Key Insights

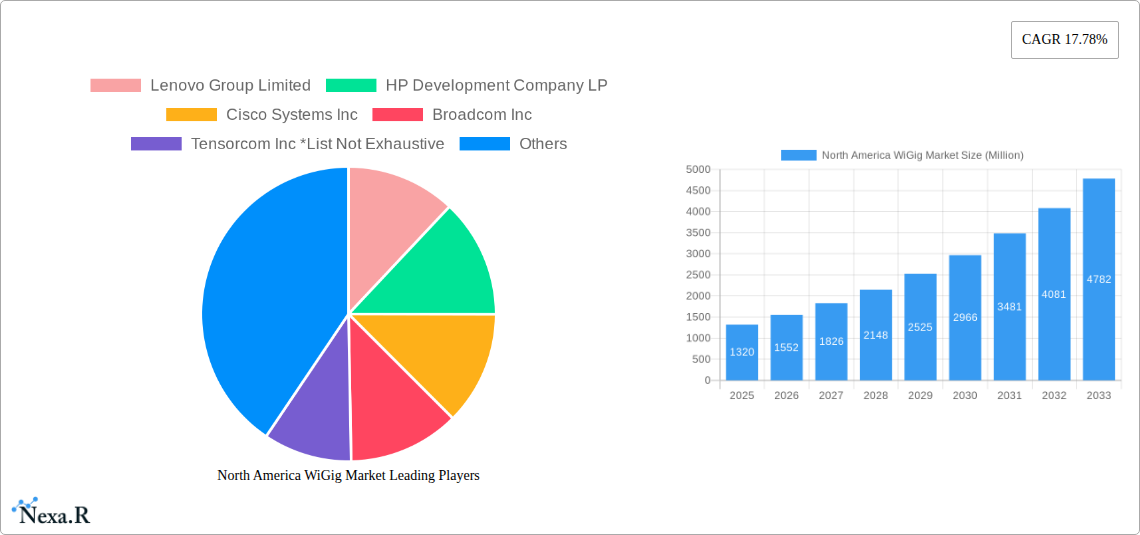

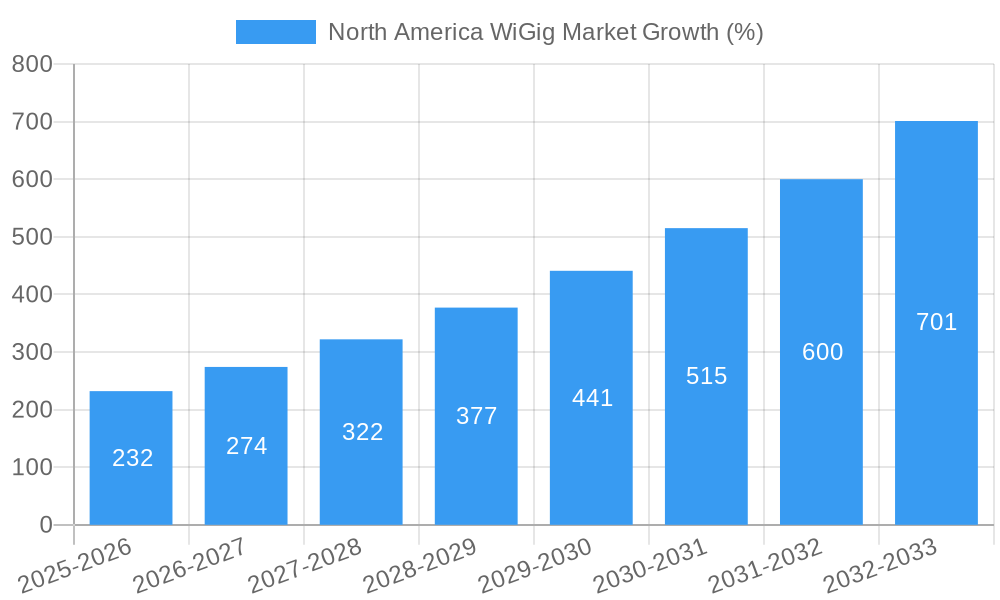

The North American WiGig market, valued at $1.32 billion in 2025, is projected to experience robust growth, driven by increasing demand for high-bandwidth, low-latency wireless connectivity in various sectors. The Compound Annual Growth Rate (CAGR) of 17.78% from 2025 to 2033 signifies significant market expansion. This growth is primarily fueled by the proliferation of high-resolution display devices and the burgeoning need for seamless connectivity in gaming and multimedia applications. The adoption of WiGig technology in network infrastructure is also contributing to market expansion, enabling faster data transfer rates and reduced congestion in enterprise and residential settings. Key players like Lenovo, HP, Cisco, Broadcom, and Qualcomm are actively developing and deploying WiGig-enabled devices and infrastructure solutions, further driving market growth. While challenges such as high initial costs and limited interoperability could act as restraints, the advantages of high-speed wireless communication outweigh these limitations, paving the way for continued market expansion. The United States and Canada represent the largest segments within the North American market, reflecting strong technological adoption and infrastructure development. The continued development and integration of WiGig into next-generation devices and networks will underpin the market's sustained growth trajectory in the coming years.

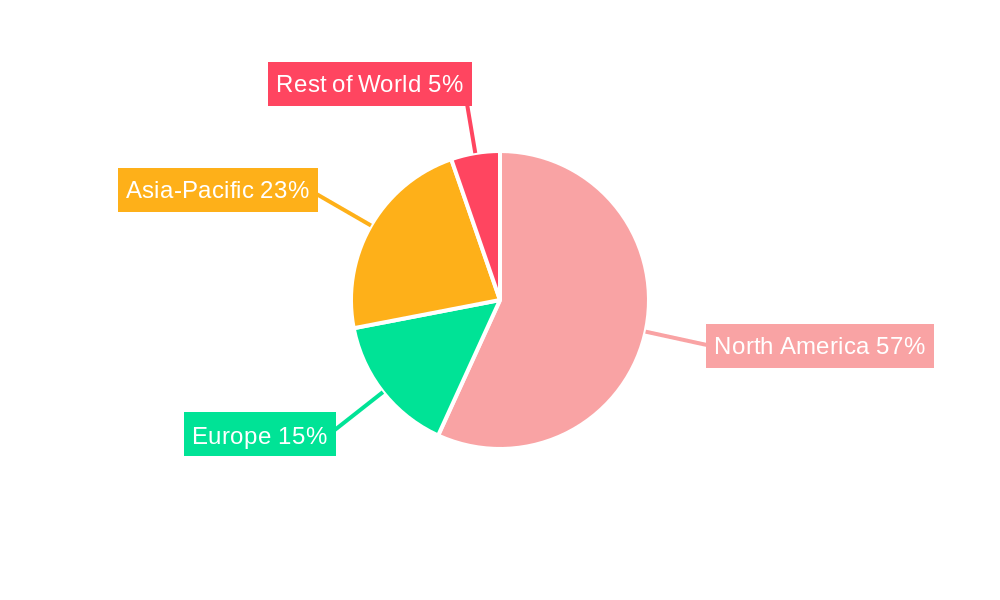

The forecast period of 2025-2033 anticipates significant market expansion in specific application segments. Gaming and multimedia applications, with their increasing demands for high-bandwidth content streaming and low-latency interactive experiences, are poised for substantial growth. Similarly, the networking sector will benefit significantly from WiGig’s ability to handle large data volumes efficiently. The geographical focus remains concentrated on North America, particularly the United States and Canada, due to established technological infrastructure and high consumer spending on electronics and networking solutions. Mexico, although part of the North American market, may see slower growth compared to the US and Canada due to potentially lower adoption rates. However, emerging economies within the region could present future growth opportunities. Competitive intensity is expected to remain high among established players, prompting innovation and price competition to capture market share.

This comprehensive report provides an in-depth analysis of the North America WiGig market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report analyzes the parent market of wireless communication and the child market of high-speed wireless data transmission.

North America WiGig Market Dynamics & Structure

The North America WiGig market is characterized by moderate concentration, with key players such as Lenovo Group Limited, HP Development Company LP, Cisco Systems Inc, Broadcom Inc, Tensorcom Inc, Qualcomm Technologies Inc, Dell Technologies Inc, and Intel Corporation driving innovation and competition. The market is witnessing significant technological advancements, particularly in 60 GHz technology and 802.11ay standards. However, regulatory hurdles and the need for robust infrastructure development pose challenges. The market is further shaped by increasing demand for high-bandwidth applications and the cost-effectiveness of WiGig compared to fiber optic solutions.

- Market Concentration: Moderately concentrated, with a few dominant players holding significant market share (xx%).

- Technological Innovation Drivers: Advancements in 60 GHz technology, 802.11ay standards, and improved antenna designs.

- Regulatory Frameworks: Varying regulations across different regions impacting deployment and spectrum allocation.

- Competitive Product Substitutes: Fiber optics, 5G, and other high-speed wireless technologies.

- End-User Demographics: Primarily businesses and consumers requiring high-bandwidth applications such as gaming, multimedia streaming, and networking.

- M&A Trends: Moderate M&A activity, focused on acquiring technology and expanding market reach (xx deals in the last 5 years).

North America WiGig Market Growth Trends & Insights

The North America WiGig market is experiencing robust growth, driven by increasing demand for high-speed wireless connectivity and the cost-effectiveness of WiGig solutions compared to traditional wired infrastructure. The market size is projected to reach xx Million units by 2025 and xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by the adoption of WiGig in various applications, including gaming, multimedia streaming, and enterprise networking. Technological advancements, such as improved power efficiency and range, are further driving market expansion. Consumer behavior is shifting towards preference for seamless and high-speed connectivity, bolstering WiGig adoption. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in North America WiGig Market

The United States represents the largest segment of the North America WiGig market, driven by robust technological advancements, strong demand for high-bandwidth applications, and supportive regulatory environment. Canada exhibits moderate growth, fueled by increasing infrastructure development and investments in technology. Within the product segments, Network Infrastructure Devices are currently the dominant segment, followed by Display Devices. In terms of applications, the Networking segment shows the highest growth potential, followed by Gaming and Multimedia.

- United States: High market share, driven by strong demand, robust infrastructure, and technological advancements.

- Canada: Moderate growth, fueled by increasing infrastructure development and government initiatives.

- Network Infrastructure Devices: Largest market segment, due to the prevalence of WiGig in enterprise networks.

- Networking Applications: Highest growth potential, driven by the increasing need for high-speed connectivity in various business applications.

North America WiGig Market Product Landscape

The WiGig market offers a range of products including display devices, network infrastructure devices, and various other application-specific solutions. These products boast unique selling propositions such as high-speed data transfer rates, low latency, and improved range compared to previous generation wireless technologies. Significant advancements are being made in antenna designs, power management, and integrated system solutions.

Key Drivers, Barriers & Challenges in North America WiGig Market

Key Drivers:

- High-speed connectivity demand: Increasing need for faster data transfer rates in various applications.

- Cost-effectiveness: WiGig offers a cost-competitive alternative to fiber optic deployments.

- Technological advancements: Improvements in range, power efficiency, and data transfer rates.

Key Barriers and Challenges:

- Regulatory hurdles: Spectrum allocation issues and varying regulations across different regions.

- Interference and susceptibility: Sensitivity to interference from other wireless technologies.

- Limited market awareness: Lack of widespread knowledge about the benefits of WiGig.

Emerging Opportunities in North America WiGig Market

Untapped markets in residential and industrial settings present significant growth opportunities. Innovative applications, particularly in augmented reality/virtual reality (AR/VR) and autonomous vehicles, promise increased demand. Emerging trends indicate a shift toward integrating WiGig with other technologies for enhanced capabilities.

Growth Accelerators in the North America WiGig Market Industry

Technological breakthroughs in 60 GHz technology, strategic partnerships between technology providers and telecom operators, and targeted market expansion strategies focusing on niche applications are poised to accelerate long-term growth within the North America WiGig market.

Key Players Shaping the North America WiGig Market Market

- Lenovo Group Limited

- HP Development Company LP

- Cisco Systems Inc

- Broadcom Inc

- Tensorcom Inc

- Qualcomm Technologies Inc

- Dell Technologies Inc

- Intel Corporation

Notable Milestones in North America WiGig Market Sector

- January 2023: Follett USA and Kwikbit Internet partnered to deploy WiGig broadband services in eight manufactured housing communities.

- March 2022: Edgecore Networks launched the MLTG-CN LR, a 60 GHz WiGig product for high-speed wireless connectivity.

In-Depth North America WiGig Market Market Outlook

The North America WiGig market is poised for significant expansion, driven by continuous technological advancements and the growing need for high-bandwidth wireless solutions. Strategic partnerships and targeted market penetration strategies will be crucial for players seeking to capitalize on the emerging opportunities within this rapidly evolving market. The market shows strong potential for growth in sectors like smart homes, industrial IoT and automotive, creating lucrative avenues for businesses willing to invest and innovate.

North America WiGig Market Segmentation

-

1. Product

- 1.1. Display Devices

- 1.2. Network Infrastructure Devices

-

2. Application

- 2.1. Gaming and Multimedia

- 2.2. Networking

- 2.3. Other Applications

North America WiGig Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America WiGig Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Technological Advancement in Communication Industry; Rising Adoption of High-resolution Videos

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. Networking to Hold a major share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Display Devices

- 5.1.2. Network Infrastructure Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gaming and Multimedia

- 5.2.2. Networking

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lenovo Group Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HP Development Company LP

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cisco Systems Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Broadcom Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tensorcom Inc *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Qualcomm Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dell Technologies Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Intel Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Lenovo Group Limited

List of Figures

- Figure 1: North America WiGig Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America WiGig Market Share (%) by Company 2024

List of Tables

- Table 1: North America WiGig Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America WiGig Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America WiGig Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America WiGig Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America WiGig Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America WiGig Market Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America WiGig Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: North America WiGig Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America WiGig Market?

The projected CAGR is approximately 17.78%.

2. Which companies are prominent players in the North America WiGig Market?

Key companies in the market include Lenovo Group Limited, HP Development Company LP, Cisco Systems Inc, Broadcom Inc, Tensorcom Inc *List Not Exhaustive, Qualcomm Technologies Inc, Dell Technologies Inc, Intel Corporation.

3. What are the main segments of the North America WiGig Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Technological Advancement in Communication Industry; Rising Adoption of High-resolution Videos.

6. What are the notable trends driving market growth?

Networking to Hold a major share of the Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

January 2023: Follett USA, a company that owns and operates manufactured housing communities across the United States, and Kwikbit Internet, a provider of wireless gigabit (WiGig) broadband services to manufactured housing communities, entered into a partnership to provide their services to eight communities in 2023. Kwikbit Internet's innovative 60 GHz wireless solution, known as WiGig, offers internet speeds comparable to fiber optics at a significantly reduced cost and faster installation time, enabling the delivery of affordable and reliable symmetrical 1 Gig service to residents in manufactured housing communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America WiGig Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America WiGig Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America WiGig Market?

To stay informed about further developments, trends, and reports in the North America WiGig Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence