Key Insights

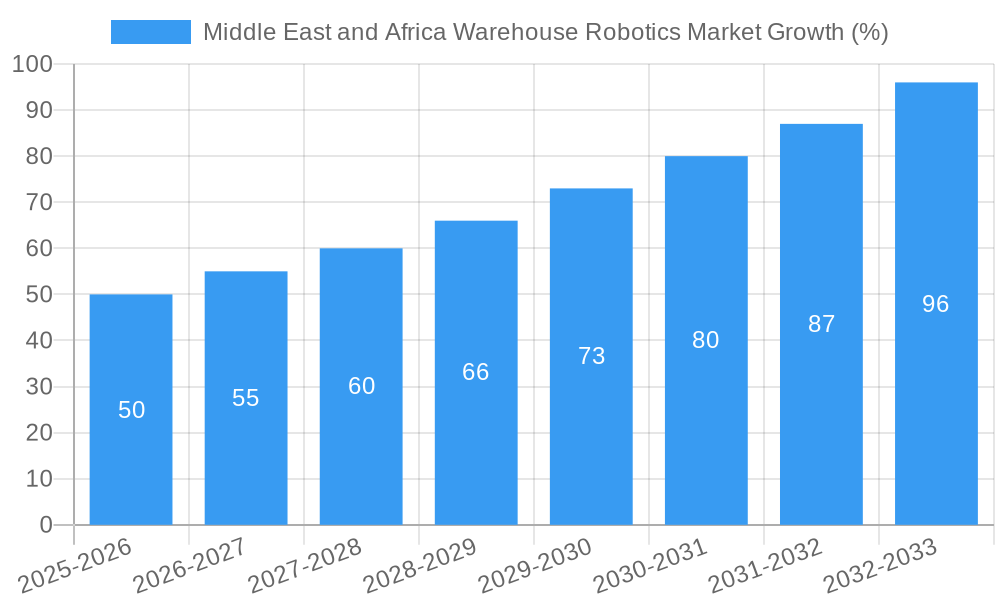

The Middle East and Africa Warehouse Robotics Market is experiencing robust growth, driven by the expanding e-commerce sector, increasing labor costs, and the need for enhanced supply chain efficiency across various industries. The market's Compound Annual Growth Rate (CAGR) of 10.46% from 2019 to 2024 suggests a significant upward trajectory. This growth is particularly pronounced in countries like Saudi Arabia, the United Arab Emirates, and South Africa, where substantial investments in infrastructure and logistics are fueling demand for automated warehouse solutions. The food and beverage, automotive, and retail sectors are leading adopters, leveraging robotics for tasks such as picking, packing, and transporting goods, improving speed, accuracy, and overall productivity. Furthermore, the increasing focus on optimizing warehouse operations and reducing operational costs is a key driver for market expansion. The market is segmented by function (storage, packaging, trans-shipment, and others), end-user (food and beverage, automotive, retail, electrical and electronics, pharmaceutical, and other end-users), and geography, allowing for targeted market penetration strategies. Challenges include the initial high investment costs associated with robotic systems and the need for skilled workforce training to operate and maintain the technology. However, the long-term benefits of increased efficiency and reduced operational costs are outweighing these initial hurdles. The forecast period (2025-2033) anticipates continued market expansion, driven by technological advancements and sustained growth in e-commerce across the region.

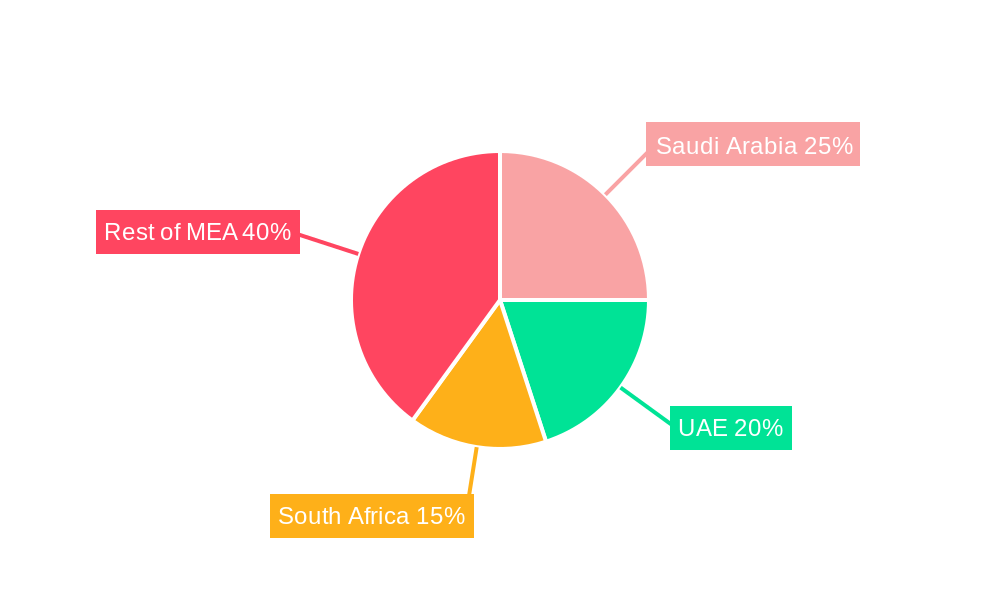

While precise market size figures for specific years are unavailable, a reasonable estimation can be derived. Considering the CAGR of 10.46% from 2019 to 2024 and a base year of 2025, we can project a steady increase in market value throughout the forecast period. Factors such as government initiatives promoting automation and digitalization in the region, as well as the ongoing expansion of major e-commerce players, will continue to stimulate demand for warehouse robotics solutions. The regional disparities in market penetration will likely persist, with developed economies such as the UAE and Saudi Arabia exhibiting faster adoption rates than some nations in sub-Saharan Africa. However, increasing urbanization and infrastructural development across the region are expected to contribute to a broader adoption of warehouse automation technologies across the Middle East and Africa in the coming years.

Middle East and Africa Warehouse Robotics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Warehouse Robotics Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously analyzes market dynamics, growth trends, dominant segments, and key players, equipping readers with a holistic understanding of this rapidly evolving sector. The market is segmented by End User (Food and Beverage, Automotive, Retail, Electrical and Electronics, Pharmaceutical, Other End Users), Country (Saudi Arabia, South Africa, United Arab Emirates, Rest of Middle East and Africa), and Function (Storage, Packaging, Trans shipments, Other Functions). The total market value in 2025 is estimated at XX Million Units.

Middle East and Africa Warehouse Robotics Market Market Dynamics & Structure

The Middle East and Africa Warehouse Robotics market is characterized by moderate concentration, with key players like Yaskawa Electric Corporation (Yaskawa Motoman), Fanuc Corporation, and ABB Limited holding significant market share (xx%). Technological advancements, particularly in AI and computer vision, are driving market growth, alongside increasing e-commerce adoption and the need for efficient logistics. However, regulatory hurdles and a relatively nascent automation culture pose challenges. Mergers and acquisitions (M&A) activity has been relatively low (xx deals in the last 5 years), but is expected to increase as larger players seek to consolidate their presence.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: AI-powered robotics, improved navigation systems, and collaborative robots (cobots) are driving innovation.

- Regulatory Framework: Varying regulations across countries present both opportunities and challenges for market expansion.

- Competitive Substitutes: Manual labor remains a significant competitor, particularly in smaller businesses.

- End-User Demographics: Growth is driven by large-scale warehousing and distribution centers in key sectors like e-commerce, food and beverage, and automotive.

- M&A Trends: Low M&A activity to date, but projected increase in consolidation activity in the forecast period.

Middle East and Africa Warehouse Robotics Market Growth Trends & Insights

The Middle East and Africa Warehouse Robotics market witnessed significant growth between 2019 and 2024, expanding at a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, driven by factors such as rising labor costs, the growth of e-commerce, and increasing government investments in infrastructure and logistics. Market penetration is still relatively low (xx%) in 2025, indicating substantial untapped potential. Technological disruptions, including the emergence of autonomous mobile robots (AMRs) and advanced warehouse management systems (WMS), are further accelerating adoption rates. Consumer behavior shifts towards online shopping are also significantly fueling market expansion. Furthermore, increasing awareness regarding warehouse safety and efficiency is influencing the decision to integrate robotics.

Dominant Regions, Countries, or Segments in Middle East and Africa Warehouse Robotics Market

The United Arab Emirates (UAE) currently holds the largest market share (xx%) within the Middle East and Africa region, followed by Saudi Arabia (xx%). This dominance is primarily attributed to the UAE’s robust e-commerce sector, advanced logistics infrastructure, and government support for technological advancements. The automotive and food & beverage sectors are currently the largest end-user segments, with high growth potential in the pharmaceutical and retail sectors.

- Key Drivers in UAE: Advanced logistics infrastructure, supportive government policies, and a rapidly growing e-commerce sector.

- Key Drivers in Saudi Arabia: Government initiatives to diversify the economy, increased investment in industrial automation, and growth in the logistics sector.

- Growth Potential in South Africa: Increasing adoption of automation in response to rising labor costs and improving infrastructure.

- High Growth Potential Segment: The pharmaceutical sector is expected to demonstrate significant growth due to stringent regulatory requirements and increasing demand for efficient handling of sensitive materials.

Middle East and Africa Warehouse Robotics Market Product Landscape

The market offers a diverse range of warehouse robotics solutions, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), robotic arms for picking and packing, and automated storage and retrieval systems (AS/RS). These solutions are designed to improve efficiency, accuracy, and safety in warehousing operations. Recent advancements include AI-powered vision systems for precise object recognition and manipulation, enabling robots to handle a wider variety of items. The increasing use of cloud-based platforms for robotics management further enhances operational flexibility and data analysis capabilities.

Key Drivers, Barriers & Challenges in Middle East and Africa Warehouse Robotics Market

Key Drivers:

- Rising labor costs and labor shortages.

- Increased e-commerce activities demanding faster and more efficient fulfillment.

- Government initiatives promoting industrial automation and technological advancement.

Key Challenges:

- High initial investment costs associated with robotics implementation.

- Lack of skilled workforce to operate and maintain robotics systems.

- Concerns regarding job displacement due to automation. This has led to a slowdown of xx% in adoption in some regions.

Emerging Opportunities in Middle East and Africa Warehouse Robotics Market

- Untapped markets: Expanding into smaller businesses and rural areas.

- Innovative applications: Implementing robotics in specialized warehousing, such as cold storage and hazardous materials handling.

- Evolving consumer preferences: Meeting the demands for faster and more reliable delivery through improved warehousing efficiency.

Growth Accelerators in the Middle East and Africa Warehouse Robotics Market Industry

Technological breakthroughs such as the development of more advanced AI and computer vision systems will greatly accelerate market growth. Strategic partnerships between robotics manufacturers, logistics providers, and e-commerce companies will enable wider adoption. Expansion strategies focused on providing customized solutions tailored to the unique needs of different industries and regions will also contribute significantly to the market's expansion.

Key Players Shaping the Middle East and Africa Warehouse Robotics Market Market

- Yaskawa Electric Corporation (Yaskawa Motoman)

- Fanuc Corporation

- Honeywell International Inc

- Singapore Technologies Engineering Ltd (Aethon Incorporation)

- Grey Orange Pte Ltd

- Syrius Robotic

- Toshiba Corporation

- ABB Limited

- Kuka AG

Notable Milestones in Middle East and Africa Warehouse Robotics Market Sector

- 2022 Q3: ABB launches a new range of collaborative robots specifically designed for warehouse applications in the Middle East.

- 2023 Q1: Grey Orange secures a major contract to supply its autonomous mobile robots to a large e-commerce fulfillment center in Saudi Arabia.

- 2024 Q4: A significant merger between two regional robotics companies leads to increased market consolidation.

In-Depth Middle East and Africa Warehouse Robotics Market Market Outlook

The Middle East and Africa Warehouse Robotics market is poised for substantial growth, driven by technological advancements, increasing e-commerce penetration, and supportive government policies. Strategic opportunities lie in focusing on niche segments, developing customized solutions, and forming strategic partnerships to overcome existing challenges. The market's long-term potential is significant, with ample room for expansion across various sectors and countries.

Middle East and Africa Warehouse Robotics Market Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

-

2. Function

- 2.1. Storage

- 2.2. Packaging

- 2.3. Trans shipments

- 2.4. Other Functions

-

3. End User

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End Users

Middle East and Africa Warehouse Robotics Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Warehouse Robotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Investments in Technology and Robotics

- 3.3. Market Restrains

- 3.3.1. ; Initiative of Zero Routine Flaring by 2030

- 3.4. Market Trends

- 3.4.1. Sortation Systems to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Packaging

- 5.2.3. Trans shipments

- 5.2.4. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Africa Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. South Africa Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Sudan Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Uganda Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Tanzania Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Kenya Middle East and Africa Warehouse Robotics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Yaskawa Electric Corporation (Yaskawa Motoman)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fanuc Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Honeywell International Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Singapore Technologies Engineering Ltd (Aethon Incorporation)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Grey Orange Pte Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Syrius Robotic

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Toshiba Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ABB Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kuka AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Yaskawa Electric Corporation (Yaskawa Motoman)

List of Figures

- Figure 1: Middle East and Africa Warehouse Robotics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Warehouse Robotics Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 6: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Function 2019 & 2032

- Table 7: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 25: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 26: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Function 2019 & 2032

- Table 27: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 29: Middle East and Africa Warehouse Robotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Middle East and Africa Warehouse Robotics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Saudi Arabia Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Saudi Arabia Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: United Arab Emirates Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United Arab Emirates Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Israel Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Israel Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Qatar Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Qatar Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Kuwait Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Kuwait Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Oman Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Oman Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Bahrain Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Bahrain Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Jordan Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Jordan Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Lebanon Middle East and Africa Warehouse Robotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Lebanon Middle East and Africa Warehouse Robotics Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Warehouse Robotics Market?

The projected CAGR is approximately 10.46%.

2. Which companies are prominent players in the Middle East and Africa Warehouse Robotics Market?

Key companies in the market include Yaskawa Electric Corporation (Yaskawa Motoman), Fanuc Corporation, Honeywell International Inc, Singapore Technologies Engineering Ltd (Aethon Incorporation), Grey Orange Pte Ltd, Syrius Robotic, Toshiba Corporation, ABB Limited, Kuka AG.

3. What are the main segments of the Middle East and Africa Warehouse Robotics Market?

The market segments include Type, Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Investments in Technology and Robotics.

6. What are the notable trends driving market growth?

Sortation Systems to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Initiative of Zero Routine Flaring by 2030.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Warehouse Robotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Warehouse Robotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Warehouse Robotics Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Warehouse Robotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence