Key Insights

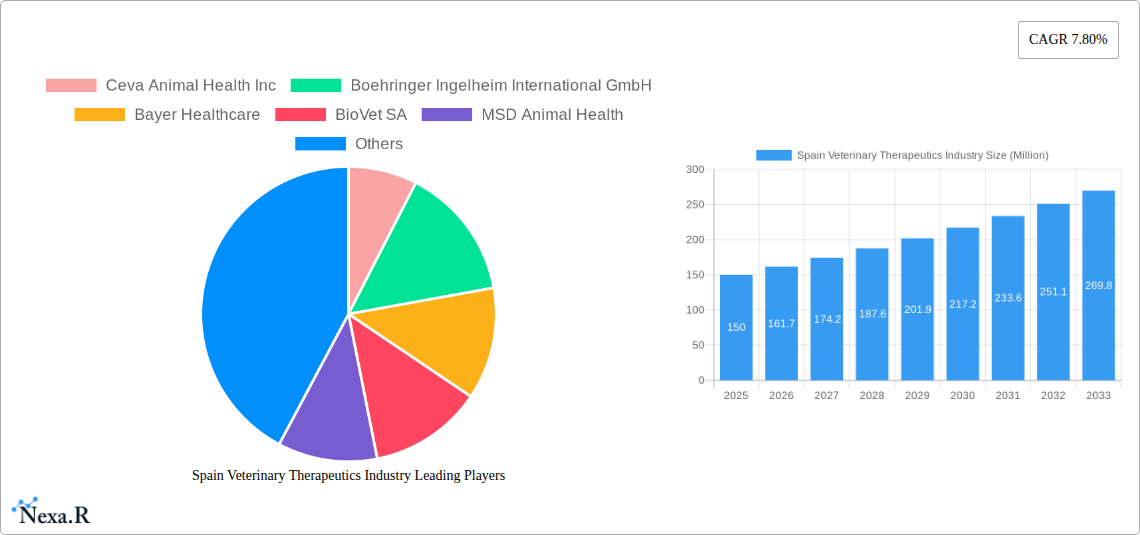

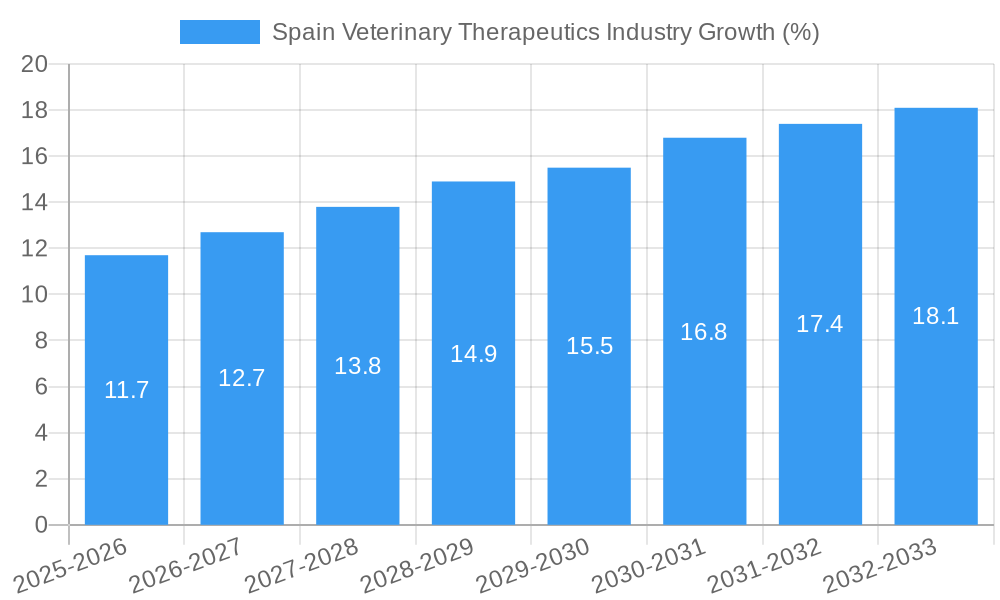

The Spain veterinary therapeutics market, valued at approximately €150 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 7.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing pet ownership in Spain, coupled with a rising humanization of pets, leads to greater investment in animal health and wellness. Secondly, advancements in veterinary therapeutics, including the development of more effective and targeted treatments for various animal diseases, contribute significantly to market growth. The growing prevalence of chronic diseases in companion animals, particularly in aging populations of dogs and cats, further fuels demand for sophisticated therapeutic solutions. Finally, rising awareness among veterinarians and pet owners regarding preventative healthcare, including vaccinations and parasite control, strengthens the market's overall trajectory. The market segmentation reveals a dominance of companion animal (dogs and cats) therapeutics, although the equine and ruminant sectors also demonstrate noteworthy growth potential, driven by the agricultural importance of these animals in Spain.

While the market enjoys substantial growth prospects, it faces certain challenges. Competition among established multinational players and smaller, specialized companies is intensifying. Price sensitivity within certain segments, particularly for routine treatments, could constrain overall revenue growth. Furthermore, regulatory hurdles and the cost associated with bringing new therapies to market may pose limitations. However, the ongoing focus on research and development, particularly in areas such as personalized medicine for animals, promises to overcome these hurdles and sustain the market's long-term growth. The significant investment by major players like Zoetis Inc., Boehringer Ingelheim International GmbH, and Ceva Animal Health Inc. further indicates a positive outlook for the Spanish veterinary therapeutics market.

Spain Veterinary Therapeutics Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Spain veterinary therapeutics market, encompassing market dynamics, growth trends, key players, and future opportunities. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by product (therapeutics and other therapeutics including diagnostics) and animal type (dogs and cats, horses, ruminants, swine, poultry, and other animals), offering granular insights for informed strategic decision-making.

Spain Veterinary Therapeutics Industry Market Dynamics & Structure

The Spanish veterinary therapeutics market is characterized by a moderately concentrated landscape, with both multinational giants and domestic players vying for market share. Technological innovation, driven by advancements in diagnostics and targeted therapies, plays a crucial role in shaping market growth. Stringent regulatory frameworks and evolving animal health policies impact market access and product development. Competitive pressures from generic substitutes and the increasing availability of alternative treatment options influence pricing and market dynamics. The demographics of pet ownership, particularly the growing trend of pet humanization, are significant drivers of market demand, particularly within the companion animal segment (dogs and cats). The recent years have witnessed increased mergers and acquisitions (M&A) activity, with xx deals recorded between 2019 and 2024, indicating industry consolidation and strategic expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on targeted therapies, advanced diagnostics, and personalized medicine.

- Regulatory Framework: Stringent regulations governing drug approvals and market access.

- Competitive Landscape: Intense competition from both established players and emerging companies.

- M&A Activity: Increasing consolidation through acquisitions and partnerships.

Spain Veterinary Therapeutics Industry Growth Trends & Insights

The Spanish veterinary therapeutics market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of €xx million in 2024. This growth is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, driven by factors such as rising pet ownership, increasing veterinary expenditure, and the growing adoption of advanced therapeutic solutions. Technological disruptions, such as the integration of AI in diagnostics and the development of novel drug delivery systems, are reshaping market dynamics. Consumer behavior shifts towards premium pet care products and services are further bolstering market demand. The market penetration of advanced therapeutics remains relatively low, presenting significant growth opportunities for innovative players.

Dominant Regions, Countries, or Segments in Spain Veterinary Therapeutics Industry

The companion animal segment (dogs and cats) dominates the Spanish veterinary therapeutics market, accounting for approximately xx% of total market value in 2024. This dominance is driven by high pet ownership rates, increasing pet humanization trends, and higher willingness to spend on pet healthcare. Geographically, urban areas exhibit higher market penetration due to increased pet ownership density and access to veterinary services. The therapeutics segment is the largest product category, followed by diagnostics.

- Key Drivers: High pet ownership, rising disposable incomes, increasing pet insurance coverage, and growing awareness of animal health.

- Dominance Factors: Higher pet ownership in urban areas, advanced veterinary infrastructure, and strong consumer preference for premium pet healthcare.

- Growth Potential: Continued growth is expected in the companion animal segment, driven by increasing pet humanization and demand for advanced therapeutic solutions.

Spain Veterinary Therapeutics Industry Product Landscape

The Spanish veterinary therapeutics market offers a diverse range of products, including pharmaceuticals, biologics, and diagnostics. Innovation in this space focuses on targeted therapies with reduced side effects, improved efficacy, and convenient administration methods. Technological advancements in diagnostics, such as point-of-care testing and advanced imaging techniques, enhance diagnostic capabilities and treatment effectiveness. Unique selling propositions (USPs) often center on improved product efficacy, reduced treatment duration, and enhanced animal welfare.

Key Drivers, Barriers & Challenges in Spain Veterinary Therapeutics Industry

Key Drivers:

- Rising pet ownership and increasing pet humanization.

- Growing awareness of animal health and welfare.

- Technological advancements in diagnostics and therapeutics.

- Favorable regulatory environment for innovation.

Key Challenges:

- Price competition from generic drugs.

- High R&D costs associated with developing new therapies.

- Supply chain disruptions affecting product availability and pricing.

- Regulatory hurdles for new product approvals.

Emerging Opportunities in Spain Veterinary Therapeutics Industry

- Growing demand for personalized medicine in veterinary care.

- Untapped potential in specialized animal therapeutic segments (e.g., equine, livestock).

- Expansion of telehealth and remote diagnostic services.

- Increasing adoption of preventative healthcare strategies.

Growth Accelerators in the Spain Veterinary Therapeutics Industry

Technological advancements, such as AI-powered diagnostics and personalized medicine approaches, are accelerating market growth. Strategic collaborations between pharmaceutical companies, veterinary clinics, and technology providers are fostering innovation and expanding market access. Market expansion into underserved regions and the development of novel therapeutic solutions for emerging animal health challenges offer significant growth opportunities.

Key Players Shaping the Spain Veterinary Therapeutics Industry Market

- Ceva Animal Health Inc

- Boehringer Ingelheim International GmbH

- Bayer Healthcare

- BioVet SA

- MSD Animal Health

- SUPER'S DIANA S L

- LABORATORIOS EURISKO

- Bioiberica S A U

- S P Veterinaria

- Zoetis Inc

Notable Milestones in Spain Veterinary Therapeutics Industry Sector

- May 2022: TheraVet signs exclusive distribution agreement with Nuzoa for BIOCERA-VET product line in Spain.

- January 2022: VetPartners acquires first veterinary practices in Spain.

In-Depth Spain Veterinary Therapeutics Industry Market Outlook

The Spanish veterinary therapeutics market is poised for significant growth in the coming years, driven by technological advancements, expanding pet ownership, and increased investment in animal healthcare. Strategic partnerships, product innovation, and market expansion into underserved segments will be crucial for achieving long-term success. The focus on preventative healthcare and personalized medicine offers substantial opportunities for companies to establish a strong market position.

Spain Veterinary Therapeutics Industry Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

Spain Veterinary Therapeutics Industry Segmentation By Geography

- 1. Spain

Spain Veterinary Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Pollution Related to Allergens; Increasing Dog Ownership

- 3.3. Market Restrains

- 3.3.1. Lack of Veterinarians and Shortage of Skilled Farm Workers; Increasing Cost of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. Vaccines Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Veterinary Therapeutics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ceva Animal Health Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Boehringer Ingelheim International GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BioVet SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MSD Animal Health

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUPER'S DIANA S L

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LABORATORIOS EURISKO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bioiberica S A U

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 S P Veterinaria

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zoetis Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ceva Animal Health Inc

List of Figures

- Figure 1: Spain Veterinary Therapeutics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Veterinary Therapeutics Industry Share (%) by Company 2024

List of Tables

- Table 1: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 6: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Animal Type 2019 & 2032

- Table 7: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 12: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 14: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Animal Type 2019 & 2032

- Table 15: Spain Veterinary Therapeutics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Veterinary Therapeutics Industry?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the Spain Veterinary Therapeutics Industry?

Key companies in the market include Ceva Animal Health Inc, Boehringer Ingelheim International GmbH, Bayer Healthcare, BioVet SA, MSD Animal Health, SUPER'S DIANA S L, LABORATORIOS EURISKO, Bioiberica S A U, S P Veterinaria, Zoetis Inc.

3. What are the main segments of the Spain Veterinary Therapeutics Industry?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Pollution Related to Allergens; Increasing Dog Ownership.

6. What are the notable trends driving market growth?

Vaccines Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Veterinarians and Shortage of Skilled Farm Workers; Increasing Cost of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

In May 2022, TheraVet, a pioneer in the treatment of osteoarticular diseases in pets, announced the signing of an exclusive distribution agreement with Nuzoa, a leading Spanish company in the distribution of veterinary products and services. This agreement will allow the distribution of the BIOCERA-VET product line in Spain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Veterinary Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Veterinary Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Veterinary Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Spain Veterinary Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence