Key Insights

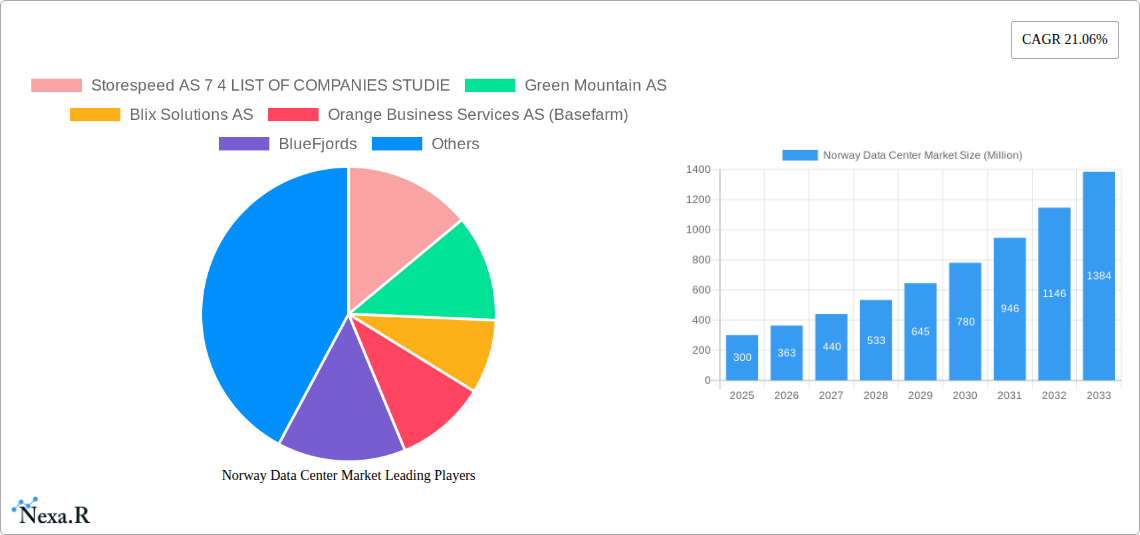

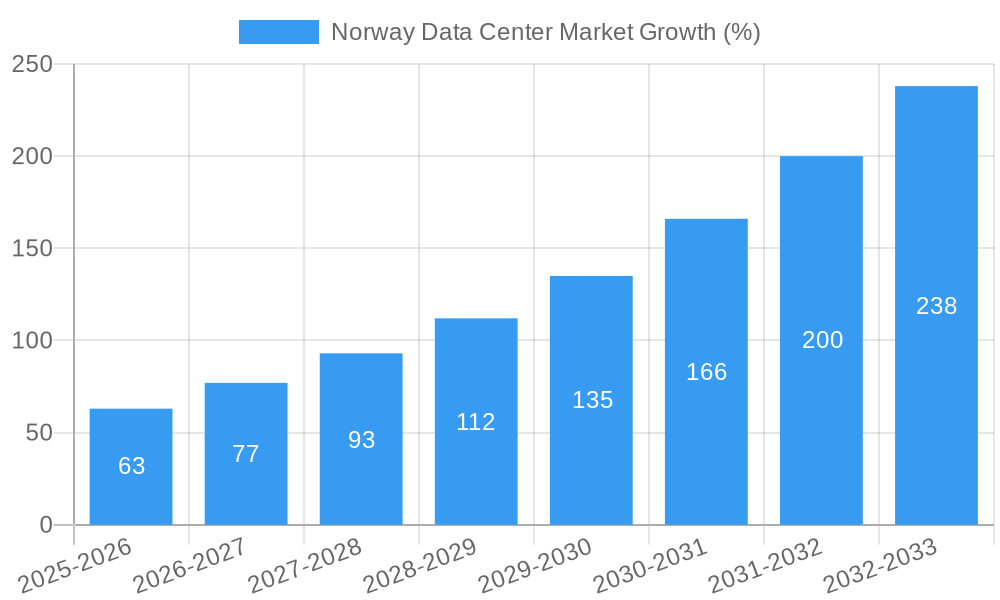

The Norway data center market is experiencing robust growth, driven by increasing digitalization, rising cloud adoption, and the nation's strategic location within the Nordics. With a CAGR of 21.06% from 2019-2033, the market is projected to reach significant value. Key growth drivers include the burgeoning e-commerce sector, expanding government initiatives promoting digital infrastructure, and the increasing demand for high-bandwidth connectivity from businesses across diverse sectors like BFSI, telecom, and media & entertainment. The Oslo and Vestland regions are emerging as hotspots, attracting significant investments in large and hyperscale data centers. The market segmentation reveals a strong presence of Tier III and Tier IV facilities, catering to the demands for high reliability and availability. While the exact market size for 2025 is not explicitly stated, extrapolating from the provided CAGR and considering the current global data center market trends, a reasonable estimation would place the Norwegian market value in the hundreds of millions of USD. This growth is further fueled by the availability of renewable energy sources, making Norway an attractive location for environmentally conscious data center operations.

However, the market also faces certain restraints. High infrastructure costs, limited skilled labor, and the potential for regulatory complexities could pose challenges to sustained growth. The competitive landscape is dynamic, with both established international players like Stack Infrastructure and local companies like Green Mountain and Storespeed AS competing for market share. Future growth will depend on addressing these challenges through strategic partnerships, investments in talent development, and a proactive approach to regulatory compliance. The market's future depends on successfully navigating these factors to maintain its current trajectory of rapid expansion. Companies should focus on providing tailored solutions to meet specific sector needs and leverage Norway's unique strengths to attract further investment in the coming years.

Norway Data Center Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Norway data center market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It offers invaluable insights for investors, industry professionals, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report segments the market by data center size (Large, Massive, Medium, Mega, Small), tier type (Tier 1 & 2, Tier 3, Tier 4), absorption (Utilized, Non-Utilized), colocation type (Hyperscale, Retail, Wholesale), and end-user (BFSI, Cloud, E-commerce, Government, Manufacturing, Media & Entertainment, Telecom, Other). Key geographical hotspots analyzed include Oslo, Vestland, and the Rest of Norway.

Norway Data Center Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends impacting the Norway data center market. The market is characterized by a moderately concentrated structure, with several key players holding significant market share. However, the emergence of new entrants and innovative technologies continues to shape the competitive dynamic.

Market Concentration & Competitive Dynamics:

- Market concentration is moderate, with the top 5 players holding approximately xx% of the market share in 2025.

- Intense competition is driving innovation and price optimization within the sector.

- Mergers and acquisitions (M&A) activity is expected to remain relatively high, with xx deals anticipated between 2025 and 2033.

Technological Innovation & Regulatory Framework:

- Increased adoption of advanced technologies such as AI, machine learning, and edge computing is driving demand for data center capacity.

- Stringent government regulations concerning data security and energy efficiency influence the market.

- The Norwegian government's focus on sustainable energy solutions is creating opportunities for green data centers.

End-User Demographics & Market Substitutes:

- The BFSI, cloud, and telecom sectors represent the largest end-user segments, contributing approximately xx% to overall market demand in 2025.

- The emergence of cloud computing and edge data centers is creating new opportunities.

- Limited availability of viable substitutes for traditional data center services makes the market less susceptible to disruption from alternative offerings.

Norway Data Center Market Growth Trends & Insights

The Norway data center market is experiencing significant growth, driven by increasing data volumes, the rise of cloud computing, and government initiatives promoting digitalization. The market size is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by factors such as expanding digital infrastructure, rising internet penetration, and increased adoption of data-intensive applications across various industries.

- Market Size Evolution: The market exhibited a steady growth trajectory during the historical period (2019-2024), expanding from xx Million in 2019 to xx Million in 2024.

- Adoption Rates: Adoption of cloud-based services is accelerating, pushing the demand for data center capacity. The market penetration rate for cloud services is expected to reach xx% by 2033.

- Technological Disruptions: Advancements in virtualization, software-defined networking, and edge computing are shaping the market landscape.

- Consumer Behavior Shifts: Increased reliance on digital services and the growing importance of data security are driving market expansion.

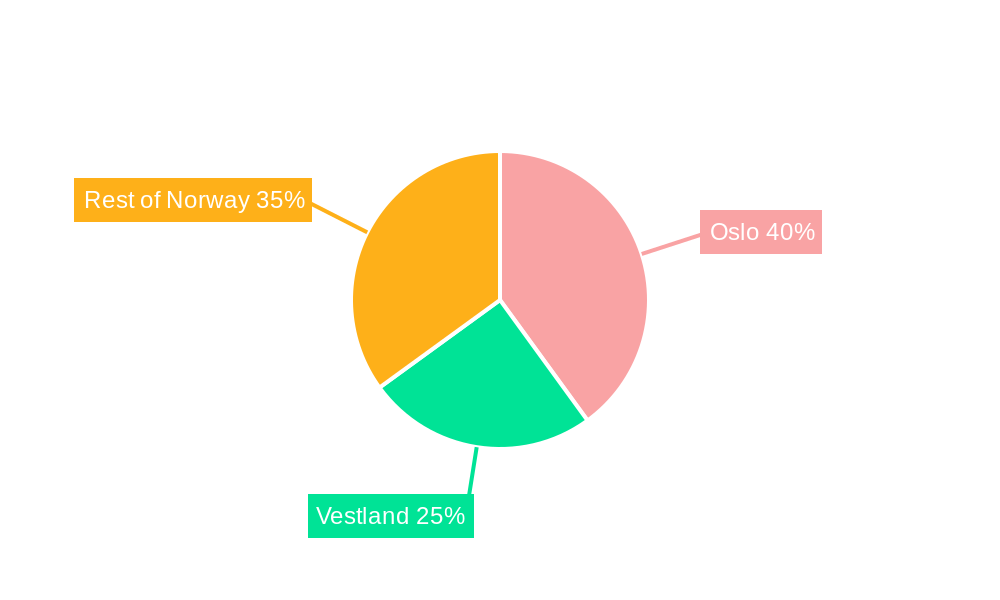

Dominant Regions, Countries, or Segments in Norway Data Center Market

Oslo emerges as the dominant region, driven by high concentration of businesses and advanced digital infrastructure. However, Vestland and other regions are also experiencing significant growth, boosted by government initiatives fostering regional development. In terms of data center size, the Large and Mega segments dominate, while the Hyperscale colocation type holds the largest share, reflecting the increasing adoption of cloud services and large-scale deployments.

Leading Regions & Drivers:

- Oslo: Concentrated business activity, advanced digital infrastructure, and proximity to major telecom networks contribute to Oslo's dominance.

- Vestland: Growing investments in digital infrastructure and supportive government policies are accelerating growth.

- Rest of Norway: Strategic investments in regional data centers are promoting balanced expansion.

Dominant Segments:

- Data Center Size: Large and Mega facilities account for the largest share of the market due to their economies of scale.

- Tier Type: Tier III and Tier IV data centers are expected to exhibit higher growth rates due to their enhanced reliability and availability.

- Colocation Type: Hyperscale colocation is the leading segment fueled by the booming cloud market.

- End-User: The BFSI, cloud, and telecom sectors remain the key drivers of market demand.

Norway Data Center Market Product Landscape

The Norway data center market offers a diverse range of products and services, including colocation, managed services, cloud services, and connectivity solutions. Innovations focus on improving energy efficiency, enhancing security, and optimizing performance. Key differentiators include enhanced security features, sustainable energy solutions, and flexible scalability options tailored to specific customer needs. Advancements in virtualization and automation technologies enhance operational efficiency and reduce operational costs.

Key Drivers, Barriers & Challenges in Norway Data Center Market

Key Drivers:

- Growing demand for cloud services and digital transformation initiatives.

- Increasing data volumes generated by various industries.

- Government initiatives promoting digitalization and technological advancement.

- Investments in renewable energy sources supporting sustainable data center operations.

Key Barriers & Challenges:

- High initial capital expenditure required for data center construction and deployment.

- Regulatory hurdles concerning data privacy and security.

- Competition for skilled workforce and talent acquisition.

- Energy costs and the need for sustainable energy solutions. Energy costs are projected to increase by xx% by 2033, influencing operational expenses.

Emerging Opportunities in Norway Data Center Market

Untapped opportunities lie in the expansion of edge computing deployments, the growth of the Internet of Things (IoT), and the increasing adoption of AI and machine learning. Furthermore, catering to the needs of smaller businesses and expanding into rural areas presents significant growth potential. The focus on sustainability and green data centers is creating new market opportunities.

Growth Accelerators in the Norway Data Center Market Industry

Technological breakthroughs in areas such as AI, machine learning, and edge computing, coupled with strategic partnerships between data center providers and technology companies, will fuel market growth. Expansion into new regions and the development of innovative service offerings tailored to specific industry needs will further drive market expansion.

Key Players Shaping the Norway Data Center Market Market

- Storespeed AS

- Green Mountain AS

- Blix Solutions AS

- Orange Business Services AS (Basefarm)

- BlueFjords

- Nordic Hub Data Centers AS

- New Mining (Dataroom AS)

- Lefdal Mine Data Center AS

- AQ Compute Data Center (Aquila Capital Management GmbH)

- Bulk Infrastructure Group AS

- Stack Infrastructure Inc

- GlobalConnect AB

Notable Milestones in Norway Data Center Market Sector

- 2022 (Q3): Green Mountain AS announced expansion of its data center facility in Oslo.

- 2023 (Q1): New government regulations regarding data security came into effect.

- 2024 (Q4): A major M&A deal involving two key players reshaped the market landscape. (Further details pending data availability)

In-Depth Norway Data Center Market Market Outlook

The Norway data center market is poised for substantial growth over the next decade, driven by technological advancements, supportive government policies, and the burgeoning demand for digital services across various sectors. Strategic opportunities exist for companies focusing on sustainability, innovation, and providing specialized solutions tailored to niche market segments. The market's future growth trajectory will be shaped by the interplay of technological advancements, regulatory frameworks, and the evolving needs of end-users.

Norway Data Center Market Segmentation

-

1. Hotspot

- 1.1. Oslo

- 1.2. Vestland

- 1.3. Rest of Norway

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Norway Data Center Market Segmentation By Geography

- 1. Norway

Norway Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Oslo

- 5.1.2. Vestland

- 5.1.3. Rest of Norway

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Storespeed AS 7 4 LIST OF COMPANIES STUDIE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Green Mountain AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blix Solutions AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orange Business Services AS (Basefarm)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BlueFjords

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nordic Hub Data Centers AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 New Mining (Dataroom AS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lefdal Mine Data Center AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AQ Compute Data Center (Aquila Capital Management GmbH)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bulk Infrastructure Group AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Stack Infrastructure Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GlobalConnect AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Storespeed AS 7 4 LIST OF COMPANIES STUDIE

List of Figures

- Figure 1: Norway Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Norway Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Norway Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Norway Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Norway Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: Norway Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Norway Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Norway Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Norway Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 11: Norway Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 12: Norway Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Norway Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 14: Norway Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 15: Norway Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Norway Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Data Center Market?

The projected CAGR is approximately 21.06%.

2. Which companies are prominent players in the Norway Data Center Market?

Key companies in the market include Storespeed AS 7 4 LIST OF COMPANIES STUDIE, Green Mountain AS, Blix Solutions AS, Orange Business Services AS (Basefarm), BlueFjords, Nordic Hub Data Centers AS, New Mining (Dataroom AS), Lefdal Mine Data Center AS, AQ Compute Data Center (Aquila Capital Management GmbH), Bulk Infrastructure Group AS, Stack Infrastructure Inc, GlobalConnect AB.

3. What are the main segments of the Norway Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Data Center Market?

To stay informed about further developments, trends, and reports in the Norway Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence