Key Insights

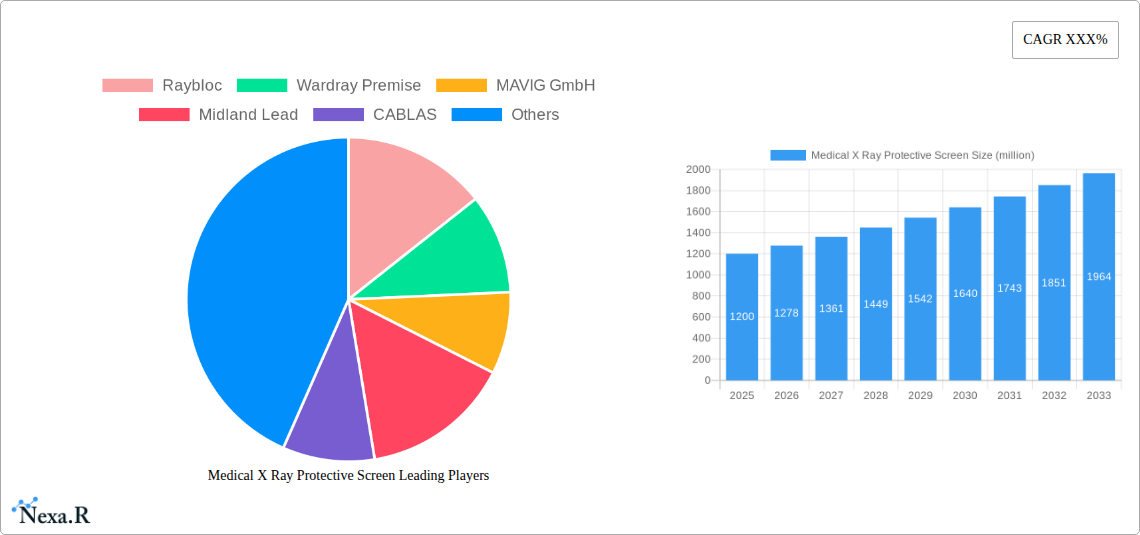

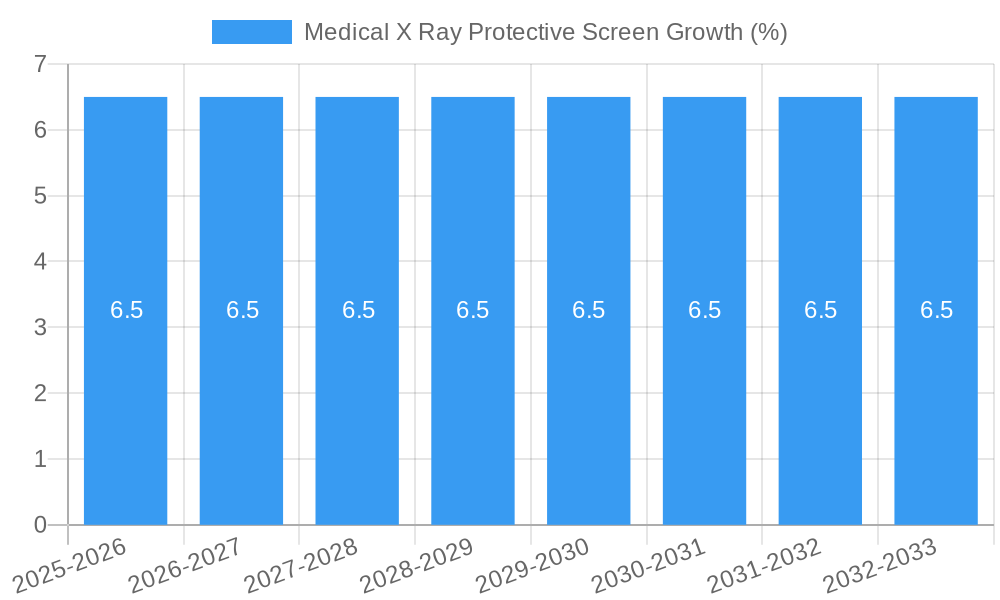

The Medical X-ray Protective Screen market is poised for substantial growth, estimated to reach approximately $1.2 billion in 2025. This upward trajectory is fueled by a projected Compound Annual Growth Rate (CAGR) of around 6.5% from 2025 to 2033, indicating a robust and expanding industry. The increasing global demand for advanced diagnostic imaging, driven by rising healthcare expenditures and a growing prevalence of diseases requiring radiological examination, forms the primary catalyst for this expansion. Furthermore, stringent regulatory mandates for radiation safety in healthcare facilities worldwide are compelling healthcare providers to invest in high-quality protective equipment, including X-ray screens, thereby bolstering market demand. The ongoing technological advancements in materials science, leading to the development of lighter, more effective, and aesthetically pleasing protective screens, are also contributing significantly to market penetration and adoption across various healthcare settings.

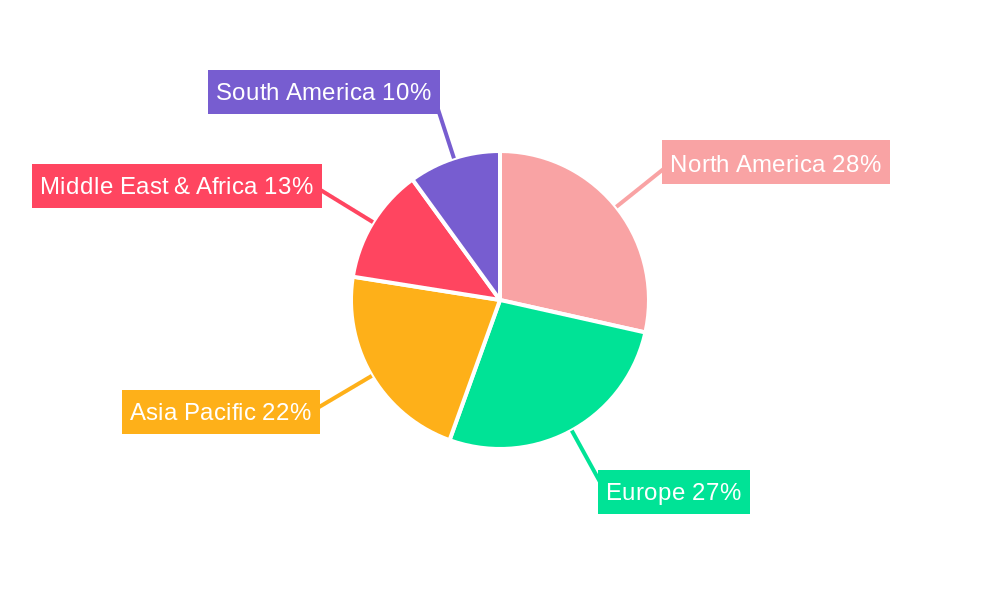

The market is segmented by application into Hospitals, Clinics, and Others, with Hospitals representing the largest share due to their higher volume of diagnostic procedures and comprehensive imaging facilities. The Mobile and Fixed types also delineate key market segments, with mobile screens offering flexibility and adaptability to various procedural needs. Geographically, North America and Europe currently dominate the market, owing to their established healthcare infrastructures, advanced technological adoption, and high awareness regarding radiation safety. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by rapid healthcare infrastructure development, increasing medical tourism, and a growing middle class with enhanced access to advanced medical services. Key players like Raybloc, Wardray Premise, and MAVIG GmbH are actively innovating and expanding their product portfolios to cater to diverse market needs, further shaping the competitive landscape and pushing market boundaries.

This report provides an in-depth analysis of the global Medical X Ray Protective Screen market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and a detailed outlook for the period 2019–2033. With a base year of 2025 and a forecast period extending to 2033, this research is designed to equip industry stakeholders with actionable insights for strategic decision-making in this vital healthcare sector. The report leverages high-traffic keywords such as "medical X-ray shielding," "radiation protection screens," "radiology safety equipment," and "healthcare imaging accessories" to maximize search engine visibility and attract relevant professionals. It delves into both parent and child market segments to offer a holistic view of market penetration and potential. All monetary values are presented in millions of units.

Medical X Ray Protective Screen Market Dynamics & Structure

The Medical X Ray Protective Screen market exhibits a moderately concentrated structure, with a few key players holding significant market share, while a broader base of smaller manufacturers caters to niche segments. Technological innovation, particularly in materials science and ergonomic design, is a primary driver. Advances in lead-free shielding materials, improved transparency, and integrated mobility solutions are continuously reshaping the competitive landscape. Stringent regulatory frameworks, such as those mandated by the FDA in the US and CE marking in Europe, ensure product safety and efficacy, acting as both a barrier to entry for new players and a driver of quality improvements. Competitive product substitutes, primarily alternative shielding methods or less advanced protective gear, are present but are increasingly being outpaced by the specialized functionality and safety offered by dedicated X-ray protective screens. End-user demographics are shifting towards an aging population requiring more diagnostic imaging, thereby increasing demand. Mergers and acquisitions (M&A) activity, while not intensely high, is present, with larger entities acquiring smaller, innovative companies to expand their product portfolios and market reach.

- Market Concentration: Moderately concentrated with key players like Raybloc and MAVIG GmbH holding substantial shares.

- Technological Innovation Drivers: Development of lightweight, lead-free materials; enhanced radiation attenuation; improved visual clarity for practitioners.

- Regulatory Frameworks: Compliance with international standards (e.g., IEC 61331, FDA regulations) is critical for market access.

- Competitive Product Substitutes: Existing lead aprons, mobile barriers, and architectural shielding solutions.

- End-User Demographics: Growing demand driven by an aging population and increased medical imaging procedures.

- M&A Trends: Strategic acquisitions to gain market share and access innovative technologies.

Medical X Ray Protective Screen Growth Trends & Insights

The Medical X Ray Protective Screen market is poised for robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is fueled by a confluence of factors, including the escalating global prevalence of diseases requiring advanced diagnostic imaging and a heightened awareness of radiation safety protocols among healthcare providers and patients. The increasing adoption of digital radiography and CT scanners, which often necessitate improved shielding solutions due to higher exposure levels, is a critical growth driver. Furthermore, technological disruptions are leading to the development of lighter, more flexible, and aesthetically integrated protective screens, enhancing usability and compliance. Consumer behavior shifts are also playing a role, with healthcare facilities prioritizing patient and staff well-being, leading to greater investment in state-of-the-art radiation protection. The market penetration of advanced X-ray protective screens is expected to rise as healthcare infrastructure develops in emerging economies. The global market size, estimated at approximately $1.2 billion in the base year 2025, is projected to reach $2.5 billion by 2033, demonstrating a healthy growth trajectory. This evolution is underpinned by consistent innovation and a growing understanding of the long-term benefits of investing in high-quality radiology safety equipment.

Dominant Regions, Countries, or Segments in Medical X Ray Protective Screen

North America and Europe currently represent the dominant regions in the Medical X Ray Protective Screen market, driven by well-established healthcare infrastructures, high adoption rates of advanced medical imaging technologies, and stringent radiation safety regulations. In North America, the United States, with its vast network of hospitals and specialized clinics, leads in demand for both mobile and fixed X-ray protective screens. Government initiatives promoting healthcare accessibility and technological upgrades further bolster this dominance. European countries, particularly Germany and the UK, also showcase significant market share due to robust national health services and a proactive approach to adopting new medical equipment that enhances safety.

The Hospital application segment overwhelmingly drives market growth, accounting for an estimated 70% of the total market. Hospitals, performing a higher volume of complex imaging procedures, require comprehensive radiation shielding solutions for diagnostic suites, operating rooms, and interventional radiology labs. The Clinic segment, while smaller, is also experiencing steady growth, driven by the increasing number of specialized outpatient imaging centers.

Within the Type segment, Fixed X-ray protective screens, such as those integrated into CT rooms or fluoroscopy suites, command a larger market share due to their permanent installation and critical role in shielding against high-energy radiation. However, the Mobile X-ray protective screen segment is exhibiting a higher growth rate, fueled by the need for flexible shielding solutions in diverse imaging environments, including portable X-ray units used in patient wards, emergency departments, and veterinary clinics. The growing emphasis on infection control and the ability to reposition screens quickly for multiple patients also contribute to the rising popularity of mobile options. Emerging economies in Asia-Pacific are anticipated to witness the fastest growth, propelled by increasing healthcare expenditure and the expansion of medical facilities.

Medical X Ray Protective Screen Product Landscape

The Medical X Ray Protective Screen product landscape is characterized by continuous innovation focused on enhancing radiation attenuation, improving visibility, and optimizing user ergonomics. Manufacturers are actively developing screens utilizing advanced lead-free composites, offering comparable or superior shielding to traditional lead-based materials while reducing weight and environmental concerns. Features such as high optical clarity, adjustable positioning mechanisms, and integrated cable management are becoming standard. Applications span across diagnostic radiology, interventional cardiology, surgical suites, and veterinary imaging. Performance metrics are centered around radiation attenuation levels (measured in Pb equivalent), impact resistance, and optical transmission. Unique selling propositions include customized sizing, specialized coatings for easy cleaning, and compatibility with various imaging modalities.

Key Drivers, Barriers & Challenges in Medical X Ray Protective Screen

Key Drivers:

- Increasing Incidence of Chronic Diseases: Leading to higher demand for diagnostic imaging procedures.

- Technological Advancements in Imaging Modalities: CT, MRI, and digital X-ray systems necessitate advanced protective solutions.

- Growing Awareness of Radiation Safety: Mandates and best practices by healthcare organizations and regulatory bodies.

- Government Investments in Healthcare Infrastructure: Particularly in emerging economies, driving the adoption of modern radiology equipment.

Key Barriers & Challenges:

- High Initial Investment Costs: Premium protective screens can be expensive, posing a barrier for smaller healthcare facilities.

- Stringent Regulatory Compliance: Navigating complex international and national safety standards can be challenging for manufacturers.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished products.

- Competition from Lower-Cost Alternatives: The availability of less advanced, cheaper shielding options in certain markets.

Emerging Opportunities in Medical X Ray Protective Screen

Emerging opportunities in the Medical X Ray Protective Screen market lie in the development of smart, integrated shielding solutions that offer real-time radiation monitoring and adaptive protection. The expansion of mobile imaging services, particularly in remote or underserved areas, presents a significant opportunity for lightweight and portable screen designs. Furthermore, the growing veterinary sector, with its increasing adoption of advanced imaging techniques, represents an untapped market segment. Innovations in antimicrobial coatings and ease-of-cleaning features are also gaining traction due to heightened infection control concerns.

Growth Accelerators in the Medical X Ray Protective Screen Industry

Catalysts for long-term growth in the Medical X Ray Protective Screen industry include relentless R&D in novel shielding materials that offer superior protection with reduced weight and enhanced flexibility. Strategic partnerships between protective screen manufacturers and imaging equipment vendors are crucial for developing integrated solutions that optimize workflow and safety. Market expansion into developing regions with improving healthcare infrastructure, coupled with favorable government policies promoting medical technology adoption, will also act as significant growth accelerators. The ongoing shift towards personalized medicine, which often involves more frequent and specialized imaging, will further fuel demand for advanced protective screens.

Key Players Shaping the Medical X Ray Protective Screen Market

- Raybloc

- Wardray Premise

- MAVIG GmbH

- Midland Lead

- CABLAS

- KIRAN

- Advin Health Care

- STERIS

- Aktif Dış Ticaret

Notable Milestones in Medical X Ray Protective Screen Sector

- 2019: Launch of advanced lead-free composite materials for X-ray shielding, offering lighter and more environmentally friendly alternatives.

- 2020: Increased demand for mobile protective screens due to the COVID-19 pandemic, facilitating flexible radiation protection in temporary imaging setups.

- 2021: Introduction of integrated LED lighting and adjustable height features in mobile screens, enhancing user experience and workflow.

- 2022: Focus on antimicrobial coatings for protective screens to improve hygiene in clinical environments.

- 2023: Expansion of product lines by key players to cater to the growing veterinary imaging market.

- 2024: Enhanced regulatory focus on radiation dose optimization and the corresponding need for superior protective equipment.

In-Depth Medical X Ray Protective Screen Market Outlook

- 2019: Launch of advanced lead-free composite materials for X-ray shielding, offering lighter and more environmentally friendly alternatives.

- 2020: Increased demand for mobile protective screens due to the COVID-19 pandemic, facilitating flexible radiation protection in temporary imaging setups.

- 2021: Introduction of integrated LED lighting and adjustable height features in mobile screens, enhancing user experience and workflow.

- 2022: Focus on antimicrobial coatings for protective screens to improve hygiene in clinical environments.

- 2023: Expansion of product lines by key players to cater to the growing veterinary imaging market.

- 2024: Enhanced regulatory focus on radiation dose optimization and the corresponding need for superior protective equipment.

In-Depth Medical X Ray Protective Screen Market Outlook

The Medical X Ray Protective Screen market is projected for sustained and substantial growth, driven by a confluence of technological innovation, increasing global healthcare expenditure, and a perpetual emphasis on patient and staff safety. Growth accelerators, including the development of novel, lightweight shielding materials and strategic collaborations between imaging device manufacturers and protective equipment providers, will pave the way for enhanced product offerings. The expanding healthcare infrastructure in emerging economies presents a significant untapped market. Future strategic opportunities lie in the development of intelligent, connected shielding solutions that offer real-time data and adaptive protection, further solidifying the market's trajectory towards an estimated market size of $2.5 billion by 2033.

Medical X Ray Protective Screen Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Type

- 2.1. Mobile

- 2.2. Fixed

Medical X Ray Protective Screen Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical X Ray Protective Screen REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical X Ray Protective Screen Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mobile

- 5.2.2. Fixed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical X Ray Protective Screen Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Mobile

- 6.2.2. Fixed

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical X Ray Protective Screen Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Mobile

- 7.2.2. Fixed

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical X Ray Protective Screen Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Mobile

- 8.2.2. Fixed

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical X Ray Protective Screen Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Mobile

- 9.2.2. Fixed

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical X Ray Protective Screen Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Mobile

- 10.2.2. Fixed

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Raybloc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wardray Premise

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MAVIG GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Midland Lead

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CABLAS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KIRAN

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Advin Health Care

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STERIS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aktif Dış Ticaret

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Raybloc

List of Figures

- Figure 1: Global Medical X Ray Protective Screen Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical X Ray Protective Screen Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical X Ray Protective Screen Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical X Ray Protective Screen Revenue (million), by Type 2024 & 2032

- Figure 5: North America Medical X Ray Protective Screen Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Medical X Ray Protective Screen Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical X Ray Protective Screen Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical X Ray Protective Screen Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical X Ray Protective Screen Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical X Ray Protective Screen Revenue (million), by Type 2024 & 2032

- Figure 11: South America Medical X Ray Protective Screen Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Medical X Ray Protective Screen Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical X Ray Protective Screen Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical X Ray Protective Screen Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical X Ray Protective Screen Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical X Ray Protective Screen Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Medical X Ray Protective Screen Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Medical X Ray Protective Screen Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical X Ray Protective Screen Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical X Ray Protective Screen Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical X Ray Protective Screen Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical X Ray Protective Screen Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Medical X Ray Protective Screen Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Medical X Ray Protective Screen Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical X Ray Protective Screen Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical X Ray Protective Screen Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical X Ray Protective Screen Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical X Ray Protective Screen Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Medical X Ray Protective Screen Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Medical X Ray Protective Screen Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical X Ray Protective Screen Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical X Ray Protective Screen Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical X Ray Protective Screen Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical X Ray Protective Screen Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Medical X Ray Protective Screen Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical X Ray Protective Screen Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical X Ray Protective Screen Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Medical X Ray Protective Screen Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical X Ray Protective Screen Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical X Ray Protective Screen Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Medical X Ray Protective Screen Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical X Ray Protective Screen Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical X Ray Protective Screen Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Medical X Ray Protective Screen Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical X Ray Protective Screen Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical X Ray Protective Screen Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Medical X Ray Protective Screen Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical X Ray Protective Screen Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical X Ray Protective Screen Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Medical X Ray Protective Screen Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical X Ray Protective Screen Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical X Ray Protective Screen?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Medical X Ray Protective Screen?

Key companies in the market include Raybloc, Wardray Premise, MAVIG GmbH, Midland Lead, CABLAS, KIRAN, Advin Health Care, STERIS, Aktif Dış Ticaret.

3. What are the main segments of the Medical X Ray Protective Screen?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical X Ray Protective Screen," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical X Ray Protective Screen report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical X Ray Protective Screen?

To stay informed about further developments, trends, and reports in the Medical X Ray Protective Screen, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence