Key Insights

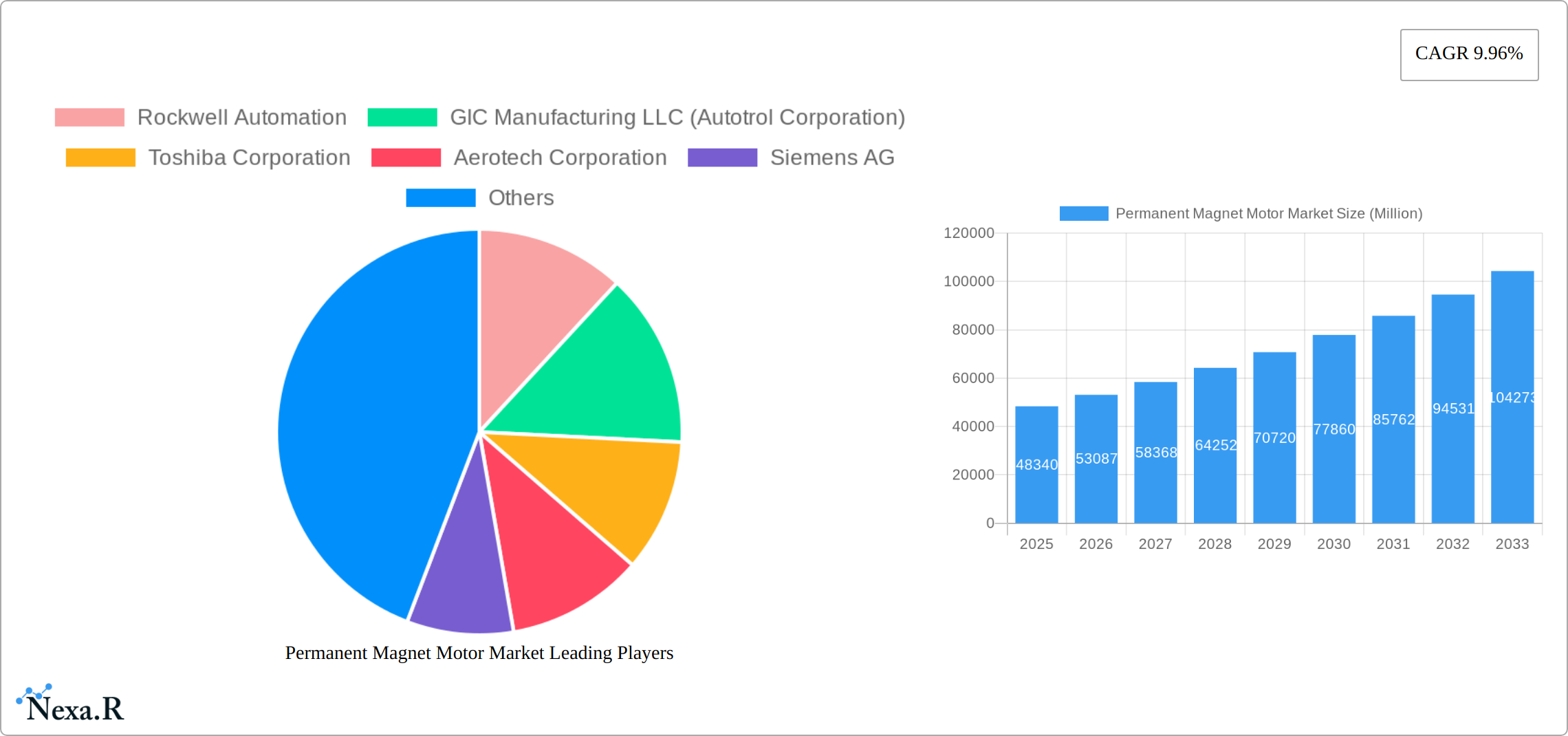

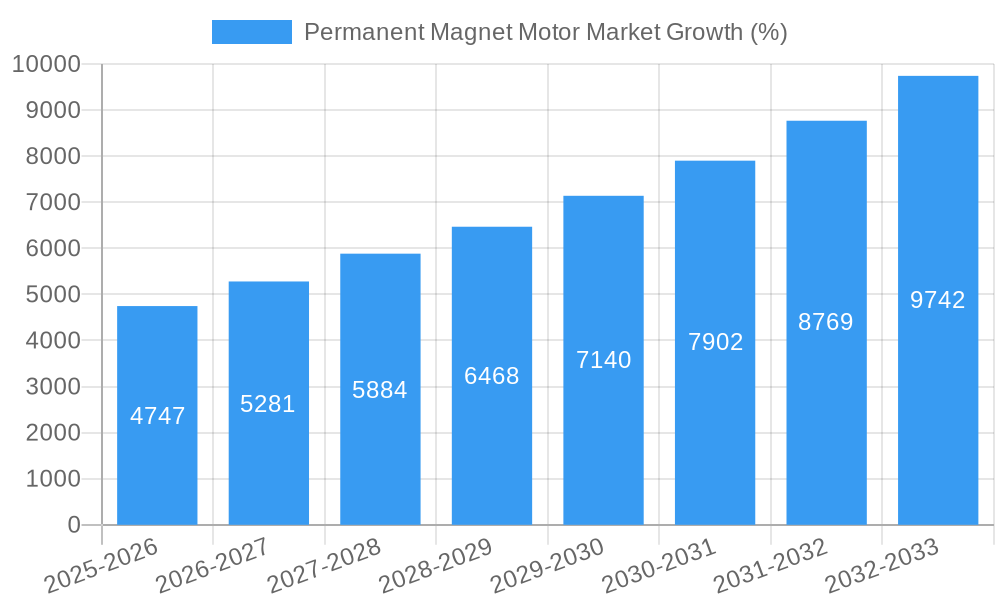

The Permanent Magnet Motor (PMM) market is experiencing robust growth, projected to reach a market size of $48.34 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 9.96% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of electric vehicles (EVs) in the automotive sector significantly fuels demand for high-efficiency PMMs. Furthermore, the burgeoning renewable energy sector, particularly wind and solar power generation, relies heavily on PMMs for efficient energy conversion. Industrial automation, with its rising need for precise and energy-efficient motor solutions, also contributes significantly to market growth. The diverse application across various end-user verticals, including general industrial machinery, water and wastewater management systems, and aerospace and defense equipment, further broadens the market scope. Technological advancements leading to improved motor performance, smaller sizes, and increased durability are also key drivers. While material costs and supply chain disruptions represent potential restraints, ongoing research and development efforts focused on cost-effective materials and manufacturing processes are mitigating these challenges. The market is segmented by magnetic material type (ferrite, neodymium, samarium cobalt, and others), end-user vertical (automotive, industrial, energy, and others), and motor type (DC and AC). Major players such as Rockwell Automation, Toshiba, Siemens, and Nidec are actively shaping the market through innovation and strategic partnerships.

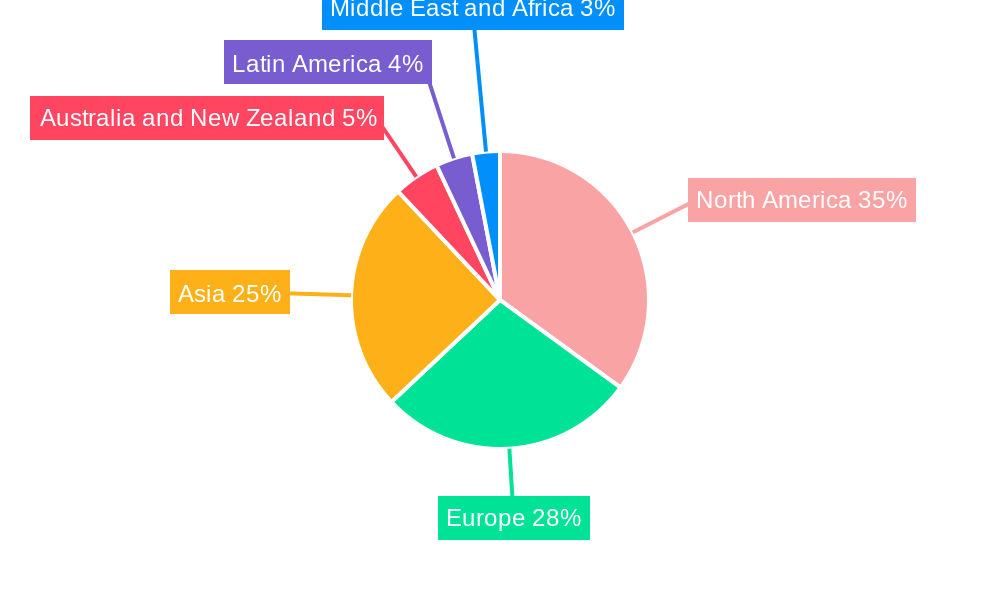

The forecast period (2025-2033) anticipates continued growth, propelled by sustained demand across all key segments. The automotive sector is expected to remain a dominant driver, fueled by the ongoing transition to electric mobility. However, growth within the industrial and renewable energy segments will also play a crucial role in shaping the overall market trajectory. The competitive landscape is characterized by both established industry leaders and emerging players, fostering innovation and driving down costs. Strategic collaborations and mergers and acquisitions are likely to reshape the market structure in the coming years, with a focus on enhancing technological capabilities and expanding market reach. Regional variations will likely persist, with North America and Asia-Pacific regions expected to dominate market share due to significant manufacturing activity and growing demand.

Permanent Magnet Motor Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Permanent Magnet Motor market, encompassing its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategists seeking to navigate this dynamic market. The report analyzes the parent market of electric motors and the child market segments of permanent magnet motors across diverse applications. The market size is projected to reach xx million units by 2033.

Permanent Magnet Motor Market Dynamics & Structure

The permanent magnet motor market is characterized by moderate concentration, with several major players and numerous smaller niche participants. Technological innovation, particularly in materials science and motor design, is a significant driver, while regulatory frameworks focused on energy efficiency and emissions play a crucial role. Competitive substitutes, such as induction motors, exist but are increasingly challenged by the efficiency and performance advantages of permanent magnet motors. The end-user demographics are diverse, with significant demand from automotive, industrial, and energy sectors. M&A activity in the sector has been moderate in recent years, with xx major deals recorded in the historical period.

- Market Concentration: Moderately concentrated, with a top 5 market share of xx%.

- Technological Innovation: Significant advancements in rare-earth magnets and motor control systems.

- Regulatory Landscape: Stringent energy efficiency standards driving demand.

- Competitive Substitutes: Induction motors and other electric motor types.

- End-User Demographics: Automotive, industrial automation, renewable energy, and HVAC are key segments.

- M&A Trends: xx major acquisitions and mergers observed during 2019-2024.

Permanent Magnet Motor Market Growth Trends & Insights

The permanent magnet motor market has witnessed robust growth over the past few years, driven by the rising adoption of electric vehicles, industrial automation, and renewable energy technologies. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by factors such as increasing demand for energy-efficient motors, stringent government regulations, and technological advancements. Significant market penetration is observed in the automotive sector, leading to increased demand for high-performance permanent magnet motors.

Dominant Regions, Countries, or Segments in Permanent Magnet Motor Market

The automotive sector dominates the end-user vertical, with a market share of xx%, driven by the rapid growth of electric vehicles. Geographically, the Asia-Pacific region holds the largest market share, exceeding xx%, fueled by strong manufacturing and industrial growth. Within magnetic material types, Neodymium magnets command the largest share (xx%), due to their high performance and versatility.

- Leading Region: Asia-Pacific (xx% market share). Key drivers include robust industrial growth and government support for electric vehicle adoption.

- Leading End-user Vertical: Automotive (xx% market share), driven by the global transition to electric vehicles.

- Leading Magnetic Material Type: Neodymium magnets (xx% market share), thanks to their superior magnetic properties.

- Leading Motor Type: Permanent magnet DC motors hold a significant share, driven by their use in smaller applications, followed by AC motors which are prevalent in higher-power applications.

Permanent Magnet Motor Market Product Landscape

Permanent magnet motors are available in a wide range of sizes and configurations, tailored to specific applications. Innovations focus on enhancing efficiency, reducing size and weight, improving durability, and optimizing performance across various operating conditions. Unique selling propositions often center on high power density, precise control, and long operational lifespan. Technological advancements encompass the use of advanced magnetic materials, sophisticated control algorithms, and improved thermal management techniques.

Key Drivers, Barriers & Challenges in Permanent Magnet Motor Market

Key Drivers:

- Rising demand for energy-efficient motors in diverse industries.

- Government regulations promoting electric vehicle adoption and energy conservation.

- Technological advancements in material science and motor design.

Key Challenges:

- Fluctuations in the price of rare-earth materials like Neodymium.

- Supply chain vulnerabilities and geopolitical risks impacting rare-earth sourcing.

- Intense competition and the emergence of new market entrants.

Emerging Opportunities in Permanent Magnet Motor Market

- Growth in renewable energy sectors (solar, wind) driving demand for high-efficiency motors.

- Increasing adoption of robotics and automation in industrial settings.

- Expansion into niche applications in medical devices and aerospace.

Growth Accelerators in the Permanent Magnet Motor Market Industry

Technological breakthroughs in high-temperature superconducting magnets promise significantly enhanced efficiency and performance. Strategic partnerships between motor manufacturers and automotive/industrial OEMs are accelerating product development and market penetration. Expansion into emerging markets with robust industrial growth will unlock substantial growth opportunities.

Key Players Shaping the Permanent Magnet Motor Market Market

- Rockwell Automation

- GIC Manufacturing LLC (Autotrol Corporation)

- Toshiba Corporation

- Aerotech Corporation

- Siemens AG

- Allied Motion Technologies Inc

- Danaher Corporation

- Ametek Inc

- Johnson Electric Holdings Ltd

- Franklin Electric Company Inc

- Robert Bosch GmbH

- Crouzet Automatismes

- Buhler Motors GmbH

- Nidec Corporation

- ABB Limited

- Bonfiglioli Group

Notable Milestones in Permanent Magnet Motor Market Sector

- July 2023: WEG invested USD 9.83 million to expand its permanent magnet motor production capacity in Brazil, focusing on air conditioner motors.

- December 2022: A UK-based consortium secured GBP 6 million (USD 7.23 million) in government funding to develop high-volume manufacturing processes for permanent magnet motors, primarily for electric vehicles.

In-Depth Permanent Magnet Motor Market Outlook

The permanent magnet motor market is poised for continued robust growth, driven by technological advancements, expanding applications, and supportive government policies. Strategic investments in R&D, coupled with strategic partnerships, will be crucial for market leadership. The focus on sustainable and energy-efficient solutions will further fuel market expansion in the coming years, creating lucrative opportunities for both established players and new entrants.

Permanent Magnet Motor Market Segmentation

-

1. Motor Type

- 1.1. Direct Current (DC) Motor

- 1.2. Alternating Current (AC) Motor

-

2. Magnetic Material Type

- 2.1. Ferrite

- 2.2. Neodymium

- 2.3. Samarium Cobalt

- 2.4. Other Magnetic Material Types

-

3. End-user Vertical

- 3.1. Automotive

- 3.2. General Industrial

- 3.3. Energy

- 3.4. Water and Wastewater Management

- 3.5. Mining, Oil, and Gas

- 3.6. Aerospace and Defense

- 3.7. Other End-user Verticals

Permanent Magnet Motor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Permanent Magnet Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Motor Efficiency due to Permanent Magnets; Rising Demand for Electric Vehicles; Rising Demand for Permanent Magnet Motor (PMM) in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. High Initial Investment in Creating Supporting Infrastructure and Automation

- 3.4. Market Trends

- 3.4.1. Direct Current Motor Holds Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Motor Type

- 5.1.1. Direct Current (DC) Motor

- 5.1.2. Alternating Current (AC) Motor

- 5.2. Market Analysis, Insights and Forecast - by Magnetic Material Type

- 5.2.1. Ferrite

- 5.2.2. Neodymium

- 5.2.3. Samarium Cobalt

- 5.2.4. Other Magnetic Material Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Automotive

- 5.3.2. General Industrial

- 5.3.3. Energy

- 5.3.4. Water and Wastewater Management

- 5.3.5. Mining, Oil, and Gas

- 5.3.6. Aerospace and Defense

- 5.3.7. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Motor Type

- 6. North America Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Motor Type

- 6.1.1. Direct Current (DC) Motor

- 6.1.2. Alternating Current (AC) Motor

- 6.2. Market Analysis, Insights and Forecast - by Magnetic Material Type

- 6.2.1. Ferrite

- 6.2.2. Neodymium

- 6.2.3. Samarium Cobalt

- 6.2.4. Other Magnetic Material Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Automotive

- 6.3.2. General Industrial

- 6.3.3. Energy

- 6.3.4. Water and Wastewater Management

- 6.3.5. Mining, Oil, and Gas

- 6.3.6. Aerospace and Defense

- 6.3.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Motor Type

- 7. Europe Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Motor Type

- 7.1.1. Direct Current (DC) Motor

- 7.1.2. Alternating Current (AC) Motor

- 7.2. Market Analysis, Insights and Forecast - by Magnetic Material Type

- 7.2.1. Ferrite

- 7.2.2. Neodymium

- 7.2.3. Samarium Cobalt

- 7.2.4. Other Magnetic Material Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Automotive

- 7.3.2. General Industrial

- 7.3.3. Energy

- 7.3.4. Water and Wastewater Management

- 7.3.5. Mining, Oil, and Gas

- 7.3.6. Aerospace and Defense

- 7.3.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Motor Type

- 8. Asia Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Motor Type

- 8.1.1. Direct Current (DC) Motor

- 8.1.2. Alternating Current (AC) Motor

- 8.2. Market Analysis, Insights and Forecast - by Magnetic Material Type

- 8.2.1. Ferrite

- 8.2.2. Neodymium

- 8.2.3. Samarium Cobalt

- 8.2.4. Other Magnetic Material Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Automotive

- 8.3.2. General Industrial

- 8.3.3. Energy

- 8.3.4. Water and Wastewater Management

- 8.3.5. Mining, Oil, and Gas

- 8.3.6. Aerospace and Defense

- 8.3.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Motor Type

- 9. Australia and New Zealand Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Motor Type

- 9.1.1. Direct Current (DC) Motor

- 9.1.2. Alternating Current (AC) Motor

- 9.2. Market Analysis, Insights and Forecast - by Magnetic Material Type

- 9.2.1. Ferrite

- 9.2.2. Neodymium

- 9.2.3. Samarium Cobalt

- 9.2.4. Other Magnetic Material Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Automotive

- 9.3.2. General Industrial

- 9.3.3. Energy

- 9.3.4. Water and Wastewater Management

- 9.3.5. Mining, Oil, and Gas

- 9.3.6. Aerospace and Defense

- 9.3.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Motor Type

- 10. Latin America Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Motor Type

- 10.1.1. Direct Current (DC) Motor

- 10.1.2. Alternating Current (AC) Motor

- 10.2. Market Analysis, Insights and Forecast - by Magnetic Material Type

- 10.2.1. Ferrite

- 10.2.2. Neodymium

- 10.2.3. Samarium Cobalt

- 10.2.4. Other Magnetic Material Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Automotive

- 10.3.2. General Industrial

- 10.3.3. Energy

- 10.3.4. Water and Wastewater Management

- 10.3.5. Mining, Oil, and Gas

- 10.3.6. Aerospace and Defense

- 10.3.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Motor Type

- 11. Middle East and Africa Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Motor Type

- 11.1.1. Direct Current (DC) Motor

- 11.1.2. Alternating Current (AC) Motor

- 11.2. Market Analysis, Insights and Forecast - by Magnetic Material Type

- 11.2.1. Ferrite

- 11.2.2. Neodymium

- 11.2.3. Samarium Cobalt

- 11.2.4. Other Magnetic Material Types

- 11.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.3.1. Automotive

- 11.3.2. General Industrial

- 11.3.3. Energy

- 11.3.4. Water and Wastewater Management

- 11.3.5. Mining, Oil, and Gas

- 11.3.6. Aerospace and Defense

- 11.3.7. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Motor Type

- 12. North America Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Permanent Magnet Motor Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Rockwell Automation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 GIC Manufacturing LLC (Autotrol Corporation)

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Toshiba Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Aerotech Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Siemens AG

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Allied Motion Technologies Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Danaher Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Ametek Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Johnson Electric Holdings Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Franklin Electric Company Inc

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Robert Bosch GmbH

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Crouzet Automatismes

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Buhler Motors GmbH

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Nidec Corporation*List Not Exhaustive

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 ABB Limited

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 Bonfiglioli Group

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.1 Rockwell Automation

List of Figures

- Figure 1: Global Permanent Magnet Motor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Permanent Magnet Motor Market Revenue (Million), by Motor Type 2024 & 2032

- Figure 15: North America Permanent Magnet Motor Market Revenue Share (%), by Motor Type 2024 & 2032

- Figure 16: North America Permanent Magnet Motor Market Revenue (Million), by Magnetic Material Type 2024 & 2032

- Figure 17: North America Permanent Magnet Motor Market Revenue Share (%), by Magnetic Material Type 2024 & 2032

- Figure 18: North America Permanent Magnet Motor Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 19: North America Permanent Magnet Motor Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 20: North America Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Permanent Magnet Motor Market Revenue (Million), by Motor Type 2024 & 2032

- Figure 23: Europe Permanent Magnet Motor Market Revenue Share (%), by Motor Type 2024 & 2032

- Figure 24: Europe Permanent Magnet Motor Market Revenue (Million), by Magnetic Material Type 2024 & 2032

- Figure 25: Europe Permanent Magnet Motor Market Revenue Share (%), by Magnetic Material Type 2024 & 2032

- Figure 26: Europe Permanent Magnet Motor Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Europe Permanent Magnet Motor Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Europe Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Permanent Magnet Motor Market Revenue (Million), by Motor Type 2024 & 2032

- Figure 31: Asia Permanent Magnet Motor Market Revenue Share (%), by Motor Type 2024 & 2032

- Figure 32: Asia Permanent Magnet Motor Market Revenue (Million), by Magnetic Material Type 2024 & 2032

- Figure 33: Asia Permanent Magnet Motor Market Revenue Share (%), by Magnetic Material Type 2024 & 2032

- Figure 34: Asia Permanent Magnet Motor Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 35: Asia Permanent Magnet Motor Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 36: Asia Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Australia and New Zealand Permanent Magnet Motor Market Revenue (Million), by Motor Type 2024 & 2032

- Figure 39: Australia and New Zealand Permanent Magnet Motor Market Revenue Share (%), by Motor Type 2024 & 2032

- Figure 40: Australia and New Zealand Permanent Magnet Motor Market Revenue (Million), by Magnetic Material Type 2024 & 2032

- Figure 41: Australia and New Zealand Permanent Magnet Motor Market Revenue Share (%), by Magnetic Material Type 2024 & 2032

- Figure 42: Australia and New Zealand Permanent Magnet Motor Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 43: Australia and New Zealand Permanent Magnet Motor Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 44: Australia and New Zealand Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Australia and New Zealand Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Latin America Permanent Magnet Motor Market Revenue (Million), by Motor Type 2024 & 2032

- Figure 47: Latin America Permanent Magnet Motor Market Revenue Share (%), by Motor Type 2024 & 2032

- Figure 48: Latin America Permanent Magnet Motor Market Revenue (Million), by Magnetic Material Type 2024 & 2032

- Figure 49: Latin America Permanent Magnet Motor Market Revenue Share (%), by Magnetic Material Type 2024 & 2032

- Figure 50: Latin America Permanent Magnet Motor Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 51: Latin America Permanent Magnet Motor Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 52: Latin America Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Latin America Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East and Africa Permanent Magnet Motor Market Revenue (Million), by Motor Type 2024 & 2032

- Figure 55: Middle East and Africa Permanent Magnet Motor Market Revenue Share (%), by Motor Type 2024 & 2032

- Figure 56: Middle East and Africa Permanent Magnet Motor Market Revenue (Million), by Magnetic Material Type 2024 & 2032

- Figure 57: Middle East and Africa Permanent Magnet Motor Market Revenue Share (%), by Magnetic Material Type 2024 & 2032

- Figure 58: Middle East and Africa Permanent Magnet Motor Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 59: Middle East and Africa Permanent Magnet Motor Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 60: Middle East and Africa Permanent Magnet Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Permanent Magnet Motor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Permanent Magnet Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Permanent Magnet Motor Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 3: Global Permanent Magnet Motor Market Revenue Million Forecast, by Magnetic Material Type 2019 & 2032

- Table 4: Global Permanent Magnet Motor Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Global Permanent Magnet Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Permanent Magnet Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Permanent Magnet Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Permanent Magnet Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Permanent Magnet Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Permanent Magnet Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Permanent Magnet Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Permanent Magnet Motor Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 19: Global Permanent Magnet Motor Market Revenue Million Forecast, by Magnetic Material Type 2019 & 2032

- Table 20: Global Permanent Magnet Motor Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 21: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Permanent Magnet Motor Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 23: Global Permanent Magnet Motor Market Revenue Million Forecast, by Magnetic Material Type 2019 & 2032

- Table 24: Global Permanent Magnet Motor Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 25: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Permanent Magnet Motor Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 27: Global Permanent Magnet Motor Market Revenue Million Forecast, by Magnetic Material Type 2019 & 2032

- Table 28: Global Permanent Magnet Motor Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Permanent Magnet Motor Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 31: Global Permanent Magnet Motor Market Revenue Million Forecast, by Magnetic Material Type 2019 & 2032

- Table 32: Global Permanent Magnet Motor Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 33: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Permanent Magnet Motor Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 35: Global Permanent Magnet Motor Market Revenue Million Forecast, by Magnetic Material Type 2019 & 2032

- Table 36: Global Permanent Magnet Motor Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 37: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Permanent Magnet Motor Market Revenue Million Forecast, by Motor Type 2019 & 2032

- Table 39: Global Permanent Magnet Motor Market Revenue Million Forecast, by Magnetic Material Type 2019 & 2032

- Table 40: Global Permanent Magnet Motor Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 41: Global Permanent Magnet Motor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Permanent Magnet Motor Market?

The projected CAGR is approximately 9.96%.

2. Which companies are prominent players in the Permanent Magnet Motor Market?

Key companies in the market include Rockwell Automation, GIC Manufacturing LLC (Autotrol Corporation), Toshiba Corporation, Aerotech Corporation, Siemens AG, Allied Motion Technologies Inc, Danaher Corporation, Ametek Inc, Johnson Electric Holdings Ltd, Franklin Electric Company Inc, Robert Bosch GmbH, Crouzet Automatismes, Buhler Motors GmbH, Nidec Corporation*List Not Exhaustive, ABB Limited, Bonfiglioli Group.

3. What are the main segments of the Permanent Magnet Motor Market?

The market segments include Motor Type, Magnetic Material Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Motor Efficiency due to Permanent Magnets; Rising Demand for Electric Vehicles; Rising Demand for Permanent Magnet Motor (PMM) in the Industrial Sector.

6. What are the notable trends driving market growth?

Direct Current Motor Holds Significant Share.

7. Are there any restraints impacting market growth?

High Initial Investment in Creating Supporting Infrastructure and Automation.

8. Can you provide examples of recent developments in the market?

July 2023- WEG invested USD 9.83 million to expand its production capacity of motor manufacturing in Brazil. The company aims to produce a new line of permanent magnet electric motors for air conditioners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Permanent Magnet Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Permanent Magnet Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Permanent Magnet Motor Market?

To stay informed about further developments, trends, and reports in the Permanent Magnet Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence