Key Insights

The global Addison's Disease Therapeutics Market is projected to expand significantly, reaching an estimated market size of $2.25 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 9.7% from the 2025 base year. Key growth drivers include the rising incidence of autoimmune diseases, advancements in diagnostic technologies, and a focus on enhancing patient outcomes. Glucocorticoids and mineralocorticoids dominate the market due to their proven efficacy in hormone replacement. The parenteral administration route is anticipated to see substantial growth, offering efficient drug delivery, especially in acute care settings. Improved laboratory and imaging capabilities are facilitating earlier and more precise diagnoses, broadening the patient base and increasing demand for therapies. Furthermore, expanding healthcare infrastructure in emerging economies and heightened awareness of Addison's disease management among patients and healthcare providers are significant growth catalysts.

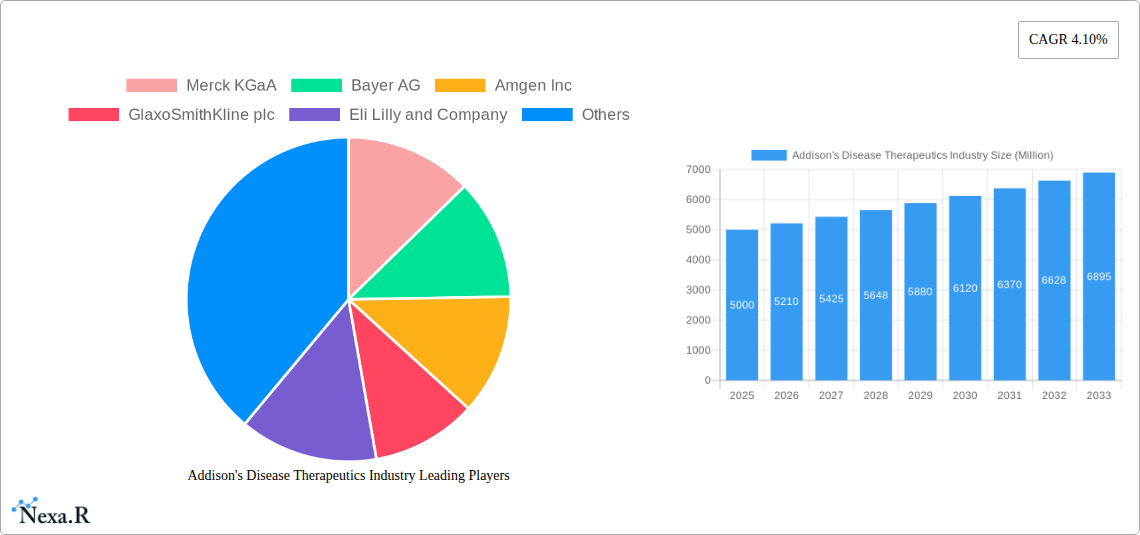

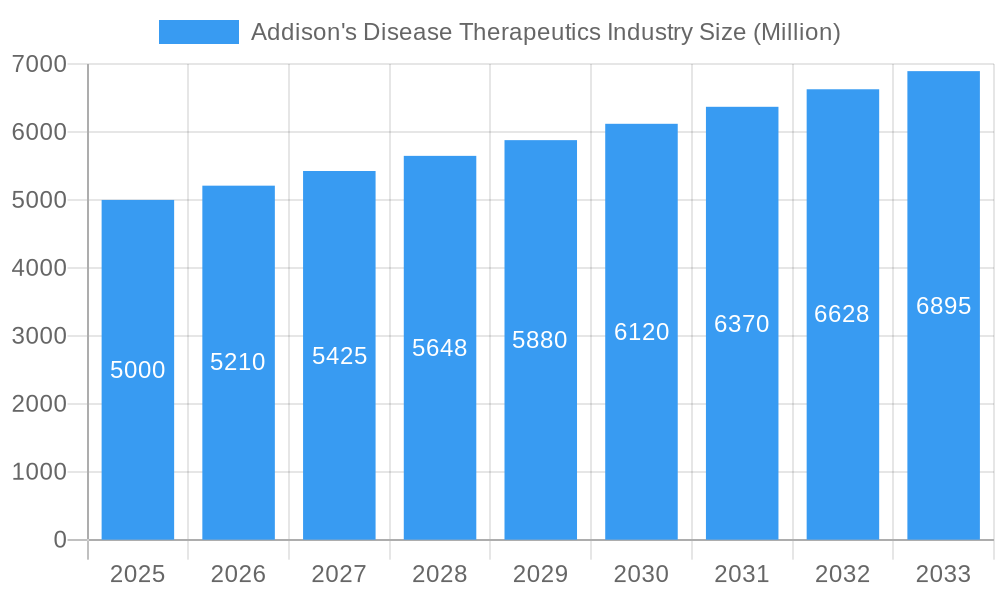

Addison's Disease Therapeutics Industry Market Size (In Billion)

Leading pharmaceutical companies such as Merck KGaA, Bayer AG, Amgen Inc., GlaxoSmithKline plc, and Eli Lilly and Company are actively involved in research and development of innovative treatments and existing therapy enhancements. Strategic partnerships and acquisitions are also influencing the competitive landscape, aiming to broaden product offerings and market penetration. While established therapies drive current market growth, emerging research in combination treatments and personalized medicine offers future potential. Market restraints may include the high cost of specialized treatments and the requirement for lifelong patient adherence. Geographically, North America and Europe are expected to lead due to developed healthcare systems and higher diagnosis rates. The Asia Pacific region presents a considerable growth opportunity driven by its large population, improving healthcare accessibility, and increasing investment in medical research.

Addison's Disease Therapeutics Industry Company Market Share

Addison's Disease Therapeutics Industry: A Comprehensive Market Analysis and Forecast (2019-2033)

This report offers an in-depth analysis of the global Addison's Disease Therapeutics market, providing critical insights for industry stakeholders. We cover the market's dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities from 2019 to 2033, with a base year of 2025. The report focuses on high-traffic keywords such as "Addison's disease treatment," "cortisol replacement therapy," "adrenal insufficiency drugs," and "endocrine disorder therapeutics" to maximize visibility. We also analyze parent and child markets, presenting all values in Million Units for clarity.

Addison's Disease Therapeutics Industry Market Dynamics & Structure

The Addison's Disease Therapeutics market is characterized by a moderate level of concentration, with several key players vying for market share. Technological innovation is primarily driven by the pursuit of improved drug delivery systems and more precise hormone replacement therapies. Regulatory frameworks, overseen by bodies like the FDA and EMA, significantly influence product development and market access, ensuring patient safety and therapeutic efficacy. Competitive product substitutes are limited, as Addison's disease requires specific hormonal replacement, but alternative management strategies and lifestyle modifications can indirectly impact treatment adherence. End-user demographics are diverse, encompassing patients of all ages requiring lifelong management. Mergers and acquisitions (M&A) trends, while not as prevalent as in larger pharmaceutical markets, play a role in consolidating expertise and expanding product portfolios.

- Market Concentration: Dominated by a few key pharmaceutical companies, with increasing participation from smaller biotech firms focusing on niche solutions.

- Technological Innovation: Focus on enhanced hydrocortisone formulations, auto-injector technologies for emergency rescue, and potentially novel diagnostic tools.

- Regulatory Landscape: Stringent approval processes for hormone replacement therapies, requiring extensive clinical trials and post-market surveillance.

- Competitive Landscape: Primarily direct competition among hormone replacement therapies, with limited therapeutic alternatives.

- End-User Profile: Lifelong treatment requirement for patients, leading to stable demand.

- M&A Activity: Strategic acquisitions to gain access to innovative drug delivery platforms or specialized patient populations.

Addison's Disease Therapeutics Industry Growth Trends & Insights

The Addison's Disease Therapeutics market is poised for steady growth, driven by increasing disease awareness, advancements in diagnostic capabilities, and a growing understanding of the long-term impact of untreated or undertreated adrenal insufficiency. The market size evolution is expected to reflect a consistent upward trajectory, fueled by an aging global population and improved healthcare infrastructure in emerging economies. Adoption rates of new and improved therapeutic formulations are projected to rise as their benefits in patient compliance and quality of life become more evident. Technological disruptions, such as the development of more convenient and patient-friendly drug delivery systems, will play a crucial role in shaping market dynamics. Shifts in consumer behavior are also influencing the market, with patients increasingly seeking personalized treatment plans and greater involvement in their healthcare decisions. The CAGR is predicted to be around 5.2% during the forecast period, reflecting sustained demand and therapeutic advancements. Market penetration is expected to increase with greater accessibility to diagnostics and treatments.

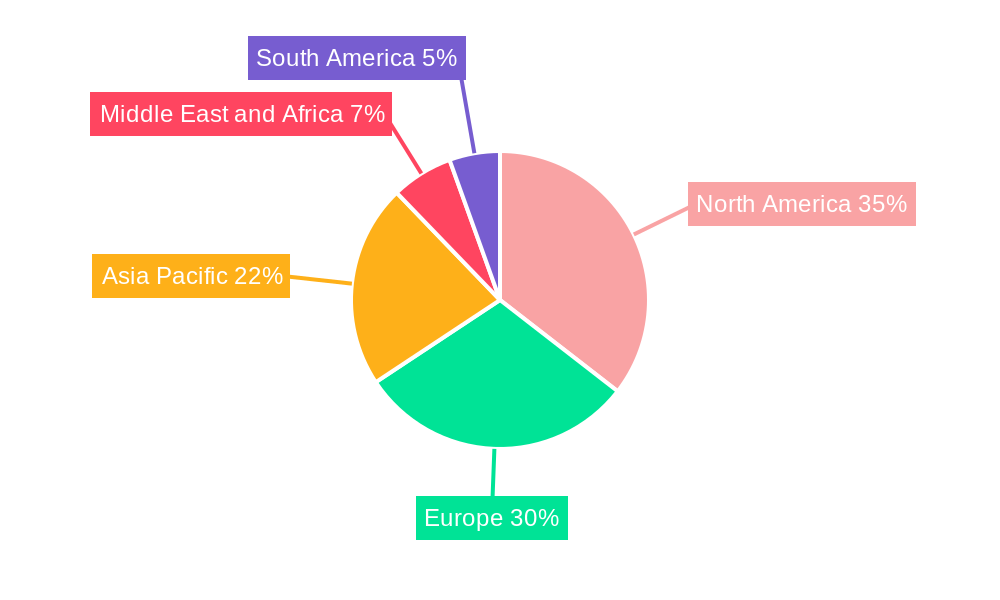

Dominant Regions, Countries, or Segments in Addison's Disease Therapeutics Industry

North America currently dominates the Addison's Disease Therapeutics market, driven by a well-established healthcare system, high disease prevalence, and significant investment in research and development. The United States, in particular, holds a substantial market share due to advanced diagnostic technologies and widespread access to specialized endocrine care. Glucocorticoid drugs represent the largest segment within the drug class category, forming the cornerstone of Addison's disease management. Oral administration remains the most prevalent route of administration due to its convenience and patient compliance. Laboratory testing, specifically hormone level assays, is the primary diagnostic method, offering high accuracy and accessibility. Hospitals are the leading end-user segment, owing to their comprehensive diagnostic and treatment capabilities. Economic policies supporting healthcare access and robust research funding are key drivers in this region's dominance.

- Dominant Region: North America, specifically the United States, due to advanced healthcare infrastructure and high disease awareness.

- Leading Drug Class: Glucocorticoids, essential for cortisol replacement therapy.

- Primary Route of Administration: Oral, offering convenience and patient adherence.

- Key Diagnostic Method: Laboratory Testing, enabling accurate hormone level assessment.

- Leading End-User: Hospitals, providing integrated diagnostic and treatment services.

- Growth Potential Drivers: Favorable reimbursement policies, presence of leading pharmaceutical companies, and a strong focus on patient outcomes.

Addison's Disease Therapeutics Industry Product Landscape

The product landscape for Addison's Disease Therapeutics is centered around hormone replacement therapies, primarily focusing on glucocorticoids and mineralocorticoids. Innovations are geared towards improving the bioavailability, pharmacokinetic profiles, and patient convenience of these essential medications. The development of modified-release formulations, such as Efmody, aims to mimic the natural diurnal rhythm of cortisol secretion, thereby enhancing therapeutic outcomes and reducing side effects. Furthermore, advancements in auto-injector technology, as seen with Antares Pharma's ATRS-1902, are revolutionizing emergency treatment for adrenal crises, offering rapid and reliable delivery of hydrocortisone. These product advancements enhance patient adherence and quality of life, distinguishing therapeutic offerings.

Key Drivers, Barriers & Challenges in Addison's Disease Therapeutics Industry

The primary forces propelling the Addison's Disease Therapeutics market include the increasing incidence of autoimmune diseases, which are a major cause of primary adrenal insufficiency, and the continuous innovation in drug formulations for improved efficacy and patient convenience. Advances in diagnostic technologies are also enabling earlier and more accurate diagnosis, leading to greater demand for therapeutic interventions. Furthermore, supportive government initiatives and growing awareness among healthcare professionals and patients about the management of chronic endocrine disorders contribute to market growth.

However, the market faces several challenges and restraints. Limited awareness of Addison's disease in certain demographics and geographical regions can hinder early diagnosis and treatment. The high cost of some advanced therapeutic formulations and diagnostic tests can pose an accessibility barrier, particularly in low-income countries. The lifelong nature of treatment necessitates consistent patient adherence, which can be challenging for some individuals. Supply chain disruptions and the potential for drug shortages also represent significant concerns for market stability.

Emerging Opportunities in Addison's Disease Therapeutics Industry

Emerging opportunities in the Addison's Disease Therapeutics industry lie in the development of novel treatment modalities beyond conventional hormone replacement. This includes exploring gene therapy or cell-based therapies for a potential cure or more sustained long-term management. The expansion of diagnostic services into remote and underserved areas through telemedicine and point-of-care testing presents a significant untapped market. Furthermore, the development of personalized medicine approaches, tailoring hormone replacement therapy based on individual genetic profiles and lifestyle factors, holds immense promise for improving patient outcomes and market differentiation.

Growth Accelerators in the Addison's Disease Therapeutics Industry Industry

Several catalysts are expected to accelerate long-term growth in the Addison's Disease Therapeutics industry. Technological breakthroughs in understanding the underlying pathophysiology of adrenal insufficiency may pave the way for disease-modifying therapies rather than just symptomatic treatment. Strategic partnerships between pharmaceutical companies and research institutions can foster collaborative efforts in drug discovery and development. Market expansion strategies targeting emerging economies with growing healthcare infrastructure and increasing disposable incomes will also be crucial. The ongoing evolution of patient support programs and educational initiatives will further enhance treatment adherence and patient engagement, driving sustained demand.

Key Players Shaping the Addison's Disease Therapeutics Industry Market

- Merck KGaA

- Bayer AG

- Amgen Inc

- GlaxoSmithKline plc

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Biogen

- Abbott

- Sandoz International GmbH

- Bristol-Myers Squibb Company

- Pfizer Inc

Notable Milestones in Addison's Disease Therapeutics Industry Sector

- April 2022: Diurnal Group extended its distribution agreement with Er-Kim to include the distribution and marketing of Alkindi (hydrocortisone granules in capsules for opening) and Efmody (hydrocortisone modified-release hard capsule) in Greece, Cyprus and Malta.

- January 2022: Antares Pharma announced that the United States Food and Drug Administration had granted Fast Track designation for ATRS-1902 for adrenal crisis rescue in adults and adolescents using the company's Vai novel proprietary auto-injector platform to deliver a stable liquid formulation of hydrocortisone.

In-Depth Addison's Disease Therapeutics Industry Market Outlook

The Addison's Disease Therapeutics industry market outlook is highly positive, driven by a confluence of factors. Continued investment in research and development for improved hormone replacement therapies, alongside novel drug delivery systems, will be a key growth accelerator. The increasing global prevalence of autoimmune disorders directly correlates with the demand for Addison's disease treatments. Furthermore, advancements in diagnostic accuracy and accessibility will lead to earlier interventions. Strategic collaborations among key players and expansion into under-penetrated markets will broaden the therapeutic reach. The market is expected to witness sustained growth, with an increasing focus on enhancing patient quality of life through more precise and convenient treatment options.

Addison's Disease Therapeutics Industry Segmentation

-

1. Drug Class

- 1.1. Glucocorticoid

- 1.2. Mineralocorticoid

- 1.3. Others

-

2. Route of Administration

- 2.1. Oral

- 2.2. Parenteral

- 2.3. Others

-

3. Diagnosis

- 3.1. Laboratory Testing

- 3.2. Imaging Testing

-

4. End-user

- 4.1. Hospitals

- 4.2. Homecare

- 4.3. Specialty Clinics

- 4.4. Others

Addison's Disease Therapeutics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Addison's Disease Therapeutics Industry Regional Market Share

Geographic Coverage of Addison's Disease Therapeutics Industry

Addison's Disease Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidences of Addison's Disease; Growing Awareness about the Addison's Disease and Rising Healthcare Expenditure

- 3.3. Market Restrains

- 3.3.1. Inability to Diagnose the Disease in Early Stages; High Costs Associated with the Treatment

- 3.4. Market Trends

- 3.4.1. Oral Route is Expected to Have the Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Addison's Disease Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Glucocorticoid

- 5.1.2. Mineralocorticoid

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Parenteral

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Diagnosis

- 5.3.1. Laboratory Testing

- 5.3.2. Imaging Testing

- 5.4. Market Analysis, Insights and Forecast - by End-user

- 5.4.1. Hospitals

- 5.4.2. Homecare

- 5.4.3. Specialty Clinics

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Addison's Disease Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Glucocorticoid

- 6.1.2. Mineralocorticoid

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Oral

- 6.2.2. Parenteral

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Diagnosis

- 6.3.1. Laboratory Testing

- 6.3.2. Imaging Testing

- 6.4. Market Analysis, Insights and Forecast - by End-user

- 6.4.1. Hospitals

- 6.4.2. Homecare

- 6.4.3. Specialty Clinics

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Addison's Disease Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Glucocorticoid

- 7.1.2. Mineralocorticoid

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Oral

- 7.2.2. Parenteral

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Diagnosis

- 7.3.1. Laboratory Testing

- 7.3.2. Imaging Testing

- 7.4. Market Analysis, Insights and Forecast - by End-user

- 7.4.1. Hospitals

- 7.4.2. Homecare

- 7.4.3. Specialty Clinics

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Addison's Disease Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Glucocorticoid

- 8.1.2. Mineralocorticoid

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Oral

- 8.2.2. Parenteral

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Diagnosis

- 8.3.1. Laboratory Testing

- 8.3.2. Imaging Testing

- 8.4. Market Analysis, Insights and Forecast - by End-user

- 8.4.1. Hospitals

- 8.4.2. Homecare

- 8.4.3. Specialty Clinics

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Addison's Disease Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Glucocorticoid

- 9.1.2. Mineralocorticoid

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Route of Administration

- 9.2.1. Oral

- 9.2.2. Parenteral

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Diagnosis

- 9.3.1. Laboratory Testing

- 9.3.2. Imaging Testing

- 9.4. Market Analysis, Insights and Forecast - by End-user

- 9.4.1. Hospitals

- 9.4.2. Homecare

- 9.4.3. Specialty Clinics

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Addison's Disease Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Glucocorticoid

- 10.1.2. Mineralocorticoid

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Route of Administration

- 10.2.1. Oral

- 10.2.2. Parenteral

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Diagnosis

- 10.3.1. Laboratory Testing

- 10.3.2. Imaging Testing

- 10.4. Market Analysis, Insights and Forecast - by End-user

- 10.4.1. Hospitals

- 10.4.2. Homecare

- 10.4.3. Specialty Clinics

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merck KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amgen Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GlaxoSmithKline plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly and Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Takeda Pharmaceutical Company Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Biogen*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abbott

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sandoz International GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bristol-Myers Squibb Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Merck KGaA

List of Figures

- Figure 1: Global Addison's Disease Therapeutics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Addison's Disease Therapeutics Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 3: North America Addison's Disease Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 4: North America Addison's Disease Therapeutics Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 5: North America Addison's Disease Therapeutics Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 6: North America Addison's Disease Therapeutics Industry Revenue (billion), by Diagnosis 2025 & 2033

- Figure 7: North America Addison's Disease Therapeutics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 8: North America Addison's Disease Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 9: North America Addison's Disease Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 10: North America Addison's Disease Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Addison's Disease Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Addison's Disease Therapeutics Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 13: Europe Addison's Disease Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 14: Europe Addison's Disease Therapeutics Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 15: Europe Addison's Disease Therapeutics Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 16: Europe Addison's Disease Therapeutics Industry Revenue (billion), by Diagnosis 2025 & 2033

- Figure 17: Europe Addison's Disease Therapeutics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 18: Europe Addison's Disease Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 19: Europe Addison's Disease Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 20: Europe Addison's Disease Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Addison's Disease Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Addison's Disease Therapeutics Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 23: Asia Pacific Addison's Disease Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 24: Asia Pacific Addison's Disease Therapeutics Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 25: Asia Pacific Addison's Disease Therapeutics Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 26: Asia Pacific Addison's Disease Therapeutics Industry Revenue (billion), by Diagnosis 2025 & 2033

- Figure 27: Asia Pacific Addison's Disease Therapeutics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 28: Asia Pacific Addison's Disease Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Asia Pacific Addison's Disease Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Asia Pacific Addison's Disease Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Addison's Disease Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Addison's Disease Therapeutics Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 33: Middle East and Africa Addison's Disease Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 34: Middle East and Africa Addison's Disease Therapeutics Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 35: Middle East and Africa Addison's Disease Therapeutics Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 36: Middle East and Africa Addison's Disease Therapeutics Industry Revenue (billion), by Diagnosis 2025 & 2033

- Figure 37: Middle East and Africa Addison's Disease Therapeutics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 38: Middle East and Africa Addison's Disease Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 39: Middle East and Africa Addison's Disease Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 40: Middle East and Africa Addison's Disease Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Addison's Disease Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Addison's Disease Therapeutics Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 43: South America Addison's Disease Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 44: South America Addison's Disease Therapeutics Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 45: South America Addison's Disease Therapeutics Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 46: South America Addison's Disease Therapeutics Industry Revenue (billion), by Diagnosis 2025 & 2033

- Figure 47: South America Addison's Disease Therapeutics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 48: South America Addison's Disease Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 49: South America Addison's Disease Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 50: South America Addison's Disease Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: South America Addison's Disease Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 2: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 3: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Diagnosis 2020 & 2033

- Table 4: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 5: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 7: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 8: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Diagnosis 2020 & 2033

- Table 9: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 10: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 12: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 13: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Diagnosis 2020 & 2033

- Table 14: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 15: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 17: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 18: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Diagnosis 2020 & 2033

- Table 19: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 20: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 22: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 23: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Diagnosis 2020 & 2033

- Table 24: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 25: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 27: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 28: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Diagnosis 2020 & 2033

- Table 29: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 30: Global Addison's Disease Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Addison's Disease Therapeutics Industry?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Addison's Disease Therapeutics Industry?

Key companies in the market include Merck KGaA, Bayer AG, Amgen Inc, GlaxoSmithKline plc, Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Biogen*List Not Exhaustive, Abbott, Sandoz International GmbH, Bristol-Myers Squibb Company, Pfizer Inc.

3. What are the main segments of the Addison's Disease Therapeutics Industry?

The market segments include Drug Class, Route of Administration, Diagnosis, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidences of Addison's Disease; Growing Awareness about the Addison's Disease and Rising Healthcare Expenditure.

6. What are the notable trends driving market growth?

Oral Route is Expected to Have the Significant Market Share.

7. Are there any restraints impacting market growth?

Inability to Diagnose the Disease in Early Stages; High Costs Associated with the Treatment.

8. Can you provide examples of recent developments in the market?

In April 2022 Diurnal Group extended its distribution agreement with Er-Kim to include the distribution and marketing of Alkindi(hydrocortisone granules in capsules for opening) and Efmody (hydrocortisone modified-release hard capsule) in Greece, Cyprus and Malta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Addison's Disease Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Addison's Disease Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Addison's Disease Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Addison's Disease Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence