Key Insights

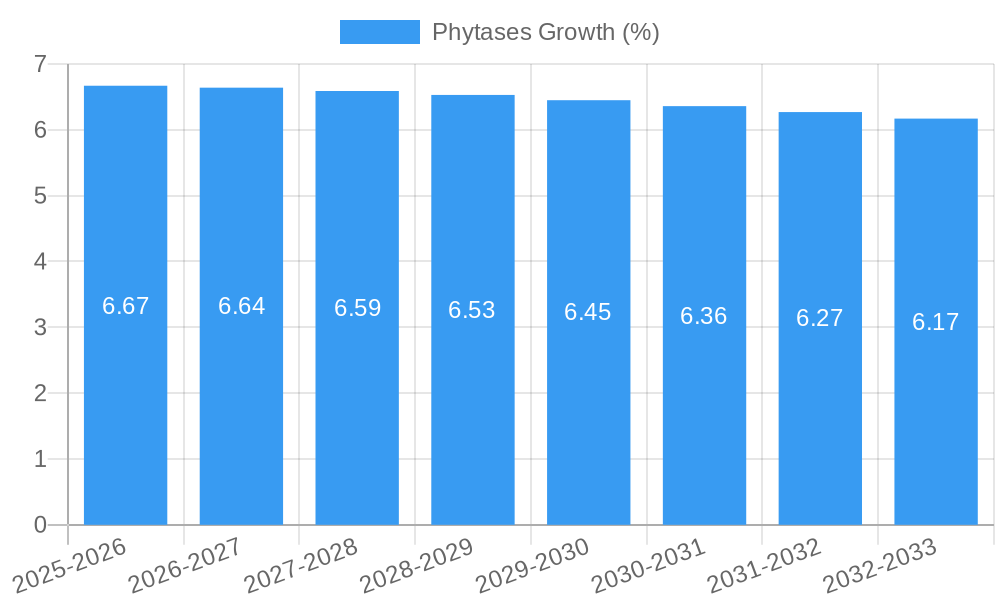

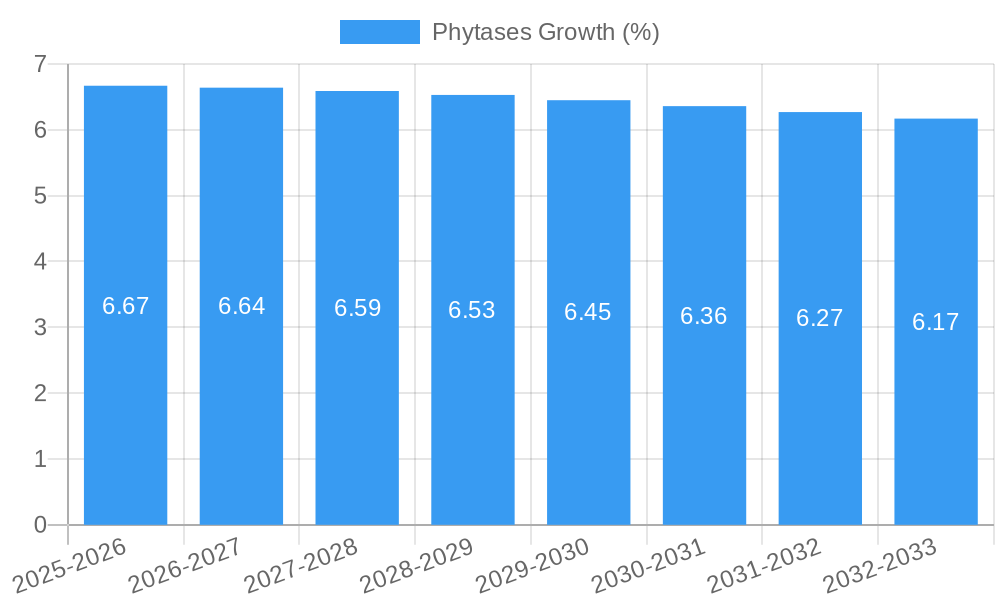

The global Phytases market is experiencing robust growth, projected to reach a market size of approximately $1,200 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is primarily fueled by the increasing demand for animal feed additives that enhance nutrient absorption, particularly phosphorus, thereby reducing reliance on inorganic phosphorus supplements. This trend is strongly supported by the growing global meat consumption and the concurrent emphasis on sustainable and cost-effective animal farming practices. The pharmaceutical industry is also contributing to market growth, utilizing phytase enzymes for their potential therapeutic applications, while the food industry leverages them for improved food processing and nutrient fortification. Key market drivers include stricter environmental regulations concerning phosphorus runoff from animal waste and the continuous innovation in enzyme technology leading to more efficient and stable phytase formulations.

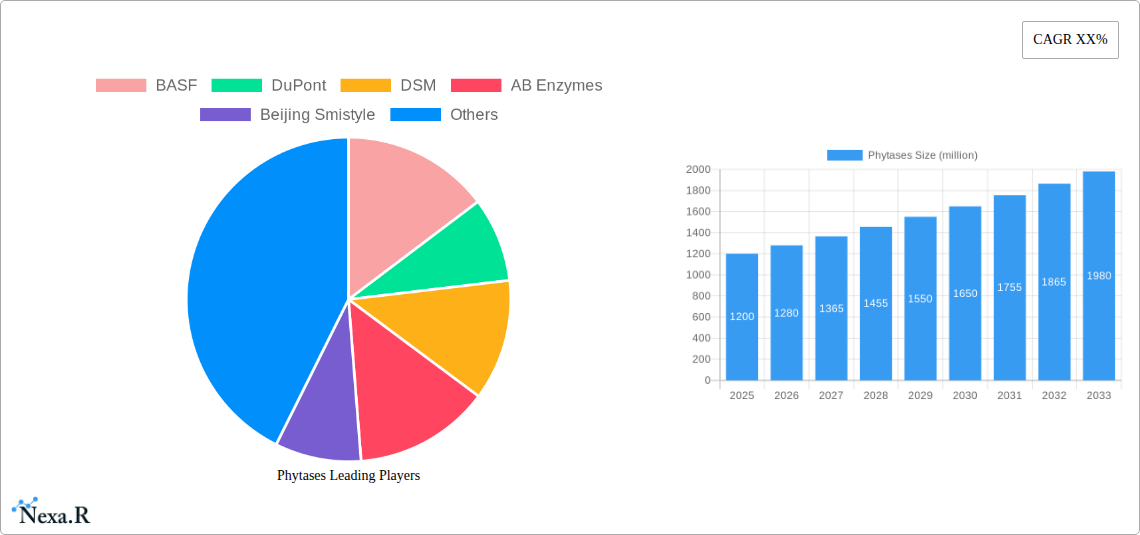

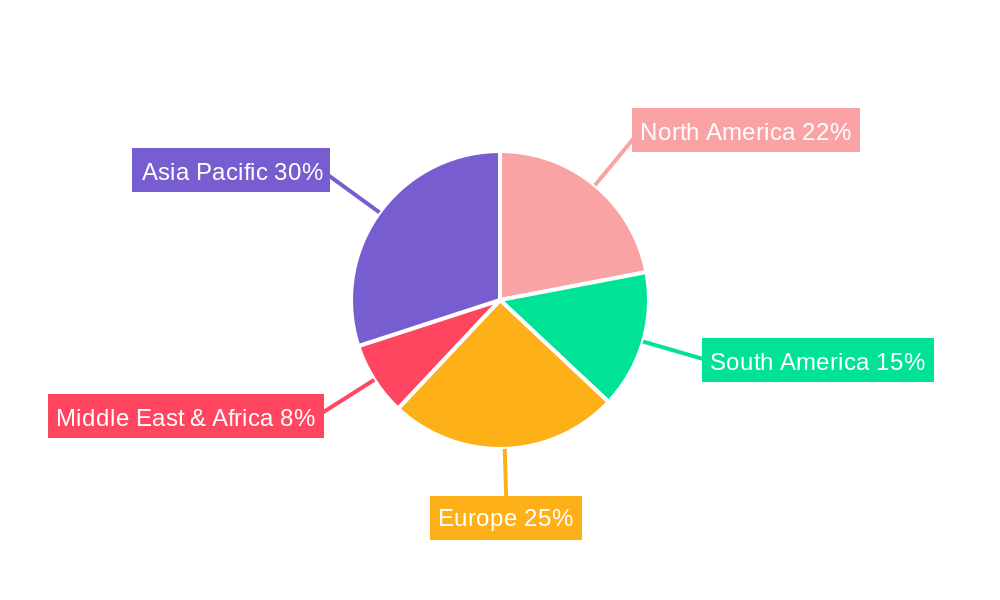

The phytase market is segmented into Granular, Powder, Liquid, and Thermostable Phytases, with Granular and Thermostable variants expected to witness significant adoption due to their ease of handling, stability during feed processing, and enhanced efficacy. Geographically, the Asia Pacific region, led by China and India, is emerging as a dominant market due to its large and growing animal husbandry sector and increasing adoption of advanced feed technologies. North America and Europe remain significant markets, driven by established animal farming industries and a strong focus on sustainable agriculture. Restraints to market growth include the high initial investment costs for enzyme production and the fluctuating prices of raw materials. However, the continuous research and development by leading companies like BASF, DuPont, and Novozymes, focusing on novel enzyme discovery and process optimization, are expected to mitigate these challenges and ensure sustained market expansion.

Comprehensive Phytases Market Report: Trends, Dynamics, and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global phytase market, offering critical insights into its dynamics, growth trajectory, and future potential. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this report is an essential resource for industry stakeholders. We explore market concentration, technological advancements, regulatory landscapes, and competitive factors. The report details growth trends, segment dominance, product innovations, and the key drivers, barriers, and emerging opportunities shaping the phytase industry. With a focus on both parent and child markets, this SEO-optimized report integrates high-traffic keywords to maximize visibility and deliver actionable intelligence for professionals in the food, pharmaceutical, and feed industries. All values are presented in million units.

Phytases Market Dynamics & Structure

The global phytase market exhibits a moderately concentrated structure, with a few key players holding significant market share. Technological innovation remains a primary driver, propelled by continuous research and development focused on enhancing phytase efficacy, thermostability, and application specificity. Regulatory frameworks, particularly concerning animal feed additives and food processing, play a crucial role in shaping market entry and product development. Competitive product substitutes, while present in some niche applications, have limited impact on the core phytase market due to its established benefits in nutrient bioavailability and environmental sustainability. End-user demographics are increasingly influenced by growing awareness of animal welfare, sustainable agriculture, and the demand for healthier food products. Mergers and acquisitions (M&A) are an active trend, as larger companies seek to expand their product portfolios, gain access to new technologies, and consolidate market presence. For instance, approximately 15-20 M&A deals have been observed in the enzyme market over the past five years, with a growing interest in specialized enzyme solutions like phytases. Innovation barriers include the high cost of research and development, stringent regulatory approval processes for new formulations, and the need for extensive field trials to demonstrate efficacy across diverse conditions.

- Market Concentration: Moderately concentrated, with leading players like BASF, DuPont, DSM, and Novozymes holding substantial market influence.

- Technological Innovation Drivers: Focus on enzyme engineering for improved thermostability, broader pH activity ranges, and enhanced substrate specificity.

- Regulatory Frameworks: Stringent approvals for feed additives in the EU and North America, influencing product formulation and market access.

- Competitive Product Substitutes: Limited for core applications; focus remains on optimizing phytase efficacy and cost-effectiveness.

- End-User Demographics: Driven by demand for sustainable animal nutrition, reduced environmental impact, and improved food quality.

- M&A Trends: Active consolidation, with companies acquiring smaller entities to strengthen their enzyme portfolios and technological capabilities.

Phytases Growth Trends & Insights

The global phytase market has witnessed robust and sustained growth, driven by a confluence of economic, environmental, and technological factors. The market size has evolved significantly from approximately $950 million in 2019 to an estimated $1,500 million in 2025, showcasing a remarkable CAGR of around 8.2% during the historical period. This growth is further projected to continue at an accelerated pace, reaching an estimated $2,800 million by 2033. The increasing adoption rates of phytases, particularly in the animal feed industry, are a primary indicator of market expansion. This surge in adoption is fueled by the growing imperative to reduce phosphorus excretion in livestock, thereby mitigating environmental pollution and complying with stricter environmental regulations. Technological disruptions, such as the development of next-generation phytases with enhanced stability in feed processing and improved efficacy, have been pivotal in driving this trend. Furthermore, shifting consumer preferences towards sustainably produced meat, poultry, and fish are indirectly bolstering the demand for phytase enzymes as a key component in efficient and environmentally friendly animal husbandry. Market penetration of phytases in emerging economies is also on the rise, as their benefits in improving animal health and reducing feed costs become more widely recognized and accessible. The increasing focus on precision nutrition in animal feed formulations further accentuates the role of enzymes like phytase in optimizing nutrient utilization and animal performance.

Dominant Regions, Countries, or Segments in Phytases

The Feed Industry segment is unequivocally the dominant force driving growth in the global phytase market, accounting for over 85% of the total market share. This dominance is underpinned by several critical factors.

Key Drivers for Feed Industry Dominance:

- Environmental Regulations: Increasingly stringent regulations worldwide, particularly in North America and Europe, mandate the reduction of phosphorus levels in animal waste. Phytases are essential in breaking down phytate, a form of phosphorus poorly digestible by monogastric animals, thereby significantly reducing phosphorus excretion and environmental impact.

- Economic Benefits: By increasing the bioavailability of phosphorus from plant-based feed ingredients, phytases allow for a reduction in the inclusion of inorganic phosphorus supplements, leading to substantial cost savings for feed manufacturers and livestock producers. This cost-effectiveness is a major driver in price-sensitive agricultural markets.

- Animal Health and Performance: Phytases improve the absorption of not only phosphorus but also other essential minerals and amino acids, leading to enhanced animal growth rates, improved feed conversion ratios, and better overall animal health. This translates to increased profitability for farmers.

- Sustainable Agriculture Initiatives: The global push towards sustainable and eco-friendly food production systems places phytases at the forefront as a critical enzyme solution for resource efficiency and reduced environmental footprint.

Among the various types of phytases, Granular Phytases currently hold the largest market share within the feed industry. This is due to their superior handling characteristics, stability during feed pelleting processes, and ease of incorporation into feed formulations.

Dominance Factors for Granular Phytases:

- Thermostability: Granular formulations are specifically designed to withstand the high temperatures encountered during feed manufacturing processes, ensuring enzyme integrity and activity.

- Ease of Application: Their physical form allows for uniform mixing and distribution within feed premixes and finished feeds, ensuring consistent dosage and efficacy.

- Extended Shelf Life: Granular phytases generally offer a longer shelf life compared to liquid or powder forms when stored under appropriate conditions.

While the Food Industry and Pharmaceutical Industry represent smaller but growing segments for phytases, their growth is driven by different factors. In the food industry, phytases are increasingly used as processing aids to improve mineral bioavailability in plant-based foods and enhance dough properties. The pharmaceutical industry explores phytases for applications in dietary supplements and as potential therapeutic agents. However, the sheer volume and economic impact of animal feed production solidify the Feed Industry's position as the primary growth engine for phytases.

Phytases Product Landscape

The phytase product landscape is characterized by continuous innovation aimed at enhancing enzyme performance and expanding application versatility. Key developments include the engineering of phytases with improved thermostability, allowing them to withstand the rigorous conditions of animal feed processing, such as high-temperature pelleting. Researchers are also focusing on developing phytases with broader pH optima and substrate specificity, ensuring efficacy across diverse animal digestive systems and feed matrices. Next-generation phytases are designed for increased specific activity, meaning a smaller dose is required for the same or better results, leading to cost efficiencies. Innovations in enzyme immobilization techniques are also contributing to improved stability and reusability in certain industrial applications. Unique selling propositions often revolve around enhanced phosphorus release, improved digestibility of other nutrients, and superior performance in challenging environments.

Key Drivers, Barriers & Challenges in Phytases

Key Drivers:

- Growing Demand for Sustainable Animal Nutrition: The global imperative to reduce environmental impact from livestock farming drives the adoption of phytases to minimize phosphorus excretion.

- Increasing Global Meat Consumption: A rising global population and increasing disposable incomes lead to higher demand for meat and animal products, consequently boosting the animal feed industry and phytase usage.

- Technological Advancements: Continuous innovation in enzyme engineering leads to more efficient, stable, and cost-effective phytase products.

- Favorable Regulatory Landscape: Increasingly strict environmental regulations regarding phosphorus pollution in many regions mandate the use of phytases.

- Cost-Effectiveness in Feed Formulation: Phytases reduce the need for expensive inorganic phosphorus supplements, offering significant economic benefits to feed producers.

Key Barriers & Challenges:

- Fluctuating Raw Material Prices: The production of enzymes is reliant on microbial fermentation, and the cost of nutrient media can be subject to price volatility.

- Stringent Regulatory Approval Processes: Obtaining regulatory approval for new phytase formulations can be time-consuming and expensive, especially in different geographical regions.

- Development of Resistance: While not a major issue currently, the potential for microbial resistance to enzymes over extended periods is a theoretical concern that requires monitoring.

- Competition from Inorganic Phosphorus: In some markets or specific feeding programs, inorganic phosphorus supplements can still present a cost-competitive alternative, especially when environmental regulations are less stringent.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and finished enzyme products.

Emerging Opportunities in Phytases

Emerging opportunities in the phytase market lie in the expansion of applications beyond traditional animal feed. The food industry presents a significant untapped market, with potential for phytases in enhancing mineral bioavailability in fortified plant-based foods, improving bread quality, and aiding in the production of specialized food ingredients. In the pharmaceutical sector, research into phytase's role in improving mineral absorption in humans, managing certain metabolic conditions, and its potential as a component in oral care formulations are areas of growing interest. Furthermore, the development of novel phytase variants with enhanced activity against diverse phytate structures and greater resilience to varying processing conditions will unlock new applications. The increasing focus on gut health in both animals and humans also opens avenues for enzymes that can improve nutrient utilization and reduce anti-nutritional factors.

Growth Accelerators in the Phytases Industry

Long-term growth in the phytases industry will be significantly accelerated by advancements in synthetic biology and genetic engineering, leading to the development of highly tailored and potent enzyme variants. Strategic partnerships between enzyme manufacturers and feed producers or food ingredient companies will streamline market penetration and foster co-innovation. The expansion of phytase applications into novel areas, driven by ongoing research and development, will create new market segments and revenue streams. Furthermore, increased global emphasis on circular economy principles and waste valorization may present opportunities for phytases in applications related to the breakdown of agricultural by-products. Market expansion into developing economies, coupled with rising awareness of the benefits of enzyme technology, will also serve as a critical growth accelerator.

Key Players Shaping the Phytases Market

- BASF

- DuPont

- DSM

- AB Enzymes

- Beijing Smistyle

- VTR

- Jinan Tiantianxiang (TTX)

- Huvepharma

- Novozymes

- Vland Biotech Group

Notable Milestones in Phytases Sector

- 2019: Introduction of novel thermostable phytase formulations by major players, enhancing stability during feed processing.

- 2020: Increased M&A activity focused on enzyme companies with specialized microbial fermentation capabilities.

- 2021: Growing regulatory pressure in key markets for reduced phosphorus excretion in livestock.

- 2022: Advancements in enzyme engineering leading to phytases with improved specific activity, requiring lower dosage.

- 2023: Expansion of phytase applications into the food processing sector for enhanced nutrient fortification.

- 2024: Significant investments in R&D for next-generation phytases with broader substrate specificity.

In-Depth Phytases Market Outlook

The future outlook for the phytases market is exceptionally bright, driven by persistent global trends in sustainable agriculture, growing demand for animal protein, and continuous technological innovation. The market is poised for sustained high growth, fueled by the irreplaceable role of phytases in optimizing nutrient utilization, reducing environmental impact, and enhancing the economic viability of animal production. Strategic opportunities lie in tapping into the vast potential of emerging markets, further diversifying product applications in the food and pharmaceutical sectors, and leveraging advancements in biotechnology to create highly specialized and efficient enzyme solutions. The industry's commitment to research and development, coupled with increasing regulatory support for environmentally friendly practices, positions phytases as a cornerstone of future bio-based solutions.

Phytases Segmentation

-

1. Application

- 1.1. Food Industry

- 1.2. Pharmaceutical Industry

- 1.3. Feed Industry

-

2. Types

- 2.1. Granular Phytases

- 2.2. Powder Phytases

- 2.3. Liquid Phytases

- 2.4. Thermostable Phytases

Phytases Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Phytases REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phytases Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Industry

- 5.1.2. Pharmaceutical Industry

- 5.1.3. Feed Industry

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Granular Phytases

- 5.2.2. Powder Phytases

- 5.2.3. Liquid Phytases

- 5.2.4. Thermostable Phytases

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Phytases Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Industry

- 6.1.2. Pharmaceutical Industry

- 6.1.3. Feed Industry

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Granular Phytases

- 6.2.2. Powder Phytases

- 6.2.3. Liquid Phytases

- 6.2.4. Thermostable Phytases

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Phytases Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Industry

- 7.1.2. Pharmaceutical Industry

- 7.1.3. Feed Industry

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Granular Phytases

- 7.2.2. Powder Phytases

- 7.2.3. Liquid Phytases

- 7.2.4. Thermostable Phytases

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Phytases Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Industry

- 8.1.2. Pharmaceutical Industry

- 8.1.3. Feed Industry

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Granular Phytases

- 8.2.2. Powder Phytases

- 8.2.3. Liquid Phytases

- 8.2.4. Thermostable Phytases

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Phytases Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Industry

- 9.1.2. Pharmaceutical Industry

- 9.1.3. Feed Industry

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Granular Phytases

- 9.2.2. Powder Phytases

- 9.2.3. Liquid Phytases

- 9.2.4. Thermostable Phytases

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Phytases Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Industry

- 10.1.2. Pharmaceutical Industry

- 10.1.3. Feed Industry

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Granular Phytases

- 10.2.2. Powder Phytases

- 10.2.3. Liquid Phytases

- 10.2.4. Thermostable Phytases

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DuPont

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DSM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AB Enzymes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Beijing Smistyle

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VTR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jinan Tiantianxiang (TTX)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Huvepharma

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Novozymes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vland Biotech Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Phytases Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Phytases Revenue (million), by Application 2024 & 2032

- Figure 3: North America Phytases Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Phytases Revenue (million), by Types 2024 & 2032

- Figure 5: North America Phytases Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Phytases Revenue (million), by Country 2024 & 2032

- Figure 7: North America Phytases Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Phytases Revenue (million), by Application 2024 & 2032

- Figure 9: South America Phytases Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Phytases Revenue (million), by Types 2024 & 2032

- Figure 11: South America Phytases Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Phytases Revenue (million), by Country 2024 & 2032

- Figure 13: South America Phytases Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Phytases Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Phytases Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Phytases Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Phytases Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Phytases Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Phytases Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Phytases Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Phytases Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Phytases Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Phytases Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Phytases Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Phytases Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Phytases Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Phytases Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Phytases Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Phytases Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Phytases Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Phytases Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Phytases Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Phytases Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Phytases Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Phytases Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Phytases Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Phytases Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Phytases Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Phytases Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Phytases Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Phytases Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Phytases Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Phytases Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Phytases Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Phytases Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Phytases Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Phytases Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Phytases Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Phytases Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Phytases Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Phytases Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Phytases Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phytases?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Phytases?

Key companies in the market include BASF, DuPont, DSM, AB Enzymes, Beijing Smistyle, VTR, Jinan Tiantianxiang (TTX), Huvepharma, Novozymes, Vland Biotech Group.

3. What are the main segments of the Phytases?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phytases," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phytases report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phytases?

To stay informed about further developments, trends, and reports in the Phytases, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence