Key Insights

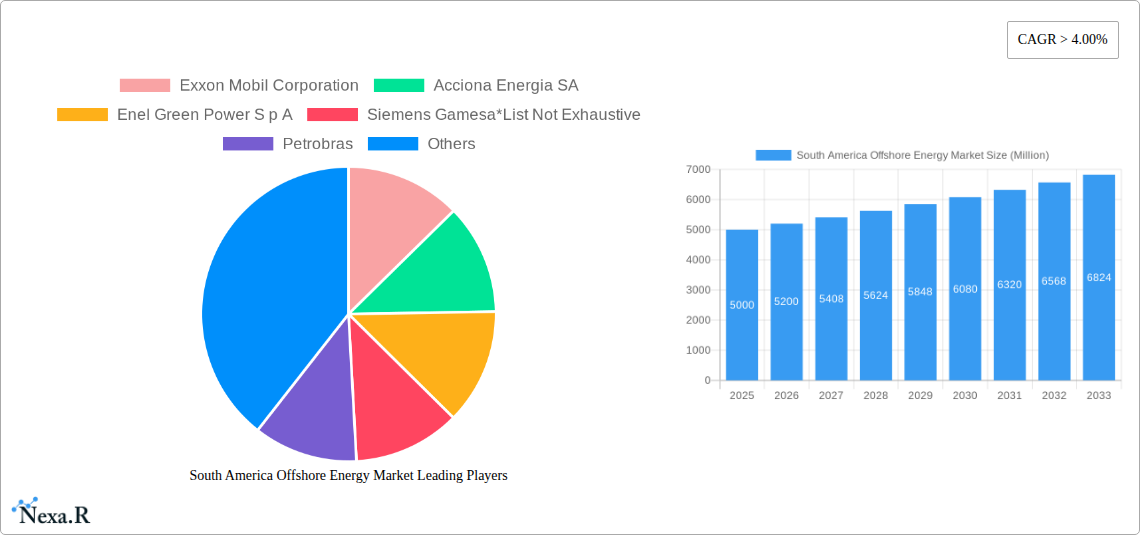

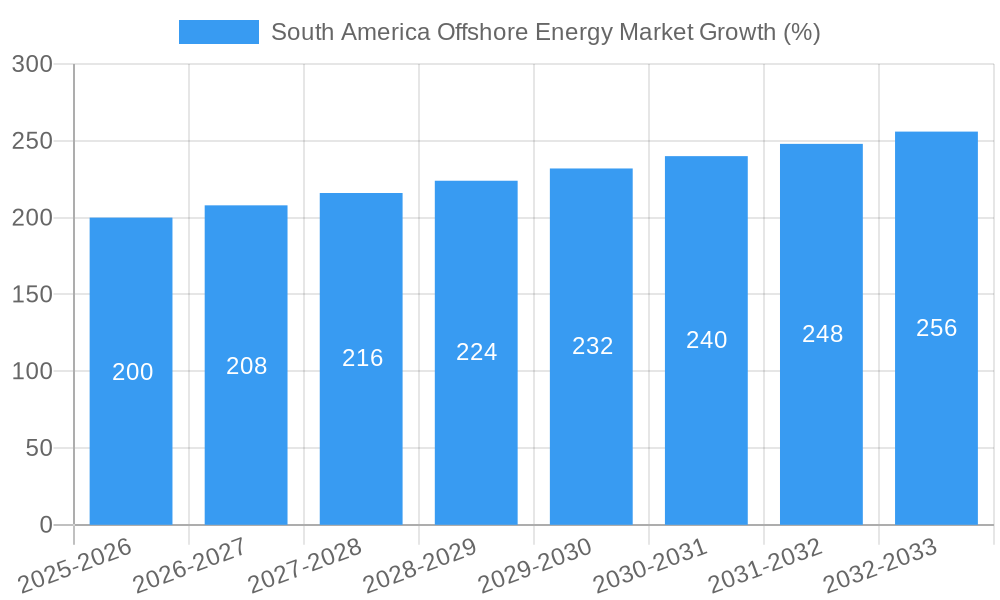

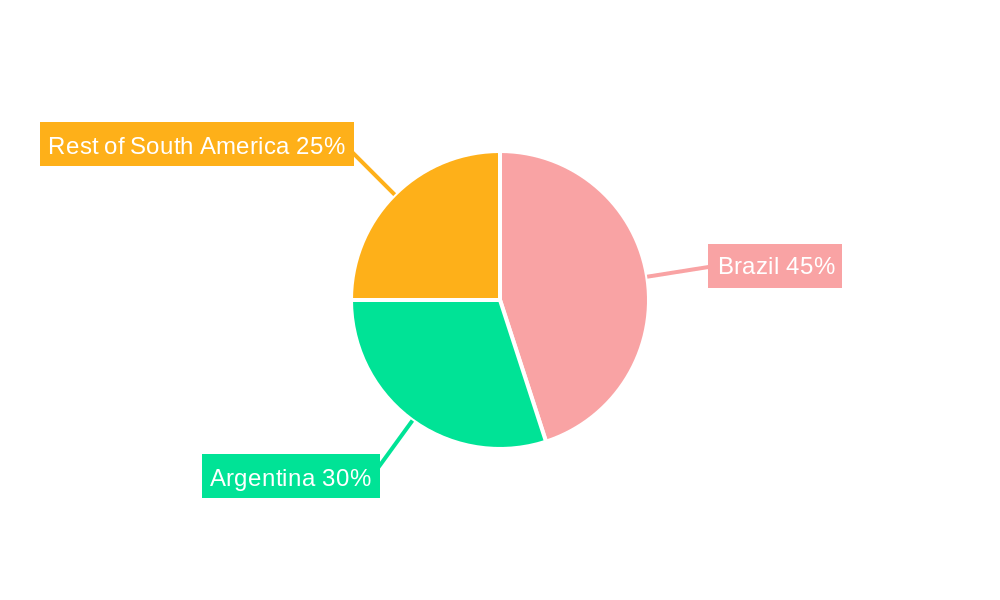

The South American offshore energy market, encompassing wind, oil & gas, and tidal wave energy, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing energy demands across South American nations, coupled with a growing focus on diversifying energy sources beyond traditional fossil fuels, are creating significant opportunities for offshore renewable energy projects. Secondly, substantial investments in infrastructure development, including improved port facilities and grid connectivity, are streamlining project implementation. Governmental support through favorable policies and incentives further accelerates market growth. However, challenges remain. High upfront capital costs for offshore projects, regulatory complexities, and environmental concerns related to marine ecosystems pose significant restraints. The market is segmented by energy type, with offshore wind energy showing particularly strong potential given the region's extensive coastlines and favorable wind resources. Brazil and Argentina represent the largest national markets, benefiting from significant investment and technological advancements. Key players like ExxonMobil, Acciona Energía, Enel Green Power, Siemens Gamesa, Petrobras, Chevron, General Electric, Vestas, and Repsol are actively shaping market dynamics through project development and technological innovation.

While precise market sizing is unavailable, a reasonable estimation can be made. Assuming a 2025 market size of $5 billion (based on typical values for developing offshore energy markets of comparable size and potential), and a CAGR of 4%, the market would reach approximately $7.4 billion by 2033. This estimation considers the factors influencing market growth and the limitations of available information. The substantial potential and ongoing investment in offshore energy within South America signal a promising trajectory for continued expansion in the coming decade. Future growth will largely depend on ongoing investments in technology, streamlining regulatory processes, and the successful implementation of large-scale offshore renewable energy projects across the region. Brazil's ambitious renewable energy targets and Argentina's burgeoning offshore wind sector are particularly important for this growth trajectory.

South America Offshore Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Offshore Energy market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It offers invaluable insights into market dynamics, growth trends, key players, and emerging opportunities within the parent market of Renewable Energy and its child markets of Wind, Oil & Gas, and Tidal Wave energy. The report is tailored for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic sector.

South America Offshore Energy Market Dynamics & Structure

This section delves into the intricacies of the South America Offshore Energy market, analyzing market concentration, technological innovation, regulatory landscapes, and competitive dynamics. We examine the impact of mergers and acquisitions (M&A) activity, end-user demographics, and the presence of substitute products. Quantitative data, including market share percentages and M&A deal volumes, are provided alongside qualitative assessments of innovation barriers and market structure.

- Market Concentration: The South American Offshore Energy market exhibits a [xx]% concentration ratio (CRx), indicating a [highly concentrated/moderately concentrated/fragmented] market structure.

- Technological Innovation: Key innovation drivers include advancements in [Specify technologies, e.g., floating wind turbine technology, subsea oil & gas extraction techniques, wave energy converters]. Barriers to innovation include [e.g., high initial investment costs, regulatory uncertainties, limited skilled labor].

- Regulatory Frameworks: Varying regulatory frameworks across South American countries influence investment decisions and project development timelines. [Describe specific regulatory aspects, e.g., licensing procedures, environmental regulations].

- Competitive Landscape: Key competitive dynamics include [e.g., price competition, technological differentiation, strategic partnerships]. The market is characterized by [describe competitive intensity: e.g., fierce competition, oligopolistic competition].

- M&A Activity: The historical period (2019-2024) witnessed [xx] M&A deals, totaling approximately [xx Million] in value. [Describe trends and implications of M&A activity].

- End-User Demographics: The primary end-users include [e.g., power generation companies, oil & gas companies, industrial consumers]. [Provide details on end-user consumption patterns and preferences].

South America Offshore Energy Market Growth Trends & Insights

This section analyzes the evolution of the South America Offshore Energy market size, adoption rates, technological disruptions, and evolving consumer behavior. We present quantitative data such as Compound Annual Growth Rate (CAGR) and market penetration rates to provide a comprehensive overview. Utilizing advanced analytical techniques, we forecast market growth and identify emerging trends that will shape the future of the industry.

[Insert 600 words of analysis here focusing on CAGR, market penetration, adoption rates, technological disruptions, and consumer behaviour shifts. Use data to support the analysis]

Dominant Regions, Countries, or Segments in South America Offshore Energy Market

This section identifies the leading regions, countries, and segments (Wind, Oil & Gas, Tidal Wave) driving market growth in South America. We delve into the factors contributing to their dominance, including economic policies, infrastructure development, and resource availability.

- Dominant Segment: [Wind/Oil & Gas/Tidal Wave] is the dominant segment, accounting for [xx]% of the market share in 2025.

- Leading Country: [Brazil/Argentina/Chile/Other] is projected to be the leading country in the South America Offshore Energy market due to [e.g., favorable government policies, abundant resources, robust infrastructure].

- Key Drivers:

- Brazil: Significant oil and gas reserves, supportive government policies, and investments in offshore infrastructure.

- Argentina: Growing renewable energy targets and potential for offshore wind development.

- Chile: High wind resources and government incentives for renewable energy projects.

- [Other Countries]: [State specific drivers]

[Insert 600 words of analysis here, including reasons for the dominance of a specific region, country, or segment. Support analysis with data on market share and growth potential. Include paragraphs and bullet points.]

South America Offshore Energy Market Product Landscape

This section provides a concise overview of product innovations, applications, and performance metrics within the South America Offshore Energy market. It highlights unique selling propositions and technological advancements driving market growth.

[Insert 100-150 words describing product innovations, applications, performance metrics, unique selling propositions, and technological advancements.]

Key Drivers, Barriers & Challenges in South America Offshore Energy Market

This section outlines the key factors driving market growth and the challenges and restraints impacting its expansion.

Key Drivers:

- Abundant offshore resources (oil, gas, wind, wave).

- Increasing energy demand and diversification needs.

- Government support for renewable energy and energy independence.

- Technological advancements improving efficiency and cost-effectiveness.

Challenges and Restraints:

- High capital expenditures required for offshore projects.

- Complex regulatory frameworks and permitting processes.

- Environmental concerns and regulatory hurdles.

- Supply chain complexities and logistical challenges.

- Geopolitical risks and uncertainties.

[Insert 150 words for each section (Drivers and Challenges), using paragraphs or bullet points as appropriate. Quantify impacts where possible.]

Emerging Opportunities in South America Offshore Energy Market

This section highlights the promising avenues for growth within the South America Offshore Energy market.

- Untapped Markets: Exploration and development of offshore resources in less explored regions.

- Innovative Applications: Integration of renewable energy sources with offshore oil and gas platforms.

- Evolving Consumer Preferences: Growing demand for clean and sustainable energy.

[Insert 150 words outlining emerging trends and opportunities.]

Growth Accelerators in the South America Offshore Energy Market Industry

This section analyzes the catalysts driving long-term growth in the South America Offshore Energy market.

[Insert 150 words discussing technological breakthroughs, strategic partnerships, and market expansion strategies.]

Key Players Shaping the South America Offshore Energy Market Market

- Exxon Mobil Corporation

- Acciona Energia SA

- Enel Green Power S p A

- Siemens Gamesa

- Petrobras

- Chevron Corporation

- General Electric Company

- Vestas

- Repsol SA

List Not Exhaustive

Notable Milestones in South America Offshore Energy Market Sector

- April 2022: Petrobras discovers oil in a wildcat well in the pre-salt Campos Basin offshore Brazil.

- April 2021: Enel Green Power Chile installs the PB3 PowerBuoy, the first full-scale wave energy converter in Latin America.

[Insert further milestones if available using year/month bullet points and emphasizing their impact on market dynamics.]

In-Depth South America Offshore Energy Market Market Outlook

The South America Offshore Energy market is poised for significant growth driven by increasing energy demand, supportive government policies, and technological advancements. Strategic investments in offshore infrastructure, exploration activities, and renewable energy projects will play a crucial role in shaping the future of this dynamic sector. The market presents attractive opportunities for both established players and new entrants seeking to capitalize on the region's vast offshore energy resources.

South America Offshore Energy Market Segmentation

-

1. Type

- 1.1. Wind

- 1.2. Oil & Gas

- 1.3. Tidal Wave

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Venezuela

- 2.4. Rest of South America

South America Offshore Energy Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Venezuela

- 4. Rest of South America

South America Offshore Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. Increase in Adoption of Alternative Fuel Vehicles

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wind

- 5.1.2. Oil & Gas

- 5.1.3. Tidal Wave

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Venezuela

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Venezuela

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wind

- 6.1.2. Oil & Gas

- 6.1.3. Tidal Wave

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Venezuela

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wind

- 7.1.2. Oil & Gas

- 7.1.3. Tidal Wave

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Venezuela

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Venezuela South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wind

- 8.1.2. Oil & Gas

- 8.1.3. Tidal Wave

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Venezuela

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wind

- 9.1.2. Oil & Gas

- 9.1.3. Tidal Wave

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Venezuela

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Brazil South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Offshore Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Exxon Mobil Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Acciona Energia SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Enel Green Power S p A

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Siemens Gamesa*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Petrobras

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Chevron Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Electric Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vestas

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Repsol SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Exxon Mobil Corporation

List of Figures

- Figure 1: South America Offshore Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Offshore Energy Market Share (%) by Company 2024

List of Tables

- Table 1: South America Offshore Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Offshore Energy Market Volume gigawatts Forecast, by Region 2019 & 2032

- Table 3: South America Offshore Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2019 & 2032

- Table 5: South America Offshore Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2019 & 2032

- Table 7: South America Offshore Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Offshore Energy Market Volume gigawatts Forecast, by Region 2019 & 2032

- Table 9: South America Offshore Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Offshore Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Offshore Energy Market Volume (gigawatts) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Offshore Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Offshore Energy Market Volume (gigawatts) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Offshore Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Offshore Energy Market Volume (gigawatts) Forecast, by Application 2019 & 2032

- Table 17: South America Offshore Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2019 & 2032

- Table 19: South America Offshore Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2019 & 2032

- Table 21: South America Offshore Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2019 & 2032

- Table 23: South America Offshore Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2019 & 2032

- Table 25: South America Offshore Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2019 & 2032

- Table 27: South America Offshore Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2019 & 2032

- Table 29: South America Offshore Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2019 & 2032

- Table 31: South America Offshore Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2019 & 2032

- Table 33: South America Offshore Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2019 & 2032

- Table 35: South America Offshore Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2019 & 2032

- Table 37: South America Offshore Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2019 & 2032

- Table 39: South America Offshore Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Offshore Energy Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the South America Offshore Energy Market?

Key companies in the market include Exxon Mobil Corporation, Acciona Energia SA, Enel Green Power S p A, Siemens Gamesa*List Not Exhaustive, Petrobras, Chevron Corporation, General Electric Company, Vestas, Repsol SA.

3. What are the main segments of the South America Offshore Energy Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Dominate the market.

7. Are there any restraints impacting market growth?

Increase in Adoption of Alternative Fuel Vehicles.

8. Can you provide examples of recent developments in the market?

In April 2022, Brazilian state-owned giant Petrobras discovered oil in a wildcat well in the pre-salt Campos Basin offshore Brazil. The company aims to resume the drilling operations until the final depth is reached to evaluate the discovery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Offshore Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Offshore Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Offshore Energy Market?

To stay informed about further developments, trends, and reports in the South America Offshore Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence