Key Insights

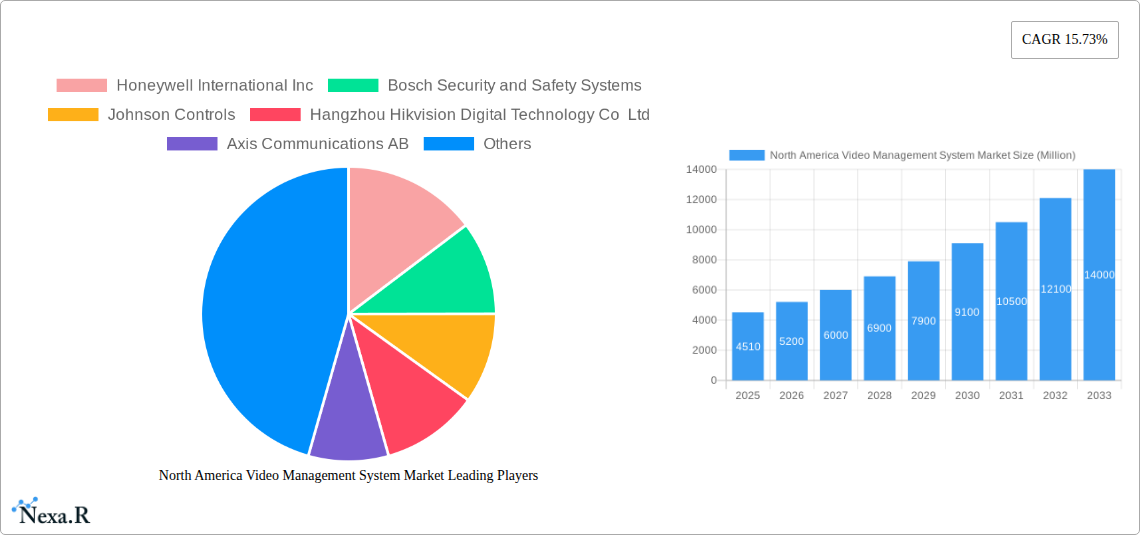

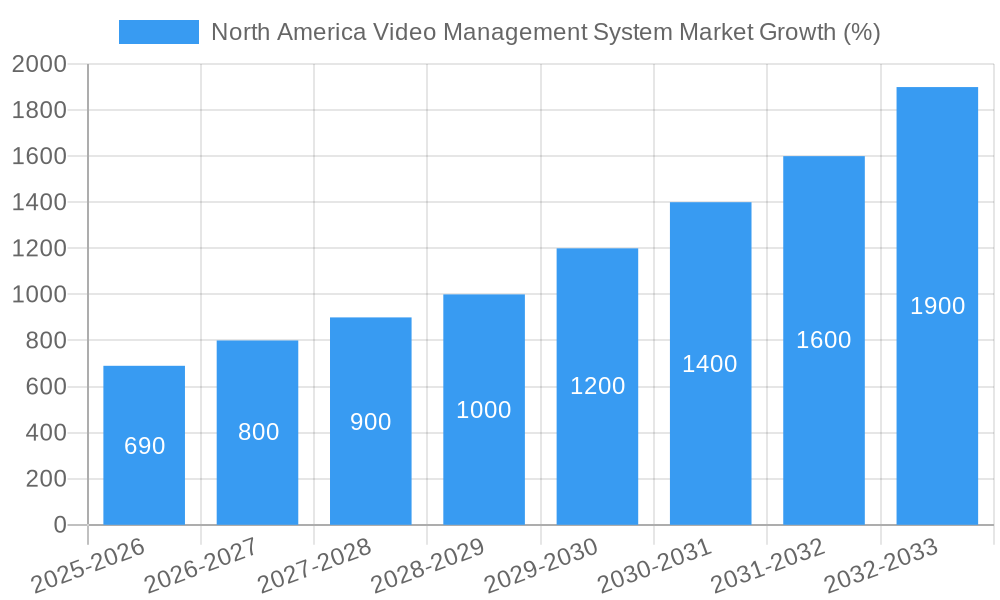

The North American Video Management System (VMS) market, valued at approximately $4.51 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 15.73% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing need for enhanced security across various sectors, including commercial buildings, critical infrastructure, and transportation, is a primary driver. The rising adoption of cloud-based VMS solutions, offering scalability, cost-effectiveness, and remote accessibility, further contributes to market growth. Furthermore, advancements in artificial intelligence (AI) and analytics, enabling features like facial recognition, object detection, and behavioral analysis, are creating new opportunities and driving demand for sophisticated VMS systems. The integration of VMS with other security technologies, such as access control and intrusion detection systems, is also contributing to the market's expansion. Competition among established players like Honeywell, Bosch, and Johnson Controls, alongside emerging technology providers, fosters innovation and drives down costs, making VMS solutions accessible to a wider range of users.

The North American market's segmentation likely reflects this diverse application landscape. We can infer a strong presence of enterprise-level solutions catering to large organizations alongside smaller, more specialized systems for smaller businesses and residential applications. The market's growth will be influenced by factors like government regulations mandating security upgrades, particularly in sensitive sectors, and increasing cybersecurity concerns. While the restraining forces might include high initial investment costs and complexities associated with system integration, the long-term benefits in terms of security enhancements and operational efficiencies outweigh these concerns, ensuring continued market expansion in the foreseeable future. The continued development of edge computing technologies, allowing for faster processing of video data closer to the source, will also be a significant factor in shaping the market's trajectory.

North America Video Management System (VMS) Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Video Management System (VMS) market, encompassing its current state, future trajectory, and key players. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It segments the market to provide granular insights into various sub-sectors, helping businesses make informed decisions and capitalize on emerging opportunities within this rapidly evolving landscape. The parent market is the broader North American security market, while the child market encompasses VMS solutions across various verticals. The market size is presented in million units.

North America Video Management System Market Dynamics & Structure

This section analyzes the North American VMS market's competitive landscape, technological advancements, regulatory influences, and market trends. The market is characterized by a moderately concentrated structure, with key players like Honeywell International Inc., Bosch Security and Safety Systems, and Johnson Controls holding significant market share, but with emerging players steadily increasing their presence. Technological innovation, driven by the increasing adoption of AI and cloud-based solutions, is a major growth driver. However, challenges such as data security concerns and the complexity of integrating various systems remain. The regulatory environment, particularly concerning data privacy (e.g., GDPR), plays a crucial role, impacting product development and market access. The significant rise in cyber security threats has also intensified demand.

- Market Concentration: Moderately concentrated with top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: AI-powered video analytics, cloud-based VMS, and edge computing are key drivers.

- Regulatory Framework: Compliance with data privacy regulations like GDPR and CCPA influences market growth.

- Competitive Substitutes: Limited direct substitutes, but alternative security solutions (e.g., access control systems) exist.

- End-User Demographics: Growth driven by increasing adoption across various sectors, including retail, transportation, and critical infrastructure.

- M&A Trends: A moderate level of mergers and acquisitions activity, with xx major deals recorded between 2019 and 2024.

North America Video Management System Market Growth Trends & Insights

The North America VMS market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to increasing security concerns, rising adoption of IP-based video surveillance, and the expanding application of video analytics. The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by factors such as the increasing demand for cloud-based solutions, technological advancements, and rising government investments in infrastructure security. Consumer behavior shifts towards increased reliance on remote monitoring and proactive security measures further accelerate market adoption. Market penetration is projected to reach xx% by 2033. The transition to cloud-based systems and the incorporation of AI-driven analytics are predicted to significantly reshape the market landscape, driving higher adoption rates and value creation.

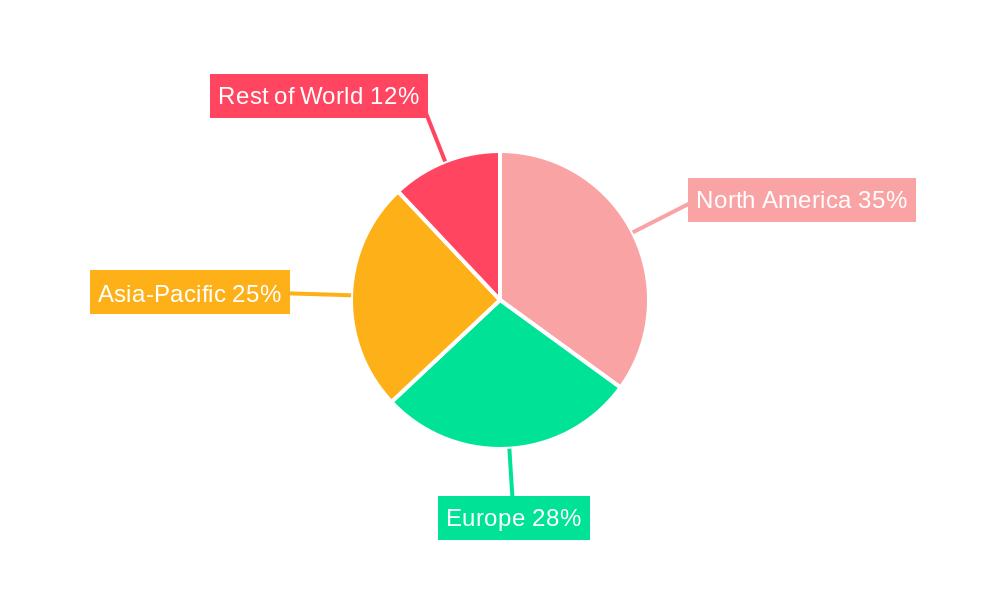

Dominant Regions, Countries, or Segments in North America Video Management System Market

The United States holds the largest market share within North America, driven by its substantial investment in security infrastructure, high technological adoption rates, and a large number of established security companies. Canada follows with a significant market size, largely influenced by its robust regulatory framework, while Mexico showcases strong growth potential, driven by increasing urbanization and industrialization. The government and commercial segments show the highest adoption rates.

- United States: High market share driven by strong demand, technological advancements, and regulatory drivers.

- Canada: Significant market size propelled by robust regulatory frameworks and a growing security consciousness.

- Mexico: High growth potential due to rising urbanization, industrialization, and security concerns.

- Key Drivers: Stringent security regulations, increasing crime rates, and rising investments in smart city initiatives.

North America Video Management System Market Product Landscape

The VMS market offers a wide range of products, including software-based systems, hardware-based systems, and hybrid solutions. Significant innovation is observed in areas like cloud-based VMS, AI-powered video analytics, and integration with other security systems. Unique selling propositions often focus on ease of use, scalability, cost-effectiveness, and the ability to integrate advanced analytics.

Key Drivers, Barriers & Challenges in North America Video Management System Market

Key Drivers: Growing security concerns across various sectors, increasing adoption of IP-based video surveillance, technological advancements, and government initiatives promoting smart cities and public safety.

Key Challenges: High initial investment costs, complex system integration, data security and privacy concerns, and the potential for cyberattacks. Supply chain disruptions related to component shortages could also impact market growth.

Emerging Opportunities in North America Video Management System Market

Emerging opportunities lie in the expanding adoption of cloud-based VMS, the integration of AI and machine learning for advanced analytics, and the development of solutions tailored to specific industry needs (e.g., healthcare, transportation). The integration of VMS with other IoT devices and the expansion into untapped markets present further opportunities.

Growth Accelerators in the North America Video Management System Market Industry

Long-term growth will be accelerated by ongoing technological innovation, strategic partnerships between VMS providers and other technology companies, and the expansion into new and emerging markets. Government investments in smart city infrastructure and cybersecurity initiatives will also significantly boost market growth. The increasing demand for remote monitoring capabilities and proactive security solutions will further propel market expansion.

Key Players Shaping the North America Video Management System Market Market

- Honeywell International Inc

- Bosch Security and Safety Systems

- Johnson Controls

- Hangzhou Hikvision Digital Technology Co Ltd

- Axis Communications AB

- Dahua Technology

- AxxonSoft Inc

- Genetec Inc

- Identiv Inc

- March Networks

- Milestone Systems

- Qognify Inc

- Salient Systems Corporation

- Verint Systems *List Not Exhaustive

Notable Milestones in North America Video Management System Market Sector

- July 2024: Milestone Systems announced its merger with Arcules, strengthening its position in cloud-based VMS and VSaaS.

- April 2024: Schneider Electric's strategic collaboration with IPConfigure integrates advanced video surveillance into its EcoStruxure Buildings platform, creating a comprehensive security ecosystem.

In-Depth North America Video Management System Market Market Outlook

The future of the North American VMS market is bright, driven by continued technological innovation, increasing security concerns, and expanding applications across various sectors. Strategic partnerships, expansion into untapped markets, and the adoption of AI-driven analytics will shape the market landscape. The market is poised for robust growth, offering significant opportunities for both established players and new entrants.

North America Video Management System Market Segmentation

-

1. Component

- 1.1. System

- 1.2. Services

-

2. Technology

- 2.1. Analog-Based

- 2.2. IP- Based

-

3. Mode of Deployment

- 3.1. On-Premise

- 3.2. Cloud

-

4. End-user Industry

- 4.1. Banking and Financial Services

- 4.2. Education

- 4.3. Retail

- 4.4. Transportation

- 4.5. Logistics

- 4.6. Healthcare

- 4.7. Airports

North America Video Management System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Video Management System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.3. Market Restrains

- 3.3.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.4. Market Trends

- 3.4.1. Cloud Based Video Management System is Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Video Management System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. System

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Analog-Based

- 5.2.2. IP- Based

- 5.3. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.3.1. On-Premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Banking and Financial Services

- 5.4.2. Education

- 5.4.3. Retail

- 5.4.4. Transportation

- 5.4.5. Logistics

- 5.4.6. Healthcare

- 5.4.7. Airports

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security and Safety Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axis Communications AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dahua Technology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AxxonSoft Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Genetec Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Identiv Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 March Networks

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Milestone Systems

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Qognify Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Salient Systems Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Verint Systems*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Video Management System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Video Management System Market Share (%) by Company 2024

List of Tables

- Table 1: North America Video Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Video Management System Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: North America Video Management System Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: North America Video Management System Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: North America Video Management System Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: North America Video Management System Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 7: North America Video Management System Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 8: North America Video Management System Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 9: North America Video Management System Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: North America Video Management System Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 11: North America Video Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Video Management System Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: North America Video Management System Market Revenue Million Forecast, by Component 2019 & 2032

- Table 14: North America Video Management System Market Volume Billion Forecast, by Component 2019 & 2032

- Table 15: North America Video Management System Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: North America Video Management System Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 17: North America Video Management System Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 18: North America Video Management System Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 19: North America Video Management System Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: North America Video Management System Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 21: North America Video Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Video Management System Market Volume Billion Forecast, by Country 2019 & 2032

- Table 23: United States North America Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States North America Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Canada North America Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada North America Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Mexico North America Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Mexico North America Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Video Management System Market?

The projected CAGR is approximately 15.73%.

2. Which companies are prominent players in the North America Video Management System Market?

Key companies in the market include Honeywell International Inc, Bosch Security and Safety Systems, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications AB, Dahua Technology, AxxonSoft Inc, Genetec Inc, Identiv Inc, March Networks, Milestone Systems, Qognify Inc, Salient Systems Corporation, Verint Systems*List Not Exhaustive.

3. What are the main segments of the North America Video Management System Market?

The market segments include Component, Technology, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

6. What are the notable trends driving market growth?

Cloud Based Video Management System is Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

8. Can you provide examples of recent developments in the market?

July 2024: Milestone Systems announced its plans to merge with Arcules, a provider of cloud-based video surveillance solutions. This merger is expected to unite the strengths of Milestone and Arcules in video management software (VMS), video analytics, and video surveillance as a service (VSaaS), delivering a holistic video technology package.April 2024: Schneider Electric announced a strategic collaboration with IPConfigure to incorporate advanced video surveillance solutions into its EcoStruxure Buildings platform. By merging Schneider Electric's Access Expert and Security Expert products with IPConfigure's Orchid video management system (VMS), a top-notch security ecosystem will be established, delivering a holistic and unified approach to safeguarding individuals, resources, and information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Video Management System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Video Management System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Video Management System Market?

To stay informed about further developments, trends, and reports in the North America Video Management System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence