Key Insights

The North American handbags market is poised for significant expansion, projected to reach $14.91 billion by 2025, with a compound annual growth rate (CAGR) of 9.4%. This robust growth is propelled by rising disposable incomes among young professionals and millennials, alongside an increasing appetite for luxury and designer goods. Social media influence and celebrity endorsements are pivotal in shaping consumer preferences and driving purchasing decisions, further augmented by the convenience and variety offered by e-commerce platforms.

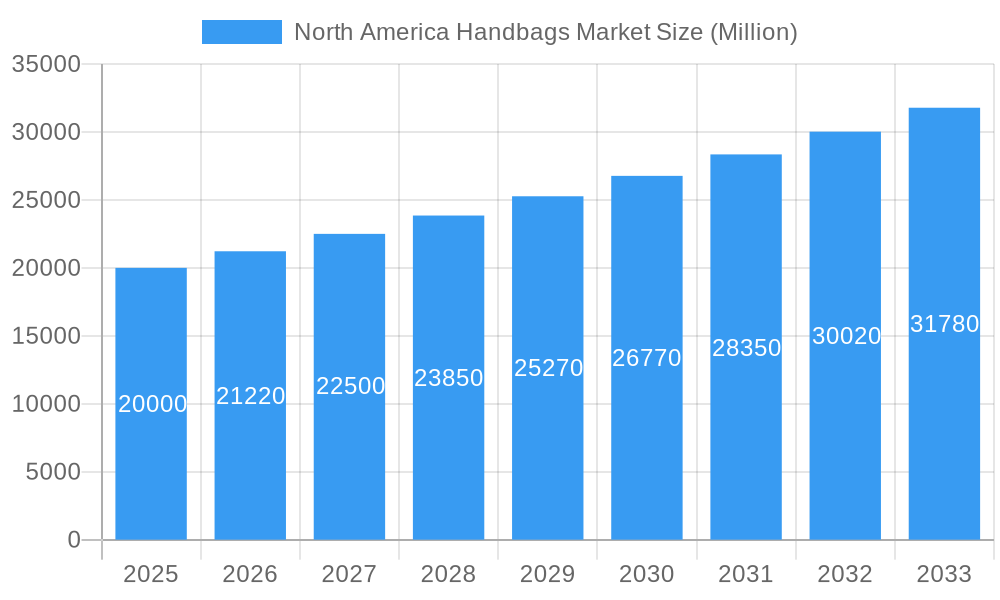

North America Handbags Market Market Size (In Billion)

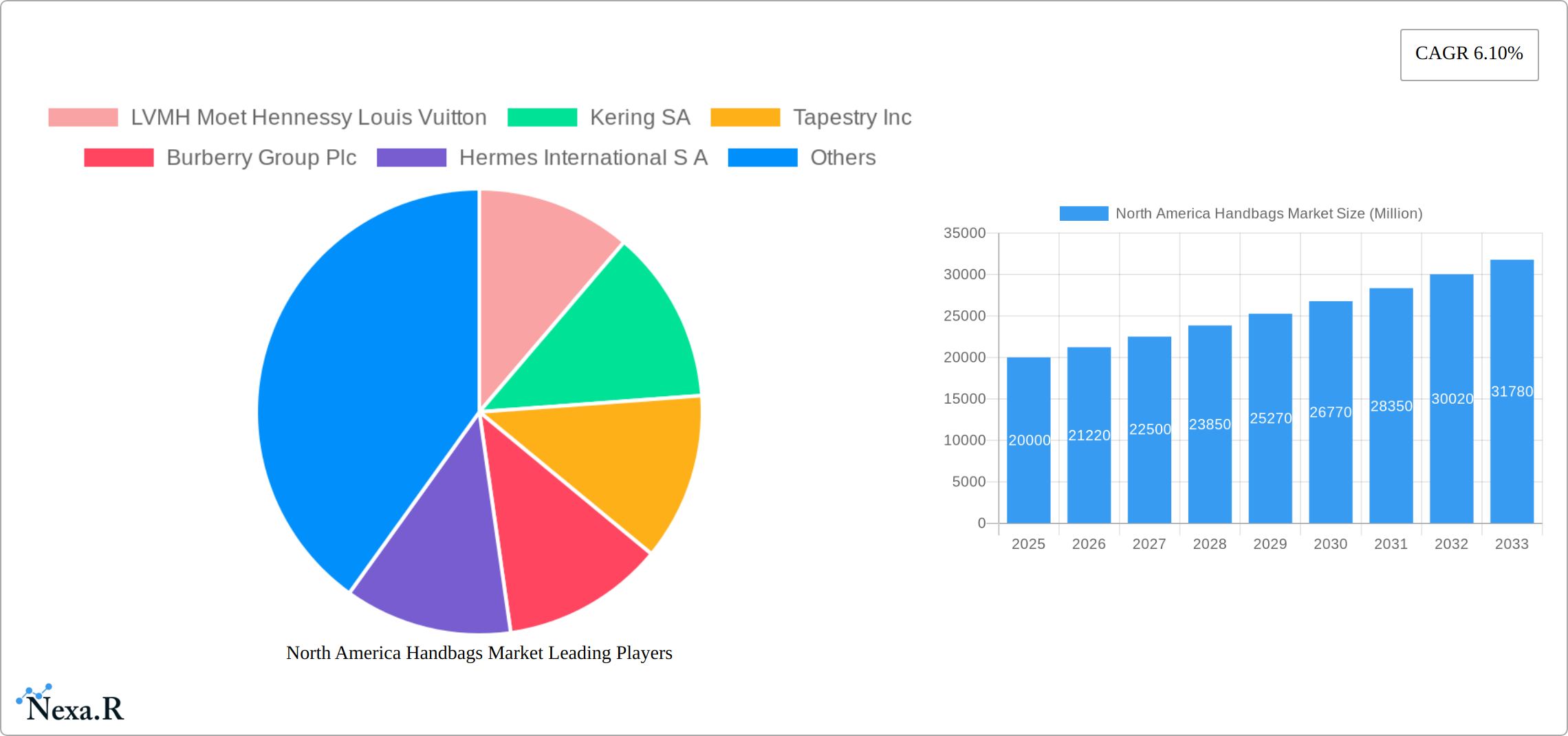

The market is segmented by distribution channel, with online platforms demonstrating rapid expansion mirroring evolving consumer shopping habits, and by product type, including satchels, clutches, tote bags, sling bags, and others. Key industry players like LVMH, Kering, Tapestry, Burberry, Hermès, Tory Burch, Michael Kors, Fossil Group, and Prada are engaged in intense competition, leveraging strong brand recognition and established distribution networks. Simultaneously, emerging brands such as Pixie Mood are gaining traction by offering stylish and accessible alternatives.

North America Handbags Market Company Market Share

Several trends are shaping the North American handbags market. A growing emphasis on sustainability and ethical sourcing influences material selection and production processes. Consumer demand for personalized and customized handbags is on the rise, catering to a desire for unique self-expression. Technological innovations, including augmented reality (AR) in online retail, are enhancing the customer experience and boosting sales. Potential challenges include economic downturns and fluctuations in consumer confidence. The proliferation of counterfeit handbags poses a significant threat to brand integrity and revenue. Despite these challenges, the North American handbags market is anticipated to maintain its growth trajectory throughout the forecast period.

North America Handbags Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America handbags market, encompassing market dynamics, growth trends, dominant segments, product landscape, and key players. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is an essential resource for industry professionals, investors, and anyone seeking a thorough understanding of this lucrative market valued at xx million units in 2025.

North America Handbags Market Dynamics & Structure

The North American handbags market is a dynamic landscape characterized by intense competition, significant technological advancements, and evolving consumer preferences. Market concentration is moderate, with several major players holding substantial market share but numerous smaller brands contributing significantly. The market is segmented by distribution channel (online stores and offline stores) and by type (satchel, clutch, tote bag, sling bag, and others).

Market Concentration & Competition:

- The market exhibits a moderately concentrated structure with top players like LVMH Moet Hennessy Louis Vuitton, Kering SA, and Tapestry Inc. holding significant shares. Smaller players and niche brands also contribute to market vibrancy. Estimated market share of top 5 players in 2025: xx%.

- Intense competition drives innovation and pricing strategies, leading to diverse product offerings catering to various consumer segments. Mergers and acquisitions (M&A) activities play a significant role in shaping market dynamics. Estimated M&A deal volume in 2024: xx.

Technological Innovation Drivers:

- E-commerce platforms and advanced supply chain management systems are reshaping distribution and reducing operational costs. Integration of AR/VR technologies for virtual try-ons enhances online shopping experiences.

- Sustainable and ethically sourced materials are gaining traction, influenced by environmentally conscious consumer choices. Innovation in materials, design, and manufacturing techniques is key to attracting and retaining customers.

Regulatory Frameworks & Consumer Behavior:

- Compliance with labeling and safety standards is crucial for market participation. Evolving consumer preferences towards personalization, luxury, and sustainable products are significant influencers. Demographics and buying behavior are also important factors. The millennial and Gen Z segment holds significant market power.

- Counterfeit products pose a challenge to legitimate brands and negatively impact market growth. Stricter enforcement of intellectual property rights is crucial.

North America Handbags Market Growth Trends & Insights

The North American handbags market is experiencing robust expansion, poised for significant growth throughout the forecast period (2025-2033). This surge is primarily fueled by a confluence of factors including rising disposable incomes, the dynamic evolution of fashion trends, and the pervasive influence of e-commerce. Projections indicate a substantial increase in market value, with an anticipated Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, culminating in a market size of around $XX billion units by 2033. The market's trajectory is further bolstered by the escalating adoption of online shopping for handbags, a pronounced consumer preference for personalized and bespoke creations, and continuous technological advancements. A growing consumer consciousness towards sustainability and ethical sourcing practices is increasingly shaping material choices and production methodologies. The digital retail landscape is set to dominate, with online channels projected to capture a market penetration of nearly 65% by 2033, acting as a key accelerator for overall market expansion.

Dominant Regions, Countries, or Segments in North America Handbags Market

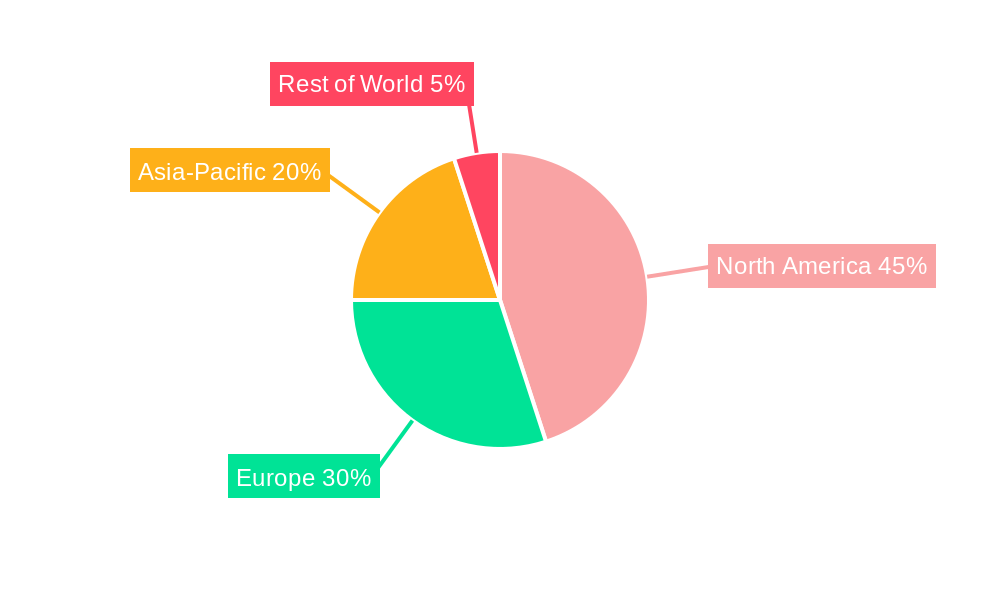

The United States unequivocally holds the leading position in the North American handbags market, attributed to its extensive consumer base, considerable purchasing power, and a well-established and influential fashion industry. Within the US, demand is particularly concentrated in major metropolitan hubs, reflecting urban lifestyle trends. Canada presents a compelling growth narrative, driven by a burgeoning middle class and a significant shift towards online retail channels. Examining market segments reveals distinct dynamics:

By Distribution Channel:

- Online Stores: This segment is the undisputed growth engine, characterized by unparalleled convenience, an expansive product selection, and competitive pricing strategies. The proliferation of mobile commerce is a significant catalyst, further propelling online sales volume.

- Offline Stores: While experiencing a more moderate growth rate compared to online counterparts, physical retail outlets continue to command a substantial market share. This enduring appeal stems from the tangible shopping experience, allowing consumers to physically interact with products and enjoy immediate gratification.

By Type:

- Tote Bags: These remain a perennial favorite, owing to their exceptional versatility and practical functionality, making them ideal for everyday use.

- Satchels: A strong demand persists for satchels, particularly among professional women and individuals seeking a classic, structured aesthetic that complements business and formal attire.

- Clutch Bags: Clutch bags continue to be an indispensable accessory for formal events and evening wear, maintaining their niche appeal. While their growth may be less dynamic than tote bags, they remain a staple in many wardrobes.

North America Handbags Market Product Landscape

The North American handbag market is characterized by a diverse and innovative product portfolio designed to cater to an extensive spectrum of styles, preferences, and functional requirements. Technological advancements are playing a pivotal role in driving material innovation, with a notable emphasis on sustainable and ethically produced alternatives. This includes the widespread adoption of vegan leather, recycled fabrics, and other eco-conscious materials. Product development is increasingly focused on enhancing durability, optimizing functionality through thoughtful compartment and pocket design, and creating unique, trend-driven aesthetics. The trend towards personalization is exceptionally strong, with customization options and bespoke design services becoming a significant differentiator, especially within the premium and luxury segments. Performance metrics for products are also evolving, with a greater emphasis being placed on sustainability certifications, transparent ethical sourcing practices, and the overall longevity of the product.

Key Drivers, Barriers & Challenges in North America Handbags Market

Key Drivers:

- Rising disposable incomes and increased spending on fashion accessories.

- Growing popularity of online shopping and e-commerce platforms.

- Increased demand for personalized and customized handbags.

Key Challenges:

- Intense competition from both established and emerging brands.

- Fluctuations in raw material prices and supply chain disruptions.

- Counterfeit products impacting brand reputation and market integrity. This resulted in xx million units of lost sales in 2024.

Emerging Opportunities in North America Handbags Market

- The escalating consumer demand for handbags that are both sustainable and ethically produced presents a significant growth avenue.

- Untapped market potential exists in expanding reach to smaller cities and rural areas, where brand penetration may be lower.

- Opportunities abound in the development of innovative product features, including the integration of smart technology for enhanced functionality and user experience.

- The rise of direct-to-consumer (DTC) brands offering unique designs and strong brand narratives is a growing opportunity.

- Collaborations between handbag designers and other industries, such as technology or apparel, can lead to novel product offerings.

Growth Accelerators in the North America Handbags Market Industry

Strategic partnerships between brands and influencers, targeted marketing campaigns emphasizing sustainability and ethical production, and expansion into new geographical markets are key catalysts for long-term growth. Technological advancements driving personalized experiences and improved supply chain efficiency will further accelerate market expansion.

Key Players Shaping the North America Handbags Market Market

- LVMH Moët Hennessy Louis Vuitton

- Kering SA

- Tapestry Inc.

- Burberry Group Plc

- Hermès International S.A.

- Tory Burch LLC

- Pixie Mood

- Michael Kors (USA) Inc.

- Fossil Group Inc.

- Prada Holding S.p.A.

- Coach (Tapestry, Inc.)

- Kate Spade New York (Tapestry, Inc.)

- Chloé (Richemont)

Notable Milestones in North America Handbags Market Sector

- March 2022: Aranyani, an Indian luxury handbag brand, expanded into the US market.

- September 2021: Pixie Mood redesigned its website and launched its Fall/Winter '21 collection.

- October 2020: Schutz launched its handbag line in the United States.

In-Depth North America Handbags Market Market Outlook

The North American handbags market is poised for continued growth, driven by evolving consumer preferences, technological innovations, and a focus on sustainability. Strategic investments in e-commerce, targeted marketing, and product diversification will be key to success. The market offers significant opportunities for established players and new entrants alike, particularly those who can effectively leverage emerging trends and address consumer demand for ethically sourced, personalized, and technologically advanced products.

North America Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Clutch

- 1.3. Tote Bag

- 1.4. Sling Bag

- 1.5. Others

-

2. Distibution Channel

- 2.1. Online Stores

- 2.2. Offline Stores

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Handbags Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Handbags Market Regional Market Share

Geographic Coverage of North America Handbags Market

North America Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Luxury Handbags

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Clutch

- 5.1.3. Tote Bag

- 5.1.4. Sling Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Online Stores

- 5.2.2. Offline Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Clutch

- 6.1.3. Tote Bag

- 6.1.4. Sling Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Online Stores

- 6.2.2. Offline Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Clutch

- 7.1.3. Tote Bag

- 7.1.4. Sling Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Online Stores

- 7.2.2. Offline Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Clutch

- 8.1.3. Tote Bag

- 8.1.4. Sling Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Online Stores

- 8.2.2. Offline Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Satchel

- 9.1.2. Clutch

- 9.1.3. Tote Bag

- 9.1.4. Sling Bag

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Online Stores

- 9.2.2. Offline Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kering SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tapestry Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Burberry Group Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hermes International S A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tory Burch LLC*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pixie Mood

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Michael Kors (USA) Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fossil Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prada Holding SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: North America Handbags Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Handbags Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 7: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 11: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 15: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 19: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Handbags Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the North America Handbags Market?

Key companies in the market include LVMH Moet Hennessy Louis Vuitton, Kering SA, Tapestry Inc, Burberry Group Plc, Hermes International S A, Tory Burch LLC*List Not Exhaustive, Pixie Mood, Michael Kors (USA) Inc, Fossil Group Inc, Prada Holding SpA.

3. What are the main segments of the North America Handbags Market?

The market segments include Type, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors.

6. What are the notable trends driving market growth?

Increase in Demand for Luxury Handbags.

7. Are there any restraints impacting market growth?

Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus.

8. Can you provide examples of recent developments in the market?

In March 2022, Aranyani, an Indian luxury handbag brand expanded its presence in the United States and launched its products in New York at the Consulate General of India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Handbags Market?

To stay informed about further developments, trends, and reports in the North America Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence