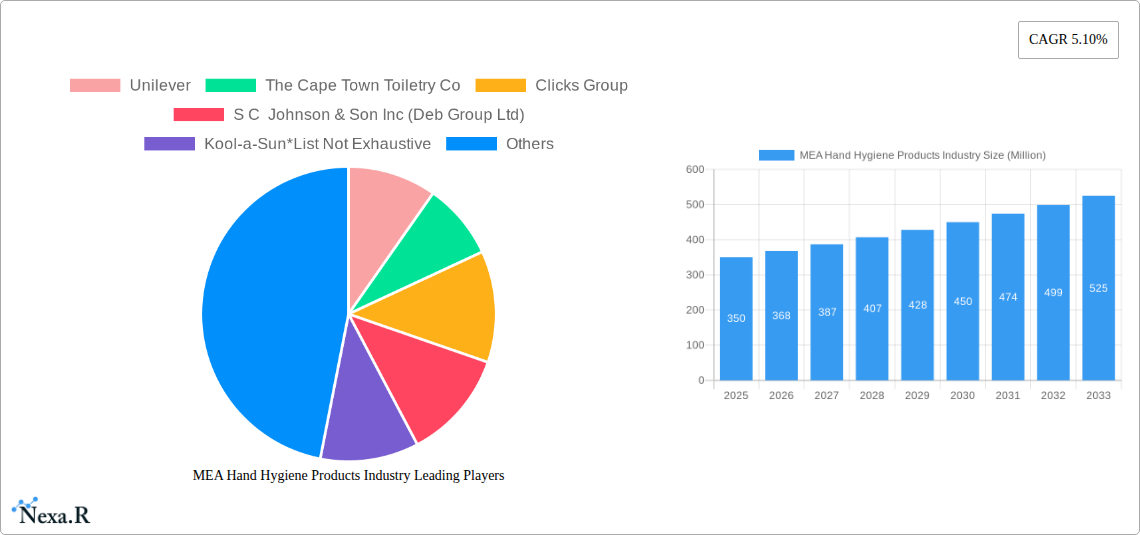

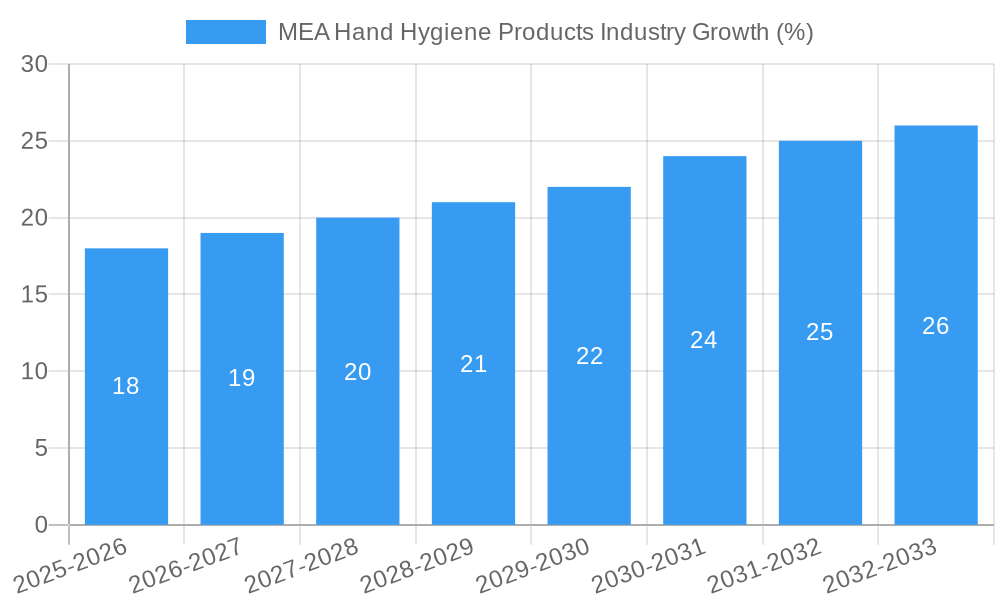

The MEA hand hygiene products market, encompassing nations like the United Arab Emirates, Saudi Arabia, and South Africa, exhibits robust growth potential. Driven by increasing health awareness, stringent hygiene regulations, and a rising prevalence of infectious diseases, the market is projected to expand significantly over the forecast period (2025-2033). The 5.10% CAGR indicates a steady, upward trajectory. While precise market sizing for 2025 is unavailable, considering a base year of 2025, a logical estimation, based on global hand hygiene market trends and the region's economic growth, would place the market size (in value terms) between $300 and $400 million. The market segmentation highlights the dominance of gel and liquid hand sanitizers, with a growing demand for convenient formats like sprays and wipes. Supermarkets and hypermarkets are major distribution channels, but the online segment is experiencing rapid expansion due to enhanced e-commerce penetration and convenience. Key players like Unilever, Reckitt Benckiser, and regional brands are vying for market share, driving innovation in product formulations and packaging. Growth is further fueled by increasing public health initiatives promoting hand hygiene and the adoption of advanced sanitizing technologies.

However, factors such as economic fluctuations, price sensitivity in certain market segments, and the potential for regulatory changes could pose challenges. The market’s future depends on sustained consumer awareness, effective marketing campaigns promoting hand hygiene practices, and continued investment in research and development of innovative, effective, and eco-friendly hand hygiene products. The diverse product range, including varied formats and specialized formulations catering to different needs (e.g., antimicrobial, moisturizing), is a key aspect driving sustained growth within this expanding market. The expansion of healthcare infrastructure and growing tourism in the region will also significantly contribute to the market’s continued positive trajectory. The strategic focus on hygiene, especially post-pandemic, provides further impetus to the market's expansion in the coming years.

MEA Hand Hygiene Products Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) hand hygiene products industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. The report delves into both parent (Personal Care) and child (Hand Hygiene Products) markets for a comprehensive understanding. Market values are presented in Million units.

MEA Hand Hygiene Products Industry Market Dynamics & Structure

This section analyzes the MEA hand hygiene products market's competitive landscape, technological advancements, regulatory environment, and market trends. We examine market concentration, highlighting the leading players and their market share percentages. The analysis includes an evaluation of M&A activity within the industry, quantifying deal volumes during the historical period (2019-2024) and projecting trends for the forecast period (2025-2033). Further, we delve into technological innovation drivers such as the development of antimicrobial formulations and the rise of eco-friendly products. Regulatory frameworks impacting product safety and labeling are also assessed. The impact of competitive product substitutes, like traditional soaps, is explored. Finally, end-user demographics, focusing on age groups and income levels, are analyzed alongside their influence on consumption patterns.

- Market Concentration: xx% dominated by top 5 players in 2024; expected to decrease slightly to xx% by 2033.

- M&A Activity: xx deals recorded between 2019-2024; projected xx deals for 2025-2033.

- Technological Innovation: Significant investments in antimicrobial technology and sustainable packaging.

- Regulatory Landscape: Stringent regulations on labeling and product safety are driving product innovation.

- Competitive Substitutes: Traditional soaps still hold a considerable market share, especially in rural areas.

- End-user Demographics: Growing middle class and increasing health awareness are key drivers of market growth.

MEA Hand Hygiene Products Industry Growth Trends & Insights

This section provides a detailed analysis of the MEA hand hygiene products market's growth trajectory from 2019 to 2033. Utilizing comprehensive market research data, we present a thorough examination of market size evolution, exploring growth rates and fluctuations over time. Adoption rates of different product types (gel, liquid, etc.) are analyzed, revealing consumer preferences and market penetration levels. The impact of technological disruptions, such as the introduction of touchless dispensers, is assessed, along with its effect on market dynamics. Furthermore, this section dives into shifting consumer behaviors, pinpointing factors like increased health consciousness and changing purchasing habits. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates are provided to illustrate market growth and potential.

- Market Size Evolution: The market expanded from xx million units in 2019 to xx million units in 2024 and is projected to reach xx million units by 2033.

- CAGR (2019-2024): xx%

- Projected CAGR (2025-2033): xx%

- Market Penetration: xx% in 2024, projected to reach xx% by 2033.

- Technological Disruptions: Smart dispensers and IoT-enabled hand hygiene solutions are gaining traction.

- Consumer Behavior Shifts: Increased awareness of hygiene and sanitation post-pandemic driving increased demand.

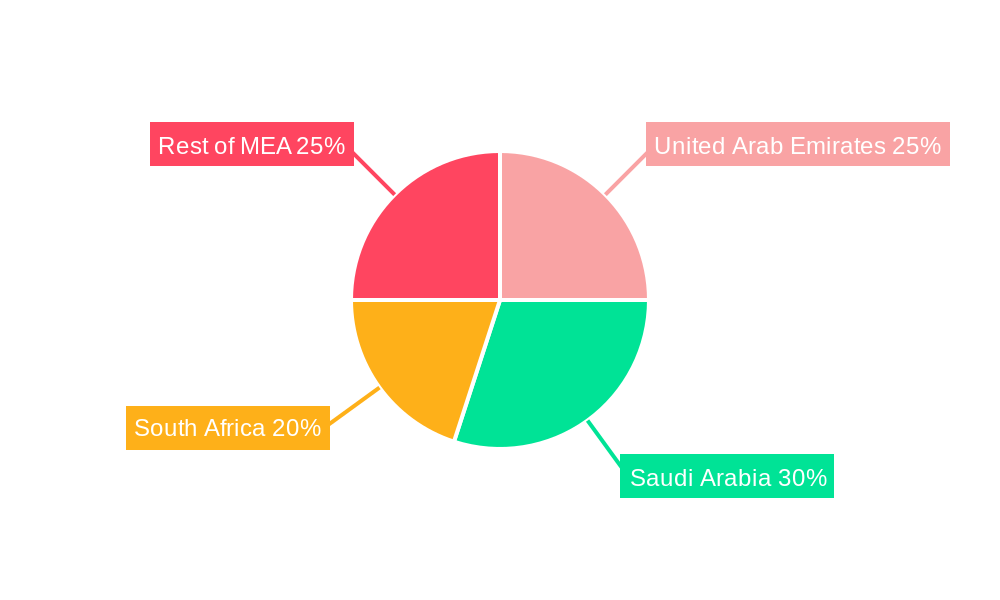

Dominant Regions, Countries, or Segments in MEA Hand Hygiene Products Industry

This section identifies the leading regions, countries, and segments (by type and distribution channel) within the MEA hand hygiene products market. We analyze the factors driving market growth in these dominant areas, highlighting key economic policies, infrastructure development, and consumer preferences contributing to their market leadership. Market share and growth potential are also analyzed for each dominant segment, providing insights into investment opportunities.

Dominant Region: North Africa and the Levant show the highest growth.

Dominant Country: Egypt holds the largest market share within MEA.

Dominant Segment (By Type): Gel and liquid hand sanitizers dominate the market due to affordability and wide availability.

Dominant Segment (By Distribution Channel): Supermarkets and hypermarkets represent the largest distribution channel.

Key Drivers (North Africa): Rising disposable income and urbanization.

Key Drivers (Egypt): Strong government initiatives promoting public health.

Key Drivers (Gel): Convenience and effectiveness.

Key Drivers (Supermarkets): Extensive reach and established supply chains.

MEA Hand Hygiene Products Industry Product Landscape

The MEA hand hygiene products market offers a diverse range of products, each with unique selling propositions and technological advancements. Innovations in formulations, such as the incorporation of natural ingredients and enhanced antimicrobial properties, are driving product differentiation. The development of sustainable and eco-friendly packaging is also gaining traction. Performance metrics, including efficacy against various microorganisms and skin compatibility, are critical considerations for consumers and regulatory bodies.

Key Drivers, Barriers & Challenges in MEA Hand Hygiene Products Industry

Key Drivers: The increasing awareness of hygiene and sanitation, coupled with government initiatives promoting public health, are significant drivers of market growth. Technological advancements, such as the development of touchless dispensers and innovative formulations, further propel the market. Economic growth in several MEA countries boosts disposable income, leading to increased spending on personal care products.

Key Barriers & Challenges: Supply chain disruptions, particularly during times of crisis, pose a major challenge. Regulatory hurdles regarding product registration and labeling can also create barriers to market entry. Intense competition from established players and the emergence of new entrants create competitive pressures. Fluctuations in raw material prices can affect product costs and profitability.

Emerging Opportunities in MEA Hand Hygiene Products Industry

Untapped markets in rural areas present significant opportunities for market expansion. The growing demand for natural and organic hand hygiene products provides avenues for innovation. The increasing adoption of e-commerce platforms offers new distribution channels, especially in urban areas.

Growth Accelerators in the MEA Hand Hygiene Products Industry Industry

Technological breakthroughs, such as the development of advanced antimicrobial formulations and smart dispensers, are accelerating market growth. Strategic partnerships between manufacturers and distributors are creating wider market reach. Expansion into untapped markets through targeted marketing campaigns is enhancing market penetration.

Key Players Shaping the MEA Hand Hygiene Products Market

- Unilever

- The Cape Town Toiletry Co

- Clicks Group

- S C Johnson & Son Inc (Deb Group Ltd)

- Kool-a-Sun

- Reckitt Benckiser

Notable Milestones in MEA Hand Hygiene Products Industry Sector

- 2020: Increased demand for hand sanitizers due to the COVID-19 pandemic.

- 2021: Introduction of several new touchless hand sanitizer dispensers.

- 2022: Several mergers and acquisitions in the industry.

- 2023: Increased focus on sustainable and eco-friendly packaging.

In-Depth MEA Hand Hygiene Products Industry Market Outlook

The MEA hand hygiene products market is poised for continued growth, driven by rising health awareness, technological advancements, and economic development. Strategic partnerships, focused marketing initiatives, and expansion into untapped markets will shape future market dynamics. The market's potential for innovation and growth remains high, presenting attractive opportunities for both established players and new entrants.

MEA Hand Hygiene Products Industry Segmentation

-

1. Type

- 1.1. Gel

- 1.2. Liquid

- 1.3. Spray

- 1.4. Foam

- 1.5. Sanitizing Wipes

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmaceutical Stores

- 2.4. Online Channels

- 2.5. Others

-

3. Geography

-

3.1. Middle East and Africa

- 3.1.1. South Africa

- 3.1.2. Saudi Arabia

- 3.1.3. Rest of Middle East & Africa

-

3.1. Middle East and Africa

MEA Hand Hygiene Products Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. South Africa

- 1.2. Saudi Arabia

- 1.3. Rest of Middle East

MEA Hand Hygiene Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Skin Concerns Among Men Leading to Purchase of Skincare Products; The Taming and Beard Maintenance Market Dominates the Men's Grooming Products Market

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness Regarding the Side Effects Associated with Chemical Cosmetic/Skincare Products

- 3.4. Market Trends

- 3.4.1. Rising Awareness towards Hand Hygiene owing to Rising Coronavirus Disease Cases in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Hand Hygiene Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gel

- 5.1.2. Liquid

- 5.1.3. Spray

- 5.1.4. Foam

- 5.1.5. Sanitizing Wipes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmaceutical Stores

- 5.2.4. Online Channels

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle East and Africa

- 5.3.1.1. South Africa

- 5.3.1.2. Saudi Arabia

- 5.3.1.3. Rest of Middle East & Africa

- 5.3.1. Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates MEA Hand Hygiene Products Industry Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia MEA Hand Hygiene Products Industry Analysis, Insights and Forecast, 2019-2031

- 8. South Africa MEA Hand Hygiene Products Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of Middle East and Africa MEA Hand Hygiene Products Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Unilever

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The Cape Town Toiletry Co

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Clicks Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 S C Johnson & Son Inc (Deb Group Ltd)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kool-a-Sun*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Reckitt Benckiser

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Unilever

List of Figures

- Figure 1: Global MEA Hand Hygiene Products Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: MEA MEA Hand Hygiene Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: MEA MEA Hand Hygiene Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (Million), by Geography 2024 & 2032

- Figure 9: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 10: Middle East and Africa MEA Hand Hygiene Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa MEA Hand Hygiene Products Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates MEA Hand Hygiene Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia MEA Hand Hygiene Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Africa MEA Hand Hygiene Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Middle East and Africa MEA Hand Hygiene Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Global MEA Hand Hygiene Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: South Africa MEA Hand Hygiene Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia MEA Hand Hygiene Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Middle East MEA Hand Hygiene Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Hand Hygiene Products Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the MEA Hand Hygiene Products Industry?

Key companies in the market include Unilever, The Cape Town Toiletry Co, Clicks Group, S C Johnson & Son Inc (Deb Group Ltd), Kool-a-Sun*List Not Exhaustive, Reckitt Benckiser.

3. What are the main segments of the MEA Hand Hygiene Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Skin Concerns Among Men Leading to Purchase of Skincare Products; The Taming and Beard Maintenance Market Dominates the Men's Grooming Products Market.

6. What are the notable trends driving market growth?

Rising Awareness towards Hand Hygiene owing to Rising Coronavirus Disease Cases in the Region.

7. Are there any restraints impacting market growth?

Increasing Awareness Regarding the Side Effects Associated with Chemical Cosmetic/Skincare Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Hand Hygiene Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Hand Hygiene Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Hand Hygiene Products Industry?

To stay informed about further developments, trends, and reports in the MEA Hand Hygiene Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence