Key Insights

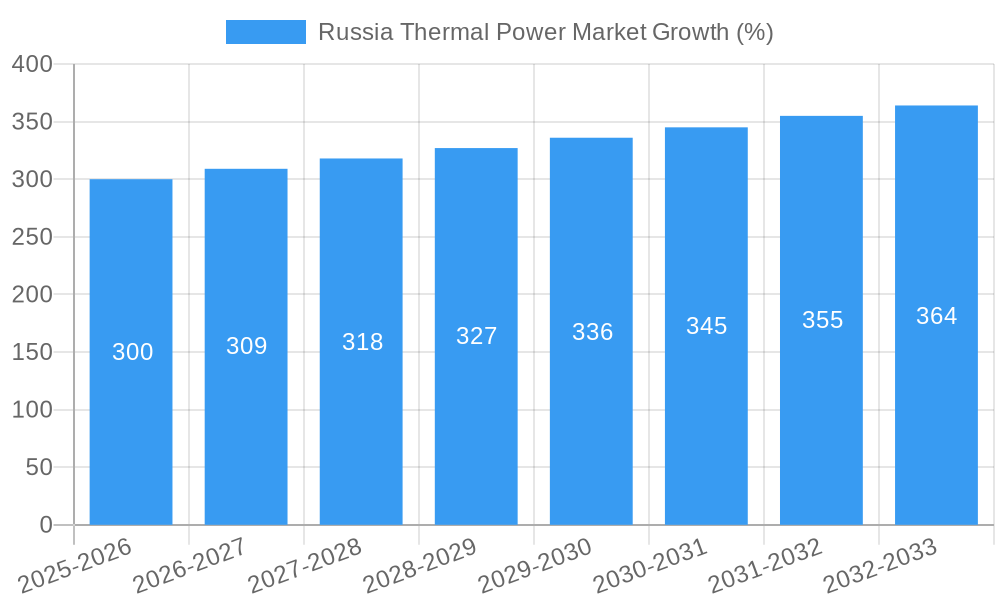

The Russian thermal power market, valued at approximately $XX million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) exceeding 2.00% from 2025 to 2033. This growth is fueled by increasing energy demand driven by industrial expansion and population growth, particularly in rapidly developing regions like Western and Southern Russia. The market is segmented by fuel source (oil, natural gas, nuclear, coal) and power plant technology (conventional thermal, combined cycle, cogeneration). Natural gas is expected to remain the dominant fuel source due to its abundance and relative cost-effectiveness. However, the market is also witnessing a gradual shift towards more efficient combined cycle plants and a sustained presence of nuclear power, reflecting a focus on improving energy efficiency and reducing carbon emissions, albeit with limited progress compared to global standards. Key players like SUEK JSC, Unipro PJSC, and Gazprom are actively investing in modernizing existing infrastructure and expanding capacity to meet growing energy needs. While government policies supporting domestic energy production contribute positively, regulatory hurdles and potential environmental concerns pose challenges to market expansion. The regional distribution of the market shows significant concentration in Western and Southern Russia, mirroring the industrial and population density in these areas.

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace compared to the historical period (2019-2024), primarily due to the ongoing global transition towards renewable energy sources and potential economic factors affecting investment in new power generation projects. The market's future trajectory hinges on the interplay between energy demand growth, investment in modern power plants, and government policies aimed at balancing energy security with environmental sustainability. The presence of significant state-owned players ensures a degree of stability in the market, but their strategic decisions will also be crucial in shaping its future. Competitive pressures will likely remain moderate, given the concentration of key players and the relatively controlled nature of the Russian energy sector.

Russia Thermal Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia thermal power market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It delves into market dynamics, growth trends, key players, and emerging opportunities within the parent market of the Russian energy sector and its child market of thermal power generation. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and navigate this complex and evolving market. The total market size in 2025 is estimated at XX Million.

Russia Thermal Power Market Market Dynamics & Structure

This section analyzes the structure and dynamics of the Russian thermal power market, considering market concentration, technological advancements, regulatory influences, competitive substitutes, end-user demographics, and M&A activities. The market is characterized by a relatively concentrated structure, with a few major players holding significant market share.

- Market Concentration: The top 5 players (SUEK JSC, Unipro PJSC, PJSC Lukoil, PJSC OGK-2, PJSC Gazprom) control an estimated 70% of the market. Smaller players compete in niche segments.

- Technological Innovation: While conventional thermal power plants remain dominant, there’s increasing adoption of combined cycle power plants (CCPPs) for enhanced efficiency. Innovation is hampered by sanctions and technological dependence.

- Regulatory Framework: Government regulations, including emission standards and energy security policies, significantly influence market dynamics. Recent geopolitical events have led to increased regulatory uncertainty.

- Competitive Substitutes: Renewable energy sources, particularly nuclear power (Rosatom State Atomic Energy Corporation plays a major role), are emerging as significant competitors. However, the reliance on fossil fuels remains high.

- End-User Demographics: The primary end-users are industrial facilities, residential consumers, and commercial establishments. The distribution of demand varies across regions.

- M&A Trends: The number of M&A deals in the sector has decreased since 2022 due to geopolitical instability and sanctions, with a total deal volume of approximately XX Million in 2024.

Russia Thermal Power Market Growth Trends & Insights

The Russian thermal power market experienced [positive/negative - select one] growth between 2019 and 2024, driven by [positive/negative - select one] factors such as [list key factors]. The market size is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period. Technological disruptions, particularly the increasing adoption of CCPPs and modernization efforts, influence the growth trajectory. Consumer behavior remains largely dependent on government policies and energy pricing. Sanctions and geopolitical instability significantly impact the market outlook, creating both challenges and potential opportunities for market players. The energy mix is predicted to shift gradually toward cleaner alternatives, but the dominance of fossil fuels is expected to persist in the near term. Further analysis will reveal the specifics of these trends, providing a comprehensive view of Russia's energy market.

Dominant Regions, Countries, or Segments in Russia Thermal Power Market

The regions with the highest concentration of thermal power plants and energy consumption drive market growth. Siberia and the Ural region demonstrate significant demand due to their industrial activities. The growth is driven by a combination of factors:

- Natural Gas Dominance: Natural gas serves as the primary fuel source across regions, contributing to a larger market share for natural gas-fired plants.

- Coal Dependence: Coal continues to play a significant role in several regions, particularly those with large coal reserves.

- Regional Economic Activities: Industrial hubs and densely populated areas contribute significantly to energy demand, fueling the growth in specific regions.

- Government Initiatives: Investment in upgrading existing power plants and the construction of new facilities influences the growth of the thermal power market.

Furthermore, the Conventional Thermal Power Plants segment holds the largest market share, but the Combined Cycle Power Plants segment is poised for rapid growth owing to its superior efficiency.

Russia Thermal Power Market Product Landscape

The Russian thermal power market is characterized by a diverse product landscape, including conventional thermal power plants, combined cycle power plants (CCPPs), and cogeneration plants. Technological advancements focus on improving efficiency, reducing emissions, and enhancing reliability. Key product innovations include advancements in turbine technology, improved heat recovery systems in CCPPs, and the integration of smart grid technologies. The emphasis is on upgrading existing infrastructure and optimizing plant performance to meet energy demands and environmental standards.

Key Drivers, Barriers & Challenges in Russia Thermal Power Market

Key Drivers: Increased industrialization, rising energy demand from residential and commercial sectors, government investments in infrastructure development, and modernization of existing thermal power plants are all contributing factors to market growth.

Key Barriers & Challenges: Geopolitical instability, international sanctions, volatile fuel prices (particularly natural gas), environmental regulations, and technological limitations associated with the adoption of new technologies and adapting existing ones present significant hurdles. The impact of sanctions has been estimated to reduce market growth by approximately XX% in the forecast period.

Emerging Opportunities in Russia Thermal Power Market

Emerging opportunities in the Russian thermal power market include optimizing existing plants to increase efficiency and reduce emissions; investing in modernizing older facilities; and exploring niche segments focused on renewable energy integration or innovative financing models. Expanding into remote areas with limited access to energy and developing small-scale cogeneration plants present additional growth potential.

Growth Accelerators in the Russia Thermal Power Market Industry

Long-term growth in the Russian thermal power market will be driven by ongoing modernization efforts, government policies aimed at improving energy security and efficiency, and strategic partnerships between domestic and international companies, focusing on technology transfer and investment. Technological advancements, particularly in CCPPs and smart grid technologies, will contribute substantially to efficiency improvements.

Key Players Shaping the Russia Thermal Power Market Market

- SUEK JSC

- Unipro PJSC

- PJSC Lukoil

- PJSC OGK-2

- PJSC Gazprom

- Rosatom State Atomic Energy Corporation

- Inter RAO YEES PAO

- JSC Tatenergo

Notable Milestones in Russia Thermal Power Market Sector

- October 2022: Damage to the Crimea thermal power plant in Moscow due to a drone attack highlighted the vulnerability of energy infrastructure and increased security concerns.

- May 2022: Fortum Oyj's suspension of operations and asset sale underscored the impact of the Russia-Ukraine war on foreign investment and market participation.

In-Depth Russia Thermal Power Market Market Outlook

The future of the Russian thermal power market is intertwined with geopolitical factors, energy policy, and technological innovation. While challenges remain, opportunities exist for companies that can adapt to the changing environment, embrace technological advancements, and navigate the regulatory landscape. Modernization of existing infrastructure and strategic partnerships are key factors determining long-term market success. The market's resilience and potential for growth depend on overcoming existing barriers and capitalizing on emerging trends.

Russia Thermal Power Market Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Nuclear

- 1.4. Coal

Russia Thermal Power Market Segmentation By Geography

- 1. Russia

Russia Thermal Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Natural Gas-Fired Power Generation is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Nuclear

- 5.1.4. Coal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Western Russia Russia Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 SUEK JSC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Unipro PJSC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 PJSC Lukoil

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PJSC OGK-2

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PJSC Gazprom

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rosatom State Atomic Energy Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Inter RAO YEES PAO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JSC Tatenergo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 SUEK JSC

List of Figures

- Figure 1: Russia Thermal Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Thermal Power Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Thermal Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Russia Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Russia Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 5: Russia Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Russia Thermal Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Russia Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Russia Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Western Russia Russia Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Russia Russia Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 11: Eastern Russia Russia Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Russia Russia Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Southern Russia Russia Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Southern Russia Russia Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Northern Russia Russia Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Northern Russia Russia Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Russia Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 18: Russia Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 19: Russia Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Russia Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Thermal Power Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Russia Thermal Power Market?

Key companies in the market include SUEK JSC, Unipro PJSC, PJSC Lukoil, PJSC OGK-2, PJSC Gazprom, Rosatom State Atomic Energy Corporation, Inter RAO YEES PAO, JSC Tatenergo.

3. What are the main segments of the Russia Thermal Power Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Natural Gas-Fired Power Generation is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

October 2022: The Russian government announced that Crimea thermal power plant in Moscow was damaged in a drone war.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Thermal Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Thermal Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Thermal Power Market?

To stay informed about further developments, trends, and reports in the Russia Thermal Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence