Key Insights

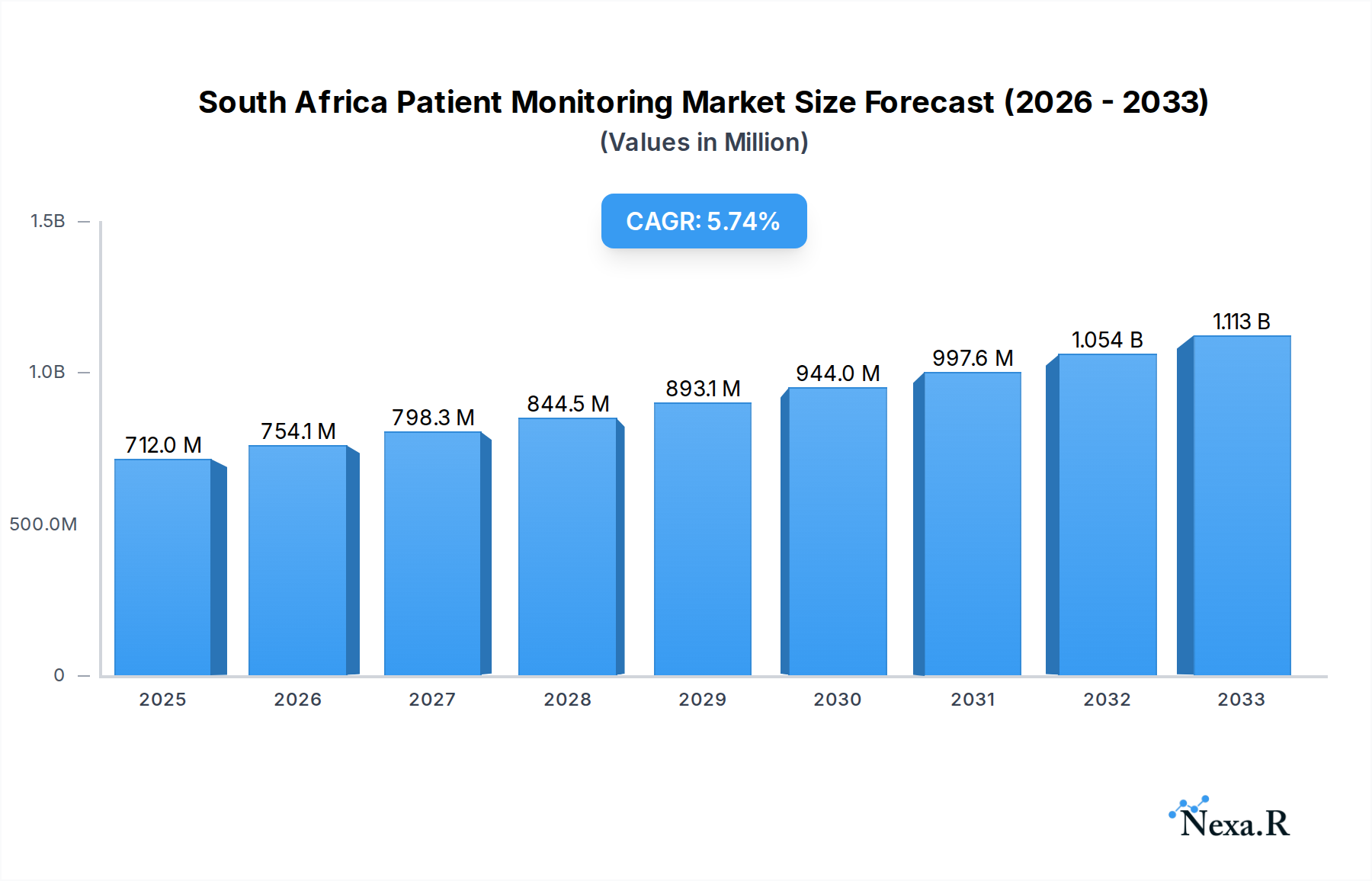

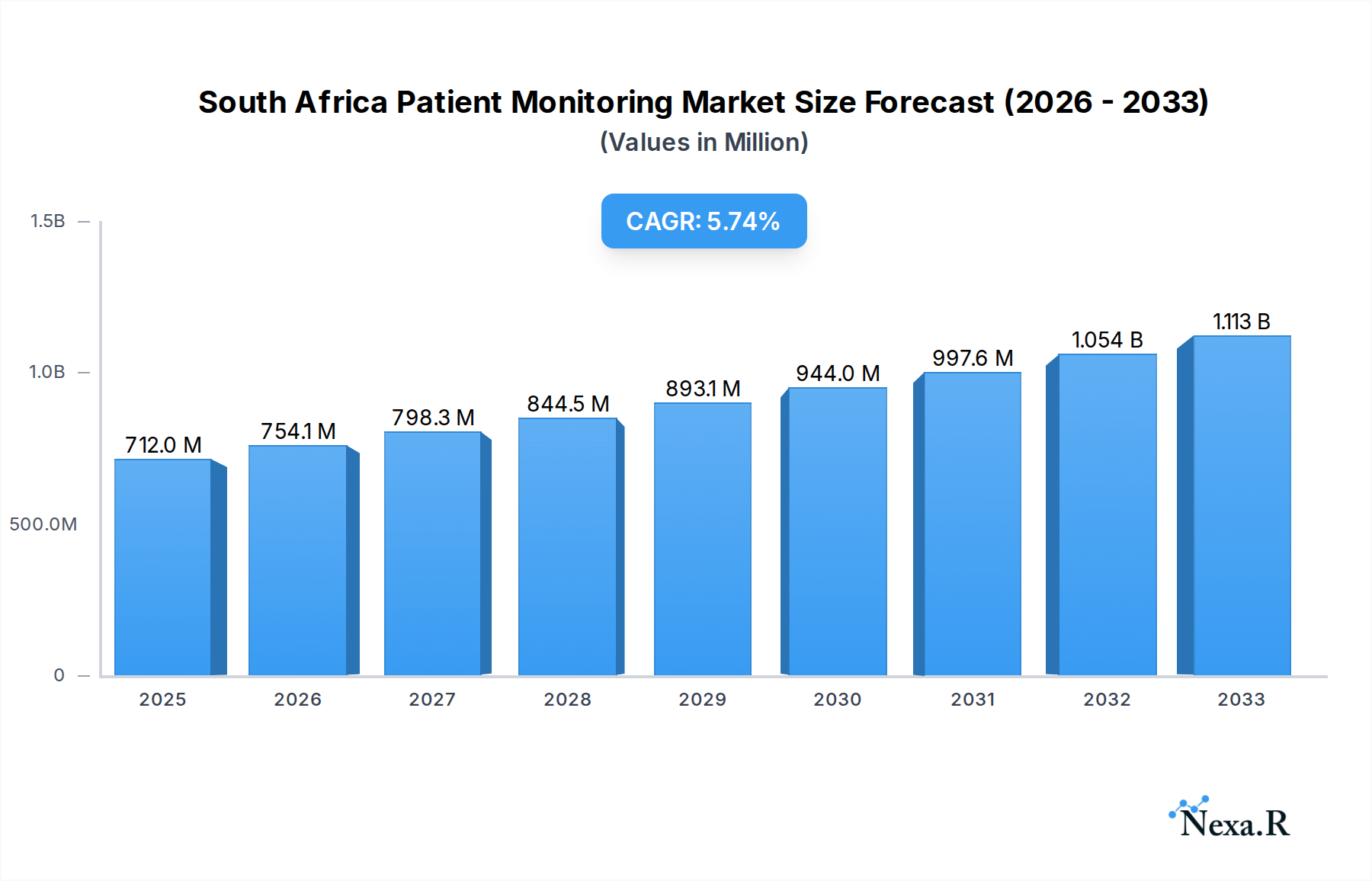

The South African patient monitoring market is poised for significant expansion, projected to reach $712.00 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.92% throughout the forecast period of 2025-2033. This growth is primarily fueled by an increasing prevalence of chronic diseases, such as cardiovascular and respiratory conditions, coupled with a rising demand for advanced healthcare solutions that enhance patient outcomes and reduce healthcare burdens. The growing adoption of home healthcare and ambulatory care settings, driven by the need for more accessible and cost-effective patient management, also plays a crucial role. Furthermore, technological advancements leading to more sophisticated and user-friendly devices, including remote monitoring solutions, are set to accelerate market penetration. The emphasis on early disease detection and continuous patient observation in managing conditions like neurological disorders and fetal complications will continue to drive investment and innovation within this dynamic sector.

South Africa Patient Monitoring Market Market Size (In Million)

The competitive landscape features a mix of global and local players, including Becton Dickinson and Company, Siemens Healthcare, GE Healthcare, Abbott Laboratories, and Medtronic PLC, among others, actively contributing to market development through product innovation and strategic collaborations. The market segments of Hemodynamic Monitoring Devices, Cardiac Monitoring Devices, and Respiratory Monitoring Devices are anticipated to witness substantial growth, aligning with the prevalent health challenges in the region. In terms of applications, Cardiology and Neurology are expected to dominate, reflecting the significant burden of these conditions. The expanding reach of home healthcare and ambulatory care centers as preferred end-user segments underscores a broader shift towards decentralized healthcare delivery models. This evolving market structure indicates a strong future for patient monitoring solutions in South Africa, addressing critical healthcare needs and promoting better health management across diverse patient populations.

South Africa Patient Monitoring Market Company Market Share

Unveiling the South Africa Patient Monitoring Market: A Comprehensive 2025-2033 Outlook

This in-depth report provides an exhaustive analysis of the South Africa Patient Monitoring Market, offering critical insights into its dynamics, growth trajectories, and competitive landscape. Covering the historical period from 2019-2024, a base year of 2025, and a comprehensive forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to understand the evolution of patient monitoring solutions in South Africa. We delve into key segments including Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Respiratory Monitoring Devices, and Remote Monitoring Devices, and analyze their adoption across vital applications such as Cardiology, Neurology, Respiratory, and Fetal and Neonatal care. Furthermore, the report scrutinizes the role of various End Users, including Home Healthcare, Ambulatory Care Centers, and Hospitals, in shaping market demand. Values are presented in Million units for clear quantitative understanding.

South Africa Patient Monitoring Market Market Dynamics & Structure

The South Africa patient monitoring market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and a competitive product landscape. Market concentration is moderately fragmented, with key players like Becton Dickinson and Company, Siemens Healthcare, GE Healthcare, Abbott Laboratories, Medtronic PLC, Koninklijke Philips NV, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc, and Draegerwerk AG vying for market share. Technological innovation is a significant driver, fueled by advancements in AI-powered analytics, wearable sensors, and miniaturization of devices, leading to more accurate, less invasive, and user-friendly monitoring solutions. Regulatory frameworks, while ensuring patient safety and efficacy, can also act as a barrier to rapid market entry for new entrants. Competitive product substitutes are emerging, particularly in the remote patient monitoring segment, offering cost-effective alternatives to traditional in-hospital solutions. End-user demographics are shifting, with an increasing elderly population and a growing prevalence of chronic diseases driving demand for continuous and proactive monitoring. Merger and acquisition (M&A) trends, though currently moderate in volume, indicate strategic consolidation efforts by larger players to expand their product portfolios and market reach.

- Market Concentration: Moderately fragmented with key global and regional players.

- Technological Innovation Drivers: AI integration, IoT connectivity, wearable sensor technology, miniaturization.

- Regulatory Frameworks: Emphasis on data privacy, device efficacy, and interoperability standards.

- Competitive Product Substitutes: Rise of advanced home-use devices and telehealth platforms.

- End-User Demographics: Growing elderly population, increasing chronic disease burden.

- M&A Trends: Strategic acquisitions for portfolio enhancement and market expansion.

South Africa Patient Monitoring Market Growth Trends & Insights

The South Africa patient monitoring market is poised for robust growth, driven by a confluence of escalating healthcare needs and technological advancements. The market size is projected to expand significantly from XXX million units in 2025 to an estimated XXX million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of XX%. This upward trajectory is largely fueled by the increasing adoption of advanced patient monitoring devices, particularly in managing chronic conditions such as cardiovascular diseases, respiratory illnesses, and neurological disorders. The growing awareness among healthcare providers and patients about the benefits of early detection and continuous monitoring is accelerating market penetration. Technological disruptions, including the integration of artificial intelligence for predictive analytics and the proliferation of Internet of Things (IoT)-enabled devices for seamless data transmission, are revolutionizing patient care paradigms. Furthermore, shifts in consumer behavior, with a growing preference for remote and home-based care solutions, are creating new avenues for market expansion. The demand for wearable devices and implantable sensors is on the rise, enabling personalized healthcare and proactive intervention. Telehealth platforms are gaining traction, facilitating remote consultations and monitoring, thereby enhancing accessibility and affordability of healthcare services across South Africa. The emphasis on preventative healthcare and the increasing burden of lifestyle-related diseases further underscore the critical role of patient monitoring in improving health outcomes.

Dominant Regions, Countries, or Segments in South Africa Patient Monitoring Market

Within the South Africa patient monitoring market, Hospitals emerge as the dominant end-user segment, accounting for a significant XX% of the market share in the base year of 2025, projected to reach XX% by 2033. This dominance is attributable to the critical need for sophisticated patient monitoring equipment in critical care units, intensive care units (ICUs), operating rooms, and emergency departments. Hospitals are at the forefront of adopting advanced technologies, driven by the imperative to improve patient outcomes, reduce readmission rates, and enhance operational efficiency. The increasing prevalence of complex medical conditions requiring continuous and intensive monitoring further solidifies the position of hospitals as primary consumers of patient monitoring devices.

Among the device types, Cardiac Monitoring Devices are projected to witness substantial growth, capturing an estimated XX% of the market by 2033. This surge is propelled by the high incidence of cardiovascular diseases in South Africa, including hypertension, coronary artery disease, and heart failure. The demand for electrocardiograms (ECGs), Holter monitors, and implantable cardiac monitors is particularly strong, enabling early diagnosis, personalized treatment, and proactive management of cardiac conditions.

In terms of applications, Cardiology remains the leading application area, holding a XX% market share in 2025, expected to grow to XX% by 2033. The escalating burden of cardiovascular diseases, coupled with advancements in cardiac monitoring technologies, drives this segment's expansion.

- Dominant End User: Hospitals, driven by critical care needs and advanced technology adoption.

- Leading Device Segment: Cardiac Monitoring Devices, due to the high prevalence of cardiovascular diseases.

- Primary Application Area: Cardiology, propelled by ongoing advancements and disease burden.

- Key Drivers for Hospital Dominance: Advanced diagnostics, critical care requirements, regulatory compliance.

- Growth Factors for Cardiac Monitoring: Increasing cardiovascular disease incidence, technological innovation in ECG and remote monitoring.

- Market Share Potential: Hospitals expected to maintain and grow their market share significantly.

South Africa Patient Monitoring Market Product Landscape

The South Africa patient monitoring market is characterized by a diverse and rapidly evolving product landscape. Innovations are centered on enhancing device accuracy, portability, connectivity, and user-friendliness. Leading companies are investing in the development of smart wearables that offer continuous physiological data collection, including vital signs, activity levels, and sleep patterns. The integration of AI and machine learning algorithms within these devices is enabling real-time data analysis, predictive diagnostics, and personalized treatment recommendations. For instance, advanced Cardiac Monitoring Devices now feature enhanced ECG interpretation capabilities, while Respiratory Monitoring Devices are incorporating non-invasive ventilation support. The burgeoning segment of Remote Monitoring Devices is witnessing a surge in connected devices capable of transmitting data securely to healthcare providers, facilitating proactive interventions and reducing the need for hospital visits.

Key Drivers, Barriers & Challenges in South Africa Patient Monitoring Market

The South Africa patient monitoring market is propelled by several key drivers. The escalating prevalence of chronic diseases like diabetes, hypertension, and cardiovascular conditions necessitates continuous monitoring for effective management. Technological advancements, particularly in AI, IoT, and wearable technology, are enhancing device functionality and affordability. Growing awareness among healthcare providers and patients about the benefits of early detection and proactive care is also a significant driver. Furthermore, favorable government initiatives and increasing healthcare expenditure are contributing to market expansion.

However, the market faces several barriers and challenges. High initial costs of advanced patient monitoring systems can be a deterrent, especially for smaller healthcare facilities and in resource-constrained settings. Inadequate healthcare infrastructure and limited access to skilled healthcare professionals in certain regions can hinder adoption. Regulatory hurdles and the need for stringent data privacy compliance can also pose challenges. Intense competition among established players and emerging startups creates pricing pressures and necessitates continuous innovation.

Emerging Opportunities in South Africa Patient Monitoring Market

Emerging opportunities in the South Africa patient monitoring market lie in the expanding domain of Remote Patient Monitoring (RPM) for chronic disease management. The increasing penetration of smartphones and internet connectivity across South Africa creates a fertile ground for telehealth platforms and connected home-care devices. There is a growing demand for user-friendly, AI-powered diagnostic tools that can be utilized in home settings, empowering patients and reducing the burden on healthcare facilities. Furthermore, the development of integrated patient monitoring systems that can seamlessly communicate with electronic health records (EHRs) presents a significant opportunity for improved data management and clinical decision-making. The focus on preventative healthcare and wellness monitoring is also creating a niche for wearable devices catering to fitness enthusiasts and individuals seeking proactive health management.

Growth Accelerators in the South Africa Patient Monitoring Market Industry

Several catalysts are accelerating the growth of the South Africa patient monitoring market. The ongoing digital transformation within the healthcare sector, driven by government support for e-health initiatives, is a major accelerator. Strategic partnerships between technology providers, healthcare institutions, and insurance companies are fostering wider adoption of patient monitoring solutions. The increasing investment in research and development by key market players, leading to the introduction of innovative and cost-effective devices, is also fueling growth. Moreover, the growing acceptance of telemedicine and remote care models, further emphasized by recent global health events, is creating a sustained demand for advanced patient monitoring technologies.

Key Players Shaping the South Africa Patient Monitoring Market Market

- Becton Dickinson and Company

- Siemens Healthcare

- GE Healthcare

- Abbott Laboratories

- Medtronic PLC

- Koninklijke Philips NV

- Johnson & Johnson

- Boston Scientific Corporation

- Baxter International Inc

- Draegerwerk AG

Notable Milestones in South Africa Patient Monitoring Market Sector

- October 2022: Biospectal SA and Amref Health Africa launched a Mobile Remote Patient Monitoring (MRPM) hypertension management pilot program in Kibera, Kenya, impacting remote patient monitoring strategies in Africa.

- October 2022: Quro Medical, a South African digital health company, partnered with Operation Healing Hands, demonstrating a commitment to community-based healthcare solutions and the advancement of the local medical industry.

In-Depth South Africa Patient Monitoring Market Market Outlook

The South Africa patient monitoring market is set to experience sustained expansion, driven by ongoing technological advancements and a growing demand for proactive healthcare solutions. The integration of AI and IoT is poised to revolutionize diagnostics and treatment delivery, with a particular emphasis on remote patient monitoring and home-based care. Strategic collaborations and increasing healthcare investments are expected to further accelerate market growth, creating a more accessible and efficient healthcare ecosystem for South African citizens. The market holds immense potential for innovation in areas such as personalized medicine and preventative health, solidifying its crucial role in the nation's healthcare future.

South Africa Patient Monitoring Market Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Respiratory Monitoring Devices

- 1.5. Remote Monitoring Devices

- 1.6. Other Type of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End User

- 3.1. Home Healthcare

- 3.2. Ambulatory Care Centers

- 3.3. Hospitals

- 3.4. Other End Users

South Africa Patient Monitoring Market Segmentation By Geography

- 1. South Africa

South Africa Patient Monitoring Market Regional Market Share

Geographic Coverage of South Africa Patient Monitoring Market

South Africa Patient Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Ease of Use and Portability Devices to Promote the Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Technology; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Application in Cardiology Expected to Dominate the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Respiratory Monitoring Devices

- 5.1.5. Remote Monitoring Devices

- 5.1.6. Other Type of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Healthcare

- 5.3.2. Ambulatory Care Centers

- 5.3.3. Hospitals

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Healthcare

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Laboratories

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Johnson & Johnson

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baxter International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Draegerwerk AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: South Africa Patient Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Patient Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Patient Monitoring Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: South Africa Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 3: South Africa Patient Monitoring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: South Africa Patient Monitoring Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: South Africa Patient Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: South Africa Patient Monitoring Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: South Africa Patient Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South Africa Patient Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: South Africa Patient Monitoring Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 10: South Africa Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 11: South Africa Patient Monitoring Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: South Africa Patient Monitoring Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: South Africa Patient Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: South Africa Patient Monitoring Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: South Africa Patient Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South Africa Patient Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Patient Monitoring Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the South Africa Patient Monitoring Market?

Key companies in the market include Becton Dickinson and Company, Siemens Healthcare, GE Healthcare, Abbott Laboratories, Medtronic PLC, Koninklijke Philips NV, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc, Draegerwerk AG.

3. What are the main segments of the South Africa Patient Monitoring Market?

The market segments include Type of Device, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 712.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Ease of Use and Portability Devices to Promote the Growth.

6. What are the notable trends driving market growth?

Application in Cardiology Expected to Dominate the Growth of the Market.

7. Are there any restraints impacting market growth?

High Cost of Technology; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

October 2022: Biospectal SA, the remote patient monitoring and biosensing software company, and Amref Health Africa, the largest health NGO in Africa, reported the launch of a Mobile Remote Patient Monitoring (MRPM) hypertension management pilot program in Kibera (Nairobi), Kenya, the largest informal settlement in Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Patient Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Patient Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Patient Monitoring Market?

To stay informed about further developments, trends, and reports in the South Africa Patient Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence