Key Insights

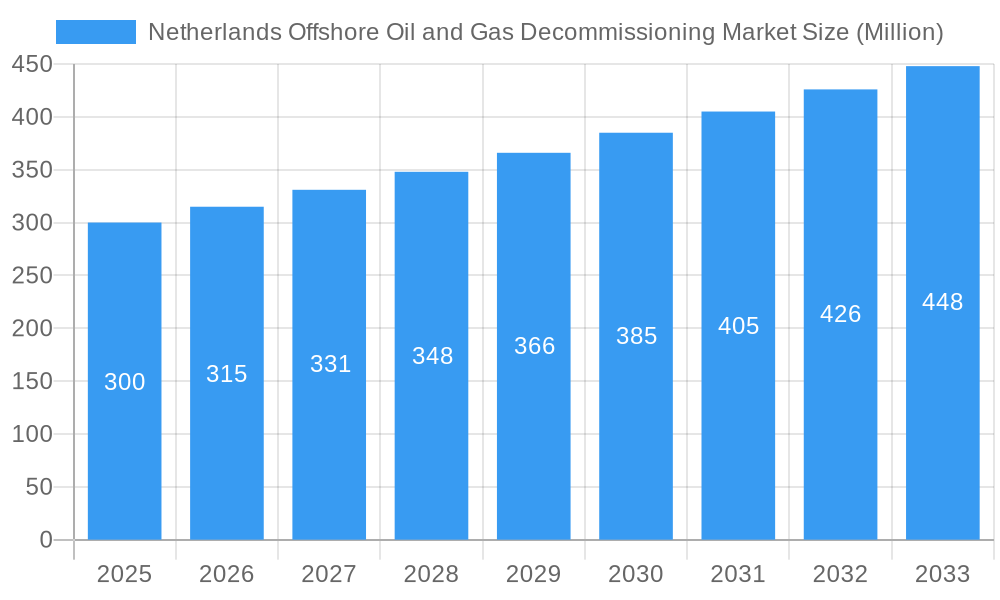

The Netherlands offshore oil and gas decommissioning market is projected for substantial growth, propelled by aging infrastructure and stringent environmental remediation mandates. With a compound annual growth rate (CAGR) of 6.5%, the market is set for expansion. Key growth drivers include proactive Dutch government decommissioning policies, advancements in efficient and cost-effective decommissioning technologies, and increasing demand for specialized expertise. The market is segmented by location and voltage level, catering to diverse project requirements. Major industry players are actively engaged, leveraging their comprehensive capabilities to secure market share. The Netherlands' strategic North Sea position and established offshore energy infrastructure further bolster market expansion.

Netherlands Offshore Oil and Gas Decommissioning Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained expansion as more offshore assets reach their end-of-life. Despite potential challenges such as oil price volatility and complex operational environments, the market outlook is robust. The market size is estimated at 11.1 billion in the base year 2025, with continuous growth anticipated. This projection accounts for significant investment requirements and the inherent complexities of offshore decommissioning projects, influenced by evolving regulations and technological innovations.

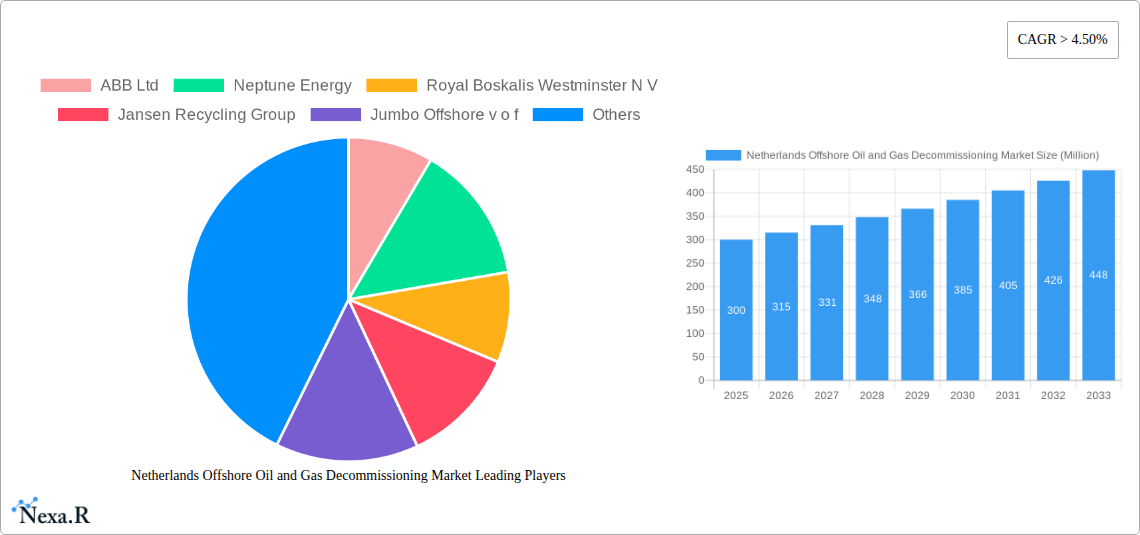

Netherlands Offshore Oil and Gas Decommissioning Market Company Market Share

Netherlands Offshore Oil and Gas Decommissioning Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Netherlands offshore oil and gas decommissioning market, encompassing market dynamics, growth trends, regional segmentation, key players, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. This in-depth study is essential for industry professionals, investors, and policymakers seeking a clear understanding of this evolving sector. The market is segmented by Location of Deployment (Overhead, Underground, Submarine) and Voltage Level (High Voltage, Extra High Voltage, Ultra High Voltage).

Netherlands Offshore Oil and Gas Decommissioning Market Market Dynamics & Structure

The Netherlands offshore oil and gas decommissioning market is characterized by increasing regulatory pressure, technological advancements, and a growing number of aging offshore installations requiring decommissioning. Market concentration is moderate, with several large players and numerous smaller specialized companies competing for projects. The market is driven by stringent environmental regulations, a declining production of oil and gas, and rising safety concerns. Mergers and acquisitions (M&A) activity is expected to increase as companies consolidate their position within this specialized market. The historical period (2019-2024) saw a steady increase in decommissioning activity, primarily driven by government incentives and the need to mitigate environmental risks. The total market value during this time was approximately xx Million.

- Market Concentration: Moderate, with a mix of large multinational companies and smaller specialized firms. Market share for the top 3 players is estimated at xx%.

- Technological Innovation: Significant innovation in robotics, remotely operated vehicles (ROVs), and advanced recycling technologies are driving efficiency and reducing costs. Barriers to innovation include high upfront investment costs and the need for specialized expertise.

- Regulatory Framework: Stringent environmental regulations and safety standards imposed by the Dutch government are key drivers. These regulations mandate safe and responsible decommissioning practices, boosting market demand.

- Competitive Product Substitutes: Limited viable substitutes exist for specialized decommissioning services, resulting in a relatively inelastic market.

- End-User Demographics: Primarily comprised of oil and gas operators, both major international companies and smaller independent producers.

- M&A Trends: Consolidation is expected to continue, with larger companies acquiring smaller specialists to gain access to specific technologies and expertise. The number of M&A deals in the historical period was xx, with a total value of xx Million.

Netherlands Offshore Oil and Gas Decommissioning Market Growth Trends & Insights

The Netherlands offshore oil and gas decommissioning market is experiencing substantial growth, driven by several key factors, including the aging infrastructure of existing offshore oil and gas fields, the rising cost of compliance with increasingly stringent environmental regulations, and the growing adoption of advanced decommissioning technologies. The market size in 2024 is estimated at xx Million and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is influenced by several factors: an increase in the number of platforms requiring decommissioning, technological advancements that are reducing the cost and time of decommissioning activities, and government policies that incentivize responsible decommissioning practices. The market penetration of advanced technologies like ROVs and automated systems is steadily increasing, further accelerating the growth of this market. Furthermore, changes in consumer behavior towards renewable energy sources also contributes to this growth.

Dominant Regions, Countries, or Segments in Netherlands Offshore Oil and Gas Decommissioning Market

The Dutch North Sea remains the dominant region for offshore oil and gas decommissioning activities, owing to its mature oil and gas fields. Submarine decommissioning holds the largest market share due to the presence of numerous subsea installations needing removal. High Voltage and Extra High Voltage decommissioning projects account for a significant portion of the market, driven by the prevalence of these voltage levels in older offshore platforms.

- Key Drivers:

- Government Policies: Stringent environmental regulations and financial incentives for decommissioning projects.

- Aging Infrastructure: The need to decommission aging offshore oil and gas facilities.

- Technological Advancements: Improvements in decommissioning technologies leading to cost reduction and efficiency gains.

- Dominance Factors:

- High Concentration of Offshore Assets: The Dutch North Sea's historical role as a major oil and gas producer leads to a substantial number of installations requiring decommissioning.

- Favorable Regulatory Environment: Clear guidelines and supportive government policies encourage investment in decommissioning projects.

- Geographic Accessibility: Proximity to ports and established infrastructure facilitates efficient decommissioning operations.

- Market Share: The submarine segment holds the largest market share (xx%), followed by overhead (xx%) and underground (xx%). High Voltage holds the largest market share in voltage segments (xx%), followed by Extra High Voltage (xx%) and Ultra High Voltage (xx%).

Netherlands Offshore Oil and Gas Decommissioning Market Product Landscape

The Netherlands offshore oil and gas decommissioning market features a diverse range of products and services, including platform removal, well plugging and abandonment, pipeline decommissioning, and waste management. Recent product innovations include the development of more efficient and environmentally friendly decommissioning techniques, such as robotic systems for subsea operations and improved recycling processes for platform components. These innovations are aimed at minimizing environmental impact and reducing the overall cost of decommissioning. The key performance indicators (KPIs) in this market include cost efficiency, safety records, environmental compliance, and project completion timelines.

Key Drivers, Barriers & Challenges in Netherlands Offshore Oil and Gas Decommissioning Market

Key Drivers:

- Stringent Environmental Regulations: The increasing pressure to comply with stricter environmental protection laws is driving demand for responsible decommissioning practices.

- Aging Offshore Infrastructure: A large number of aging oil and gas platforms and pipelines are approaching the end of their operational life, requiring decommissioning.

- Technological Advancements: Innovations in decommissioning technologies offer more efficient and cost-effective solutions.

Key Challenges & Restraints:

- High Decommissioning Costs: The cost associated with decommissioning offshore installations remains a major barrier.

- Complex Regulatory Landscape: Navigating the intricate regulatory environment can be challenging and time-consuming.

- Supply Chain Constraints: Securing specialized equipment and expertise can be difficult, especially for complex projects. This can lead to project delays and cost overruns. The impact is estimated to be an average delay of xx months per project, resulting in a cost increase of xx Million annually.

Emerging Opportunities in Netherlands Offshore Oil and Gas Decommissioning Market

- Growth in Renewable Energy: The decommissioning of old oil and gas platforms can create opportunities for repurposing the infrastructure for offshore wind farms.

- Technological Advancements: Further innovation in robotics, AI, and automation can lead to cost-effective and sustainable solutions.

- Circular Economy: The focus on recycling and reuse of decommissioned materials presents an opportunity for the development of a circular economy within the sector.

Growth Accelerators in the Netherlands Offshore Oil and Gas Decommissioning Market Industry

The long-term growth of the Netherlands offshore oil and gas decommissioning market will be driven by several key factors. Technological breakthroughs in areas such as robotics and AI will continue to increase efficiency and reduce costs. Strategic partnerships between oil and gas companies, specialized decommissioning firms, and recycling companies will enhance the effectiveness of decommissioning operations. The expansion of decommissioning activity into new areas, such as offshore wind farm decommissioning, will create additional growth opportunities.

Key Players Shaping the Netherlands Offshore Oil and Gas Decommissioning Market Market

- ABB Ltd

- Neptune Energy

- Royal Boskalis Westminster N V

- Jansen Recycling Group

- Jumbo Offshore v o f

- SALTWATER ENGINEERING B V

- Veolia Environnement SA

- Nexstep

Notable Milestones in Netherlands Offshore Oil and Gas Decommissioning Market Sector

- September 2022: Neptune Energy awarded a USD 30 million decommissioning contract to Well-Safe Solutions for over 20 wells across eight Dutch and UK North Sea fields. This signifies a significant investment in decommissioning activity and highlights the growing market demand.

- October 2022: TotalEnergies and AF Offshore Decom signed a contract for the engineering, preparation, removal, transportation, dismantling, and recycling (EPRD) of 10 production platforms from the L7 field. This illustrates the scale of decommissioning projects underway and underscores the need for specialized expertise.

In-Depth Netherlands Offshore Oil and Gas Decommissioning Market Market Outlook

The Netherlands offshore oil and gas decommissioning market is poised for continued growth, driven by the increasing number of aging offshore assets, ongoing technological advancements, and a favorable regulatory environment. Strategic opportunities exist for companies specializing in innovative decommissioning technologies, efficient waste management, and the development of a circular economy approach to decommissioning. The market's future potential is substantial, offering attractive investment opportunities for those willing to navigate the complexities of this specialized sector.

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation By Geography

- 1. Netherlands

Netherlands Offshore Oil and Gas Decommissioning Market Regional Market Share

Geographic Coverage of Netherlands Offshore Oil and Gas Decommissioning Market

Netherlands Offshore Oil and Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth

- 3.4. Market Trends

- 3.4.1. Shallow Water Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Offshore Oil and Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Neptune Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Boskalis Westminster N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jansen Recycling Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jumbo Offshore v o f

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SALTWATER ENGINEERING B V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Veolia Environnement SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nexstep

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Offshore Oil and Gas Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Offshore Oil and Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Netherlands Offshore Oil and Gas Decommissioning Market?

Key companies in the market include ABB Ltd, Neptune Energy, Royal Boskalis Westminster N V, Jansen Recycling Group, Jumbo Offshore v o f, SALTWATER ENGINEERING B V, Veolia Environnement SA*List Not Exhaustive, Nexstep.

3. What are the main segments of the Netherlands Offshore Oil and Gas Decommissioning Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Shallow Water Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Neptune Energy announced the award of a USD 30 million decommissioning contract to Well-Safe Solutions, for a campaign covering more than 20 wells located across eight Dutch and UK North Sea fields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Offshore Oil and Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Offshore Oil and Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Offshore Oil and Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the Netherlands Offshore Oil and Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence